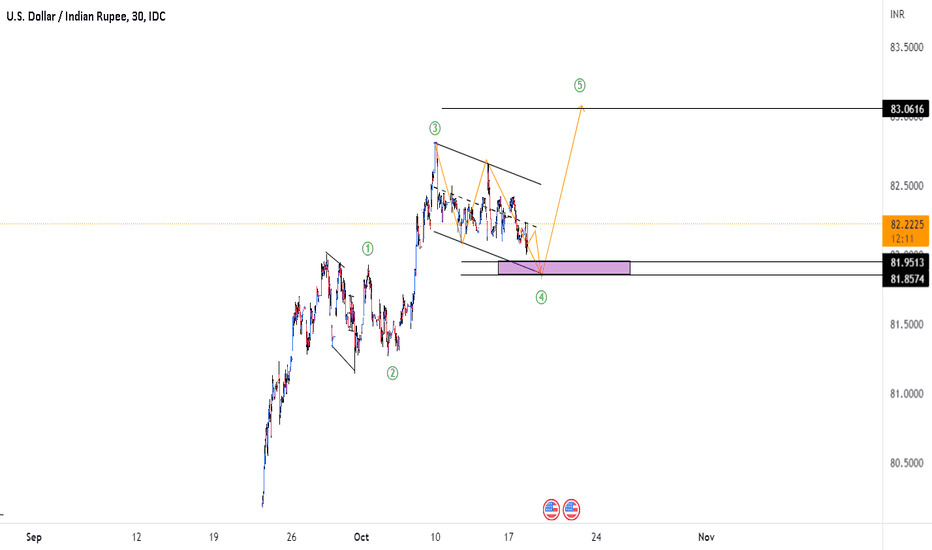

Elliott Wave Principles: A Study on US Dollar IndexHello friends, today we'll attempt to analyze the (DXY) US Dollar Index chart using Elliott Wave theory. Let's explore the possible Elliott Wave counts with wave Principles (Rules).

We've used the daily time frame chart here, which suggests that the primary cycle degree in Black weekly wave ((A)) and ((B)) waves have already occurred. Currently, wave ((C)) is in progress.

Within wave ((C)) in Black which are Weekly counts, Subdivisions are on daily time frame, showing Intermediate degree in blue wave (1) & (2) are finished and (3) is near to completion. Post wave (3), we can expect wave (4) up in Blue and then wave (5) down in Blue, marking the end of wave ((C)) in Black.

Additionally, within blue wave (3) Intermediate degree, we should see 5 subdivisions in red of Minor degree, which is clearly showing that waves 1 & 2 are done and now we are near to completion of wave 3 in Red. followed by waves 4 and 5, which will complete blue wave (3).

Key Points to Learn:

When applying Elliott Wave theory, it's essential to follow specific rules and principles. Here are three crucial ones:

1. Wave 2 Retracement Rule: Wave two will never retrace more than 100% of wave one.

2. Wave 3 Length Rule: Wave three will never be the shortest among waves 1, 3, and 5. It may be the largest most of the time, but never the shortest.

3. Wave 4 Overlap Rule: Wave four will never enter into the territory of wave one, meaning wave four will not overlap wave one, except in cases of diagonals or triangles.

Invalidation level is a level which is decided based on these Elliott wave Principles only, Once its triggered, then counts are Invalidated so we have to reassess the chart study and other possible counts are to be plotted

The entire wave count is clearly visible on the chart, and this is just one possible scenario. Please note that Elliott Wave theory involves multiple possibilities and uncertainties.

The analysis we've presented focuses on one particular scenario that seems potentially possible. However, it's essential to keep in mind that Elliott Wave counts can have multiple possibilities.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Waveprinciple

BNBUSDT right-angled broadening wedgeBNBUSDT is about to fill the corrective a-b-c retrace. After the last target reached, I'm updating this chart with potential targets based on demand zone for the next short position. An impulse wave downward can be expected. Fisher Transform oscillator on 4h-time-frame was added to speculate a price-time correlation.

BNBUSDT 5% drawdown channeling H&S5% drawdown from the right shoulder of a Head and Shoulders pattern setup can be expected as drawn on this 15m chart. Price action in a parallel channel and downward impulse wave to fill the wave-iii. Chaikin Money Flown in a negative divergence as diving below zero plus Fisher transform 2H bearish crossing suggesting time correlation in 16h ahead.

PERLUSDT Impulse wave reactionPERLUSDT is igniting an impulse wave in reaction as the price bounce inner a broadening structure, in a micro triangle breakout. Fisher Transform bullish crossing is suggesting the direction in time correlation. Aiming 5% upward wave-iii.

BNB c-wave failure plus CMF bear divergenceBNBUSDT is heading a potential downward leg to complete iv-wave of this channel. On the 4H chart we can see a strong bearish correlation between the price action and Chaikin Money Flow bearish divergence, in which we have a c-wave failure case. The next demand zone is confluent with the Fibonacci retracement projection.

BTCUSDT Wave B seems to be accomplishedBTCUSDT just made a peak accomplishing the wave B, likely starting a impulse wave inner the next wave C downward. On Chaikin Money Flow we can see a hidden bearish divergence on this daily chart. Overbought condition on ESCGO_LB suggesting that a bearish leg is coming to close the week. I'm expecting a drop to the 20k demand zone region to finish this minor A-B-C zigzag correction phase.

BTCUSDT A Head & Shoulders to builtBTCUSDT have a Head & Shoulders pattern to built in a Zig Zag downward, in which a wave 1 can be expected for an 2-D swing trade as a breakdown from the micro symmetrical triangle is expected. Thereby, a new supply target will expecting for a reaction. This will be an increase of confidence for the sell-side. Displayed on this H4 chart: daily LSMA (least squares moving average) resistance plus AVWAP (anchored volume weighted average) from peak of wave (ii) of this ending diagonal (as showed on my actual cyclical wave analysis). Technicals: serious divergences on Commodity Channel Index and Chaikin Money Flow suggesting a condition to a dip soon. Overbought condition.

Short CZ coin below volume POCPotential bearish trend reversal expected. Projecting BCD reciprocal targets extending 2.618 and 3.618 aiming local demand zone. That's a potential wave 1 to ignite. Wave 2 about to extend Fibonacci @ 61.8% (future local supply).

Technicals:

* Fisher Transform cross; Overbought;

* Chaikin Money Flow hidden bearish divergence:

XMR tradeI'm pretty sure that if there are no clearing red bars around the white 800MA , the green 200 will cross over the ORANGE 3200 MA on the 1 hr

so about 187$ or so or higher is my target

This applies like virtually market wide - XMR C waves are super direct nowadays and will more or less glide diagonally to that fib range

My lower target still stands, I think the Z wave is not done on a larger wave degree, which is unfortunately sub 50$ with the rest of market movement

𝘾𝙤𝙥𝙥𝙚𝙧 𝙁𝙪𝙩𝙪𝙧𝙚𝙨 (𝙃𝙂1!) — 𝙀𝙒𝘼HG1!: 🕐 6h

A big review of this asset is planned for the first half of next year, but decided to make a small update to the count, as the current sideways formation looks very much like a bullish contracting triangle that is about to be completed. On completion of the final wave E of (B) , there will be a good trading setup for a long position.

The wave marking in the double circle parenthesis corresponds to the green marking in the circle on the chart.

BTC still making bullish patterns on the top. what's going on?If you want to understand what the market is doing, the best thing you can do is spot these pattern combinations.

Elliott's wave principle is not a theory, it's a principle. that word itself means it explains the behavior of the waves. how they start.

it's a big different concept from a hypothesis, which may or not happen, a theory.

We get impulsive, corrective, impulsive sequence every time the market moves. slow, and fast movements.

At a certain Fibonacci levels and proportions, these pictures get drawn in every time frame.

When smaller forms are completed, they start drawing bigger formations.

the bigger the formation, the more significant movement is coming.

and inside bigger formations, smaller patterns can be found.

Size translate into a different time, price and shapes.

Wouldn't you like to read the markets?

Here's a Language you can learn.

It requires no technical indicators, no news/ fundamental analysis ..

You only need to see them once, to start seeing them twice.

Let me know if you are ready to start.

I'll start analyzing different pattern combinations so that you can see them too.

-----

Lito

-----

The Wave Principle begins with the fact that everything in the universe moves according to the Law of Nature following a mathematical pattern of contraction and expansion. (Fibonacci).

This applies to human beings and everything created by them, including the financial market.

According to the Wave Principle, markets always move in waves of action and reaction (impulses and corrections) of greater and lesser degree. Different shapes, strength, and time to complete.

Recognizing these patterns with Fibonacci and Golden Ratio (Phi | 0.618) can help us understand the market behavior to anticipate the next move.

#WavePrinciple #WaveAnalysis #WaveTrader #WaveTheory #Phi #GoldenRatio #Forex #Bitcoin

#BTC #Charts #TA #TechnicalAnalysis #Crypto #Cryptocurrency #RalphNelsonElliott #ElliottWaves

#ElliottTheory #NeoWave #NelsonElliott #TheWaveAcademy

GOLD NEXT WEEK #15Forecast:

Price action is a bit stuck and out of favor. Downside target's @ ~1725, ~1716 or ~1707. Upside target's - retest of last weeks high @ ~1757. If bull's get the upper hand and momentum pick's up, look for target @ ~1785ish.

As always, keep eye on Bond selling. Trade safe, be well... I'll keep you posted.

About Gold Next Week #

A weekly 3-10-minute forecast video on Gold's price action on a weekly basis. I'll follow up with charts throughout the week as price action develops patterns and pivot reversals points.

Topics: Market sentiment, Gold Shares / Gold EFT's, $DXY and US10/30yr bonds and yields

System: I use a hybrid blend of Wave Principle price action, Fibonacci ratios, RSI indicator and some fundamentals.

Disclaimer: nothing talked about in this video should be regarded or seen as trade advise, a trade call, a recommendation, or a trade signal. Do your own due diligence or seek advice from a licensed professional before entering a trade.

Best Regards

OmarDjurhuus

Bottom of Bitcoin 2018-2019 How The End Of Corrective Wave LooksIf you want to understand what the market is doing, the best thing you can do is spot these pattern combinations.

Elliott's wave principle is not a theory, it's a principle. that word itself means it explains the behavior of the waves. how they start.

it's a big different concept from a hypothesis, which may or not happen, a theory.

We get impulsive, corrective, impulsive sequence every time the market moves. slow, and fast movements.

At a certain Fibonacci levels and proportions, these pictures get drawn in every time frame.

When smaller forms are completed, they start drawing bigger formations.

the bigger the formation, the more significant movement is coming.

and inside bigger formations, smaller patterns can be found.

Size translate into a different time, price and shapes.

Wouldn't you like to read the markets?

Here's a Language you can learn.

It requires no technical indicators, no news/fundamental analysis..

You only need to see them once, to start seeing them twice.

Let me know if you are ready to start.

I'll start analyzing different pattern combinations so that you can see them too.

-----

Lito

-----

The Wave Principle begins with the fact that everything in the universe moves according to the Law of Nature following a mathematical pattern of contraction and expansion. (Fibonacci).

This applies to human beings and everything created by them, including the financial market.

According to the Wave Principle, markets always move in waves of action and reaction (impulses and corrections) of greater and lesser degree. Different shapes, strength, and time to complete.

Recognizing these patterns with Fibonacci and Golden Ratio (Phi | 0.618) can help us understand the market behavior to anticipate the next move.

#WavePrinciple #WaveAnalysis #WaveTrader #WaveTheory #Phi #GoldenRatio #Forex #Bitcoin

#BTC #Charts #TA #TechnicalAnalysis #Crypto #Cryptocurrency #RalphNelsonElliott #ElliottWaves

#ElliottTheory #NeoWave #NelsonElliott #TheWaveAcademy

BTC pattern combination before making a new high!If you want to understand what the market is doing, the best thing you can do is spot these pattern combinations.

Elliott's wave principle is not a theory, it's a principle. that word itself means it explains the behavior of the waves. how they start.

it's a big different concept from a hypothesis, which may or not happen, a theory.

We get impulsive, corrective, impulsive sequence every time the market moves. slow, and fast movements.

At a certain Fibonacci levels and proportions, these pictures get drawn in every time frame.

When smaller forms are completed, they start drawing bigger formations.

the bigger the formation, the more significant movement is coming.

and inside bigger formations, smaller patterns can be found.

Size translate into different time, price and shapes.

Wouldn't you like to read the markets?

Here's a Language you can learn.

It requires no technical indicators, no news/fundamental analysis..

You only need to see them once, to start seeing them twice.

Let me know if you are ready to start.

I'll start analyzing different pattern combinations so that you can see them too.

Lito

--------------------------------------------------------------

The Wave Principle begins with the fact that everything in the universe moves according to the Law of Nature following a mathematical pattern of contraction and expansion. (Fibonacci).

This applies to human beings and everything created by them, including the financial market.

According to the Wave Principle, markets always move in waves of action and reaction (impulses and corrections) of greater and lesser degree. Different shapes, strength, and time to complete.

Recognizing these patterns with Fibonacci and Golden Ratio (Phi | 0.618) can help us understand the market behavior to anticipate the next move.

#WavePrinciple #WaveAnalysis #WaveTrader #WaveTheory #Phi #GoldenRatio #Forex #Bitcoin

#BTC #Charts #TA #TechnicalAnalysis #Crypto #Cryptocurrency #RalphNelsonElliott #ElliottWaves

#ElliottTheory #NeoWave #NelsonElliott #TheWaveAcademy

Bitcoin Wave analysisas you can see on the chart we are below any possible moving average below 100 and also we are below 200-daily moving average. but i am very bullish on bitcoin because of my wave counts. i believe we completed wave 1 and probable wave 2 in big scope starting from the 3100 bottom. i believe we have completed the correction starting from 14k till the 7.7k and we have started the wave three and we have actually completed wave 1 of wave 3 and actually! we have completed wave 1 of this last mentioned wave 3! it means we are initiating the wave 3 of 3 of 3. it is the most bullish point of time in bitcoin that we have seen in the past 2 years.

Great opportunity to trade Apple stocki can see a three wave up it is definitely an ABC correction or a new impulse wave. i counted apple right now as a corrective wave because it has reached its previous resistance.

i will enter in a short position at 213 because in that case two things will prove to me:

1 the trend line of diagonal triangle is broken

2 wave 4 have entered wave 1 territory (the wave i labeled as A) so it will invalidate the bullish case count.

i will update this trade. stay tuned

EP -> 213

TP -> 173

SL -> 229

Flat or Triangle or wxy does not matterit doesn't matter we are forming a zig zag or a flat or a triangle only thing that i know we are at a corrective wave. this is not a motive wave because it is complicated and has a lot of overlaps.

regardless, may be we are forming a regular flat(A 3-3-5 correction) . after completion of correction i will tell you guys where to put your orders. now we should wait. just wait

Dive into S&P 500In grand supercycle I see wave 1 and 2 and three and i have shown the potential targets for future. it does not matter that these forecasts will play out or not but we can see that we are at wave three and i am goin to dive into details in this idea. by the way this mounthly chart of spx since 1970.