RAD - Is there such a thing as a safe SHORT?If there was ever a thing such as a safe short- I think it would be Rite Aid (RAD)

As shown on a monthly chart, RAD triple topped in 2015=2017 and has been in a decline

every since. It has shed 90% of its market cap in the intervening 6-8 years. Now, it is

fundamentally fighting for survival. This is because as a weaker drugstore retailer and

the rise of Walgreens, CVS and others as well as RAD's role in the opioid epidemic

( I have insider knowledge) RAD is now filing for bankruptcy protection against

claims and litigation which will vastly outstrip its liability protections. All confirmations

on the monthly chart ( high validity given the time frame) considered in context, RAD

is near to its death bed. The judge will be ing the rights of shareholders against the rights

of litigants ( which include Medicare, Medicaid and state governments). The shareholders will

loose and loose very badly. I will go short in a stock trade and take a large put option position.

There is no need to buy call options here for backside protection. The writing is on the wall.

WBA

RAD Rite Aid Bull Flag consolidation RAD recently popped in a big way and on the 2H chart is now settled in consolidation

about 67% above the prior base. That is to say, it is in a horizontal channel awaiting

further volume and direction from traders. The bias is for a bullish breakout of

continuation and momentum. Potentially RAD could rise the height of the flag pole

but this seems unlikely given the current general market. the dual RS indicator shows

support at the 50 level a good sign the retracement is over, The MACD lines are dancing

around under the histogram. I am putting this on watch. If RAD goes over the top of the

channel I will go long. If it goes under the channel I will go short. I could do both and hedge

but that is complicated and with more risk. The stop loss is outside the opposite side

of the channel. My target is a more up or down about 50% of the completed move represented

by the flagpole. I consider RAD a mem stock with a potential short squeeze in process.

Buckle up and drive safely. DYODD.

WBA Walgreens Boots Alliance Options Ahead of EarningsIf you haven`t sold WBA here:

Then Analyzing the options chain of WBA Walgreens Boots Alliance prior to the earnings report this week,

I would consider purchasing the $32.5 strike price Calls with

an expiration date of 2023-10-20,

for a premium of approximately $1.62.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

WBA Walgreens Boots Alliance Options Ahead of EarningsLooking at the WBA Walgreens Boots Alliance options chain ahead of earnings , I would buy the $30 strike price Puts with

2023-6-16 expiration date for about

$1.01 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

Green on Walgreens. WBAConfirmed pivot.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

Walgreens Boots Alliance: Take Your Medicine 💊Walgreens Boots Alliance should take its medicine as the share needs some more strength to make it above the resistance at $42.29. From there, the course should rise into the green zone between $52.38 and $59.29 to conclude wave 3 in green before we anticipate a countermovement. A 38% chance remains, though, that WBA could drop below the support at $32.70 instead, subsequently slipping below the support at $30.39 as well.

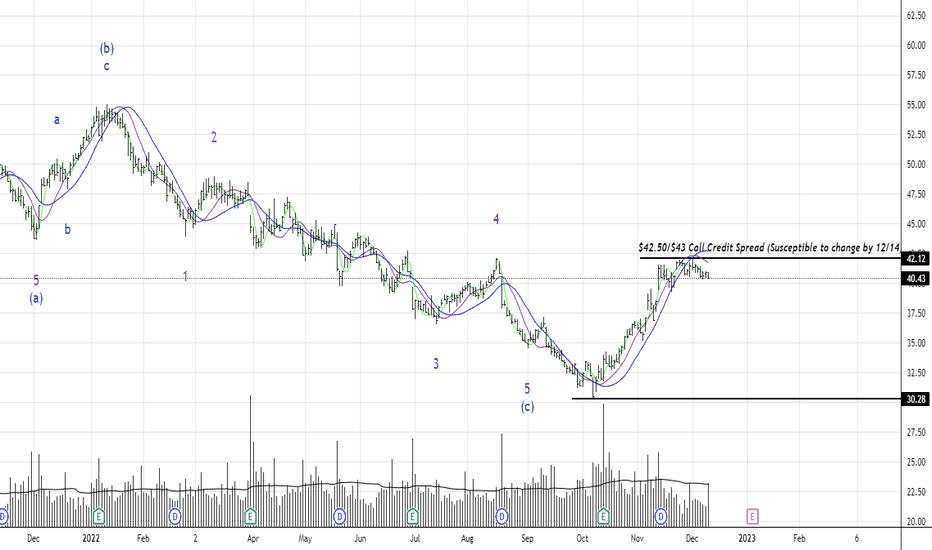

WBA (Range Trade)The last two times price touched $42 was in August ($42.10) and December ($42.03). Price hovered near $42 highs in November but didn't hold. Could also be a start of new impulsive wave to the downside. Might wait til the fed decision and cpi reports pass next week to get a second look.

WBA - Horizontal Support Leading to Double BottomWBA has formed a strong horizontal support

This provides a good support for price

Price has already bounced once off this area recently

Right now we are just waiting on the next test

This is on the Weekly timeframe but it would also be evident on the daily

WBAexcelente riesgo beneficio

patron armonico

Walgreens Boots Alliance, Inc. engages in the provision of drug store services. It operates through the following segments: Retail Pharmacy USA and Retail Pharmacy International. The Retail Pharmacy USA segment consists of the Walgreens business, which includes the operation of retail drugstores, health and wellness services, and mail and central specialty pharmacy services. The Retail Pharmacy International segment consists of pharmacy-led health and beauty retail businesses and optical practices. The company was founded in 1901 and is headquartered in Deerfield, IL.

RAD Swing Trade Setup LongNYSE:RAD

RAD is the Rite Aid drug store chain0 being in healthcare and

consumer staples it is relatively resilient in a recessionary context.

On the Chart, RAD is at swing lows sitting on support with

25% upside potential. The RSI indicator shows an impending

K & D line cross under the histogram.

A recent triple top helps mark the resistance while an

earlier double bottom shows the support. The order block

indicator provides confirmation.

I see this as nearly ready for a swing-long entry.

What is your opinion?

WalgreensI see a possible M pattern forming here. I'm thinking about more people being sick and pharmacy visits over the cold winter season. Walgreens is a great convenience store with solid customer service from my experience. They've been around for a long time. I want to see price retrace the previous high up to 38 - 61%. We are currently in consolidation. However, I believe that since that previous was broken and the current low being higher than the previous, I can see WBA respecting that sentiment on a long term scale. The win goes to the longest holder. On the weekly , we are on the bottom of the Mac D as well and looks to be losing its bearish momentum.

Not advice!

WBA LONG L >56.00

WBA is going to push the price to 59.20

I see, that there is a good chance to long if price will go higher 56.00

i put an alert on 56.00$ and will try to long.

I see that 53.92 is a place, where buyers put there orders. I think, if 1D candle will close below 53.92 that will cause a giant sellout of long positions.