Western Digital Shares Soars Despite Market VolatilityShares of Western Digital Corp. (WDC) surged more than 6 % in early trading Tusday before giving back some gains after the computer hard drive manufacturer said it would spin off its flash memory business.

The decision comes amid lower demand for flash memory chips that has led to a supply glut in recent quarters. Last week, Western Digital abandoned lengthy discussions of a merger with Kioxia, a Japanese memory drive maker, which is owned by a consortium led by Bain Capital and is the former semiconductor unit of Toshiba.

Western Digital's decision to spin off its flash memory unit is a win for activist investor Elliott Investment Management, which last year advised the company to make such a move.

Western Digital first ventured into the flash drive business in 2016, when it acquired SanDisk, a California-based manufacturer of flash memory cards, for $19 billion. The spinoff of the flash memory unit will effectively unwind that transaction.

Western Digital shares were nearly 8% higher around 3:30 p.m. ET, after surging more than 10% early in the session. They've risen by almost a third so far this year.

Analysts at Wedbush Securities assigned an "outperform" rating for WDC, and are eyeing a price target of $60 per share.

Price Momentum

WDC is trading in the middle of its 52-week range and above its 200-day simple moving average.

What does this mean?

Investors are still evaluating the share price, but the stock still appears to have some upward momentum. This is a positive sign for the stock's future value.

Wdclong

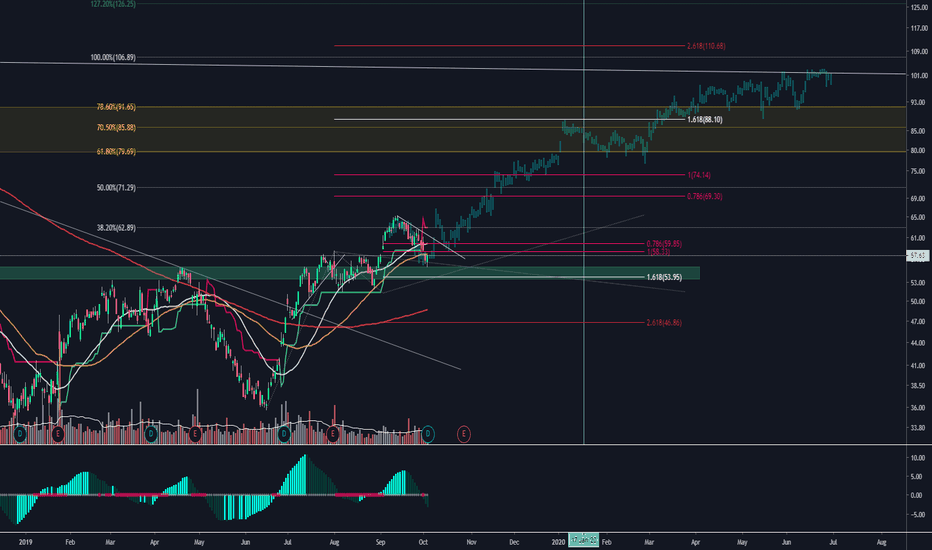

First 80W cycle after major 56M concludedAccording to our forecast, we are moving now over the first 80W cycle bottom after the great reset in 2020.

We are getting big time into WDC now, expecting the price to go even over 100USD next year, with a safe target of 90 USD

When we proceeded with phasing analysis just around the big dump in March 2020 we saw that a major 56month cycle bottom got aligned with it.

The price moves later confirmed 100% the phasing analysis was correct.

This way we got one of best deals in 2020.

Now is the chance to get the second shot.

1/2/22 WDCWestern Digital Corporation ( NASDAQ:WDC )

Sector: Electronic Technology (Computer Peripherals)

Market Capitalization: 20.321B

Current Price: $65.21

Breakout price: $67.25

Buy Zone (Top/Bottom Range): $65.20-$59.90

Price Target: $71.80-$72.90 (1st), $77.00-$78.20 (2nd)

Estimated Duration to Target: 35-41d, 100-110d

Contract of Interest: $WDC 2/18/22 67.5c, $WDC 4/14/22 70c

Trade price as of publish date: $3.25/contract, $3.95/contract

WDC shines with multi-chart oversold signalsI have changed up how to best display projected movement. In the case of WDC, 5 of my algorithms signaled a BUY on March 23, 2021. Equities nearly always obey the signal and move up, but sometimes it may continue to move down first.

I have placed two red boxes and two green boxes on the chart. The larger red box depicts all of the historical movement, from a percentage standpoint, that this stock has moved on the Hourly chart after a BUY signal occurred. Therefore, this box represents 100% of previous movement downward before the stock finally moved upward. The smaller red box represents 50% of all historical movement downward, before the stock moved upward. The smaller box is more of a precise target for the potential bottom in this instance.

The green boxes represent the same thing. In this instance, the smaller green box would be my projected target for the final top.

The black dotted arrow represents median historical movement. Medians are a good metric, but they are just one of many I use when forecasting future movement.

As always, the stock could rise the very next bar after the signal without looking back (therefore the red boxes would not come into play) or the stock may never rise (and the green boxes may never come into play).

All statistics and the full analysis are available for free as always at the site below.

WDC WESTERN DIGITAL CORP 68.02% upside potential I have 45 Western Digital hard drives without any issues in many years. In my opinion Western Digital is the best affordable storage devices company.

8/6/2020 Morgan Stanley Lower Price Target Overweight $63.00 ➝ $58.50

8/6/2020 Wells Fargo & Co Lower Price Target Overweight $60.00 ➝ $55.00

8/6/2020 Bank of America Lower Price Target Buy $61.00 ➝ $52.00

8/6/2020 Robert W. Baird Lower Price Target Outperform $75.00 ➝ $50.00

Market Cap$11.02 billion

Annual Sales$16.74 billion

Net Income$-250,000,000

If you are interested to test some amazing BUY and SELL INDICATORS, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

WDCGood spot for some mid range longs.

Pink area are targets for the longs.

Green zone good spot for entry. Although, if it reaches here, it may pull back further to teal before pushing to target zone. Orange line is stop loss for green zone entry.

Teal zone should be stronger. Red line is stop loss for teal zone entry.

Western Digital Corporation Possible bullish movesAs per the Chart

Abbreviations;

ND=No demand

NS= No supply

DW= Demand Wave

RFSB= Resistance from Supply Bar

SFDB support from Demand Bar

SLK= Stop Loss killer

SLKB= Stop Loss Killer Bottom

DB= Demand Bar

SB= Supply Bar

EVRB= effort vs Result Bottom

My Mentors and Inspiration

Volume Analysis - Oleg Alexandrov

Money and risk Management - Dmitriy Lavrov-

WESTERN DIGITAL/WDC - LONG POSITIONI share my longterm expectation of this trade.

Memory prices stabilizing. This could bring great gains for this stock in the longterm view.

I am in this trade for a long time. But for those who are not in this trade yet...we got a pinbar on the 4H, which is first good sign for the entry if you still hesitate.

You can also wait for the daily candle confirmation.

WDC Approaching Support, Potential Bounce! WDC is approaching our first support at 28.27 (horizontal swing low support, 100% fibonacci extension, 76.4% fibonacci retracement) where a strong bounce might occur above this level pushing price up to our major resistance at 47.52 (horizontal swing high resistance, 23.6% fiboancci retracement, 61.8% fibonacci extension).

Stochastic (55,5,3) is also approaching support and we might see a corresponding bounce in price.