BITCOIN → The price is consolidating, but there is a BUT!BINANCE:BTCUSDT is forming a consolidation after a false breakout of trend resistance. Against the backdrop of the global market crash (stock market, futures, forex) bitcoin looks quite strong, but I wouldn't get excited ahead of time

Bitcoin is trading inside a downtrend and also inside a range (global 81200 - 88800 and local 81200 - 85600). As long as the price is inside the local range and below trend resistance it is worth considering selling. There have been periods in history when the price seemed strong in the moment, but then, bitcoin caught up with the fall of indices...

The fundamental background for bitcoin is unstable:

First of all, the price has hardly reacted in any way to the introduction of tariffs, backlash and economic data. The Fed is not giving a clear signal, the market is in uncertainty. Any info noise ( China, Fed rhetoric, company reports ) can cause shake-ups. But at the same time, the same old problems remain: the crypto community is not getting any support. Bitcoin's dominance is growing against the backdrop of its decline. Altcoins continue to storm the bottom.

Technically , the situation is weak, the price cannot update local highs and consolidate above any strong support. It is possible to retest the trend resistance, or the zone of interest 85590 before the reversal and fall. Or, emphasis on the trigger 81187. A breakdown will provoke an impulse.

Resistance levels: trend, 85585, 88840.

Support levels: 81187, 78170, 73500

Buying in the medium term can be considered either after reaching the main target - 73-66K, or after the exit from the descending channel and price fixation above 88840. Now the emphasis is on a possible fall either from the resistance 85580, or when the support 81180 is broken

Regards R. Linda!

Wedge

Bitcoin Holding PRZ Support Lines – Is a Weekend Rebound Coming?First of all, I would like to say that the Trading Volume is generally low on Saturdays and Sundays , so I don't expect the Support Lines and Potential Reversal Zone(PRZ) [$82,340-$82,000 ] to break. Of course, we should always be prepared for any scenario.

Bitcoin ( BINANCE:BTCUSDT ) is moving near the Support lines and PRZ , and with the help of the Failed Falling Wedge Pattern , Bitcoin has declined in the last few hours .

Educational Note : In technical analysis, if a Reversal Pattern fails , it often acts as a Continuation Pattern instead .

I expect Bitcoin to trend upward in the coming hours and be able to reach the targets I have outlined on the chart.

Note: If Bitcoin touches $81,900, we should most likely expect more dumping.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EUR/JPY Falling Wedge Breakout | Bullish Potential Ahead🔍 Chart Overview: EUR/JPY – Daily Timeframe

This chart illustrates the price action of the Euro against the Japanese Yen and highlights a Falling Wedge Pattern developing over several months. This is a classic bullish continuation/reversal setup, supported by key technical levels.

📐 1. Chart Pattern: Falling Wedge

A falling wedge is a bullish chart pattern that occurs when the market consolidates between two downward-sloping trendlines.

Characteristics Seen in the Chart:

Converging Trendlines: The upper (resistance) and lower (support) boundaries are both sloping downward, indicating a narrowing price range.

Volume (not shown) usually decreases during the formation, followed by a surge on breakout.

Multiple Touch Points: The price action respects both boundaries multiple times, confirming the pattern's validity.

🏛️ 2. Key Levels

✅ Support Level (Demand Zone):

Marked around 156.000 – 158.000

Multiple bounces from this area, indicating strong buying interest.

Aligned with the lower wedge trendline and historical price reaction zones.

🚫 Resistance Level (Supply Zone / Breakout Zone):

Around 164.500 – 166.000

Price repeatedly failed to break this level, confirming it as a strong supply area.

Confluence of horizontal resistance and the upper wedge boundary.

📊 3. Trade Setup

💼 Entry Strategy:

Confirmation Buy: Enter a long position upon a daily candle close above the wedge resistance (around 166.000).

Aggressive traders may consider an earlier entry near the wedge’s support with a tight stop.

🎯 Target:

The projected target is 172.962, calculated based on the height of the wedge pattern added to the breakout point.

This aligns with a previous swing high area, serving as a logical profit-taking zone.

🛑 Stop Loss:

Positioned at 155.576, just below the key support zone.

This allows the trade room to breathe while protecting against a full pattern failure.

⚖️ 4. Risk Management

Risk-to-Reward Ratio (RRR): Target around 172.962 and Stop Loss at 155.576 offer a favorable RRR of approximately 2.5:1 or more, depending on entry.

Position Sizing: Use appropriate lot size based on your account risk tolerance (e.g., 1-2% of equity per trade).

📅 5. Timeframe Outlook

Medium to Long-Term Setup: Since this is a daily chart, the trade may take weeks to months to fully play out.

Patience and proper trade management are essential.

🔎 6. Additional Notes

Retest Opportunity: If price breaks out, look for a retest of the resistance zone as new support before continuation to the upside.

Fundamental Factors: Keep an eye on EUR and JPY economic data, ECB and BoJ policy announcements, and global risk sentiment, which can influence the pair.

🧭 Professional Takeaway

This is a textbook bullish falling wedge pattern within a well-defined technical structure. The chart provides:

A clear pattern breakout level,

Strong historical support/resistance zones,

A defined risk management plan,

And a realistic price target based on technical projection.

If you are a swing trader or position trader, this setup offers a high-probability opportunity with favorable risk-reward dynamics—provided a breakout is confirmed.

JPY/USD Daily Chart – Falling Wedge Breakout & Bullish Target🔍 Full Technical Analysis of JPY/USD (Daily Timeframe)

🧭 Overview

The chart shows a sophisticated price structure unfolding over several months. A falling wedge reversal pattern formed during a sustained downtrend, which later transitioned into a bullish breakout and continuation. This analysis provides insights into market behavior, price psychology, and a high-probability trading opportunity supported by classical technical analysis principles.

🔶 1. Market Context & Structure

Before diving into the pattern, it’s essential to understand the macro structure of the chart:

The pair experienced a strong bearish move from around August to December 2024, marked by lower highs and lower lows.

During this decline, volatility gradually decreased, which often indicates seller exhaustion.

A reversal zone emerged near a major support region — historically significant and previously tested.

🔷 2. The Falling Wedge Pattern (Reversal Signal)

A falling wedge is a bullish reversal pattern that forms when price is in a downtrend but begins to consolidate within converging trendlines. This pattern typically signals that the downtrend is losing momentum and a breakout to the upside is imminent.

📌 Characteristics of This Wedge:

Downward Convergence: The highs and lows begin to narrow over time, indicating reduced selling pressure.

Volume Decline (Implied): Though not displayed, falling wedges usually see volume dry up before breakout.

Duration: This wedge developed over several months (October 2024 – January 2025), lending strength to the pattern.

False Break Attempts: Several lower spikes failed to break the support, showing buying interest building.

✅ Bullish Breakout:

The breakout occurred decisively in late January 2025, with a large bullish candlestick closing above the upper wedge boundary — a confirmed breakout.

Post-breakout, the price rallied strongly, indicating that buyers were firmly in control.

🔷 3. Support & Resistance Zones

🔽 Support Zone (Demand Area):

Range: 0.006300 – 0.006400

Historical pivot zone where price previously reversed, now serving as a demand base.

The lower wick rejections near this zone reinforce it as a high liquidity zone for buyers.

🔼 Resistance Zone (Supply Area):

Range: 0.006850 – 0.006950

This area capped price during several prior rally attempts, making it a key breakout point.

Once price broke above this zone, it became a support flip zone, indicating trend reversal confirmation.

🎯 Target Level:

Marked at 0.007126, derived from a measured move:

Measure the height of the wedge at its widest point.

Project this vertically from the breakout level.

This target aligns with psychological round numbers and prior resistance, adding confluence.

🔶 4. Post-Breakout Price Action: Bullish Retest

A breakout is only the first part of a trade; the retest phase confirms the move and offers an optimal entry.

🔁 Retest Details:

After reaching the resistance zone, price pulled back, testing both:

The broken wedge trendline (now acting as dynamic support).

The horizontal structure support zone near 0.006650–0.006700.

A bullish engulfing candle or similar reversal pattern formed at this level — a classic retest entry.

📌 Trendline Respect:

A rising dotted trendline was drawn from the breakout low through higher lows.

This line acted as price memory and was respected multiple times, reinforcing the uptrend.

🔷 5. Trade Setup Breakdown

This is a swing trade setup based on pattern breakout, structural confluence, and trend continuation. Here's how it’s structured:

Component Details

Pattern Falling Wedge (Reversal)

Trade Bias Long (Buy)

Entry Price ~0.006700

Stop Loss 0.006614 (below trendline)

Target Price 0.007126 (measured wedge move)

R/R Ratio Approx. 3:1

Timeframe Daily (Medium-term swing)

🧠 6. Market Psychology & Behavior

Understanding the sentiment behind the candles is critical:

❗ Before the Breakout:

Sellers dominated but with weakening momentum.

Each push down was met with buying strength, seen in long wicks and smaller-bodied candles.

✅ At the Breakout:

Buyers overwhelmed sellers, often with a volume spike and wide-bodied green candle.

This is usually driven by institutional positioning and stop-loss triggering from short-sellers.

🔁 During the Retest:

Some retail traders exited prematurely, fearing a fakeout.

Smart money used the dip to accumulate positions, confirmed by the bounce from trendline.

🔼 Continuation Rally:

Strong continuation candle signals momentum traders entering.

Break above resistance signals a shift in sentiment and structure.

🛠️ 7. Strategy Notes & Professional Tips

📌 Risk Management:

Never risk more than 1–2% of capital.

Use dynamic trailing stop if price breaks above target zone.

📌 Trade Confirmation Ideas:

Look for volume spikes on breakout candles.

Use RSI or MACD divergence to confirm reversal (optional).

Look for candlestick patterns (engulfing, pin bar) on retests.

📌 Exit Plan:

Partial exit at key resistance.

Full exit at projected target or if price forms reversal signs (e.g., doji at resistance).

✅ Final Summary

This JPY/USD chart demonstrates an exemplary price action-based trading setup rooted in:

A well-formed falling wedge (bullish reversal).

Clean breakout + retest + continuation structure.

Multiple confluence factors: trendline, horizontal S/R, pattern projection.

Professional-grade risk/reward profile with a logical entry, stop, and target.

This kind of setup is highly favored among swing traders, price action purists, and institutional-level strategists due to its clarity and predictability.

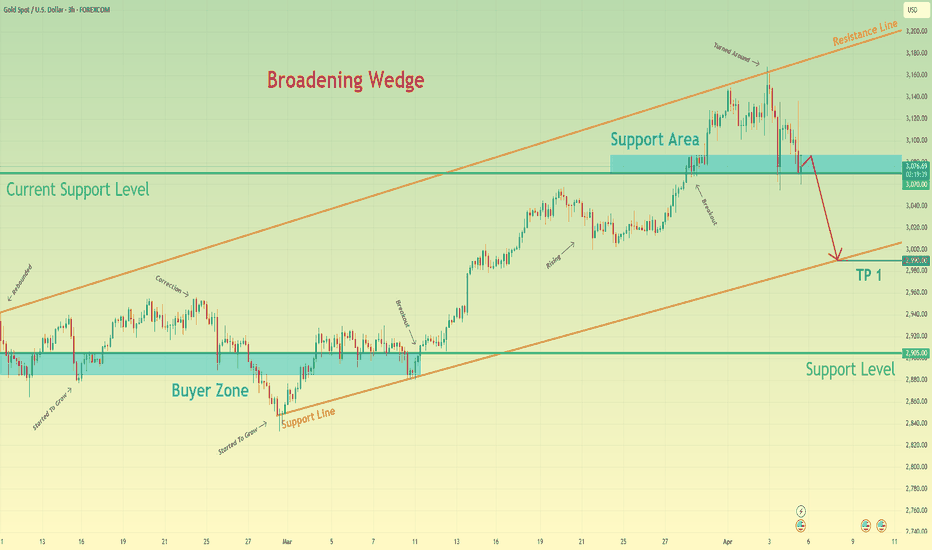

Gold may break support level and continue to decline nextHello traders, I want share with you my opinion about Gold. The price started to grow from the buyer zone between 2885–2905 points, forming a clean bullish impulse and entering a broadening wedge structure. During the uptrend, Gold made several rebounds from the support line and broke above the current support level at 3070, which later became a key point in the price structure. After reaching the resistance line of the wedge, the price turned around and began a downward correction. The decline brought it back into the support area between 3087–3070 points, but this zone has already failed to hold the momentum. Currently, XAU is trading below the upper boundary of the support area and showing clear signs of weakness. The breakout to the downside from the wedge structure has already taken place, and the price is starting to form a local pullback. I expect this pullback to be short-lived, followed by a continuation of the downward movement. My target for this move is the 2990 level, which aligns with the support line of the broadening wedge and serves as the next strong reaction zone. Given the failed rebound from resistance, the breakdown of the support area, and the structure of the broadening wedge, I remain bearish and expect Gold to continue declining toward TP 1 — 2990 level. Please share this idea with your friends and click Boost 🚀

Downside Risk Grows for NZD/USD After Structure FailThe NZD/USD pair has broken down from a well-defined rising wedge pattern, signaling a shift in short-to-medium term momentum. After trending within this rising structure for several weeks, price has now decisively violated the lower trendline, confirming a bearish breakout. The move coincides with a sharp rejection near the 200 EMA, which continues to act as dynamic resistance overhead.

Price is now hovering around a key support zone between 0.555 and 0.558 — a level that has historically served as a pivot point. The breakdown is also supported by a clear bearish RSI divergence, where price made higher highs while RSI formed lower highs, indicating weakening momentum. Currently, the RSI sits at around 32.47, approaching oversold territory but not yet showing signs of bullish reversal.

If the current support zone fails to hold, we could see further downside pressure, potentially driving the pair toward the next major support region near 0.548–0.540. On the other hand, if buyers step in and absorb the sell-off at these levels, a relief bounce toward the broken trendline or the 200 EMA could be expected — though such a move may face strong resistance.

$SPY #RisingWedge #BreakDOWN #ReTest #RecessionI highlighted the potential topping formation that could for especially if we see a rejection around 598-601 on XMas EVE via #XMasAlert.

This morning I am seeing signs of momentum wearing off PLUS what looks like a #BreakDOWN-ReTEST of a rising wedge look to the AMEX:SPY , check my TSLA to 420.69 Chart for conceptualization of this break out BELOW;

In my post 2 days ago () I mentioned Strikes TBD.

Well here are my favorites;

SPY 560P 3.21 (Bigger Risk Reward)

SPY 600P 3.21 (Essentially ATM Short w some Leverage)

-Prophecies

PS;

1) "I LOVE GOLD" - Fat BastarD

2) DONT OVER LOOK GOLD SAFETY HAVEN VIA CRYPTOCAP:BTC Headwinds?

3) And Don't Overlook NASDAQ:TSLA momentum... TO UPSIDE STILL (500Cs will be a play at somepoint this year #StayTuned)

EUR/GBP (1H) – Rising Wedge Breakdown & Short Trade Setup1. Overview of Market Structure

The EUR/GBP pair is forming a Rising Wedge Pattern, a well-known bearish reversal formation, which suggests that the current uptrend may soon reverse into a downtrend. The price has been moving within a tightening range, making higher highs and higher lows, but the upward momentum appears to be weakening.

A breakdown from this wedge is a strong bearish signal, indicating that sellers are gaining control, and a significant price drop is expected.

2. Chart Pattern: Rising Wedge – Bearish Reversal

A Rising Wedge is a pattern that occurs when price moves upward within a contracting range. This pattern typically forms after an uptrend and suggests that bullish momentum is slowing down.

Characteristics of the Rising Wedge in This Chart:

The price has tested the upper resistance zone multiple times, but each attempt has resulted in a rejection.

The lower support trendline has been tested frequently, showing that buyers are losing strength.

The breakdown of the wedge signals a strong bearish move, with price expected to drop toward key support levels.

This pattern becomes valid once the price breaks below the lower trendline, confirming the bearish outlook.

3. Key Technical Levels & Zones

A. Resistance Zone (0.84853) – Strong Supply Area

Marked as a Resistance Zone, where price has struggled to break through.

Sellers have stepped in around this level multiple times, preventing any further bullish movement.

Acts as a major stop-loss level for bearish trades, as a breakout above this zone could invalidate the setup.

B. Support Zones (Potential Take-Profit Targets)

1st Support Level (TP1) – 0.82539

This level has previously acted as strong support, where buyers have entered the market before.

A short-term pullback or consolidation may occur here.

2nd Support Level (TP2) – 0.81332

This is the final bearish target, marking a key demand zone from where price has bounced in the past.

If bearish momentum continues, price could reach this level, making it an ideal take-profit zone for swing traders.

4. Trading Strategy & Execution

A. Entry Strategy

A short trade is ideal after the price breaks below the rising wedge pattern. There are two possible entries:

Aggressive Entry:

Enter immediately after the breakout of the lower trendline, anticipating strong downside momentum.

Higher risk as price might retest the trendline before moving down.

Conservative Entry:

Wait for a retest of the broken trendline before entering short.

This confirms the breakdown, reducing false breakout risks.

B. Stop-Loss Placement

Stop-loss should be placed just above the resistance zone (0.84853).

This prevents being stopped out by minor pullbacks before the actual move happens.

C. Take-Profit Targets

TP1: 0.82539 (First major support level – potential profit booking area)

TP2: 0.81332 (Final bearish target – strong demand zone)

5. Risk Management & Trade Management

Risk-to-Reward Ratio (RRR)

This trade offers a high RRR, making it an attractive setup.

The stop-loss is small compared to the potential downside move.

Trailing Stop Strategy

A trailing stop can be used to lock in profits as price moves lower.

If price reaches TP1, move stop-loss to breakeven to secure capital.

If price reaches TP2, close the trade for maximum profit.

Exit Strategy

Exit early if price fails to break key support zones.

Monitor price action around TP1 & TP2 for signs of reversal.

6. Sentiment Analysis & Market Context

Bearish Confirmation:

Breakdown from the wedge signals bearish sentiment in the market.

If price fails to sustain above support zones, further downside is likely.

News & Fundamentals:

Major economic events or interest rate decisions could impact EUR/GBP volatility.

Traders should check for UK & Eurozone news before entering the trade.

7. Conclusion – Bearish Outlook

The Rising Wedge breakdown is a strong short-selling opportunity.

Confirmation is key: Enter short after the breakdown, use proper risk management, and aim for TP1 & TP2.

If price invalidates the pattern by breaking above 0.84853, the trade setup should be reconsidered.

This setup provides a high-probability bearish trade with a well-defined stop-loss and risk-to-reward ratio.

JPY/USD – Rising Wedge Breakdown & Bearish Trading Setup1. Market Structure & Technical Pattern:

The Japanese Yen (JPY) against the U.S. Dollar (USD) has been exhibiting a clear Rising Wedge Pattern over the past few months. This is a classic bearish reversal pattern, indicating that buying momentum is gradually weakening, and a strong decline is likely to follow.

Formation of the Rising Wedge:

The price has been making higher highs and higher lows, confined within two converging trendlines (black lines).

The lower boundary (support trendline) has been consistently acting as a dynamic support level.

The upper boundary (resistance trendline) has been limiting further upward movement, indicating exhaustion of buying pressure.

Breakout Confirmation:

The price action tested the resistance zone multiple times but failed to sustain bullish momentum.

A strong rejection from the upper resistance level led to a sharp sell-off, causing a breakdown of the support trendline.

Once the price broke below the wedge, selling pressure intensified, confirming the trend reversal.

2. Key Technical Levels & Zones:

Resistance Level (0.006895):

The price previously struggled to break above this resistance zone, forming a strong supply area where sellers dominated.

This level aligns with the upper boundary of the rising wedge, making it a significant turning point.

The rejection from this zone initiated the bearish breakdown.

Support Level (Broken – 0.006650):

This level acted as a strong demand zone, preventing further downside movement during the wedge formation.

However, once the price broke below this level, it confirmed the end of the uptrend and the beginning of a downtrend.

This level may now act as a new resistance (role reversal principle).

Stop Loss Placement (Above 0.006895):

A logical stop-loss is placed just above the resistance level to protect against a potential invalidation of the bearish setup.

If the price closes above this level, the bearish thesis would be invalidated.

3. Trading Execution & Risk Management:

Sell Entry Strategy:

Traders looking for short positions should enter after a confirmed break below the wedge’s support.

A potential pullback (retest) to the broken trendline could offer an additional shorting opportunity.

The retest would confirm the previous support turning into resistance before a continuation of the downtrend.

Take Profit Targets (TP1 & TP2):

TP1 (0.006481):

This level represents a strong demand zone where short-term buyers may step in.

Traders may choose to book partial profits here.

TP2 (0.006251):

This is a deeper support level and the final target for this trade setup.

If the price sustains bearish momentum, it is likely to reach this level before stabilizing.

Risk-to-Reward Ratio Consideration:

This setup offers a high probability short trade with an attractive risk-to-reward ratio.

The stop-loss is well-defined, minimizing potential losses while maximizing profit potential.

4. Expected Price Movement & Projection:

Short-term Outlook:

A possible pullback to the broken wedge (previous support now acting as resistance) before continuation lower.

If the price retests and rejects the 0.006650 level, expect acceleration in the downtrend.

Medium-term Outlook:

If the price reaches TP1 (0.006481) and breaks below, it increases the probability of hitting TP2 (0.006251).

A bearish trend continuation could form, potentially leading to further downside levels.

Invalidation Scenario:

If the price closes above the stop-loss level (0.006895), the bearish setup is invalidated, and a bullish breakout could follow instead.

5. Conclusion & Trading Plan:

The rising wedge breakdown signals a shift from bullish to bearish market sentiment.

Traders should look for short entries after a confirmed breakdown or wait for a pullback before executing trades.

The risk-to-reward ratio makes this a strong high-probability trade setup.

Following the plan with strict stop-loss placement ensures risk is controlled while maximizing profit potential.

6. Summary & Key Takeaways:

✅ Pattern: Rising Wedge (Bearish Reversal)

✅ Breakout Direction: Downside

✅ Resistance Level: 0.006895

✅ Support Levels: 0.006650 (broken), 0.006481 (TP1), 0.006251 (TP2)

✅ Stop-Loss Placement: Above 0.006895

✅ Profit Targets: TP1 – 0.006481, TP2 – 0.006251

✅ Trade Bias: Bearish

Chainlink LongAfter a few months of waiting on the sidelines we are back with a chainlink long after a deep retrace.

Link is showing bullish divergence on the lower timeframes after double bottoming at this crucial support and completing an 886 retracement of an informal Gartley. The support level can be seen across time below.

The only question would be to either wait until the end of the day for this support candle to print or to go in now before confirmation. We will go in with 50% of our ideal position size now and then allocate at the end of the day or tomorrow.

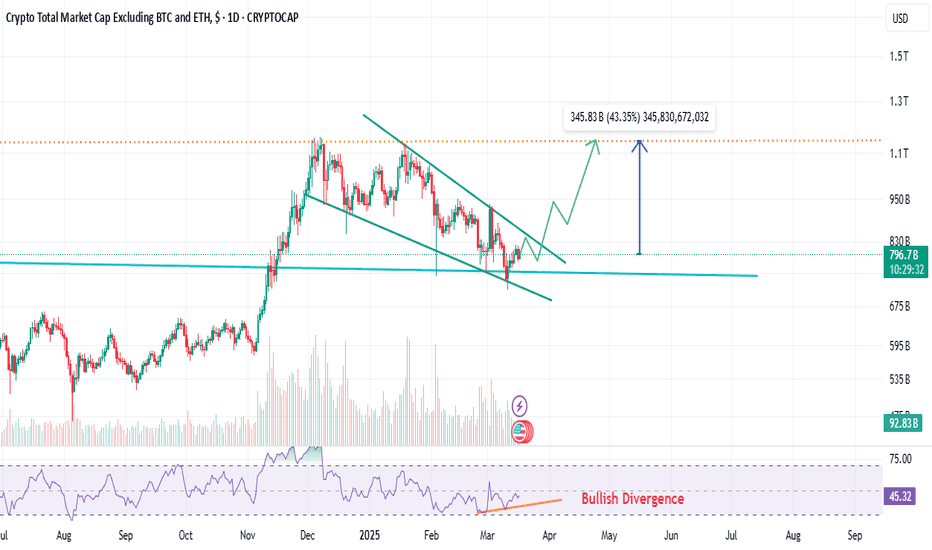

Altcoins' Market Cap is About to Reclaim $1 Trillion..!Hello Traders 🐺

In my last idea about Altcoins' total market cap, I talked about the midterm price targets. Now, in this idea, I want to focus on the short-term volatility. As you can see in the chart, the price is already in a falling wedge pattern, and the target of the falling wedge is the top of the wedge. This means we are about to see a nice bounce in Altcoins, which could break BTC.D's upward movement and lead to a bigger correction.

In my opinion, in this case, we can also treat this pattern as a bull flag, and the target will vary accordingly. If you want to know more about the price target for TOTAL3, you can check my previous idea, where I also mentioned my final price target for this Altcoin Season. I hope you enjoy this idea! Don’t forget to like and follow! 🚀🔥

🐺 KIU_COIN 🐺

Be careful with TRX !!!As you can see, the price has now formed an ascending wedge , which is promising. The price could rise to $0.27 after breaking this wedge...

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Gold (XAU/USD) – Rising Wedge Breakdown & Bearish SetupOverview

Gold (XAU/USD) has been in a strong uptrend, making consistent higher highs and higher lows. However, the price action has formed a Rising Wedge Pattern, which is typically a bearish reversal formation. This pattern suggests that the bullish momentum is weakening, and a potential sell-off could follow.

The recent breakdown of the wedge structure confirms the bearish bias, and sellers are now in control. Based on price action analysis, we can anticipate further downside movement toward key support levels.

📊 Technical Analysis – Rising Wedge Breakdown

1️⃣ Understanding the Rising Wedge Pattern

The Rising Wedge is a bearish pattern that occurs when the price consolidates within an upward-sloping channel but shows signs of exhaustion. Here’s how it developed:

Higher Highs & Higher Lows: The price consistently formed higher peaks and troughs, indicating an uptrend.

Declining Bullish Momentum: As the wedge progressed, price action became increasingly squeezed, showing reduced bullish strength.

Breakout Confirmation: Once the lower trendline of the wedge was breached, it confirmed that buyers were losing control and that sellers had stepped in.

2️⃣ Key Levels & Market Structure

🔵 Resistance Level: The upper boundary of the wedge around $3,150 - $3,163 acted as a supply zone, where sellers pushed prices lower.

🟠 Support Level: The lower boundary of the wedge, around $3,100 - $3,120, initially provided demand but eventually failed to hold.

🔻 Breakdown Confirmation: The price broke below the wedge, which is a strong bearish signal.

🎯 Trade Setup & Strategy

3️⃣ Bearish Trading Plan

Given the breakdown of the wedge pattern, the setup favors a short (sell) trade. Here’s how to approach it:

📉 Sell Entry:

The ideal short position is initiated after a confirmed break of the wedge’s support level.

📍 Stop Loss (SL):

A tight stop-loss is placed above the previous resistance at $3,163.67, ensuring risk is controlled if the trade goes against the bias.

🎯 Take Profit (TP) Targets:

TP 1: $3,080.66 – First major support level, where buyers might step in temporarily.

TP 2: $3,057.33 – Extended downside target, offering a greater risk-to-reward ratio.

4️⃣ Additional Price Expectations

Retest of the Wedge Breakdown: The price may pull back to the broken wedge support before continuing downward.

Stronger Bearish Momentum: If selling pressure remains strong, price could fall even lower, breaking TP 2.

Invalidation Level: If price climbs above $3,163, the wedge breakdown would be invalidated, signaling that bulls have regained control.

📌 Conclusion & Market Sentiment

🔹 Rising Wedge Breakdown Signals Further Downside – The market structure suggests that sellers are gaining control.

🔹 Sell Setup with Risk-Managed Approach – With a defined stop-loss and two profit targets, this trade offers a favorable risk-to-reward setup.

🔹 Gold’s Short-Term Bearish Outlook – The chart confirms a potential correction, and price may drop towards $3,080 and $3,057 if the bearish momentum continues.

📊 Final Thought:

This is a high-probability short trade based on classic technical analysis. Traders should monitor for confirmation retests and manage risk accordingly. ✅

Would you like any refinements or additional insights? 🚀

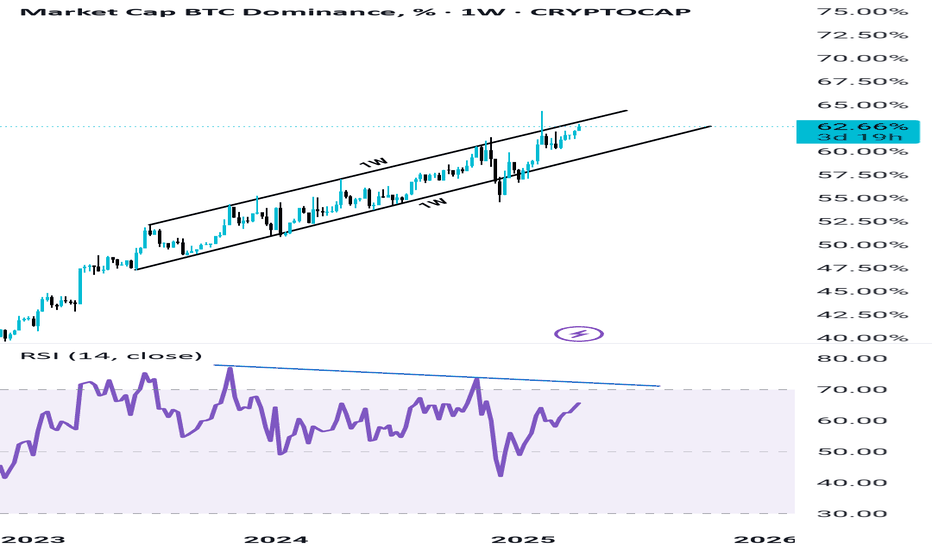

BTC DOMINANCE in Rising wedge Pattern BTC Dominance Showing Signs of Weakness – Altseason Incoming?

BTC dominance is finally topping out, displaying clear signs of weakness. Rising wedge Pattern forming on weekly time frame which is also bearish. Despite reaching new highs, momentum appears to be fading, with bearish RSI divergence further confirming the exhaustion. All indicators point towards an imminent breakdown in BTC dominance, potentially triggering a long-awaited Altseason in the coming days. Stay prepared for major moves in the altcoin market!

1. Weakness in the uptrend =Bearish

2. Rising wedge Pattern = Bearish

3. RSI divergence on weekly = Bearish

All things indicating towards upcoming Bearish trend for BTC Dominance.

What do you think share your thoughts in the comments.

🚀 🚀 🚀 🚀

This is not a Financial Advise

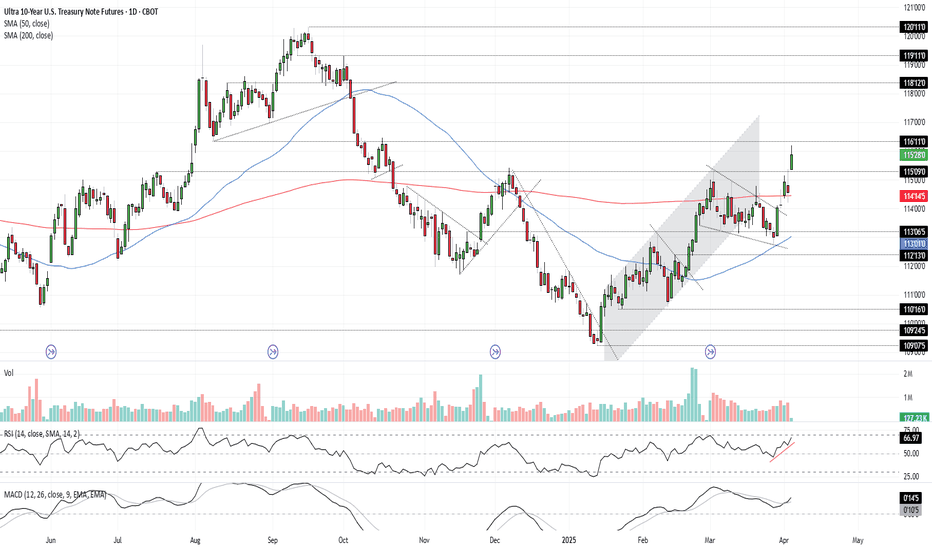

Bonds Don’t Lie: The Signal is ClearU.S. 10-year Treasuries are a crucial cog in the global financial machine, serving as a benchmark borrowing rate, a tool for asset valuation, and a gauge of the longer-term outlook for U.S. economic growth and inflation.

As such, I keep a close eye on 10-year note futures, as they can offer clues on directional risks for bond prices and yields. The price action over the past few days has sent a clear and obvious signal as to where the risks lie: prices higher, yields lower.

Futures had been grinding lower within a falling wedge for several weeks but broke higher last Friday on decent volumes following soft U.S. household spending data. It has since extended bullish the move, reclaiming the 200-day moving average before surging above key resistance at 115’09’0 after Trump’s reciprocal tariff announcement on Wednesday.

RSI (14) is trending higher but isn’t yet overbought, while MACD has crossed the signal line above 0, confirming the bullish momentum signal. That favours further upside, putting resistance at 116’11’0 and 118’12’0 on the immediate radar. For those who prefer it expressed in yield terms, that’s around 4% and 3.8% respectively.

Good luck!

DS

EUR/USD: Bullish Falling Wedge Breakout Towards TargetLet’s analyze the 1-hour candlestick chart of EUR/USD (Euro / U.S. Dollar) on TradingView, published by GoldMasterTraders on April 2, 2025, at 19:04 UTC. The chart highlights a trading setup based on a Falling Wedge pattern, indicating a potential bullish breakout. I’ll describe the chart pattern and the trading setup in detail.

Chart Pattern: Falling Wedge

Pattern Description

Type: The chart identifies a Falling Wedge pattern, which is a bullish chart pattern that typically signals a reversal or continuation of an uptrend. A Falling Wedge forms when the price consolidates between two downward-sloping trendlines that converge over time, with the upper trendline (resistance) sloping more steeply than the lower trendline (support).

Appearance on the Chart:

The Falling Wedge is clearly marked with two converging trendlines:

Upper Trendline (Resistance): Connects the lower highs, sloping downward.

Lower Trendline (Support): Connects the lower lows, also sloping downward but at a less steep angle.

The pattern began forming around March 19, after a sharp decline from 1.9400 to 1.8700, and continued until the breakout on April 2, 2025.

Breakout Direction:

Falling Wedges are typically bullish, meaning the price is expected to break out to the upside. The chart shows the price breaking above the upper trendline of the wedge around April 2, 2025, with a strong bullish candle, confirming the breakout.

The breakout level is around 1.90840, and the price has moved slightly above this level, closing at 1.90864 at the time of the chart.

Key Levels and Trading Setup

1. Support Level

A horizontal support zone is marked around 1.90730 (approximately 1.9070–1.9080).

This level acted as a base during the wedge formation, with the price bouncing off this zone multiple times (e.g., on March 23 and March 30).

The support level aligns with the lower boundary of the wedge, reinforcing its significance as a key area of buying interest.

2. Resistance Level

A resistance zone is marked around 1.92000 (approximately 1.9190–1.9210).

This level corresponds to a previous high reached on March 19, before the wedge formation began. It represents a significant barrier where selling pressure previously emerged.

After the breakout, the price is expected to test this resistance as part of the bullish move.

3. Target

The target for the breakout is projected at 1.92110.

This target is likely calculated by measuring the height of the wedge at its widest point (from the highest high to the lowest low within the pattern) and projecting that distance upward from the breakout point.

The chart indicates a potential move of 0.00435 (0.40%), which aligns with the distance from the breakout level (around 1.90840) to the target (1.92110).

4. Stop Loss

A stop loss is suggested below the support level at 1.90730.

This placement ensures that if the breakout fails and the price falls back into the wedge, the trade is exited with a manageable loss.

The stop loss is just below the breakout level (1.90840), with a distance of approximately 0.00110, representing the risk on the trade.

Trading Setup Summary

Entry:

The setup suggests entering a long (buy) position after the price breaks out above the upper trendline of the Falling Wedge, which occurred around April 2, 2025. The breakout is confirmed by a strong bullish candle closing above the trendline at approximately 1.90840.

Stop Loss:

Place a stop loss below the support level at 1.90730 to protect against a false breakout or reversal. The distance from the breakout level (1.90840) to the stop loss (1.90730) is 0.00110, or about 0.06% of the entry price.

Take Profit/Target:

Aim for the target at 1.92110, which is near the next significant resistance level. The distance from the breakout level to the target is 0.01270, or a 0.40% move.

Risk-Reward Ratio:

The risk is 0.00110 (from 1.90840 to 1.90730), and the reward is 0.01270 (from 1.90840 to 1.92110), giving a risk-reward ratio of approximately 11.55:1 (0.01270 / 0.00110). This is an exceptionally high risk-reward ratio, making the setup very attractive, though traders should ensure the breakout is well-confirmed due to the tight stop loss.

Additional Observations

Price Action Context:

Before the wedge formed, the price experienced a sharp decline from 1.9400 (March 13) to 1.8700 (March 19), indicating a strong bearish trend.

The Falling Wedge represents a consolidation phase within this downtrend, and the upside breakout suggests a potential reversal or at least a corrective move higher.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of a Falling Wedge breakout would include:

An increase in volume on the breakout candle, indicating strong buying interest.

Bullish momentum signals, such as an RSI above 50 or a bullish MACD crossover.

Traders might want to check these indicators for additional confirmation of the breakout’s strength.

Timeframe:

This is a 1-hour chart, so the setup is intended for short-term trading, with the target potentially being reached within a few hours to a day.

Market Context:

EUR/USD is influenced by factors like U.S. dollar strength, Eurozone economic data, and interest rate differentials. A bullish move in EUR/USD could be driven by a weaker dollar (e.g., due to dovish U.S. economic data) or positive Eurozone developments.

Conclusion

The TradingView idea presents a bullish setup for EUR/USD based on a Falling Wedge pattern on the 1-hour chart. The price has broken above the wedge’s upper trendline, confirming a bullish move with a target of 1.92110. The setup includes a stop loss at 1.90730 to manage risk, offering an impressive risk-reward ratio of 11.55:1. Key levels to watch include the support at 1.90730 and the resistance at 1.92000. Traders should consider additional confirmation from volume and momentum indicators, as well as broader market conditions, before executing the trade. Since this chart is from April 2, 2025, market conditions may have evolved, and I can assist with searching for more recent data if needed!

XAG/USD Bullish Setup - Falling Wedge Breakout Towards TargetChart Overview

Asset: Silver / U.S. Dollar (XAG/USD)

Timeframe: 1-hour (1H)

Date and Time: Published on April 2, 2025, at 11:17 UTC

Publisher: GoldMasterTraders on TradingView

Current Price (at the time of the chart):

Open: 33.82300

High: 33.89005

Low: 33.79435

Close: 33.88880

Change: -0.05780 (-0.20%)

Price on the Right Axis: The price scale ranges from approximately 32.80000 to 35.25000, with the current price around 33.88880.

Chart Elements and Technical Analysis

1. Candlestick Price Action

The chart displays a 1-hour candlestick representation of XAG/USD, showing price movements from late March to early April 2025.

Trend Context:

Prior to the formation of the pattern, the price experienced a sharp rally from around 32.80000 (March 21) to a high near 34.60000 (March 27). This indicates a strong bullish trend.

Following this rally, the price entered a consolidation phase, forming lower highs and lower lows, which is characteristic of the Falling Wedge pattern.

Recent Price Action:

On April 2, the price appears to have broken out of the wedge pattern, closing above the upper trendline with a strong bullish candle. The current price of 33.88880 is above the breakout level, suggesting a potential continuation of the uptrend.

2. Chart Pattern: Falling Wedge

Pattern Identification:

The chart highlights a Falling Wedge pattern, a bullish chart pattern that can act as either a reversal or continuation pattern. In this case, given the preceding uptrend, it’s likely a continuation pattern.

A Falling Wedge is characterized by two converging trendlines:

Upper Trendline (Resistance): Connects the lower highs, sloping downward.

Lower Trendline (Support): Connects the lower lows, also sloping downward but at a less steep angle than the upper trendline.

The wedge started forming around March 27, after the price peaked near 34.60000, and continued until the breakout on April 2.

Pattern Dynamics:

The narrowing range between the trendlines indicates decreasing selling pressure and a potential buildup of buying interest.

Falling Wedges typically resolve with a breakout to the upside, as the price breaks above the upper trendline, signaling a resumption of the prior trend (bullish in this case).

Breakout Confirmation:

The price broke above the upper trendline of the wedge on April 2, with a strong bullish candle closing at 33.88880. This breakout is a key signal for a potential upward move.

The breakout level appears to be around 33.85000–33.90000, and the price is currently holding above this level, which is a positive sign for bulls.

3. Key Support and Resistance Levels

Support Level:

A horizontal support zone is marked around 33.58553 (approximately 33.58–33.60).

This level acted as a significant support during the wedge formation, with the price bouncing off this zone multiple times (e.g., on March 28 and March 31).

The support level aligns with the lower boundary of the wedge, reinforcing its importance as a key area of buying interest.

Resistance Level:

A resistance zone is marked around 34.60000 (approximately 34.60–34.80).

This level corresponds to the high reached on March 27, before the wedge formation began. It represents a significant barrier where selling pressure previously emerged.

After the breakout, the price is expected to test this resistance as part of the bullish move.

Target Level:

The target for the breakout is projected at 34.82470 (approximately 34.82).

This target is likely calculated using the standard method for wedge patterns: measuring the height of the wedge at its widest point (from the highest high to the lowest low within the pattern) and projecting that distance upward from the breakout point.

The target of 34.82470 is just above the resistance zone, suggesting that a break above 34.60000 could lead to further upside toward this level.

4. Stop Loss and Risk Management

Stop Loss:

The stop loss is suggested below the support level at 33.58553.

Placing the stop loss below this level ensures that if the breakout fails and the price falls back into the wedge, the trade is exited with a controlled loss.

The distance from the breakout level (around 33.90000) to the stop loss (33.58553) is approximately 0.31447, which represents the risk on the trade.

Risk-Reward Ratio:

The chart indicates a risk-reward ratio of 0.9467 (2.80% / 9,469.7).

The potential reward is the distance from the breakout level (33.90000) to the target (34.82470), which is approximately 0.92470, or a 2.80% gain.

The risk is the distance to the stop loss (0.31447), making the risk-reward ratio approximately 2.94:1 (0.92470 / 0.31447), which is favorable for a trading setup.

5. Additional Annotations

Arrows and Labels:

A blue arrow labeled “Falling Wedge” points to the pattern, clearly identifying it for viewers.

A green arrow labeled “Support Level” points to the 33.58553 zone, indicating where buyers have stepped in.

A red arrow labeled “Resistance Level” points to the 34.60000 zone, highlighting the next significant barrier.

A blue arrow labeled “Target” points to 34.82470, showing the projected price objective.

A blue arrow labeled “Stop Loss” points to 33.58553, indicating the risk management level.

Price Labels on the Right Axis:

The right axis shows key price levels, with the current ask price at 33.89900 (red) and bid price at 33.88558 (black), reflecting the live market spread.

Trading Setup Breakdown

Based on the chart, here’s the detailed trading setup:

Entry:

Position: Long (buy) XAG/USD.

Entry Point: The setup suggests entering after the price breaks out above the upper trendline of the Falling Wedge, which occurred around 33.85000–33.90000 on April 2.

Confirmation: The breakout is confirmed by a strong bullish candle closing above the trendline, with the current price at 33.88880, slightly below the high of 33.89005 but still above the breakout level.

Traders might wait for a retest of the breakout level (now acting as support) for a safer entry, though this isn’t explicitly suggested in the chart.

Stop Loss:

Level: Place the stop loss below the support level at 33.58553.

Rationale: This placement protects against a false breakout. If the price falls back below the wedge’s upper trendline and breaches the support, the bullish thesis is invalidated, and the trade should be exited.

Risk: The distance from the entry (33.90000) to the stop loss (33.58553) is 0.31447, or approximately 0.93% of the entry price.

Take Profit/Target:

Level: The target is set at 34.82470.

Rationale: This target is derived from the height of the wedge projected upward from the breakout point. It also aligns with a logical extension beyond the resistance at 34.60000.

Reward: The distance from the entry (33.90000) to the target (34.82470) is 0.92470, or approximately 2.80% of the entry price.

Risk-Reward Ratio:

The risk-reward ratio is approximately 2.94:1, which is attractive for a trading setup. For every unit of risk (0.31447), the potential reward is nearly 3 units (0.92470).

Trade Management:

Trailing Stop: Once the price approaches the resistance at 34.60000, traders might consider trailing the stop loss to lock in profits, especially if the price shows signs of stalling.

Partial Profit Taking: Some traders might take partial profits at the resistance level (34.60000) and let the remaining position run toward the target.

Broader Market Context

Trend Analysis:

The broader trend before the wedge was bullish, as evidenced by the rally from 32.80000 to 34.60000. The Falling Wedge, therefore, acts as a consolidation within this uptrend, and the breakout suggests a continuation of the bullish trend.

The price action after the breakout will be critical. A strong move toward 34.60000 with high volume would confirm the bullish momentum.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of a Falling Wedge breakout includes:

Volume: An increase in volume on the breakout candle, indicating strong buying interest.

Momentum: A bullish signal from indicators like RSI (e.g., moving above 50 or 70) or MACD (e.g., a bullish crossover).

Traders should check these indicators to validate the breakout’s strength.

Market Factors:

Silver prices are influenced by factors like U.S. dollar strength, interest rates, inflation expectations, and geopolitical events. On April 2, 2025, traders should consider:

U.S. Dollar Index (DXY): A weakening dollar typically supports higher silver prices.

Economic Data: Key releases like U.S. non-farm payrolls, inflation data, or Federal Reserve statements around this time could impact silver.

Geopolitical Events: Any risk-off sentiment (e.g., due to global tensions) could drive safe-haven demand for silver.

Potential Risks and Considerations

False Breakout:

If the price fails to hold above the breakout level (33.85000–33.90000) and falls back into the wedge, the setup is invalidated. The stop loss at 33.58553 mitigates this risk.

Resistance at 34.60000:

The resistance level has previously capped the price, and there’s a risk of rejection at this level. Traders should watch for bearish price action (e.g., a shooting star or bearish engulfing candle) near 34.60000.

Market Volatility:

Silver can be volatile, especially on a 1-hour timeframe. Unexpected news or economic data could lead to sharp price swings, potentially triggering the stop loss prematurely.

Timeframe Limitations:

This is a short-term setup on a 1-hour chart, so the target might be reached within hours to a couple of days. However, intraday noise could lead to choppy price action, requiring active trade management.

Conclusion

The TradingView chart by GoldMasterTraders presents a well-structured bullish trading setup for XAG/USD based on a Falling Wedge pattern. The price has broken out above the wedge’s upper trendline on April 2, 2025, signaling a potential move toward the target of 34.82470. Key levels include support at 33.58553 (where the stop loss is placed) and resistance at 34.60000, which the price must overcome to reach the target. The setup offers a favorable risk-reward ratio of approximately 2.94:1, making it an attractive trade for short-term traders.

However, traders should confirm the breakout with additional indicators (e.g., volume, RSI) and monitor broader market conditions, as this chart is a snapshot from April 2, 2025, and market dynamics may have evolved since then. If you’d like to search for more recent data on XAG/USD or check the outcome of this setup, I can assist with that!

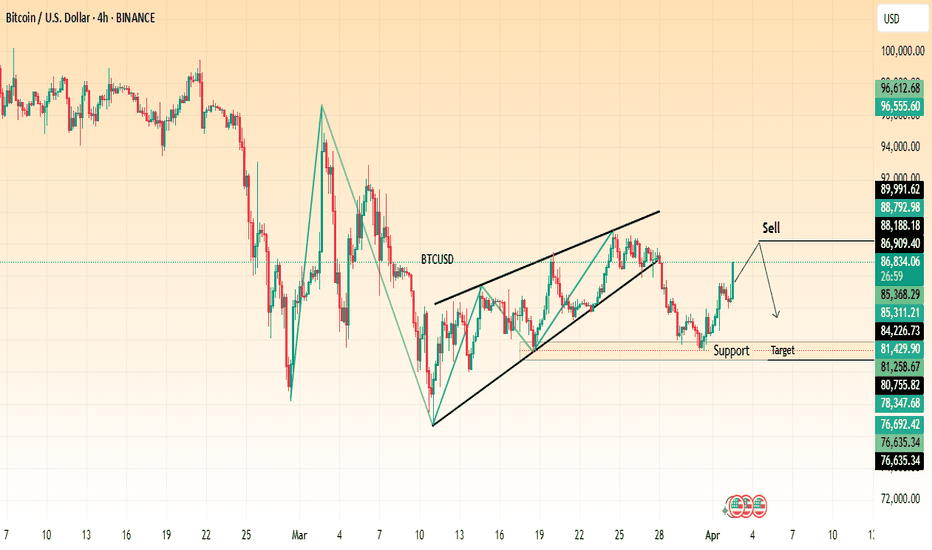

Bitcoin (BTC/USD) Reversal? Rising Wedge Breakdown Signals Sell! The chart suggests a potential bearish move after a rising wedge pattern breakdown.

Key Observations:

Rising Wedge Breakdown:

BTC formed a rising wedge, which is a bearish reversal pattern.

The price has broken down from this wedge, indicating a potential downtrend.

Support and Resistance Levels:

Resistance Zone: Around $88,188 – $88,792, marked as a key level where selling pressure may increase.

Support Zone: Around $85,368 – $84,226, where buyers may step in.

Target: $81,429 – $81,258, a strong support level where price could drop.

Bearish Setup:

The chart suggests a sell opportunity near resistance, expecting a downward move toward the target zone.

Trading Idea:

Entry: Sell near $88,000 after confirmation.

Target: $81,429 – $81,258 (support zone).

Stop-Loss: Above $89,991 (resistance zone).

This setup suggests Bitcoin could decline further, making it a potential short trade opportunity. However, traders should watch for confirmation and overall market sentiment before executing trades.

EURO - Price can bounce from support level to top part of flatHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some days ago, price entered a wedge pattern, bounced down from the resistance line to the support line, and broke the $1.0415 level.

Next, the price turned around and started to grow. In a short time, it rose to the $1.0415 level and broke one more time.

Then, price some time traded between resistance line with $1.0415 level and later corrected to support line of wedge.

After this, EUR made a strong upward impulse, thereby exiting from wedge pattern and starting to trades inside flat.

In flat, price reached top part and then made a correction movement to $1.0735 support level and turned around.

In my mind, Euro can correct to support level and then rise to $1.0950 top part of flat.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Euro may bounce up from support area to 1.0950 pointsHello traders, I want share with you my opinion about Euro. Analyzing the chart, we can observe how the price initially reached the support level that aligned with the buyer zone and broke through it. After that, the Euro moved into a wedge pattern, where it reversed near the resistance line and started to decline sharply toward the support line, forming a strong gap and breaking the support once again. Soon after, the price reversed direction and began to climb, breaking through the 1.0360 level again and rising to the resistance line of the wedge. A brief correction followed, bringing the price back down to the support level. From there, the market made a strong upward impulse, breaking out of the wedge and reaching the current support area. After the breakout, the price started moving within a triangle pattern. It broke above the 1.0785 level and climbed to the resistance line of the triangle. Then, a correction took place down to the support area, followed by a quick bounce back up to the resistance, from where the price recently started to decline. Given this structure, I expect the price to complete its correction at the support area and then bounce upward, breaking out of the triangle pattern. If this plays out, I anticipate further upward movement, with my target set at 1.0950 points. Please share this idea with your friends and click Boost 🚀