DKNG 1W – Technical and Fundamental AnalysisDKNG shares have broken a rising wedge on the weekly chart, reinforcing a bearish signal. The price is testing the $35.29 level after failing to hold above $36.88. A breakdown below $31.74 could accelerate a decline toward $28.67 and $14.89. RSI indicates weakening bullish momentum, MACD shows a bearish crossover, and EMA 50 and EMA 200 confirm a long-term uptrend but signal correction risks.

Fundamentally, DraftKings remains a leader in online gambling, but its stock is sensitive to Fed rate decisions and macroeconomic conditions. The upcoming earnings report could also impact price action. Correlation with the Nasdaq and S&P 500 increases its dependence on overall market sentiment.

A confirmed break below $31.74 could lead to further downside toward $28.67 and $14.89. If the price holds above $35.29, a recovery toward $36.88 is possible.

Wedge

Rising wedge breakdown may take BTC below 84K and lowerCRYPTO:BTCUSD has broken down from a bearish wedge in hourly. I expect it to do at least 38.2% retracement around 84k, though it could likely go lower around 50% as well which is around 82,600. Closing below 80k might open doors to resumption of downside trend.

CAD-CHF Nice Bearish Setup! Sell!

Hello,Traders!

CAD-CHF made a retest

Of the horizontal resistance

Level and is already marking

A bearish pullback while trading

In a bearish wedge pattern so

If we see a breakout then

A further move done is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WOLF: Bullish divergence on the weekly (SEP24-FEB25)It appears that this is yet another stock that has been declining in price over the past some weeks while the RSI shows a declining downside momentum (green lines on RSI/price chart) - AKA Class A bullish divergence.

This indicates to me (a non-professional, newbie investor) that the selloff is cooling down and a reversal might be on the horizon.

RSI could be arguably forming a wedge but with only two touches of the higher trend line it's a bit too early to tell IMO.

I did enter this trade at around $7 so at a loss for now. But I figure this has potential for a pretty big move it it does actually reverse.

Again I am a newish trader so I haven't learned the benefits of setting targets yet the hard way. As such, I am just pulling some gains off the table at some point when the time feels right to cover investments and leaving the rest of my shares intact so I can ride the wave if this does shoot upwards.

I don't do stop loss and what not because I wouldn't invest money that I can't do without, and I have enough savings to live without the invested amount for an indefinite (for now at least) amount of time. Might be a bad take but it is what it is.

APEUSDT: Will This Major Resistance Trigger a Sharp Rejection?Yello Paradisers, have you spotted what’s brewing on APEUSDT? We’re sitting at a critical zone—one that could either trigger a steep drop or trap late shorts before a breakout. Here's why this level demands your full attention.

💎APEUSDT is showing strong bearish potential, currently trading inside a rising wedge pattern accompanied by bearish divergence. What's even more crucial is that this price action is unfolding right at a key resistance zone, reinforced by both the 0.618 Fibonacci level and the 200 EMA. This confluence of technical factors significantly increases the probability of a bearish rejection from here.

💎If APEUSDT consolidates around this level and begins forming clear bearish structures—such as an M-pattern, a bearish CHoCH (Change of Character), a Head & Shoulders, or even an Inverse Cup & Handle—the bearish case strengthens further. This would also allow for a tighter risk setup, improving the risk-to-reward ratio for traders who are patient and precise.

💎On the flip side, if the price breaks and closes decisively above the invalidation level, this will invalidate the bearish setup entirely. In that scenario, the smart move would be to wait for a new structure or a clean retest before making any trading decisions.

🎖This is the only way you will make it far in your crypto trading journey. Be a professional—stick to your plan, reduce your risk, and never chase the market. Timing and discipline are what separate consistent traders from the rest. Stay sharp, Paradisers.

MyCryptoParadise

iFeel the success🌴

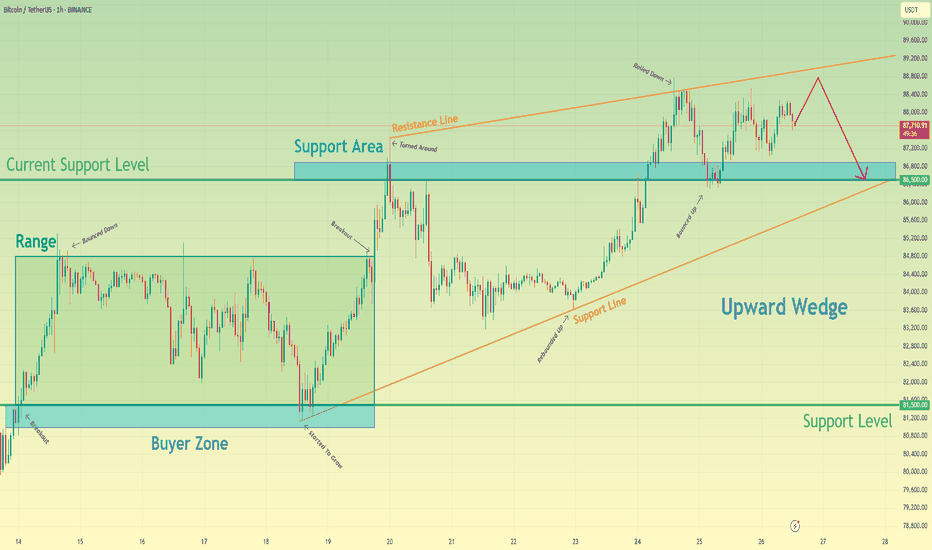

BITCOIN - Price can reach support level and then start to growHi guys, this is my overview for BTCUSDT, feel free to check it and write your feedback in comments👊

Some time ago, the price long time traded near $83700 level, broke it and started to grow inside an upward wedge.

Firstly, BTC rose to the resistance line of the wedge and then corrected to the support level, after which it reached the $87800 level.

After several attempts to break resistance, price turned around and dropped, thereby exiting from wedge.

Now it is correcting and approaching support level, slowly moving toward $83700 key support level.

In my opinion, when BTC reaches $83700 level, it can turn around and start to grow to the $87800 resistance level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Silver (XAG/USD) Rising Wedge – Bearish Breakdown Setup!A rising wedge is a pattern that typically forms when the price makes higher highs and higher lows, but the upward momentum starts weakening. The narrowing structure of the wedge indicates that buyers are losing strength, and a breakout to the downside is likely.

Key Characteristics of the Rising Wedge:

✔ Higher highs & higher lows – but with reduced momentum

✔ Trendline support (lower boundary) & resistance (upper boundary)

✔ Volume decline – suggests a potential reversal

Expected Scenario:

If the price breaks below the lower trendline, it signals bearish pressure, and Silver could see a strong decline.

2. Key Levels & Trading Setup

📌 Resistance Level ($34.50 - $34.80)

The upper boundary of the wedge is acting as strong resistance.

Historically, this zone has rejected price action multiple times, indicating sellers are defending this area.

📌 Support Level ($30.20 - $30.50)

A major demand zone where buyers previously stepped in.

If the wedge breaks down, this is the most likely target for the decline.

📌 Stop Loss ($34.81)

Placed just above the recent high and resistance zone to limit risk in case of an unexpected upside breakout.

📌 Target ($30.20)

Measured move from the wedge breakdown projects a sharp decline toward the next strong support at $30.20.

3. Trade Execution Strategy

🔴 Bearish Breakdown Scenario

If the price breaks below the lower trendline (around $33.00), we expect a strong move downward.

📉 Short Entry: Below $33.00 (after confirmation)

🎯 Target: $30.20

❌ Stop Loss: $34.81 (above resistance)

Confirmation Needed:

✅ Strong bearish candle close below support

✅ Increased volume during breakdown

✅ Retest of broken support turning into resistance

🟢 Bullish Alternative (Invalidation)

If price breaks and holds above $34.81, the bearish setup will be invalidated, and a breakout towards $36.00 - $37.00 could be expected.

4. Additional Considerations

📌 Fundamental Factors: Keep an eye on macroeconomic news, Fed decisions, and USD strength, as these impact Silver prices.

📌 Risk Management: Avoid overleveraging and use a proper risk-reward ratio (1:3 or higher).

📌 Market Sentiment: Watch volume trends and confirm breakout or fakeout before entering trades.

Conclusion

This chart presents a high-probability short trade setup based on the rising wedge breakdown.

If the breakdown occurs, Silver could drop toward the $30.20 support zone. However, traders should wait for confirmation before entering to avoid fakeouts.

Would you like me to refine this further for a TradingView post? 🚀

CHF/USD – Rising Wedge Breakdown | Bearish Setup The CHF/USD (Swiss Franc to US Dollar) 15-minute chart is currently displaying a classic Rising Wedge Pattern, which is widely recognized as a bearish reversal pattern. This setup signals weakening bullish momentum and an increased probability of a price breakdown. The chart provides a clear sell trade setup, with key levels including entry, stop loss, and target, making it a structured and well-defined opportunity for traders.

🔹 Key Technical Elements on the Chart

1️⃣ Resistance Level (Sell Zone)

📌 Location: Near 1.1350 – 1.1360

📌 Significance:

This level represents a strong supply zone, meaning sellers have consistently pushed prices down from this area.

Price attempted to break through this zone multiple times but was rejected, reinforcing the bearish outlook.

It serves as the upper boundary of the rising wedge, confirming its role in restricting upward movement.

Traders should be cautious of any false breakouts above this level before confirming a bearish move.

2️⃣ Support Level (Demand Zone)

📌 Location: Near 1.1295 – 1.1305

📌 Significance:

This level has historically acted as a demand zone, where buyers stepped in to push prices back up.

However, the formation of the rising wedge suggests weakening demand at this level.

Once the price breaks below this support zone, it confirms a bearish trend continuation.

3️⃣ Rising Wedge Pattern (Bearish Setup)

📌 Pattern Characteristics:

The rising wedge is a bearish continuation pattern that typically signals an upcoming sell-off.

Price moves inside a narrowing upward-sloping range, where buyers lose strength while sellers gradually gain control.

The lower trendline (dotted black line) has been providing support, but as price struggles near resistance, a breakdown becomes likely.

Once price breaks below the wedge, the pattern confirms a strong bearish move.

📌 Why Is This Important?

This pattern indicates that buyers are losing momentum, and a shift toward bearish control is taking place.

The expected move is a sharp downward breakout, leading to lower price levels.

4️⃣ Trendline Support (Breakdown Confirmation)

📌 Location: The dashed black line below price action

📌 Significance:

This trendline acted as a rising support, keeping price within the wedge.

A clean break below this trendline confirms the bearish breakout.

The breakdown is expected to be followed by increased selling pressure and higher trading volume.

📉 Bearish Trade Setup (Short Position Strategy)

Based on the rising wedge breakdown, traders can consider the following sell trade setup:

✅ Entry Point: Sell below 1.1325 (Confirm breakdown with volume)

✅ Stop Loss: Above 1.1356 (To avoid false breakouts)

✅ Target 1: 1.1295 (First support level)

✅ Target 2: 1.1275 (Deeper downside potential if momentum continues)

🛠 Trade Rationale (Why Take This Trade?)

🔸 Bearish Price Action → Price is rejecting resistance and forming a lower high, signaling weakness in the uptrend.

🔸 Pattern Confirmation → The rising wedge has a high probability of breaking downward, leading to a sharp decline.

🔸 Risk-Reward Ratio → The setup provides a favorable risk-to-reward ratio, as traders can manage risk efficiently by placing a stop loss above resistance.

🔸 Volume Analysis → If selling volume increases upon breakout, the move becomes more reliable.

📊 Market Outlook & Final Thoughts

🔹 Bearish Scenario:

If price breaks below 1.1325, expect a strong decline toward 1.1295 and potentially lower.

A sharp move downward could accelerate selling pressure, targeting 1.1275 in an extended move.

🔹 Bullish Reversal Risk:

If price closes back above 1.1356, the bearish setup is invalidated.

Traders should exit shorts if price reclaims the resistance level.

🚨 Final Verdict: Bearish Breakdown Expected!

📉 Short Setup Activated – Targeting 1.1295 🚀

📊 Watch for Volume Confirmation Before Entering!

GBPJPY: Breakout & Bullish Continuation 🇬🇧🇯🇵

I see a confirmed breakout of a significant daily resistance on GBPJPY.

The price will most likely continue rising within a wedge pattern.

The next goal for the buyers is 197.0.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

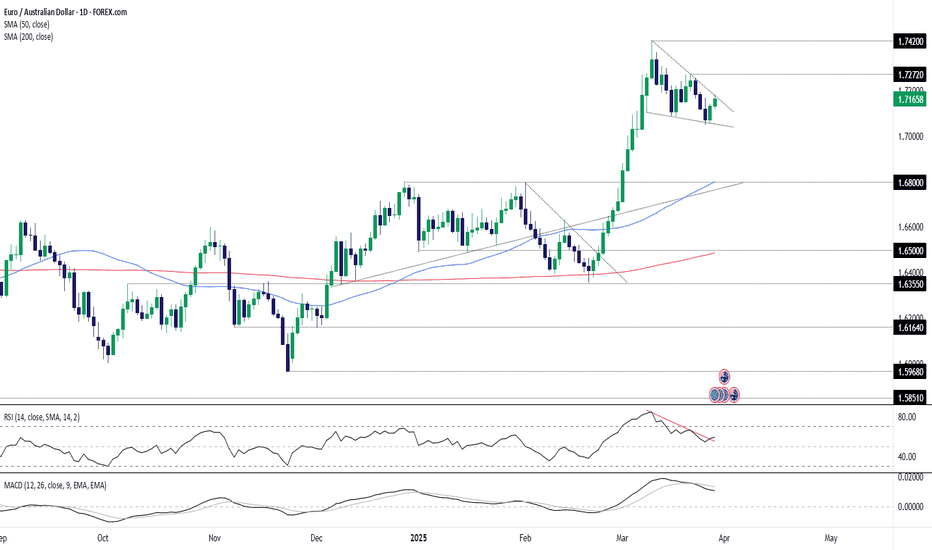

EUR/AUD: Wedge Break in SightTraders should be alert to the risk of a resumption of the bullish trend in EUR/AUD.

It’s been coiling within a falling wedge for much of March, with the price rebound over the past two sessions leaving the pair testing downtrend resistance.

A bullish wedge break would put 1.7272 on the radar. If that were to give way it would open the door for a run towards the March 11 high of 1.7420. A stop beneath the downtrend would offer protection against reversal.

RSI (14) has broken its downtrend, suggesting bullish momentum may be starting to build again even though MACD has yet to confirm the signal.

Good luck!

DS

CAD_CHF BEARISH WEDGE PATTERN|SHORT|

✅CAD_CHF made a retest of

The horizontal resistance

Of 0.6213 which makes us

Locally bearish biased and

On top that we are seeing a

Fully formed bearish wedge

Pattern so IF we see a bearish

Breakout from the wedge

Pattern we will be expecting

A further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAT - Falling Wedge PatternKUCOIN:CATUSDT (3D CHART) Technical Analysis Update

CAT is currently trading at $0.000008225 and showing overall bullish sentiment

Price has broken out from the falling wedge pattern and we are seeing beginning of the bullish trend. Expecting this trend to continue until the price hits the resistance zone.

Entry level: $0.000008225

Stop Loss Level: $0.000004602

TakeProfit 1: $0.000011536

TakeProfit 2: $0.000011536

TakeProfit 3: $0.000034238

TakeProfit 4: $0.000065098

Max Leverage: 2x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

SUI - Falling Wedge - Confirmed BreakoutBINANCE:SUIUSDT (1D CHART) Technical Analysis Update

SUI is currently trading at $2.77 and showing overall bullish sentiment

Price has formed nice falling wedge and we see a clear breakout from the falling wedge pattern. I'm expecting this trend to hold and read the resistance level around $5.3

Entry level: $2.7

Stop Loss Level: $1.8

TakeProfit 1: $3.1

TakeProfit 2: $4

TakeProfit 3: $5.3

Max Leverage: 2x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

NASDAQ INDEX (US100): Bullish Reversal Confirmed?!

I see 2 very strong bullish reversal confirmation on US100 on a daily.

First the market violated a resistance line of a falling channel.

Then, a neckline of a cup & handle pattern was broken.

Both breakouts indicate the strength of the buyers.

We can expect a growth at least to 20300 resistance.

❤️Please, support my work with like, thank you!❤️

Bitcoin Train Continues?$76400 is a key level. When the next high volume spike occurs on the daily that will be the next "bottom" or at least a spot for a strong entry if and when price returns to it.

Obviously, the stronger the outlier in the volume peak, the stronger the support level is if and when price returns to it.

Bitcoin can make small move up and then drop to support levelHello traders, I want share with you my opinion about Bitcoin. Earlier, price was moving inside a range, where the price repeatedly bounced between the upper boundary and the buyer zone. After multiple failed attempts to break higher, the price finally broke out and started an upward movement, forming a strong bullish impulse. This upward momentum led BTC into the support area, where it consolidated briefly before continuing to rise. From there, the price began to form an upward wedge, respecting both the support line and the resistance line of the structure. Recently, BTC tested the upper boundary of the wedge and rolled down, confirming the resistance. Now, the price is trading closer to the upper half of the wedge but shows signs of weakness near the resistance line. Based on this setup, we might see that the price can one more short-term attempt to grow, followed by a rejection from the upper boundary and a move downward toward the 86500 support level. If the price fails to hold this level, the next stop could be the support line of the wedge. Please share this idea with your friends and click Boost 🚀

HelenP. I Bitcoin may grow to trend line and then drop to $82200Hi folks today I'm prepared for you Bitcoin analytics. Looking at the chart, we can observe how Bitcoin made a strong upward impulse, reaching the trend line and breaking through the resistance level that aligned with the resistance zone. After that move, the price began to decline within a wedge pattern and soon dropped below the same resistance level, effectively breaking it again. BTC then attempted to recover, climbing back up, but the growth was short-lived — the price failed to hold and fell toward the support level, eventually breaking below it and even dipping under the resistance once more. Following this drop, Bitcoin reversed and gained momentum. Shortly after, it broke through the 82200 level, successfully retested it, and continued moving higher. Later on, the price reached the trend line again — a level that also acted as resistance — but failed to break above and started pulling back from that area. At this point, I anticipate that BTCUSDT may retest the trend line once more before making a move downward toward the support level, potentially breaking out of the wedge pattern. For now, my goal is the 82200 support level. If you like my analytics you may support me with your like/comment ❤️

Bitcoin’s Next Move: Falling to $79K?This detailed technical analysis of Bitcoin (BTC/USD) on the 1-hour timeframe highlights a Rising Wedge pattern, key support and resistance levels, a trade setup, and projected price movements. The chart suggests a bearish breakdown, and traders can use this analysis to make informed decisions.

1. Understanding the Chart Pattern – Rising Wedge Formation

A Rising Wedge is a bearish reversal pattern that occurs when the price moves upwards within two converging trendlines. The slope of the lower trendline is steeper than the upper trendline, indicating weaker bullish momentum and an increasing probability of a downside breakdown.

📌 Key Observations:

The black solid trendlines outline the wedge pattern.

The price action remained inside this wedge from March 11 to March 26, 2025.

A breakdown has now occurred, confirming bearish momentum.

🔺 Why is this Bearish?

Rising Wedges are considered distribution patterns, meaning buyers are losing strength, and sellers are gradually taking control.

The price fails to make aggressive new highs and instead grinds upward weakly.

Once support is broken, a strong sell-off usually follows.

2. Key Chart Levels – Support & Resistance Zones

🔵 Resistance Level (Upper Bound of Wedge & Supply Zone)

The red arrow marks a strong rejection at $88,500 - $89,000, which acted as a major resistance level.

This zone has seen multiple failed breakout attempts, signaling that sellers dominate this area.

Stop-losses for short trades should be placed above this resistance zone.

🟢 Support Level (Lower Bound of Wedge & Demand Zone)

The wedge's lower boundary previously acted as strong support until it was breached.

The blue highlighted box represents a demand zone around $81,000, where buyers previously stepped in.

Losing this level could trigger a much stronger bearish move.

3. Breakdown Confirmation & Trading Setup

With the wedge broken to the downside, we now look for a confirmed bearish setup to enter a trade.

📉 Bearish Confirmation:

✅ The price broke below the wedge’s lower boundary, signaling a reversal.

✅ A retest of the broken wedge trendline confirms the breakdown.

✅ The price is now showing lower highs and lower lows, indicating a new bearish trend.

🎯 Trade Setup – How to Play This Move?

🔴 Entry for Short Position:

Enter short between $86,900 - $87,200 after confirming a rejection at the broken trendline.

🔵 Stop Loss:

Place a stop-loss above $89,282 to protect against a fakeout.

If BTC closes back inside the wedge, the short setup is invalidated.

🟢 Target 1: $81,000 – This is a key demand zone, and price might temporarily bounce here.

🟢 Target 2: $79,031 – This is the next strong support level, making it a final bearish target.

⚠ Risk Management Note:

Adjust position size based on risk tolerance.

Be mindful of short squeezes (where price temporarily spikes before continuing lower).

4. Expected Price Movement – Bearish Projection

🔮 The dashed black lines on the chart indicate a likely price pathway:

1️⃣ A breakdown below the wedge, followed by a minor retest of the broken trendline.

2️⃣ A continuation toward $81,000 (support level).

3️⃣ A small bounce before further decline.

4️⃣ The price reaching the final target of $79,031, where buyers may start accumulating again.

📌 If Bitcoin breaks below $81,000 with high volume, the bearish trend will likely accelerate.

5. Market Psychology & Trading Strategy

📌 Why This Setup Makes Sense?

The market exhibited exhaustion at the top of the wedge.

The break-and-retest confirms seller dominance.

The lower highs & lower lows show bearish momentum.

🚀 Alternative Bullish Scenario?

If BTC reclaims the wedge and breaks above $89,000, then the bearish setup is invalid.

A close above $89,500 would signal strong buying pressure and potential bullish continuation.

6. Conclusion – What to Watch Next?

🔎 Key Points to Monitor:

✔ Retest & rejection at $87,000 – $88,000 (confirming bearish momentum).

✔ Break of $81,000 to signal continuation toward the target.

✔ Stop-loss protection above $89,000 to manage risk.

📊 Final Thoughts:

The Rising Wedge breakdown suggests a shift from bullish to bearish sentiment.

This is a high-probability short trade with well-defined entry, stop-loss, and targets.

Traders should wait for price action confirmation before entering trades.

Would you like any refinements, or do you need further trade ideas? 🚀📉

The 3 Steps System Called "The Rocket Booster Strategy"Yesterday I took a long walk and i thought about you.

Because I want to help you learn how to trade.

Look at this chart in order to find this chart I used the rocket booster strategy.

What is the rocket booster strategy?

Yesterday I took a long walk and i thought about you.

Because I want to help you learn how to trade.

Look at this chart in order to find this chart I used the rocket booster strategy.

What is the rocket booster strategy?

It has 3 Steps:

#1-Price has to be above the 50 EMA

#2-Price has to be above the 200 EMA

#3-Price has to Gap up

These shows you a strong uptrend on the week and on the day ratings.

Also considering the oscillator

Should give you a sell signal on your *New* TradingView screener.

But this has to be on a daily chart.

But one last step.

The MACD signal line (blue) Should be below the MACD level line (orange).

This gives you a red bar below the zero line.

If you don't understand this don't worry I will make video for you next time.

For now understanding the technical terms

Including the Rocket Booster Strategy is the key.

Learn more rocket boost this content

Disclaimer ⚠️ Trading is risky please learn Risk Management And Profit Taking Strategies. Also feel free to use a simulation trading account before you use real money.

GOLD → Price returns to the channel to form a bullish structureFX:XAUUSD is completing a correction, breaking channel resistance and consolidating above the downtrend line. Traders are waiting for economic data and tariff war actions

Trump confirmed plans to impose retaliatory tariffs on April 2, limiting exemptions. The new duties have raised fears for the U.S. economy, which has weakened the dollar and boosted demand for gold.Markets are also keeping an eye on talks between the U.S., Ukraine and Russia.Focus is also on US durable goods orders data - a strong reading could cool expectations of a Fed rate cut, limiting gold's gains

Resistance levels: 3033, 3045, 3056

Support levels: 3013, 3004

Gold may test the support zone before rising further. The focus is on the current consolidation 3033 - 3013. A key resistance is formed ahead, a breakdown of this zone may provoke a continuation of growth to 3045 - 3056.

Regards R. Linda!