Russell 2000 Futures: Bearish Reversal in Play?Russell 2000 futures may resume the bearish trend established earlier this year, trading below wedge support following the completion of an evening star reversal pattern on Wednesday.

Shorts could be established on the break with a stop above the former uptrend for protection. Support may be encountered around 2050, although 1994.8 looms as a more appropriate target for those seeking greater risk-reward.

RSI (14) has rolled over, while MACD remains negative despite grinding higher over the past fortnight, painting a picture of waning momentum that complements the bearish price signals.

If RTY were to reclaim the former uptrend, the bearish setup would be invalidated.

Good luck!

DS

Wedge

Baidu Inc. (BIDU) 1WTechnical Analysis 1W

A breakout from the "falling wedge" could signal potential upside.

Key levels:

-Support: 94.26 | 77.24

-Resistance: 107.61 | 116.99 | 156.75

Fundamental Analysis

-AI Leadership: Baidu continues expanding in AI, cloud computing, and autonomous driving.

-Financials: Solid revenue growth but faces regulatory risks in China.

-Competition: Strong rivalry with Alibaba and Tencent in AI and cloud services.

-Risks: U.S.-China tensions and economic slowdown may impact performance.

A breakout above $116.99 could confirm further upside.

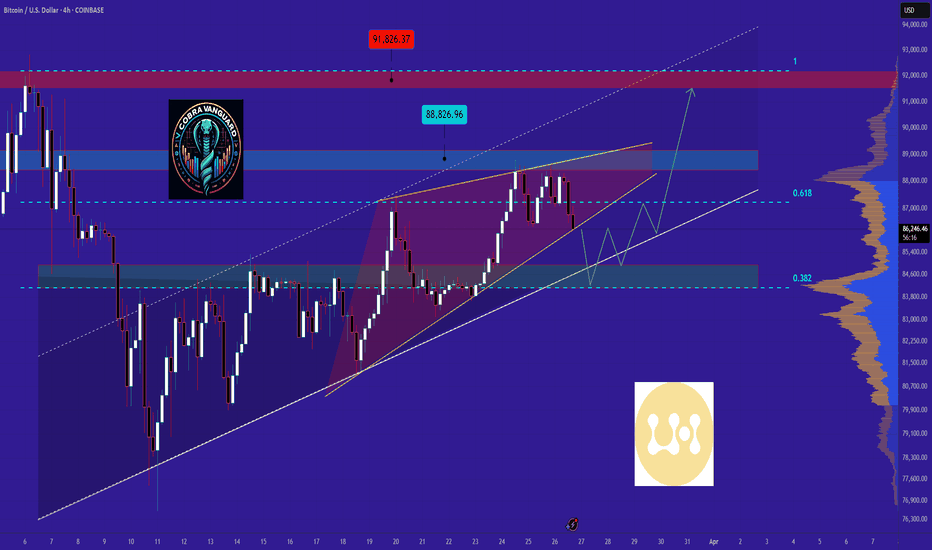

BTC in coming days ...If the price breaks the wedge, it will drop to the 0.382 line and then rise to $90K .

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Shiba INU is repeating the history !!!!Trading patterns often tend to repeat themselves due to market psychology, investor behavior, and historical price movements. The current Shiba Inu chart appears to be mirroring past formations, reinforcing the cyclical nature of technical patterns.

Stage 1, a Falling Wedge, was completed , similar to previous corrections on September 24 before a breakout.

Stage 2, a Cup and Handle pattern, was confirmed , resembling earlier bullish continuation setups in August 2024.

Now, the market awaits, Stage 3, the formation of a W pattern , which historically signals strong upward momentum in September 2024.

Finally, Stage 4, an Inverted Head and Shoulders pattern expected, could mark a significant breakout, much like previous bullish reversals.

These recurring patterns highlight the importance of studying historical charts to anticipate future price movements.

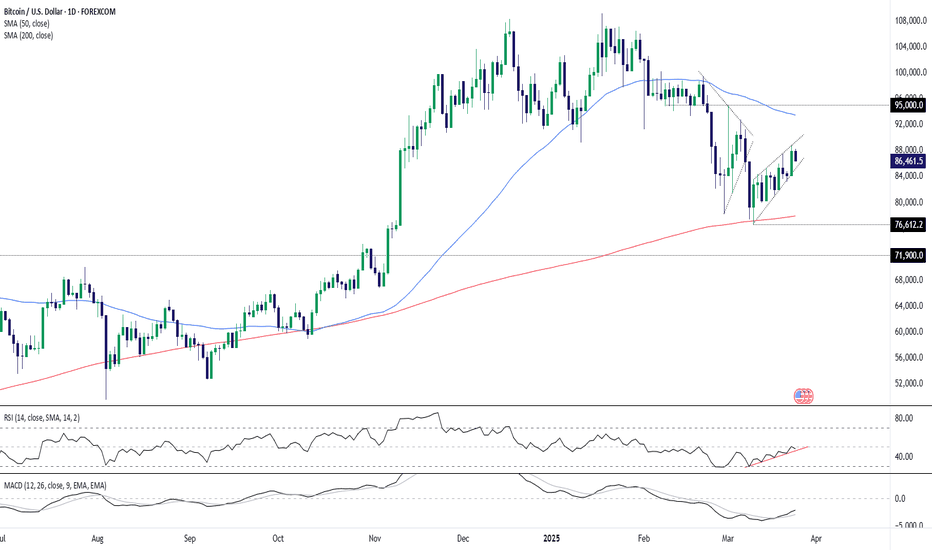

Bitcoin in Ascending Wedge?Looks like a rising wedge guys - I'm not a charting TA expert but would love to here your thoughts. Many bears keep posting a drop to $70K level.. I guess that drop is written in some prophecy somewhere, and they believe (or hope) it MUST happen, before we go for new ATH. Maybe so... however can anyone explain WHY that must play out like that? A couple of weeks back i was in that camp but after I see the slow and steady Bitcoin recovery, I have changed my mind.

BITCOIN Wait For Breakout! Sell!

Hello,Traders!

BITCOIN is trading below

The horizontal resistance

Of 92,000$ and has formed

A bearish wedge pattern so

We are bearish biased and

IF we see a bearish breakout

From the wedge we can

Be expecting a further move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

HelenP. I Bitcoin can little grow and then drop to support levelHi folks today I'm prepared for you Bitcoin analytics. Some time ago price started to decline and when it fell to 93500 points, it rebounded up to the trend line. Then BTC started to fall inside the wedge, where it soon broke the 91200 level and then in a short time declined to the support zone. After which it turned around and rose to the trend line, which is the support line of the wedge as well. Then Bitcoin fell to the support level again, breaking the resistance level again, but later it tried to back up and failed. Price dropped to the support zone and even a little lower, after which it turned around and in a short time rose to the trend line, breaking the support level one more time. A few moments ago price exited from the wedge and some time traded near the trend line. After this, it started to grow, so, in my opinion, I expect that BTCUSDT will almost rise to the resistance level and then it drop to the 81200 support level, which is my goal. If you like my analytics you may support me with your like/comment ❤️

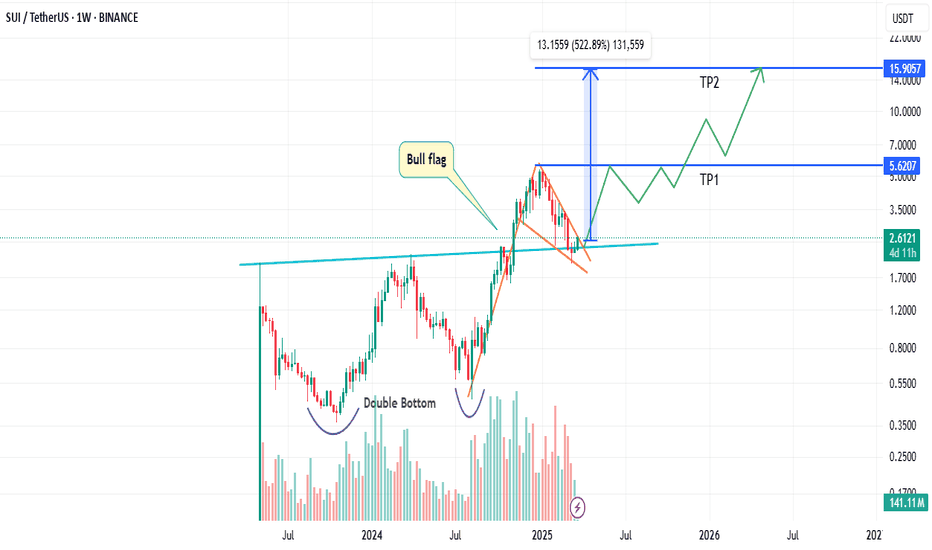

From $5 to $16 ? The SUI Setup You Need to See !Hello Traders 🐺

These days, everyone is talking about SUI—a U.S.-based cryptocurrency that’s showing serious potential to become one of the top gainers in the upcoming Altcoin Season. Let me break it down for you 👇

📈 Chart Analysis

On the chart, we can clearly see a Double Bottom formation, which led to a breakout and a rally to a new ATH at $5.62. After reaching that level, SUI pulled back to retest the previous resistance—which has now flipped into support. ✅

📉 What Now?

Currently, SUI is trading inside a falling wedge pattern, which in my opinion has great potential to act as a bull flag. Depending on how we interpret the pattern, price targets can vary—but don’t worry, I’ve simplified it for you:

🎯 Price Targets

1️⃣ First Target → Top of the falling wedge at $5.62 (ATH)

2️⃣ Second Target → Around $16 🚀

Make sure to take partial profits along the way and manage your risk properly.

Thanks for reading my idea—I hope you found it helpful! 🙌 Don’t forget to like and follow for more updates and support. And always remember:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

Silver (XAG/USD) – Rising Wedge Breakdown & Retest📌 Overview of the Chart

The chart illustrates a classic Rising Wedge pattern that has broken down, signaling a potential bearish continuation. The price action respected technical structures, including support and resistance levels, trendlines, and key psychological zones.

The breakdown of the rising wedge led to a sharp decline, followed by a retest of the previous support as resistance, confirming further downside momentum. Traders analyzing this setup can identify clear entry points, stop-loss placements, and target objectives based on price action behavior.

🔹 1️⃣ Understanding the Rising Wedge Pattern

A Rising Wedge is a bearish pattern that forms when price moves upward within converging trendlines. It indicates that buying momentum is slowing, and a potential reversal or breakdown is imminent.

✔ Characteristics of the Rising Wedge on This Chart:

📈 Higher Highs and Higher Lows: The price was trending upwards, but the narrowing structure indicated exhaustion.

📊 Decreasing Momentum: Volume likely started declining as the price approached resistance.

📉 Bearish Breakdown: Price broke below the lower trendline, confirming the pattern’s bearish nature.

🔻 What Happened Next?

The price dropped sharply after the wedge breakdown.

A retest of the broken trendline acted as a confirmation of resistance.

The downtrend continued, targeting a lower support level.

🔹 2️⃣ Key Support & Resistance Levels

🔵 Major Resistance – 34.27 USD (All-Time High & Supply Zone)

This level served as a strong supply zone, rejecting multiple bullish attempts.

Price struggled to break this level, leading to a sell-off.

The stop-loss for short trades is placed above this zone to minimize risk.

🟠 Support Level – 32.80 USD (Previous Support Turned Resistance)

This was a key support zone before the wedge breakdown.

Once broken, price retested this level and faced rejection, confirming a trend shift.

⚫ Trendline Support (Now Broken)

The lower support trendline was a crucial guide for bulls.

Once price broke below, it signaled strong bearish control.

A retest of the trendline was unsuccessful, confirming a bearish continuation.

🟢 Target Zone – 31.93 USD (Projected Breakdown Target)

The measured move target of the rising wedge aligns around 31.93 USD.

If selling pressure continues, price may reach this level.

🔹 3️⃣ Trading Strategy – Short Setup & Execution

This setup provides a high-probability short trade based on the pattern breakdown.

📉 Short (Sell) Entry Criteria:

✅ Entry Zone: After the price broke below the wedge and retested the trendline (~33.80 USD).

✅ Confirmation:

Bearish candlestick formations (Doji, Engulfing, or Pin Bars).

Increased volume on bearish moves.

🚫 Stop-Loss Placement:

🔹 Above the resistance level (34.27 USD) – If price breaks above this, the setup is invalid.

🔹 Reasoning: Protects against unexpected bullish reversals.

🎯 Take-Profit Target:

🔻 Target Price: 31.93 USD (based on measured move projection).

🔻 Risk-Reward Ratio: At least 2:1 (adjusted based on volatility).

🔹 4️⃣ Market Psychology & Price Action Analysis

Understanding trader sentiment is crucial:

📌 Before the Breakdown:

Bulls were in control, pushing price higher.

However, momentum slowed down, forming the rising wedge.

Traders who identified this pattern anticipated a potential trend reversal.

📌 After the Breakdown:

Sellers overpowered buyers, causing a rapid break of structure.

The price retested the previous support as resistance, confirming further downside.

The market sentiment shifted to bearish, aligning with technical confirmations.

🔹 5️⃣ Alternative Scenarios & Risk Factors

🔄 Bullish Reversal (Invalidation of Bearish Bias)

🚨 If price reclaims 34.00-34.27 USD, it invalidates the bearish setup.

📌 A break above this level could trigger a new bullish wave, targeting higher highs.

⚠️ Key Risk Factors:

Unexpected macroeconomic events (e.g., Fed policy, inflation data, geopolitical tensions).

Strong bullish rejection at lower support zones (~32.00 USD).

Volume divergence (if selling volume dries up, bears may lose control).

📢 Conclusion: High-Probability Bearish Trade with Clear Risk Management

This rising wedge breakdown provides a strong short setup, with technical confirmations and price structure supporting further downside movement.

📉 Bearish Bias Until 31.93 USD

A breakdown retest suggests sellers remain in control.

Price is expected to continue lower unless bulls regain 34.00+ levels.

🔍 Key Trading Question:

Will Silver (XAG/USD) continue to its measured target of 31.93 USD, or will bulls defend key support and push prices higher?

Let’s discuss! 🚀👇

BTC/USD Rising Wedge – Bearish Breakdown Ahead?Introduction: Understanding the Market Structure

This Bitcoin (BTC/USD) 4-hour chart presents a technical setup with a mix of bullish and bearish formations. The analysis focuses on key support and resistance zones, trendlines, and chart patterns to determine the next possible move.

🔍 The key takeaway? BTC has formed a Rising Wedge, a bearish reversal pattern, signaling potential downside unless a breakout invalidates the setup.

1. Market Structure & Current Trend Analysis

📌 Market in Curve Formation – The Accumulation Phase

Before the recent rally, Bitcoin was in a downtrend, making lower lows and lower highs, suggesting a period of price weakness.

However, price found strong support at around $77,600 - $80,000, forming a curved bottom structure—an early signal of an accumulation phase.

This bottoming pattern transitioned into a bullish uptrend, leading to the formation of a rising wedge.

🔹 Key Observations:

✔ Accumulation near $77,600 created a base for buyers.

✔ The gradual recovery curve suggests a shift from bearish to bullish momentum.

✔ Bitcoin later formed higher lows, confirming a temporary uptrend.

⚠ Shift in Momentum – The Rising Wedge Appears

The price rallied from the support zone but started forming a Rising Wedge pattern, which is typically a bearish signal.

A rising wedge indicates that although buyers are pushing prices up, they are losing momentum.

The narrowing price range suggests that sellers are entering at higher levels, weakening bullish strength.

2. Key Technical Levels to Watch

🔵 Resistance Zone ($92,000 - $94,957)

The shaded area near $92,000 - $94,957 is a major resistance level, where BTC previously failed to sustain a breakout.

This supply zone has been tested multiple times, reinforcing its strength.

The Stop Loss for short positions is placed above $94,957—any breakout above this level would invalidate the bearish setup.

🟠 Support Zone ($77,600 - $80,000)

The strong demand zone between $77,600 - $80,000 aligns with previous support levels.

If the rising wedge breaks down, this is the first major price target where BTC could find support.

A strong breakdown below $77,600 could lead to further declines toward $75,000 or lower.

3. The Rising Wedge Pattern – Bearish Warning!

🔍 What is a Rising Wedge?

A Rising Wedge is a bearish reversal pattern that forms during an uptrend when price moves within two converging trendlines.

It indicates that buyers are losing strength, and sellers are preparing to take control.

Once the lower trendline breaks, it confirms bearish momentum, leading to a price drop.

📝 Current BTC/USD Rising Wedge Analysis:

BTC has formed higher highs and higher lows, but the price range is narrowing.

The lower trendline is critical—a breakdown below this level could trigger a sharp decline.

The bearish target aligns with the support zone near $77,600.

4. Trading Plan – Possible Scenarios

📉 Bearish Breakdown Scenario (High Probability)

✅ Entry: Short BTC if the price breaks below the rising wedge (~$86,000 - $85,500).

✅ Stop Loss: Above $94,957 to protect against invalidation.

✅ Take Profit Target: $77,600 - $80,000 (first support level).

✅ Extended Target: If BTC drops below $77,600, watch for $75,000 - $72,000.

✅ Risk-Reward Ratio: Ideally 1:3 or higher for optimal trade management.

📈 Bullish Breakout Scenario (Low Probability but Possible!)

If BTC breaks and closes above $94,957, the bearish setup becomes invalid.

A confirmed breakout above resistance could push BTC towards $98,000 - $100,000.

Traders should wait for volume confirmation before entering long positions.

5. Risk Management & Final Thoughts

⚠ Risk Factors to Consider:

If BTC breaks the wedge with low volume, the move might be a false breakdown.

Macroeconomic events, such as interest rate decisions, can influence price behavior.

Watch for bullish divergences in indicators like RSI or MACD before shorting aggressively.

🔎 Conclusion:

The Rising Wedge pattern suggests a bearish reversal—a breakdown could send BTC toward $77,600.

Traders should wait for confirmation before entering trades.

If BTC breaks above $94,957, a bullish continuation could push it toward $100,000.

🔥 Bearish Bias Until Breakdown Confirmation!

Would you like an indicator-based analysis (e.g., RSI, MACD, or Moving Averages)? 🚀

Free Report #1:How To Build A Solid WatchlistFinding this chart pattern took about two days.

First i had to create a screener to find the momentum

then today i looked at the watch list.

While looking at the watchlist i tried to screen

for a candle stick pattern,

This candlestick pattern is called the lower long shadow.

It is part of another chart pattern called the frying pan

bottom.

This means the chart price has hit higher new low

as you can see from the drawing on the chart

that looks like a triangle

ALso remember that on this chart is

a technial analysis system called

the rocket booster strategy.

Check out the references to learn about this

strategy.

Also take note of one the best osicllators

in technical analysis called the MACD

look close you will see two lines Crossing

This is rare sight to behold

and this is why i have to document this

and share it with you as well

Trade safe.

Rocket boost this content to learn more

Disclaimer: Trading is risky please learn risk management

and profit taking strategies.Also feel free

to use a simulation trading account before you

trade with real money

Silver’s Bullish Breakout Raises Stakes for $34.24 RetestSilver delivered a monster bullish candle on Tuesday, completing a morning star pattern while smashing through wedge resistance that had capped gains earlier in the week. With RSI (14) setting higher lows and MACD on the verge of a bullish crossover, price and momentum signals suggest a growing risk of a retest of the March 18 high at $34.24.

Silver has a habit of gravitating toward round figures, making any pullback toward $33.50 a potential buying opportunity where longs could be established above with a stop beneath for protection. Resistance may emerge near $34, though $34.24 appears a more meaningful initial target. A break above that could encourage bulls to chase a move toward the October high of $34.87.

If silver reverses back beneath former wedge resistance and holds there, the bullish bias would be invalidated.

Good luck!

DS

S/USDT: FALLING WEDGE BREAKOUT!! 🚀 Hey Traders! SONIC Breakout Alert – ATH Incoming? 👀🔥

If you’re excited for this setup, smash that 👍 and hit Follow for premium trade ideas that actually deliver! 💹🔥

🔥 SONIC/USDT – Breakout & Retest in Play! 🚀

SONIC is breaking out of a falling wedge on the 4H timeframe and is currently retesting the breakout level. With momentum building, we’re expecting a move toward ATH soon.

💰 Trade Setup:

📍 Entry: CMP, add more up to $0.50

🎯 Targets: $0.56 / $0.62 / $0.69 / $0.78 / $0.85 / $0.96

🛑 Stop-Loss: $0.46

⚡ Leverage: Low (Max 5x)

🔎 Strategy:

Enter with low leverage now

Add more on dips and ride the wave higher

💬 What’s Your Take?

Are you bullish on SONIC’s breakout? Share your analysis, predictions, and strategies in the comments! Let’s lock in those gains and ride this pump together! 💰🚀🔥

EUR/JPY Breakdown: Falling Wedge Breakout & Bullish SetupThe EUR/JPY 4-hour chart is presenting a well-structured price action setup, featuring a falling wedge breakout, a strong bullish trendline, and key resistance and support levels. This detailed analysis will walk through each aspect of the chart to provide a professional trading perspective.

1. Market Context & Price Action Overview

At the beginning of the chart, EUR/JPY was experiencing a downtrend, characterized by a series of lower highs and lower lows, forming a falling wedge pattern. This pattern is typically a bullish reversal signal, indicating that sellers are losing strength and buyers may take control.

Once the price reached a key support zone near 156.08, it bounced, leading to a breakout of the falling wedge. Since the breakout, the price has been moving in a bullish trend, forming higher highs and higher lows, respecting an ascending trendline.

2. Technical Patterns & Key Levels

🔹 Falling Wedge Pattern – Bullish Breakout

The falling wedge is identified by two converging trendlines sloping downward.

It indicates that bearish momentum is weakening as price compresses.

A breakout above the upper wedge line confirmed the shift in trend direction.

The breakout candle had strong bullish momentum, suggesting increased buyer interest.

🔹 Support and Resistance Levels

📉 Major Support Level (~156.08):

This level acted as a demand zone, where buyers aggressively stepped in.

The price formed multiple rejections at this level before breaking upwards.

A stop-loss placement below this level is ideal for bullish trades.

📈 Resistance Level (~163.50 - 164.00):

This zone has been tested multiple times as price approaches from below.

A break and retest of this resistance would confirm further bullish momentum.

If price faces strong rejection, a short-term pullback to the trendline may occur.

🎯 Final Target (~166.79):

This is the next major resistance level, aligning with previous swing highs.

It serves as a strong take-profit (TP) level for long positions.

If price reaches this level, we may see a consolidation phase or possible reversal.

3. Trend Analysis & Market Structure

📈 Bullish Trendline:

The price has been respecting an ascending trendline, acting as dynamic support.

This trendline connects higher lows, confirming a strong bullish trend.

As long as price stays above this line, buyers remain in control.

📊 Market Structure:

Since breaking out from the falling wedge, the price is forming a classic bullish structure of higher highs and higher lows.

This indicates sustained buyer pressure and a potential continuation toward resistance levels.

4. Trading Setup & Risk Management

📌 Entry Strategy:

Aggressive Entry: After the wedge breakout with a tight stop-loss.

Conservative Entry: Wait for a pullback to the trendline support or a break and retest of resistance at 163.50 - 164.00.

🔻 Stop Loss Placement:

Below 156.08 (previous support zone) to protect against trend invalidation.

Alternatively, below the rising trendline for a dynamic SL approach.

🎯 Take Profit Targets:

TP1: 163.50 - 164.00 resistance zone (Partial profits).

TP2: 166.79 final target, aligning with historical resistance.

5. Market Outlook & Potential Scenarios

✅ Bullish Scenario (High Probability)

If price holds above the trendline and breaks 163.50 - 164.00, we expect a continuation towards 166.79.

The structure remains intact as long as higher highs and higher lows persist.

❌ Bearish Scenario (Low Probability, but Possible)

If price fails at resistance and breaks below the trendline, it could signal a deeper retracement.

A break below 156.08 would completely invalidate the bullish setup, leading to a potential downtrend.

6. Summary & Key Takeaways

Trend Bias: Bullish, supported by a falling wedge breakout and higher highs.

Key Levels: Support at 156.08, resistance at 163.50 - 164.00, final target at 166.79.

Trading Strategy: Buy on retests of trendline or resistance breakouts.

Risk Management: Use dynamic stop-loss levels to minimize downside exposure.

🔹 Final Verdict:

If price remains above support and successfully breaks 163.50 - 164.00, a strong move toward 166.79 is expected. However, traders should remain cautious of trendline breakdowns and manage risk accordingly.

📊 Stay disciplined, follow your trading plan, and always use stop-loss protection! 🚀 #EURJPY #Forex #TradingStrategy #PriceAction

EUR/USD 1H Chart Analysis – Falling Wedge Breakout StrategyOverview of the Chart

The EUR/USD 1-hour chart is forming a falling wedge pattern, which is a bullish reversal setup. This indicates that although the price has been trending downward, the selling pressure is weakening, and a breakout to the upside is becoming more likely.

Currently, the price has broken above the wedge, signaling potential trend reversal. However, traders should watch for a retest of the breakout level to confirm whether the price holds above the resistance-turned-support area before further upward movement.

Key Components of the Chart

1️⃣ Falling Wedge Pattern (Bullish Reversal Signal)

A falling wedge consists of two downward-sloping trendlines that converge, showing a narrowing price range. This pattern is formed when:

The price makes lower highs and lower lows, indicating a downtrend.

The slope of the lower trendline is less steep than the upper one, meaning sellers are losing momentum.

Eventually, the price breaks out above the upper trendline, confirming a bullish reversal.

2️⃣ Support & Resistance Levels

✅ Support Zone (Key Demand Area)

The price recently tested a strong support level (highlighted in beige), where buyers aggressively entered the market.

This level has held multiple times, indicating that buyers are stepping in whenever the price reaches this zone.

The green upward arrow suggests that this is a key accumulation area, where demand is stronger than supply.

🚫 Resistance Zone (Profit Target)

The resistance zone near 1.09450 is the first major target for bulls.

Historically, price action has struggled to break through this level, making it a logical place to take profits.

3️⃣ Breakout Confirmation & Retest

The price has successfully broken out above the falling wedge, which is a strong buy signal.

However, a retest of the breakout level (marked by the yellow circle) might occur before further bullish continuation.

If the price retests and holds above the previous resistance (now support), this will confirm the breakout and provide an additional buying opportunity.

Trade Execution Strategy

📌 Entry Point:

Enter a long trade after the breakout confirmation.

For conservative traders, waiting for a successful retest before entering can reduce risk.

📌 Stop-Loss Placement:

Place a stop loss just below the recent swing low at 1.07541 to limit downside risk.

This ensures that if the breakout fails, the trade is exited with minimal loss.

📌 Profit Target:

The first take-profit target is at 1.09450, the key resistance level.

If bullish momentum continues, traders can look for higher targets based on price action.

📌 Risk-to-Reward Ratio:

This setup provides a favorable risk-to-reward ratio, meaning that potential profits outweigh the risk taken on the trade.

Technical Indicators Supporting the Trade

📈 Trend Reversal Signals

The market has been in a downtrend, but the falling wedge signals a potential reversal.

A higher low after the breakout would further confirm the uptrend.

📊 Volume Confirmation

Ideally, a breakout should be accompanied by increased volume, showing strong buying pressure.

If volume is low, a false breakout could occur, requiring careful trade management.

🔍 Retest & Price Action

A retest of the breakout level should hold above the wedge to confirm bullish momentum.

If the price fails to hold and falls back below, the breakout may have been a fakeout, meaning traders should exit or wait for re-entry.

Risk Management & Trade Considerations

Always use a stop-loss to manage risk.

If the price fails to stay above the breakout level, consider exiting early.

Watch for external market factors such as news events or economic data releases, which can impact EUR/USD volatility.

Conclusion: Bullish Momentum is Building 🚀

This falling wedge breakout on the EUR/USD chart provides a high-probability long trade setup. As long as price holds above the breakout level, bullish continuation toward 1.09450 is expected. Traders should monitor price action carefully and adjust their positions accordingly to maximize gains while managing risks.

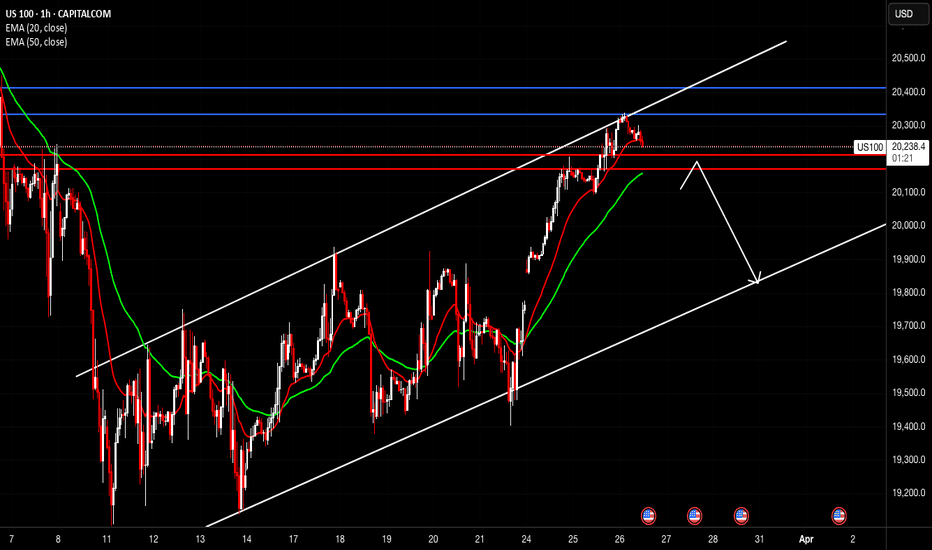

Bitcoin (BTC/USD) – Rising Wedge Breakdown & Trading Setup 📊 Chart Overview & Market Context

The provided chart represents Bitcoin's (BTC/USD) price movement on the 1-hour (H1) timeframe, highlighting a Rising Wedge pattern. This pattern is generally bearish and signals a potential reversal or breakdown.

Over the past few trading sessions, BTC has been moving inside an ascending wedge formation, making higher highs and higher lows. However, this movement is narrowing, indicating weakening bullish momentum. As BTC approaches a critical resistance level, sellers appear to be gaining control, increasing the likelihood of a sharp decline.

This chart outlines a well-structured bearish trading setup, identifying key areas of resistance, support, stop-loss placement, and potential downside targets.

📌 Technical Analysis & Key Levels

🔹 1. Chart Pattern: Rising Wedge (Bearish Reversal Signal)

A Rising Wedge is a technical pattern characterized by:

✔ Two upward-sloping trendlines, converging over time.

✔ Diminishing bullish momentum, as higher highs become weaker.

✔ Breakdown expectation, where price typically falls below the lower support trendline.

📉 Why is this pattern important?

The rising wedge signals that buyers are losing strength and that a reversal is likely.

When price breaks below the lower boundary, selling pressure increases, leading to a strong downward move.

Traders often anticipate a breakdown from this pattern to enter short positions.

🔹 2. Resistance Level (Key Rejection Zone)

📌 Zone: 88,500 - 89,500 USD

This area has acted as a strong resistance, preventing further upside movement.

Sellers stepped in, causing the price to reject and start declining.

A confirmed rejection from this level adds bearish confluence to the setup.

🔹 3. Rising Wedge Support (Breakdown Level)

📌 Zone: 85,000 - 84,500 USD

This is the lower boundary of the wedge pattern.

If BTC closes below this level with strong volume, it confirms the breakdown.

A retest of this level as resistance after a breakdown would provide an ideal short entry.

🔹 4. Key Support Levels & Bearish Targets

Once BTC breaks down, the next areas of interest are:

📌 First Bearish Target: 80,500 - 79,500 USD

A previous demand zone where buyers previously pushed prices higher.

BTC could pause here before continuing lower.

📌 Final Target (Full Breakdown Projection): 76,802 USD

If the wedge pattern fully plays out, BTC could drop toward this level.

This aligns with a major historical support zone, where significant buying interest could emerge.

🔹 5. Stop-Loss & Risk Management

📌 Stop-Loss: 90,483 USD

If BTC moves above this level, it invalidates the bearish setup.

Keeping a tight stop-loss ensures controlled risk while maximizing potential rewards.

📉 Trading Plan: How to Trade This Setup?

✅ Short Entry Strategy:

Enter a short trade once BTC breaks below 85,000 USD, confirming the wedge breakdown.

If BTC retests the broken support (now resistance), it offers a second entry opportunity.

✅ Stop-Loss Placement:

Place a stop-loss above 90,483 USD, in case of a bullish breakout.

✅ Take-Profit Levels:

First Target: 80,500 - 79,500 USD (Support zone)

Final Target: 76,802 USD (Full wedge breakdown projection)

📌 Key Takeaways & Market Sentiment

🔸 Bearish Structure Formation: BTC is losing momentum inside a rising wedge, signaling a potential downturn.

🔸 Breakdown Confirmation Needed: A close below 85,000 USD with volume confirms the bearish trade setup.

🔸 Risk Management is Key: The stop-loss above 90,483 USD protects against invalidation.

🔸 Watch for Retests: If BTC retests the breakdown level, it can provide an ideal entry point.

🚨 Bitcoin is showing early signs of a bearish reversal! If the rising wedge breaks down, a significant decline toward 76,802 USD could follow. Traders should monitor price action carefully and execute the setup accordingly. 🚀

Bitcoin on Breakdown Alert as Rising Wedge FormsBitcoin traders should be alert to the risk of renewed downside with the price forming a rising wedge pattern that often signals weakness ahead. While it's holding for now, the narrowing range suggests price momentum is fading, increasing the risk of a breakdown.

If the signal proves accurate, traders could establish shorts beneath wedge support with a stop above for protection. The obvious target would be the key 200DMA where the price bounced strongly from on March 11.

RSI (14) and MACD are both grinding higher, reinforcing the need to see a bearish price signal first before considering the trade.

Good luck!

DS