EURUSD → Price is in consolidation. Emphasis on false breakdownFX:EURUSD is forming a correction within the consolidation that was formed on the uptrend. The reason for the consolidation is the halt in the movement of the dollar index...

The dollar is forming a counter-trend correction due to political and econmoic data, but the general background is bearish. But, the fall of the dollar, to which the index may soon return, may strengthen the growth of the currency pair. EURUSD consolidation within the uptrend (against the background of the dollar index correction). The zone of interest is the support at 1.078 and the imbalance area

Resistance levels: 1.078, 1.074

Support levels: 1.0936.1.1009

The price has not tested the support and is forming a correction to the imbalance zone 1.087 - 1.09 from which the price may return to the downward movement to 1.078. The emphasis is on the range support from which we should wait for a false breakdown before further growth.

Regards R. Linda!

Wedge

SOLANA (SOLUSD): Bullish Reversal Confirmed

It looks like Solana is ready to return to a bullish trend.

We see multiple strong price action confirmations after

a test of a significant daily support.

The price formed the ascending triangle on that, and violated

both its neckline and a resistance line of a falling wedge pattern.

Looks like the market can reach 180 level easily soon.

❤️Please, support my work with like, thank you!❤️

Bullish Divergence on Weekly TF.Bullish Divergence on Weekly TF.

Seems like taking Support from a Very Important

fib. level around 10.30 - 11.40

Falling Wedge Pattern on Daily TF.

10.90 Should be Sustained on Monthly Basis, otherwise

we may witness further Selling pressure till 8.

Important Resistance is around 12.30 - 12.65 as of now.

Hidden Bullish Setup on AVAX – Just Revealed !Hello Traders 🐺

In this idea, I want to talk about one of the top altcoin projects in the crypto space—AVAX. If you’ve been around, you probably know the name... but here’s why I’m bullish on it right now: 🔥👇

✅ 1. Massive Weekly Triangle Pattern

On the weekly timeframe, AVAX is already inside a huge triangle formation, which—if it breaks out—could push the price to at least its previous ATH (~$165). If you enter now, that’s potentially a 750% profit! 🚀💰

I’ll go deeper into this long-term price target in a future idea, because this move still needs to break the weekly resistance—and there are multiple resistance levels along the way. But for now, we’re focusing on the immediate short-term setup. ⚠️📈

✅ 2. Repeating Price Patterns Inside the Triangle

Inside this gigantic triangle, AVAX price tends to repeat a similar structure each time:

The first pattern was made of converging trendlines → breakout → strong pump to the triangle’s top.

The second setup was a falling wedge → breakout → same explosive move.

👉 And now guess what? We have another bullish channel, and it’s currently breaking out as we speak! ⛓📉➡️📈

So make sure to act accordingly and keep your eyes on the chart! 👀🔥

and always remember :

🐺 Discipline is rarely enjoyable , but almost always profitable 🐺

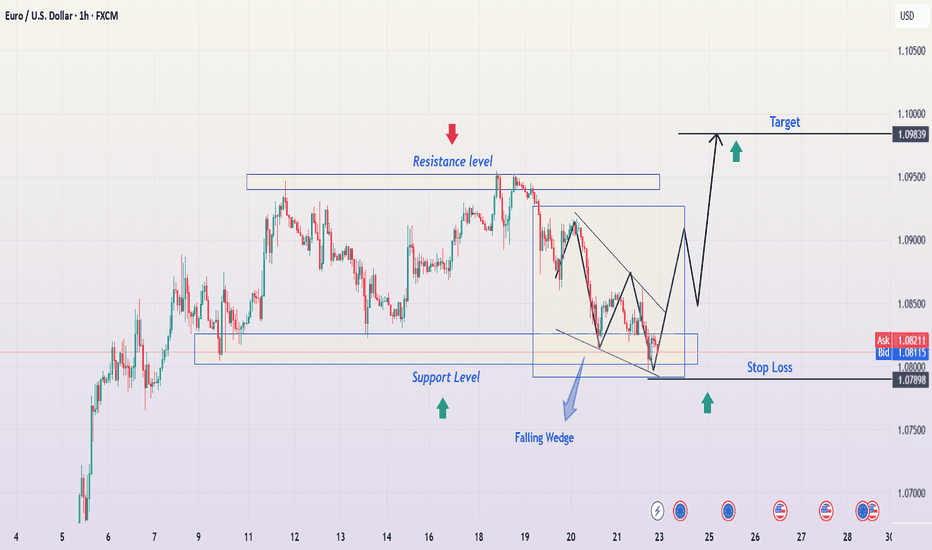

EUR/USD Falling Wedge Breakout – Professional Chart AnalysisOverview of the Chart

The EUR/USD 1-hour chart presents a bullish trading setup, featuring a well-defined falling wedge pattern, a trendline breakout, and a retest phase, signaling a potential upward move. The chart is marked with key technical elements such as support and resistance zones, breakout confirmation, and risk management parameters.

This analysis will break down each component of the chart, explaining the logic behind the setup and how traders can approach this opportunity.

1. Identified Chart Patterns

Falling Wedge Formation (Bullish Reversal Signal)

The price action formed a falling wedge, characterized by lower highs and lower lows, creating a narrowing price channel.

This pattern is typically a bullish reversal structure, as it indicates weakening selling pressure before an expected breakout.

The wedge’s downward movement ended with a strong breakout to the upside, signaling buyers regaining control.

2. Key Technical Levels

Support & Resistance Zones

Support Level (Buyers’ Stronghold)

The horizontal support level is a price area where buyers have previously stepped in, preventing further declines.

This level has been tested multiple times, reinforcing its strength as a key demand zone.

Resistance Zone (Profit Target Area)

The highlighted resistance zone represents a supply area where the price has struggled to move past in previous sessions.

The target price level aligns with this resistance, making it a realistic profit target for the long position.

3. Trendline Breakout Confirmation

Before forming the wedge, the chart shows an uptrend with a breakout above a trendline.

This trendline breakout was an early signal of bullish strength, aligning with the later wedge breakout.

After the breakout, the price came back for a retest, which is a key confirmation before further upward movement.

4. Retesting Phase Before the Upward Move

After breaking out of the wedge, the price returned to the breakout level to confirm support.

Retesting is a crucial validation step—if the price holds above this level, it increases the probability of a continued bullish move.

This retesting action provides a potential entry point for traders looking to go long.

5. Trade Setup & Risk Management Strategy

Trade Entry:

A buy entry is considered after the retest is confirmed (price holding above the breakout level).

Stop Loss Placement (Risk Control):

The stop loss is placed below the previous low at 1.07790, ensuring protection against fake breakouts or unexpected reversals.

Take Profit Target (Projected Price Move):

The target price is set at 1.09698, which aligns with previous resistance levels and the measured move from the wedge breakout.

This provides a strong risk-to-reward ratio, making the setup favorable for bullish traders.

6. Risk-Reward Ratio & Trade Viability

Risk: The distance between the entry point and the stop loss is relatively small, making it a low-risk trade.

Reward: The potential upside move is significantly higher than the risk, creating a high reward-to-risk ratio trade.

This type of technical confluence increases the probability of a successful trade, making it an attractive opportunity.

7. Conclusion & Trading Strategy

📌 Key Takeaways:

✅ The falling wedge breakout signals a bullish reversal.

✅ The trendline breakout and retest add further confirmation to the trade setup.

✅ The support and resistance zones provide a clear risk management strategy.

✅ The risk-reward ratio makes this an attractive long trade setup.

💡 Trading Plan:

🔹 Enter Long after retest confirmation above the breakout level.

🔹 Stop Loss: 1.07790 (below previous low).

🔹 Take Profit: 1.09698 (previous resistance zone).

Final Thoughts

This EUR/USD setup is a textbook example of a bullish reversal following a falling wedge breakout. Traders who patiently wait for a confirmed retest can capitalize on this high-probability trade setup, aiming for a strong bullish continuation.

🔹 Tags: #EURUSD #ForexTrading #TechnicalAnalysis #Breakout #PriceAction #TradingSetup #SupportResistance

Bitcoin (BTCUSD) Falling Wedge Breakout – Bullish Setup! 📌 Overview of the Chart Setup

This daily Bitcoin (BTC/USD) chart presents a technical breakout from a falling wedge pattern, a well-known bullish reversal signal. The price has been forming lower highs and lower lows over the past months, consolidating within a tightening structure. However, the current price action suggests an early breakout attempt, which could lead to significant upside movement in the coming weeks.

Let’s break down the key levels, technical insights, and trading opportunities visible in this chart.

📉 Chart Pattern: Falling Wedge (Bullish Reversal)

🔹 What is a Falling Wedge?

A falling wedge is a bullish continuation or reversal pattern characterized by converging downward-sloping trendlines. It typically signals a loss of bearish momentum, leading to a breakout to the upside.

🔹 Key Observations in the Chart

The price has been moving inside the falling wedge structure, with clear lower highs and lower lows.

The support level around $75,000-$80,000 has been repeatedly tested, forming a strong demand zone.

A trendline breakout has occurred, suggesting that bulls are regaining control over the price action.

Volume is expected to increase upon a confirmed breakout, reinforcing the bullish momentum.

📊 Important Technical Levels

1️⃣ Support & Resistance Zones

📌 Support Level: The $75,000-$80,000 zone has acted as a strong base, preventing further downside. Buyers have stepped in multiple times here.

📌 Resistance Level: The $95,000-$100,000 range represents a historical resistance where price has struggled to break through.

2️⃣ Trendline Breakout

The chart clearly shows a breakout above the falling wedge’s upper boundary, indicating a potential trend reversal from bearish to bullish.

If this breakout holds, Bitcoin could see strong buying pressure pushing it toward its next major resistance level.

📈 Trading Strategy & Setup

🔹 Entry Confirmation

To enter a long position, traders should wait for:

✅ A daily close above the wedge resistance (confirmed breakout).

✅ A successful retest of the breakout zone, which strengthens the bullish case.

A breakout retest is ideal because it provides a lower-risk entry point, ensuring the breakout is legitimate rather than a false move.

🔹 Target Price Projection

Using the height of the falling wedge as a projection, the potential price target is set at $118,000.

This level aligns with a 35%+ upside from the breakout zone.

Bitcoin must clear the $95,000-$100,000 resistance before reaching the final target.

🔹 Stop Loss Placement

A stop loss is positioned at $59,896, slightly below the previous major support zone.

This ensures that if the breakout fails, losses are minimized while still allowing price fluctuations within expected volatility.

🔹 Risk-to-Reward Ratio

Entry around breakout level (~$87,000)

Target: $118,000 (35% upside)

Stop Loss: $59,896 (~30% downside)

Risk-to-reward ratio: ~1:3, making this an attractive trade setup.

📢 Market Psychology & Sentiment

Why This Pattern Matters?

A falling wedge represents seller exhaustion. Over time, the bearish pressure weakens, leading to a bullish breakout.

If Bitcoin can maintain this breakout, momentum traders and institutional investors may step in, accelerating the rally.

Breaking above the resistance at $95K-$100K would confirm bullish dominance, potentially leading to new all-time highs.

Potential Risks

❌ Fake Breakout: If Bitcoin fails to hold above the wedge resistance, we may see a pullback to support before another breakout attempt.

❌ Macro Factors: External factors like regulatory news, interest rate decisions, and market-wide sentiment could impact price action.

❌ Bitcoin Dominance: If altcoins start rallying, some capital may rotate out of Bitcoin, slowing the upside move.

🚀 Final Thoughts: A High-Probability Bullish Setup

✅ The falling wedge breakout suggests a strong bullish shift, with a 35%+ potential upside.

✅ A confirmed breakout above $95K-$100K will act as a final confirmation before the next leg up.

✅ Risk is managed with a stop loss at $59,896, ensuring downside protection.

🔹 Best trading approach? Wait for confirmation, manage risk, and let the trend develop.

Would you like additional insights on entry techniques, volume confirmation, or potential invalidation points? 😊

BTC/USD Trading Analysis – Double Bottom & Rising Wedge BreakoutThis BTC/USD 4-hour chart showcases a potential bullish breakout setup based on technical patterns, key support and resistance levels, and price action analysis. The chart suggests a trend reversal following a downtrend, with signs of bullish momentum building up.

Let's break down the full technical analysis, covering the chart structure, key levels, price patterns, and trading strategy.

1. Market Structure & Identified Patterns

A. Double Bottom Reversal – Strong Bullish Signal

A double bottom pattern has formed, which is a bullish reversal signal that indicates the end of a downtrend.

This pattern consists of two significant low points (Bottom 1 and Bottom 2) near the $80,000 - $81,000 support zone.

The pattern confirms strong buying interest at this level, preventing further price drops.

A breakout above the resistance level would confirm the pattern’s validity, signaling a move toward higher targets.

B. Rising Wedge Formation – Potential Bullish Breakout

The price action is consolidating in a rising wedge, forming higher highs and higher lows within a narrowing range.

A rising wedge often suggests a potential breakout.

Since this wedge forms after a double bottom, the breakout is expected to be bullish, rather than a bearish breakdown.

If the price breaks above the wedge’s upper trendline, it will confirm a strong upward momentum.

2. Key Support & Resistance Levels

Support Levels:

Major Support Zone (80,000 – 81,000):

This level has been tested twice, confirming buyer strength.

It serves as the foundation for the double bottom pattern.

Stop Loss Level (72,921):

If the price drops below this level, it would invalidate the bullish setup.

This level is strategically placed to manage risk and protect against potential downturns.

Resistance Levels:

First Resistance Zone (95,000 – 100,000):

This is a critical level, as the price has faced multiple rejections here.

A breakout above this zone would confirm a strong bullish trend continuation.

Take Profit Targets:

TP1 (108,481): The first take-profit target aligns with previous highs and is a logical point for partial profit booking.

TP2 (114,372): This is the second profit target, calculated based on Fibonacci extensions and historical price movements.

3. Trading Strategy & Execution Plan

A. Entry Strategy

To execute a successful trade, we need to wait for confirmation of the breakout.

Ideal Entry: After a strong breakout above 95,000 – 100,000, indicating bullish momentum.

Confirmation Factors:

Increased trading volume → Signals strong buying interest.

Candle close above resistance → Confirms breakout.

Retest of broken resistance as support → Strengthens bullish continuation.

B. Risk Management

Stop Loss Placement: Below 72,921, ensuring limited downside risk.

Risk-to-Reward Ratio: The trade setup aims for a 1:3 or better risk-to-reward ratio.

C. Potential Scenarios

✅ Bullish Breakout:

If BTC breaks and holds above 95,000 – 100,000, we can expect a rally toward 108,481 (TP1) and 114,372 (TP2).

❌ Bearish Rejection:

If BTC fails to break resistance, it could retest 80,000 or drop lower, invalidating the bullish setup.

4. Final Thoughts – What to Expect?

This BTC/USD 4-hour chart analysis provides a high-probability bullish trade setup, supported by:

✅ Double Bottom Formation → Strong Reversal Signal

✅ Rising Wedge Breakout Potential → Momentum Building

✅ Key Resistance Breakout Levels Identified

📌 Conclusion:

If Bitcoin breaks above 95,000 – 100,000, expect a major bullish move toward 108,481 and beyond. However, if resistance holds, we might see a retest of lower support levels. Risk management is essential for a successful trade execution. 🚀

Is altseason soon?Hi, traders 👋

I’d like to share my thoughts and observations regarding Bitcoin dominance and the timing of the long-awaited altseason.

In general, I like to determine the phase altcoins are in by analyzing one of the oldest representatives of this group — Litecoin.

Like other financial instruments, cryptocurrency tends to follow certain patterns. Although each cycle comes with its own unique characteristics, historical similarities are often present.

Let’s take a look at the Litecoin chart.

When reviewing the chart, we can see a number of similarities with the previous cycle. Based on this, and if we assume that markets are cyclical and certain chart patterns and behaviors tend to repeat, it appears we are currently either in the equivalent of March or September 2020.

The case for March is supported by the fact that we haven’t yet seen a final liquidity sweep according to the Wyckoff model — the so-called “spring” phase. On the other hand, the case for September is supported by the timing following the end of the previous bear market phase.

Now, let’s take a look at the Bitcoin dominance chart.

In this cycle, the dominance chart has been showing clear and reliable chart patterns.

The pattern that has been forming since November 21, 2024, could potentially be either a Wolfe wave or an ending diagonal triangle according to Elliott Wave theory. At the moment, waves 1, 2, and 3 are clearly visible, and wave 4 is currently in the process of forming. There is also a clear alternation between waves 2 and 4, which strengthens this observation.

If the assumption about the Wolfe wave pattern is correct, we should still see one final push higher in Bitcoin dominance as part of wave 5. This would likely lead to a further decline in altcoins. In that case, referring back to the Litecoin chart analysis, it would confirm that we are currently in the equivalent of March 2020.

I’m glad to share my observations with you.

EUR/JPY Chart Analysis - Falling Wedge Target with Bullish SetupThis EUR/JPY 1-hour chart reveals a well-defined falling wedge pattern, which is a bullish reversal formation. Additionally, we see key support and resistance levels, a double bottom, and a breakout potential that traders can use to plan an entry. Let’s dissect this chart in a professional and detailed manner to understand the trade setup and market psychology.

🔹 Market Trend & Structure Analysis

The market was previously in an uptrend, making higher highs and higher lows, until it faced strong resistance at the 163.500 level. Upon reaching this zone, the price reversed downward, forming a series of lower highs and lower lows, which resulted in a falling wedge pattern.

This downward movement was accompanied by a trendline break, signaling a shift in momentum. The price has since reached a strong support level and is showing signs of potential bullish reversal.

🔹 Key Technical Patterns & Indicators

1️⃣ Falling Wedge Pattern (Bullish Reversal Signal)

A falling wedge is a pattern characterized by two downward-sloping trendlines that converge, indicating that selling pressure is weakening. This pattern is considered a bullish signal because:

✔️ The declining price movement shows exhaustion of sellers.

✔️ Volume typically decreases as the wedge forms, indicating a breakout is coming.

✔️ Once price breaks out of the wedge, a strong bullish move often follows.

The key here is to wait for a breakout above the upper trendline, which will confirm the bullish momentum.

2️⃣ Double Bottom Formation at Support (Reversal Confirmation)

The price tested the 160.500 support level twice, forming a double bottom pattern. This is another bullish sign, as it indicates:

✔️ Buyers are actively defending this level.

✔️ There’s strong demand around this price zone.

✔️ If price breaks above the wedge resistance, it could trigger a significant rally.

🔹 Key Support & Resistance Levels

Identifying support and resistance is crucial for defining entry and exit points.

✅ Support Levels:

160.500 – Strong horizontal support (Price tested this twice).

158.982 – Stop-loss level (Below this, the bullish setup is invalid).

✅ Resistance Levels:

163.500 – Major resistance (Previous high and supply zone).

165.090 – Final target (Key breakout level).

If the price successfully breaks out of the wedge, it has room to rise significantly, with 163.500 as the first target and 165.090 as the ultimate goal.

🔹 Trade Setup & Execution Plan

🎯 Bullish Breakout Trade Strategy

Since this setup signals a potential reversal, here’s how traders can execute a high-probability trade:

🔹 Entry Points:

✅ Aggressive Entry: Enter as soon as price breaks above the wedge resistance.

✅ Conservative Entry: Wait for a breakout and a retest of the resistance-turned-support before entering.

🔹 Target Levels:

🎯 First target: 163.500 (Previous resistance level).

🎯 Final target: 165.090 (Major resistance zone).

🔹 Stop-Loss Placement:

❌ Place the stop loss below 158.982, as a break below this level would invalidate the bullish setup.

🔹 Risk-Reward Ratio & Trade Justification

📈 Why This Trade Has a High Potential Reward?

Low-risk, high-reward: The stop loss is tight, while the upside potential is large.

Confluence of bullish signals: Falling wedge + Double bottom + Strong support.

Institutional interest likely: Buyers are stepping in at key levels.

A proper risk-to-reward ratio (RRR) for this trade would be at least 1:3, meaning for every 1% risk, there’s a 3% profit potential. This makes it a great swing trading setup.

🔹 Market Psychology Behind the Setup

The falling wedge represents a market correction after a strong bullish trend.

The double bottom shows that sellers are exhausted and buyers are gaining control.

If price breaks out, many traders will enter, triggering a strong upward rally.

This bullish breakout setup aligns with the smart money concept, where institutions accumulate positions before a big move.

🔹 Final Thoughts & Trade Outlook

This EUR/JPY setup presents a high-probability trade opportunity with a bullish breakout scenario. The combination of:

✅ Falling Wedge Pattern (Bullish reversal)

✅ Double Bottom at Support (Buyers stepping in)

✅ Key Resistance Targets (Clear trade exit points)

…creates a great trading setup.

📌 Trading Plan Summary:

✔️ Buy on breakout above the falling wedge.

✔️ Target 163.500 & 165.090 for profits.

✔️ Stop-loss below 158.982 for risk management.

🚀 If executed correctly, this trade has the potential for strong bullish momentum. Would you like a real-time update once the price confirms the breakout? Let’s keep an eye on this trade! 📊🔥

BTC Dominance at Critical Level – Altcoin Rally Incoming?🚀 Hey Traders! 👋

If you find this analysis valuable, show some love by smashing that 👍 and hitting Follow for high-probability setups that actually deliver! 💹🔥

BTC Dominance Update:

We’re seeing a rising wedge formation on the daily timeframe—a classic bearish pattern. Right now, BTC.D is testing resistance, and if it rejects here, we could see an explosive Altcoin rally! 🚀

📉 Breakdown = Altseason incoming!

🚨 Invalidation: A break and close above 62.5 would cancel this setup.

What do you think about this? Let me know in the comment section.

👉 Stay ahead of the game! Follow us for real-time updates and pro-level trade setups. Let’s dominate the markets together! 💪🔥

Falling Wedge Pattern For ZCash??When a security's price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move.

The trend lines drawn above the highs and below the lows on the price chart pattern can converge as the price slide loses momentum and buyers step in to slow the rate of decline.

Before the lines converge, the price may breakout above the upper trend line.

WLDUSDT: Is This the Last Chance Before a Major Breakdown?Yello Paradisers, are you prepared for what could be a textbook bearish opportunity on WLDUSDT? Because based on current price action and key confluences, this chart is screaming caution — and the next move might be much sharper than most expect.

💎WLDUSDT has broke down from a rising wedge pattern — a classic bearish signal that often leads to aggressive downside continuation. Alongside this, we’ve identified a clear internal Change of Character (I-CHoCH), followed by the formation of Fair Value Gaps (FVGs). These developments alone raise the probability of a bearish continuation, but that’s not all. The price structure is now forming a Head & Shoulders pattern — another strong reversal signal — increasing the bearish bias with multiple layers of confirmation.

💎If WLDUSDT pulls back from its current level and fills the FVG, we will be watching closely for a bearish candlestick pattern right around our defined resistance zone. This level also aligns perfectly with the Fibonacci golden pocket, adding even more weight to the area as a high-probability short entry. Should this setup form, the reward-to-risk (RR) potential becomes extremely favorable, providing an optimal entry for those waiting patiently.

💎On the other hand, for those considering entries from the current level — while the bearish probability still exists — the RR is much less attractive, hovering around 1:1 or even below. That’s not ideal, especially when managing risk like a pro. The probability of a pullback into the resistance area is still high, so it’s far better to wait for price to come to you. Only then will you have the proper setup to ensure a well-managed trade.

💎However, if WLDUSDT breaks above the resistance zone and we get a candle close above it, that would invalidate this bearish scenario entirely. In that case, it’s best to step aside and wait for better price action to develop. No need to force trades when the market is giving mixed signals — patience always pays.

🎖This is the only way you will make it far in your crypto trading journey. Be a PRO

MyCryptoParadise

iFeel the success🌴

EUR/USD Trading Analysis – Falling Wedge Breakout StrategyChart Overview

The EUR/USD 1-hour chart presents a classic falling wedge pattern, which is a bullish reversal setup indicating that selling momentum is weakening and a breakout to the upside is imminent. This chart provides a structured trading plan, highlighting support and resistance levels, entry points, stop-loss placement, and a target price.

Traders can use this setup to capitalize on the potential bullish move while effectively managing risk. Let’s break it down step by step.

1. Understanding the Falling Wedge Pattern

A falling wedge is formed when price action moves within two downward-sloping trendlines that converge. It signals decreasing bearish pressure, as the price forms lower highs and lower lows within a narrowing range. The decreasing range indicates that sellers are losing control, and an upside breakout is likely.

In this chart, we observe the following key characteristics of a falling wedge:

✅ Two converging downward trendlines that contain price movement.

✅ Lower highs and lower lows showing seller exhaustion.

✅ Decreasing volume as the price approaches the breakout zone.

✅ Support near 1.08000, which has held price several times before.

A breakout above the wedge signals a shift from bearish to bullish sentiment, making this a strong trade setup.

2. Key Support & Resistance Levels

🔹 Support Level (Demand Zone)

The horizontal blue zone at 1.07898 – 1.08000 is a critical support level.

This level has been tested multiple times, making it a strong demand zone where buyers step in.

The falling wedge bottom aligns with this area, reinforcing its importance.

If price stays above this zone, it confirms the potential for a bullish breakout.

🔹 Resistance Level (Supply Zone)

The resistance zone at 1.09300 - 1.09839 has acted as a barrier to upward movement.

Price previously reversed from this zone, making it a logical take-profit area.

If the breakout happens, this level will be tested again.

A break above 1.09839 would signal further bullish momentum.

3. Trading Strategy – Step-by-Step Execution

📌 Entry Confirmation

To enter this trade with confidence, traders should wait for a confirmed breakout above the wedge.

A strong bullish candle breaking above the wedge’s upper trendline signals entry.

Ideally, a pullback and retest of the breakout level would provide additional confirmation before entering long.

📌 Stop-Loss Placement

Risk management is key, and stop-loss placement should be strategic to avoid unnecessary losses.

A stop-loss is set just below 1.07898, slightly under the recent low.

This placement ensures protection against false breakouts.

📌 Take-Profit Target

The take-profit target is set at 1.09839, aligning with key resistance and the projected wedge breakout distance.

This level has historically acted as resistance, making it an ideal zone to exit profits.

Partial profit-taking can be considered near 1.09300, before the final target.

📌 Risk-to-Reward Ratio

With a tight stop-loss and a higher profit target, this trade offers a favorable risk-reward ratio (RRR).

A minimum RRR of 1:3 is recommended, meaning potential reward is three times the risk taken.

4. Expected Market Behavior & Possible Scenarios

📊 Scenario 1: Bullish Breakout Confirmation 🚀

If price breaks and closes above the wedge, we expect a rally towards 1.09300 - 1.09839.

Pullback to retest the breakout zone would further confirm bullish strength.

Strong volume would validate the breakout, leading to a high-probability move.

📉 Scenario 2: Bearish Breakdown (Invalidation) ❌

If price breaks below 1.07898, the bullish setup is invalidated.

A downside move could push the price lower, possibly towards 1.07500 or below.

Traders should exit long positions if this scenario unfolds.

5. Additional Technical Indicators for Confirmation

To strengthen this trade setup, traders can use:

✅ RSI (Relative Strength Index) – Look for RSI divergence or a move above 50, confirming bullish strength.

✅ MACD (Moving Average Convergence Divergence) – A bullish crossover on MACD would reinforce the breakout.

✅ Volume Analysis – A spike in volume at the breakout level adds confidence in the move.

6. Conclusion & Trading Plan

This falling wedge setup suggests a high-probability bullish breakout if the price confirms above the resistance zone.

🔹 Trading Plan Summary:

✅ Wait for a breakout above the wedge before entering.

✅ Confirm breakout with a retest or strong bullish candle.

✅ Set stop-loss below 1.07898 to limit downside risk.

✅ Take profit at 1.09839, securing profits at resistance.

This strategy offers an excellent risk-to-reward ratio, making it a well-structured trade setup. Always manage risk and avoid premature entries without confirmation.

📌 TradingView Tags for Maximum Visibility

#EURUSD #Forex #TechnicalAnalysis #FallingWedge #Breakout #PriceAction #ForexSignals #SupportResistance #TradingSetup #DayTrading #SwingTrading

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish Setup📌 Overview

This 1-hour chart of Silver (XAG/USD) presents a textbook Rising Wedge pattern, which is known as a bearish reversal signal. The price was in a strong uptrend but started showing signs of buyer exhaustion, leading to a breakdown from the wedge formation.

The chart clearly identifies:

✅ A Rising Wedge formation

✅ Resistance Level where price faced multiple rejections

✅ Breakdown Confirmation and shift in trend direction

✅ Projected Target & Stop Loss Zones

This setup suggests a strong potential for further downside movement in silver prices. Now, let’s break it down step by step like a professional trader.

🔹 Key Technical Analysis Breakdown

1️⃣ Rising Wedge Pattern – The Bearish Setup

The Rising Wedge is a bearish reversal pattern that forms when price action moves higher within two converging trendlines. The slope of the lower trendline is steeper than the upper trendline, meaning that buyers are getting weaker.

This pattern suggests that even though the price is rising, bullish momentum is fading.

Once the price breaks below the wedge, it confirms a bearish trend.

🔸 Characteristics of this Wedge:

📌 Multiple Higher Highs & Higher Lows – But with decreasing strength

📌 Narrowing Price Action – Indicates weaker buying power

📌 Breakdown Below Support Line – Confirms the bearish move

2️⃣ Resistance Level – Key Price Rejection Zone

The price tested the Resistance Level multiple times before breaking down. This area is where sellers overpowered buyers, preventing further upside movement.

The resistance zone was a liquidity area, meaning large institutional traders likely placed sell orders here.

The price attempted to push higher but failed, showing that demand was exhausted.

Once rejection happened, selling pressure increased, and the breakdown followed.

3️⃣ Breakdown Confirmation – Bearish Momentum Kicks In

After the wedge broke down, the price started moving in a structured downtrend, forming lower highs and lower lows. This confirms that the breakdown was valid and that the trend has shifted.

🔹 Signs of Breakdown Strength:

✅ Strong Bearish Candles – Indicating aggressive selling

✅ No Immediate Recovery – Suggests sellers are in control

✅ Lower Highs Forming – Bearish trend structure confirmed

4️⃣ Risk Management – Stop Loss & Target Zones

A well-planned trade must include a Stop Loss and a Target to manage risk effectively.

📌 Stop Loss Placement (33.95)

Placing a Stop Loss just above the resistance level protects against false breakouts.

If the price goes back above 33.95, it would invalidate the bearish setup.

📌 Profit Target (31.96)

The target is based on the measured move projection, meaning the expected price drop is equal to the height of the wedge at its widest point.

If the price reaches 31.96, traders can lock in profits.

📌 Risk-Reward Ratio (RRR)

The setup offers a favorable risk-to-reward ratio, making it a high-probability trade.

5️⃣ Expected Price Movement – Bearish Outlook

From here, we can expect the following price movement:

📉 Scenario 1: Continuation of Downtrend (High Probability)

The price will likely form lower highs and lower lows on its way to 31.96.

Each small rally should be met with selling pressure.

📈 Scenario 2: False Breakdown (Low Probability but Possible)

If the price moves back above 33.95, the wedge breakdown will be invalid.

This could lead to a bullish reversal instead.

6️⃣ Final Thoughts – How to Trade This Setup?

This Rising Wedge Breakdown provides an excellent short-selling opportunity. Here’s how a professional trader would approach it:

✅ 🔹 Entry Strategy:

Short after a retest of the broken wedge support

Confirmation of lower highs ensures trend continuation

✅ 🔹 Risk Management:

Place Stop Loss above 33.95

Take profits around 31.96

✅ 🔹 Confirmation Signals to Watch:

Lower highs forming after breakdown

Increased selling volume on bearish candles

Price respecting the downtrend structure

🔔 Conclusion – Bearish Bias Confirmed

🔻 Trend Shift: The breakdown signals a potential trend reversal in silver.

🔻 Bearish Targets: The price is expected to fall toward 31.96 in the coming sessions.

🔻 High-Probability Trade: Strong technical reasons support a bearish outlook.

🚨 Watch for further confirmations and manage risk effectively! 📊💰

$JPM Navigating a Narrow ChannelJPM has 2 plots playing out, a rising wedge nested with a larger broadening wedge. We have negative divergence showing up on TSI & RSI showing that we might reach an early peak in current weekly cycle. Though price is above the a horizontal resistance, there is a higher probability that this is a false breakout.

A weekly swing high can be a signal for an entry with expectation we break below wedge support.

BTCUSD Bitcoin Rising Wedge Breakdown – Professional AnalysisBitcoin's price action is forming a Rising Wedge pattern on the 1-hour chart, a well-known bearish reversal formation. This pattern suggests that although the price has been making higher highs and higher lows, the upward momentum is weakening. Historically, when a rising wedge breaks to the downside, it often leads to strong downward movement, making it an ideal shorting opportunity.

This analysis will cover the pattern formation, key support and resistance levels, price action expectations, trading strategy, and risk management to ensure a well-informed trade setup.

1. Chart Pattern Breakdown: Understanding the Rising Wedge

Formation of the Rising Wedge

The price has been moving within two converging trendlines (black lines), forming a wedge shape.

The slope of both the upper and lower trendlines is positive, indicating an uptrend, but the lower trendline is steeper, suggesting weakening bullish pressure.

As Bitcoin moves higher, buying volume is declining, indicating that buyers are losing control.

The price has tested the upper resistance trendline multiple times, failing to break above it, further confirming bearish exhaustion.

The lower trendline has acted as strong support, but multiple touches suggest a possible breakdown soon.

Why This Pattern is Bearish

The rising wedge is inherently bearish because it signals that although the price is rising, the upward movement is slowing down. Eventually, the price is likely to break below the lower support trendline, triggering a sharp sell-off.

A breakdown from this wedge structure would confirm the start of a downtrend, making it an excellent opportunity for short traders.

2. Key Technical Levels to Watch

Resistance Level (~$86,000 - $86,500) - Strong Sell Zone

Bitcoin has repeatedly failed to break above this zone, indicating heavy selling pressure.

If the price unexpectedly moves above this level, the bearish setup would be invalidated.

Support Level (~$80,000 - $80,500) - Breakdown Zone

This support level has held strong multiple times.

If BTC loses this zone, it will likely trigger a massive drop due to stop-loss orders being hit and panic selling.

Stop Loss ($88,062) - Risk Management

A stop loss above $88,062 ensures protection against unexpected bullish breakouts.

This level is placed just above recent highs to minimize the risk of premature stop-outs.

Target Level ($75,718) - Profit Objective

The projected price target is based on measuring the height of the wedge and applying it to the breakout point.

This level also aligns with a major historical support zone, where buyers might step in.

3. Trading Setup & Strategy

Bearish Trading Plan - Short Setup

📌 Entry:

Enter short after Bitcoin breaks below the wedge’s lower support and confirms the breakdown by retesting support as new resistance.

Ideal entry price is around $81,500 - $82,000 after confirmation.

📌 Stop Loss:

Place above $88,062, which is beyond the wedge’s upper resistance.

This protects against unexpected bullish breakouts.

📌 Take Profit:

First target: $78,000 (psychological support).

Final target: $75,718 (technical breakdown target).

Confirmation Signals for a Strong Short Trade

✔ Candle Close Below Support – A 1-hour candle closing below the wedge confirms a breakdown.

✔ Increase in Selling Volume – Rising bearish volume supports downward momentum.

✔ Retest of Broken Support as Resistance – If the price retests the wedge’s lower trendline and fails to reclaim it, it confirms further downside.

4. Risk Management & Considerations

Risk-to-Reward Ratio: The trade offers a 3:1 risk-reward ratio, making it highly favorable.

Market Conditions: External news events, institutional activity, or macroeconomic trends (like inflation reports) could impact price action.

Bear Trap Possibility: If Bitcoin breaks below but quickly reclaims support, it could be a fakeout, so wait for confirmation before entering.

5. Alternative Scenario – When to Invalidate the Bearish Outlook?

Although the primary expectation is a bearish breakdown, we must consider alternate scenarios:

🚨 Bullish Invalidation: What if Bitcoin Rallies?

If Bitcoin breaks above the resistance zone at $86,500 - $88,000, the rising wedge breakdown would be invalidated. In that case:

✅ A breakout above $88,062 could trigger a short squeeze, pushing BTC toward $90,000+.

✅ Bulls will regain control, shifting the trend to bullish continuation instead of reversal.

🔹 In such a case, traders should exit short positions and re-evaluate market conditions before re-entering trades.

6. Conclusion – Trading Plan Summary

📊 Current Bias: Bearish 📉

🔹 Pattern: Rising Wedge (Breakdown Expected)

🔹 Entry: Short after wedge breakdown & confirmation

🔹 Stop Loss: Above $88,062

🔹 Target: $75,718

Bitcoin is forming a classic Rising Wedge, which historically leads to strong downward movement once it breaks support. If BTC follows the expected scenario, a high-probability short trade is in play, targeting a decline toward $75,718. However, traders must wait for confirmation and manage risk effectively to avoid fakeouts.

📢 Stay updated, follow price action closely, and trade responsibly! 🚀

DJT/SPX comparisonBearish case for equities.

Chart comparing DJT and SPX. DJT in wave ((c)) of regular flat, SPX in wave ((c)) of expanded flat.

SPX showing ending diagonal (wedge) to complete wave ((b)).

Bottom of SPX pitchfork (blue line) broke support and now acting as resistance.

This count anticipates each market to soon have a large (15-20%) 5-wave impulsive move down, DJT to complete wave 5 of (3) of ((c)) and SPX to complete wave (3) of ((c)).

After this proposed move, each market will have completed its wave (3) of ((c)).

I would expect wave (4) to be zigzag corrections for DJT and SPX before large wave (5)'s

to take price down towards March 2020 lows.

GOLD → Consolidation (correction) before growth to $3100FX:XAUUSD is going into consolidation after strong growth on the back of dollar correction. The metal may test deeper support areas before attempting a new high

Gold is correcting, but remains in an uptrend

The decline in quotations may be seen as a buying opportunity, given the economic uncertainty due to Trump's tariffs and expectations of Fed rate cuts.

The Fed reiterated its forecast of two rate cuts in 2025 despite Powell's cautious comments. Gold is further supported by rising inflation risks and geopolitical tensions in the Middle East.

Resistance levels: 3045, 3057

Support levels: 3024, trending, 3004

Reaction to support is weakening, even amid the uptrend. Gold may stay in this consolidation until the middle of next week, or it may try to break out of the consolidation to retest deeper support zones, such as the rising trend line or the 3004 imbalance zone, from which the growth may resume.

Regards R. Linda!

EUR/JPY Trading Setup – Falling Wedge Breakout Potential1. Overview of the Market Structure

The EUR/JPY daily chart presents a falling wedge pattern, which is a classic bullish reversal setup. This pattern has been forming for several months, indicating that the price has been consolidating within a narrowing range. The falling wedge typically suggests that selling pressure is weakening, and a potential breakout to the upside could follow.

The chart also highlights key support and resistance zones, along with a well-defined trading setup based on technical confluences.

2. Key Technical Levels

Support Level: ~ 155.819 (Marked as Stop Loss)

This level has acted as strong support multiple times.

A break below this level would invalidate the bullish bias.

Resistance Level: ~ 163-164

The price has previously struggled to break above this region.

Currently, it is retesting this level after a breakout attempt.

Target Levels:

175.246 – This aligns with a previous all-time high zone and a strong resistance level.

179.562 – Marked as the ultimate target, indicating a full breakout potential.

3. Falling Wedge Formation & Breakout Analysis

A falling wedge is a bullish pattern that indicates a decrease in selling pressure over time.

The price has tested the lower trendline multiple times, showing strong demand at support.

Recently, the price broke above the upper wedge trendline, suggesting that a breakout is in progress.

However, the breakout needs confirmation in the form of a successful retest at the previous resistance level (~163-164).

4. Retest Confirmation & Trade Setup

Retest Scenario: If the price holds above the previous resistance and confirms it as support, the probability of continuation towards 175-179 increases.

Entry Strategy: A buy entry can be considered after a successful retest with bullish price action confirmation.

Stop-Loss Placement: Below 155.819 (previous strong support).

Risk-Reward Ratio: The target offers a strong risk-reward ratio if the breakout holds.

5. Market Sentiment & Volume Analysis

The previous downward move showed declining bearish momentum, further confirming the validity of the falling wedge.

A volume increase on the breakout would provide additional confirmation.

If the price consolidates near the breakout zone with low volatility, a strong move upward could follow.

Final Conclusion: Bullish Breakout in Progress

The falling wedge breakout suggests that EUR/JPY is poised for further upside.

A successful retest at 163-164 could push the price towards 175.246 and ultimately 179.562.

Risk management is crucial, and a stop-loss below 155.819 is recommended to avoid invalidation of the setup.

This setup presents a high-probability trading opportunity, but confirmation through price action and volume analysis remains key.

Key Trading Plan Summary:

📌 Pattern: Falling Wedge (Bullish)

📌 Breakout Confirmation: Yes, but retesting is ongoing

📌 Entry Point: Above 163-164 after successful retest

📌 Stop Loss: Below 155.819

📌 Target Levels: 175.246, then 179.562

📌 Risk-Reward: Favorable if breakout sustains

Would you like any refinements or a more concise version for your TradingView post? 🚀📈

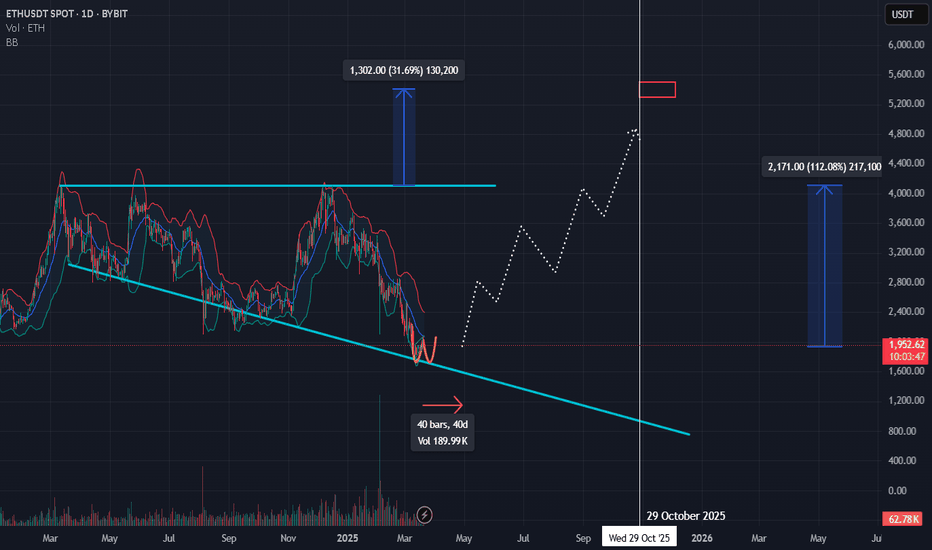

ETH to at least $ 5400 in November 2025?ETH has declined by 53% since its 2024 year high (YH24) of $ 4108. A bottom price could lie around $ 1760.

However, TA shows ETH could rise to $ 5400, or more, based on a megaphone pattern / broadening wedge on the weekly chart. This price target could be reached in November 2025.

For ETH a difference of $ 2170 (the height) between the present price at the support line and the upper trendline around exists. Once the resistance of $ 4108 is broken the price target is calculated by adding 60% of $ 2170 (= $ 1302) to the price at the breakout point. So $ 4108 + $ 1302 ≈ $ 5400. The price target of $ 5400 could be a modest one given the fact that a break out is likely to happen at the end of September 2025 and the height of the pattern is larger then.

A strong correlation between ETH and BTC exists. This allows us to get an estimate when ETH may start to rise significantly when looking at BTC. Possibly this rise could start in early May.

Strong rises in the past for ETH and BTC occured in November 2024 and October 2023. On both instances BTC broke out of a broadening wedge pattern and crossed RSI = 70 on the daily chart.

Those broadening wedge patterns lasted 40 - 60 days. At present time no such pattern can be seen, so in case history repeats ETH may start to rise strongly at the start of May (40 days from now).

The bottom could be a price of around $ 1760, showing by possibly a double bottom (or Adam & Eve or 'cup n handle' etc.). Anyway exciting times await us.

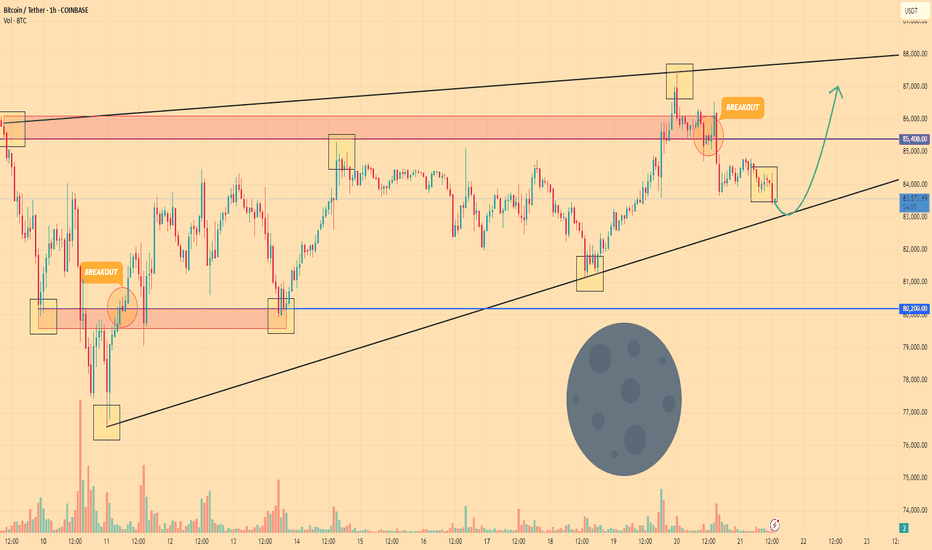

BITCOIN - Price can bounce up to $87K, breaking resistance levelHi guys, this is my overview for BTCUSDT, feel free to check it and write your feedback in comments👊

Price entered to wedge and at once dropped to support line, breaking two levels, after which it bounced up.

Soon, it broke $80200 level and then tried to grow, but failed and made a correction to $80200 support level.

Later BTC rose to $85400 level and then some time traded near, after which it turned around and corrected to support line.

Then price in a short time rose to resistance line of wedge, breaking the resistance level, but a not long time ago fell back.

Bitcoin broke $85400 level and continued to decline, and in my mind, it can soon reach support line of wedge.

After this movement, I expect that BTC can bounce up to $87000, breaking resistance level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️