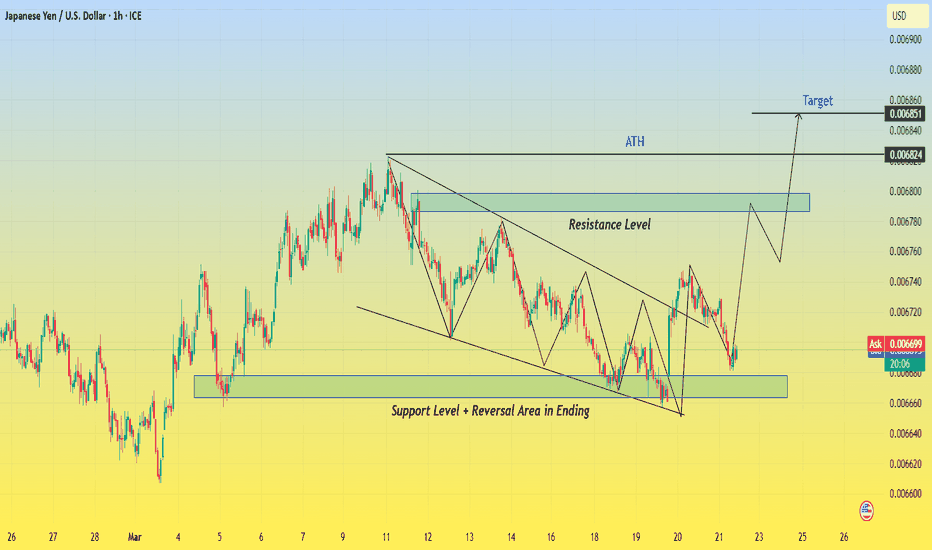

JPY/USD Trading Setup – Falling Wedge Breakout & Bullish MoveThe JPY/USD 1-hour chart is displaying a well-defined falling wedge pattern, which is typically a bullish reversal setup. This pattern forms as price action moves within converging trendlines, indicating that selling pressure is gradually weakening. The breakout from this pattern signals a potential trend reversal, and the price may be heading toward key resistance zones and an eventual bullish target.

This analysis will break down the chart structure, market psychology, key levels, and a trading setup to help traders make an informed decision.

1. Understanding the Falling Wedge Pattern

The falling wedge is a common price action pattern characterized by:

🔹 Lower highs and lower lows forming within two downward-sloping trendlines.

🔹 Decreasing volume, indicating that sellers are losing momentum.

🔹 A breakout above the upper trendline, confirming a shift in trend and signaling the start of bullish momentum.

Market Psychology Behind the Wedge Pattern:

📉 During the wedge formation, the market is in a downtrend, and sellers are in control. However, with each new lower low, the price finds strong support, and buyers start stepping in.

📊 As the wedge narrows, the downward momentum weakens, and sellers struggle to push the price lower. Eventually, demand exceeds supply, leading to a breakout to the upside, which is exactly what we see on this chart.

2. Key Levels & Market Structure

🔹 Support Zone & Reversal Area:

The support zone between 0.006660 - 0.006680 acted as a strong demand area, preventing further downside.

This is also labeled as a reversal area, meaning buyers were aggressive in this zone.

The final touch at this support led to a strong bounce, initiating the breakout.

🔹 Resistance Level:

The price is now approaching a key resistance area at 0.006780 - 0.006800, which previously acted as a supply zone.

A break and retest of this level would further confirm bullish momentum.

🔹 All-Time High (ATH) & Target Level:

The ATH region is marked on the chart as a historical resistance level where price faced strong selling pressure before.

If the current breakout holds, price action could aim for the 0.006851 target level, completing the measured move from the wedge pattern.

3. Trading Strategy & Execution Plan

📈 Entry Strategy:

There are two main ways to enter this trade:

1️⃣ Aggressive Entry: Enter immediately after the breakout above the falling wedge.

2️⃣ Conservative Entry: Wait for a breakout AND retest of the previous resistance turned support (0.006780 zone) before entering long.

🔻 Stop-Loss Placement:

To manage risk, traders should consider placing stop-loss orders:

Below the previous support zone (0.006660) to minimize downside risk.

Alternatively, below the wedge breakout point if using a tight stop-loss.

🎯 Take-Profit Targets:

1️⃣ First Target: 0.006780 (near-term resistance level).

2️⃣ Final Target: 0.006851 (based on wedge breakout projection).

4. Confirmation & Risk Management

🔎 Key Confirmation Factors for a Strong Breakout:

✅ Price breaks above the falling wedge with strong bullish candles.

✅ Volume increases, showing strong buying interest.

✅ RSI or other momentum indicators confirm bullish divergence.

⚠️ Potential Risks to Consider:

False Breakout: If price falls back inside the wedge, this could invalidate the bullish setup.

Rejection at Resistance: If buyers fail to push price above the 0.006780 resistance, it could lead to another consolidation.

5. Final Thoughts & Trading Outlook

📌 This JPY/USD chart presents a high-probability bullish setup due to the breakout from a falling wedge pattern.

📌 The breakout, strong support zone, and bullish price action indicate further upside potential.

📌 Risk management is key—waiting for confirmation can increase the probability of success.

💡 Final Verdict: Bullish Bias – Watching for Retest & Continuation to Target! 🚀

Wedge

EURJPY → False breakout of key resistance ...FX:EURJPY is forming a false breakdown of resistance and draws us a reversal pattern against the upper boundary of the descending price channel, as well as the pressure on the market creates the correction of the dollar...

On the daily chart the structure is bearish. After the false breakout of the global resistance a correction is formed, within which the price can test the imbalance zone or the previously broken resistance and continue its fall after the liquidity capture. The global trend is neutral and in this case it is worth considering local support levels as targets

Resistance levels: channel boundary, 162.3, 163.0

Support levels: 160.84, 158.9

A retest of the channel resistance or the area of 162.4 - 163 is possible. But any return of the price under the resistance of the descending channel and consolidation of the price in the selling zone may provoke further decline

Regards R. Linda!

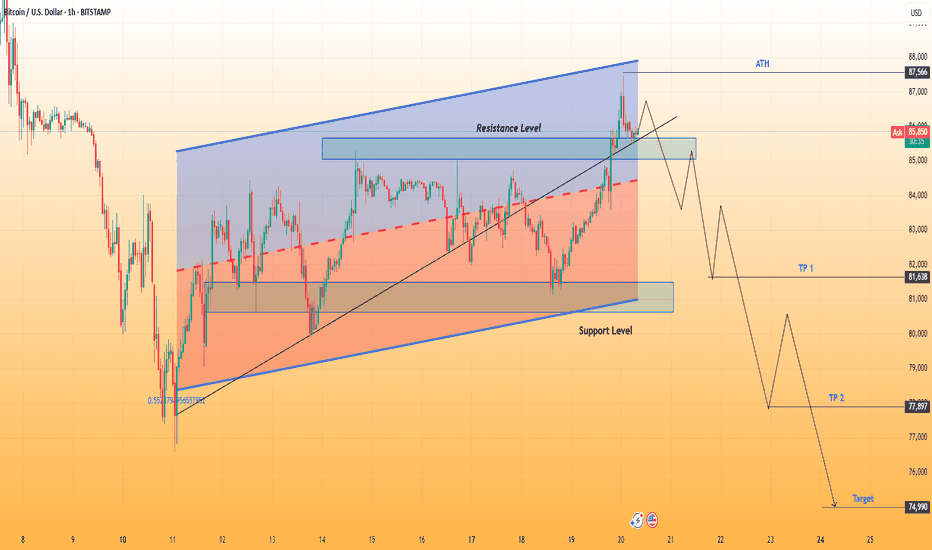

(BTC/USD) – Rising Wedge Pattern - Critical Breakout Setup🔍 Market Overview & Technical Breakdown

Bitcoin (BTC/USD) is currently forming a rising wedge pattern on the 4-hour timeframe, which is a bearish signal indicating a potential reversal. The price action shows higher highs and higher lows, but the narrowing wedge suggests that buying momentum is weakening.

BTC has been battling a major resistance zone around $85,000 - $87,500, struggling to break higher. If Bitcoin fails to hold above the key support level at $80,000, we could see a strong downside move. However, if BTC breaks the upper resistance, the bearish setup may be invalidated, opening the door for a push toward $95,000+.

📉 Rising Wedge Pattern (Bearish Formation)

A rising wedge occurs when the price moves upward within two converging trendlines, making higher highs and higher lows but with a weakening bullish momentum. This pattern often breaks downward, leading to a sharp sell-off.

Characteristics of This Wedge Formation:

✅ Upward Sloping Support & Resistance Lines: BTC is trending higher, but the slope is narrowing, showing a loss of bullish strength.

✅ Decreasing Volume: Volume is declining as price moves higher, indicating buyers are losing control.

✅ Bearish Breakout Probability: Rising wedges typically break down 75% of the time, suggesting a high likelihood of a drop below support.

🔑 Key Levels to Watch

🔺 Resistance Zones (Potential Breakout Levels)

1️⃣ $85,000 - $87,500 → Strong resistance; BTC has repeatedly failed to break above.

2️⃣ $90,000+ → A confirmed breakout would invalidate the wedge and shift the trend bullish.

3️⃣ $107,000 Target → If BTC breaks above resistance, we could see a move toward the psychological $100,000 - $107,000 level.

🔻 Support Levels (Bearish Breakdown Zones)

1️⃣ $80,000 - $82,000 → Key support within the wedge; a breakdown confirms the bearish move.

2️⃣ $75,000 → Strong historical demand zone; BTC could bounce here if it drops.

3️⃣ $70,000 and Below → Ultimate bearish target if selling pressure accelerates.

📈 Bullish vs. Bearish Scenarios

⚠️ Bearish Scenario (Rising Wedge Breakdown)

🔴 Entry: Below $80,000 (confirmed breakdown).

📉 Stop-Loss: Above $83,500 (to avoid fakeouts).

🎯 Take-Profit Targets:

TP1: $78,000

TP2: $75,000

TP3: $70,000

🔹 Confirmation: Look for increased selling volume and a retest of $80,000 as resistance after breakdown.

🚀 Bullish Scenario (Breakout Above Resistance)

✅ Entry: Above $87,500, confirming bullish momentum.

📉 Stop-Loss: Below $85,000 (to minimize risk).

🎯 Take-Profit Targets:

TP1: $90,000

TP2: $95,000

TP3: $107,000

🔹 Confirmation: BTC must break the wedge’s upper boundary with strong volume for bullish continuation.

📊 Technical Indicators & Market Sentiment

🔵 RSI (Relative Strength Index)

Currently near 60 – Showing bullish momentum but not yet overbought.

A move above 70 could signal an overbought market and potential reversal.

🔴 Volume Profile

Volume is decreasing as BTC rises, suggesting a possible exhaustion of buying power.

A breakout should be accompanied by strong volume to confirm bullish strength.

🟢 Moving Averages (EMA & SMA)

BTC is trading above key EMAs (50 & 200), supporting the bullish case.

A breakdown below the 50 EMA could accelerate selling pressure.

📢 Final Thoughts: High-Risk, High-Reward Setup

🚨 BTC is at a critical decision point! The rising wedge pattern suggests a bearish reversal, but confirmation is needed. If BTC breaks below $80K, expect a strong sell-off. However, if bulls manage to break above resistance, BTC could rally toward $100K+.

🔹 Risk Management Tip:

✅ Always wait for confirmation before entering a trade.

✅ Use stop-losses to protect your capital.

✅ Monitor volume & key levels for stronger trade signals.

🔥 What’s your take on this setup? Will BTC break down or push higher? Let’s discuss in the comments! 👇

The THETA chart sure has a story to tell!*"Here is a copy of my latest THETA chart, which I recently covered. There is a lot of information to be discovered simply by looking at it and drawing the proper conclusions. This will be one to watch as we move forward into the 'April flash crash' thesis I have been widely discussing.

Even if it doesn't materialize as I've theorized, there are still some interesting developments that could be coming regarding the future of this asset.

Good luck, and always use a stop loss!

Rising Wedge: "Continuation"OKX:DOGEUSDT Analysis – Potential Downtrend Continuation

The bulls initially pushed the price above the rising wedge but failed to hold it as support. As a result, the price retraced, breaking below the trendline once again. The bears not only successfully breached this level but also converted the upper trendline into resistance. Subsequently, within 2 to 3 hours, the price broke below the lower trendline, signaling further bearish momentum.

Traders should be cautious of a potential downtrend continuation. At the $0.161694 level, a large-scale liquidation of approximately $3.01 million is present, making it a potential profit-taking zone if the bears manage to hold the lower trendline as resistance.

This is just my perspective—trade wisely! 🤞⚡💰

Oil Market at Risk: Potential Breakdown Below Key SupportThe oil market is showing signs of weakness, with a technical triangle formation on the verge of breaking down. Key support at USD 66.50 per barrel is under threat, and several fundamental and macroeconomic factors suggest further downside risks.

Some Key Bearish Factors for Oil

1. Weakening Global Economy

Economic indicators across major economies are flashing warning signs. A slowdown in global growth, particularly in China and Europe, is reducing industrial demand for oil. Weaker economic activity typically translates to lower energy consumption, putting pressure on oil prices.

2. Stronger U.S. Dollar

A rising USD makes oil more expensive for buyers using other currencies, leading to lower demand. If the Federal Reserve maintains its hawkish stance on interest rates, a stronger dollar could continue weighing on oil prices.

3. Supply Overhang and Shale Resilience

Despite OPEC+ production cuts, oil supply remains ample. U.S. shale producers have kept output steady, while global inventories are rising. If supply continues to outpace demand, downward pressure on prices is likely.

4. China’s Slowing Recovery

China, the world’s largest oil importer, has struggled with weaker-than-expected economic data. Lower manufacturing activity and sluggish domestic demand are reducing the country’s need for crude oil, further dampening market sentiment.

5. Geopolitical De-escalation

A potential ceasefire in Ukraine could ease concerns over energy supply disruptions. Lower geopolitical risk would reduce the war-driven risk premium on oil, potentially triggering a price decline.

6. Growth in Alternative Energy

The increasing adoption of electric vehicles (EVs) and renewable energy is gradually reducing structural demand for crude oil. As governments push for greener energy solutions, long-term oil consumption trends may continue declining.

7. Speculative Unwinding

Traders and hedge funds could accelerate the sell-off if USD 66.50 support breaks. Technical breakdowns often lead to increased short-selling and stop-loss triggers, intensifying downward momentum.

Conclusion: More Downside Ahead?

With a weakening economy, strong dollar, and growing supply concerns, oil faces multiple headwinds. If key technical support at USD 66.50 breaks, the market could see further declines in the short term. Unless demand picks up or supply constraints emerge, the bearish trend may persist.

#OilMarket #CrudeOil #BearishOutlook #Energy

EURJPY Breakout Analysis: Falling Wedge & Key LevelsChart Pattern Breakdown

The chart presents a 4-hour timeframe for EUR/JPY, revealing a strong technical setup with multiple key patterns in play. The price action has been forming a falling wedge, a bullish reversal pattern, followed by a breakout.

Falling Wedge Formation

A falling wedge pattern is characterized by a narrowing range, where both highs and lows trend downward but converge towards a breakout point. This setup indicates a loss of bearish momentum and the potential for a strong bullish move once the price breaks out.

The wedge began forming in early February, with price making lower highs and lower lows within the structure.

The support level remained stable, while the resistance trendline kept the price within a tightening range.

Around early March, the price successfully broke above the wedge resistance, confirming the bullish breakout.

Key Resistance & Support Levels

Resistance Level (Marked on the chart)

Around 163.500 - 164.000, where the price faced rejection multiple times.

The market tested this level but struggled to break through immediately, confirming its importance.

Support Level (Marked on the chart)

Around 158.500 - 159.000, acting as a strong demand zone.

This area provided multiple bounces before the final wedge breakout.

Current Price Action & Trading Setup

Breakout Confirmation: The price successfully broke the wedge and moved higher, testing the resistance zone.

Pullback & Retest: The market is currently pulling back, testing the recent breakout area. This could be an ideal entry point for a long trade.

Bullish Target: The next significant resistance is at 166.754, followed by an extended target at 166.938.

Trade Plan

✅ Long Entry: On a successful retest of support near 160.500 - 161.000

🎯 Target 1: 166.754

🎯 Target 2: 166.938

🔒 Sell Stop (Stop Loss): Below 158.918 to minimize risk

Conclusion

The EURJPY chart is showcasing a strong bullish setup with a confirmed falling wedge breakout. As long as price holds above the key support level, the market is likely to continue its bullish momentum towards the 166+ zone. Traders should watch for confirmations such as bullish candlestick patterns, volume surges, and trendline support before entering a long position.

🚀 Do you agree with this setup? Drop your thoughts in the comments! 🚀

ENA/USDT: 100% PROFIT POTENTIAL TRADE SETUP!!🚀 Hey Traders! ENA Breakout Alert – 100% Move Incoming? 👀🔥

If you’re excited for this setup, smash that 👍 and hit Follow for premium trade ideas that actually deliver! 💹🔥

🔥 ENA/USDT – Breakout & Retest in Play! 🚀

ENA has broken out of a falling wedge and is now retesting the breakout level. With momentum building, it looks poised for a massive 90-100% upside move from here! 💥

💰 Trade Setup:

📍 Entry: CMP, add more up to $0.36

🎯 Targets: $0.46 / $0.58 / $0.66 / $0.77

🛑 Stop-Loss: $0.325

⚡ Leverage: Low (Max 5x)

🔎 Strategy:

Enter with low leverage now

Add more on dips and ride the breakout momentum higher 🚀

💬 What’s Your Take?

Are you bullish on ENA’s potential for a 100% move? Share your analysis, predictions, and strategies in the comments! Let’s crush it together and lock in those gains! 💰🚀🔥

ETH/BTC a precarious position..ETH has certainly struggled this cycle as many would begrudgingly admit. BUT.. I do think ETH will shine towards the end of Q1 and into Q2. That being said I am looking for bottom signals on ETH/BTC to truly gauge it's relative USD bottom. I think ETH/BTC is on a cliff right now. Does it take off and begin to soar? or does it take one more dive before it finally awakens? A short term reversal is in the cards right now as it's testing support on a wedge breakout from the bottom. IF IT HOLDS I think a retest of 0.025/0.0295 is next.

IF IT FAILS and 0.0227 does not hold I think 0.02 is in the cards. and possibly a quick wick to 0.0178/0.0161

#NFA #Godspeed

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish OutlookChart Overview

This is a 1-hour chart of Silver (XAG/USD) from OANDA, showing recent price action forming a rising wedge pattern followed by a bearish breakdown. The price initially rallied within the wedge but failed to sustain gains above the key resistance zone, leading to a strong rejection and downward momentum.

Key Chart Elements & Analysis

1. Rising Wedge Formation (Bearish Pattern)

The market was in an uptrend, forming higher highs and higher lows within a rising wedge pattern.

A rising wedge is a classic bearish reversal pattern, which indicates weakening buying pressure as price consolidates upward.

The price eventually broke below the lower trendline, signaling a shift in momentum from bullish to bearish.

2. Resistance Zone & Rejection

A strong resistance zone was identified around $33.80 - $34.20 USD (highlighted in blue).

Price attempted multiple times to break above this level but faced selling pressure, leading to a sharp reversal.

The final breakout attempt failed, confirming that sellers are in control.

3. Breakdown & Retest of Support

After breaking down from the wedge, the price found temporary support around $33.20 USD, which aligns with a previous consolidation area.

A retest of the broken wedge support turned into resistance, further confirming the bearish bias.

The rejection from this level strengthened the case for a move lower.

4. Next Support Level & Target Projection

The next significant support zone is around $31.95 - $32.00 USD (marked as the "Target" area).

This level coincides with previous price action support, making it a high-probability bearish target.

The breakdown is expected to follow a measured move projection, bringing price toward this level.

Trade Plan & Execution Strategy

📉 Bearish Setup (Short Opportunity)

Ideal Entry: A pullback to the previous support (now resistance) at $33.20 - $33.40 USD could offer an entry for shorts.

Stop-Loss: Above $33.80 USD, just above the resistance zone.

Target Levels:

Primary Target: $32.50 USD

Final Target: $31.95 - $32.00 USD

Confirmation: Look for price rejection or bearish candlestick formations at resistance before entering.

⚠️ Risk Management & Considerations

Bullish Scenario: If price reclaims $33.80 USD, the bearish setup could be invalidated, and a move higher toward $34.50 USD is possible.

Market Conditions: Keep an eye on macroeconomic factors, news events, and USD strength, as they can influence silver prices.

Conclusion: Bearish Outlook with Downside Target 🎯

The rising wedge breakdown signals further downside potential.

A support retest rejection confirms selling pressure.

$31.95 - $32.00 USD remains the main target, aligning with technical projections.

Short positions with proper risk management remain favorable in this setup.

What is a Rising Wedge? - Opportunities on GALA and ARWEAVE!What is a rising wedge?

A rising wedge pattern is a bearish chart formation that signals either a potential trend reversal or the continuation of a downtrend. It occurs when the price consolidates within two upward-sloping, converging trendlines, indicating weakening momentum.

Key Characteristics of a Rising Wedge:

1. Higher Highs and Higher Lows – The price moves upward, but the momentum gradually weakens.

2. Converging Trendlines – Both the upper and lower trendlines slope upward while moving closer together, suggesting a loss of strength in the trend.

3. Breakout Direction – The pattern typically breaks below the lower trendline, confirming a bearish reversal.

How to Trade a Rising Wedge:

• Wait for Confirmation – A breakdown below the lower trendline with increased volume confirms the pattern.

• Set a Target – Measure the height of the wedge and project it downward, often aiming for the starting point of the wedge.

• Use a Stop-Loss – Place a stop-loss just above the recent swing high to manage risk.

Rising wedge on GALA and ARWEAVE

There will be some opportunities with the rising wedge pattern on GALA Games and ARWEAVE. With the projected downside move in BTC and ETH, these falling wedges could play out perfectly. The stop-losses are around 5%, so make sure to manage your risk accordingly.

Keep an eye on both setups for possible trade opportunities in the coming hours/days!

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Lets chat in the comment section. See you there :)

GOLD → Fading out before the news. Possible long-squeezeFX:XAUUSD continues its bullish trend, but locally, the movement is in a very narrow channel (wedge). To form a potential for further movement, the price may form a long-squeeze before or at the time of news...

Fundamentally, gold remains a bullish asset due to the Fed's rate cut forecasts and economic risks associated with Trump's tariff policy. Gold hit a new high on Wednesday after the Fed reiterated plans to cut rates twice this year, raised its inflation forecast and worsened growth and employment estimates.The price is further supported by escalating geopolitical tensions in the Middle East, with Israel announcing the resumption of ground operations in Gaza.

Gold is forming a bull market. Before further growth (before the news) the price may enter the liquidity zone (fvg, 3028, 3024), after which it will continue to grow. Dollar enters local correction before the news, which creates pressure on gold

Resistance levels: 3046, 3051, 3056

Support levels: 3038, 3030, 3024

Price is forming a retest of the wedge support, which increases the chances of a breakdown. If the support fails to hold, the price may go down to the above support before rising further.

But! If gold bounces from 3038 and consolidates above 3044, the growth will continue without a deep pullback

Regards R. Linda!

BTCUSD | Rising Wedge Breakdown – Bearish SetupChart Overview:

This chart represents Bitcoin (BTC/USD) on the 1-hour timeframe and showcases a Rising Wedge pattern. The price action has reached a key resistance level, and a potential breakdown scenario is unfolding.

1️⃣ Pattern Identification: Rising Wedge Formation

A Rising Wedge is a bearish reversal pattern that forms when price moves within two converging upward-sloping trendlines. The narrowing price range indicates a weakening trend, and a breakdown usually leads to a significant price drop.

Upper Trendline (Resistance): Marked in blue, this trendline connects the higher highs.

Lower Trendline (Support): Also in blue, connecting the higher lows.

Breakdown Confirmation: The price has already moved below the wedge support, confirming the bearish bias.

2️⃣ Key Price Levels & Zones

🔹 Resistance Zone (Blue Box)

This strong resistance level has repeatedly rejected the price.

The final rejection led to a breakout failure and potential trend reversal.

🔹 Support Zone (Blue Box)

A strong demand zone, but a breakdown below it triggers a bearish trend.

This level is now acting as potential resistance after the breakdown.

🔹 ATH (All-Time High) – $87,566

This marks the highest price level reached in the given timeframe.

3️⃣ Market Structure Breakdown

🔻 Bearish Momentum & Breakdown

After touching the resistance, BTC failed to sustain upward movement.

A breakout of the wedge's lower trendline confirms a trend reversal.

Price action suggests a lower-high, lower-low structure, indicating a bearish market shift.

📉 Expected Price Movement (Wave Structure)

The breakout retest could result in a small pullback to previous support (now resistance).

After confirmation, price is likely to continue downward in a wave-like structure.

Fibonacci levels or key support zones will act as profit-taking targets.

4️⃣ Trade Setup & Targets

🔻 Short Setup (Bearish Trade Idea)

Entry: On a successful retest of the broken support zone.

Stop-Loss (SL): Above the previous resistance zone for risk management.

Take Profit (TP) Targets:

TP 1: $81,638

TP 2: $77,897

Final Target: $74,990

5️⃣ Summary & Conclusion

📌 BTC/USD has broken out of a Rising Wedge pattern, confirming a bearish trend.

📌 A pullback and retest may occur before further downside continuation.

📌 The chart suggests a short opportunity, targeting lower support zones for potential profit-taking.

📌 Traders should manage risk with a well-placed stop-loss above key resistance.

This setup aligns with technical analysis principles, confirming a high-probability short trade for BTC. 🚀

Charting the Path Forward: Key Levels to WatchPrevious Analysis: Successful Bullish Breakout

In our previous analysis, we identified a Falling Wedge pattern accompanied by bullish divergence, forecasting a breakout above 147.807. The price hit our target, confirming the bullish momentum and reaching key Fibonacci levels.

What’s Next:

Upon analyzing the chart, we observe that price has found support at 147.535 after a pullback during the American session. We anticipate the price to reach our first target, and after consolidation and a possible pullback, we expect to hit our second target near the upper line of the channel.

However, if the price declines from the first target and breaches support at 147.535, the next key support level is at 146.306.

Remember to follow your risk management strategies to protect your capital.

USDJPY → Resistance retest (wedge) before the Fed meetingFX:USDJPY is forming a correction to trend resistance as part of the dollar index consolidation. An interesting situation is forming which could be a continuation of the downtrend.

Fundamentally, today is an important day. The FED interest rate meeting is ahead. Traders are waiting, the dollar is consolidating at this time. Most likely the rate will remain unchanged, but in this key everyone is interested in Powell's comments on monetary policy and their future actions.

USDJPY at this time is forming a correction to the bearish trend resistance, before the news the currency pair may test the resistance conglomerate: a wedge, 0.79 fibo, or an orderblock located outside the channel

Resistance levels: 150.16, 150.95

Support levels: 148.92

False breakout of the resistance zone can provoke a fall, as well as breakdown of the support of the “wedge” with the subsequent consolidation of the price in the selling zone. The price may test the zone of interest at 147.6, 146.54.

Regards R. Linda!

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish ContinuationTechnical Analysis & Market Outlook

The Silver (XAG/USD) 1-hour chart presents a clear rising wedge formation, a well-recognized bearish reversal pattern. This formation develops when price action creates higher highs and higher lows within a contracting range, signaling a potential exhaustion of bullish momentum.

Currently, Silver has broken below the lower trendline of the wedge, confirming a bearish breakout. This move suggests that the recent uptrend is weakening, and sellers are beginning to take control. A retest of the broken support level as new resistance could provide an ideal entry for a short position.

Key Technical Levels & Trading Plan

1️⃣ Resistance & Supply Zone: 34.00 - 34.20

Price has struggled to break above this region multiple times, confirming strong selling pressure.

The market rejected this level sharply, leading to the current downside movement.

A stop-loss can be placed slightly above this zone to protect against unexpected reversals.

2️⃣ Support Level & Retest Zone: 33.50

Previously, this level acted as a strong support, but the breakdown confirms a shift in market structure.

If price retests this level and faces rejection, it could serve as an optimal entry point for short trades.

3️⃣ Short Entry Confirmation

Traders should look for price rejection from the 33.50 zone before entering a short position.

A bearish candlestick pattern (e.g., bearish engulfing, pin bar, or a lower high formation) would further validate the entry.

4️⃣ Bearish Target: 31.90 - 32.00

The projected downside move aligns with the measured move of the wedge breakdown and previous support zones.

If price maintains bearish momentum, further downside potential exists beyond this target.

5️⃣ Stop-Loss Placement: Above 34.20

Setting a stop-loss above the recent resistance ensures protection against invalidation of the bearish setup.

This placement accounts for potential price spikes or false breakouts.

Trade Execution Strategy:

📌 Entry: Short on a retest of the 33.50 level, ensuring confirmation via price rejection.

📌 Stop-Loss: Above 34.20 to avoid premature stop-outs.

📌 Take-Profit: Targeting the 31.90 - 32.00 zone for an optimal risk-to-reward ratio.

Conclusion & Risk Management:

The breakdown from the rising wedge signals a shift in market sentiment, favoring a bearish move. Traders should remain patient for a retest of broken support to confirm the validity of the trade. Proper risk management with a well-placed stop-loss and a defined target ensures controlled exposure to market fluctuations.

📊 Overall Bias: Bearish 📉

🔍 Key Watch Areas: Retest of 33.50 for Short Confirmation

The Bitcoin Google trends wedge pattern. Good day traders & investors,

Is the Google trends search for Bitcoin about to explode ?! The chart pattern is a bullish one. The Google trend search topped out back in 2017 and has been in a wedge pattern since then. The search/interest recently broke out of this 8 year wedge pattern and this month retested the breakout. This is typically a bullish pattern and shows the interest and search volume is picking up and could very soon explode again.

The settings for this search was world wide , bitcoin and a custom time interval set from Jan 1st 2009 to Mar 19th 2025

Since inception the interest for Bitcoin gained volume/growth until it peaked in 2017. Ever since then the interest and searches has been making lower lower highs until very recently (last Oct) where it made a higher high as it broke out of this wedge. Also, since 2017 while making lower highs the google trend has been making higher lows, thus forming this wedge pattern. The break out and retest of this pattern is what shows the signs of strength and a possible explosion of interest in the near future.

I have underlaid both timelines of the price and the Google trend to match, and we can clearly see that when the search trend rises, so does the price which shows a strong correlation.

All of my other cycle analysis shows that May/June time could see higher prices, so you could say this is a sneak peak or confluence to other indicators.

Let me know what you think in the comments below what you think. Does Google trend holds any weight? Do you think this wedge pattern and break out could lead to anything big?

Please like and share. My socials are listed in the bio

Kind regards,

WeAreSatoshi

USD/JPY: Bear Wedge and Pin Candle Flash Warning SignsThe ducks may be lining up for a resumption of the USD/JPY downtrend.

Firstly, it remains in a defined falling channel. Secondly, Tuesday’s reversal delivered a bearish pin candle, often seen around market tops. Thirdly, the rebound from last week’s lows resembles a bear wedge pattern, warning of a potential downside break and resumption of the bear trend.

Momentum indicators aren’t fully on board, with RSI (14) and MACD trending higher, so the case for initiating shorts is not yet a slam dunk. But it should be on the watchlist.

A break of the bear wedge would put a retest of 148.65 on the radar, with a move beyond that level opening the door for a possible flush towards 147.10, where buyers were lurking last week. If the price were to keep pushing higher and break channel resistance, the bearish bias would be invalidated.

As covered in the attached analysis, when it comes to risks around rates guidance from the Fed and BOJ later today, this scribe sees those for the former skewed towards a slightly more dovish outcome than market pricing, and a more hawkish tone from the BOJ.

Good luck!

DS