Booking Holdings Inc Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Booking Holdings Inc Stock Quote

- Double Formation

* ((Wedge Structure)) | Completed Survey

* (Uptrend Argument) | Long Bias Entry | Subdivision 1

- Triple Formation

* ABC Flat Feature & Retest Area | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 225.00 USD

* Entry At 250.00 USD

* Take Profit At 290.00 USD

* (Uptrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

Wedge

D.R. Horton Inc Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# D.R. Horton Inc Stock Quote

- Double Formation

* 0.618 Retracement Area | Completed Survey

* (Wedge Structure) | Short Bias Entry | Subdivision 1

- Triple Formation

* (Consolidation Argument)) At 200.00 USD Subdivision 2

* 012345 Wave Structure Ongoing At Wave (3)) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 100.00 USD

* Entry At 90.00 USD

* Take Profit At 70.00 USD

* (Downtrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

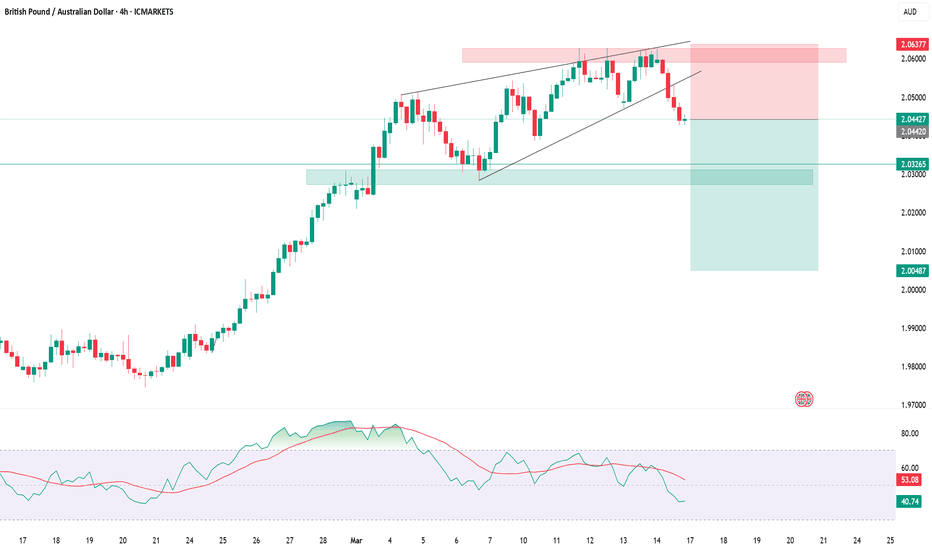

AUDUSD PRE-OPEN ANALYSISPrice is forming a wedge pattern in the last 3 months.

I imagine price is not yet to break the pattern, and we will see downside for the remainder of March.

Technically, looking for a trend switch on the 15 minute chart (moving averages bearish cross) out of these resistance levels.

Thanks for reading!

Nauticus Robotics - The Roaring $KITTNauticus Robotics ( NASDAQ:KITT ) is a picture-perfect pick-up for the coming market conditions. With capital about to be re-allocated into markets, following the month long sell-off of late and rotation into precious metals/bonds.

Technicals

Already broken-out of its downwards wedge pattern on high volume, NASDAQ:KITT recently just put in a double bottom.

If the initial move from December 19th to 6th January, was an Elliott Wave 1, I would wait & prepare for volatility to come, and if to the upside it will put some of the most volatile cryptocurrency tokens to shame.

Wave 2 should now be complete, having bottomed on March 4th. Friday March 14th should have been the completion of its 1st higher low.

As early as next week, I am expecting NASDAQ:KITT to reach $2.80. This coincides with the 0.618 fibonacci level, resulting from its recent decline. From there, a shallow retrace into the end of the month before catapulting itself to levels not seen since September 2023 at around $80.

That would conclude Wave 3, the most volatile of moves in Elliott Wave theory, between May and June. Reaching the 2.272 fib level at $80.

The entire move can reach a final impulse conclusion of around $155 of the 2.618 fib level 👀. A potential 150x in just a few short months.

-----

Fundamentals

Nauticus Robotics is creating an entirely new industry right before our eyes. They are pioneers and future monopolists for the underwater economy, just like Tesla are becoming to battery, automation & automotive technology.

Think deep-sea oil refining, precious metal mining, environmental studies and even underwater city construction. Combined with a domestic administration that for the first time in decades is supportive of such novel energy & infrastructural investments.

For those expecting an AI bubble to soon take hold of markets, this stock is arguably one of the few companies that could simply not exist without artificial intelligence. Thanks to this new technology, it opens up commercially and fundamental new opportunities to deploy unmanned robotics deep into our oceans, for days at a time without costly supervision.

Currently (at $1.06) with a market cap of $6.79 million , there is far too much upside to this stock. One that employs dozens of ex-NASA engineers.

This stock is one of the 100 most highly shorted stocks on markets. With RICO and an administration hostile towards & actively investing such practices, this stock is likely to undergo a swift revaluation.

All of this combined, suggests to me the ocean tide is on your side with $KITT.

NMIH strength during fearI believe this sector will perform

Going forward. As the market continues to be fearful and uncertain, insurance plays will shine. A quick review of its competitors and this stock is valued less but with better financials and growth. This monthly wedge setup is very bullish after a very nice run for the stock. This small cap is overlooked.

Gold can exit from wedge and then continue grow to 3100 pointsHello traders, I want share with you my opinion about Gold. This chart shows how the price moved upward within a rising channel, reaching the 2665 level, which aligned with the buyer zone, and breaking through it. After that, the price retested this level and continued to rise within the channel. It then touched the support line, rebounded to the current support level, and broke through that as well. Following this, Gold made another retest and climbed to the resistance line of the channel before starting to decline. In a short time, the price dropped to the channel’s support line, then broke out of the pattern and continued falling within an ascending wedge. Eventually, it reached the 2835 support level, which coincided with the wedge’s support line and a broader support area, before beginning to recover. For some time, Gold traded near the wedge’s support line, and recently, it rebounded and reached the resistance line. Given this structure, I believe Gold may first make a corrective move before breaking out of the wedge by surpassing the resistance line. If that happens, I expect further growth, which is why my TP is set at 3100. Please share this idea with your friends and click Boost 🚀

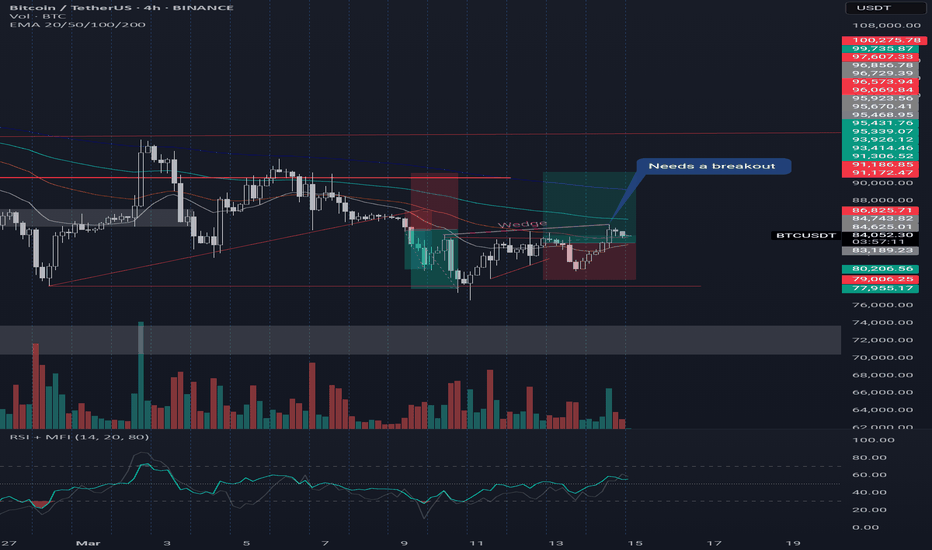

BITCOIN - Price can reach resistance line of wedge and then dropHi guys, this is my overview for BTCUSDT, feel free to check it and write your feedback in comments👊

Some time ago price started to decline inside falling channel, where it aat once boucned from support line and rose to resistance line.

Then it continued to fall and reached $91300 level, broke it soon, and continued to decline next.

Price exited from channel and started to trades inside wedge, where it at once made upward impulse to $91300 level.

After this, price some time traded near $91300 level and then in a short time declined to support area.

But soon, BTC bounced from this area and recently it started to grow from $80000 support level.

In my mind, Bitcoin can rise to resistance line and then drop to $77850 support line of wedge pattern.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

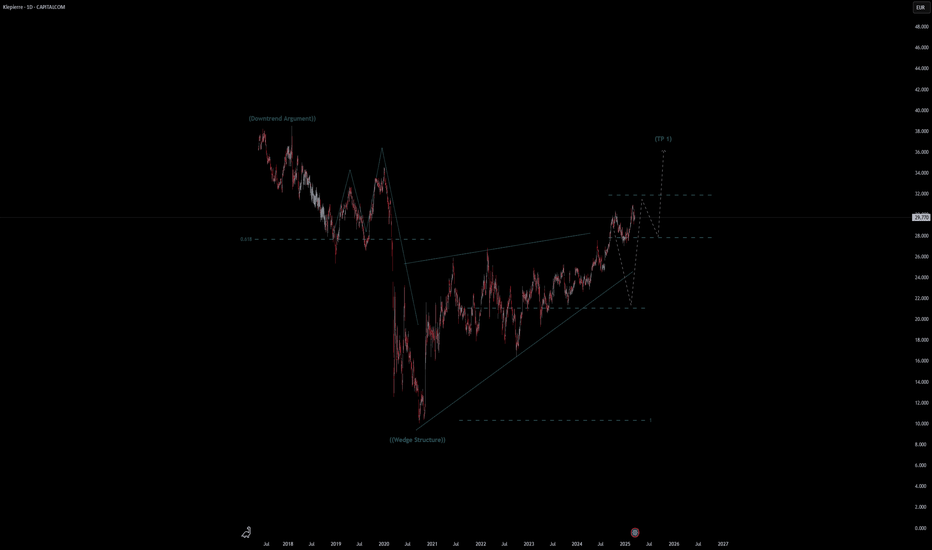

Kleppiere Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Kleppiere Stock Quote

- Double Formation

* (Downtrend Argument)) | Completed Survey

* 0.618 Retracement Area | Short Bias Entry | Subdivision 1

- Triple Formation

* ((Wedge Structure)) & Uptrend Area | Subdivision 2

* (TP1) At Resistance Area(Previous Levels) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 74.00 EUR

* Entry At 82.00 EUR

* Take Profit At 94.00 EUR

* (Uptrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

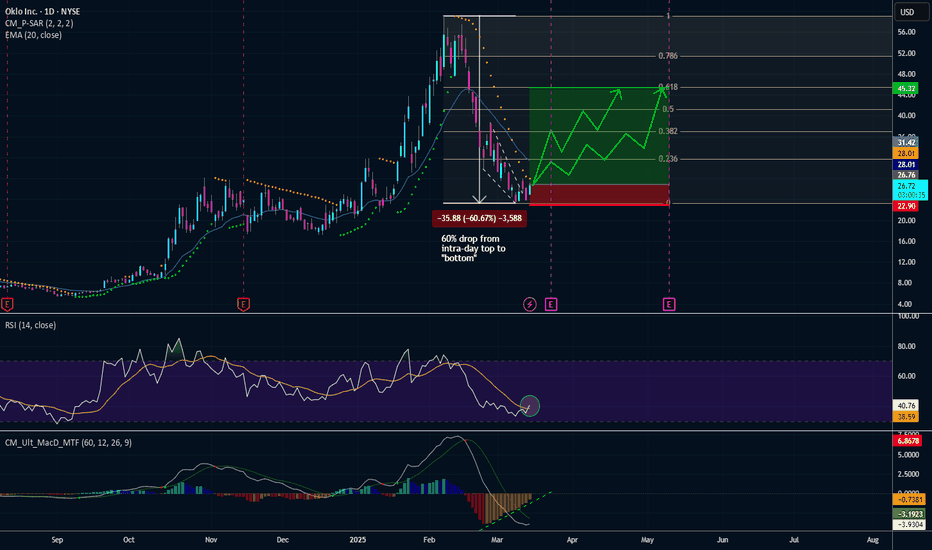

70% Upside Potential in this Nuclear StockOKLO is my personal favorite nuclear play that feeds off the AI energy. Really beat up since it's height in early February, down over 50% as of today (as are a lot of other stocks given the macroeconomic backdrop). Chris Wright, a member of its Board of Directors, was confirmed as the U.S. Secretary of Energy on February 3, 2025. As a result, Wright has stepped down from Oklo’s Board to assume this critical role in advancing the nation’s energy policies.

I can see upside trade heading closer to Q4 earnings March 24.

Bullish Technicals:

- Rounding Bottom

- RSI breaking above RSI MA

- MACD: histogram trending up

- Moving out of the falling wedge

- Just sitting below daily PSAR

OKLO's Key Focus Areas:

- Microreactors – Oklo’s primary product is the Aurora microreactor, a compact and efficient reactor designed to produce power for remote areas, industrial sites, and off-grid locations.

- Fast Reactors – Their reactors use a fast neutron spectrum and liquid metal coolant (like sodium) rather than water, making them more efficient and capable of reusing nuclear waste as fuel.

- Fuel Recycling – Oklo aims to use recycled nuclear fuel (like spent fuel from conventional reactors), reducing nuclear waste and increasing fuel efficiency.

- Long Lifespan – The Aurora reactor is designed to operate for up to 20 years without refueling, minimizing maintenance and operational costs.

Bitcoin can reach resistance line of wedge and then dropHello traders, I want share with you my opinion about Bitcoin. This chart illustrates how the price dropped into the buyer zone within an ascending wedge. After that, BTC reversed direction and began to rise, eventually reaching the wedge’s resistance line before making a correction to the support line. The price then made a strong upward impulse, breaking through the resistance level and exiting the ascending wedge. BTC surged to 94800 before reversing and dropping to 82600, breaking through the 87000 level. Following this decline, the price started to recover within a descending wedge and soon reached the resistance line, breaking through another resistance level. However, after this move, BTC reversed again and began to decline, eventually falling back to the 87,000 level, which coincided with the seller zone, where it traded for some time. It then broke through this level and continued declining toward the support level, even entering the buyer zone. BTC also dropped to the support line of the descending wedge before rebounding sharply, breaking above the 80000 support level once again. Currently, the price is continuing its upward movement. Given this setup, I anticipate that Bitcoin will reach the resistance line of the wedge before pulling back to the support level, potentially even lower. For this scenario, my TP is set at 78000. Please share this idea with your friends and click Boost 🚀

Euro can decline to support area, after which it will rebound upHello traders, I want share with you my opinion about Euro. By analyzing this chart, we can see that the price entered a range before dropping into the buyer zone, which aligned with the lower boundary of the range. After that, it reversed and started to rise, eventually reaching the upper boundary of the range, which coincided with the 1.0515 support level and support area. The price then immediately turned around and fell below but soon bounced back to the support area, consolidating there for a while before breaking lower. Following this, the Euro reversed direction and began to climb, soon reaching the upper boundary of the range and breaking out of this pattern, surpassing the 1.0515 level as well. After this move, it continued to rise within a wedge pattern, eventually reaching the 1.0775 support level, which aligned with another support area, and broke through it too. The price then touched the resistance line of the wedge and made a corrective move toward the support line of the pattern. In my view, the Euro could enter the support area before rebounding toward the resistance line of the wedge. Based on this, I set my TP at 1.1000, as it aligns with this resistance level. Please share this idea with your friends and click Boost 🚀

BTC/S&P500 weekly looking like August 2020Two wedges/triangles being retestet after a breakout.

The one in 2019/2020 was more like a triangle as it had a steeper upper line down slope and was way shorter then this current one.

However August 2020 S&P500 was not going down like it does now.

Note that BTC nearly never goes up when S&P goes down.

Could mean that S&P is done going down soon aswell if this pattern were to play out similar to 2020.

QUICKUSDT → Pending a false breakout of resistanceBINANCE:QUICKUSDT is forming counter-trend movement to the resistance of the range - 0.02957. A false breakdown of the key level is formed against the background of the downtrend

The cryptocurrency market is experiencing bad times. While bitcoin is testing new lows - 76K, altcoins are cutting through to find another bottom.

QUICK stands out in this picture, testing a strong resistance (liquidity) zone 0.02845 - 0.02957 and forming a false breakout.

BUT! in the morning session bitcoin strengthens after a strong fall and can pull the whole market up with it. Thus, before the further fall another attempt to retest 0.02953 or update the tail of the false breakout at 0.03000 (0.7fibo) is possible.

Resistance levels: 0.0285, 0.02953, 0.0300.

Support levels: 0.0243, 0.02118

If the next resistance retest ends in a false breakdown and price consolidation under 0.02957, QUICK coin may continue its decline in the short and medium term.

Regards R. Linda!

Bitcoin in a falling wedge / bull pennant It’s hard to say where it will. Break up from ths pennant, I put the dotted measured line in an arbitrary spot which will almost certainly have to be readjusted and most likely further down than where I placed it but if it were to somehow break up from the wedge by then and confirm that breakout the target would be in the 145k zone. *not financial advice*

XRPUSDT: A Massive Move Is Coming – But Will It Be Up or Down?Yello, Paradisers! Are we about to see an explosive breakout in XRP, or is a deeper pullback lurking around the corner? Let’s break it down.

💎XRPUSDT has formed a falling wedge alongside a bullish divergence, signaling a potential upside move. Adding to the bullish case, we also see an inverse head & shoulders pattern forming underneath – a combination that significantly increases the probability of a breakout.

💎For a high-probability bullish confirmation, we need a breakout and candle close above the falling wedge.

💎That said, if price retraces deeper, we should be watching the major support zone for a potential bounce. A bullish I-ChoCH on lower timeframes will serve as the key confirmation for a reversal.

💎The invalidation level? If XRPUSDT breaks down and closes candle below the major support zone, this bullish setup will be completely invalidated.

🎖Stay sharp, Paradisers. The next move will decide everything! As always, discipline and patience will separate the winners from the crowd. Be strategic, trade smart, and wait for the highest probability setups.

MyCryptoParadise

iFeel the success 🌴

$NYSE:VRT (Vertiv Holdings, LLC) Bullish Outlook NYSE:VRT

Company Overview:

Cooling for Data Centers. One of the very few.

Vertiv Holdings Co. engages in the design, manufacture, and service of critical digital infrastructure technology that powers, cools, deploys, secures and maintains electronics that process, store and transmit data. It also offers power management products, thermal management products, integrated rack systems, modular solutions, and management systems for monitoring and controlling digital infrastructure.

Vertiv Group Corp., established in 2016 after its acquisition by Platinum Equity, stands as a global leader in data center cooling solutions. Offering precision cooling systems and thermal management solutions since its inception, Vertiv has garnered recognition for its innovative technologies and commitment to sustainability. Recent developments, especially in energy-efficient cooling systems, underscore its dedication to meeting evolving market needs. Vertiv's focus on innovation, reliability, and customer satisfaction has solidified its position as a top choice for organizations seeking cutting-edge cooling solutions for their critical digital infrastructure.

Other companies may partake in Data Center Cooling but Vertiv (VST) specializes in it. That's the big difference. It's not a side piece of the business to make additional $. That's what makes it special. That's why I mentioned there really isn't many companies that specialize in this critical area especially with the growth of data centers.

Technicals:

Positive Divergence

RSI at 36 and as of now crossing RSI-Based MA

Descending Wedge (breaking out as of 3/12)

Downside: A lot of resistance to break through as in it 's under ALL Moving Average's.

Overall NYSE:VRT continues to to increase every single quarter and is in a very strong market of data centers as these will continue to increase and need cooling. Institutions own 83.77%

VRT Snapshot

VRT Growth