Weed

NWGFF is our new cannabis breakout pick. See why a +60pct move..=====================

NWGFF New Age Brands Inc.

Alert Price: $0.0478

Chart Analysis

========================

Members,

Are you ready to kickoff the month of February with a bang?

For our next trade idea, we are focusing on a red-hot sector that has proven highly profitable for our members time and time again.

That's right, it's time for another cannabis play...

Please turn your full attention to NWGFF (New Age Brands Inc.).

After witnessing a downtrend the past few months, NWGFF appears to have finally bottom'd out.

NWGFF has been quietly building up momentum, and is now showing signs of a highly profitable bullish reversal in the making

Shares of NWGFF closed up over +17% today, while trading on higher than average volume, and we are feeling confident that another double-digit move is in store for NWGFF tomorrow.

There's a strong change that today's double-digit move caught the Street's attention, so don't be surprised if we see a move past $0.05 early tomorrow!

If you look at NWGFF's 1-year chart, you will see that the last time we saw this particular setup, shares rallied +200% from $0.04 all the way to $0.12!

NWGFF appears to be grossly oversold and undervalued at these levels, especially when you take into account the growth initiatives their management has made over the past few months.

The Company has made several market friendly announcements as of late, all of which could be considered bullish catalysts as we head into Q1 2019.

MassRoots, Inc. a leading technology and rewards platform, signed an agreement with NWGFF subsidiary, We are Kured, LLC, to serve as a leading online retailer of the Company's #1 best-selling CBD Pen.*

Wholly owned subsidiary, We Are Kured, LLC (“Kured”), plans to launch a new vape option for their broad spectrum 48% CBD oil. Although their main product offering will be the current 500mg disposable vaporizing pen, this new vaporizing cartridge will help round out KURED’s product line.

We Are Kured, LLC’s Pineapple Express vape pen is the top selling vape pen at the iconic Native Roots Wellness CBD store in Denver, Colorado. The success of the vape product in the leading CBD market in Denver, one of the most advanced in the country, is helping to increase awareness of both the Company and the benefits of the new and burgeoning CBD market for consumers and investors.

Entered into a “Drop Ship” agreement with The Grown Depot with respect to their two fully owned subsidiaries, We Are Kured, LLC and Drink Fresh Water LLC. Under the terms of the agreement, The Grown Depot will sell the Company’s products through their website (www.TheGrownDepot.com) while the Company will facilitate the shipment of orders through their Denver, Colorado warehouse.

Secured an order of its wholly owned subsidiary’s Fresh Water CBD product with Colorado’s largest liquor store, Argonaut Liquors, located on Colfax in downtown Denver. Argonaut Liquors, a historical Denver staple liquor store, is seeing the momentum of CBD water and wants to be ahead of the competition by offering Fresh Water CBD to their 21+ clientele.

As you can see, the management at NWGFF is taking a highly aggressive approach in increasing brand awareness.

The Company's CBD Pen is a hit already, and its only a matter of time until we see its effect on NWGFF's bottom line.

In addition to having a top selling product, NWGFF is also very attractive from a technical standpoint.

Based on our very own chart analysis, we see the potential for a move of +60%!

We know it has already been a highly profitable week/month for our members, but we believe NWGFF could add a significant amount to that already impressive gains total.

That being said, we ask that all members read our full profile, start their research now, and consider grabbing up a position in NWGFF tomorrow morning at 9:30AM EST!

About New Age Brands Inc.

New Age Brands is an innovative Cannabidiol ("CBD") lifestyle Company. Through the Company's wholly owned subsidiaries We are Kured and Drink Fresh Water, the Company's main business activities encompass the development, marketing and distribution of CBD products (including vaporizer pens and beverages) throughout the United States and internationally. In addition, New Age Brands has extensive retail and cultivation land investments in Oregon.

About We Are Kured, LLC

KURED is a wholly owned subsidiary of New Age Brands, acquired in December 2017. KURED is building an innovative online CBD and lifestyle company. KURED has partnered with best in class hemp cultivators, edible manufacturers, cutting edge product formulators to develop, market and distribute multiple lines of CBD products including, but not limited to, CBD vaporizer pens, topicals, gel capsules and more. All of We Are Kured's products are 100% THC free and will be available for purchase internationally. THC, or tetrahydrocannabinol, is the primary active ingredient in cannabis.

NWGFF is growing quickly in the Cannabis industry, and it's doing so by focusing on the fundamentals. The Denver-based company is meticulously carving out its share of the emerging hemp and CBD markets in the U.S., Canada and South America. And, in the process, it's providing the cannabis space with more choices while offering investors an opportunity to get in on the ground floor of an ever-expanding company.

First and foremost, to understand more about New Age Brands , we have to understand the markets within the cannabis industry that they've chosen to call home—the Hemp and CBD markets. Hemp is the fiber and seed part, and the most valuable part of the Cannabis plant, which is why hemp is often called a "cash crop."

Meanwhile, CBD or cannabidiol is a naturally occurring cannabinoid in hemp that has significant medicinal benefits without the psychoactivity of THC. CBD is an appealing option for patients looking for relief from inflammation, pain, anxiety, psychosis, seizures, spasms, and a host of other conditions.

So how has New Age Brand's management chosen to create what it feels will be a successful footprint in the cannabis industry?

Well, while many smaller companies use lots of press releases and promises of great things to come to attract investors, executives at New Age Brands are actually building the company fundamentally with:

Acquisitions that make up a growing portfolio of revenue-producing companies already operating in the CBD/hemp space

A number of property assets in Washington State and Oregon

The expansion of its footprint into markets that provide a sustainable operating environment and allow New Age Brands to maintain its goal of becoming a worldwide "brand."

With continued success in these three areas of growth, this small company's future in a burgeoning industry looks very attractive.

When asked about New Age Brand's focus moving forward, management said that it has decided to move its attention and resources into acquiring already proven business entities and businesses that it feels have strong growth potential and strong core management in the hemp and CBD space.

Additionally, the company says it's currently working with a number of science teams to develop innovative products that New Age Brands is confident can accompany its growing portfolio while also standing out on their own in the industry.

Currently, New Age Brands has two subsidiaries that it recently acquired:

We Are Kured or "Kured" (www.wearekured.com) and Drink Fresh Water (www.drinkfreshcbd.com). Both companies are generating revenue with the sale of products in the hemp and CBD industries.

Through its subsidiary, Kured, New Age Brands is building an innovative online CBD and lifestyle company. Kured has partnered with best-in-class hemp cultivators, edible manufacturers, and cutting edge product formulators to develop, market and distribute a number of CBD products. In addition to filling orders in the U.S. and Canada, Kured recently expanded into South America where it plans to distribute products throughout the region with "Kured Latin America LLC."

Its other subsidiary, Drink Fresh Water, is a California-based company created by a group of industry leaders that offers New Age Brands immediate entry into the CBD-infused beverage industry with its flagship product, "Fresh Water." The CBD-infused, nano-amplified alkaline water can be found in retail stores in 35 different states across the U.S., and with the drink's success, management has already expressed that it expects to expand the company's lineup of products by adding additional SKUs in the near future.

New Age Brands is also growing a portfolio of properties that are proving to be revenue-producing assets for the company as well. Management at New Age Brands says they look to acquire properties that have strong, proven and permitted operating tenants, and if the company chooses to acquire a property, they will implement their industry-leading expertise to optimize the potential revenue and overall net profit with that asset.

The company says the properties it recently acquired in Oregon have already proven to be a great acquisition that they were able to take advantage of, while they're still evaluating the properties the company owns in Washington State to decide the best course of action for these properties.

New Age Brands acts as the "landlord" of the two properties it acquired in Oregon—the Cave Junction, Oregon, property and the Portland, Oregon, property where New Age Brands generates almost $250,000 annually in rent payments alone.

A state of the art outdoor and greenhouse cannabis cultivation facility is operated by Trellis Farms on the company's Cave Junction property, and the Portland property has been home to an established dispensary for the last four years.

New Age Brands has laid out a plan that, so far, management has done a great job of sticking to, while being flexible enough to expand upon that plan when necessary. Its expansion into Latin America is one such example of the company not being afraid to grow where they feel there is a sustainable operating environment.

Executives at New Age Brands feel that due to the uniqueness of the company's focus on hemp, regardless of being housed in the United States, they are not hand cuffed to the same onerous and expensive state-by-state marijuana licensing laws. Simply put management sees New Age Brands as a global brand. The company feels strongly that the wave of the future is in the hemp derived CBD market, and they will be building a plethora of brands to gain as much market share as possible in the industry.

When asked to offer a report card of sorts on the plan that management has put into place, we were told that Kured is growing at a faster pace than they expected with profit margins increasing by 100 percent with its in-house manufacturing. The newly acquired Oregon properties are a great monthly revenue addition. Fresh Water is already in 35 states and by adding its own team's expertise, they are hopeful to be generating sales of Fresh Water on 2 continents by the end of 2018. The company says they're in talks with other existing CBD brands to potentially acquire, and New Age Brands also has ideas for its own CBD brands, which it says will be first to market.

Market Outlook

The cannabis market has grown at a tremendous pace over the recent years and as such, the industry has established itself a major global market. According to data compiled by Grand View Research, the global legal cannabis market is projected to reach USD 146.4 Billion by the 2025. It is also expected to grow at a CAGR of 34.6%. The market itself is witnessing a widespread legalization movement due to the growing adoption of the plant within the medical sector. Cannabis is being used heavily around the global for medical applications and treatments for maladies such as cancer, mental disorders, chronic pain, and others. However, the recreational market is thriving as well due specifically to the U.S. and Canada. States like California, Colorado, and Nevada are expected to propel the recreational sector forward at an encouraging rate.

The acceleration of research and development has led to new products within the market, enhancing consumer experiences. The research suggests that the industry is expecting strong exchanges of technological knowledge and information. Meanwhile, as countries like Canada, the U.S., Germany, and Australia lead the market in sales, countries like Israel are focusing on research and technology development to further expand within the industry. Additionally, there are various new forms of technology being introduced into the cannabis sector, such as virtual reality, payment solutions, and medical devices. "That's why we firmly believe that technology stands at the center of the industry's advancement and growth," said Ben Curren Chief Executive Officer of Green Bits, "This innovation will continue to generate market growth, improve public perception, protect public health and safety and enhance the implementation of state programs and regulations.

Technical Analysis

Those of you who love "buying the dip" should be licking your chops at NWGFF.

The Company is down nearly +75% from its 52-week high of $0.184.

That being said, NWGFF appears to have been building momentum over the past few days, and we believe a bullish reversal is just starting to take shape.

A reversal all the way back to its 52-week high would net members gains of over +284%!

We did our own chart analysis, and see the potential for a more realistic move of around +60%!

No matter which way you slice it, NWGFF looks like the next potential double-digit winner in our book.

As such, we are urging all members to start their research now, and consider grabbing up a position in NWGFF tomorrow morning at 9:30AM EST!

(*Remember to use a basic Stop-Loss Order or more advanced Stop-limit Order to protect your gains, as well as limit possible losses.)

Best Regards,

The TopMarketGainers Team

Don't Miss Our Next Huge Winner...

Text 'GAINS' to '67076'

to have our Trade Alerts

Delivered Direct

to your Cell Phone.

(There is no charge.

Msg&data rates may apply.)

DISCLAIMER

This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated and edited by both MJ Capital, LLC and PennyStockLocks, LLC. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to MJ Capital, LLC and PennyStockLocks, LLC. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature, and are therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions, and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. MJ Capital does NOT own any shares of the companies mentioned herewithin, nor intends to buy any in the future.

MJ Capital’s business model is to receive financial compensation to promote public companies. We have been compensated twelve thousand five hundred dollars by third party to conduct investor relations advertising and marketing for NWGFF. Any compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. The investor relations marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, MJ Capital often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice.

Mass Roots: MSRT operates a technology platform for cannabisMass Roots operates a technology platform for the medical cannabis community in the United States. Its platform enables users to share their cannabis content, follow their favorite dispensaries, and stay connected with the legalization movement. The company's MassRoots network is accessible as a free mobile application through the Apple App Store, the Amazon App Store, and the Google Play Marketplace. It also operates massroots.com a business and adverting portal that enable companies can edit their profiles, distribute information to users, and view analytics, such as impressions, views and clicks.

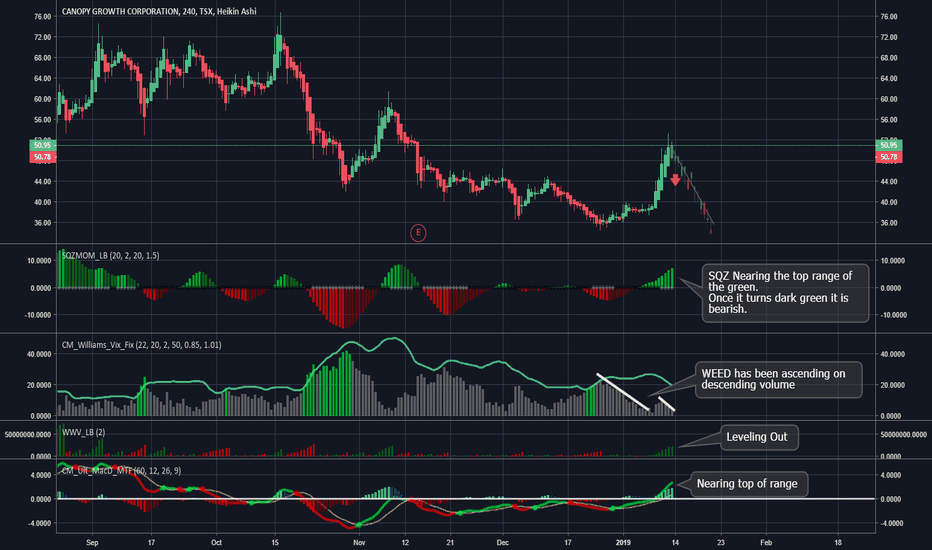

Weed - RSI Overbought, hitting previous resistance at $65Weed - RSI Overbought, hitting previous resistance at $65. I was wrong with my short at $58 level. Short interest went up 4x from jan 1-16th, shortdata.ca. Earnings is Feb 14th, so I am on sidelines and will wait post ER. If spy breaks over 270 next week, weed can go higher! FOMC is Jan 30th. Holding $TGOD shares from 2.99. Safe trading!

WEED.TO Bullflag triple top on daily +60 = breakoutWEED.TO has been running on positive sentiments and news of hemp production in New York. They are currently holding strong in a consolidation pattern.

A bull flag will be completed if it runs passed 60 with any amount of decent volume. Buyers are not letting up and they're not letting go of any shares.

If 60 doesn't break it will retrace and retest 54-55 levels.

Let's see what happens

200 shares if it runs passed 60 with any good volume.

*Any idea listed here is just my opinion of what I plan to do and not trading advice.*

Weed - Hit .618 Fib level, pull back on 4 hour chart to $55Weed - Hit .618 Fib level, pull back for higher low. Look for back test $54.62 on 4 hour chart as support. RSI overbought, good news about hemp facility in NY. I will wait for support level to buy more shares. Picked up some TGOD for long hold last week at $2.99. Good luck!

LIHT PULLBACK/CONSOLIDATIONCan't go up forever without some sort of consolidation around these price levels. Looking for a healthy correction to around the 0.618 fib and then hopefully more movement upward. The fundamentals look strong and the price/share will start to look more and more undervalued as the winter months drag on.

CGC/WEED bulls deserve congratulations!I missed this entire move as I've been busy with other life obligations, but no FOMO! This size of this bounce tells me the temporary bottom is in and I'll be looking for an entry in the coming weeks after a healthy pullback so I can join the party and take part in some MJ profit fun!

$weed looking for pull back on daily chart , RSI OB, Fib level$weed looking for pull back on daily chart , RSI OB, Fib level closed right around .382 level or $50.80. Looking for consolidation and higher low, volume is not bullish and $spy is hitting resistance at $259. Tech Earnings next will set market direction. *own canopy shares, $nbev calls and bought $pyx feb calls friday. Shortdata.ca for short interest information. Good luck, happy trading!

MEDICAL MARIJUANA SHORT (MJNA)Okay so this is uncharted territory for me. The pot-head market seems very bearish but it has gone through its fair share of market cycles. Prices might just edge a bit higher in order for them to test the upper channel resistance, but i would advise traders to open a short position at the break of the short-term bullish trendline which i drew in the descending channel.

TLRY Tilray Bullish Signal- CANNABIS STOCK IG: @BULLRINGANALYSIS

Tlry is a very interesting pick here. Early stages of company growth but, descending triangle pattern is meeting major resistance level. Bullish signal from this pick, but could be interesting to see what happens at this intersection point. RSI is also in interesting position for growth as well.

not financial advice

ITHUF (iAnthus) Pump coming ahead?- CANNABIS STOCKIG: @BULLRINGANALYSIS

seeing channel breakouts over the past few trading months

RSI is is good position for forward growth in the short term

we can see this price drop to it's second support level (upward trending), and then possibly bullish movement

Increase in adoption as legalization increases in early 2019. Analyst EPS estimate increase in future

not financial advice

Time for a bounce! CANOPY GROWTH CORPORATION NYSE: CGC WEEDSTOCK

Canopy had a masSive sell of in the recent weeks and its time for a bounce. RSI is oversold and pointing up. Not a trading advice!

Looking for a short-term bounce from these levels

#cgc #canopygrowth #weed #weedstocks

HAPPY TRADING!

Quick Opportunity for a short-term upside for HEXO (HYYDF) WEEDWaves might not be perfect but HEXO ( HYYDF ) is due for a pullback. Watch price go up on Wednesday and it will do so in 5 wave pattern. Looking hit $5.00. VERY RISKY trade but could pay off. Not looking to see a major upswing so be cautious. Not a trading advice, only analysis. RSI is oversold on Daily and Hourly charts so time for it to go up.

Happy Trading!

#weed #marijuana #HEXO # WEED #CGC #TLRY