Aurora - Technical AnalysisDear Traders,

Looks like we enterred a second ''bearish'' tunnel, but if we succeed in breaking out of it like we did the first time we might see another run soon. But if we break downwards we will officially retracing towards the 0.5 fib level again, which held twice already so that looks like a good entry point for those who want to re-enter this trade, but this will only happen if we break downwards of this channel.

About Aurora:

Aurora Cannabis Inc is a Canada-based company engaged in the production and distribution of medical cannabis. The Company is vertically integrated and horizontally diversified across every key segment of the value chain, from facility engineering and design to cannabis breeding and genetics research, cannabis and hemp production, derivatives, home cultivation, wholesale and retail distribution. The Company's purpose-built facilities, which integrate technologies across all processes, are defined by automation and customization. The Company has a funded capacity of more than 500,000 kilograms per year, as well as sales and operations in more than 18 countries worldwide.

Weed

WEED bears assert dominance, finally breaking the daily uptrendWEED broke the daily equilibrium bearish today and closed down 6.5%. A small bounce at the end of the day cooled off RSI levels and we're no longer oversold on any timeframe. I was looking forward to an oversold bounce tomorrow but after hours trading further cooled off RSI and finished trading in a bear flag setup.

Two daily supports were broken today, after low of today our next support is 52.80 - that's a good 10% further to the downside. I'm personally going to be patient waiting for a setup I like. If we get a big gap down tomorrow, for example, opening below $55.00, that's a setup that will have me interested. Otherwise, RSI levels have cooled down enough at the end of day bounce that we could easily see another -6% day tomorrow.

I've been talking a lot in my past ideas about the psychology of what's going on right now in the sector. To further drive home how sentiment has shifted from bulls to bears, note that it's been a full three weeks since we've had two green days in a row - and this is when everybody has been expecting a huge bull run into October 17th. I'm not going to be entering positions based on what I want to happen, I'm going to watch the charts for a setup that favours a bull entry.

CGC bears assert dominance, finally breaking the daily uptrendCGC broke the daily equilibrium bearish today and closed down 6.5%. a small bounce at the end of the day cooled off RSI levels and we're no longer oversold on any timeframe. I was looking forward to an oversold bounce tomorrow but after hours trading further cooled off RSI and finished trading in a bear flag setup.

Two daily supports were broken today, after low of today our next support is 40.68 - that's a good 10% further to the downside. I'm personally going to be patient waiting for a setup I like. If we get a big gap down tomorrow, for example, opening below $42.00, that's a setup that will have me interested. Otherwise, RSI levels have cooled enough that we could easily see another -6% day tomorrow.

I've been talking a lot in my past ideas about the psychology of what's going on right now in the sector. To further drive home how sentiment has shifted from bulls to bears, note that it's been a full three weeks since we've had two green days in a row - and this is when everybody has been expecting a huge bull run into October 17th. I'm not going to be entering positions based on what I want to happen, I'm going to watch the charts for a setup that favours a bull entry.

CGC bulls prove nothing (Do I sound like a broken record yet?)CGC opened significantly higher considering the big bearish momentum Friday afternoon into the weekend. Bulls made two attempts first thing this morning to break the high of Friday and fell short both times, resulting in profit taking and another close down at the low of the day. We have an inside bar on the daily to watch for clues. It's worth noting CGC has rejected from the daily Middle Bollinger Band two days in a row after losing it on Thursday. Zooming into the hourly, every test of the hourly Middle Bollinger Band has been a rejection as well since losing it on Sept 26th.

The range I'm watching remains the same as it's been for the past week; 48.02 - 55.00, and we're much more closer to a bear break than to a bull break. The MACD is signaling bearish momentum, backing up the selling pressure we're seeing on the charts. Volume has been well below average for the past two weeks in a row and I expect that pattern to continue until we get a break of that range.

Much like the price action, daily RSI is tight against the support level as well.

I feel like a broken record to keep using the same phrase, but the bulls really have their backs against the wall here and to make a move, or lose the daily uptrend and significantly shift momentum just two weeks out from legalization. I am absolutely looking to enter a swing short entry on the loss of $48.00 psychological support, looking for significant follow-through to the downside

Many people are looking for a bull run into Oct 17th and I keep pointing out one thing. We've been running since Aug 14th, during which the price has increased more than 120%. That's significant and this run will not continue forever. The psychology of the chart is bulls fighting as hard as they can waiting for the buyers that everybody thinks are about to show up. If those buyers don't show up, investors are going to take profit, and that will result in a bear break and a significant shirt in momentum for the entire sector.

Cara is Up and will continue to Go Up!Cara is one of many unreliable weed stocks that many follow but the good news for you is that it is on a uproar! Cara has been down for the last couple weeks but it has made its way back to +0>13% in the last couple days. Like many weed stocks they fluctuate because of the shareholders within the stock are untrained and new to the stock market. This is where you can gain percentage and capital on. By watching the moves of the stock holders you can easily predict where the stock will drop. The only risk in tis is being on top of your buy and sell because the stock holders scare easily. If one jumps they all follow but being the ones who jump at about 25% you can gain the upper hand. for the first 25% of stockholders who jump there will still be people buying into the stock but i have found as soon as you roll over the quarter mark buying stops and everyone scares off. so having said this this you can pinpoint the rough placement of where the drop will be and after you gains are finalized you can buy back in when it has hit rock bottom.

-Jon Matthews

WEED bulls proving nothing to meWEED started the day Friday with a gap down open just above our key daily level, providing a great bottom-fishing opportunity to play in our daily equilibrium. The entire move was given back in the afternoon when news came out of Canopy withdrawing their 'Chronic By Dre' trademark request after forgetting to get permission from the rapper to use his name. The result is a very bearish candlestick on the daily chart, still within our daily equilibrium, and still very close to a bear break. Turning on after hours on the American ticker, you can see the price rejecting from EMAs and providing a bear flag setup if the low of the afternoon sell-off 48.55 breaks.

The past two weeks on the daily chart have been a chopfest and I've been sitting on my hands waiting for it to play out, so we can finally have some clarity for the short term. I'm not giving the bulls any benefit of the doubt here, they need to prove it to me. First step would be to hold our key level 62.02 and break Friday's high 66.19.

Key range for me is 52.81 - 72.00. Until one of these levels break, I don't expect much trading opportunity as the range is so narrow it's difficult to find a pattern to play off of. If we break bullish, I will be a buyer looking for a new all time high heading into Oct 17th, and if we break bearish, I'll be entering as a short looking for a 5-7% move to the downside.

If we break bearish I would zoom out to the weekly chart and anticipate forming a weekly equilibrium, with a new higher low above 52.81. After covering my short I would be looking to enter long, as a range of 52.81 - 72.00 is more than enough room to play within and not have to worry about choppy price action giving false signals.

Reading the psychology of the chart, the past four days have clearly seen traders taking profit as they run out of patience waiting for new buyers. Many people are anticipating a run into Oct 17th, but I'm becoming skeptical there are many people looking to buy in the next two weeks that haven't already bought in.

I'm remaining neutral on what I think will happen, but we are 1% away from a bear break on the daily and 14% away from a bull break. The weekly chart remains very healthy.

CGC bulls proving nothing to meCGC started the day Friday with a gap down open just above our key daily level, providing a great bottom-fishing opportunity to play in our daily equilibrium. The entire move was given back in the afternoon when news came out of Canopy withdrawing their 'Chronic By Dre' trademark request after forgetting to get permission from the rapper to use his name. The result is a very bearish candlestick on the daily chart, still within our daily equilibrium, and still very close to a bear break. Hourly RSI has cooled and could very easily see a significant move down. Turning on after hours (American ticker only) you can see the price rejecting from EMAs and providing a bear flag setup if the low of the afternoon sell-off 48.55 breaks.

The past two weeks on the daily chart have been a chopfest and I've been sitting on my hands waiting for it to play out, so we can finally have some clarity for the short term. I'm not giving the bulls any benefit of the doubt here, they need to prove it to me. First step would be to hold our key level 48.02 and break Friday's high 51.21.

Key range for me is 48.02 - 55.69. Until one of these levels break, I don't expect much trading opportunity as the range is so narrow it's difficult to find a pattern to play off of. If we break bullish, I will be a buyer looking for a new all time high heading into Oct 17th, and if we break bearish, I'll be entering as a short looking for a 5-7% move to the downside.

If we break bearish I would zoom out to the weekly chart and anticipate forming a weekly equilibrium, with a new higher low above 40.68. After covering my short I would be looking to enter long, as a range of 40.68 - 55.69 is more than enough room to play within and not have to worry about choppy price action giving false signals.

Reading the psychology of the chart, the past four days have clearly seen traders taking profit as they run out of patience waiting for new buyers. Many people are anticipating a run into Oct 17th, but I'm becoming skeptical there are many people looking to buy in the next two weeks that haven't already bought in.

I'm remaining neutral on what I think will happen, but we are 1% away from a bear break on the daily and 14% away from a bull break. The weekly chart remains very healthy.

Canopy Growth AnalysisWEED is in a weekly uptrend with nearest significant weekly demand at 37.19. Buying at current prices is not advised.

On the daily, the upward momentum has been broken creating a range. Due to Weekly trend, longs are still favoured at lower prices.

Zones of Interest:

Demand @ 52.45

Supply @ 65.81

Long on Namaste - Parallel Channel I just bought in N.Tsx. Namaste Technologies is within a parallel channel. Right now, the stock is touching the lower limit. RSI shows an oversold tendency. I believe that the stock could bounce, as the sentiment towards Cannabis remains fairly positive. This is a short-term long that'll be closed before Friday.

Trade safe guys!

Weed Stock(Aurora)! Watch CloseAurora Stocks are going to drop within the next days in my opinion. the reason i think that is because I have been watching the charts and watching the news and this is what i found. I have found that no matter what anyone says about a weed stock, it doesn't matter the majority in weed stocks are the people who don't know how to get into stocks and they are super easy to predict. the way to predict a weed based stock is that if the stock goes up past around 10% jump off. I say this because having a bunch of amateurs on this kind of stock is that once they gain a-lot of money on it as it is going up they get scared and jump, by doing this the shock then become short and everyone jumps together. So the best place you can be is the ones that jump at about 25% of the majority of the stock has jumped before you because once the stock beings to drop people stop buying and once the buying stops the stock goes straight down but if you jump to early you may lose capital by jumping before sales have stopped selling. So my opinion and my long term analysis is that jump at about 25% when the buying stops and then jump at the peak.

- Jon Matthews

WEED closing in on key supportWEED small gap down open today, pulling back on a significant increase in bear volume is certainly a concern for the bulls. The weak afternoon bounces certainly have me looking for possible bear-flag confirmation and to further downside; bulls must hold $62.02 and break above $65.05 to negate that flag potential.

Key support for the bulls to maintain the daily uptrend is $62.02. This sits in the middle of a low volume node, meaning a break could see price continue downwards towards $59.70 where we start to see much more volume support.

Resistance to break are $65.05 and $66.64 high of today.

I'm not giving the bulls any benefit of the doubt - a pullback this significant on increasing bear volume is a definite red flag for me.

How WEED (really, how CGC) moves from here will dictate the direction for the rest of the sector heading into legalization on October 17th. Losing that support at $62 makes it less likely we will see new highs heading into next month.

CGC closing in on key supportCGC small gap down open today, pulling back on a significant increase in bear volume is certainly a concern for the bulls. The weak afternoon bounces certainly have me looking for possible bear-flag confirmation and to further downside; bulls must hold $48.90 and break above $50.00 psychological to negate that flag potential.

Key support for the bulls to maintain the daily uptrend is $48.02. This sits in the middle of a low volume node, meaning a break could see price continue downwards towards $46.20 where we start to see much more volume support.

Resistance to break are $48.98 (call it $50 psychological) and $51.04 high of today.

I'm not giving the bulls any benefit of the doubt - a pullback this significant on increasing bear volume is a definite red flag for me.

How CGC moves from here will dictate the direction for the rest of the sector heading into legalization on October 17th. Losing that support at $48 makes it less likely we will see new highs heading into next month.

CGC will soon set the direction for the entire sectorCGC has been getting tighter and tighter in the two weeks since the oversold bounce Sept 14th. We're at a point on the hourly chart where we're likely to see a break, giving direction for the entire sector heading into next week. Daily candle is still bearish, indicating we could see further downside to start the morning. However if we hold the low of the day tomorrow...

The most important levels for me are 53.43 resistance and 51.09 support. Losing 51.09 means we will have to wait a little longer for a break as the bulls search a new support above key level 48.02. But holding the low of today will be a very important first test.

Watch for SPY tomorrow, looking for potential further downside tomorrow in reaction to the FOMC, and watch the correlation to see how CGC responds in the face of any SPY strength or weakness.

LONG on CRON - Parallel Channel and Falling WedgeI just took my gains on the short idea that I published on CRON -2.79% a couple days ago. Right now I believe the stock can bounce on the channel and price shows a falling wedge pattern. MACD is crossing as well and shows sign of a bullish opportunity.

I believe that the general sentiment on pot stocks is still fairly positive. However, there is a lot of speculation around it and I believe most pot stocks are way overvalued

CANOPY GROWTH CORPORATION (TSX:WEED) SHORT TERM ANALYSIS - 30MMy short term outlook for Canopy Growth Corporation (TSX:WEED). I believe we are in the midst of a small correction. I see the price bottoming out around the vicinity of $50 before we see a return to the higher upside trend. Going to continue to monitor and purchase shares at the bottom if my analysis holds true.

New Rising StarThe Green Organic Dutchman Provides Update on Spin-off Transaction and Announces Intention of TGOD Acquisition to Complete Private Placement Offering of Subscription Receipts. - News of the day.

"I am excited to share our story with CNBC's Jim Cramer this Friday," said Brian Athaide, TGOD's CEO. "With such a vast US shareholder base and our objective to list on the NYSE in the near future, I look forward to the opportunity to showcase our company, methodology, and differentiated approach focused on both organic, beverages, and the international markets to a strong, sophisticated US audience," Continued Athaide.

Pursuant to the Arrangement, TGOD shareholders of record as of the distribution date for the Distribution (the "Distribution Record Date") will receive 0.15 of one SpinCo Unit Warrant for each TGOD share held.

The mj stocks are hot niche, there are a lot of great names like TLRY, CGC, CRON and others, but let's see on TGOF. This company has big plans for cannabis market, just look at their CEO, Former Procter & Gamble Co. executive Brian Athaide, which has the aim to make this company 'Whole Foods of Cannabis' and you will understand why this CO is the new rising star.

TA.

There's definitely something here. I like stocks and cryptocurrencies that have uptrend on the board, TGODF is one of them. And so, the price is trading above the 7EMA and 30EMA lines, the RSI > 50, the MACD indicator isn't readable right now.

ENTER: $6.40-6.60

PT: $16-19

GL Traders.

Short on CRON - Divergence Technicals - CRON 9.78% broke out of a strong resistance today but failed to hold. Price is back within the parallel channel . In addition, RSI is diverging from price action. These are really simple, but strong bearish signals.

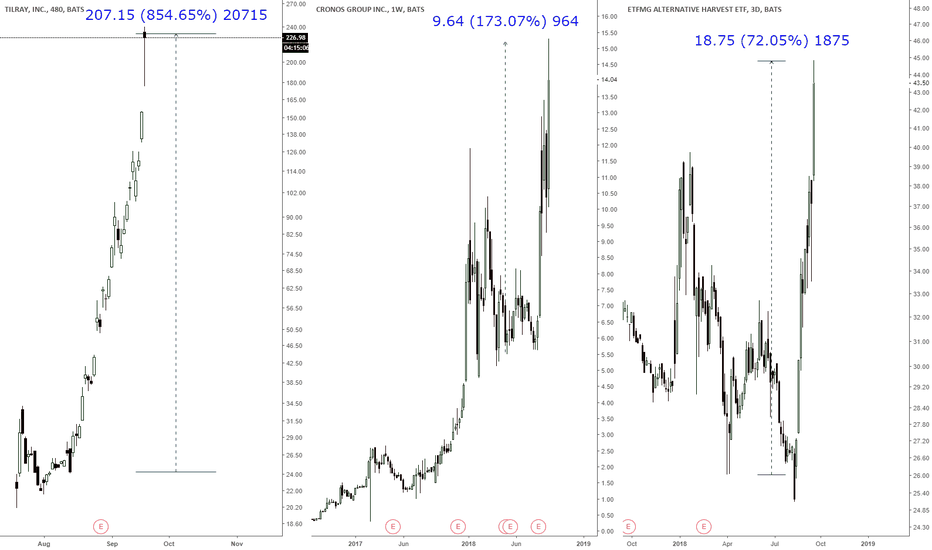

Fundamentals - Following the success of Tilray 38.12% , CRON 9.78% soared two days in a row, breaking new highs. However, no significant fundamental news within the company justifies such a jump in prices. I believe that the 560% change in price in 52 weeks is clearly an overreaction and could lead to a massive dump. Institutional investors are massively short on Cannabis stocks in general; CRON 9.78% is overpriced and will drop back down to the $9.13-10 level.

Bullrun started...;)

www.ccn.com

No one gives a rat's ass about MJ stocks. Go try talking about it in a crypto chat... They are so obsessed with crypto dead market that they joined late :)

Should have bought a few months ago, but it probably just started.

Sell at +5000% in a few months to years to the monkeys in bitcoin reddit and /biz right now (they will leave Bitcoin reddit to join the MJ stocks reddit when they see it went up 10000% in the news).

* I am not following this actively, don't count on me to post when to exit.

We probably drop soon lol.

ETFMG AH earnings are so high.... Wtf did I read that wrong?

Looking at previous WEED.TO all time highs for clues into next wThe similarities I've highlighted here look better on WEED.TO than on CGC because Jan 15th saw the TSX trade but not the US exchanges. That said I'm looking at similarities in the first oversold bounces following the last two all time highs at 44.00 in January and 48.72 in June. Subsequent those bounces we saw a tightening range playing out across more than a week of trading before the equilibrium finally broke - down.

In each of the previous two examples the price set a lower low compared to the low of the oversold bounce. It's very possible this happens again, but with legalization being such a huge catalyst, it's also quite likely that support holds and we enter into a larger daily equilibrium prior to continuation of the current bull move.

The most important support to me heading into next week is 52.81. The best case scenario for the bulls is to hold 59.70 to show they're in absolute control over the coming days.

There are several fundamental things I'm watching here. CNBC is covering the MJ sector numerous times each day, and I've noticed a shift in their coverage from "stocks rocketing higher", to "we're in a bubble." This shifted with the implosion of TLRY on Wednesday and the 50% drop in share price within an hour (now down a full 65% from the highs). CNBC has an agenda here, and that's currently a risk to bullish positions in the sector.

Second is the amount of short interest in these stocks right now. each of WEED.TO, ACB.TO, and APH.TO are among the most shorted stocks on the TSX, and each have had an incredible increase in short positions opened over the course of September (regrettably I do not know if this information exists for CGC - if someone has this info please hit me up in the comment section below!)

Finally, there is the potential of other major catalysts such as global companies entering into the sector in the form of investments, partnerships, and other agreements or LOIs. These events have the potential of squeezing short positions to cover, now so they can enter again later.

Looking at previous CGC all time highs for clues into next weekThe similarities I've highlighted here look better on WEED than on CGC because Jan 15th saw the TSX trade but not the US exchanges. That said I'm looking at similarities in the first oversold bounces following the last two all time highs at 35.88 in January and 36.55 in June. Subsequent those bounces we saw a tightening range playing out across more than a week of trading before the equilibrium finally broke - down.

In each of the previous two examples the price set a lower low compared to the low of the oversold bounce. It's very possible this happens again, but with legalization being such a huge catalyst, it's also quite likely that support holds and we enter into a larger daily equilibrium prior to continuation of the current bull move.

The most important support to me heading into next week is 40.68. The best case scenario for the bulls is to hold 46.20 to show they're in absolute control over the coming days.

There are several fundamental things I'm watching here. CNBC is covering the MJ sector numerous times each day, and I've noticed a shift in their coverage from "stocks rocketing higher", to "we're in a bubble." This shifted with the implosion of TLRY on Wednesday and the 50% drop in share price within an hour (now down a full 65% from the highs). CNBC has an agenda here, and that's currently a risk to bullish positions in the sector.

Second is the amount of short interest in these stocks right now. each of WEED, ACB, and APH are among the most shorted stocks on the TSX, and each have had an incredible increase in short positions opened over the course of September (regrettably I do not know if this information exists for CGC - if someone has this info please hit me up in the comment section below!)

Finally, there is the potential of other major catalysts such as global companies entering into the sector in the form of investments, partnerships, and other agreements or LOIs. These events have the potential of squeezing short positions to cover, now so they can enter again later.

@DonnaSko, on a previous idea you asked about my thoughts on a long position in CGC. I don't like a long position right now; If this tightening pattern does break upwards and we see new highs, I fully expect a selloff on or within a few days (before/after) of October 17th, 2018 legalization date, followed by a long drawn out period of consolidation. If for whatever reason we do not see new highs, and break down setting new lows from here, I will have to reassess the situation from that stand point. From here I only really like two entries for longs. The first would be to bottomfish against 40.68 support with a stop-loss below that price to protect your capital should should the sector break down from here for whatever reason. The second would be to enter on the break of 52.60, which would be a bull-break of the current 4hr equilibrium we're currently suspended in. With an entry there I'd place my stop-loss below the most recent low, which is currently 46.20. Either way, I would absolutely take profit on or just before October 17th as I fully expect that catalyst to be a sell the news event, should we continue the bull run up until that date. Then I'd wait patiently to buy back in much cheaper for a long term investment position.