WLD

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.410, acting as strong support from which the price can rebound.

Entry price: 0.500

First target: 1.568

Second target: 1.691

Third target: 1.818

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 1.15, which acts as strong support from which the price can rebound.

Entry price: 1.16

First target: 1.19

Second target: 1.23

Third target: 1.28

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.18.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1.26

First target: 1.316

Second target: 1.36

Third target: 1.408

WLD's situation+ Target PredictionThe BINANCE:WLDUSDT is in a Bullish phase by a Falling Wedge Pattern.

A falling wedge indicates the potential for price to reach to $3.

Note if the Wedge Pattern is broken downwards with the strength of Bearish candles , this analysis of ours will be failed.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Worldcoin —Advanced Trading Tips For Maximum Profits In 2025Notice the corrections!

Worldcoin is trading above its September 2023 low after a classic rounded bottom pattern. Notice the corrections.

Back in 2023, WLDUSDT produced the "initial bullish breakout" as I like to call it. From September until December 2023. Then a three months correction developed. This correction ended in a higher low and was followed by massive growth. That's exactly what we should expect this time around but many times bigger, ok?

Do we agree?

Ok! Let's look at it again but now focused on the present day.

Worldcoin (WLDUSDT) will produce a strong bullish wave but this would still be only the first wave, the "initial bullish breakout." This wave will be corrected and this correction can last several months. It will end in a higher low and this higher low will produce a bull run. Makes sense?

I am preparing you for what is about to happen. If you are prepared, you can better engage the market. You can make better decisions and better decisions can translate into higher profits. It can be life changing for sure.

Choose wisely. Some Altcoins will grow more than others, some will stay behind.

Take your time to choose. The market is not going away.

There will be winners and losers.

Those that trade at the bottom, with the condition of being a solid project, have higher potential for growth.

If you are coming from TA only perspective, like yours truly, then you know the solid projects are the ones with the big names and those available for trading everywhere.

Your support is highly appreciated.

Namaste.

WLD - AI Cycle Is Back!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈WLD has been in a correction phase. However it is still overall bullish long-term trading within the rising channel marked in blue.

Moreover, the green zone is a strong support and round number $1.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower blue trendline acting non-horizontal support.

📚 As per my trading style:

As #WLD retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.03.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 1.12

First target: 1.15

Second target: 1.19

Third target: 1.250

WLD: The Worldcoin Recovery#WLD endured a tough year from March 2024 until its strong rebound last month, which might lead to shift it's bearish trend.

Maintaining $0.57 is essential, breaking it would lead to new all-time lows.

Passing $4.20 opens the door to $8.50 and possibly new ATHs.

#Worldcoin

WLDUSDT | Strong Buyers SpottedThere’s no denying that WLDUSDT is attracting serious buyer interest. The volume structure and price behavior are both signaling strong hands are quietly accumulating — and that’s usually the precursor to something much bigger.

🔹 The Blue Box – The Area of Interest

While I’m not rushing to jump in at current levels, my eyes are on the blue box. This zone offers the kind of setup I love: a confluence of previous demand, liquidity potential, and a great spot for whales to reload. If price reaches this area, it could be our opportunity to enter with tight risk and high reward.

But like always, I won’t blindly act just because we hit the level. I’ll wait for lower time frame breakouts or strong reactions in this area to confirm that buyers are stepping in again.

🔹 What to Look For Before Entering:

Entry only if we get a bounce or breakout on the 15min–1H timeframe

Volume confirmation (not just a wick)

Clean invalidation levels under the zone for safe risk management

🧠 Why This Approach Works

Most traders either FOMO at the top or try to catch falling knives. But our edge is waiting for the market to come to us, not chasing it. This approach keeps us on the right side of the move and avoids unnecessary emotional decisions.

So yes, I hope we reach the blue box, not because I’m desperate to enter, but because that’s where the trade becomes real. Until then, patience is power.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

We are looking for stability above the 100 moving average.

Entry price: 0.878

First target: 0.946

Second target: 0.984

Third target: 1.03

WLD Main trend. Super pump +1118 and decline -95. 09 05 2025Logarithm. Main trend. Time frame 3 days.

Super pump +1118.42% and decline -95.16%.

Smart and stupid money. The legend of the project is quite interesting, it is quite possible that there will be attempts to implement it, but always in the first place in such projects is: "money from nothing". The chart confirms this. After the pump +1118.42%, a huge distribution zone, which formed the upper part of the pattern of one of the varieties of "head and shoulders" at an angle. Which makes it clear that the profit is huge. Even now, with a price decrease below the listing prices, from the peak of the pump by -95.16%, which is normal for assets of such liquidity, the profit of some "investors" is +25 X !! Think about what profit was when pumping +1118% (it is impossible to implement, the pump is done just for the chart, to raise the price, for "false goals" and hype, so that on rollbacks "cheap", in the distribution zone they were not afraid to buy on the conditional hype "whales bought". Although now it is unlikely that they will pour. In order to constantly sell at excess profit "at any prices", you need to make interest, both for traders and for investors, that is, volatility waves. They will pump under the market.

Local trend . Local impulse from the minimum prices. Locally, the price rested against the median, in case of its breakthrough - the implementation of the ascending pennant.

Worldcoin WLD price analysisSam Altman has officially launched the World ID project in the United States, a digital identity system based on iris scanning.

Users are scanned using the Orb device and receive a digital ID (World ID) and 14 #WLD tokens

Last time then the price of OKX:WLDUSDT has been actively growing , when more than 12 million people from 100+ countries "sold" their "scanned eye" for a reward in #Worldcoin

Do you believe that history will repeat itself and the price of #WLDUSD will rise, at least to $3.75?

WLD Bearish Head and Shoulders Pattern ConfirmedWLD Bearish Head and Shoulders Pattern Confirmed 🚨

WLD has formed a bearish head and shoulders pattern and is currently breaking below the red neckline. The target for this bearish move is the green line level.

📈 Technical Overview:

Pattern: Bearish Head and Shoulders

Neckline: Red level, currently being broken.

🎯 Target: Green line level.

.

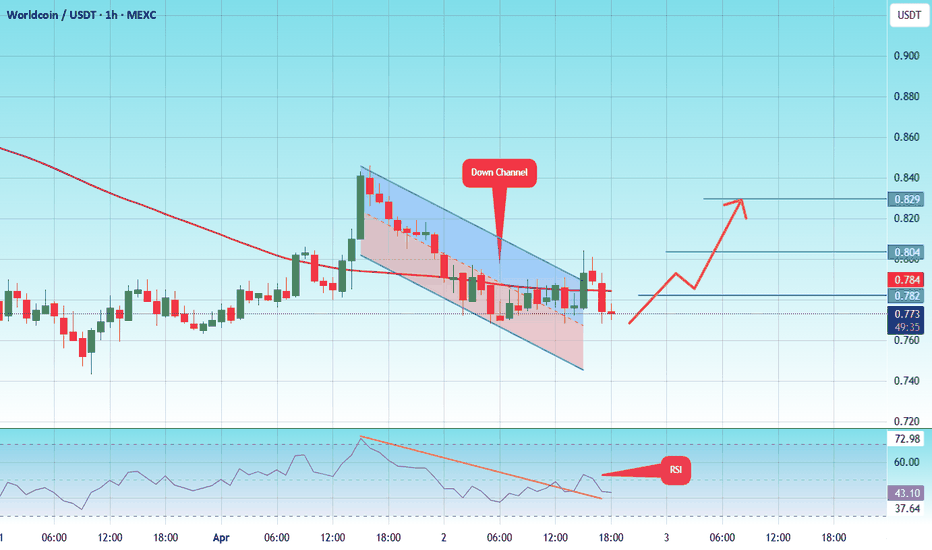

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.750.

Entry price: 0.0764

First target: 0.0782

Second target: 0.800

Third target: 0.829

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.725.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.747

First target: 0.769

Second target: 0.788

Third target: 0.812

TradeCityPro | WLD: Waiting for Reversal in Altman’s Web3 Coin👋 Welcome to TradeCity Pro!

In this analysis, I want to review the WLD coin for you. This project is one of the notable Web3 and Identity projects, founded by Sam Altman, who is also the CEO of OpenAI — and that adds a layer of trust to the project.

🔍 Currently, this coin has a market cap of $984 million, placing it at rank 64 on CoinMarketCap.

📅 Daily Time Frame

As you can see in the daily time frame, the price has dropped significantly since the previous analysis. After breaking below the 1.349 level, the main bearish leg began, and the price fell to the 0.603 area.

🧩 Currently, the price is in a correction phase, moving slowly upward on low volume, and has broken above the SMA25, now trading above this moving average.

🎲 Keep in mind: even though the price is above the SMA25, the slope of the moving average is still downward, which indicates that bearish momentum is still present in the market. However, since the price is now above the SMA, bearish strength is weakening.

📈 To confirm a bullish reversal for WLD, the key trigger right now is the breakout of the 0.947 level. If the price stabilizes above this level, we can say the trend has shifted to bullish.

✔️ A sooner confirmation of the trend change would be a positive slope on the SMA25 combined with increasing volume and green candles — this would be an early sign of a reversal.

🛒 For spot buying, the first trigger is the break of 0.947, and if the price holds above that, the bullish trend could begin.

🔽 The next resistance levels — which could act as targets or secondary buy triggers — are at 1.349 and 2.5776 respectively.

📊 If you already hold this coin and are looking to set a stop-loss, a break and confirmation below 0.603 would be a good level to activate your stop.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.600.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.640

First target: 0.660

Second target: 0.680

Third target: 0.700

WLD — Heavy Discount. Long-Term Opportunity on the TableWLD has pulled back over 80% from its previous high — a massive correction that now opens the door for long-term accumulation. The current range looks like a gift for patient players. Don’t sleep on setups like this — they don’t come often.

Follow for more high-conviction plays like this one.

Entry: 0,7-0,71

TP: 1,37-3,35