Analysis of the BRENT chart with expectations for 2025-2026◽️Technically, all conditions for the completion of the second wave correction have been met, and now quotes can be safely reversed up. However, current events in the global economy do not yet provide grounds for confidently asserting this. Locally, the price may still be driven down to $50 per barrel and even slightly lower. One way or another, it is important to understand a simple thing: everything below $70 per barrel should be seen as an opportunity to buy oil and everything related to it cheaply.

◽️According to my estimates, there is probably still time for deliberation on purchases until the end of spring. But further, from the beginning of summer, I expect a sharp rise in prices amid the escalation in the Middle East. From above, in the $100-150 range, growth will likely be contained for some time, which will be interpreted as the formation of sub-waves (i)-(ii), where after sharp rise in the first sub-wave from approximately $50-60 to $120-130, a local correction will follow within the second sub-wave.

◽️The growth period may take 3-6 months, and the correction to it another 2-4 quarters, and then a breakout of the $120-150 resistance zone and further "to the moon" in the third waves is expected.

🙏 Thank you for your attention and 🚀 for the idea.

☘️ Good luck, take care!

📟 See you later.

Wticrude

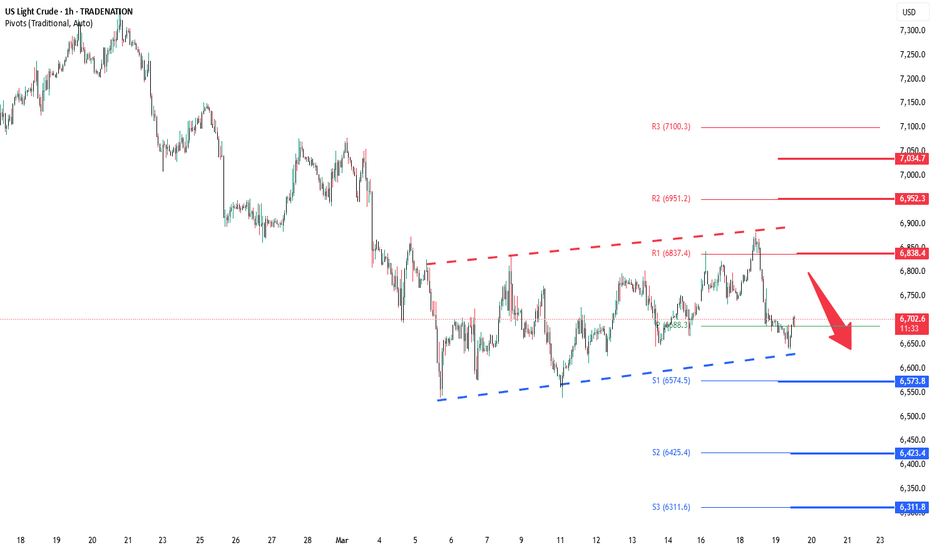

WTI Crude oversold bounceback capped at 63,40WTI Crude Oil is showing bearish sentiment, in line with the current downtrend. Recent price action appears to be an oversold bounce back. A break below a key consolidation zone, could add pressure to the downside.

Key Levels:

Resistance: 6340 (former support, now resistance), 6413, 6530

Support: 5920, 5708, 5520

Bearish Outlook:

Price has broken below 6620, which was a key intraday consolidation level. If WTI sees a short-term bounce but fails to break above 6340, it could resume its downward move toward 5920, then 5700, and possibly 5520 over time.

Bullish Scenario:

If WTI breaks above 6340 and closes above it on the daily chart, the bearish setup would be invalidated. This could open the door for a short squeeze rally toward 6413, then 6530.

Conclusion:

The trend remains bearish below 6340. A rejection at this level would reinforce the downside bias. However, a confirmed break and daily close above 6340 would shift the outlook to bullish in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

WTI gets a boost, but is this really enough?We saw yesterday the positive reaction due to the pausing of tariffs. However, because of the economic uncertainties and OPEC+ production increases, the price of TVC:USOIL may see more downside.

Let's dig in.

MARKETSCOM:OIL

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

WTI Crude Oil selling pressure continuationWTI Crude Oil is showing bearish sentiment, in line with the current downtrend. Recent price action confirms a break below a key consolidation zone, adding pressure to the downside.

Key Levels:

Resistance: 6065 (former support, now resistance), 6307, 6400

Support: 5480, 5336, 5200

Bearish Outlook:

Price has broken below 6065, which was a key intraday consolidation level. If WTI sees a short-term bounce but fails to break above 6065, it could resume its downward move toward 5480, then 5336, and possibly 5200 over time.

Bullish Scenario:

If WTI breaks above 6065 and closes above it on the daily chart, the bearish setup would be invalidated. This could open the door for a rally toward 6307, then 6400.

Conclusion:

The trend remains bearish below 6065. A rejection at this level would reinforce the downside bias. However, a confirmed break and daily close above 6065 would shift the outlook to bullish in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

WTI Continues Sharp Decline and Enters Oversold TerritoryOver the past five trading sessions, oil prices have dropped more than 17% , with WTI crude falling below the $60 per barrel mark. This move reflects ongoing market uncertainty, as investors expect the new trade war to significantly weaken oil demand in the coming months. As long as confidence remains in a fragile zone, downward pressure on oil prices is likely to persist.

Break of the Sideways Channel

In recent weeks, a key sideways channel that had held since November 2023 has been broken. This shift could alter the neutral outlook that has dominated the oil market in the long term and now points toward seller dominance. As price movements stabilize, a stronger bearish trend may begin to develop in the short term.

Oversold Conditions Appear

RSI: The RSI line is currently holding below the 30 level, which signals oversold conditions on the indicator. This suggests that while bearish pressure has been dominant, the market may be entering an early stage of exhaustion, potentially opening the door for short-term bullish corrections.

Bollinger Bands: The price has completely broken through the lower Bollinger Band, indicating that it has moved beyond two standard deviations from the mean. This reflects high volatility and could signal a pause in selling momentum. In turn, it may lead to potential rebound zones forming soon.

Key Levels:

$58 – Near Support: This is the most important short-term barrier, aligning with multi-year lows not seen since 2021. Continued selling below this level could reinforce the current bearish bias.

$66 – Near Resistance: This level marks the lower boundary of the former sideways channel. It may act as a potential zone for bullish corrections in the short term.

$73 – Distant Resistance: This level aligns with the 200-period moving average. Price action approaching this area could reactivate the previously abandoned uptrend.

By Julian Pineda, CFA – Market Analyst

Market Analysis: WTI Crude Oil Crashes As Trade War EscalatesMarket Analysis: WTI Crude Oil Crashes As Trade War Escalates

WTI Crude oil is down over 10% and remains at risk of more losses.

Important Takeaways for WTI Crude Oil Prices Analysis Today

- WTI Crude oil prices extended downsides below the $65.00 support zone.

- A major bearish trend line is forming with resistance near $60.70 on the hourly chart of XTI/USD at FXOpen.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price struggled to continue higher above $72.00 against the US Dollar. The price formed a short-term top and started a fresh decline below $70.00.

There was a steady decline below the $65.60 pivot level. The bears even pushed the price below $62.20 and the 50-hour simple moving average. Finally, the price tested the $59.20 zone. The recent swing low was formed near $59.21, and the price is now consolidating losses.

There was a minor move above the $60.00 level. On the upside, immediate resistance is near the $60.70 level. There is also a major bearish trend line forming with resistance near $60.70.

The next resistance is near the $62.20 level and the 23.6% Fib retracement level of the downward move from the $71.97 swing high to the $59.21 low. The main resistance is near a trend line at $65.60.

The 50% Fib retracement level of the downward move from the $71.97 swing high to the $59.21 low is also near $65.60. A clear move above the $65.60 zone could send the price toward $68.70. The next key resistance is near $71.85. If the price climbs further higher, it could face resistance near $72.20. Any more gains might send the price toward the $75.00 level.

Immediate support is near the $59.20 level. The next major support on the WTI crude oil chart is near $58.00. If there is a downside break, the price might decline toward $55.00. Any more losses may perhaps open the doors for a move toward the $52.00 support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XTI/USD "WTI LIGHT CRUDE OIL" Energy Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XTI/USD "WTI LIGHT CRUDE OIL" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (68.00) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout Level (or) placing the Buy limit orders within a 15 or 30 minute timeframe, Entry from the most Recent or Swing low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (66.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Primary Target - 71.00 (or) Escape Before the Target

🏴☠️Secondary Target - 74.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢️ XTI/USD "WTI LIGHT CRUDE OIL" Energy Market is currently experiencing a neutral trend (high chance to bullishness),., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XTI/USD "WTI Crude Oil" Energy Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XTI/USD "WTI Light Crude Oil" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (71.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (68.500) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 73.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢🔥XTI/USD "WTI Light Crude Oil" Energy Market Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

WTI , road map on high time frame

"Hello traders, focusing on WTI on high time frames, this analysis is based on the liquidity concept. Observing the chart, the price has surpassed the $69 level, which was significant for institutional orders. Consequently, I anticipate a decline towards lower prices. In my view, the next potential level could be around $64."

If you have any specific questions or require further assistance with your message, feel free to let me know!

Oil - Short Term Buy Idea Update!!!Hi Traders, on March 25th I shared this "Oil - Expecting Retraces and Further Continuation Higher"

I expected to see retraces and further continuation higher. You can read the full post using the link above.

The bullish move delivered as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTI Crude Oil INTRADAY breakout level retest at 7045WTI Crude Oil maintains a bullish sentiment, supported by the prevailing uptrend. The recent intraday movement suggests a corrective pullback toward a key support zone.

Key Level: 70.45

This level represents the previous consolidation zone and now acts as a critical support area.

Bullish Scenario: If the price bounces from 70.45, it could resume its upward trend, targeting 72.27, followed by 72.71 and 73.46 over a longer timeframe.

Bearish Scenario: A confirmed break below 70.45 with a daily close under this level would weaken the bullish outlook, potentially leading to further declines toward 69.30 and 68.23.

Conclusion:

WTI Crude Oil remains bullish unless it loses support at 70.45. Traders should watch for either a bounce or a breakdown at this level to determine the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Oil - Expecting The Price To Bounce Higher FurtherH1 - Price has created series of higher highs, higher lows structure

Strong bullish momentum

Higher highs based on the moving averages of the MACD indicator

Expecting retraces and further continuation higher until the two strong support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOil Key Resistance Hit: Is WTI Crude Due for a Correction?WTI crude oil appears overextended after a strong bullish rally, trading into a key resistance level amid heightened geopolitical tensions and market volatility. The current price action suggests a potential retracement, with equilibrium around the 50% Fibonacci level being a likely target for correction 📉. Given the reactionary nature of the market, traders should remain cautious as political developments could drive further instability ⚠️. While the technical setup supports a pullback, external factors may disrupt this scenario, so risk management is essential. 📊

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research before making trading decisions.

69.374-70.880 section is a crossroads

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

The April TradingView competition is sponsored by PEPPERSTONE.

Accordingly, we will look at the coins (tokens) and items that can be traded in the competition.

Let's talk about the SPOTCRUDE chart.

--------------------------------------

(SPOTCRUDE 1M chart)

We need to see whether it will rise along the trend line (1) or fall along the trend line (2).

Since the volume profile section is formed around 75.723, the key is whether it can rise above this section.

If it fails to rise, it will eventually meet the HA-Low indicator of the 1M chart.

Currently, the HA-Low indicator of the 1M chart is formed at 43.327.

-

(1D chart)

The M-Signal indicators of the 1D, 1W, and 1M charts are in reverse arrangement.

Therefore, in order to continue the upward trend, it must eventually rise above the M-Signal indicator of the 1M chart.

Therefore, the key is which direction it deviates from the 69.374-70.880 section.

When the competition started,

- If the price is maintained above 70.880, the long position is expected to be advantageous,

- If the price is maintained below 69.374, the short position is expected to be advantageous.

However, since the overall trend of the chart is down, a short and quick response is required when trading with a long position.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

WTI Oil Short Drill Baby,Drill!???Is it drill baby drill of President Trump? Or bearish profit taking before Oil season starts soon?

Well I dont know!

All I know is that the charts are communicating to me to sell oil for now.

I am already short in this, 2 approches that I use for good, in case a short bullish pullback happens,I will add more to my selling positions(red arrows)

2 different profit targets whereas the 2nd one has higher reward-resik-ration

Oil - Expecting Retraces and Further Continuation HigherH1 - Bullish trend pattern in the form of higher highs, higher lows structure

Strong bullish momentum

Bearish divergence on the moving averages of the MACD indicator.

Expecting retraces and further continuation higher until the two strong support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Market Analysis: WTI Crude Oil Face HurdlesMarket Analysis: WTI Crude Oil Face Hurdles

Crude oil is attempting a recovery wave but upsides could be limited.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude oil prices started a recovery wave from the $66.00 support zone.

- There is a key bullish trend line forming with support at $67.50 on the hourly chart of XTI/USD at FXOpen.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price remained in a bearish zone below the $70.00 level against the US Dollar. The price started a fresh decline below the $68.00 support.

The price even dipped below the $67.50 level and the 50-hour simple moving average. Finally, the bulls appeared near $66.00 and the price started a recovery wave. The price recovered above $67.50 and tested the $68.50 zone.

The price is now consolidating gains below the 23.6% Fib retracement level of the upward move from the $66.54 swing low to the $68.48 high. There is also a key bullish trend line forming with support at $67.50.

If there is a fresh increase, it could face resistance near the $68.30 level. The first major resistance is near the $68.50 level. Any more gains might send the price toward the $69.20 level.

The main resistance could be near the $70.00 level. Conversely, the price might continue to move down and revisit the $67.50 support and the 50% Fib retracement level of the upward move from the $66.54 swing low to the $68.48 high. The next major support on the WTI crude oil chart is $67.00.

If there is a downside break, the price might decline toward $66.55. Any more losses may perhaps open the doors for a move toward the $66.10 support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

WTI - Positioning for Upside After Anticipated CorrectionThe US Light Crude 4-hour chart shows price action currently oscillating near the $68,60 level after recovering from early March lows. The recent price structure suggests we may see a short-term pullback before a stronger upward move develops. The chart indicates a potential bullish scenario with price expected to eventually rally toward the blue reaction zone (around $69,00-$69,50) after a possible retracement. This anticipated upside move is supported by the higher lows forming since mid-March and the overall recovery pattern from the $65,67 support level (marked by the red line). A prudent approach would be monitoring for reversal signs at lower levels before positioning for the higher probability move toward the blue reaction zone, with the orange resistance at $70,77 serving as the ultimate target if bullish momentum accelerates.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTI Crude Oversold bounce back consolidationThe WTI Crude Oil price action exhibits a bearish sentiment, driven by the prevailing downtrend. The recent price movement appears to be an oversold bounce back, forming a bearish sideways consolidation pattern. This indicates that the bears remain in control, with limited buying interest observed despite the temporary upward correction.

Key Level (69.52):

The critical trading level to watch is at 69.52, which marks the previous intraday consolidation zone. An oversold rally approaching this level could face bearish rejection, reinforcing the downtrend. A failure to break above this zone would likely prompt a continuation of the downside movement.

Support Levels:

If the bearish sentiment prevails and the price is rejected from the 69.52 level, the downside targets include:

67.00 - Immediate support level.

65.73 - Secondary support.

64.23 - Long-term support level.

Bullish Scenario:

On the flip side, a confirmed breakout above the 69.52 resistance level, followed by a daily close above it, would negate the bearish outlook. This breakout could trigger further upward momentum, targeting:

70.42 - Initial resistance post-breakout.

71.02 - Subsequent resistance level.

Conclusion:

While the overall trend remains bearish, an oversold bounce could temporarily push prices higher toward the 69.52 resistance level. Traders should watch for potential rejection or a confirmed breakout at this level to gauge the next directional move. A failure to break above 69.52 would favor bearish continuation, while a breakout and daily close above would open the door for further bullish rallies.

WTI Crude INTRADAY ahead of US inventories reportThe WTI Crude Oil price action sentiment appears bearish, reinforced by the prevailing long-term downtrend. The recent price action indicates a potential oversold rally, approaching a critical resistance zone.

Key Levels and Price Action

The primary trading level to watch is 68.40, representing the current intraday swing high and falling resistance trendline. An oversold rally towards this level, followed by a bearish rejection, could confirm continued downward momentum. In this case, the next downside support targets are at 65,73, 64,23, and 63,11 over the longer timeframe.

On the other hand, a decisive breakout above the 68.40 resistance level, confirmed by a daily close, would invalidate the bearish outlook. This scenario could trigger further rallies toward the next resistance levels at 69.50 and 70.30.

Conclusion

The sentiment remains bearish as long as the 68.40 resistance level holds. Traders should carefully watch the price action around the 68.40 level to assess the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Weekly Market Forecast WTI CRUDE OIL: Bearish! Wait For SellsThis forecast is for the week of March 17 - 21st.

WTI Crude Oil is in consolidation, but forming a wedge pattern. As the market condenses, we no watch out for a breakout that could go in either direction. But if we take note of the Weekly bearish FVG that formed last week, we simply wait for price to sting into it and use it to move lower. The market is weak, and has been trending down for over two months now. Using the trend and the -FVG, the higher probability is for price to continue lower, as long as the -FVG holds.

Check the comments section below for updates regarding this analysis throughout the week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.