PEKAT MARKING UPA Type #2 of Re-Accumulation Schematic

previous entry as attached (not too much profit secured)

Past few days noticed the BUEC (phase D)

With that in mind, possiblity starting of the campaign for phase E, which is price to mark up outside the Trading Range (BOX)

With A Trigger Bar today, position initiated with tight risk

PureWyckoff

Wyckoffmethod

KPJ MARKING UPAn Atypical Re-Accmulation Scehmatic # 2 (The rising bottom)

Very Straighforward Chart

- BUEC in Action (yellow Line)

Noticed the formation of SpringBoard (Red Line)

-Position initiated @ 10/4/25 & 15/4/25

-interestingly, there is a an atypical local spring with huge vol,

that 'looks' like a success 'test' after that

Tight SL (Original SL moved up)

PureWyckoff

VRNA Likely Wyckoff Distribution with Topping pattern - SHORT!VRNA has had a Parabolic Run higher with Price > 2 Standard Dev from Mean for 11 WEEKS before showing weakness and Selling to $48 range. Price is forming a pretty picture perfect WYCKOFF Distribution. I believe we have just had the UTAD (Up Thrust After Distribution) Likely, we have lower prices in store.

Target Price $41.36.

Trade what you see.

USDJPY Technical Outlook: SMC and Wyckoff Analysis 5 May 2025As of May 5, 2025, the USDJPY pair is trading around ¥144.30, reflecting a 0.40% decrease from the previous session. This movement follows the Bank of Japan's decision to maintain interest rates while revising growth forecasts downward, leading to a depreciation of the yen.

Technical Analysis:

Support and Resistance Levels: The pair is approaching a significant support zone near ¥143.00. A break below this level could expose the next support at ¥141.00, while resistance is observed around ¥148.00.

Relative Strength Index (RSI): The RSI is nearing oversold territory, suggesting potential for a short-term rebound.

Smart Money Concepts:

Order Blocks: A bullish order block is identified between ¥142.50 and ¥143.00, indicating potential institutional buying interest.

Liquidity Pools: Liquidity above the recent highs near ¥148.00 may attract price action if bullish momentum resumes.

Wyckoff Method Perspective:

Accumulation Phase: The recent price action suggests a possible accumulation phase, with the pair trading within a range between ¥140.00 and ¥146.00.

Spring Test: A false breakout below ¥143.00 could serve as a spring, leading to potentially high buying volume.

Fundamental Factors:

Bank of Japan (BOJ) Policy: The BOJ's decision to keep rates unchanged, despite lowering growth forecasts, has contributed to yen weakness.

Federal Reserve Outlook: Market participants are closely watching the ISM Services PMI later today and the upcoming FOMC meeting for signals on US monetary policy, which could impact USDJPY dynamics.

Conclusion:

The USDJPY pair is at a critical juncture, with technical indicators pointing to potential support near ¥143.00. Traders should monitor price action around this level for signs of accumulation or further downside. Fundamental developments, particularly central bank policies, will play a crucial role in determining the pair's direction in the near term.

GAMUDA MARK UP CAMPAIGN

So, a rare schematic of wyckoff spotted. Finally.

A Type #1 Schematic of Accmulation

I have been started my position as attached, along with my clients (Red Line)

Technically :

1/ The Spring is very nice, Textbook Classic as mentioned by David Weiss

2/ The Feather's weight along with SpringBoard (Yellow LIne) prompted us to add position

With the QR, released yesterday showing an increase profit margin + revenue + earning.

PureWyckoff

PECCA MARKING UPPecca, an Atypical Type of Schematic #2 Wyckoff Re-Accmulation

Why Pecca?

technically =

1. Feather's Weight (red crescent)

2. Absoprtion (Red arrow)

3. fulfilling Wyckoff 9 Buying point

TriggerBar today, as a test, for a follow through in the upcoming days.

Position initiated as attached

PureWyckoff

LTF DistributionContinuation of previous post :

1H Range starts off this schematic by stopping the momentum at the point of the first secondary test, it fails to break the previous high and this markets goes from moving up to sideways into this TR. Each rally to previous highs reflects upside effort increasing, but upside result is decreasing indicating buyers weakness near this level. uE>, uR< = bearish indicator.

Favorable bearish confirmation would be a lower high, paired with high buy volume confirming the shift to bearish market.

WILL ECOMATE MARK UP?This is Schematic #2 Rising Bottom of Re -Accumalation

I am attracted to the TriggerBar on 11/3/25, which succesfully commit above the upper trading range

In which subsequently reacted with a very low supply (Arrow)

Made a decision for EP

Going to expose progressively, if things improving from here on wards

Bursa KLCI has been under massive selling

Im expecting a volatility in upcoming weeks

PureWcykoff

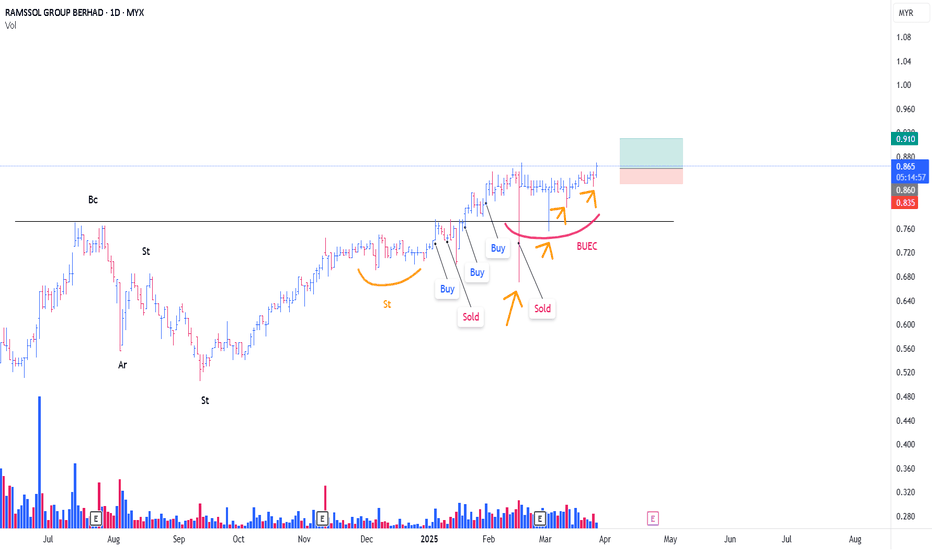

RAMSSOL CONTINUE MARKING UPI have been following ramssol since my last position

For ramssol, this is an Atypical Type #2 Re-Accumulation Schematic

The Rising Bottom

Based on the chart, I bought @ 6th Jan , i assumed that ramssol was at Phase D incoming to the phase E , awaiting for markup.

However somehow price plummeted (18th Feb) and i managed to secure some profits.

Since then, what interesting to me, is that, ramssol has 4 undercut (orange arrow) and price making uptrend

-These 'undercut' can be considered as 'Stepping Stone SPRING'

from the volume side, supply successfuly absorbed with succesful test of the 'Spring'

Position initiated as attached

Pure Wyckoff

Tight SL

$SUPER Wyckoff Accumulation – Schematic #1 or #2 in PlayBSE:SUPER Wyckoff Accumulation – Schematic #1 or #2

My base case at the moment is Wyckoff Accumulation Schematic #2 , where the Secondary Test ( ST-B ) could mark the very bottom. This idea will be validated for me especially if we see interaction with the High Time Frame VAL .

Green Zone:

We have confluence with VAL and Green TRP Zone from HTF ReAccumulation idea.

High Time Frame Wyckoff ReAccumulation Idea:

$NIO Wyckoff Accumulation – Schematic #1 or #2 in PlayMy base case at the moment is Wyckoff Accumulation Schematic #2 , where the Secondary Test ( ST-B ) could mark the very bottom. This idea will be validated for me especially if we see interaction with the High Time Frame Channel projection.

Green Zone:

We have multiple levels of confluence around this zone:

0.786 Fibonacci Retracement from the 2020 low to the 2021 top

MO – Monthly Open level

Volume cluster from previous local consolidation

Blue Zone:

If price drops as low as VAL, I expect it to be just a quick, volatile wick breaching into the Blue Zone.

High Time Frame Channel projection:

GBPUSD Sell Trade March 26 2025- Sell Limit ActivatedHello Traders!

Another great movement of GBPUSD, 1H and 15min TF confluence.

Entry: 5min TF with validity of OB (check charts for detailed annotation)

Note: This trade was a sell limit order in MT4 aiming for 1:5RR. You can see also Distribution Schematics in Higher Timeframe.

#wyckoff

#proptrader

#Riskmanagement

$TRAC @trac_btc #Ordinals — Beginning of a Wyckoff AccumulationPOLONIEX:TRACUSDT @trac_btc #Ordinals 👀

— Possibly the beginning of a Wyckoff Accumulation Range—Schematic #1 or #2 are my base case for now.

If the local range POC holds as the LPS (Last Point of Support), then Schematic #2 is in play. If it’s lost, the probability shifts toward a new low and a SPRING.

JPG MARK UP CAMPAIGNFor JGP, This is a Typical Rising Bottom (Schematic #2 of Accumulation)

Few reasons, should be pointed out :

1/ Based on Comparative Analysis , JPG somehow shows interest from the CO (JPG did HH HL, While General Market did HL LL)

-- This is a sweet spot

2/ Supply Evaporating (black arrow)

3/ JPG so far fulfilling the Wyckoff 9 Buying Criteria

4/ TriggerBar (red arrow) shows relatively higher average intraday vol influx

**Red line = Creek

EP n SL as attached

pure wyckoff

$BANANA @BananaGunBot ─ Possibly beginning of Accumulation Range🍌 $BANANA @BananaGunBot 🍌

Could this possibly be the beginning of an Accumulation Range?

As usual, my base case is Wyckoff Accumulation Schematic #1.

Time and more data will tell—adding $BANANA to the watchlist.

Clues to Support an Idea:

1️⃣ Prolonged downtrend

2️⃣ Preliminary Support (PS) – Surge in selling volume followed by above-average buying volume

3️⃣ Selling Climax (SC) – Huge increase in selling volume

4️⃣ Automatic Rally (AR) – Short-lived spike in buying volume

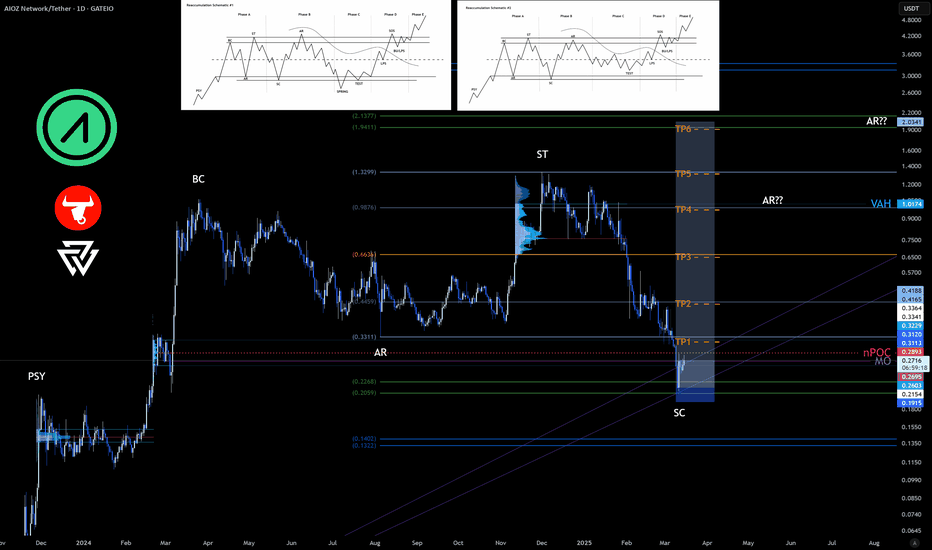

$AIOZ @AIOZNetwork Future Outlook - with Wider Range$AIOZ @AIOZNetwork ─ Wyckoff Re-Accumulation Schematic #1 or #2 scenarios.

Wider Trading Range: Range defined by Pivots from AR ─ ST

------------

------------

Note:

A long trade is the most bullish scenario possible.

As always, my play is:

✅ 50% out at TP1

✅ Move SL to entry

✅ Pre-set the rest of the position across remaining TPs

It's important to take profits along the way and not let a winning trade turn into a losing one.