NZD/JPY 4H Wyckoff 23:1 Risk to Reward RatioWyckoff Trading Method is amazing to understand the market and the big players who move the market. The idea is to understand when the market consolidates and wether it is in a distribution/re-distribution phase or accumulation/re-accumulation phase.

Wyckoff gives you a big Risk to Reward Ration if entered right.

In the NZD/JPY attached picture, the price consolidated and before it there was a change of character, there I have identified the PS (Point of Supply). Then the SC (Selling Climax) and AR (Automatic Rally) were identified alongside ST (Second Test) to mark the end of Phase A. Trading Ranges are identified by SC & AR.

Phase B had an Ultimate Thrust followed by an ST for Phase B.

Phase C is where the big players trick you into thinking the price will go down while in fact the want to push it up. That is called the Spring which is then followed by a Test. The Test usually happens to gather the hedge funds companies to join along.

Phase D is where we see Signs of Strength and could be followed by a Last Point of Supply for any companies to join along.

You could enter a trade in Phase C or Phase D only and you could even go on lower timeframes for better entries.

You have to have patiences when trading Wyckoff because you could have Re-accumulation instead of Accumulation. In our online courses, we'll teach you how you can identify the difference :)

Please share and support and let me know what you think in the comments section. Thanks !

Wyckoffspring

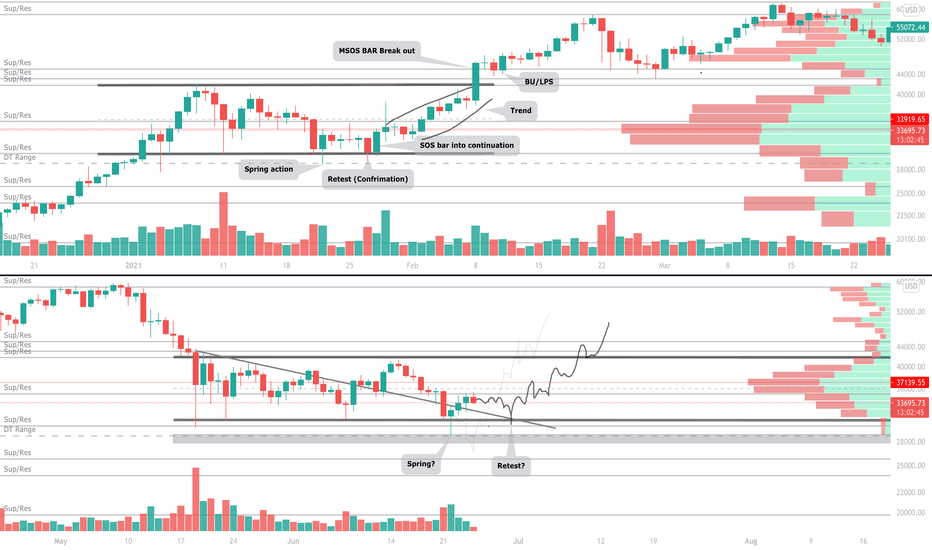

bitcoin finishes up correctionWrote the schematic of a Wyckoff accumulation on the chart of bitcoin.

Schematic explanation:

Starting with a sellng climax (SC) and a secondary test (ST) where volume is still great. After phase a completes, volume starts to diminish and liquidity gets created by the secondary test in phase B (ST B). This liquidity trendline gets taken out by the forming of the SPRING. Here volume starts kicking in again and structure to the upside gets broken.

What’s next: very often after a spring is created and we break structure to the upside, we create a sign of strength (SOS) and come back down towards the spring to test it (black arrow). If this will happen is still uncertain.

Big picture:

The reason I’m looking for a reversal point (Wyckoff accumulation is a point of reversal), is because bitcoin has just entered my 3D point of interest, ranging from around $29.3k $34.5k. This is where we should see bitcoin reverse and start pumping again. If we drop below this point of interest however, we could be looking at a lot more downside in the near future.

Bitcoin Wyckoff Price Cyclehey guys, here is wyckoff price cycle pattern. which is one of the probability for bitcoin to follow in coming days.

RIPPLE | WYCKOFF METHOD | PHASE EWyckoff’s Schematics

The Accumulation and Distribution Schematics are likely the most popular part of Wyckoff’s work - at least within the cryptocurrency community. These models break down the Accumulation and Distribution phases into smaller sections. The sections are divided into five Phases (A to E), along with multiple Wyckoff Events , which are briefly described below.

Accumulation Schematic

Phase E

The Phase E is the last stage of an Accumulation Schematic . It is marked by an evident breakout of the trading range, caused by increased market demand. This is when the trading range is effectively broken, and the uptrend starts.

---

more information on the Wyckoff Method Explained here in Binance Academy.

Potential spring for Wyckoff modelI believe this is a much more technically sound spring, while most people incorrectly assumed the previous phase B test was a Wyckoff spring. The volume was still too high last time. Volume has reduced since then and a trend change seems to be on the cards after dipping below the TR on low volume. Fingers crossed it succeeds.

Wyckoff on NASThere was so many Wyckoff Spring entries today (pink) along with unmitigated areas and liquidity created.

Yesterday was a good day also with Wyckoff.

Still waiting for a drop? Will we get one? Just an updated view of our sideways action. Looks like I will need to redraw the accumulation phase as we are stuck between 32k - 36k. I still expect a dip soon which will start our rebound possibly. This chart will not change as I am curious to see how this plays out compared to the accumulation model.

Bitcoin Wyckoff Accumulation Cheat Sheet (Update 1)Update on the previous cheat sheet with new trendlines and support/resistance levels.

Have also included the cumulative volume of each swing high and low since the Spring/Shakeout, to better show accumulation with lower volume on each pullback compared to up swings. (Note that volume is only based on BINANCE:BTCUSDT )

It appears we have just formed the second test of Phase C, with a confirmation of moving on to Phase D once we clear the 36600 swing high.

Comments and donations appreciated. Thank you!

Inspired by:

@bbrijesh

@JordanLindsey

@JKTrder

Bitcoin Wyckoff Accumulation Cheat Sheet (Repost)BINANCE:BTCUSDT

Putting the Wyckoff Accumulation pattern in the context of live charts with horizontal support/resistance and cloned trendlines .

Price has been tracking nicely since the Spring Shakeout on Jun 22 2021. Figured I'll publish this to use as a guide for trading entries if price continues to track it.

Source: @bbrijesh

Bitcoin Bullish Scenario / Possible Complex Spring Action?January's structure from earlier this year as an analog and comparing to current price action which was also within this same trading range.

We saw a penetration of the lower support in January followed by a few days of testing. The test resulted with a retest almost to the same low as the actual spring.

In Bitcoin's recent price action we saw a huge spike in demand on the penetration of lower levels although the rally has so far failed to materialise into the recent daily capitulation down bar. Whilst this does look bearish we know that the demand is aggressive at the 28/29K area.

Could it be we are in another complex spring type action similar to that of January's? Where we see testing go on for a few days giving the impression of weakness. A low liquidity weekend could be the catalyst that takes us down to test this recent low of the spring type action which could then lead to a successful rally and assault on 40K resistance.

This could be a very reliable trade set up with a favourable risk to reward ratio but do keep in mind the reversal could be a failure of the spring where see a plummet below support and down into the 20's.

I would recommend any entries to be taken on the sign of strength bar after a successful retest.

Remember to always manage your risk well.

ADA Wyckoff reaccumulation potential springWas this our Wyckoff spring? Looking at the Wyckoff accumulation schematics and I have mapped out the events on this chart.

Many are calling bear market, potential drop into distribution, etc. So much FUD and negativity at the moment.

Personally I HODL and wait. Looking forward to Alonzo upgrade and smart contracts. ADA has a bright future ahead.

Wyckoff reaccumulation potential springWas this our Wyckoff spring? Looking at the Wyckoff accumulation schematics and I have mapped out the events on this chart. Many are calling bear market, potential drop into distribution, BTC to 16K, etc. So much FUD and negativity at the moment. Personally I HODL and wait. Only time will tell...

What Happens From Here Will Be CRUCIAL for Bitcoin (BTC)BTC observed a Wyckoff's Spring * action, bullish, within the consolidation zone.

And with ARKK** is trending higher, we expect to see more demand from here.

If this bullish observation continues, we potentially see BTC breaks above current consolidation zone, back into Mark Up Phase.

Thus, upcoming trading days are crucial to BTC.

================================

* Spring denotes weak supply on the market, where price breaks below support but the supply did not sustain the move to mark price lower.

** ARK Innovation ETF (ARKK) holds emerging technology company stocks, in line with Bitcoin's underlying technology.

ARKK when plotted on the chart, trades in line and leads BTC.

ARKK is trending upwards, is positive for BTC.