Silver XAGUSD at Resistance—Will We See a Deep Pullback?In this video, we take a deep dive into silver (XAGUSD) and its recent price action. Silver has been in a strong bullish trend 📈, but it's important to consider the broader market context. The stock markets have caught a bid and are rallying after trading into key support zones, triggering a strong retracement. Given this correlation, silver could follow a similar path as it approaches resistance.

Currently, XAGUSD appears overextended on both the weekly and daily timeframes, suggesting the potential for a deeper pullback 🔄. If this scenario plays out, I’ll be watching for a 50% Fibonacci retracement 📐 as a key buying zone—provided that price action aligns with the criteria outlined in the video.

⚠️ Not financial advice.

XAG USD (Silver / US Dollar)

Bullish momentum to extend?The Silver (XAG/USD) is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance.

Pivot: 32.93

1st Support: 32.10

1st Resistance: 34.88

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

SILVER Under Pressure! SELL!

My dear subscribers,

My technical analysis for SILVER is below:

The price is coiling around a solid key level - 33.804

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 33.034

My Stop Loss - 34.159

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

SILVER Swing Long! Buy!

Hello,Traders!

SILVER made a strong

Bullish brekaout and

The breakout is confirmed

As the daily candle closed above

The key horizontal level of 33.20$

So we are bullish biased

But we will fist expect some

Correction on Monday

With the potential retest

Of the new support level

From where we believe

Growth will continue

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver is in the bullish trend after testing supportHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Silver The Week Ahead 17th March '25Silver INTRADAY bullish & overbought, key trading level is at 3300.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

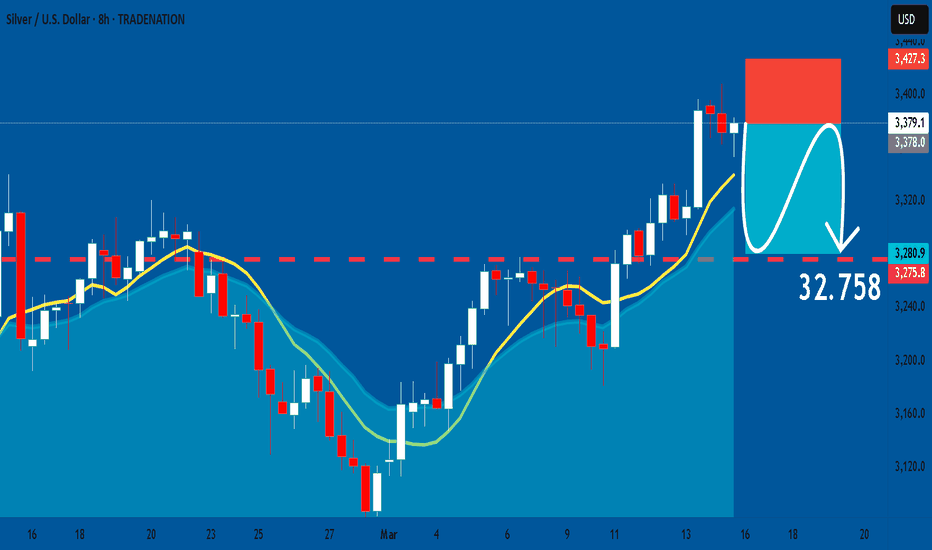

SILVER: Short Signal Explained

SILVER

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short SILVER

Entry Point - 33.791

Stop Loss - 34.273

Take Profit - 32.758

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

XAG/USD "The Silver vs U.S Dollar" Metals Market Robbery Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver vs U.S Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 32.000

Sell Entry below 30.900

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

-Thief SL placed at 31.300 for Bullish Trade

-Thief SL placed at 31.400 for Bearish Trade

Using the 3h period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 33.700 (or) Escape Before the Target

-Bearish Robbers Primary TP 30.00, Secondary TP 30.900 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

XAG/USD "The Silver vs U.S Dollar" Metals market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

# Fundamental Analysis

1. Supply and Demand: Silver supply and demand dynamics can impact XAG/USD prices.

2. Global Economic Conditions: Economic growth, inflation, and interest rates can influence silver demand and prices.

3. Geopolitical Events: Political instability, trade wars, and other geopolitical events can impact silver prices.

# Macro Economics

1. Inflation Rates: Changes in inflation can influence the value of silver and the US dollar.

2. Interest Rates: Interest rate decisions by central banks can impact currency values and commodity prices.

3. GDP Growth: Economic growth or contraction can affect demand for silver and other commodities.

4. Unemployment Rates: Changes in unemployment rates can impact consumer spending and silver demand.

# Global Market Analysis

1. Currency Markets: Changes in currency values can impact XAG/USD prices.

2. Commodity Markets: Changes in commodity prices can impact silver prices.

3. Stock Markets: Changes in stock market sentiment can impact XAG/USD prices.

# COT Data

1. Non-Commercial Traders: An increase in long positions by non-commercial traders can indicate bullish sentiment.

2. Commercial Traders: An increase in short positions by commercial traders can indicate bearish sentiment.

3. Open Interest: Changes in open interest can indicate changes in market sentiment.

# Intermarket Analysis

1. Correlation with Other Assets: XAG/USD's correlation with other assets, such as gold, copper, and oil, can impact its price.

2. Commodity Prices: Changes in commodity prices can impact silver prices.

# Quantitative Analysis

1. Technical Indicators: Technical indicators, such as moving averages and relative strength index (RSI), can provide insights into XAG/USD's trend.

2. Statistical Models: Statistical models, such as regression analysis, can help identify relationships between XAG/USD and other variables.

# Market Sentimental Analysis

1. Bullish Sentiment: Increased bullish sentiment can lead to higher XAG/USD prices.

2. Bearish Sentiment: Increased bearish sentiment can lead to lower XAG/USD prices.

# Positioning

1. Long Positions: An increase in long positions can indicate bullish sentiment.

2. Short Positions: An increase in short positions can indicate bearish sentiment.

# Next Trend Move

1. Bullish Scenario: A breakout above the current resistance level could lead to a bullish trend.

2. Bearish Scenario: A breakdown below the current support level could lead to a bearish trend.

# Overall Summary Outlook

1. Neutral Outlook: The current outlook for XAG/USD is neutral, with both bullish and bearish scenarios possible.

2. Volatility Expected: Volatility is expected to remain high in the short term, with potential price swings in both directions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "SILVER" Metal Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "SILVER" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 32.0000 (swing Trade) Using the 1H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 34.2000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "SILVER" Metal Market is currently experiencing a bullish trend,., driven by several key factors.

🟡Fundamental Analysis

Silver's current price is 32.8000, with a 1.15% increase. The metal's price is influenced by:

Supply and Demand: Silver's supply is expected to increase in 2025, while demand is expected to remain stable.

Geopolitical Tensions: Ongoing tensions between the US and China, as well as the conflict in Ukraine, are supporting Silver's safe-haven status.

Economic Trends: A stronger US dollar and higher interest rates could impact Silver prices negatively.

Inflation: Rising inflation expectations are supporting Silver's price, as it is seen as a hedge against inflation.

Industrial Demand: Silver's industrial demand is expected to increase in 2025, driven by growth in the solar and electronics industries.

🟢Macroeconomic Analysis

Global Economic Trends: The global economy is expected to grow at a moderate pace in 2025, driven by a recovery in trade and investment

Interest Rates: Central banks are expected to keep interest rates low in 2025, supporting precious metal prices

Currency Markets: A weaker US dollar is supporting silver prices

🔴COT (Commitment of Traders) Analysis

Net Long Positions: Institutional traders have increased their net long positions in silver to 65%

COT Ratio: The COT ratio has risen to 2.5, indicating a bullish trend

🟤Sentimental Market Analysis

The market sentiment for Silver is currently mixed. Some analysts predict a bullish trend, citing the metal's safe-haven status and ongoing geopolitical tensions. Others predict a bearish trend, citing the potential for a price correction.

🟣Positioning

Institutional traders are currently holding long positions in Silver, while hedge funds are holding short positions. Corporate traders are also bullish on Silver, citing its safe-haven status.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "The Silver" Metal Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 31.8000 (swing Trade Basis) Using the 2H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 34.5000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "The Silver" Metal market is currently experiencing a bullish trend,., driven by several key factors.

💎Market Overview

Current Price: 32.6000

30-Day High: 34.5000

30-Day Low: 30.5000

30-Day Average: 31.5000

Previous Close Price: 32.2000

Change: 0.4000

Percent Change: 1.24%

💎Fundamental Analysis

Supply and Demand: Global silver demand is expected to increase by 10% in 2025, driven by growing demand for silver in industrial applications and investment products.

Mine Production: Global silver mine production is expected to decrease by 5% in 2025, driven by declining ore grades and mine closures.

Recycling: Silver recycling is expected to increase by 15% in 2025, driven by growing demand for silver and increasing recycling rates.

Investment Demand: Investment demand for silver is expected to increase by 20% in 2025, driven by growing investor interest in precious metals.

💎Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for silver, driven by increasing investor confidence.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for silver as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for silver.

Commodity Prices: Commodity prices are expected to rise by 5% in 2025, driven by increasing demand for raw materials.

💎COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 65%

Open Interest: 120,000 contracts

Commercial Traders (Companies):

Net Short Positions: 25%

Open Interest: 60,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 10%

Open Interest: 15,000 contracts

COT Ratio: 2.6 (indicating a bullish trend)

💎Sentimental Outlook

Institutional Sentiment: 70% bullish, 30% bearish

Retail Sentiment: 65% bullish, 35% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +60

💎Future Market Data

3-Month Forecast: 35.0000 - 38.0000

6-Month Forecast: 38.0000 - 42.0000

12-Month Forecast: 42.0000 - 50.0000

💎Next Move Prediction

Bullish Move: Potential upside to 36.0000-38.0000.

Target: 38.0000 (primary target), 40.0000 (secondary target)

Next Swing Target: 42.0000 (potential swing high)

Stop Loss: 29.5000 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 5.4000 vs potential loss of 2.7000)

💎Overall Outlook

The overall outlook for XAG/USD is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in global silver demand, decreasing mine production, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Skeptic | Weekly Recap: Big Wins, Misses & Lessons!Hey guys! 👋I’m Skeptic , and today I’m gonna do a full recap of the past week’s positions and watchlist.

We’re gonna see what worked, what didn’t, and what lessons we learned along the way. Let’s get into it!

🚀 Position Review: What We’ll Cover

What was the trigger?

What was the result (profit/loss)?

Why did it work or fail?

I’ll be linking all the relevant ideas so you can check out the full analysis for each setup.

Also, if I don’t mention a position, it’s because the trigger I gave hasn’t activated yet.

Let’s dive in!

💥 Position #1: XAUUSD (12 March)

📈 4-Hour Time Frame

Recently, we saw a breakout of the range box, but the price quickly pulled back inside, indicating that sellers failed to maintain bearish momentum. This suggests that the long-term uptrend is still holding strong.

🔮 Next Move?

If we see a break above the 4-hour resistance at 2927.25, it could be a solid signal for continuing the uptrend.

The final bullish trigger will be after a breakout above 2954.74, confirming strong upside momentum.

📉 Short Setup:

The main short trigger is a break below 2878.84.

Once that level breaks, there’s no significant support until 2841.74, so the move could be sharp and quick.

Given the importance of this support, expect some volatility and adjust your stops accordingly.

✅ Outcome:

The long trigger at 2919 was activated, and we managed to hit an R/R of 5.

Reasons for Success:

Trading in the direction of the major trend:

Always increases R/R and win rate.

Strong breakout candle:

A solid 4-hour candle showed both buyer strength and seller presence, signaling a great breakout opportunity.

Good momentum:

Previous corrections were minimal (less than 35% on the Fib retracement), and bullish candles were strong.

💥 Position #2: XAGUSD (12 March)

We recently witnessed a range box breakout, but the price swiftly pulled back inside, showing that sellers failed to keep the momentum. The daily major uptrend still looks strong.

✅ Outcome:

This position also delivered an R/R of 3.

Reasons for Success:

Long trade aligned with the trend:

Always a safer bet.

Sharp reaction to resistance:

Breaking strong resistance often results in a sharp move.

No major resistance ahead:

This allowed the move to extend further, giving us a higher R/R.

💥 Position #3: SPX (14 March)

🔍 Market Overview:

The weekly trend is still up, but the daily time frame has entered a corrective downtrend due to trade tariff issues between the U.S. and other countries. This led to the Fed holding off on interest rate cuts, impacting risk assets like stocks and BTC.

On the 4-hour time frame, we entered a range box and recently saw a fake breakout to the downside. The price quickly bounced back into the range, showing buyer strength and seller weakness. This gives a slight long bias.

✅ Outcome:

Our trigger at 5564.67 activated with a solid indecision candle on the 1-hour time frame. If you took the trade with a safe stop loss, you should be sitting on an R/R of 2 by now.

Reasons for Success:

Fake breakout recovery:

Sellers couldn’t hold the price down, and buyers pushed it back into the range, absorbing liquidity.

Lower-than-expected inflation:

Improved sentiment and led to a bullish push.

Indecision candle confirmation:

Signaled buyer presence and seller exhaustion.

💡 Key Takeaway:

This week, we managed to secure an R/R of 10, which is fantastic.

I’m not gonna brag about how much profit we made, because that number can vary based on each trader’s risk management and position size.

A professional trader measures success through win rate, losing streaks, and R/R, not just the percentage of profit made.

🚨 Pro Tip:

If anyone claims they make “X% profit consistently,” be cautious—it’s probably a scam.

Real traders focus on maintaining consistent risk management and realistic expectations.

💬 Final Thoughts:

If you took any of these trades or have similar setups, share your experience in the comments!

And if you’ve got any questions or insights, drop them below—I’m here to help and discuss.

Let’s grow together, not alone! 💪🔥

Wishing you an awesome weekend!

Silver Nears Key Resistance at $35.00Silver prices have been climbing steadily, finding support above the 50-day SMA (31.58) and 200-day SMA (30.60), signaling a strong uptrend. The metal is now approaching a major resistance level at $35.00, which previously triggered a sharp pullback.

Momentum indicators are supportive of the rally, with the MACD ticking higher in positive territory and the RSI at 64.22, suggesting further upside potential but also cautioning that the market is nearing overbought conditions.

Key Levels to Watch:

📈 Resistance: 35.00 (psychological & historical resistance)

📉 Support: 32.00 (recent swing low), 31.58 (50-day SMA)

A breakout above $35.00 could spark further bullish momentum, while failure to clear this level may lead to consolidation or a short-term pullback.

-MW

SILVER WILL KEEP GROWING|LONG|

✅SILVER is trading in a

Strong uptrend and we saw

A very strong bullish breakout

And the breakout is confirmed

So while I am expecting a potential

Correction and even a retest

Of a broken key level of 33.29$

I will be expecting a further

Move up and a retest of the

Horizontal resistance above

At around 34.84$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver Is Eyeing 34-35 Area; Intraday Elliott Wave AnalysisSilver made a three-wave abc correction in wave 4 which can now extend the rally for wave 5 within a new five-wave bullish cycle towards 34-35 area. After recent five-wave impulse into wave "i", followed by an abc corrective setback in wave "ii", it formed a nice intraday bullish setup. Seems like it's now ready for a bullish resumption within wave "iii", so more upside is expected, especially if breaks above trendline and 32.66 level, just watch out on short-term pullbacks.

Gold long-time analysis, bull run is coming.The possibility of a global recession

Successive increase in interest rates in all economies of the world and imposing costs on economies.

Political tensions (Ukraine/Taiwan/Iran)

Printing money without backing(just see USM2 chart).

Inefficiency of the crypto market.

SILVER (XAGUSD): Bullish Rally Continues

With a yesterday's strong bullish movement, Silver

broke and closed above a key daily resistance cluster.

Watching how strong is the bullish momentum today,

I think that the market will continue rising.

Next resistance - 3440

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver Holds Near $33.80 as Fed Rate Cut Bets Provide SupportSilver edged lower to approximately $33.80 during early Asian trading on Friday, losing momentum. However, the downside may remain limited, as softer U.S. consumer and producer inflation data could provide room for the Federal Reserve to consider an interest rate cut in June, offering some support for the metal.

Additionally, concerns over U.S. President Donald Trump's protectionist policies potentially pushing the world's largest economy into a recession could further support silver's appeal.

If silver breaks above $34.00, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.

Silver (XAG/USD) Analysis: Ready for the Next Move?Welcome back, guys! 👋I'm Skeptic , and today we're diving into an analysis of Silver (XAG/USD) on the 1-hour time frame to spot potential long and short triggers.

🔮 Daily Time Frame Insight

XAG/USD remains bullish on the daily chart as we’re consistently printing higher lows, maintaining the overall uptrend. Given the current economic and geopolitical tensions, caution is essential, but the bullish structure remains intact, so we can still anticipate further upward movement.

📈1-Hour Time Frame & Long Trigger

In the 1-hour time frame, the bullish momentum is clearly visible. Pullbacks are lengthy with large candles, while uptrends are sharp with smaller, more concentrated candles. This pattern indicates strong buying interest when momentum picks up.

Our primary long trigger will be a break above the 4-hour resistance at 33.00237 . Additionally, if the RSI re-enters the overbought zone during the breakout, it will add more confirmation and confidence to the long position, allowing us to increase our risk slightly.

📉 Short Trigger

For short setups, I’ll wait for a clear break of the support at 31.92637 , which also coincides with the previous low. If the downward move is sharp and decisive, this could signal a potential short entry. Until then, I’ll stay on the sidelines for shorts, as the overall trend remains bullish.

Let me know your thoughts and ideas on XAG/USD! 💬 Drop any questions in the comments, and I’ll be happy to discuss them. Let’s grow together, not alone! 🔥

Potential bullish continuation?XAG/USD is falling towards the support level which is a pullback support that aligns with the 61.8% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 33.30

Why we like it:

There is a pullback support level that lines up with the 61.8% Fibonacci retracement.

Stop loss: 32.93

Why we like it:

There is an overlap support level that is slightly above the 50% Fibonacci retracement.

Take profit: 33.93

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Silver H4 | Potential bullish bounceSilver (XAGUSD) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 32.92 which is a pullback support.

Stop loss is at 32.53 which is a level that lies underneath an overlap support and the 38.2% Fibonacci retracement.

Take profit is at 33.38 which is a swing-high resistance that aligns with the 161.8% Fibonacci extension.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.