XAG USD (Silver / US Dollar)

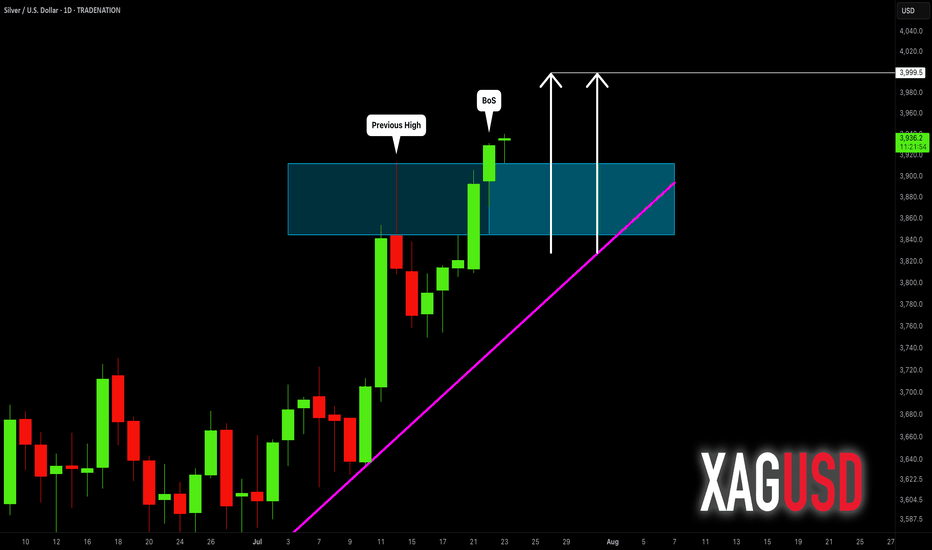

SILVER (XAGUSD): Confirmed Break of Structure

Silver updated a year's high yesterday, breaking a strong daily resistance.

With a confirmed Break of Structure BoS, we can expect that

the market will rise even more.

The next strong resistance is 40.

It is a round number based psychological level.

It can be the next goal for the buyers.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis

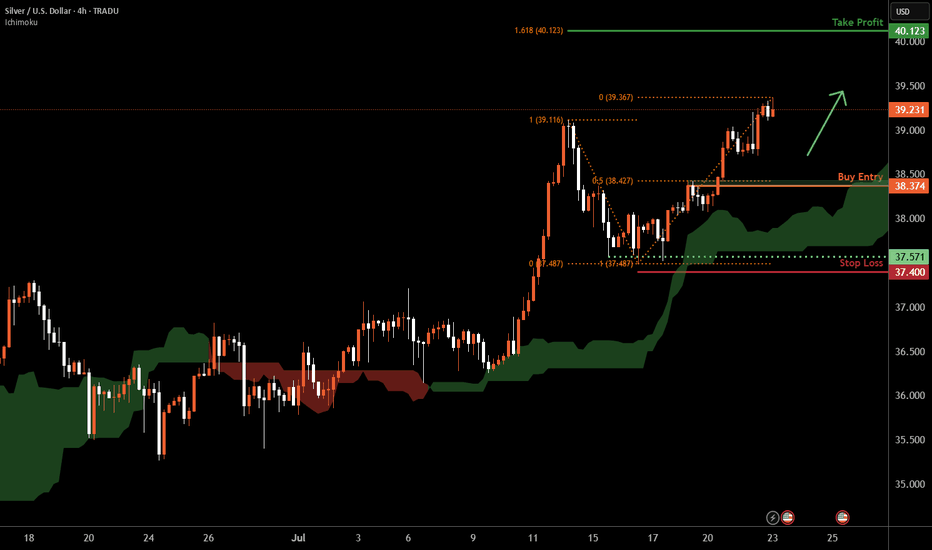

Silver H4 | Falling toward a pullback supportSilver (XAG/USD) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 38.37 which is a pullback support that aligns with the 50% Fibonacci retracement.

Stop loss is at 37.40 which is a level that lies underneath a multi-swing-low support.

Take profit is at 40.12 which is a resistance that aligns with the 161.8% Fibonacci extension.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

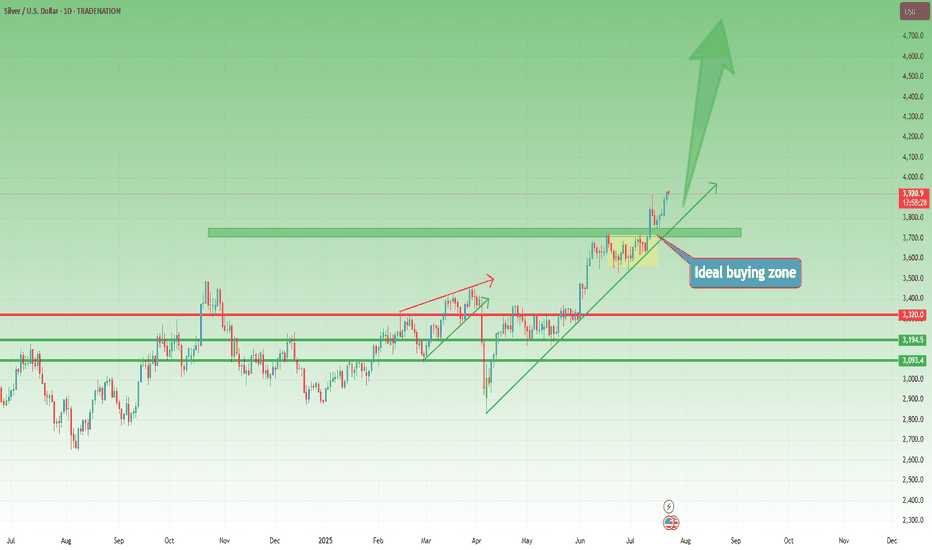

XAGUSD Outlook – 40 Remains the Next TargetIn my previous XAGUSD analysis, I argued that the trend was strongly bullish and that a move toward 40 was the next logical outcome. At the time, price was correcting, and I highlighted the 37.50 zone as a key area to look for long opportunities.

✅ Indeed, Silver respected that zone perfectly —

It retested the broken consolidation, found support, and then surged higher, marking a new multi-year high in yesterday’s session.

________________________________________

🔍 What Now?

Nothing has changed in the broader view:

• Trend: Strongly bullish

• Structure: Higher highs and higher lows remain intact

• Behavior: Dips are being bought aggressively

As long as the recent 37.50 low is not broken, the strategy remains straightforward:

Buy dips within bullish continuation

________________________________________

🎯 40 in Sight — But Don’t Be Surprised if It Goes Further

The 40 zone remains the natural next target — a major psychological level.

But based on current momentum and breakout strength, Silver could go even higher in the coming weeks and months. If buyers keep control, we might even see new ATH test by year's end (50 zone).

________________________________________

🟢 Conclusion

This breakout confirms the larger trend.

The pullback to 37.50 was bought, as expected, and now Silver is making its move.

Strategy should remain the same:

Stay long above 37.50

Buy the dips

Watch how price reacts near 40 — but keep an open mind for higher levels

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

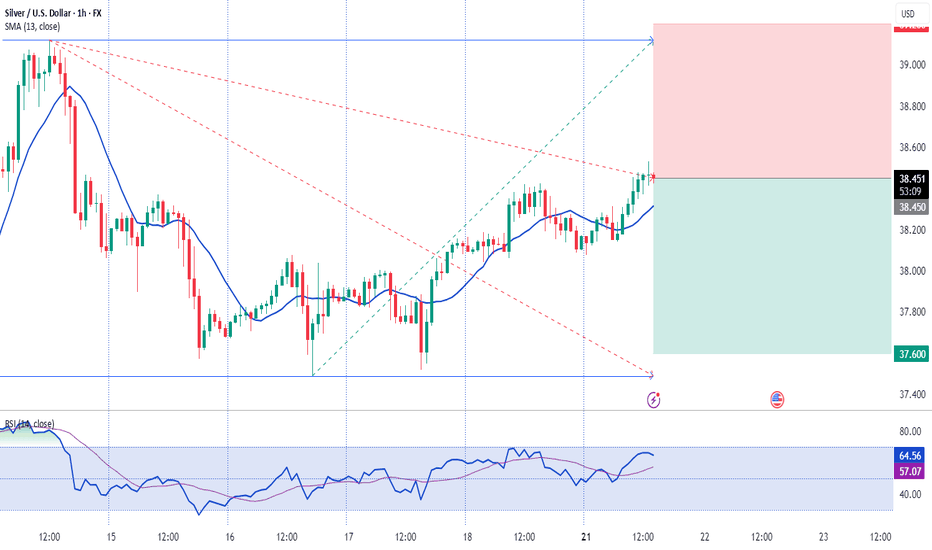

SILVER Bullish Breakout! Buy!

Hello,Traders!

SILVER is trading in a strong

Uptrend and the price made a

Bullish breakout of the key

Horizontal level of 39.10$

So we are bullish biased

And we will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

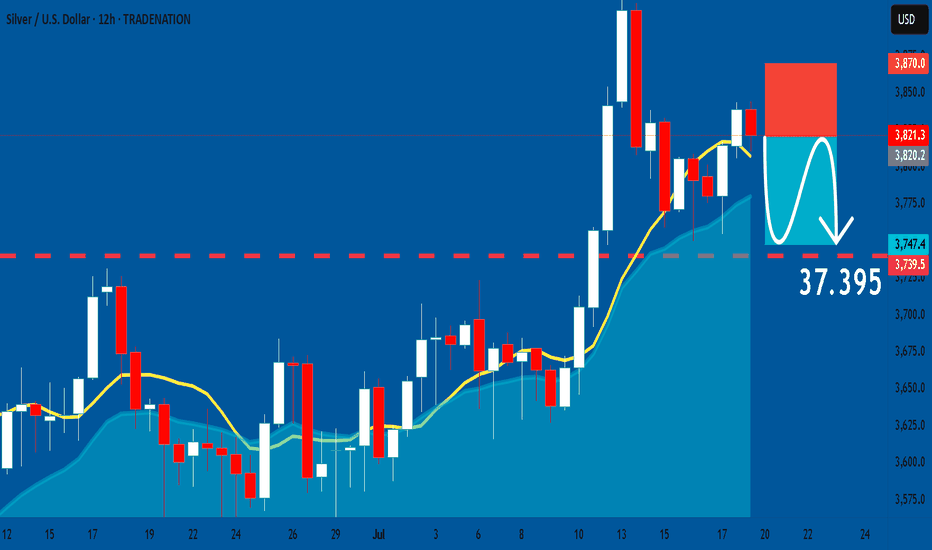

SILVER LOCAL SHORT|

✅SILVER has retested a key resistance level of 39.10$

And as the pair is already making a bearish pullback

A move down to retest the demand level below at 38.61$ is likely

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

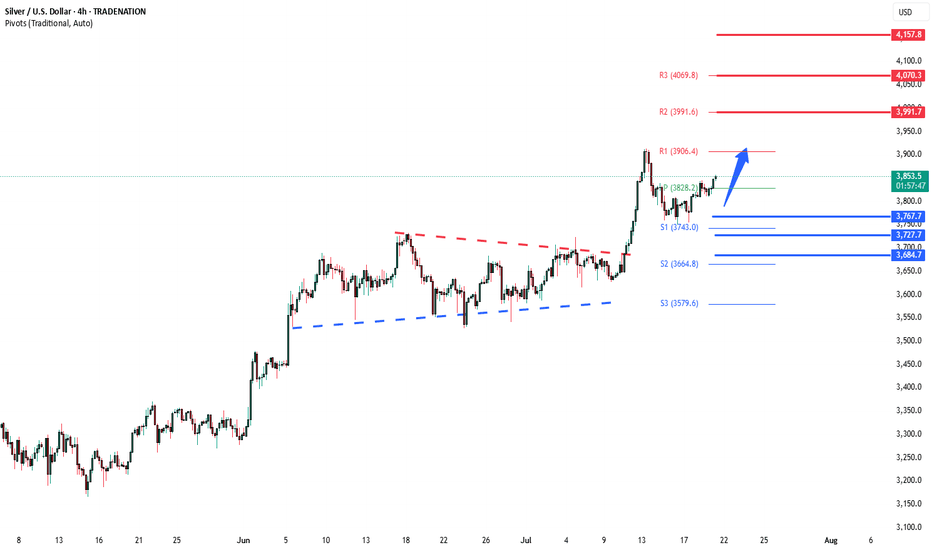

Silver Bullish continuation breakout supported at 3686The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3686 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3686 would confirm ongoing upside momentum, with potential targets at:

3814 – initial resistance

3865 – psychological and structural level

3920 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3686 would weaken the bullish outlook and suggest deeper downside risk toward:

3645 – minor support

3590 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 3686. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

SILVER: Short Trade with Entry/SL/TP

SILVER

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short SILVER

Entry Point - 38.213

Stop Loss - 38.700

Take Profit - 37.395

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

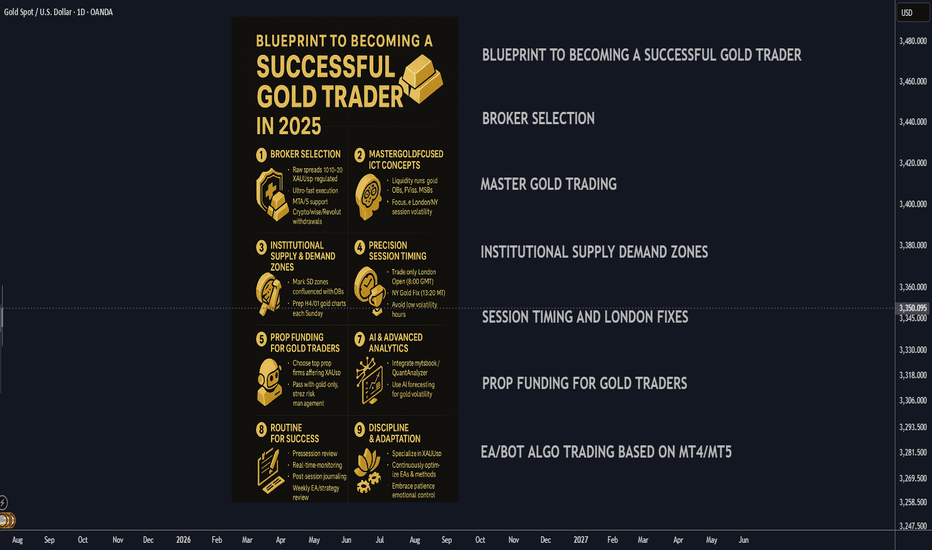

Blueprint to Becoming a Successful Gold Trader in 2025🚀 Blueprint to Becoming a Successful Gold Trader in 2025

A strategic, step-by-step plan to master gold trading by combining institutional concepts, cutting-edge automation, and the best prop funding opportunities for XAUUSD.

________________________________________

🏦 Broker Selection (Gold-Specific)

• 🔍 Choose Brokers Offering Raw Spread XAUUSD Accounts:

Seek brokers with raw/zero spread gold trading or tight gold spreads (0.10-0.30 average) with deep liquidity.

• ⚡ Prioritize Ultra-Fast Execution for Metals:

Confirm broker servers are in NY4/LD4 and latency is optimized for gold volatility spikes.

• 🛡️ Verify Regulation & Execution:

ASIC, FCA, FSCA preferred; check for proof of XAUUSD execution quality (Myfxbook/FXBlue verified).

• 📊 MetaTrader 4/5 Gold Support:

Ensure MT4/5 platform offers tick-chart precision for gold and supports custom EAs/indicators.

• 💳 Flexible Withdrawals/Payouts:

Crypto, Wise, and Revolut compatibility for fast, secure funding.

________________________________________

🎯 Gold Trading Strategy (ICT + Supply/Demand Zones)

• 🧠 Master Gold-Adapted ICT Concepts:

o Liquidity runs and stops at London/NY session highs/lows

o XAUUSD-specific Order Blocks (OBs), FVGs, and Market Structure Breaks (MSB)

• 📍 Map Institutional Supply-Demand Zones:

Gold reacts violently to these—align SD zones with ICT Order Blocks for best confluence.

• 📐 Precision Entries:

Only enter after liquidity sweeps at key XAUUSD levels (H4/D1), avoiding choppy retail entries.

• 📈 Time & Price for XAUUSD:

Focus exclusively on London Open (8:00 GMT) and NY Open/Gold Fixing (13:20 GMT)—peak volatility windows.

• 📆 Weekly Preparation:

Annotate D1/H4 gold charts every Sunday with clear OBs, liquidity points, and SD zones for the week.

________________________________________

💰 Prop Funding for Gold Trading

• 🥇 Select Firms Offering XAUUSD with Tight Rules:

Choose FTMO, The Funded Trader, MyFundedFX, or similar with high leverage and XAUUSD trading enabled.

• 📑 Pass Evaluation with Gold-Only Strategy:

Use high-probability, low-frequency XAUUSD trades—1-3 setups per week, strict risk parameters.

• 🎯 Risk Management:

Max 1% risk/trade, stop trading after 2 consecutive losses—protect account and pass evaluations.

• 📊 Analytics Monitoring:

Use prop dashboards (FTMO Metrics, FundedNext stats) to review XAUUSD trade stats and adjust.

• 📚 Diversify Funded Accounts:

Split funded capital among multiple firms to hedge against firm-specific risk and maximize payouts.

________________________________________

⚙️ Automating Gold Trading (MT4/5 EAs & Bots)

• 🛠️ Hire MQL4/5 Developers for XAUUSD EAs:

Code bots focused on gold-specific ICT (OBs, FVGs, London/NY volatility).

• 🤖 Develop EAs for Gold:

o OB/FVG/Market Structure detection on XAUUSD

o Supply/Demand zone algo entries

o Gold breakout EAs for session openings

• 📌 Trade Management Automation:

o Entry, stop loss, partial TP, BE, trailing for gold’s high volatility

o Dynamic lot-sizing by daily ATR

• 📡 VPS Hosting Near Broker’s Gold Server:

Use NY4/LD4 VPS for lowest latency (ForexVPS, Beeks).

• 📈 Quarterly Forward-Testing:

Optimize EAs in demo before live trading, retest on every major gold volatility shift (FOMC, CPI).

________________________________________

📲 Leveraging Bots & AI in 2025

• 📊 Integrate with MT4/5 Analytics Tools:

Use myfxbook, QuantAnalyzer for detailed gold trade breakdowns.

• 🔮 AI-Based Gold Forecasting:

Layer in machine learning models (e.g., TensorTrade, TradingView AI) to anticipate session volatility and direction.

• 🔔 Real-Time Alert Bots:

Set up Telegram/Discord bots for instant notification of ICT-based XAUUSD signals.

• 🧑💻 Manual Oversight:

Always review high-impact news (NFP, CPI, FOMC) and override automation when macro risk spikes.

• 🔄 Continuous Bot Updates:

Retrain your EAs monthly on latest XAUUSD price action to maintain edge.

________________________________________

🗓️ Daily Gold Trader Routine

• 🌅 Pre-Session (30 mins):

Review annotated gold charts, key session highs/lows, OB/FVG/SD levels, and upcoming news.

• 💻 During Session:

Monitor bot execution, validate setups manually, manage risk during NY/London overlap.

• 📝 Post-Session (15 mins):

Journal gold trades, note reasoning for entry/exit, emotional state, and lessons learned.

• 📆 Weekly Review:

Assess overall gold trading stats and EA performance, adjust strategy as needed.

• 📚 Continuous Learning:

Stay updated on ICT, gold market fundamentals, and new trading tech.

________________________________________

📌 Final Success Advice for 2025

• 🔍 Specialize in XAUUSD/Gold—Don’t Diversify Randomly:

Depth > Breadth—become a true gold trading expert.

• 🚩 Keep Adapting Your Gold Trading EAs:

Markets change—so must your bots and playbooks.

• 🧘 Stay Patient, Disciplined, and Selective:

Gold rewards precision and patience, not overtrading.

• 💡 Embrace AI & Automation:

Leverage every tool: AI, analytics, and custom EAs for a real 2025 trading edge.

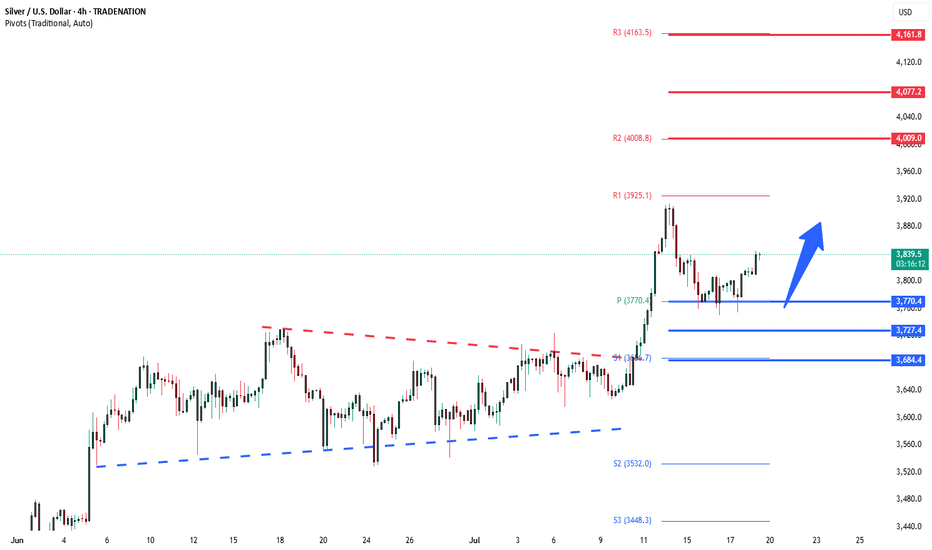

Silver bullish above 3770The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3770 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3770 would confirm ongoing upside momentum, with potential targets at:

4000 – initial resistance

4077 – psychological and structural level

4160 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3770 would weaken the bullish outlook and suggest deeper downside risk toward:

3727 – minor support

3685 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 3770. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

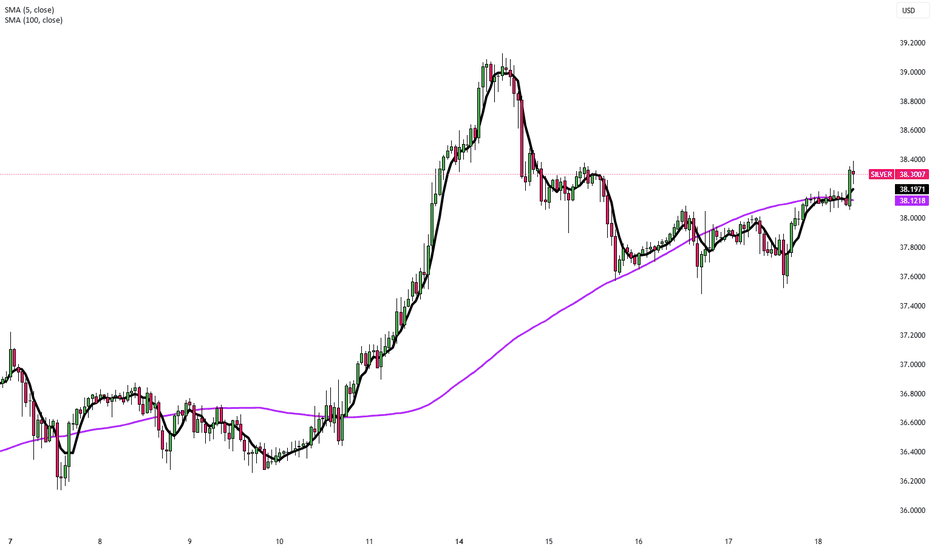

Silver Rebounds Toward $38 as Dollar EasesSilver rebounded toward $38 per ounce on Friday, recovering from a two-day decline as the U.S. dollar and Treasury yields eased. The move reflected shifting sentiment on Fed policy and trade conditions after earlier losses sparked by inflation data that reduced hopes for near-term rate cuts.

U.S. stock futures edged higher following record closes for the S&P 500 and Nasdaq, driven by strong retail sales, lower jobless claims, and optimism in AI-related tech stocks after Taiwan Semiconductor’s positive forecast. On monetary policy, Fed officials remain divided: Mary Daly expects two rate cuts this year, while Adriana Kugler urges caution due to tariff-driven inflation. President Trump reinforced trade tensions by sending letters to over 20 partners setting new tariffs between 20% and 40%.

In corporate updates, United Airlines expects stronger earnings in the second half of 2025, and Chevron signaled higher future cash flow as production in its top U.S. oil field nears a plateau.

Resistance is at 38.50, while support holds at 37.20.

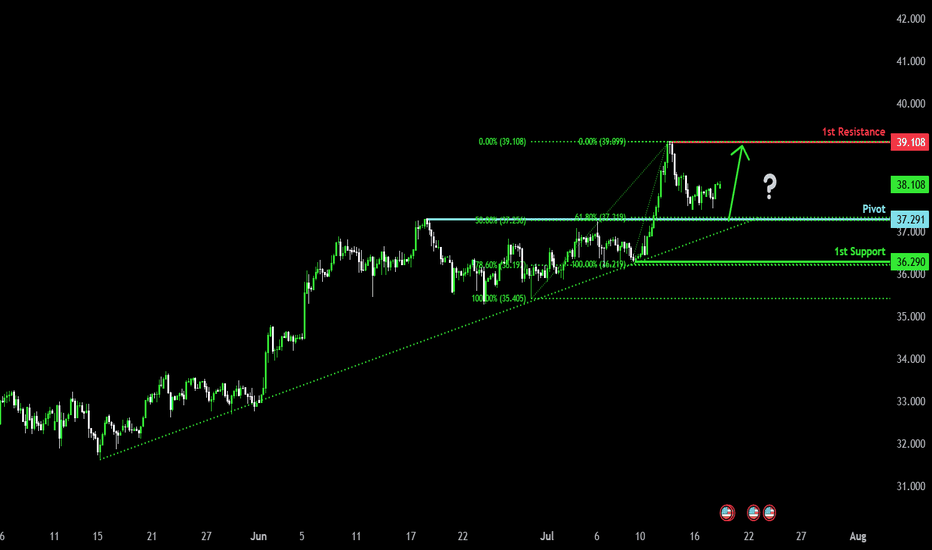

Bullish continuation?The Silver (XAG/USD) is falling towards the pivot and could bounce to the 1st resistance which has been identified as a pullback resistance.

pivot: 37.29

1st Support: 36.29

1st Resistance: 39.10

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

The AI Boom's Unsung HeroThe rise of artificial intelligence isn’t just shaking up tech companies it’s quietly transforming the global silver market in a big way. As major players like NVIDIA, Google and others ramp up their AI infrastructure silver is becoming more critical than ever. Why? Because silver, thanks to its unmatched electrical conductivity, plays a key role in powering the hardware behind AI.

Silver is the most conductive metal on Earth. That makes it perfect for high-performance computing something AI needs a lot of. It’s especially important in data centers and advanced semiconductors, where both electrical and thermal performance are mission-critical.

What’s really interesting is that AI servers tend to use two to three times more silver than traditional data center servers. That’s because AI workloads are more power-hungry, generate more heat and require more complex cooling and electrical systems. Simply put, more AI means more silver.

If there’s one company at the heart of this trend it’s NVIDIA. Analysts at Morgan Stanley expect NVIDIA to consume a staggering 77% of all silicon wafers used for AI accelerators in 2025 up from 51% in 2024. That adds up to around 535,000 300-mm wafers a year each of which contains silver in key components.

All of this AI growth is showing up in the numbers. Industrial silver demand hit an all-time high of 680.5 million ounces in 2024. The electronics industry alone uses around 250 million ounces per year and AI is now the fastest-growing part of that.

Despite all this demand, silver supply just isn’t keeping up. The market’s been in deficit for four straight years, with a total shortfall of 678 million ounces between 2021 and 2024. That’s roughly ten months of global mine output gone missing from the balance sheet.

It’s no surprise, then, that silver prices have been climbing fast. As of July 2025 silver’s up nearly 30% for the year. Looking further ahead I see room for silver to keep climbing:

In the short term (2025): $36–$42 per ounce seems realistic

By 2026: Potential for $50+ as more AI growth stays strong

AI isn’t just changing how we work, communicate, or compute—it’s literally reshaping the commodities that make this technology possible. Silver, once thought of mainly in the context of jewelry or coins, is now a backbone material for the AI revolution.

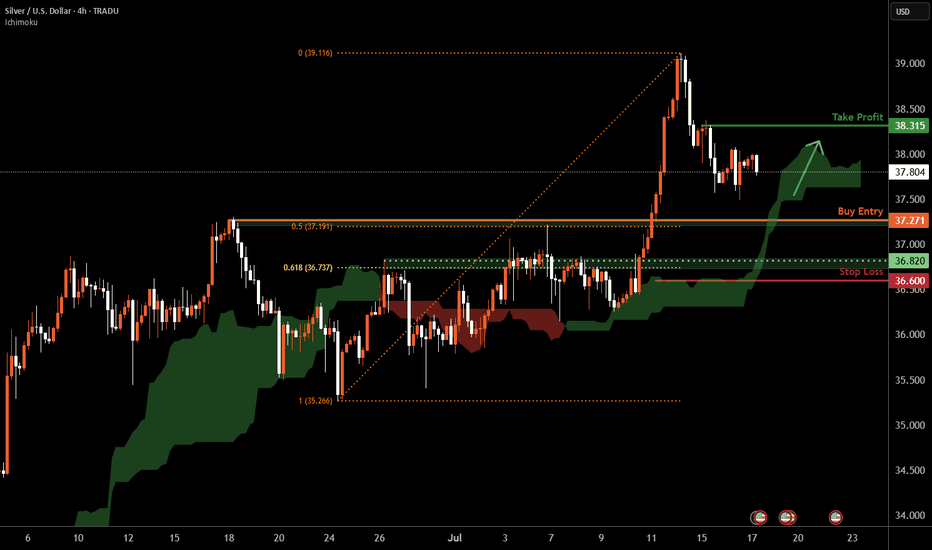

Silver H4 | Falling toward a pullback supportSilver (XAG/USD) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 37.27 which is a pullback support that aligns with the 50% Fibonacci retracement.

Stop loss is at 36.60 which is a level that lies underneath a pullback support and the 61.8% Fibonacci retracement.

Take profit is at 38.31 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

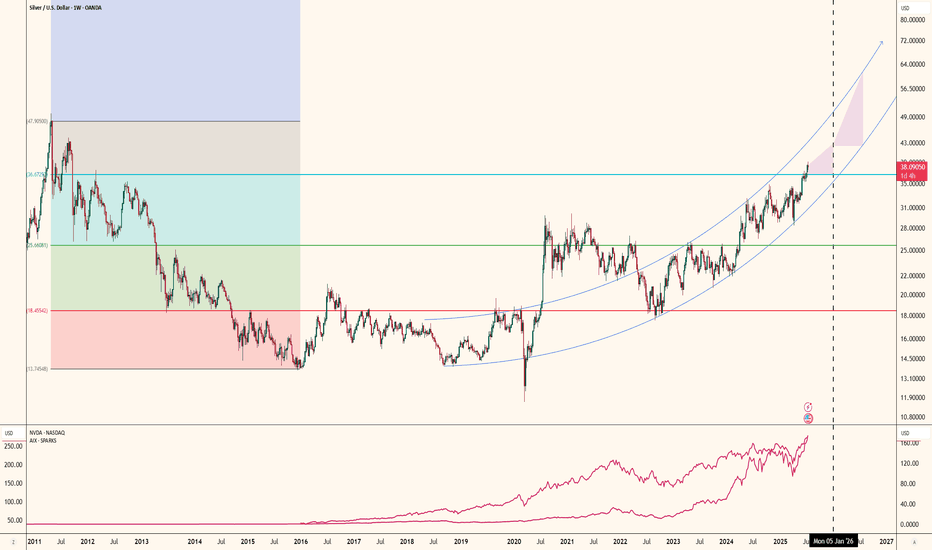

XAGUSD(SILVER):To $60 the silver is new gold, most undervaluedSilver has shown remarkable bullish behaviour and momentum, in contrast to gold’s recent decline. Despite recent news, silver remains bullish and unaffected by these developments. We anticipate that silver will reach a record high by the end of the year, potentially reaching $60.

There are compelling reasons why we believe silver will be more valuable in the coming years, if not months. Firstly, the current price of silver at 36.04 makes it the most cost-effective investment option compared to gold. This presents an attractive opportunity for retail traders, as gold may not be suitable for everyone due to its nature and price.

Silver’s price has increased from 28.47 to 36.25, indicating its potential to reach $60 in the near future. We strongly recommend conducting your own analysis before making any trading or investment decisions. Please note that this analysis is solely our opinion and does not guarantee the price or future prospects of silver.

We appreciate your positive feedback and comments, which encourage us to provide further analysis. Your continuous support over the years means a lot to us.

We wish you a pleasant weekend.

Best regards,

Team Setupsfx

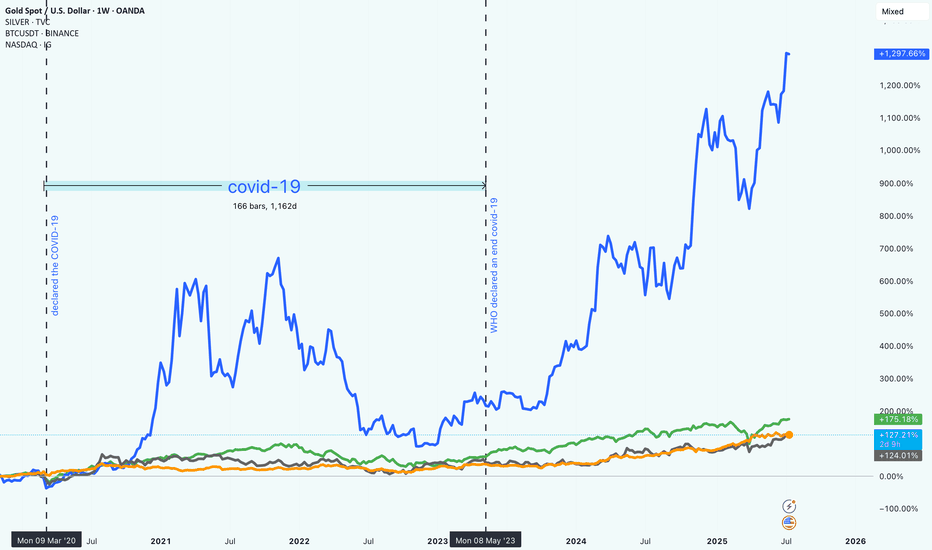

Market Trends from 2020 to 2025How Bitcoin, NASDAQ, Gold, and Silver Really Performed Since 2020

It’s been a wild few years in the markets. From early 2020 to mid-2025, investors have had to navigate uncertainty, changing interest rates, tech booms, and the rise of digital assets. Looking back, it’s clear that some assets took off while others just quietly held their ground.

So, what happened if you had invested in Bitcoin, the NASDAQ, gold, or silver five years ago?

Bitcoin (BTC): +1,297.87%

No surprise here. Bitcoin absolutely stole the show. Despite all the ups and downs (and there were plenty), BTC ended up with nearly 1,300% gains. It had a huge surge in late 2020 and 2021, crashed hard, and then climbed even higher starting in 2023.

This kind of return doesn’t come without risk. Bitcoin was by far the most volatile of the group. But for those who held on, the reward was massive. It also marked a big shift in how people think about money and investing.

"Crypto is no longer just a fringe idea."

NASDAQ: +175.26%

Tech stocks had a strong run, too. The NASDAQ gained around 175%, driven by innovation, digital expansion, and eventually, the AI boom. While there were some bumps along the way (especially when interest rates went up), the general trend was up and to the right.

Unlike Bitcoin, the NASDAQ was more predictable, less explosive.

Gold: +127.39%

Gold did what gold usually does. It held its value and slowly moved higher. Over five years, it returned about 127%, which is pretty solid for a “safe haven” asset. It didn’t grab headlines like crypto or tech stocks, but it stayed reliable through the chaos.

Silver: +124.50%

Silver had a similar story to gold, but with a bit more fluctuation. It benefited from both investor demand and industrial use, and it ended up with just over 124% in gains. Not bad for a metal that often gets overshadowed by its shinier cousin ;).

What It All Means

If you were in Bitcoin, you saw huge gains, but also had to stomach major volatility. Tech investors did well too, especially those who stayed in through the dips. Meanwhile, gold and silver offered steadier, more defensive returns.

One big takeaway: the investment landscape is changing. Traditional assets still matter, but new ones like crypto are reshaping what portfolios can look like.

In the end, it’s about balancing risk and reward!

and figuring out what kind of investor you are.

Skeptic | XAG/USD Analysis: Precision Triggers for Spot & FutureHey everyone, it’s Skeptic! 😎 Ready to ride XAG/USD’s next wave? Let’s dive into XAG/USD (Silver) to uncover long and short triggers that can deliver solid profits. Currently trading around $ 36.31 , we’re analyzing Daily and 4-hour timeframes to pinpoint high-probability setups. Here’s the no-nonsense breakdown to keep you sharp. 📊

📈 Daily Timeframe

On the Daily timeframe, we saw a strong primary uptrend sparked by a V-pattern breakout at $ 33.68317 , which drove a 10% rally, as flagged in my previous analyses—hope you caught it! We’re now in a consolidation box, potentially acting as accumulation or distribution. Today’s candle faced a strong rejection from the box ceiling. If it closes this way in 9 hours, the odds of breaking the box floor increase significantly.

Key Supports: If the floor breaks, watch $ 34.78648 and $ 34.41291 as strong reaction zones for potential bounces.

4-Hour Timeframe (Futures Triggers)

On the 4-hour timeframe, let’s lock in long and short triggers:

Long Trigger: Break above resistance at $ 37.29163 , confirmed by RSI entering overbought. Check my RSI guide for how I optimize setups with RSI.

Short Trigger: Break below support at $ 35.59660 , with volume confirmation. Additional confirmation: RSI entering oversold.

Confirmation Timing: Choose your confirmation timeframe based on your style—4-hour, 1-hour, or even 15-minute. I typically confirm triggers on 15-minute closes for precision, but if 1-hour momentum kicks in, I use 1-hour candle closes. Focus on candle body closes, not just shadows, to avoid fakeouts.

Pro Tip: Stick to 1%–2% risk per trade for capital protection.

Final Vibe Check

This XAG/USD breakdown arms you with precise triggers: long at $37.29163, short at $35.59660, with volume and RSI as your allies. The Daily consolidation signals a big move is brewing—stay patient for the ceiling or floor break. Want more cycle-based setups or another pair? Drop it in the comments! If this analysis sharpened your edge, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

Which Silver trigger are you eyeing? Share your thoughts in the comments, and let’s crush it together!

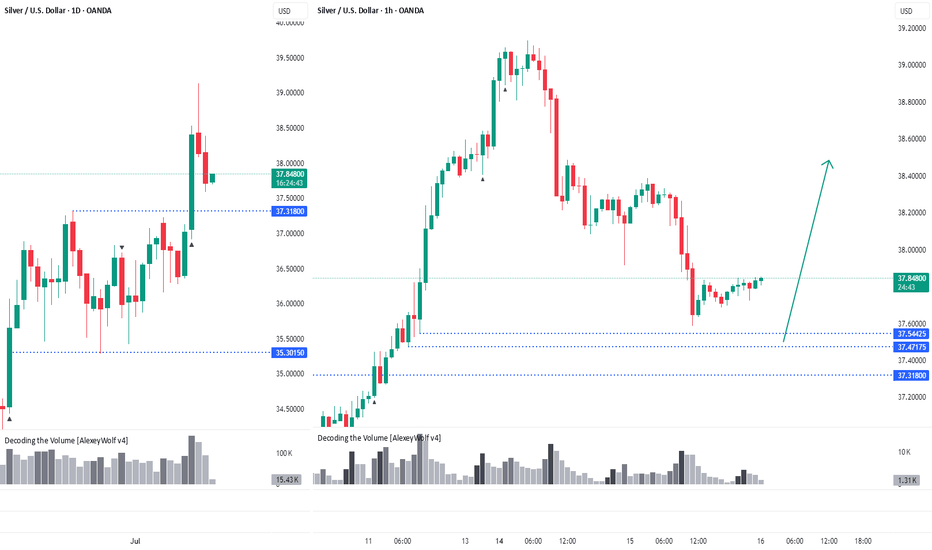

Silver. The price has pulled backHi traders and investors!

On the daily timeframe, the price has broken out of the sideways range through the upper boundary at 37.31.

The price has pulled back close to levels where potential buy patterns could form — 37.54, 37.47, and 37.31.

This analysis is based on the Initiative Analysis concept (IA).

Wishing you profitable trades!

Is it time for a correction for silver?

Hi my dears

It seems that silver, like gold, should spend a few months in a resting phase. Of course, this is a guess. There is a condition on the chart that, if it happens, we should probably see the conditions shown on the chart happen.

I would be happy to hear your opinion.

Falling towards the pullback support?The Silver (XAG/USD) is falling towards the pivot which acts as a pullback support and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 37.29

1st Support: 36.29

1st Resistance: 39.10

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

SILVER Support Ahead! Buy!

Hello,Traders!

SILVER is going down now

But the price is trading in a

Long-term uptrend so we are

Bullish biased and after the

Price retests of the horizontal

Support support below

Around 37.20$ we will be

Expecting a bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.