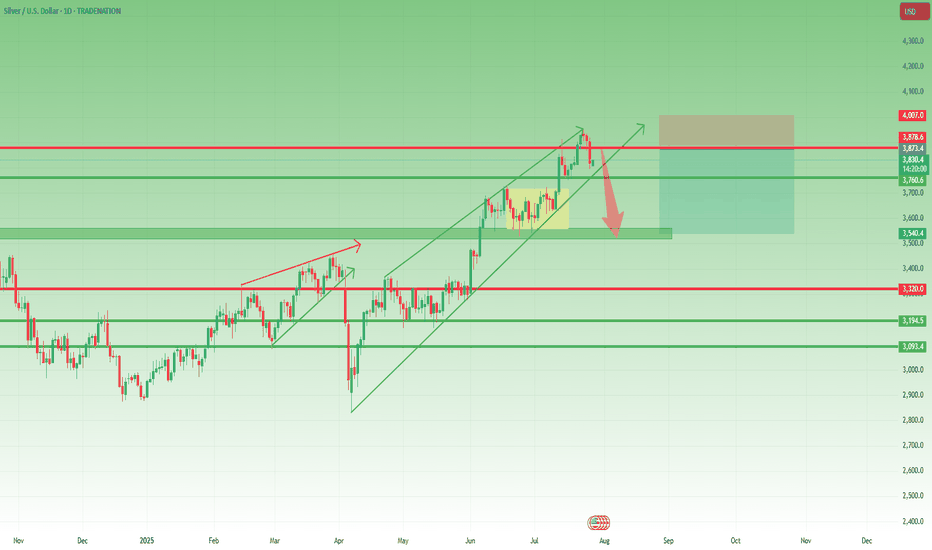

XAGUSD – Reversal Signs After the Run Toward $40Lately, I’ve been a strong advocate for a Silver rally toward $40, and indeed, we got a solid move, with price reaching as high as $39.50, not touching 40 though...

Just like with Gold, the last 3 days of last week turned bearish, and now it looks like we may be entering the early stage of a correction.

📉 Current Setup:

- The rejection from $39.50, right below the psychological $40 level, is significant

- I’ll be monitoring for a possible short entry if we get a rebound into the $38.80–$39.00 zone

- A new high above $39.50 would invalidate this setup

📌 On the downside, if price breaks below the confluence support at $37.70–$38.00, that would confirm the reversal and could lead to an acceleration toward $35.50 support

Conclusion:

The bullish narrative on Silver is pausing here. Until a new high is made, I’m looking to sell the bounce and follow the momentum if the breakdown under support is confirmed.

Let’s see how this plays out this week. 🧭

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Xagusdidea

#XAGUSD: A Strong Bullish Move, Possible Target at $45?Silver is currently experiencing a correction, but the overall price remains bullish. Analysing the data, we can see a potential price reversal in our area of interest. Following the recent higher high, price is poised to create another record high. We should closely monitor volume and price behaviour. A strong volume signal would indicate a potential bullish move in the future.

Good luck and trade safely.

Like and comment for more!

Team Setupsfx_

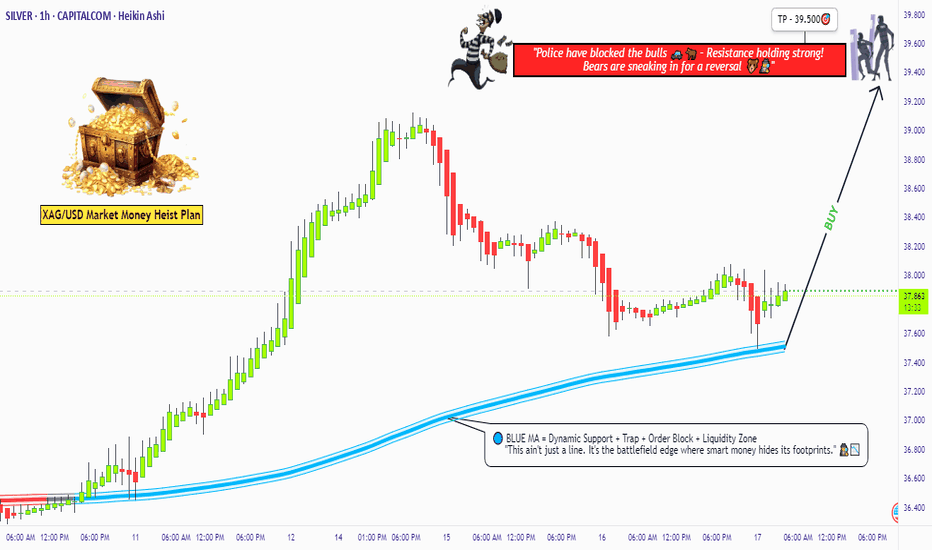

"XAG/USD: Pirate’s Treasure Trade! Bullish & Loaded"🚨 SILVER HEIST ALERT! 🚨 XAG/USD Bullish Raid Plan (Thief Trading Style) 💰🎯

🌟 Attention Market Pirates & Profit Raiders! 🌟

🔥 Thief Trading Strategy Activated! 🔥

📌 Mission Brief:

Based on our elite Thief Trading analysis (technical + fundamental heist intel), we’re plotting a bullish robbery on XAG/USD ("The Silver Market"). Our goal? Loot profits near the high-risk resistance zone before the "Police Barricade" (bear traps & reversals) kicks in!

🚨 Trade Setup (Day/Swing Heist Plan):

Entry (📈): "The vault is open! Swipe bullish loot at any price!"

Pro Tip: Use buy limits near 15M/30M swing lows for safer pullback entries.

Advanced Thief Move: Layer multiple DCA limit orders for maximum stealth.

Stop Loss (🛑): 36.900 (Nearest 1H candle body swing low). Adjust based on your risk tolerance & lot size!

Target (🎯): 39.500 (or escape early if the market turns risky!).

⚡ Scalper’s Quick Loot Guide:

Only scalp LONG!

Rich thieves? Go all-in! Broke thieves? Join swing traders & execute the plan slowly.

Use trailing SL to lock profits & escape safely!

💎 Why Silver? (Fundamental Heist Intel)

✅ Bullish momentum in play!

✅ Macro trends, COT data, & intermarket signals favor upside!

✅ News-driven volatility? Expect big moves!

⚠️ WARNING: Market Cops (News Events) Ahead!

Avoid new trades during high-impact news!

Trailing stops = Your best escape tool!

💥 BOOST THIS HEIST!

👉 Hit LIKE & FOLLOW to strengthen our robbery squad! More lucrative heists coming soon! 🚀💰

🎯 Final Note: This is NOT financial advice—just a thief’s masterplan! Adjust based on your risk & strategy!

🔥 Ready to Raid? Let’s STEAL Some Profits! 🏴☠️💸

👇 Drop a comment & boost the plan! 👇

#XAGUSD #SilverHeist #ThiefTrading #ProfitPirates #TradingViewAlerts

(🔔 Stay tuned for the next heist!) 🚀🤫

XAGUSD(SILVER):To $60 the silver is new gold, most undervaluedSilver has shown remarkable bullish behaviour and momentum, in contrast to gold’s recent decline. Despite recent news, silver remains bullish and unaffected by these developments. We anticipate that silver will reach a record high by the end of the year, potentially reaching $60.

There are compelling reasons why we believe silver will be more valuable in the coming years, if not months. Firstly, the current price of silver at 36.04 makes it the most cost-effective investment option compared to gold. This presents an attractive opportunity for retail traders, as gold may not be suitable for everyone due to its nature and price.

Silver’s price has increased from 28.47 to 36.25, indicating its potential to reach $60 in the near future. We strongly recommend conducting your own analysis before making any trading or investment decisions. Please note that this analysis is solely our opinion and does not guarantee the price or future prospects of silver.

We appreciate your positive feedback and comments, which encourage us to provide further analysis. Your continuous support over the years means a lot to us.

We wish you a pleasant weekend.

Best regards,

Team Setupsfx

Silver Update (XAGUSD): Eyeing the Next Move After the $39 SurgeAs mentioned in my Friday analysis, Silver ( TRADENATION:EURUSD XAGUSD) was preparing for an important breakout — and indeed, the market delivered. The clean break through resistance triggered a strong acceleration, pushing the metal up to $39, pretty close to the psychological $40 level.

Now, we’re seeing a healthy correction after this steep rise, and this could turn into a buying opportunity for the bulls.

📌 Key support zone:

The ideal area to watch is between $37.20 and $37.50 — this is the sweet spot where bulls might step back in.

But be aware:

👉 After strong breakouts, the broken resistance doesn’t always get retested — sometimes the price rebounds from higher levels.

🎯 Plan of Action:

• Monitor price action under $38

• Watch for reaction patterns and structure shifts

• Don’t force entries — let the market confirm

Silver remains strong as long as the structure holds, and this pullback might just be the market catching its breath before another leg up. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

"XAG/USD: BULL FLAG FORMING? LAST CHANCE TO JUMP IN!"🔥 XAG/USD "SILVER RAID" – Bullish Loot Grab Before the Cops Arrive! 🚨💰

🌟 Greetings, Market Pirates & Profit Bandits! 🌟

Based on the 🚨Thief Trading Style🚨 (a ruthless mix of technicals + fundamentals), we’re plotting a day/swing trade heist on XAG/USD (Silver). Our mission? Loot bullish gains before hitting the police barricade (resistance zone). Stay sharp—this is a high-risk, high-reward escape plan with overbought signals and bearish traps lurking!

📜 THE HEIST BLUEPRINT

🎯 Entry (Bullish Swipe):

"Vault is OPEN!" – Long at any price, but for smarter thieves:

Buy limit orders near swing lows/highs (15m-30m TF).

DCA/Layering strategy: Spread entries like a pro bandit.

🛑 Stop Loss (Escape Route):

Nearest swing low/high (1H candle body/wick) → 36.700 (adjust based on risk & lot size).

Risk management is key! Don’t get caught by the market cops.

🏴☠️ Take Profit (Escape Before Handcuffs!):

First Target: 38.500 (or bail earlier if momentum fades).

Scalpers: Only play LONG! Use trailing SL to lock profits.

💡 WHY THIS HEIST? (Market Drivers)

Bullish momentum in Silver (XAG/USD) fueled by:

Macro trends (COT report, sentiment shifts).

Intermarket moves (Gold correlation, USD weakness).

Potential breakout from consolidation.

⚠️ News Risk: Major releases can trigger volatility—avoid new trades during high-impact events!

🚨 THIEF'S PRO TIPS

✅ Trailing SL = Your getaway car.

✅ Small accounts? Ride the swing traders’ coattails.

✅ Big wallets? Go full-throttle.

✅ Boost this idea 💥 to strengthen our robbery squad!

📌 DISCLAIMER (Stay Out of Jail!)

Not financial advice! DYOR, manage risk, and adapt to market changes.

Silver is volatile—trade smart, not greedy.

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🕵️♂️

🔗 Want the Full Intel?

Check the fundamentals, COT reports, and intermarket analysis for deeper clues! (Klick the 🔗🔗).

💬 Drop a comment if you’re joining the heist! 👇

“Can This XAG/USD Setup Make You the Next Market Thief?”🏴☠️ Operation Silver Swipe — Thief Trading Heist Plan for XAG/USD

🚨 Target Locked: The Silver Vault 🧳🎯

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Hustlers & Chart Whisperers, 🕵️♂️💼📉💰

Step into the shadows with our stealth plan based on our signature Thief Trading Style—a mix of smart technicals and crafty fundamentals. Today, we’re eyeing XAG/USD (Silver) for a clean sweep. Here's how to gear up for the breakout job:

🎯 Entry Zone — “The Heist Is On!” 💥

📍Key Level: Break & Retest above 37.000 – that's your cue to act.

🔑Strategy:

Buy Stop Orders: Set above the breakout level

Buy Limit Orders: Use recent 15/30M swings for a sneaky pullback entry 🎯

🛑 Stop Loss — “Every Thief Has a Backup Plan” 🎭

Place your SL like a pro, not a panic button!

📌Recommended: Around 35.660 using the 4H nearest candle wick swing low place after the breakout entry.

⚠️Tip: Adjust based on your risk appetite, lot size, and number of entries. You’re the mastermind, not a minion.

🎯 Target — “Escape Route” 🏃♂️💸

📌 First checkpoint: 38.800

📌 Or take your loot early if the heat rises! (Overbought zones, trend traps, or reversal zones)

💡 Scalper's Shortcut 💡

Go only long for safety. If you’ve got the cash stack, jump in fast. If you’re more of a sneaky swing trader, follow the roadmap and trail your SL to secure that bag 🧳📈

🔍 Market Status

Silver’s in a Neutral Phase – but signs point to an upward getaway 🚀

Fueling this momentum:

Macro & Fundamental trends

COT Positioning

Intermarket Clues

Sentimental Signals

🔗 Read the full breakdown check there 👉🔗🔗🌏🌎!

📢 Trading Alert — News Release Caution ⚠️

Don’t get caught mid-escape during news bombs! 💣

✅ Avoid fresh entries during high-impact events

✅ Use trailing SL to lock in your gains and cover your tracks

💖 Smash the Boost Button if you vibe with this plan 💥

Support the crew and help keep the charts hot and the loot flowing. Your boost powers up our next big heist 🚁🔥

📡 Stay tuned for more street-smart setups... we rob the charts, not the rules! 🐱👤💸📊💎

“Can This XAG/USD Setup Make You the Next Market Thief?”🏴☠️ Operation Silver Swipe — Thief Trading Heist Plan for XAG/USD 🪙💸

🚨 Target Locked: The Silver Vault 🧳🎯

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Hustlers & Chart Whisperers, 🕵️♂️💼📉💰

Step into the shadows with our stealth plan based on our signature Thief Trading Style—a mix of smart technicals and crafty fundamentals. Today, we’re eyeing XAG/USD (Silver) for a clean sweep. Here's how to gear up for the breakout job:

🎯 Entry Zone — “The Heist Is On!” 💥

📍Key Level: Break & Retest above 36.500 – that's your cue to act.

🔑Strategy:

Buy Stop Orders: Set above the breakout level

Buy Limit Orders: Use recent 15/30M swings for a sneaky pullback entry 🎯

🛑 Stop Loss — “Every Thief Has a Backup Plan” 🎭

Place your SL like a pro, not a panic button!

📌Recommended: Around 31.700 using the 4H swing low

⚠️Tip: Adjust based on your risk appetite, lot size, and number of entries. You’re the mastermind, not a minion.

🎯 Target — “Escape Route” 🏃♂️💸

📌 First checkpoint: 37.700

📌 Or take your loot early if the heat rises! (Overbought zones, trend traps, or reversal zones)

💡 Scalper's Shortcut 💡

Go only long for safety. If you’ve got the cash stack, jump in fast. If you’re more of a sneaky swing trader, follow the roadmap and trail your SL to secure that bag 🧳📈

🔍 Market Status

Silver’s in a Neutral Phase – but signs point to an upward getaway 🚀

Fueling this momentum:

Macro & Fundamental trends

COT Positioning

Intermarket Clues

Sentimental Signals

🔗 Read the full breakdown check there 👉🔗🔗🌏🌎!

📢 Trading Alert — News Release Caution ⚠️

Don’t get caught mid-escape during news bombs! 💣

✅ Avoid fresh entries during high-impact events

✅ Use trailing SL to lock in your gains and cover your tracks

💖 Smash the Boost Button if you vibe with this plan 💥

Support the crew and help keep the charts hot and the loot flowing. Your boost powers up our next big heist 🚁🔥

📡 Stay tuned for more street-smart setups... we rob the charts, not the rules! 🐱👤💸📊💎

XAGUSD – Bullish Setup for a Move Toward 40 1. What happened recently

After the massive selloff in early April, Silver (XAGUSD) reversed aggressively — gaining nearly 10,000 pips and breaking into multi-decade highs near 38. That kind of move is not noise. It’s power.

The month of June brought consolidation, with price slowly correcting and stabilizing. But this doesn’t look like distribution — it looks like new accumulation.

2. The key question

Is Silver building a base for the next breakout, or has the rally run out of steam?

3. Why I expect another leg up

- 35.00 is now acting as a solid support — tested, respected

- The correction has been shallow, typical for a bull rectangle structure

- Momentum remains on the buyers’ side — no major breakdown signs

- If buyers step in strongly, the next target is clearly the 40.00 psychological level

- This is a textbook bullish continuation setup.

4. Trading plan

Swing traders should watch the 35.00–35.20 zone for buying opportunities.

The risk/reward is attractive — with a potential for +5000 pips on a move toward 40, while keeping stops under the base.

Buy the dips — not the breakouts.

5. Final thoughts 🚀

Silver is shining again. The trend is up, the structure supports further gains, and the chart is offering a clean setup. Until 35 fails, the bias remains bullish.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

"The Vault is Open!" - Time to Steal Silver Pips🔥 XAG/USD SILVER HEIST: Bearish Raid in Progress! (Short Setup) 🔥

🦹♂️ ATTENTION SILVER BANDITS!

To the Metals Mercenaries & Risk-Takers! 💰🔪

Using our 🔥Thief Trading Tactics🔥, we're executing a bearish raid on XAG/USD - this is not advice, just a strategic robbery plan for traders who play to win.

📉 THE SILVER VAULT BREAK-IN (SHORT ENTRY PLAN)

🎯 Loot Zone: 34.500 (or escape earlier if bulls fight back)

💣 High-Stakes Play: Perfect pullback to steal pips

👮♂️ Cop Trap: Where bulls get liquidated

🔪 ENTRY RULES:

"Vault Breach Confirmed!" - Strike at pullback to nearest swing high/low (15-30min TF)

Sell Limit Orders for optimal risk/reward

Aggressive? Enter at market but watch gold correlation

📌 SET ALERTS! Don't miss the rejection

🚨 STOP LOSS (Escape Plan):

Thief SL at 36.400 (Key swing level)

⚠️ Warning: "Ignore this SL? Enjoy donating to bulls."

🎯 TARGETS:

Main Take-Profit: 34.500

Scalpers: Ride the NY session momentum

🔍 WHY THIS HEIST WORKS

✅ Industrial demand slowing

✅ Dollar strength crushing metals

✅ ETF outflows accelerating

✅ Technical rejection at key level

🚨 RISK WARNING

Avoid FOMC/NFP periods (Silver loves volatility)

Trailing stops = your escape plan

💎 BOOST THIS HEIST!

👍 Smash Like to fund our next raid!

🔁 Share to build our thief army!

🤑 See you at 34.500, bandits!

⚖️ DISCLAIMER: Hypothetical scenario. Trade at your own risk.

#XAGUSD #SilverTrading #Commodities #ThiefTrading

💬 COMMENT: "Short already - or waiting for better entry?"* 👇🔥

Silver Price Retreats from 2012 HighsSilver Price Retreats from 2012 Highs

As shown on the XAG/USD chart, the price of silver climbed above $37 per ounce yesterday — a level not seen since 2012. However, this morning, the price has dropped by approximately 2.5% from yesterday’s peak.

The bullish driver behind the rally has been fears that the US could become involved in a military conflict between Israel and Iran. Concerns in financial markets intensified after media reports stated that US officials are preparing for a potential strike on Iran.

Another factor influencing silver's price was the Federal Reserve’s decision to keep interest rates unchanged and maintain a cautious policy stance. Yesterday, Jerome Powell warned that President Trump’s tariffs could fuel inflation (a bullish signal for silver) and complicate the economic outlook.

Technical Analysis of the XAG/USD Chart

In our previous analysis of the XAG/USD chart, we identified an upward channel. This channel remains relevant, though its configuration has shifted.

The price of silver remains in the upper part of the channel (a sign of strong demand). However, two signals suggest a potential correction may develop:

→ A bearish divergence on the RSI indicator;

→ A sharp decline from the channel’s upper boundary (marked with a red arrow), breaking through the local line that divides the upper half of the channel into quarters.

Nevertheless, given the scale of geopolitical risks, there is a chance that the bears may struggle to significantly shift the trend — especially with markets nearing the weekend closure.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAG/USD (Silver) Monthly Analysis – Major Resistance Test Incomi🔍 XAG/USD (Silver) Monthly Analysis – Major Resistance Test Incoming 💥🪙

📊 Overview:

This monthly chart of XAG/USD (Silver vs. US Dollar) reveals a critical technical juncture, where price action is testing a multi-year resistance-turned-support zone around $36.27. The chart is structured with major zones of support and resistance, and it includes a potential bullish extension followed by a bearish correction scenario.

📌 Key Technical Levels:

🟧 Support Zone: $22.50 – $24.00

🟨 Resistance-Turned-Support Zone: $34.00 – $36.50

🟪 Major Resistance: $43.60 – $48.80

🔼 Bullish Scenario (Preferred Path):

Current Price: ~$36.27 is at the upper edge of a crucial S/R flip zone.

📈 A breakout above this zone could propel silver toward the next resistance target at $43.60, with a potential full extension to $48.80.

✨ Momentum and historical breakout behavior from this region suggest strong buying interest if breached convincingly.

🔽 Bearish Scenario (Rejection Path):

🔄 If silver faces rejection at the $36.27 zone, it may retrace towards:

🟥 $28.31 minor support (intermediate target),

🔻 followed by a deeper correction to the $22.50–$24.00 support zone.

🔁 This would complete a classic retest of broken support, allowing accumulation before any further long-term rally.

🧠 Strategic Notes:

⚠️ Macro-driven: Silver is highly sensitive to inflation, Fed policy, and industrial demand.

📅 Long-term chart suggests cyclical behavior, with consolidation phases followed by aggressive trends.

📌 Traders should monitor weekly closes around $36.27 to confirm breakout or rejection.

✅ Conclusion:

Silver is at a make-or-break zone 🧨. A breakout may lead to a multi-year high, but failure here opens the door for a healthy pullback. The next few candles will be decisive for long-term positioning.

📉 Watch for rejection wicks at resistance

📈 Monitor volume on breakout attempts

📊 Plan for both outcomes: breakout or retest

Psst… Wanna Rob the Silver Market? XAG/USD Trade Inside!"🔥 "SILVER HEIST ALERT! 🚨 XAG/USD Bullish Raid Plan (Thief Trading Style)" 🔥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸✈️

Based on the 🔥Thief Trading Style🔥 (technical + fundamental analysis), we’re plotting a heist on XAG/USD "The Silver" Market. Follow the strategy on the chart—LONG ENTRY is key! Aim to escape near the high-risk Red Zone (overbought, consolidation, bear traps). 🏆 Take profits & treat yourself—you’ve earned it! 💪🎉

📈 ENTRY: "The Heist Begins!"

Wait for MA breakout (33.700)—then strike! Bullish profits await.

Options:

Buy Stop above Moving Average OR

Buy Limit near pullback zones (15-30min timeframe, swing lows/highs).

📌 Pro Tip: Set an ALERT for breakout confirmation!

🛑 STOP LOSS: "Listen Up, Thieves!"

For Buy Stop Orders: DO NOT set SL until after breakout!

Place SL at recent/swing low (4H timeframe)—adjust based on your risk, lot size, & order count.

Rebels, be warned: Set it wherever, but you’re playing with fire! 🔥⚡

🏴☠️ TARGET: 34.700

Scalpers: Only trade LONG. Use trailing SL to protect gains.

Swing Traders: Join the robbery squad & ride the trend!

📰 FUNDAMENTAL BACKUP:

Bullish drivers in play! Check:

Macro trends, COT reports, sentiment, intermarket analysis.

🔗 Linkks in bio/chart for deep dive.

⚠️ TRADING ALERTS:

News = Volatility! Avoid new trades during releases.

Lock profits with trailing stops. Stay sharp!

💥 BOOST THE HEIST!

Hit 👍 "LIKE" & "BOOST" to fuel our robbery team!

More heists coming—stay tuned! 🚀🤩

🎯 Let’s steal the market’s money—Thief Trading Style! 🏆💵

SILVER TO 40$ HELLO TRADERS

As i can see Silver is still trading inside a upward channel and did not created any big moves like Gold and its under value i am expected a boost from this zone to 40 $ incoming days if it did notr break the channel friends its just a trade idea share ur thoughts with us we love ur comments and support Stay Tuned for more updates

Precision Pays Off: Learn, Trade, Win — Results Speak Louder🎯 Analysis On Point Again!

My recent analysis played out exactly as expected. 📉📈 Those who followed my instructions not only gained profits but also improved their trading knowledge and decision-making skills.

Success in trading isn't just about luck — it's about learning to read the market with precision and discipline. 📚💡

To those who’ve been riding along — congratulations on your gains! 🥂 And to the new followers, stay tuned. The next winning setups are just around the corner.

Let’s grow, learn, and earn — together. 🚀💸

XAG/USD Rejection Looming at Key Resistance – Bearish Reversal 🔍 Chart Analysis – XAG/USD

1. Trend & EMAs:

The chart shows two key exponential moving averages:

📈 EMA 50 (Red): 33.1940

📉 EMA 200 (Blue): 32.8684

Price is currently above both EMAs, indicating a short-term bullish trend, but a possible bearish rejection is forming near resistance.

2. Key Zones:

🟥 Resistance Zone: 33.45 – 33.60

Price has repeatedly tested this zone and reversed, suggesting strong selling pressure.

Multiple wicks into this zone show buyer exhaustion.

🟩 Support Zone: 32.60 – 32.85

Strong demand observed here with consistent bounces.

The EMA 200 also aligns with this support, reinforcing its strength.

3. Price Behavior & Pattern:

🧱 Repetitive Bearish Drops: Marked by blue rectangles, suggesting a pattern of sharp sell-offs after touching resistance.

🔁 Potential Double Top Pattern forming near the resistance zone, a classic bearish reversal signal.

🧭 The projected path suggests:

A short-term retest of the resistance.

Followed by a pullback toward the support zone around 32.60.

Breakdown below support could open further downside potential.

📌 Summary:

⚠️ Short-Term Outlook: Bearish bias if resistance holds.

📍 Key Level to Watch: 33.60 (breakout) and 32.60 (breakdown).

🔄 Trade Plan:

Consider short entries near 33.45–33.60 resistance zone with stops above 33.65.

Target around 32.65–32.60 support zone.

📊 Indicators in Play:

EMA confluence supports trend analysis.

Price structure and rejection patterns suggest likely mean reversion to support.

Can You Snatch Silver’s Profits? XAG/USD Stealth Trade Plan🔥Silver Snatch Strategy: XAG/USD Stealth Trade Plan🔥

👋 Greetings, Profit Pirates & Chart Ninjas! 🕵️♂️💸

Welcome to the Silver Snatch Strategy—a sly, calculated approach to raiding the XAG/USD market with finesse. This plan fuses razor-sharp technicals with real-time fundamentals to swipe profits from silver’s wild swings.

Let’s move like shadows, strike fast, and vanish with the gains! 🌑📈

📜 The Silver Snatch Blueprint

Entry Triggers 🔑:

🔼 Bullish Ambush: Enter on a breakout above the 50-period EMA at ~$34.20, signaling a potential rally.

🔽 Bearish Strike: Dive in on a breakdown below the 200-period EMA at ~$31.50, riding the downward momentum.

💡 Pro Tip: Use price alerts to catch these levels without glued eyes! 🔔

Stop Loss (SL) 🛡️:

🟢 Bullish Trade: Set SL at $31.90 (recent daily low, cushioning against wicks).

🔴 Bearish Trade: Place SL at $33.80 (daily high, guarding against fakeouts).

📉 Stay Flexible: Adjust SL based on your risk tolerance, lot size, and market volatility. This is your safety net!

Take Profit (TP) 💰:

🚀 Bullish Raiders: Target $36.50 (Fibonacci 61.8% retracement) or exit on fading volume.

🕳️ Bearish Thieves: Aim for $28.80 (key support zone) or slip out if momentum stalls.

🚪 Escape Tactic: Watch RSI for overbought (>70) or oversold (<30) signals to dodge reversals.

🌐 Why Trade XAG/USD Now?

Silver’s price action is a treasure chest of opportunity, driven by:

💵 USD Strength: The US dollar is flexing due to hawkish Fed signals and robust US economic data (e.g., Q1 2025 GDP growth at 2.8% annualized). A stronger USD typically pressures silver prices.

🕊️ Geopolitical Shifts: Easing US-China trade tensions reduce safe-haven demand for silver, tilting sentiment bearish.

🎲 Speculative Bets: Speculative net-short positions on silver are rising, with traders leaning against XAG/USD.

📊 Technical Edge: RSI (14-day) at 45 signals bearish momentum, while Fibonacci retracement levels highlight resistance at $34.50 and support at $31.00.

📈 Intermarket Dynamics: Rising US Treasury yields (10-year at 4.2%) and equity market optimism divert capital from non-yielding assets like silver.

📉 Silver’s recent dip to $31.60 (May 19, 2025) reflects these pressures, but a potential rebound looms if geopolitical risks flare up.

📊 Real-Time Sentiment Snapshot (May 19, 2025)

Retail Traders:

📈 Bullish: 38% 🌟 (Eyeing silver’s safe-haven appeal amid global uncertainty).

📉 Bearish: 48% ⚡ (Swayed by USD rally and trade deal optimism).

⚖️ Neutral: 14% 🧭 (Waiting for clearer signals).

Institutional Traders:

🏦 Bullish: 25% 🏦 (Hedging with silver for recession risks).

📉 Bearish: 65% 📉 (Favoring USD assets amid higher yields).

⚖️ Neutral: 10% ⚖️ (Monitoring Fed commentary).

💥 Why This Trade?

🔥 Volatility Goldmine: XAG/USD’s recent 3% daily ranges offer quick profit potential for agile traders.

📚 Data-Backed Setup: RSI, Fibonacci, and EMA alignments provide high-probability entry/exit points.

🌬️ Macro Tailwinds: USD strength and trade optimism create a clear bearish bias, with bullish setups as contingency plans.

🛡️ Risk Control: Tight SL and dynamic TP levels keep your capital safe while chasing 2:1 reward-to-risk ratios.

🗞️ News & Risk Management ⚠️

Silver is sensitive to sudden news spikes. Stay sharp:

⏰ Avoid Entries Pre-News: Skip trades 30 minutes before major releases (e.g., Fed speeches, US CPI data on May 20, 2025).

🔁 Trailing Stops: Lock in gains as price moves your way (e.g., trail SL by 50 pips on bullish trades).

🌪️ Volatility Play: Use smaller lot sizes during high-impact events to navigate choppy waters.

Join the Silver Snatch Squad!

👉 Click that Boost button to amplify this Silver Snatch Strategy and make it a TradingView legend! 🚀

Every like and share fuels our crew to drop more high-octane trade plans.

Let’s conquer XAG/USD together! 🤜🤛

Keep your charts locked, alerts primed, and trading spirit electric.

See you in the profit zone, ninjas!

XAGUSD[SILVER] : A Start Of Swing Sell, Comment Your Views?Silver is currently consolidating in the daily timeframe, with no clear indication of where the price may move forward. Looking at the volume of the last few days or week’s candles, we can confirm that a swing sell could be imminent in the market. Fundamentals and technical data support this view, as well as our own trading experience.

This analysis predicts the future price of the XAGUSD (SILVER) but does not guarantee that the price will move exactly as described.

However, we want to emphasise that this analysis should be used for educational purposes only and should not be considered as a secondary bias.

We would love to hear your thoughts on this idea.

Additionally, please remember to like, comment, and share the idea to encourage us to bring you more trading ideas!

Much love ❤️

Team Setupsfx_

#XAGUSD 1HXAGUSD (1H Timeframe) Analysis

Market Structure:

The price is approaching a key resistance zone on the 1-hour timeframe. Previous reactions at this level suggest that sellers have been active, making it an important area to monitor for potential price rejection.

Forecast:

A sell opportunity may be considered if the price gets rejected from the resistance area with bearish confirmation signals. A failure to break above the resistance could lead to downward movement.

Key Levels to Watch:

- Entry Zone: Consider selling near the resistance zone after clear confirmation of rejection.

- Risk Management:

- Stop Loss: Positioned above the resistance area to protect against unexpected breakouts.

- Take Profit: Aim for nearby support levels or previous lows.

Market Sentiment:

As long as the price respects the resistance level and bearish confirmations appear, selling pressure could increase. A clear breakout above resistance would invalidate the current bearish setup.

Trading Silver’s Retrace: 50% Equilibrium Strategy for XAGUSD🪙 XAUUSD Technical Analysis

The daily chart for XAGUSD shows a significant sell-off after a strong bullish move, with a retracement of approximately 21.93% from the recent swing high. However, the price has since broken structure to the upside, indicating a potential shift in momentum back to the bulls. The current price action is trending upward, approaching the previous high, which could act as a resistance level. Your plan to look for a retrace into the 50% equilibrium of the recent swing on the 4-hour chart is technically sound, as this level often acts as a magnet for price and a potential area for institutional order flow. Waiting for a pullback and a bullish structural break in your area of interest increases the probability of a successful long entry.

🔍 Key Levels & Price Action

The 50% equilibrium of the recent swing (measured from the swing low to the swing high) is a classic area for price to retrace before resuming the trend. If price pulls back into this zone and forms a bullish structure (such as a higher low or a bullish engulfing candle), it could provide a high-probability long setup. Watch for confirmation on lower timeframes (like the 4H) for added confluence. The previous high around $35 may act as resistance, so partial profits or tighter stops near this level could be prudent.

🌐 Fundamentals & Sentiment

Silver is currently benefiting from a mix of macroeconomic factors. Ongoing inflation concerns, central bank buying, and geopolitical tensions (such as those in Eastern Europe and the Middle East) are supporting precious metals. Additionally, industrial demand for silver remains robust, especially with the global push toward green energy and solar panel production. However, a stronger US dollar or rising bond yields could temporarily cap gains. Sentiment among retail traders is cautiously bullish, with many looking for dips to buy, but there is also a risk of volatility if macro data surprises.

🧠 Alternative Views

Some analysts caution that the recent rally may be overextended, and a deeper correction could occur if risk-off sentiment returns or if the Fed signals more aggressive tightening. Others point to the strong uptrend and suggest that any pullback is likely to be bought, especially if it aligns with key technical levels like the 50% retracement. Keep an eye on COT (Commitment of Traders) data for signs of large speculator positioning, as well as ETF flows for additional clues on institutional sentiment.

📈 Trade Management & Risk

If entering long on a pullback to the 50% equilibrium, consider using a stop loss below the swing low to protect against a deeper correction. Scaling out profits as price approaches the previous high or key resistance zones can help lock in gains. Always use proper risk management and avoid overleveraging, especially in a volatile market like silver.

🎬 Video Title Options

"Silver’s Next Move: 50% Retrace Entry? XAGUSD Trade Idea & Analysis"

"Bullish Breakout or Bearish Trap? XAGUSD 4H Trade Setup Explained"

"Silver Price Action: Waiting for the Perfect Pullback! (XAGUSD Analysis)"

"XAGUSD: Is the Silver Rally Just Getting Started? Key Levels to Watch"

"Trading Silver’s Retrace: 50% Equilibrium Strategy for XAGUSD"

⚠️ Disclaimer

This analysis is for educational and informational purposes only and does not constitute financial advice. Trading involves risk, and you should always do your own research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

XAG/USD "The Silver" Metals Market Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (31.800) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 34.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XAG/USD "The Silver" Metals Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩