Gold Outlook 29 March 2023Gold continues to trade with no clear directional bias as the 1970 resistance level continues to limit significant upward moves.

As the DXY consolidates between 102 and 102.50, Gold is likely to maintain within the current range of 1936 and 1970.

Although the longer term view of the US Dollar is for further weakness, the current retracement on the DXY is presenting some downside potential for Gold.

Look for Gold to trade down to the 1936 key support level in the short term.

Xau-usd

XAUUSDat this point there is no way of telling whether Gold will continue to rally or decline but daily fib target remains at 2052.91

I am expecting gold to have a rally towards fib target

I need to see bullish structure and buyers take control as confirmation

market at key area

50% Fib retracement

entered into buy zone

wait for further confirmation before trading

Gold Outlook 28 March 2023The double top chart pattern discussed yesterday on the H4 and H1 timeframe worked out nicely as Gold broke below 1970 to trade down, pausing at the 1945 price level.

Although the price retraced slightly higher, Gold is likely to continue trading within the wide range of 1936 and 2000 (1970 the mid way mark), with the key resistance level proving very hard to break beyond.

Only a significant move on the DXY could see Gold develop a stronger directional bias, with a move to the upside the more likely scenario.

In the short term, look for the price to retest the 2000 key resistance level.

Gold: Key levels to watchGold FOREXCOM:XAUUSD formed a double top pattern and broke below the neckline. I will wait for confirmation of a rebound from the neckline area at 1985.35, which is the 23.60% Fibonacci retracement level and the 50-period moving average on the hourly timeframe. If the price stays below this level, it is a sell signal targeting 1963 and 1954. However, if the price continues to rise and breaks above 2003, it is a buy signal, and the price can be bought at this level or on a retest.

-------------------------------------------------------------------------

Let me know your thoughts in the comments, and show your support by liking the idea.

Please follow if you're interested in more ideas like this.

Your support is greatly appreciated!

Gold Outlook 27 March 2023On the H4 timeframe, Gold forms a double top chart pattern (20th March & 24th March) as the 2000 level holds strong resisting further upside moves. On the H1 timeframe, a similar double-top formation is formed on the 24h of March.

It is likely that the recent strength of the DXY and the formation of these chart patterns led to Gold trading lower, to the 1970 price level.

If the price of Gold breaks below 1970, this would not only signal a confirmation of the double-top formation on the H4 timeframe, it could indicate further downside for Gold, with the next support level at 1936.

However, while the uptrend on Gold is still strong, in the longer term , look for potential buying opportunities.

Gold Outlook 24 March 2023Gold approaches 2000 again. But it looks like Gold could reject 2000 again.

The last time when Gold reach the 2000 level (and breached it slightly by forming a new high of 2008) the price retraced down to the 61.8% fib level, which was 1940 price area.

A confirmation of a stronger retracement to the downside would be signaled if the price trades below the 1977 price level which coincides with the 38.2% Fibonacci retracement level.

However, anticipating further downside for the DXY, it is likely that Gold could continue with the uptrend.

Therefore, look for buying opportunities on retracements of Gold, with the key resistance levels at 2000 and 2070

Potential rebound for goldGold rejected the 2000 resistance level and formed a higher peak on the hourly chart. However, there is a noticeable divergence on the momentum indicator, indicating a weakening momentum. It is also worth noting that the price is approaching the upper edge of the ascending channel and the monthly trend line. We can wait for a break of the small local trend line (neckline of the two peaks) before the price starts to descend towards the previous support, which is also the lower edge of the ascending channel and the 50 and 100 moving averages on the hourly chart. It is possible for the price to rebound from there and continue to trend upwards, based on our previous analysis of gold.

-------------------------------------------------------------------------

Let me know your thoughts in the comments, and show your support by liking the idea.

Please follow if you're interested in more ideas like this.

Your support is greatly appreciated!

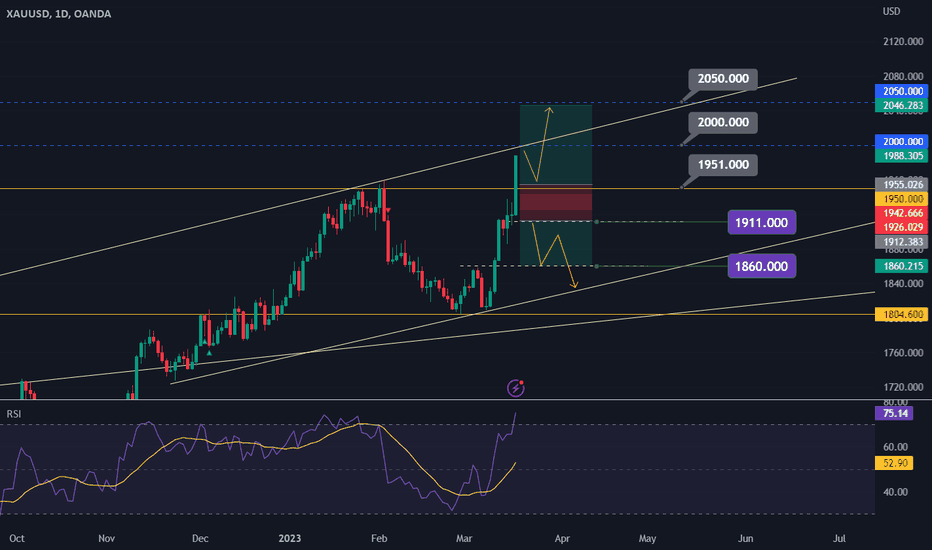

Gold faces potential correction at $2000 levelGold prices have surged to post-1988 record highs due to recent market panic and investors seeking a safe haven. As long as this panic persists, gold is likely to continue its upward trend. However, if it reaches the $2000 level, there may be a correction down to the previous resistance-turned-support level of $1951, before it resumes its upward trend towards $2000 and potentially $2050.

If it fails to rebound and breaks below $1911, there may be a bearish opportunity with a target of $1860.

But, if gold breaks and stays above the $2000 level, it could be a buying opportunity with a potential target of $2050.

-------------------------------------------------------------------------

Let me know your thoughts in the comments, and show your support by liking the idea.

Please follow if you're interested in more ideas like this.

Your support is greatly appreciated!

XAUUSD Potential Forecast | 21st March 2023Fundamental Backdrop

1. Plenty of instability in the market due to the SVB crisis and other banks being heavily affected by it.

2. GOLD, as a safe haven asset, flew to the highs to 2000 and is currently rejecting.

3. This is fuelled by the instability with the USD.

Technical Confluences

1. Price could potentially retrace back to the H4 support level at 1959.24 before heading back up.

2. Price went parabolic to the 2000 regions.

3. Bullish pressure is still intact and will be looking for longs.

Idea

Looking for price to break new highs beyond 2065 and this is just the beginning.

NOT FINANCIAL ADVICE DISCLAIMER

The trading related ideas posted by OlympusLabs are for educational and informational purposes only and should not be considered as financial advice. Trading in financial markets involves a high degree of risk, and individuals should carefully consider their investment objectives, financial situation, and risk tolerance before making any trading decisions based on our ideas.

We are not a licensed financial advisor or professional, and the information we are providing is based on our personal experience and research. We make no guarantees or promises regarding the accuracy, completeness, or reliability of the information provided, and users should do their own research and analysis before making any trades.

Users should be aware that trading involves significant risk, and there is no guarantee of profit. Any trading strategy may result in losses, and individuals should be prepared to accept those risks.

OlympusLabs and its affiliates are not responsible for any losses or damages that may result from the use of our trading related ideas or the information provided on our platform. Users should seek the advice of a licensed financial advisor or professional if they have any doubts or concerns about their investment strategies.

Gold Outlook 21 March 2023During the trading session yesterday, Gold broke above the round number level of 2000 to reach a high of 2009.55.

However, the move higher was brief as Gold quickly retraced to consolidate along the 1982 price level.

Further upside is anticipated for Gold if the price stays above the support level of 1960 which coincides with the 38.20% Fibonacci retracement level and the bullish trendline.

However, before the price trades higher, Gold price could consolidate/retrace first. In addition, an upward move in Gold could require either further downside on the DXY or increasing market uncertainty, driving investors toward the safe haven commodity.

If the price breaks above the recent high, the next key resistance level is at 2070.

Gold Outlook 20th March 2023Gold traded significantly higher last week, due to several key events;

1) gross market uncertainty increased as banks collapse (SVB and Credit Suisse).

2) flight toward the reserve commodity

3) weakness in the DXY

Currently, the price is retracing and is trading along the 1973 price level, with further downside expected. The price is likely to test the support level of 1956 which sits between the 23.60% and 38.20% Fibonacci retracement levels.

However, as the uptrend of Gold remains strong, anticipate the retracement to be brief with the price likely to rebound from the support to trade higher again.

The next key resistance level is at the round number level of 2,000 which was last visited in April 2022

#Xau | #UsdIn the one-hour time frame, gold is in an ascending channel, which is currently trying to break a dynamic resistance in the area of 1980.09. If this resistance is broken, the price can rise up to the key area of 2029.99 to 2071.77. The area can be entered into a short trade with different setups