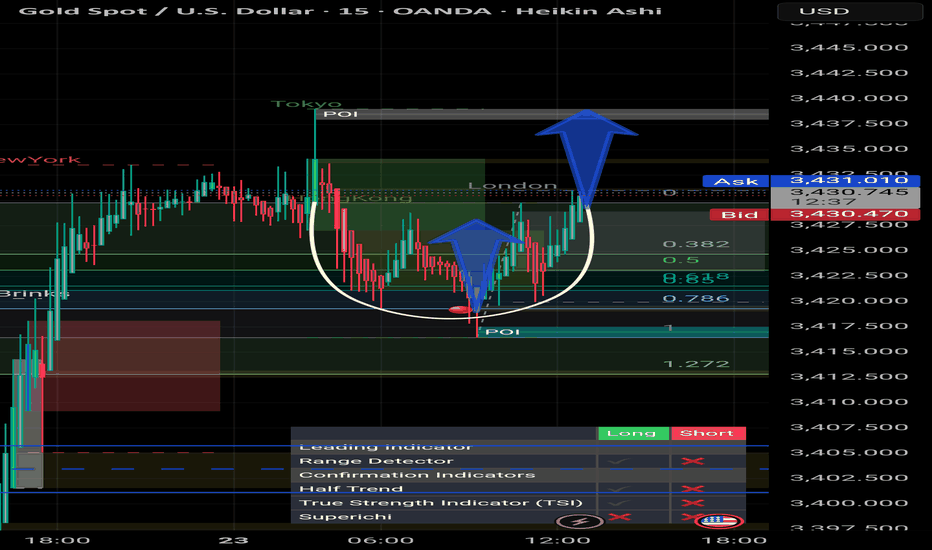

CFD XAU/USD - 5m Buy Setup# 🟦 CFD XAU/USD - 5m Buy Setup

**Market:** CFD XAU/USD

**Timeframe:** 5 Minutes (M5)

**Direction:** 🔵 BUY

---

## 📌 Setup Details

- **Entry Zone:** Inside the blue arrow structure (curved shape detected)

- **Pattern:** Bullish curve + upward break of micro-structure

- **Bias:** Buy after confirmation of support on blue arrow structure

- **Context:** Momentum pickup after prior liquidity sweep

---

## ✅ Trade Levels

- **Entry:** At the retest of the curved zone (preferably lower wick tap)

- **Stop Loss (SL):** Below the curve base – approx. `SL: XX.XX`

- **Take Profit 1 (TP1):** Reaction to intraday high – approx. `TP1: XX.XX`

- **Take Profit 2 (TP2):** Next visible supply / FVG zone – approx. `TP2: XX.XX`

- **Take Profit 3 (TP3):** Breakout continuation target / 1:3 RR level – approx. `TP3: XX.XX`

---

## 📈 Notes:

- Ensure confirmation via bullish engulfing / momentum candle before entry.

- Avoid chasing — wait for price to tap into demand with low volume.

- Align with overall bias (check higher timeframe 15m or 1h).

---

*Posted by @Persiaux_King 👑*

Xauscalper

XAU/USD - Scalping StrategyStrategy Summary:

This strategy is designed for the M1 and M5 timeframes and has been personally tested, demonstrating strong results. It is a mechanical system with strict rules to ensure discipline and consistency in trading decisions.

Whilst I have personally used this system on XAU/USD it can be applied to other volatile asset classes.

Indicators Used:

1. 55-Moving Average (High) and 55-Moving Average (Low):

* These create a channel to filter out trades during choppy market conditions.

* No trades are taken if the price is within this channel.

2. Heiken Ashi Candles:

* Used to identify the trend and determine entry/exit points.

* Stay in a trade as long as candles remain green (for buys) or red (for sells).

3. Optional Indicator:

* 200 Moving Average on a Higher Timeframe (HTF):

* Use this for directional bias:

* Only take buys if the price is above the 200-MA.

* Only take sells if the price is below the 200-MA.

Entry Criteria:

Buy Setup:

1. Price breaks above the 55-MA (High) with a green Heiken Ashi candle.

2. Stop loss options:

* Below the previous candle's low.

* ATR x 2.5.

Sell Setup:

1. Price breaks below the 55-MA (Low) with a red Heiken Ashi candle.

2. Stop loss options:

* Above the previous candle's high.

* ATR x 2.5.

Risk Management & Rules:

1. Avoid Trades in the Channel:

* No trades if the price is between the 55-MA High and Low.

2. Risk Management:

* Risk no more than 0.5% of the account balance per trade.

3. Profit Targets:

* Fixed Risk-Reward Ratio: 1:1.5.

* After reaching 1:1.5, either:

* Move stop loss to breakeven.

* Take partial profits and stay in the trade until the Heiken Ashi candle changes color.

4. Session Focus:

* Trade during the Asian and New York sessions.

Key Notes:

* Align your trades with the Higher Timeframe Trend for better success.

* Adding the 200-MA on from a higher timeframe can provide an additional layer of confluence:

* Take buys only when price is above the 200-MA.

* Take sells only when price is below the 200-MA.