GOLD: Short, Target 3041-3036After yesterday's rise, some gold indicators have formed a relatively obvious short position, so in today's trading, I personally recommend focusing on the short position.

During the trading process, we need to pay attention to the support points of 3046/3037/3032, the high point of resistance of 3060, and the possible new high of 3067.

From the overall situation, it is unlikely to break through 3067 today, but it is more likely to fall to around 3037.

Xauusd4h

GOLD: Bullish pattern, Short first then LongIn the 4H chart, the bulls have not completely unloaded their strength. From the perspective of the pattern, it should be possible to reach the area around 3050-3058.

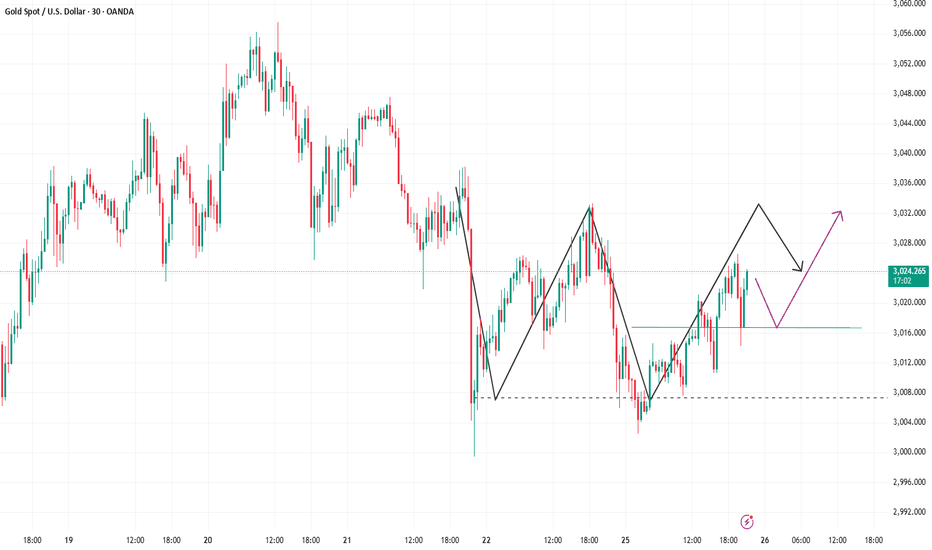

In the 30M chart, it is currently near resistance, focusing on the resistance of the 3037-3044 range. You can consider shorting around 3043, and the target is temporarily set around 3033.

Today there is initial jobless claims data, and I personally expect it to be bullish for gold, so I plan to hold long positions when the data is released.

Gold’s rebound is an opportunity for short sellingGold is still oscillating, and a rebound is an opportunity for short selling. Since gold is still oscillating within the box, you can go short if it rebounds to a high level. Gold is still oscillating within a large range for 1 hour. Since gold has not effectively broken through, you can continue to short after rebounding. If it breaks through the box shock, then gold will consider taking advantage of the trend and go long.

Gold signal: buy at 3021-3016Gold has a second chance to rise, so you can continue to go long. Pay attention to the resistance near the previous high of 3035-3038. If you can't break through, close the order in time. If you break through, 3042-3046 will be a short-term strong resistance level.

If the price falls, I personally think that the support will give priority to 3016-3011, followed by 3007

XAU/USD: Weekly Recap and Key Levels for Next WeekLast week, XAU/USD showed a pattern of high-level consolidation. After reaching the key psychological level of 3000 USD on March 17th, gold prices entered a sideways phase. On March 20th, gold hit a new all-time high of 3057 USD per ounce before pulling back. By March 22nd, gold prices had fallen for two straight trading days, briefly touching 2999 USD per ounce. However, dip-buying activity helped recover some of the losses.

From a technical perspective, the 5-day and 20-day moving averages remain in a bullish alignment. However, the price has deviated significantly from these averages, indicating a need for a technical correction.

Gold may continue its adjustment early next week, with support levels to watch in the 3000-3030 USD range. If geopolitical tensions do not escalate significantly, spot gold prices could test support near 2993 USD, though the likelihood of breaking below 3000 USD is low.

If gold prices fall below the 5-day moving average, they may further test the 20-day moving average support (2950.00-2942.00 USD). If the recent consolidation range is broken, the resistance levels to watch are the previous high of 3057 USD and beyond.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Has gold peaked? Long or short?Gold 1-hour chart has fallen from a high level, so it is difficult for gold to rise directly without news support in the short term. You can continue to short gold after it rebounds. If the Fed's interest rate decision does not rise sharply, then the idea of shorting gold at a high level will continue. Gold rebounds to observe 3045 pressure level

XAUUSD Strategy AnalysisGold has been on a consecutive rally, and caution is warranted for every attempt to chase long positions. After surging to 3045 in the afternoon, prices quickly reversed lower and failed to immediately retest the high, indicating overhead resistance. If gold cannot break out sustainably, a significant correction may be imminent.

Gold trading strategy:

sell @:3049-3054

buy @:3030-3035,3002-3007

If you are currently not satisfied with your gold trading performance, and if you also need to obtain accurate trading signals every day, you can check the information in my profile. I hope it can be of some help to you.

The Current Trading Strategy for GoldCurrently, AXUUSD is oscillating in the vicinity of 3030. A thorough market appraisal uncovers a distinct bullish impetus. Amid the global economic uncertainties, such as trade disputes and erratic monetary policies, market participants are increasingly flocking to gold as a haven asset, driving the upward trajectory of AXUUSD. Technically, pivotal indicators such as moving averages and the Relative Strength Index (RSI) suggest the sustenance of the ongoing uptrend.

For investors, a judicious course of action is to establish a long position of suitable size when the price retraces to the 3025 - 3030 support band, with a profit - taking target set at 3040 - 3050. In light of the market's inherent volatility, it is essential to closely monitor geopolitical events and key economic data in order to adeptly adjust trading strategies.

XAUUSD

buy@3025-3030

tp:3040-3050

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear.

For those who are seeking professional guidance in trading trend analysis, strategy formulation, and risk management, please click below to get the daily strategy updates.

Gold bulls are going crazy, need to be careful at this time

Gold bulls are too crazy and there is no chance of a pullback. So when the market is too hot, you have to be careful. You need to be cautious when doing long positions at high levels, and beware of gold falling back after a surge and starting to make a sharp adjustment.So at this position I think shorting would be better

XAUUSD Today's Strategy AnalysisLast Friday, after consolidating around the 2980 level, bullish momentum finally broke higher, driving prices to accelerate during European trading hours. Gold pierced the psychological 3000 resistance level but was rejected and pulled back into a choppy consolidation phase. The session closed near 2985 with a doji candlestick, maintaining the strong bullish trend with unidirectional momentum.

From a 4-hour technical perspective, today's downside support levels are focused on the vicinity of 2975-80. Particular attention should be paid to the critical bull-bear dividing line support at 2960-2963. Intraday pullbacks should maintain a bullish bias initially while holding above the 2975-80 support zone. Upside targets remain focused on breaking above recent highs.

Gold trading strategy:

sell @:3000-3005

buy @:2975-2980 , 2960-2963

If you are currently not satisfied with your gold trading performance, and if you also need to obtain accurate trading signals every day, you can check the information in my profile. I hope it can be of some help to you.

XAUUSD Start to Short?The gold price briefly pierced the $3,000 per ounce threshold again today.

From a 4-hour technical perspective, today's downside support levels remain focused on the vicinity of 2975-2980.

The current day's orders are already in profit.

Gold trading strategy:

sell @:3000-3005

buy @:2975-2980 , 2960-2963

If you are currently not satisfied with your gold trading performance and need daily accurate trading signals, you can visit my profile for free strategy updates every day.

After Reaching $3,000: Next - Week Analysis of Gold MarketThis week, the gold market witnessed an impressive upswing. Notably, the price of gold managed to reach the long - awaited $3,000 price range. After such a substantial increase, it is only natural for gold to undergo a short - term pullback and adjustment. However, the short - term bullish trend of gold remains intact, with its bullish momentum still robust.

Fundamentally, multiple factors underpin the upward movement of the gold price. On one hand, the global economic outlook is still fraught with uncertainties, and geopolitical tensions flare up from time to time. This has led to a rise in investors' risk - aversion sentiment, and gold, as a traditional safe - haven asset, has thus become highly favored. For instance, the recent escalation of trade frictions has made the market worry about the global economic growth prospects, causing a flood of capital to pour into the gold market for hedging purposes. On the other hand, the continuous accommodative monetary policies of major central banks also provide support for the gold price. In a low - interest - rate environment, the opportunity cost of holding gold decreases. Moreover, the expectation of currency depreciation has increased, enhancing the hedging appeal of gold.

In the short term, the gold price is expected to fluctuate and adjust around the $3,000 mark. If it can effectively break through this crucial psychological threshold and hold steady, there is hope for further upward potential.

Suggestions for gold trading operations next week:

buy@2960-2970

SL:2955

TP:3020

I firmly believe realized profit and a high win - rate are the best measures of trading skill. Daily, I share highly precise trading signals. These include clear entry points, stop - loss levels for risk control, and profit - taking targets from in - depth analysis. Follow me for big financial market returns. Click my profile for a trading guide on trends, strategies, and risk management.

XAUUSD: Next Week's Gold Strategy AnalysisIn the coming week, the gold market will see a game centered around the Federal Reserve meeting, and the short-term volatility is expected to increase. It is recommended that investors maintain a light position, set stop-loss strictly, and pay close attention to the breakout direction of the round number mark of $3,000 and the support level of $2,970. In the medium to long term, the gold purchases by global central banks, the weakening of the US dollar's credit, and the resilience of inflation still support the upward trend of gold prices, and the correction provides opportunities for position arrangement.

Gold trading strategy:

sell@:3000-3005

buy@:2970-2975

If you are currently not satisfied with your gold trading performance, and if you also need to obtain accurate trading signals every day, you can check the information in my profile. I hope it can be of some help to you.

XAUUSD Analysis StrategyAs of now, gold has already broken through the 3000 level. It reached a peak of 3005 at its highest point and then pulled back for adjustment.

From the analysis of the 4-hour gold trend, we should focus on the support level at 2956-2965 below, and the resistance level at 3005-3010 above. In terms of operation, we can mainly go long when there is a pullback following the trend. In the middle price range, it is advisable to observe more and act less, and be cautious when chasing orders. We should patiently wait for entry at key price levels. I will provide specific trading strategies during the trading session. Please pay attention in a timely manner.

Gold trading strategy:

buy @ 2956-2960

tp 2990-3000

If you're not satisfied with your current gold trading performance, and if you also need to get accurate trading signals every day, you can focus me. I hope I can be of some help to you.

XAUUSD Showing Strength on the 4H Chart📈 XAUUSD Gold 🟡 has been demonstrating strong resilience, maintaining a clear bullish trend on this 4H timeframe. Price action continues to align with an upward trajectory, with my target set at the previous high marked on the chart 🎯.

A pullback is expected, potentially offering an opportunity to enter at a discount before a continuation toward the target zone 🚀.

⚠️ Not financial advice—always manage risk appropriately!

XAUUSD Today's strategyAnalyzing from the current market situation, in terms of the daily chart, it closed down on Monday, effectively breaking through the support of the middle Bollinger Band. However, currently, the daily Bollinger Band is narrowing, and there is no obvious tendency of strength or weakness in the market. This means that the daily chart may not necessarily continue to close down today. If the daily chart closes up, the market may reverse and rise today; if the daily chart closes down again, forming three consecutive negative lines, then it may drop to a low of 2860 at the lowest, and then the possibility of long - short conversion can be explored. In the daily cycle, the key highs above are 2915 and 2930.

In the H4 cycle, after the decline on Monday, the Bollinger Band opened. Although the current market shows a certain pattern of unilateral weakness, attention should be paid to the cyclical changes today. If the price can stabilize above 2900 during the Asian and European sessions, the H4 cycle may form a low - level rebound, and the Bollinger Band will narrow again. At that time, the upward movement will be the main trend today, and the target above can be seen at the high of 2915 on Monday. If it fails to stand above 2900, the price of gold may continue to be weak and keep falling. In the unilateral weak market, it may drop to 2860. Therefore, the key to judging the strength or weakness of the market today lies in the gain or loss of the 2900 level.

From the perspective of the small cycle, the market tends to rise. As mentioned before, the bulls are still the main theme of the market at present. Therefore, the decline is an opportunity to go long. The hourly Bollinger Band is narrowing, and the 2880 level has not been broken after several tests. Then, opportunities to go long can be found above 2880. In the European session, it is expected that the price will rise above 2900, and in the American session, it is expected to hit the target of 2915.

Overall, in the short - term operation of gold today, it is recommended to focus on buying on dips and selling on rallies. Pay attention to the resistance level of 2920 - 2930 in the short - term above, and the support level of 2890 - 2880 in the short - term below.

XAUUSD sell @2915-2920

tp: 2880-2890

XAUUSD Buy @2880-2890

tp: 2915-2920

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates