GOLD (XAUUSD) Analysis : Major Break + Bullish Setup + Target🟩 Today’s GOLD Analysis based on Volume Behavior, Smart Money Traps & Market Structure (MMC)

🔍 Chart Breakdown and MMC Concepts Explained:

1. Preceding Downtrend – Smart Money Trap Initiated

The chart begins with an extended downtrend, marking significant bearish pressure. However, deeper into the move, we notice price entering a Volume Absorption (VA) Zone — a key MMC signal where institutional orders quietly absorb aggressive retail selling.

This Volume Absorption Zone is highlighted on the left of the chart.

Smart money quietly positions longs here while inducing panic-selling from retail traders.

Wicks and indecision candles show early signs of sell exhaustion.

2. QFL Breakdown & Liquidity Sweep

The breakdown from the QFL (Quick Flip Level) is another hallmark of MMC behavior. The market intentionally breaks previous lows to trigger stop-loss clusters — known as a liquidity sweep or stop-hunt.

Price aggressively drops to a well-marked demand zone.

Massive bullish reaction from this zone confirms that smart money has completed accumulation.

The QFL move is not a true breakout, but a trap, designed to mislead retail into chasing shorts.

3. Demand Zone Reaction – Shift in Momentum

Price finds support at the demand zone (highlighted in green) and starts forming higher lows. This transition from lower lows to higher lows is a structural confirmation of market reversal.

Buyers have regained control.

Large bullish candles and wick rejections at key levels signal institutional entry.

4. SR Interchange Zone – Key MMC Confirmation

One of the most important zones on this chart is the SR Interchange area.

This level was previously resistance and is now acting as support — a concept known as support-resistance flip.

MMC teaches us that this is where smart money re-tests the breakout zone to trap late sellers and confirm the trend.

This zone is reinforced by:

Previous rejections

Retest with wicks

Alignment with ascending trendline support

5. Minor & Major Resistance Levels

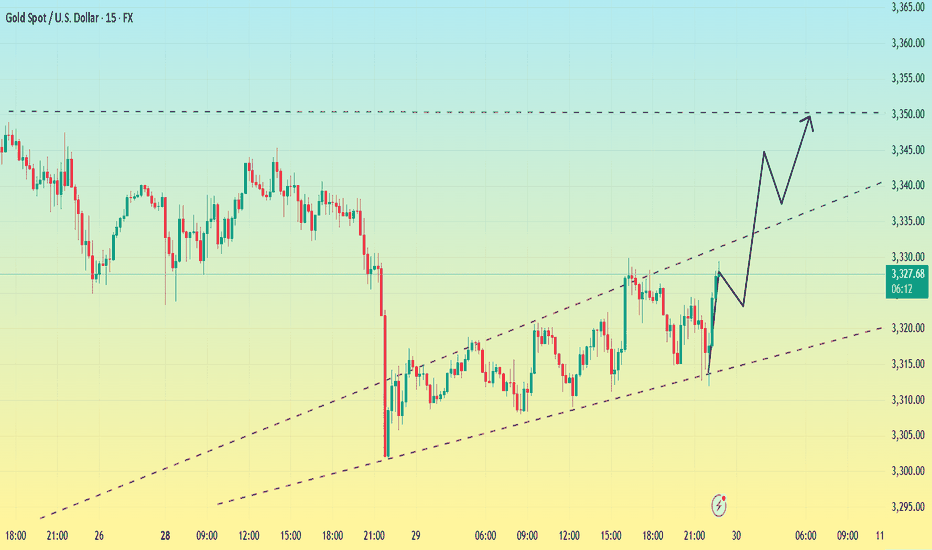

Currently, price is attempting to break above a minor resistance at ~$3,330–3,332.

If it breaks, the next major target lies at the ~$3,340–3,345 level, marked on the chart.

This zone is crucial for short-term targets and may act as a profit-taking zone for early bulls.

Once this major resistance is cleared, the trendline projection suggests a continuation toward higher highs.

📐 Trendline Analysis

An ascending trendline is supporting price action. Each bounce off this line has led to higher lows — a clear sign of bullish intent.

Trendline + SR Interchange = Confluence zone

Traders should watch for bullish engulfing candles or strong wick rejections at this trendline area for re-entry or add-ons.

🧠 MMC Strategy Interpretation (Mirror Market Concepts)

This chart perfectly follows the MMC logic:

Trap retail sellers during the downtrend.

Absorb their volume at a key zone (Volume Absorp).

Sweep liquidity below QFL level.

Reverse structure with a shift to higher highs and higher lows.

Interchange SR zone to test buyers' strength.

Continue trend post-confirmation with breakout above resistance.

This is the classic "trap-to-trend" sequence smart money uses repeatedly in gold and other volatile markets.

✅ Trade Setup Summary:

Bias: Strongly Bullish (based on market structure shift)

Entry #1: Pullback into SR Interchange (ideal if price rejects 3,326–3,328)

Entry #2: Break and retest of Minor Resistance (3,332–3,334)

Targets:

TP1: 3,340 (Major Resistance)

TP2: 3,345–3,350 (Projection based on breakout path)

Invalidation: Clean break below trendline and demand zone (~3,318)

🧭 Final Words for Traders:

Gold is currently positioned at a critical junction where structure, volume, and institutional behavior all align. If you're following MMC strategies, this is a textbook scenario:

Trap ✅

Absorption ✅

Structure Shift ✅

Trendline Support ✅

SR Interchange ✅

Now, we wait for confirmation and execute with discipline.

Xauusdanalysis

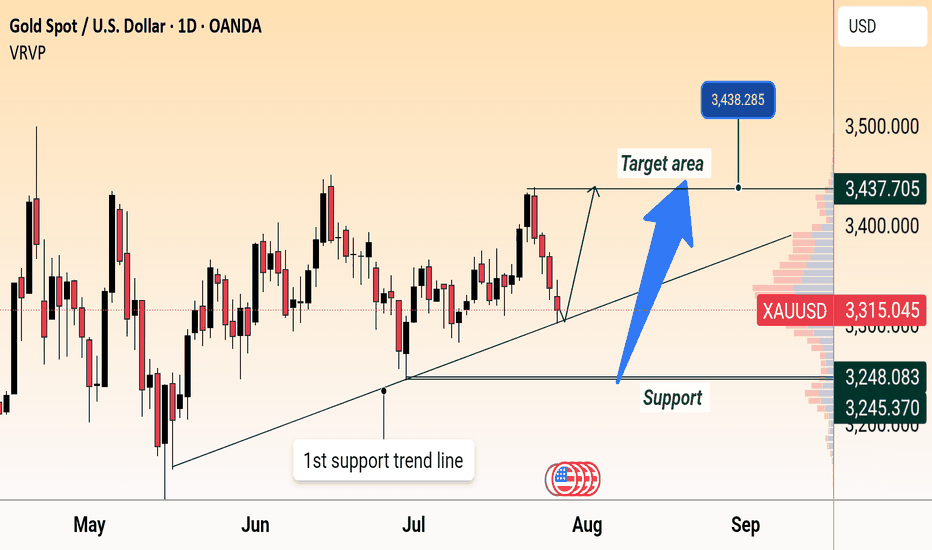

Will Gold Break Higher or Resume the Downtrend?Gold has been trading within a defined rising channel pattern, forming a short-term consolidation phase after a significant bearish leg. The current setup presents a critical inflection zone where Gold (XAUUSD) could either break out above the resistance trendline and major resistance zones or retrace and resume the prior downtrend.

Traders and investors should pay close attention to the price behavior around these key levels for possible high-probability trading opportunities.

📊 Technical Breakdown

1. Rising Channel Pattern

Gold has been bouncing between a support trend line and a resistance trend line, forming a rising channel. This indicates a controlled upward movement or short-term relief within a broader downtrend.

Support Trendline: Has been respected multiple times and offers a key reference point for bullish continuation.

Resistance Trendline: Acting as a cap on the short-term rallies.

This pattern represents a state of consolidation and indecision, often preceding a strong breakout in either direction.

2. Major Resistance Zone Ahead

The region around $3,345–$3,355 is stacked with:

Previous supply zones.

Confluence of the channel resistance and historical price rejection.

Psychological level near $3,350.

This zone is the make-or-break point for bulls. A successful breakout above this resistance could open the doors for a strong bullish continuation targeting levels such as:

$3,370

$3,390

$3,400+

But without a convincing close above this zone, bullish attempts may get rejected, resulting in a pullback or even breakdown.

3. Immediate Support Zone

On the downside, $3,320–$3,325 is a key short-term support level:

Aligned with the lower boundary of the channel.

Previous breakout retest zone.

Demand area observed in past bounces.

If this zone fails to hold, Gold could witness a strong decline, with potential targets at:

$3,310

$3,290

$3,275

🧠 Two Scenarios for Traders

✅ Bullish Breakout Scenario:

Trigger: Price breaks above $3,355 and sustains.

Retest Opportunity: If price comes back to test the breakout zone with a bullish engulfing candle or pin bar, it can serve as confirmation.

Target Zones: $3,370 / $3,390 / $3,400+

Stop Loss: Below the breakout point or recent higher low inside the channel (~$3,320)

❌ Bearish Breakdown Scenario:

Trigger: Breakdown of the support trendline and close below $3,320.

Confirmation: A bearish retest or continuation candle adds strength to the setup.

Target Zones: $3,310 / $3,290 / $3,275

Stop Loss: Above $3,335 (recent high)

📝 Final Thoughts

The XAUUSD 1H chart is setting up for a volatile move as price action coils between strong support and resistance. The rising channel within the larger downtrend makes this an ideal setup for both breakout traders and trend followers.

For bullish traders, the best entry lies above the resistance trendline, ideally after a retest. For bearish traders, a breakdown below the support line confirms downside momentum continuation.

In either direction, a clear break from this consolidation channel is likely to deliver a fast, directional move. Patience is key—wait for a clean breakout or breakdown before entering large positions.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

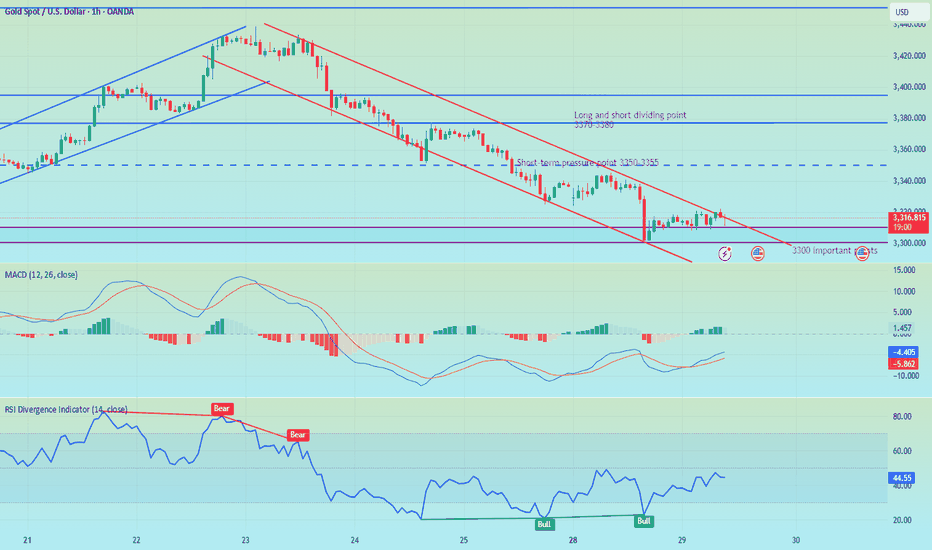

XAU/USD Intraday Plan | Support & Resistance to WatchGold remains in a bearish structure, consolidating in a narrow range after the sharp drop earlier this week. Price is trading around 3,330, testing the 3,334 resistance zone while still below the 200MA (3,362), which may act as dynamic resistance.

As long as price stays below 3,348–3,362, the bias remains to the downside, with a break below 3,309 likely exposing the 3,289–3,267 support zone.

A clean reclaim above 3,334- 3,348 would neutralize the immediate downside pressure and open the path back toward 3,373–3,387.

📌 Key Levels to Watch

Resistance:

‣ 3,334

‣ 3,348

‣ 3,362

‣ 3,373

‣ 3,387

Support:

‣ 3,309

‣ 3,289

‣ 3,267

‣ 3,241

🔎Fundamental Focus – FOMC

The FOMC rate decision and Powell’s press conference later today will be the key driver for gold. Expect sharp volatility and potential whipsaws around the release.

⚠️ Manage risk carefully, avoid chasing initial spikes, and wait for clear direction once the event dust settles.

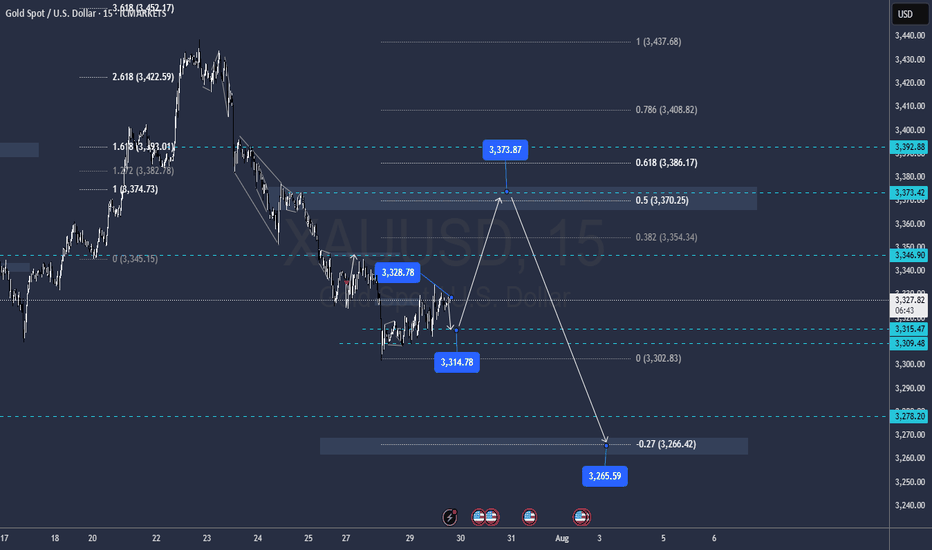

Gold Price Analysis July 30Gold (XAUUSD) Consolidating in a Triangle Pattern – Preparing for a Big Breakout

Currently, gold is moving within a triangle consolidation pattern, reflecting the market’s indecision as investors await a series of important economic data from the US this week. This hesitation suggests that a breakout from the triangle pattern could trigger a strong FOMO effect, creating a significant price movement in either direction.

The current price action is similar to a “bull flag” or “pennant” pattern, where a breakout could lead to a clearer and more decisive trend. If the support zone in the pattern fails to hold, the possibility of a sell-off is high.

Trading scenario:

🔻 Activate SELL order:

When price breaks the triangle bottom around 3324

Downside target: 3285, further is the strong support zone at 3250

🔺 Activate BUY order:

When price breaks and holds above the resistance zone 3333

Or: when there is a bearish rejection signal and candle confirmation at the area 3385

XAUUSD. MINOR UPWARDS CONSOLIDATION BEFORE THE NEXT MOVE.XAUUSD. MINOR UPWARDS CONSOLIDATION BEFORE THE NEXT MOVE.

XAUUSD rebounded from local support level of 3,300.00 and attempted to develop some bullish momentum here yesterday. However, the price went into consolidation, showing us the weakness of this short-term bullish rebound. RSI shows the bearish divergence, the price is ready to drop. Of course, fundamentals of last couple of days don't favor this asset either. The decline towards support level of 3,300.00 is expected.

XAU/USD (Gold Spot vs US Dollar) Technical Analysis – 4H Char🔍 XAU/USD (Gold Spot vs US Dollar) Technical Analysis – 4H Chart

Based on my shared image from TradingView, here's a detailed analysis of the current XAU/USD market scenario:

---

🧩 Chart Type & Indicators Used

Timeframe: 4-Hour (H4)

Platform: TradingView

Indicators:

Ichimoku Cloud

Bollinger Bands (BB)

Support/Resistance zones

Trendlines

Price Action with Target Points Marked

---

📉 Current Market Structure

Price: ~$3,324 (Sell/Buy zone shown)

Overall Trend: Turning bearish in the short term.

Price Action:

Price has broken below an ascending trendline, suggesting a shift from bullish to bearish momentum.

The price is trading below the Ichimoku cloud, reinforcing a bearish bias.

Failed retest of the cloud resistance zone (around 3,335–3,340), which now acts as a resistance.

---

🔻 Bearish Signals

1. Trendline Break:

The rising trendline support (mid-July to now) is broken.

This indicates a potential reversal from the previous bullish momentum.

2. Retest & Rejection:

Price attempted to retest the breakdown zone and was rejected from the 3,335–3,340 level.

3. Ichimoku Cloud Bearish Setup:

Price is clearly below the cloud.

Future cloud is bearish (red shaded).

Chikou Span (lagging line) is below price candles and cloud.

---

🎯 Targets

First Target Point: ~3,300

This is the next horizontal support level (near recent lows).

Final Target Point: ~3,270

Stronger support zone and measured move from breakdown.

---

🛡 Resistance Zone

Immediate Resistance: 3,335–3,340

Stronger Resistance: 3,370

---

📌 Conclusion

The XAU/USD 4H chart shows a bearish breakout below the rising channel, with confirmation from Ichimoku and price rejection at cloud resistance. The market is targeting 3,300 as the first support, and if that breaks, 3,270 will likely follow.

---

✅ Strategy Suggestion (if trading):

Bias: Short/Sell

Entry: After a weak pullback or retest near 3,330–3,335

Targets:

TP1: 3,300

TP2: 3,270

Stop Loss: Above 3,345 or near 3,350 zone

Let me know if you'd like this in simpler terms or want me to track the next setup.

XAUUSD analysis - 1H FVG and OB setupsOn the 1H timeframe, price is currently approaching two key supply zones (OB 1H):

🔴 First OB zone: around 3354 – 3360

🔴 Second OB zone: around 3368 – 3370

We're watching these zones for potential short setups, only with confirmation on the lower timeframes (5M or 3M).

If price reacts to one of these OBs, we expect a move down toward the green 1H demand zone around 3280 – 3290, where a long setup may later form.

📌 Key scenarios:

1️⃣ Price hits the first OB → confirmation → short

2️⃣ Price moves to the second OB → confirmation → short

3️⃣ Target for both setups = green OB around 3280

4️⃣ No entry without confirmation from LTF

❗️ Do NOT enter without lower timeframe confirmation.

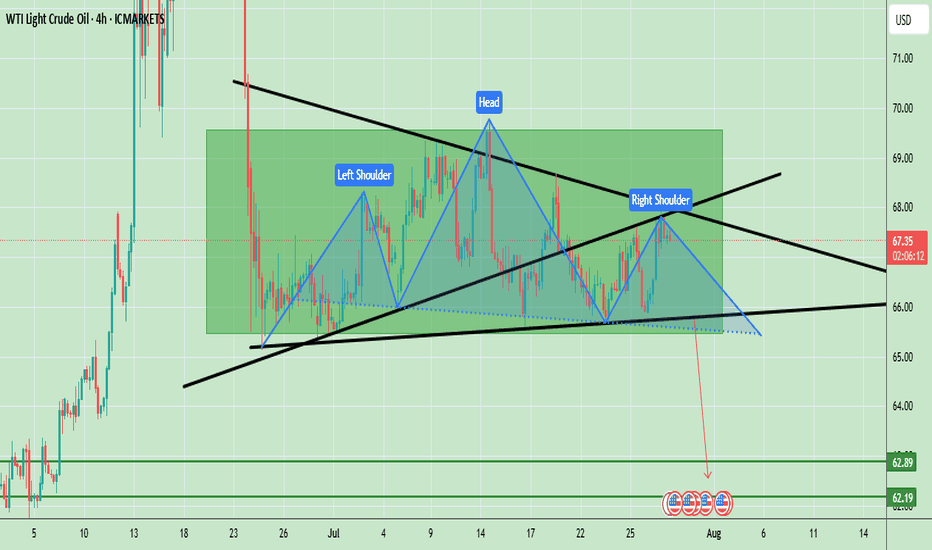

Oil Prices Form Bearish Head & Shoulders – Key Neckline in FocusWTI crude oil is showing a clear Head and Shoulders (H&S) pattern, which is a strong bearish reversal signal. The left shoulder formed in early July, followed by a higher peak forming the head in mid-July, and finally the right shoulder near the current levels, which is lower than the head. The neckline is positioned around $66.00, acting as a key support level. Currently, the price is trading at $67.34, hovering slightly above this neckline, indicating that the market is at a critical decision point. A confirmed break below the neckline could accelerate bearish momentum, targeting the $62.20 – $62.80 zone based on the pattern’s measured move. However, if the neckline holds, a possible bounce toward $68.50 – $69.00 could occur, but overall bias remains bearish unless the price can break and sustain above $69.00.

Key Price Levels:

- Resistance: $68.50 – $69.00

- Neckline Support: $66.00

- Bearish Target (if confirmed): $62.20 – $62.80

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

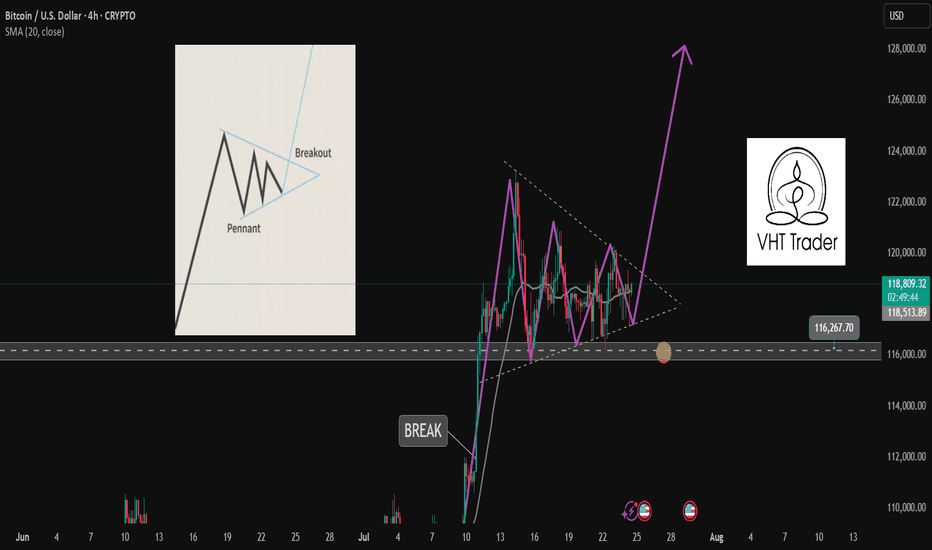

Are you ready for the BUY BTCUSD signal?✏️ The pennant pattern is forming. After BTCUSD reached a new peak, the past 1 week, BTC price has been accumulating to form a bullish pennant pattern. This is a bullish continuation pattern that signals when breaking the upper boundary of the flag pattern.

📉 Key Levels

BUY Trigger: Break and trade above 199000

Target 128000

Leave your comments on the idea. I am happy to read your views.

XAUUSD – Weak Rebound, Bearish Bias RemainsYesterday was a quiet and choppy day for Gold.

Although price managed to recover a small portion of last week’s 1400 pip drop, the rebound remains anemic — price barely reached the 23% Fibonacci retracement.

To make things worse for the bulls, the recovery from around $3300 is starting to take the shape of a bearish flag, a continuation pattern that typically signals further downside ahead.

📌 Resistance Zones to Watch:

- Initial resistance: $3345–3350

- Stronger resistance: $3370, a level already proven and well-defined

As long as the price is under those levels, I remain firmly bearish.

📈 Trading Plan:

I already have a short position open, and I'm still waiting to add more, preferably on a push into higher resistance, ideally above $3345.

No need to force entries — I’d rather scale in on strength, not weakness.

Once the correction is complete, I’m targeting:

- $3280 as the first support

- $3250 as a realistic downside objective

Conclusion:

The rebound lacks power. The structure favors the bears.

Still watching for better entries to add short, with eyes on 3280 and 3250 as likely targets.

Let’s stay patient and let the setup come to us. 🎯

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

XauUsdThere are two analyses.

As you can see, the overall trend is bullish and long positions have more chances, the important market points are drawn accurately and have high validity.

The red arrow has a 60% chance of occurring and the blue arrow has a 40% chance.

Important market points:

Resistance:

3340

3369

3390

3422

Support:

3303

3280

7/30: Watch for Sell Opportunities in the 3352–3363 ZoneGood morning, everyone!

After a period of consolidation and decline, gold has found preliminary support near the 3300 level, and early signs of a bottom formation are emerging. The key technical level now lies around the 3332–3337 resistance zone. Based on current price structure, a breakout is likely, with major resistance seen at 3352–3358, while 3323–3316 serves as the primary support range.

However, caution is warranted as today’s ADP employment data may significantly influence short-term price action. Whether gold can hold above the 3337–3343 level depends on the data's impact.

From a broader perspective:

On the weekly chart, the 20-period moving average (MA20) has climbed to around 3276, yet the overall structure remains bearish for bulls

On the daily chart, gold is still trading below the MA60, facing notable resistance

This week's key events — ADP (Wednesday), jobless claims, and NFP (Thursday and Friday) — will likely shape gold’s medium-term trend

Trading Strategy for Today:

Focus on the 3313–3353 trading range, and be highly responsive to data-driven volatility.

Important note: If gold rises to 3343–3358 before the ADP release, then regardless of whether the data is bullish or bearish, the preferred approach is to sell into strength, as a post-data pullback is a likely scenario.

GOLD Falls Back Toward the $3,300 ZoneOver the past four trading sessions, gold has depreciated more than 3.5%, showing a renewed and steady bearish bias around this major safe-haven asset in the short term. Selling pressure has remained strong recently, as confidence in financial markets has gradually improved. Investors have responded positively to the latest trade agreement developments, which have temporarily reduced concerns surrounding the trade war. As a result, demand for safe-haven assets has declined, directly impacting gold, one of the most important hedging instruments currently in the market.

Sideways Range Remains Active

Since late April, gold has been unable to establish a clear directional bias, and has remained trapped within a sideways range, with resistance around $3,400 per ounce and support at $3,300 per ounce. So far, price action has not been strong enough to break out of this structure. However, gold is now testing important support levels, where sellers could begin to face stronger barriers as the price attempts to break through the bottom of the established range.

RSI: The RSI line has consistently crossed below the neutral 50 level, indicating that selling momentum is becoming more dominant. If this trend continues in the short term, it could reinforce the presence of bearish pressure in upcoming sessions.

MACD: The MACD histogram has started to move below the zero line, suggesting that the momentum of the moving averages has shifted firmly to the downside. This reflects a strong bearish tone, and if this continues, selling pressure could become more relevant in the short term.

Key Levels:

$3,400 per ounce – Major Resistance: This level marks the recent all-time high for gold. If buying momentum pushes the price back above this zone, it could trigger a renewed bullish bias and set the stage for a sustained upward trend in the sessions ahead.

$3,300 – Current Barrier: This level defines the lower bound of the short-term channel. A break below this support could confirm a dominant bearish bias, potentially lasting for several trading sessions.

$3,200 – Final Support: This marks the lowest price level reached by gold in recent months and lies below the 100-period simple moving average. If the price drops to this zone, it could trigger the start of a new short-term downtrend on the chart.

Written by Julian Pineda, CFA – Market Analyst

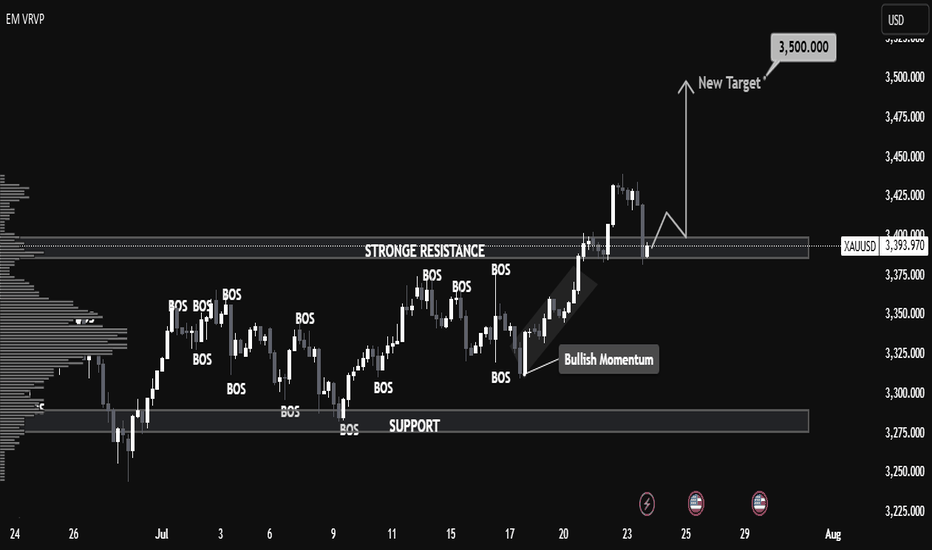

XAUUSD Monthly Technical OutlookMarket Structure Overview:

• The chart reveals consistent Breaks of Structure (BOS) to the upside, confirming a strong bullish market trend.

• Price has successfully reclaimed and retested the strong resistance zone (~3390–3400), which now acts as new support.

• A series of higher highs and higher lows show clear bullish intent, supported by sustained bullish momentum after each correction.

⸻

📈 Volume & Price Action:

• The Volume Profile (VRVP) on the left shows strong historical accumulation near the current breakout zone.

• After the breakout from resistance, the price retested this zone—validating it as support—and is expected to continue its bullish leg toward $3,500, the next psychological and technical target.

⸻

📍 Key Levels:

• Support Zone: $3,375 – $3,390 (previous resistance turned support)

• Immediate Resistance: $3,425

• Target Level: $3,500 (Monthly High Projection)

⸻

📘 Educational Note:

• This setup aligns with classic market structure theory: BOS + Retest + Continuation.

• The pullback into the breakout zone is a textbook bullish continuation signal often used in institutional trading strategies.

• Traders watching this pattern should combine it with confirmation entries such as bullish engulfing candles, FVGs, or order block rejections for safer entries.

⸻

🎯 Projection:

• As long as the price holds above $3,375, the bullish scenario toward $3,500 remains valid.

• Expect possible consolidation or minor pullbacks before continuation.

⸻

📌 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research before entering the market.

BTC's latest trading strategy and analysis layout#BTCUSD

BTC's current technical signals show a bull-bear tug-of-war situation.If a golden cross is formed near the zero axis, it may indicate a new wave of rise; if it falls below the zero axis, we need to be wary of a deep correction.

There are certain opportunities for both bulls and bears in the current market, but global regulatory policies have not yet been unified. Policies such as the US "GENIUS Act" may affect BTC and require continued attention. BTC is currently facing significant buying support around 117,500, but the hourly chart shows that there is still potential for a continued pullback. The current trend has not yet finished. Pay attention to the support level of 116,000 below. If it falls below, it may fall into the consolidation range of 116,000-114,000. For aggressive traders, consider going long at 117,500-116,500, with a target of 118,500-119,500. A break above this level could lead to 120,000.

🚀 117500-116500

🚀 118500-119500

Gold Price Analysis July 29📉 XAUUSD ANALYSIS – IS THE CORRECTION OFFICIALLY STARTING?

Gold has officially broken out of the bullish wave structure and left the rising price channel – an important technical signal that the bearish correction trend has been activated. This development opens up the possibility of retests of the broken trendline, and if that happens in today's session, this could be a good opportunity to look for SELL entry points in the new trend.

📌 Short-term trading strategy:

Potential selling zone: 3343 – 3345

Downside target: 3283 first, followed by the strong liquidity zone around 3250

Confirmation of bearish force: Price continues to maintain below the 3375 area – which will act as an important resistance level. Only when the daily candle closes back above this zone will the uptrend be re-established.

✅ Reverse buying strategy if there is a strong support signal:

Buy trigger zone: Observe the price reaction around the 3285 area - there needs to be a clear bearish rejection signal (pin bar/bullish engulfing candle...)

Deeper buying zone: 3251 - where liquidity is concentrated and there is a possibility of bottom-fishing demand appearing.

GOLD - One n Single Area, what's next??#GOLD... market just reached at his ultimate area as we discussed in our last week analysis and in Friday analysis as well.

The area is 3309-10

Keep close and don't be lazy here.

NOTE: we will go for cut n reverse below 3309 in confirmation.

Good luck

Trade wisley

Bottoming out? Be wary of the market.After a sharp drop to around 3300 on Monday, gold rebounded, reaching a high of around 3330 so far.

From the 1-hour chart,Gold has now broken out and stabilized within the hourly chart's downward trend channel. The key upward level is currently around 3330. If it breaks above 3330 again, caution is advised; it may test 3345-3350. Conversely, if it fails to break above 3330, gold may consolidate between 3300-3330 before the non-farm payrolls release.

From a short-term 15-minute perspective, the current 15-minute range has been broken out and stabilized. The current situation is unfavorable for bears. Based on the trend, a breakout above the 15-minute range would indicate a rebound. However, until 3330 holds, the 3320-3330 range is the only option. However, the current trend favors a bullish pullback, so I'm not too keen on shorting. Therefore, focus on support at 3320.

If it fails to break below 3320, enter a long position near 3320. The upper target is the top of the 3345-3350 range.

European session under pressure 3321 continue to shortI reminded everyone last night that if gold holds the 3300 mark, it will consolidate in the 3300-3345 range in the short term. The current gold price basically fluctuates narrowly between 3320-3310. Judging from the daily chart, the short-term upper pressure is at 3330. Only if the daily line stands firmly above 3330, there is a possibility of a rebound upward in the short term. Judging from the hourly chart, gold is still in a downward trend, and the hourly line is blocked near 3321. In the short term, if it cannot break through 3320-3330, gold will continue to fall. You can consider shorting, with the target at 3310-3300. If the European session is still volatile, maintain high shorts and low longs to participate in the cycle.

My premium privileges are about to expire, and subsequent trading strategies and analysis will be published in the group.

XAUUSD – Bears in Control, but Watch for a Rebound FirstYesterday, after a small bounce from the ascending trendline, Gold broke down and printed an intraday low around $3300.

Right now, the market appears bear-dominated, and further downside continuation is likely in the coming days.

________________________________________

📉 But there’s a catch:

From last week's top, Gold has dropped over 1400 pips without any meaningful correction.

That opens the door for a possible short-term rebound, which could be just a setup for new short entries.

________________________________________

📌 Key levels to watch:

• First resistance: $3350

• Major resistance: $3375 – Only a daily close above this level would shift control back to the bulls

🎯 Until then, any bounce is an opportunity to sell into strength.

A break below $3300 opens the path to $3280, with a likely extension toward $3250.

________________________________________

Conclusion:

The trend is bearish, but don’t chase.

Wait for a corrective rally, then look to sell the rip—unless bulls reclaim $3375, it’s still a bear market.

Let’s see if Gold gives us the setup. 🎯

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.