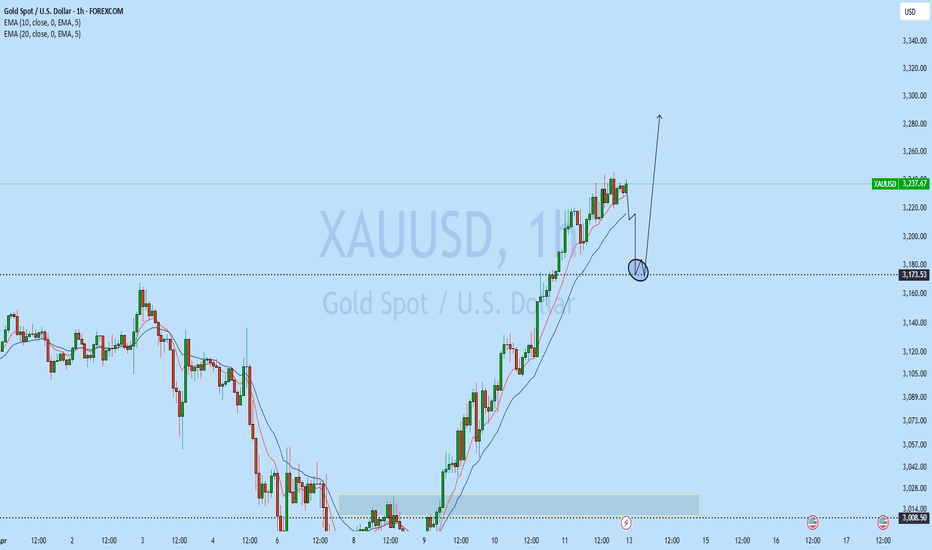

Gold Market Insight: Impact of U.S.-China Trade DevelopmentsGold has been consolidating within a rising wedge pattern since September 2023, facing resistance along a key trendline. Recent geopolitical developments, particularly the intensifying U.S.-China trade tensions, have acted as a catalyst for a significant breakout. The imposition of a 145% tariff on Chinese imports by the U.S., followed by China's retaliatory 125% tariff on U.S. goods, has heightened market uncertainties. These actions have led to a surge in safe-haven demand, propelling gold prices to record highs above $3,200 per ounce

In the past three trading sessions, gold has advanced over 2,500 pips, reflecting strong bullish momentum. However, to sustain this upward trajectory towards the $3,400 level, a period of consolidation or a corrective pullback may be necessary. Such a phase would allow for the absorption of selling pressure and the liquidation of short positions, providing a foundation for further gains.

The current market dynamics suggest that while buyers are in control, the presence of residual selling interest necessitates caution. A decisive breach above recent highs, accompanied by increased volume and momentum, would confirm the continuation of the bullish trend.\

Should the U.S. implement further tariff relaxations, particularly in sectors like technology, we may witness a retracement in gold prices towards the $3,000 level. This zone aligns with multiple Fair Value Gaps (FVGs) identified between $2,990 and $3,000, suggesting a potential area for price stabilization. Such policy shifts could alleviate some market uncertainties, reducing the demand for gold as a safe-haven asset.

Conversely, if trade negotiations between the U.S. and China remain stalled or further deteriorate, gold could resume its upward momentum, potentially targeting the $3,400 mark. This scenario would be driven by continued safe-haven demand amid escalating geopolitical uncertainties.

In summary, gold's near-term movements are contingent upon the progression of U.S.-China trade discussions. Traders should monitor these developments closely, as they will likely dictate gold's direction in the coming sessions.

Xauusdidea

Gold: Economic Risks May Drive Prices UpGold Surges Amid Global Uncertainty, Testing Key Resistance

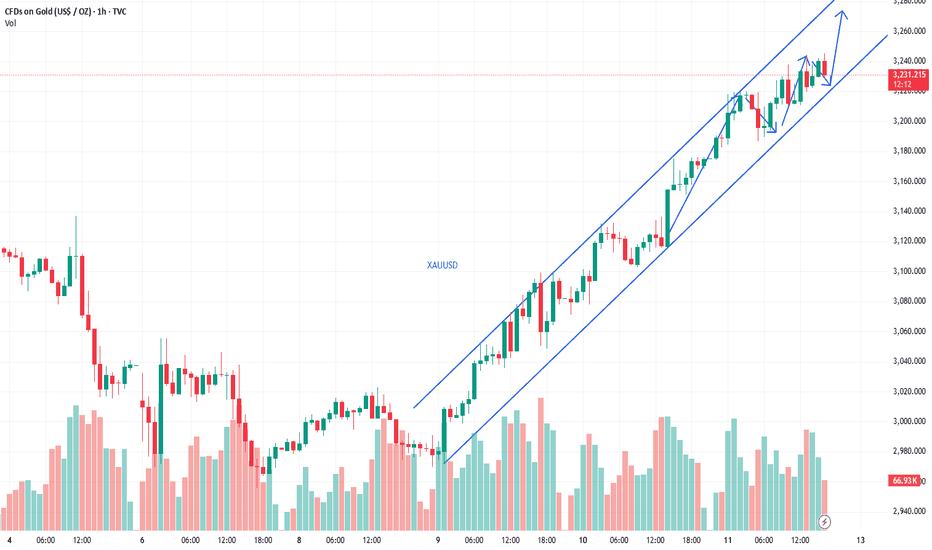

Gold has continued its impressive rebound, climbing steadily from its recent trough at $2,957 to reclaim territory above the psychological $3,000 mark. This upward momentum is being driven by a confluence of macroeconomic factors, including a softening US dollar and a pause in the previously relentless climb of US Treasury yields. With markets recalibrating their expectations around interest rate cuts by the Federal Reserve, investor appetite for safe-haven assets like gold has gained renewed strength.

At the heart of the current rally lies mounting geopolitical tension, particularly the intensifying trade standoff between the United States and China. Washington's proposal to impose 50% tariffs on a broad array of Chinese goods has rattled global markets. In response, Beijing is signaling potential retaliatory measures, further stoking fears of a prolonged economic conflict between the world's two largest economies. These developments are injecting volatility into risk assets and increasing demand for traditional hedges such as gold.

From a technical standpoint, the precious metal is currently grappling with a significant resistance level near $3,013. If the price manages to consolidate above this threshold following the current retracement, it could pave the way for a continued upward drive toward the next resistance zones at $3,033 and $3,057. These levels represent key pivot points that could dictate the short- to medium-term trajectory of gold.

On the downside, immediate support lies at $2,996, with stronger backing at $2,981. These levels may provide a cushion for any near-term pullbacks, especially as traders look for opportunities to re-enter the market during dips.

The broader narrative remains highly fluid, shaped by the ever-changing dynamics of global trade policy and monetary strategy. As the tug-of-war between Washington and Beijing intensifies, markets are left navigating a highly politicized and uncertain environment. With neither side showing signs of capitulation—China maintaining its firm stance, and the US administration likely to resist backing down—the potential for further escalation remains high.

In this context, gold’s appeal as a strategic asset grows stronger. The current setup suggests that the metal may gain additional bullish traction if it finds support around the 0.5 Fibonacci retracement level or holds above $3,013. Investors are keenly watching these technical and fundamental cues, weighing the growing economic risks that could propel gold into a sustained rally.

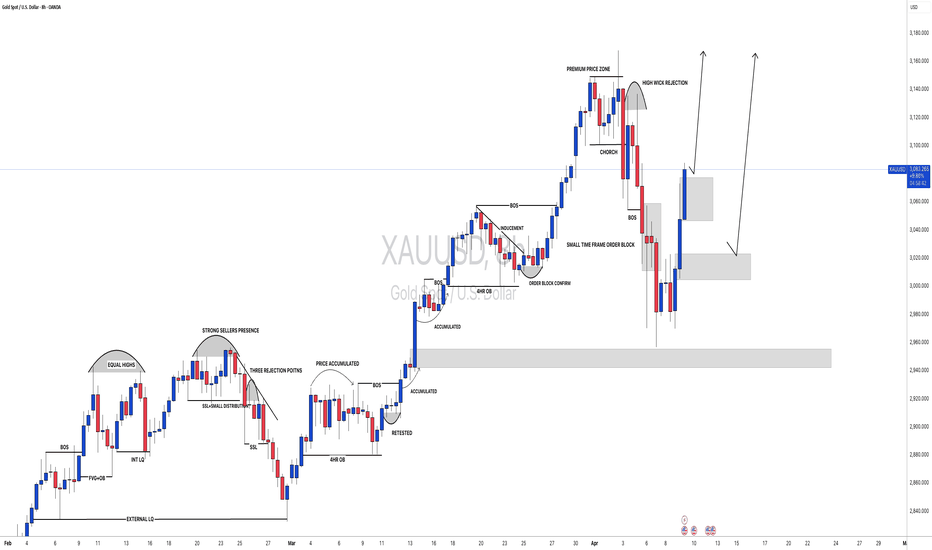

Gold's main rise is not over yet, long is still the core strategHeading into next week, we maintain a bullish medium-term outlook on gold, with a continued preference for trend-following long positions.

Although short-term bearish attempts persist, the broader upward structure remains intact, with pullbacks presenting tactical buying opportunities.

Key support is observed around $3,200/oz, which serves as a strategic level for initiating low-risk long entries within the ongoing uptrend.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Daily Analysis📈 XAUUSD Daily Analysis – 12/04/2025

🔥 Strong bullish move after a clear Market Structure Shift (MSS) and liquidity grab below the Previous Daily Low.

📉 A significant Fair Value Gap (FVG) remains between 3,100,000 and 3,175,000 – a potential pullback zone.

📍 Price could revisit this FVG before continuing the bullish momentum towards 3,300,000+.

🔹 PDL = Previous Daily Low

🔴 BAG = Breakaway Gap

🧠 Patience is key – wait for price reaction in the zone of interest.

📌 For educational purposes only – not financial advice.

💬 Drop your thoughts in the comments ⬇️

🔁 Like if you found this helpful!

XAUUSD Weekly Forecast: Probable Price Range and Trade PlanAs of April 12, 2025, gold (XAU/USD) has experienced significant volatility, reaching record highs amid global economic uncertainties. Here's an analysis based on the latest data:

📅 Economic Calendar Highlights (April 2025)

Key upcoming events that could influence gold prices include:

April 15: U.S. Consumer Price Index (CPI) release

April 17: U.S. Initial Jobless Claims

April 18: University of Michigan Consumer Sentiment Index

📈 XAU/USD Technical Overview

Trend & Momentum: Current Price: Approximately $3,236.21 per ounce.

Trend: Strong uptrend, with prices surging past the critical $3,200 mark.

RSI (14): 64.826 – approaching overbought territory, suggesting strong buying pressure.

MACD (12,26): Positive value of 21.21 – indicating bullish momentum.

ADX (14): 33.482 – confirming a strong trend.

Moving Averages: All major moving averages (MA5 to MA200) are signaling a 'Buy,' reinforcing the bullish outlook.

Support & Resistance Levels:

Immediate Resistance: $3,245.69 – recent intraday high.

Next Resistance Target: $3,300 – as projected by analysts amid ongoing market dynamics.

Immediate Support: $3,174.14 – recent intraday low.

Key Support Levels: $3,048 and $2,953 – potential pullback zones if a correction occurs.

Candlestick Patterns:

A “shooting star” pattern has emerged, which may signal a short-term reversal or consolidation phase.

Price Projection for April 14–18, 2025

Considering the current technical indicators and market conditions:

Projected Minimum Price: $3,180 – accounting for potential short-term corrections.

Projected Maximum Price: $3,280 – if bullish momentum continues without significant resistance.

XAUUSD will it break through 3200?At present, the price of gold is just one step away from its all-time high. Will it break through to a new high?

3,168 is a strong resistance point. Once this level is broken through, gold may have a chance to surpass the 3,200 mark.

Leave your opinions in the comments, and let's discuss them together.

Gold Shows Downward Correction, Short Strategy Timely EnteredIn the previous trading signal, it was advised to take profits around $3235. Based on the latest market analysis, gold prices are expected to experience a downward correction. Therefore, it is recommended to open short positions around $3230. Investors should closely monitor market trends and adjust stop-profit levels in response to price fluctuations to secure profits. Please remain flexible and responsive to market changes, capturing every trading opportunity with precision.

Gold Prices Decline, Short Strategy Successfully Captures ProfitCurrently, gold prices are showing a clear bearish trend, previously fluctuating around $3240. Based on market predictions, there is a potential for further downward movement in gold. A short position was suggested around the $3240 level, and as the market corrected, gold prices have indeed dropped, allowing short-positioned investors to lock in profits. Congratulations to those who successfully capitalized on this short opportunity and secured gains. Stay alert to market developments and carefully adjust your stop-profit levels to ensure the stability of your returns.

Gold's safe-haven demand surgesThis week, concerns over a global economic slowdown have swept across Wall Street, becoming the dominant market sentiment. In this context, U.S. President Trump's erratic messaging on tariff policies has triggered a panic sell-off in U.S. stocks, bonds, and the dollar, highlighting gold's position as a safe-haven asset. Gold prices have surged sharply, breaking through all previous resistance levels and maintaining an upward trend. Given the ongoing risk-off sentiment, the bullish momentum in gold remains strong, and the market may continue to trend higher in the near term.

In this market environment, it is recommended that investors take long positions near $3220 and consider taking profits around $3230 to fully capitalize on the current uptrend in gold. For additional trading signals, Please stay tuned.

Gold Breaks $3240, Shorting Opportunity EmergesGold prices have now surged to around $3240, continuing the recent strong upward momentum. Based on the previous trading signal, a long position at $3220 was suggested; however, due to the high volatility, many investors may have missed the opportunity to go long at that level. At this point, with prices approaching $3240, it may be an opportune time to establish short positions, with a target profit around $3225. Please note that this is just personal advice, and actual trading decisions should be made with attention to changes in key price levels.

XAU/USD 11 April 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has printed as per my analysis dated 04 April 2025 by targeting weak internal high and printing bullish iBOS.

We currently do not have an indication of bearish pullback phase initiation. Current CHoCH positioning is denoted with a blue dotted line.

Intraday Expectation:

Price to indicate bearish pullback phase initiation by printing bearish CHoCH.

It is possible for price to potentially print higher highs in order to reposition CHoCH closer to current price action.

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

As mentioned in yesterday's analysis that I will continue to monitor internal structure following the printing of a bearish CHoCH.

Price has continued higher without a meaningful pullback, therefore, I will not classify previous iBOS, which is marked in red, as a bullish iBOS.

Intraday Expectation:

Price to indicate bearish pullback phase initiation by printing bearish CHoCH. Current CHoCH positioning is denoted with a blue dotted line.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

Trump's tariff announcement will most likely cause considerably increased volatility and whipsaws.

M15 Chart:

XAU 1M Gold price formation history and future expectationsGold , or as denote the main trading pair XAUUSD , has been gaining a lot of attention around itself in recent years.

As soon as major analysts or hedge fund top-managers begin to say that the next crisis is near, investors immediately start buying gold as a defensive asset, and its price, accordingly, goes up.

Let's walk a little through the history of the Gold price.

We finished drawing the graph, to what exists on tradingview.com, based on the data that is freely available.

1) In 1933, to overcome the crisis after the "Great Depression", US President Roosevelt issued a decree on the confiscation of gold from the population. The price for an ounce of gold is set at $20.66.

2) In 1971, a real rise in the value of gold begins. After decoupling the US dollar rate from the "gold standard", which regulated the cost of 1 troy ounce of gold at $35 for a long period from 1934 to August 1971.

3) 1973 - "The First Oil Crisis" and the rise in the value of gold from $35 to $180 - as the main anti-crisis instrument, a means of hedging investment risks.

4) 1979-1980 Islamic Revolution in Iran (Second Energy Crisis). The cost of gold, as the main protective asset, in a short period of time grows more than 8 times and sets a maximum at around $850

5) During 1998-2000, the world swept through: the "Asian economic crisis", defaults in a number of countries, and the cherry on the cake - the "Dotcom Bubble". During this period, the price of gold was twice aggressively bought out by investors, from the level of $250. It was a clear signal - there will be no lower, next, only growth!

6) And so it happened, from 2001 to 2011 there was an increase in the value of gold from $250 to $1921 . Even the mortgage crisis of 2008 could not break the growth trend, but only acted as a trigger for a 30% price correction.

Looking at the XAUUSD chart now, one can assume that large investors were actively buying gold in the $1050-1350 range during 2013-2019.

It is hard to believe that investors who have been gaining long positions for 6 years will be satisfied with such a small period of growth in 2019-2020.

For ourselves, we establish a Gold purchase zone in the range of $1527-1600 per troy ounce, from where we expect the growth trend to continue to the $3180-3350 region

What are your views on the future price of gold? Share them in the comments!

XAU/USD - Major Reversal Incoming?Gold has been on a massive bullish run, but are we about to see a strong rejection from supply? Let’s break it down! 👇

🔹 Price Action: Gold has tapped into a key supply zone (🔵 Blue Area) near $3,175, which previously led to sharp sell-offs.

🔹 Liquidity Grab? Smart money often pushes price above key levels to trap retail traders before a reversal.

🔹 Key Levels to Watch:

✅ 3,143 - 3,175 (Supply Zone) - Possible rejection!

✅ 3,067 - First major support below.

✅ 2,990 - Final demand zone (🔶 Orange Area).

🛑 Bearish Scenario: If we see strong rejection from supply, expect a drop to 3,067 first, then possibly 2,990.

✅ Bullish Continuation? If gold breaks above 3,180, the next major target is 3,200+.

💬 What’s Your Bias? Will gold dump from here, or will bulls keep pushing? Let me know in the comments! 👇🔥

#forex #gold #xauusd #scalping #supplydemand #priceaction #trading

This format should help maximize views by using:

✅ Engaging hooks & emojis

✅ Clear levels with explanations

✅ Interactive questions

Would you like me to tweak anything before you post it? 🚀

You said:

add more details

🚨 XAU/USD - High Probability Sell Setup? 🚨

🔥 Gold has been on a powerful bullish run, but is it time for a major reversal? Let's break it down!

🔍 Key Analysis:

📈 Recent Price Action:

✅ Gold rallied aggressively from the $2,990 demand zone (🔶 Orange Box) after liquidity was grabbed.

✅ The price is now inside a strong supply zone at $3,143 - $3,175 (🔵 Blue Box).

✅ This level has historically triggered sharp sell-offs—will history repeat itself?

📊 Smart Money Perspective:

💎 Liquidity Trap? Price has pushed above previous highs, likely hunting stop losses before a reversal.

💎 Institutional Orders? Banks & smart money tend to sell into retail buying pressure at key zones.

📌 Critical Levels:

🔹 Supply Zone (Sell Area): $3,143 - $3,175

🔹 First Support Target: $3,067 (Key liquidity level)

🔹 Main Demand Zone: $2,990 - $2,991 (Major buy zone)

📉 Trade Setup: Possible Short Opportunity!

💀 Bearish Case (Sell Bias):

❌ If price fails to hold above $3,175, we could see a sharp drop to $3,067.

❌ Break below $3,067? Then gold might test $2,990 - $2,991 for the next big bounce.

🚀 Bullish Case (Invalidation Level):

✅ If gold breaks & holds above $3,180, expect a continuation rally toward $3,200+ and beyond.

👀 What’s Next?

🚦 Will gold break down from this supply zone, or will bulls keep pushing?

💬 Drop your thoughts below! Are you SELLING from here, or do you expect a new high? 👇🔥

📊 Like & Follow for More XAU/USD Setups! 🔥🚀

#forex #gold #xauusd #scalping #supplydemand #liquidity #smartmoney #trading #priceaction

Bull market hides falling crisis!Gold rose sharply to around 3170 in the short term. Gold is in an obvious bull market. I think we should not be too optimistic! Don't blindly chase gold in trading!!!

Although it is only one step away from the previous high, it not only faces the psychological resistance of 3200, but also multiple integer resistance. After the fundamental positive factors are exhausted, it is difficult for gold to have enough power to continue to rise and break through the heavy resistance.

So the sharp rise of gold is likely to be a bull market trap, in order to confuse more people to chase gold, and large institutional funds take the opportunity to sell! So in terms of short-term trading, I still will not vigorously chase long gold, I will start to short gold gradually in batches! The faster gold rises, the faster it may collapse!

Bros, I am not afraid of shorting gold now. I think short trading can also bring me huge profits. The retracement target first focuses on the area around 3135.The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

XAUUSD: Investors are more interested in Gold than ever! Gold reversed successfully after touching our entry point, moving to over 1400 pips. We previously advised closing the idea, but now we see a strong bullish market likely to create another record high. The ongoing tariff war between China and the US will likely create more fear in the global market.

Like, comment, and support us.

Team Setupsfx_

XAUUSD hit a new record high!calm downDue to the influence of various factors, the price of gold has reached a new high and has already set a new historical record. Will it make an attempt to break through the 3200 mark?

Perhaps we should step out of the madness of the gold price and observe the market calmly. I think it will fluctuate within a certain range in the short term, and we can make a profit by choosing to go long or short at the appropriate price points.

XAUUSD trading strategy

sell @ 3165-3170

sl 3180

tp 3155-3160

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

GOLD At Interesting Res Area , Should We Sell Now Or Wait ?Here is my GOLD Chart and this si 1H Time Frame , i`m looking to sell it if i have a bearish price action to confirm that the price will go down , i think the price will go up a little to make some wicks and take all stop losses before going down again maybe tomorrow, so i think we will see some stop hunts before the price going going down for 500 pips and then move again to upside very hard .

Gold is strong, wait for a pullback to go longThe 1-hour moving average of gold has formed a bullish arrangement with a golden cross upward, and gold is now supported near 3100. If gold can stand firm at 3100 after the data, then we can continue to go long on dips.

Trading ideas: Buy gold near 3100, stop loss 2990, target 3130

Gold's Downtrend PersistsGold's Bearish Outlook Continues Despite Temporary Upside Spike

Market Overview:

The overall outlook for gold remains bearish, even though the market recently experienced a surprising and sharp upward movement. While a deep correction was anticipated and in line with prior expectations, the nature and timing of the recent surge raised some eyebrows among analysts and traders alike.

The unexpected bullish reaction came shortly after former U.S. President Donald Trump announced a 90-day suspension on reciprocal tariffs—a development that typically would not warrant such a dramatic price rally in gold. Normally, easing geopolitical or economic tensions would dampen safe-haven demand, causing gold to retreat. In this case, however, the opposite occurred, which suggests the possibility of non-fundamental drivers at play, potentially even artificial market influence or manipulation.

Technical Outlook:

Despite the sudden upward movement, gold’s larger technical structure has not changed significantly. The overall trend remains bearish unless we see a sustained breakout above the 3167 resistance level. A clean breach above that threshold would be uncharacteristic based on current fundamentals and could indicate external interference or speculative overreaction rather than a genuine shift in sentiment or macroeconomic conditions.

The price action continues to favor the bears, with lower highs and lower lows still forming on the larger timeframes. Until there’s clear evidence to the contrary, any rallies should be viewed with skepticism and treated as potential selling opportunities rather than the start of a new bullish trend.

Key Support Zones:

Looking at potential areas where gold may find some temporary footing, the following support levels should be closely monitored:

3054 – Minor support; could serve as a short-term pause point.

3000 – A psychological level and round number that often acts as a magnet for price action.

2925 – More significant historical support zone with prior buying interest.

2840 – Deeper support, aligning with the longer-term bearish trajectory.

Conclusion:

In summary, while gold has shown a sudden upward burst, the broader picture remains cautious. The technical indicators, market context, and recent price behavior all point toward a continuation of the downtrend unless key resistance levels are convincingly breached. Traders are advised to remain vigilant, avoid emotional reactions to short-term volatility, and refer closely to technical signals when making decisions.

The chart provides further clarity on this setup—feel free to review it for a more visual representation of the analysis.

Thank you for reading, and best of luck in the markets!

Risk aversion continues to escalate, go long after gold retreats

Gold has two effective support positions. The first one is near 3048, and gold rises rapidly after hitting the bottom of 3048. The second one is near 3070. If gold does not break through 3070, it will continue its strong bull market. If gold falls back near 3048, then gold may start to maintain a large range of shocks.

Trading idea: Go long near gold 3070, stop loss 3060, target 3100

Gold: Watch for Selling OpportunitiesGold remains under pressure around the 3100 level, where previous trapped buyers are creating significant selling pressure. The heavier resistance zone lies between 3127–3146, so if you’re holding long positions, don’t be greedy — this is a crucial area to watch!

Tomorrow during the U.S. session, we’re expecting major economic data and headlines. The market will likely see high volatility, and instead of a clear one-way trend, there’s a higher chance of a two-way sweep (both up and down).

Trading Advice for Tomorrow:

Avoid chasing price or getting caught in emotional trades.

Control your position size — even if you end up holding during turbulence, a small and managed position won’t hurt you. You might even come out profitable.

But if you enter with full margin and no risk control, the result could be heavy losses or even blowing your account. This is my honest advice!

During the Asian and European sessions, the technical outlook favors short positions. Consider selling around the 3103–3123 zone, with support levels at:

3078 / 3066 / 3051 / 3027 / 3011

I will release updated strategies for the U.S. session tomorrow based on key data releases. Stay tuned and feel free to reach out if you have any questions.

Good luck and trade safe!