XAUUSD, EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Xauusdidea

GOLD: Short, Target 3041-3036After yesterday's rise, some gold indicators have formed a relatively obvious short position, so in today's trading, I personally recommend focusing on the short position.

During the trading process, we need to pay attention to the support points of 3046/3037/3032, the high point of resistance of 3060, and the possible new high of 3067.

From the overall situation, it is unlikely to break through 3067 today, but it is more likely to fall to around 3037.

Gold breaks out for new highs. Ideal for shorting!Today, major funds in the gold market are rapidly covering their short positions, triggering a short - term technical rebound. Despite the bearish outlook remaining solid from a fundamental perspective, investors should prioritize prudent position sizing and effective risk management. Notably, once this corrective upward movement concludes, the market may face a more pronounced downward trend.

XAUUSD

sell@3050-3055-3060

tp:3035-3025

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold: Safe - Haven Drop, Short - Term BetsGold remains buoyed by safe - haven sentiment. Nevertheless, subsequent to a substantial rally to a high, gold underwent a swift retracement. In truth, the support for gold emanating from safe - haven requirements is a rather commonplace occurrence. Given that the bullish impetus in the gold market failed to persist, this implies that the upside potential for gold bulls is circumscribed. During the US trading session in the gold market, gold initially rallied and then declined. We directly initiated a short position on gold at $3032. As projected, gold declined, enabling us to realize profits. Should gold rebound to an elevated level during the US trading session, a short position should still be contemplated.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Gold is expected to rise to the 3030-3040 zone againGold encountered a clear rejection signal after reaching around 3036, indicating the presence of resistance and a technical need to retest support. Currently, gold is undergoing this support retest.

Within the current structure, gold has established a notable W-bottom pattern, with key support formed around the 3000 and 3003 levels. This structural support remains relatively strong. If gold manages to hold above the 3015-3005 support zone during the retest, a renewed upward move is likely. In that scenario, gold could resume its ascent, potentially retesting the 3030-3040 resistance range.

So in terms of short-term trading, if gold pulls back to the 3015-3005 zone, we can consider going long on gold in moderation.I would make more detailed trading plans and trading signals every day according to the real-time market situation, which is also the testimony of every successful transaction and profit of mine; the article has a certain lag, if you want to copy the trading signals to make a profit, or master independent trading skills and thinking, you can choose to join the channel at the bottom of the article

XAUUSD:Keep shorting on the morning reboundGold has now entered another range-bound market. Yesterday during the US trading session, the price of gold rallied and reached the level of around 3035 but then came under pressure and retreated. A short position was directly taken at the price of 3032 for gold, and as expected, a profit was reaped as the price of gold declined. With gold in a high-level range-bound market, during the morning session, as the price rebounded and came under pressure, another short position was taken.

XAUUSD Trading Strategy:

sell@3032-3035

TP1:3010

TP2:3000

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

Gold signal: buy at 3021-3016Gold has a second chance to rise, so you can continue to go long. Pay attention to the resistance near the previous high of 3035-3038. If you can't break through, close the order in time. If you break through, 3042-3046 will be a short-term strong resistance level.

If the price falls, I personally think that the support will give priority to 3016-3011, followed by 3007

Analysis of Today's Gold Short - Selling StrategyYesterday, towards the end of the trading session, the gold price tested the vicinity of the $3,000 level again. Subsequently, it oscillated higher in the late trading, and continued to surge upward today. The Bollinger Bands are opening downward, indicating a distinctly bearish trend. However, there has been some support near the $3,000 mark, with signs of a short - term rebound. Pay attention to the resistance levels near $3,020 and $3,030. If the rebound fails to break through these resistance levels, the gold price is likely to decline again

XAUUSD

sell@3025-3035

tp:3010

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Current Analysis and Forecast of Gold PriceOn Monday, the price of gold exhibited relatively subdued behavior, largely oscillating within a narrow trading band.

During the European trading session, the yellow metal briefly ascended to test the $3,033 resistance level. Subsequently, in the US trading session, it encountered a significant pullback, with prices temporarily dipping to a low of $3,002.

Despite the emergence of a rebound, the momentum behind it appears lackluster. Looking ahead, in the subsequent trading, gold is anticipated to consolidate within the range of $3,000 - $3,030.

XAUUSD

sell@3025-3035

tp:3010

buy@3000-3010

tp:3030

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Is it profitable to be long gold now?📍Although gold is in an overall downtrend, its decline has not been smooth during multiple tests of the 3000 level. Therefore, the support zone between 3005 and 2995 remains valid. Considering the downward momentum observed during the tests of 3000, gold is unlikely to experience a sharp drop. Instead, it may follow a pattern of gradual, oscillating declines. If gold receives strong support in the 3005-2995 range, a rebound toward the 3015 level is still possible, with the potential to extend further to the 3025 level.

🔎Trade Idea:

Xauusd: Buy at 3010-3000

TP:3015-3025

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

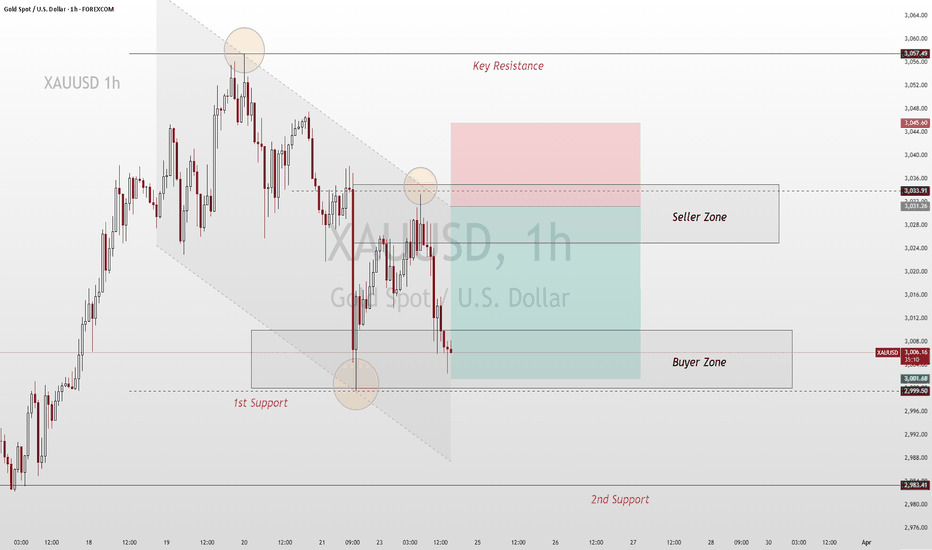

XAUUSD:Continue short - selling at night.As long as gold doesn't stage a strong rally this week, the hourly moving averages of gold may continue to head downward. Eventually, if a bearish death cross and a short - biased arrangement are formed, the downside potential of gold can be truly unlocked. The resistance of the gold moving averages has now shifted down to around 3036. Therefore, there is still some resistance within this range.

Continue to engage in short - selling at high levels around the resistance of 3033. As long as this level remains unbroken, the strategy of shorting at highs between 3030 - 3033 remains unchanged. Set a stop - loss at 3040 and a take - profit at 3010. Be cautious of risks.

XAUUSD Trading Strategy:

sell@3030-3035

TP:3010

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

Is Gold Ready to Drop? Key Levels & Strategy for the Next Move!📉🔥 Right now, XAUUSD (Gold) is pulling back from the highs and consolidating in a range. I'm watching for a buy opportunity if price breaks below the current range low and retraces into the previous swing equilibrium.

🎯 In the video, we dive into imbalances as key pullback targets, analyze price action and market structure, and discuss a potential trade setup—if the market presents the right conditions.

🚨 Not financial advice—trade smart! 🚀

Golden Signal: Go Short in the 3027-3037 AreaLast Friday, gold rebounded to near resistance. Although the indicator in the 30M level chart shows that there is still some rebound momentum, the space is not very large, because the head and shoulders pattern has appeared in the early stage, and the pressure on the bulls is still very large.

Therefore, in the intraday trading on Monday, we can focus on short trading around the resistance area of 3027-3040. The single needle bottoming provides good support, so TP does not need to be set too large for the time being. The previous rising point of 3007 is used as a reference support, and TP is controlled in the range of $10-$16. Personally, it is expected to be in the 3018-3011 area.

I will update the specific trading information during the intraday, please pay attention to the content of the intraday update. If you have any questions, you can leave me a message, and I will reply to you in time when I see it.

I wish you all a prosperous new week!

3/24 Gold Trading Signal: 3027-3037 Range ShortThe market has opened. As mentioned in the previous article, gold still has a rebound. Under the current circumstances, our main focus is the resistance area of 3027-3037. I personally think that the probability of a direct breakthrough is not high, so we maintain the trading idea of shorting in this range.

During the decline, 3018/3015/3011/3007 are the support levels that need to be paid attention to.

If you have any questions, you can leave me a message. I will reply in time after I see it. In the new week, I wish you all a lot of money!

Analysis and Forecast of Gold Price Next WeekOn Friday evening, the spot gold price broke below the key support level of $3,000, which was in line with previous expectations. After reaching a phased high of $3,057, the market witnessed a rather significant downward movement.

However, the support at the $3,000 level was relatively strong. Although the price briefly fell below this level, it failed to stabilize effectively.

During the late trading session, the gold price rebounded technically and recovered to around $3,020.

Based on the current technical analysis and market sentiment, it is expected that the gold price will continue its weak downward trend next week, accompanied by certain corrective retracement.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

XAU/USD: Weekly Recap and Key Levels for Next WeekLast week, XAU/USD showed a pattern of high-level consolidation. After reaching the key psychological level of 3000 USD on March 17th, gold prices entered a sideways phase. On March 20th, gold hit a new all-time high of 3057 USD per ounce before pulling back. By March 22nd, gold prices had fallen for two straight trading days, briefly touching 2999 USD per ounce. However, dip-buying activity helped recover some of the losses.

From a technical perspective, the 5-day and 20-day moving averages remain in a bullish alignment. However, the price has deviated significantly from these averages, indicating a need for a technical correction.

Gold may continue its adjustment early next week, with support levels to watch in the 3000-3030 USD range. If geopolitical tensions do not escalate significantly, spot gold prices could test support near 2993 USD, though the likelihood of breaking below 3000 USD is low.

If gold prices fall below the 5-day moving average, they may further test the 20-day moving average support (2950.00-2942.00 USD). If the recent consolidation range is broken, the resistance levels to watch are the previous high of 3057 USD and beyond.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

GOLD Finally Gave Bearish P.A , Short Setup Ready For You !Here is my opinion on Gold , and now the price closed below my support , and i`m waiting the price to retest it to enter a sell trade to take this 500 pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.