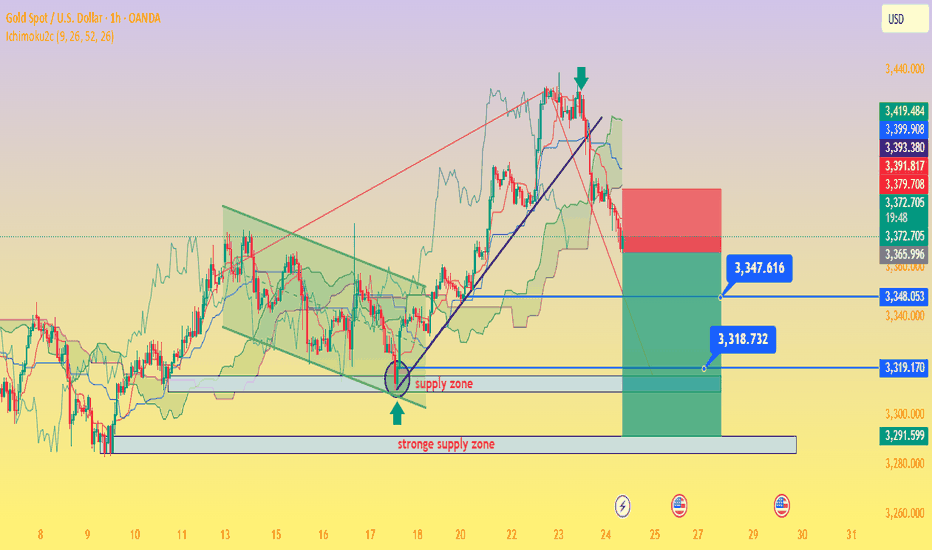

Gold (XAU/USD): Supply Zone Rejection & Bearish Breakdown Chart Breakdown:

Supply zone rejection: Gold revisited the “supply zone” (light green/grey area) and failed to break above — a classic signal of seller dominance.

Uptrend invalidated: A sharp rise (steep black trendline) ended with a peak marked by the green arrow, followed by a decisive breakdown.

Ichimoku Cloud test: Prices slipped through the Ichimoku components, reinforcing the shift to bearish sentiment.

Potential targets: The red/green risk‑reward box highlights a short position, targeting ~3,347 then ~3,318 levels (blue labels) as initial support zones.

Strong supply base: The extensive grey zone below marks a "stronger supply zone" — this could cap any modest bounce and keep the downtrend intact.

🔍 Interpretation:

Bias: Bearish — sellers have taken control after a failed breakout.

Strategy: Short on rallies toward the mid‑green/red box (~3,373–3,380), targeting ~3,347 first and then ~3,319. Watch for support at the strong supply region (~3,292) for potential reversal or consolidation.

Risk management: Keep stop above the red zone—above recent highs (~3,380+) to limit risk.

🚀 In a nutshell: After failing to break supply and losing its short‑term uptrend, gold appears poised for a pullback. The next key levels to watch are ~3,347 and ~3,319—where buyers might step back in, or the downtrend continues toward the deeper supply base.

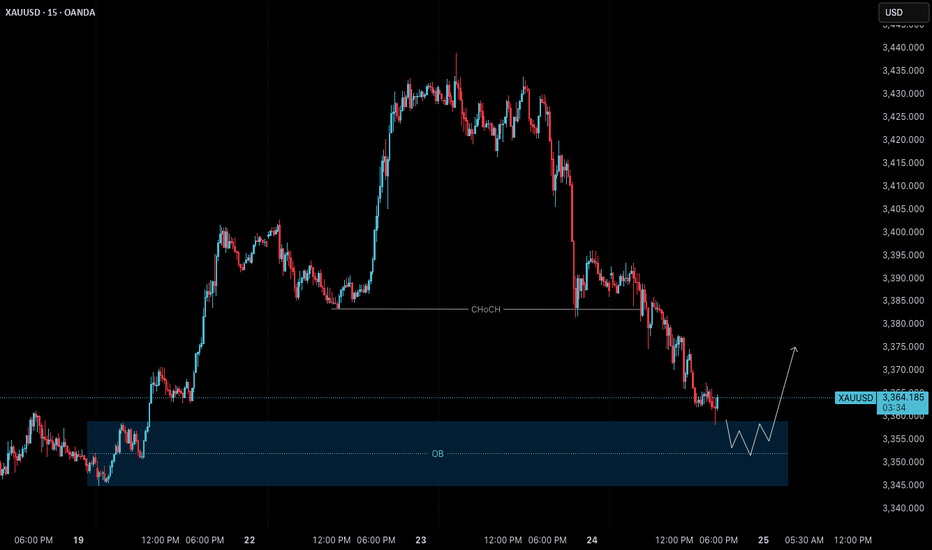

Xauusdlong

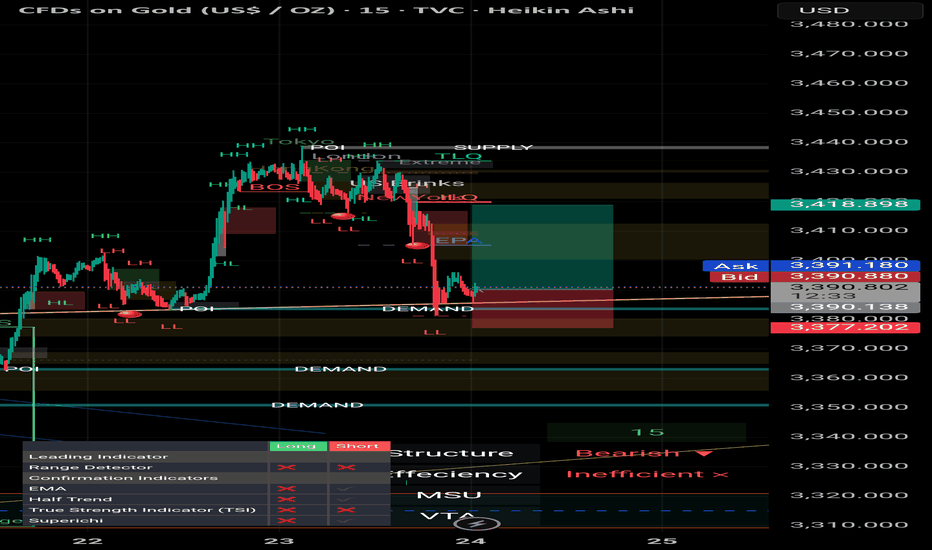

Gold – 24 July: Watching H4 OB Zone for Bullish ReversalGold – 24 July Outlook

Watching H4 OB Zone for Potential Reversal

📌 Recap of 23 July Trade:

As outlined in yesterday’s analysis, the M15 Order Block ( 3417–3412 ) held well. The market reacted precisely from this level, and our long setup successfully hit the defined 120-pip target .

However, after reaching a high near 3434 , the price failed to break above and instead rejected sharply, breaking the recent M15 higher low — a key structural sign that signals the start of a possible H4 pullback phase.

🔍 Current Market Context:

Trend Overview:

While the overall bias remains bullish, this break of M15 structure suggests short-term weakness and a corrective move in progress on the H4 chart.

Key Zone in Focus:

H4 Order Block Zone: 3359 – 3345

This is a critical zone to watch today. The market is currently trading around this area, and it could act as a potential reversal point where the uptrend resumes.

🎯 Trading Plan:

– Closely monitor the price action within the 3359–3345 zone.

– If price respects this zone and LTF (e.g., M1) shows signs of structure flip or ChoCH + BoS , it could present a fresh long setup opportunity.

– As always, only act on the trade if multiple confluences align — don’t anticipate, let the market confirm.

📈 Summary:

Bias: Watching for a bullish reversal from the 3359–3345 zone.

Setup Condition: Wait for clear LTF confirmation before entering.

Risk Management: Stick to 1:3 RR — 40 pip SL and 120 pip TP as per system.

Let the market come to your setup. Patience is your greatest edge.

📘 Shared by @ChartIsMirror

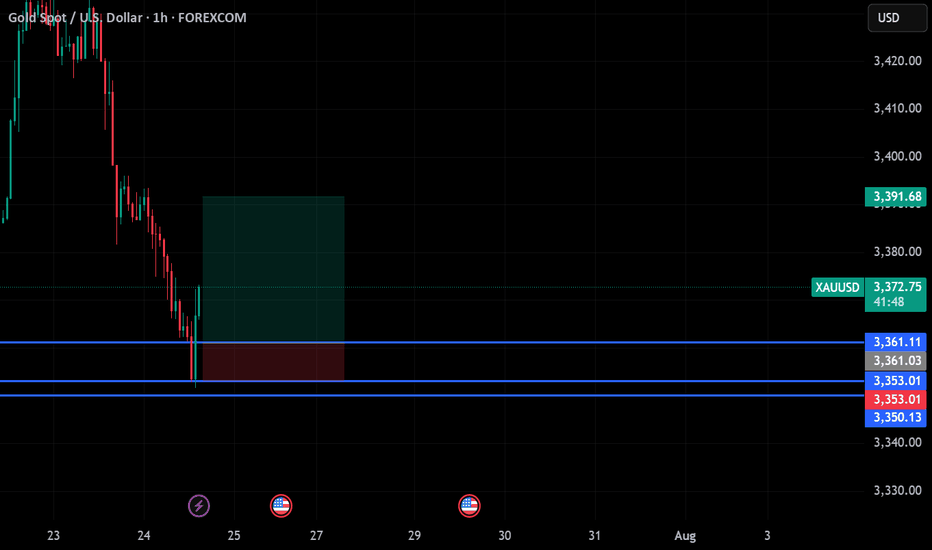

Gold's weak pattern, rebound is still empty.In fact, I strongly advise you not to attribute this wave of decline to the progress of trade negotiations. If you keep talking about these things all day, you will make mistakes inexplicably. I want to ask, do you know what its progress is? The previous rise was said to be not negotiated, so don’t you think this is a useless theory and fundamentals? As a topic of conversation with friends, it’s okay, but if you use it as a basis for trading, forget it. Every time it can take off at 3250 and fall at 3430, such a coincidental space, what other reasons are there besides the main control?

I deliberately gave a rebound expectation. If it can reach 3403, I am willing to go short again. The reason for taking this position is that gold has indeed broken the previous bottoming pattern, the support of the BD trend line, and the horizontal support of point D, but the problem is that it has not really broken the trend line of the inward channel. In this case, I must prevent a rebound, and it would be great if I could enter the market at 3403. You can look at the probability of a head and shoulders top.

Otherwise, I can only watch it fall first. Faced with this weakness, I choose to directly chase the bearish trend. The current price is still early compared to today's high of 93, and the support below is at 3360.

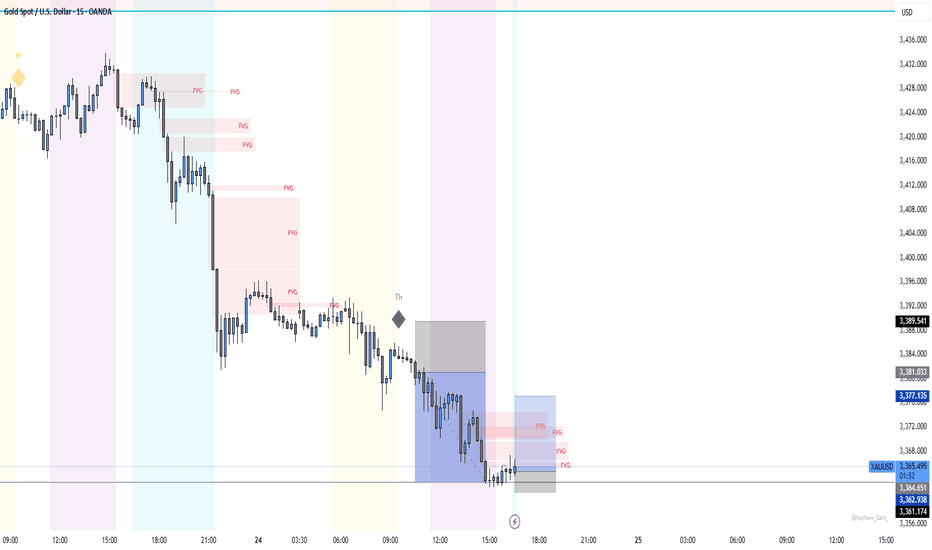

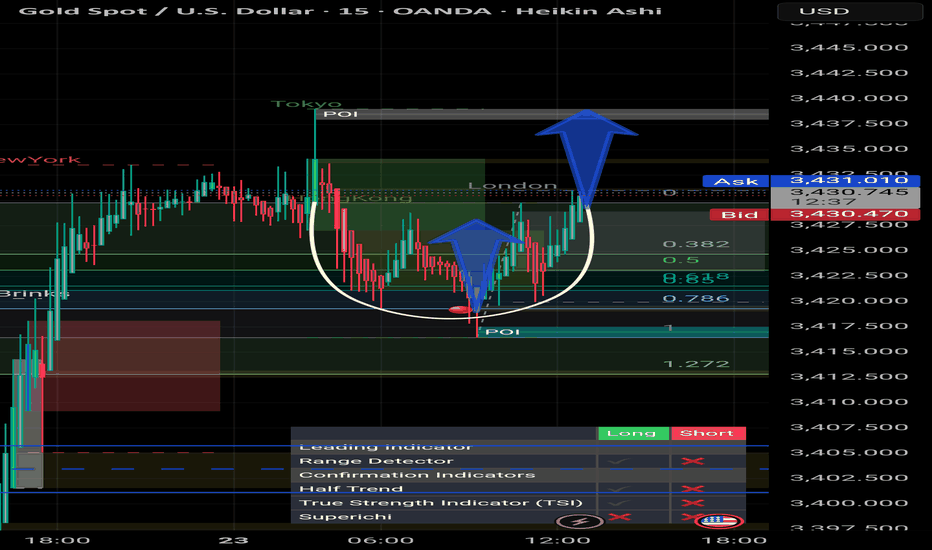

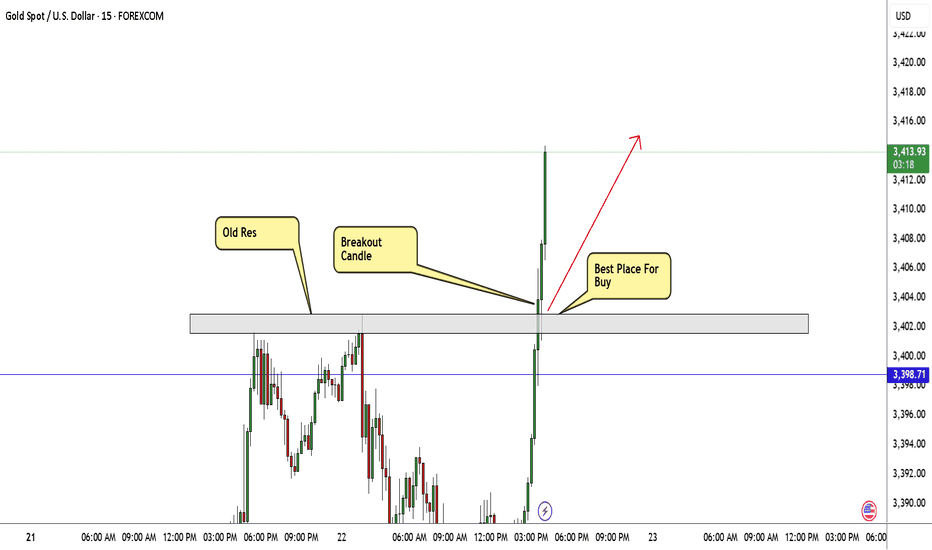

LONG Setup - Smart Money Bias (15m)

## 🟢 LONG Setup - Smart Money Bias (15m)

- **Pair**: XAU/USD (Gold)

- **Timeframe**: 15m

- **Entry Zone**: Around **3390.050**

- **Stop Loss (SL)**: **3377.200**

- **Take Profit Targets**:

- **TP1**: 3402.800

- **TP2**: 3410.500

- **TP3**: 3418.800

---

### 📌 Confluences:

- Demand zone respected and tapped.

- Bullish reaction from POI (Point of Interest).

- FVG (Fair Value Gap) filled and reversal initiated.

- BOS + CHoCH in lower timeframe confirmed.

- Forecast projection aligns with upside inefficiency.

---

### 🧠 Strategy:

- Smart Money Concepts (SMC)

- Liquidity Sweep below demand

- Risk-Reward Ratio: ~1:2.3

🚨 **Note**: Trade with caution around US market open hours (volatility expected).

📌 Disclaimer & Reflection

Before we dive into today's mark down, I want to take a moment to address the previous signal that hit stop loss. As traders, we must acknowledge that losses are part of the process—no matter how solid our analysis may be. I take full responsibility for the outcome, and I appreciate the trust and patience of this community.

Every stop is a reminder that perfection doesn't exist in the markets—only probabilities. What matters most is how we adapt, learn, and continue to evolve.

Let's move forward with clarity and discipline.

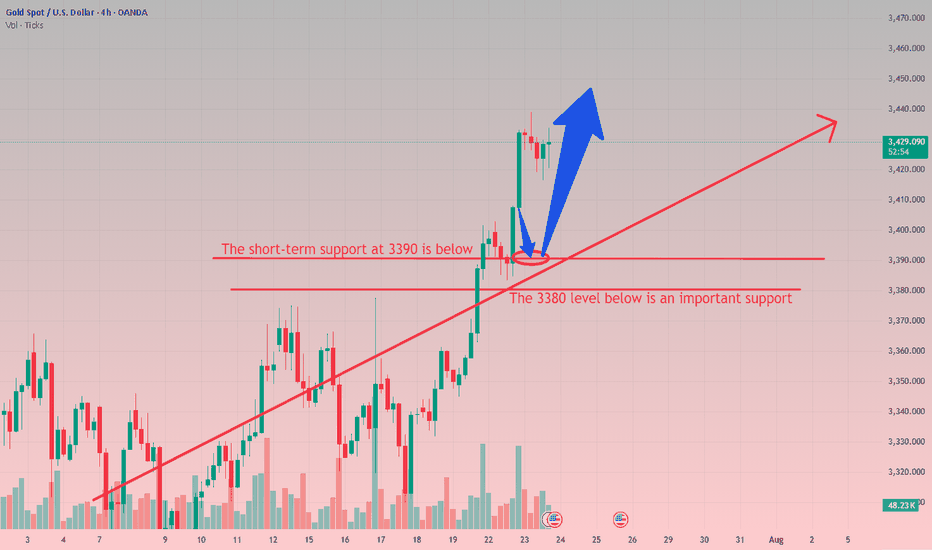

Continued price increase - gold increased to 3450⭐️GOLDEN INFORMATION:

Gold prices climbed for a second straight session on Tuesday, gaining over 0.9% as sliding US Treasury yields continued to weigh on the US Dollar. Investors remained cautious amid lingering uncertainty over upcoming US trade agreements. At the time of writing, XAU/USD is trading at $3,427, having rebounded from an intraday low of $3,383.

Yields on US government bonds have now declined for five consecutive days, pressuring the Greenback—reflected in the softer US Dollar Index (DXY). Heightened speculation that the US and European Union (EU) may fail to secure a trade agreement before the looming August 1 deadline has intensified demand for safe-haven assets. As a result, gold surged to a five-week high of $3,433.

⭐️Personal comments NOVA:

Gold price continues to increase, FOMO from the market is good and positive. Heading towards 3450

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3449- 3451 SL 3456

TP1: $3435

TP2: $3422

TP3: $3405

🔥BUY GOLD zone: $3380-$3378 SL $3373

TP1: $3390

TP2: $3400

TP3: $3415

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

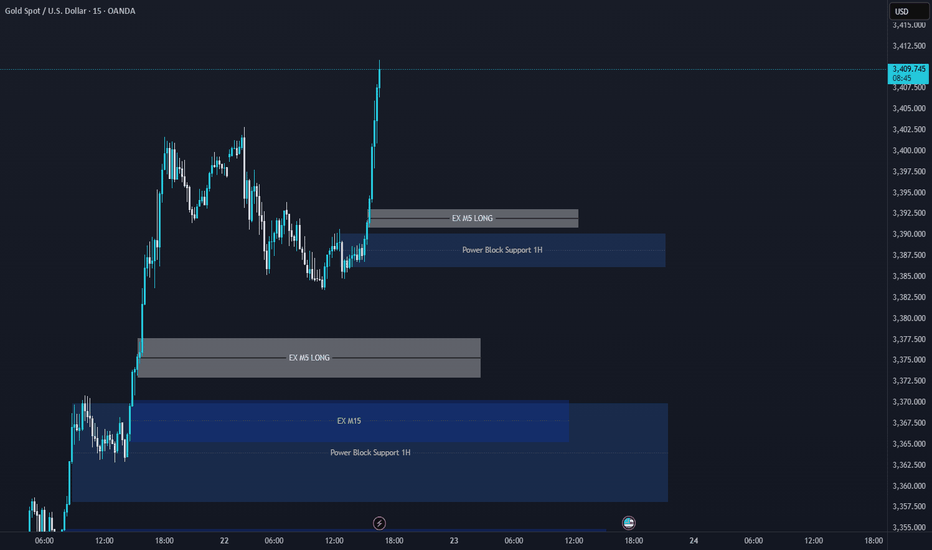

XAUUSD Support & Resistance Levels🚀 Here are some key zones I've identified on the H1/M15/M5 timeframe.

These zones are based on real-time data analysis performed by a custom software I personally developed.

The tool is designed to scan the market continuously and highlight potential areas of interest based on price action behavior and volume dynamics.

Your feedback is welcome!

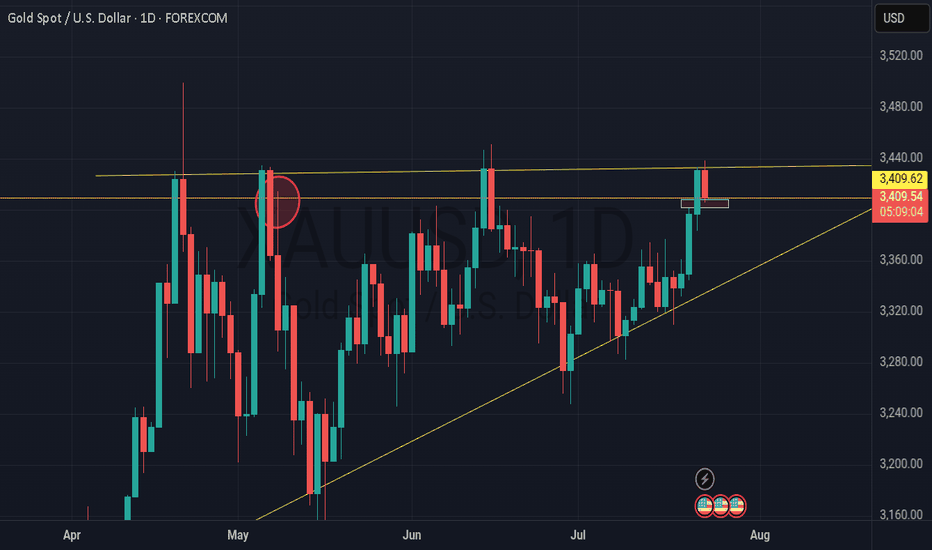

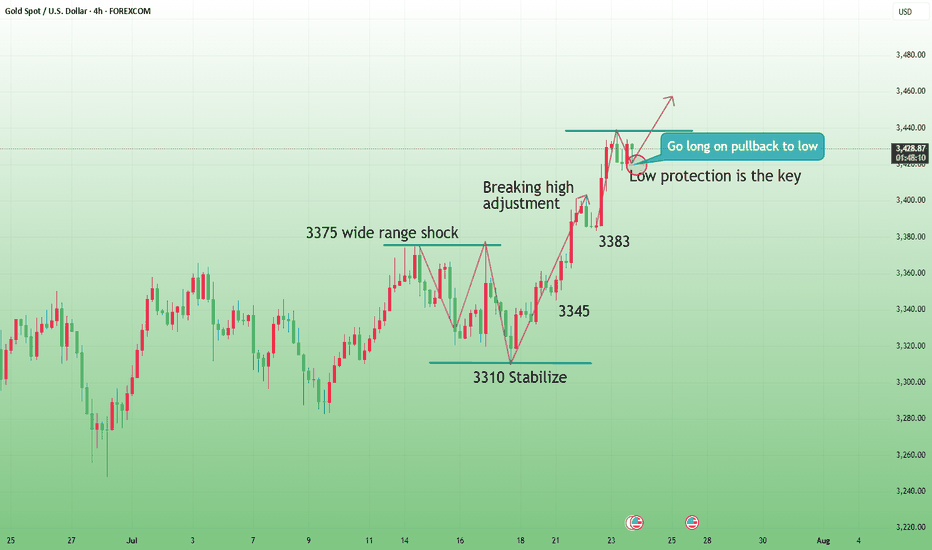

Whether gold can hold low is the key.Yesterday, the market fluctuated in a narrow range and corrected around 3402 and then went up to 3383. After repeated sideways movement, the market realized a sprint to 3400 and further accelerated to 3420. The daily line continued to close positively. Pay attention to the following points in the intraday layout;

First of all, from the perspective of the market pattern: after breaking through the wide sweeping space of 3300 as support and 3375 as suppression, the daily line structure showed a continuous rise and stabilized above 3400, and the space gradually moved upward. In the daily line structure, the Bollinger Bands have shown signs of opening upward, which means that the current wind direction is biased towards the bullish direction; under the premise of a biased direction, the operation is to follow the main low and long; the problem that needs to be considered in the short term is how the rhythm shows the switching relationship between direction and adjustment and the reverse The rebound pace (strong rise or more sweeping) are all points that need to be considered in the short term;

Price:

Pressure: 3438/3440, followed by 3450, then 3470 and above 3500

Support: 3415, followed by 3405/3400, then 3380.

Trend and time point:

Previously, it repeatedly swept widely with 3375 and 3300 as support, and finally achieved an upward breakthrough of the 3375 sweeping barrier this week. The daily line showed three consecutive positive climbs above 3400. From the corresponding daily line structure, the Bollinger band has shown signs of opening upward, and the moving average is also slowly rising, that is, the current trend is more bullish; under the premise of a slight tendency in the direction, the oscillation is mainly bullish and is confirmed.

Don't chase gold at high levels, buy more when it falls back to From the 4-hour analysis, today's support is around 3400-10. If the intraday retracement relies on this position, the main bullish trend remains unchanged. The short-term bullish strong dividing line focuses on the 3380 mark. If the daily level stabilizes above this position, the rhythm of retracement will continue. Short positions against the trend should be cautious.

Gold operation strategy:

Gold retracement to 3400-10 line to go long, retracement to 3390-95 line to cover long positions, stop loss 3379, target 3435-3440 line, continue to hold if it breaks;

CFD XAU/USD - 5m Buy Setup# 🟦 CFD XAU/USD - 5m Buy Setup

**Market:** CFD XAU/USD

**Timeframe:** 5 Minutes (M5)

**Direction:** 🔵 BUY

---

## 📌 Setup Details

- **Entry Zone:** Inside the blue arrow structure (curved shape detected)

- **Pattern:** Bullish curve + upward break of micro-structure

- **Bias:** Buy after confirmation of support on blue arrow structure

- **Context:** Momentum pickup after prior liquidity sweep

---

## ✅ Trade Levels

- **Entry:** At the retest of the curved zone (preferably lower wick tap)

- **Stop Loss (SL):** Below the curve base – approx. `SL: XX.XX`

- **Take Profit 1 (TP1):** Reaction to intraday high – approx. `TP1: XX.XX`

- **Take Profit 2 (TP2):** Next visible supply / FVG zone – approx. `TP2: XX.XX`

- **Take Profit 3 (TP3):** Breakout continuation target / 1:3 RR level – approx. `TP3: XX.XX`

---

## 📈 Notes:

- Ensure confirmation via bullish engulfing / momentum candle before entry.

- Avoid chasing — wait for price to tap into demand with low volume.

- Align with overall bias (check higher timeframe 15m or 1h).

---

*Posted by @Persiaux_King 👑*

People don't like the truth! Let's be honest, people don't like honesty. They prefer ideas that affirm their own beliefs.

When I read articles and posts from newer traders, it's often from a place of "all in" diamond hands and the notion that things go up forever.

I've been a trader for over 25 years now, and the game isn't about making a quick buck, it's about making money over and over again. This got me thinking, the issue is when you deal with a small account you require leverage, small timeframes and of course the "shit" or bust mindset. If you lose a thousand dollars, $10,000 even $100,000 - what does it matter? That's no different than a game of poker in Vegas.

The idea of being 80% in drawdown, is alien to me. The idea of one trade and one win is also a crazy notion.

Instead of playing with the future, there is an easier way to work. This isn't about slow and boring, it's about psychology and discipline. 10% returns on a million-dollar account isn't all that difficult. Instead of aiming for 300x returns on an alt coin (due to the account size being tiny) You can make less of a percentage gain with a larger account size.

In terms of psychology - the word " HOPE " is used, way too often, it's used when you hope a stock or the price of Bitcoin goes up, it's used when you hope the position comes back in your favour, it's used when you want your 10,000 bucks to double.

This isn't trading, it's gambling.

The truth is, it's not the winners that make you a good trader. It's the way you deal with the losses.

Once you learn proper risk management, a downtrend in a market move is a 1-2% loss coupled with a new opportunity to reverse the bias.

As a disciplined trader, the game is played differently.

Let's assume you don't have $100k spare - prop firms are a great option, OPM = other people's money.

Remove the risk and increase the leverage, all whilst trading with discipline.

The market goes through many phases, cycles and crashes.

You don't always need something as catastrophic to take place, but if you are all in on a position. You need to understand that losses can be severe and long-lasting.

When everyone sees an oasis in the desert, it's often a mirage.

You only have to look at the Japanese lesson in 1989, when the Nikkei was unstoppable-until it wasn't. For that short space in time, everyone was a day trader, housewives to taxi drivers.

Everyone's a genius in a Bull market.

Then comes the crash. The recovery time on that crash?

34-years!!!

I have covered several aspects of psychology here on TradingView;

When it comes to trading, if you are able to keep playing. It's a worthwhile game. If you are gambling, it's a game whereby the house often wins.

Right now, stocks are worth more than their earnings. Gold is up near all-time highs, crypto, indices the same.

All I am saying is if you are all in. Be careful!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

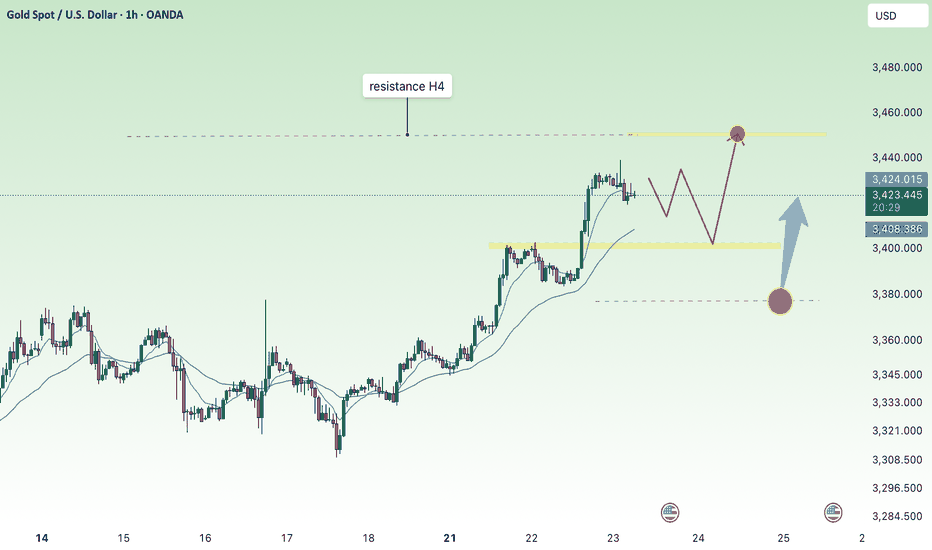

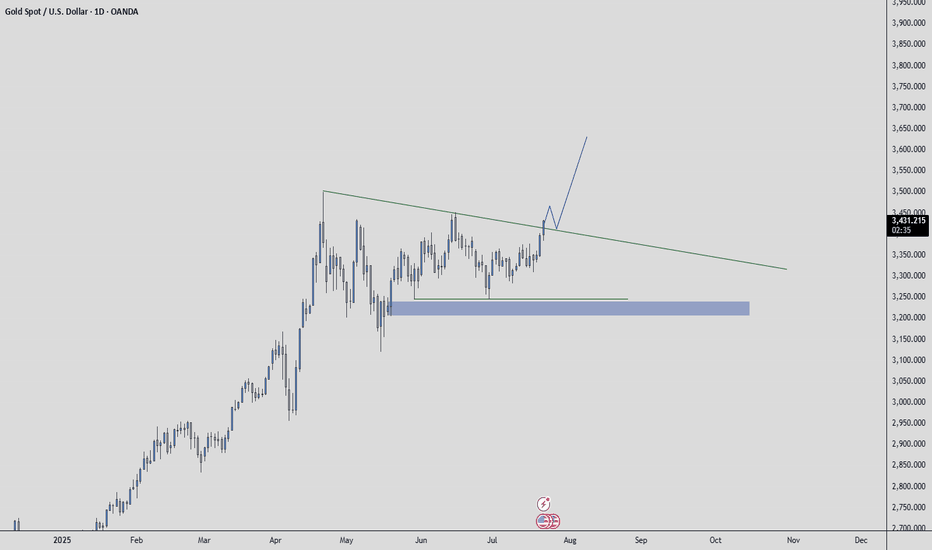

XAUUSD: Mid-Term Analysis🪙 XAUUSD Analysis

You don’t need to guess. You can join from the blue box or the movement I’ve drawn on the chart.

📈 Context (The Story)

Treasury yields just fell for the 5th session, boosting the bullish case for XAUUSD as investors look for safety and positioning ahead of next week’s Fed meeting.

🚦 The Plan

✅ If price returns to the blue box, I will look for:

Footprint absorption (buyers defending the level)

CDV support or divergence

Structure reclaim to confirm entry

✅ If momentum continues along the drawn movement, I will join with risk-managed entries on clear reclaim setups.

⚡ Why It Matters

“People don’t like to be sold, but they love to buy.” – Jeffrey Gitomer

Today’s bullish backdrop is clear, but you only benefit if you enter with clarity, not FOMO.

🎯 Action Point

No predictions. No chasing. Let the setup align with:

Today’s bullish news as a backdrop

Technical confirmation in the blue box or reclaim areas

If it aligns, execute decisively with clear risk. If not, let it go.

The market rewards those who wait for the right price and the right moment. This may be that moment if the setup confirms.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

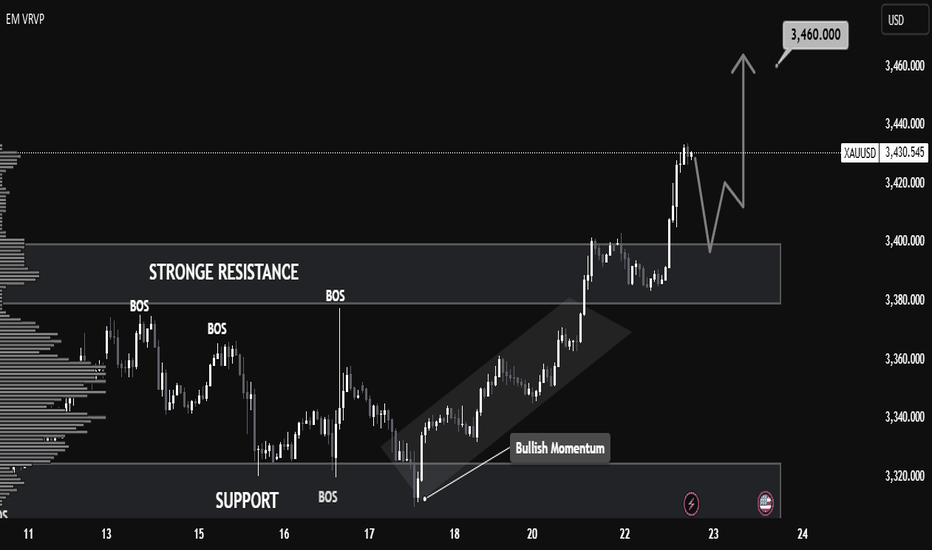

XAUUSD Technical Analysis – Resistance Turned Support, 📈 XAUUSD Technical Analysis – Resistance Turned Support, Bullish Continuation Expected

Gold (XAUUSD) has shown strong bullish momentum after breaking above the key resistance zone around $3,400, which now appears to be acting as a new support level. This structure shift signals a classic break-and-retest scenario, commonly observed in bullish continuations.

🔍 Key Observations:

Structure Shift: Previous resistance near $3,400 has been broken with strong bullish candles, suggesting buyer dominance. This level is now expected to serve as support.

Bullish Momentum: The move from the $3,320 support zone to above $3,430 was accompanied by clear trend formation and clean market structure, indicating sustained momentum.

Retest in Progress: Price is currently pulling back toward the new support zone ($3,400). If this area holds, a bullish reaction is expected.

Next Target: If support at $3,400 holds as expected, price could rally back toward the next resistance and projected target of $3,460.

📚 Educational Insight:

This setup illustrates the principle of resistance becoming support (RBS)—a foundational concept in technical analysis. After a breakout, a successful retest of former resistance often provides a high-probability entry point for trend continuation trades.

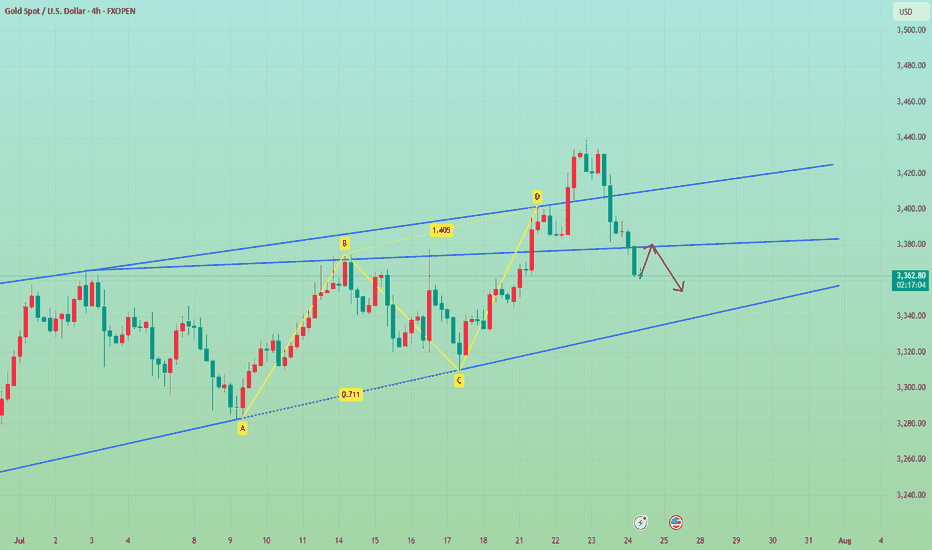

Gold Bulls Back in Control as Trump Pressures Fed for Rate CutsHey Realistic Traders!

President Trump is ramping up pressure on the Fed to cut interest rates , saying the U.S. is falling behind countries with looser policies. As several Fed officials begin to shift their stance, expectations for rate cuts are growing. That’s putting pressure on the dollar and giving gold a fresh boost.

We’ll take a closer look at what this means for OANDA:XAUUSD (Gold) through technical analysis and explore its upside potential.

Technical Analysis

On the 4-hour chart, Gold has moved above the EMA-200, signaling a shift in momentum to the upside. Price has also broken out of a Descending Broadening Wedge (DBW) pattern, which often indicates the start of a bullish trend.

The breakout was confirmed by a Bullish Marubozu candle, reflecting strong buying pressure. To add further confirmation, the MACD has formed a bullish crossover, reinforcing the upward momentum.

Looking ahead, the first target is seen at 3417. If reached, a minor pullback toward the historical resistance zone (green area) may occur, with a potential continuation toward the second target at 3500.

This bullish outlook remains valid as long as the price stays above the stop-loss level at 3271 . A break below this level would invalidate the setup and shift the outlook back to neutral.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on XAUUSD.

XAUUSD Technical Analysis – Triangle Breakout Ahead?Gold is currently consolidating in a symmetrical triangle pattern around $3,389. If it breaks above $3,402, we can expect a bullish continuation toward $3,420 and beyond. Key support lies at $3,367; a breakdown below this level would turn the trend bearish. The overall trend is still bullish, but a breakout is needed for confirmation.

📈 Potential Scenarios:

✅ Bullish Breakout Scenario:

- Break above $3,392–$3,402 zone.

- Targets: $3,420 > $3,450 > $3,480

- Supported by strong upward BOS (Break of Structure) and higher lows.

❌ Bearish Breakdown Scenario:

- Breakdown below $3,373–$3,367 zone.

- Targets: $3,355 > $3,345

- Would invalidate current bullish structure and form a lower low.

🔮 Trend Bias:

Bullish Bias remains intact as long as price stays above $3,367 and maintains higher lows. However, consolidation suggests waiting for breakout confirmation from the triangle before entering new trades.

🧭 Trend Outlook:

Gold is currently consolidating in a symmetrical triangle pattern, which typically precedes a breakout — either upward or downward. The price is holding above the key Fibonacci support levels and the overall market structure is bullish, suggesting an upward continuation is more likely if buyers maintain momentum.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

GOLD Still Bullish , Are You Ready For New Wave ? 200 Pips ValidHere is My 15Mins Gold Chart , and here is my opinion , we finally above 3400.00 and we have a 30 Mins Candle closure above this strong res , so i`m waiting the price to go back and retest this res and new support and give me a good bullish price action to can enter a buy trade and we can targeting 200 pips , and if we have a 4H Closure Above This res this will increase the reasons for buyers , just wait the price to back a little to retest it and then we can buy it . if we have a daily closure below it this idea will not be valid anymore .

XAUUSD Support & Resistance Levels🚀 Here are some key zones I've identified on the H1/M15/M5 timeframe.

These zones are based on real-time data analysis performed by a custom software I personally developed.

The tool is designed to scan the market continuously and highlight potential areas of interest based on price action behavior and volume dynamics.

Your feedback is welcome!