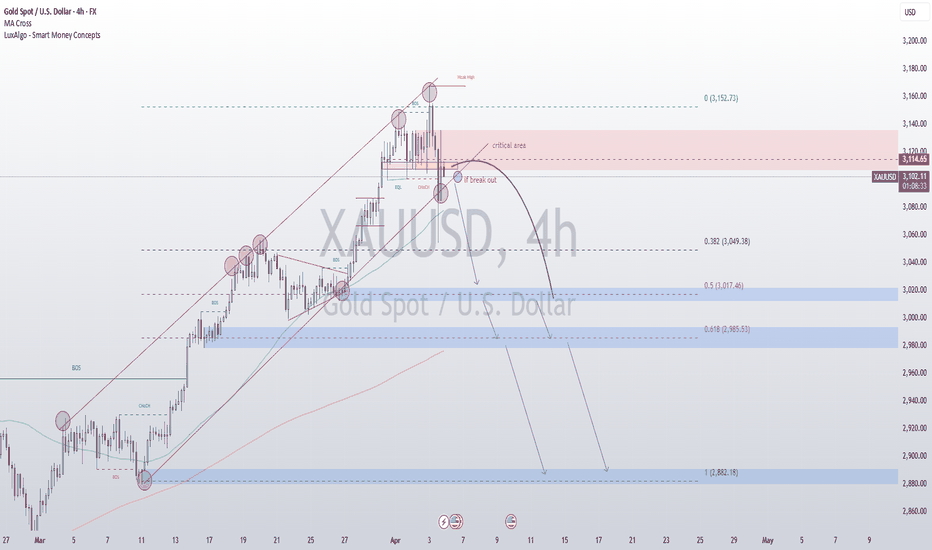

Golden Horizons on the PrecipiceGold on the Brink of a Downturn: A Shift in Market Sentiment

Gold, once a shining symbol of financial security and prosperity, now finds itself on the cusp of a significant bearish turn. The precious metal, which has long been a safe haven for investors during times of economic uncertainty, is entering a new phase that could see its value dwindle in the face of shifting global financial conditions.

The Russian central bank, historically one of the major players in the gold market, is currently at the forefront of this market retreat. By liquidating a significant portion of its gold reserves, Russia is not just participating in the market shift, but may be sending a signal to other nations and financial institutions. Their decision to sell is not an isolated move; it could well be the beginning of a broader trend.

As the Russian central bank offloads its holdings, it's highly probable that other central banks, which have long viewed gold as an essential asset for economic stability, may soon follow suit. These institutions, often holding vast quantities of the precious metal, could begin liquidating their reserves in an effort to take advantage of the currently elevated prices. The global economic landscape is constantly in flux, and with many countries facing mounting fiscal pressures, the temptation to cash in on gold's recent price surge could become too great to resist.

Hedge funds and private investors, always looking for opportunities to capitalize on price movements, may also jump on the bandwagon. They have the flexibility and agility to react swiftly to market shifts, and with a growing consensus that gold may have reached its peak, it would not be surprising if they decide to sell off their positions in the metal. With such a large portion of the market potentially pulling away from gold, the selling pressure could intensify, leading to a sharp drop in prices.

If this trend gains momentum, we could witness a rapid and dramatic decline in gold’s value. The metal, which has been the go-to asset for many investors during times of economic uncertainty, could soon lose its appeal as a safe haven. The factors driving this potential downturn are multifaceted, ranging from shifting monetary policies and global inflationary pressures to geopolitical tensions and central bank strategies.

The impact of this market shift could be far-reaching. Not only would it affect the price of gold, but it could also send shockwaves through the broader commodities and financial markets. If the sell-off gathers pace, it could have a cascading effect, causing investors to rethink their positions in other assets traditionally viewed as safe havens, such as silver or even government bonds.

The question on many investors’ minds is whether this bearish trend is a temporary correction or the beginning of a longer-term downturn. Only time will tell, but one thing is certain: the dynamics of the gold market are shifting, and the once steady climb of the metal may now be facing a downward spiral.

For those who are closely following the market, it is essential to stay updated on the latest developments. A deeper analysis of the factors driving this potential gold sell-off and the broader market implications can offer valuable insights into the direction of this volatile asset.

As we continue to monitor the situation, I encourage you to stay informed and consider how these developments could impact your own investments. While gold may still hold value in the eyes of many, its future trajectory is now uncertain, and the risk of significant price fluctuations looms large.

Thank you for your attention, and I wish you the best of luck navigating these turbulent financial waters!

Xauusdsell

Gold opens lower and moves lower, the rebound continues to be beThe gold 1-hour moving average crosses downwards and the short positions are arranged, and it continues to open downwards. So gold is now the home of the shorts. Gold rebounds or continues to be short. Gold is now in a short trend under the gap. Gold rebounds around 3050 and continues to be short.

Trading ideas: short gold near 3050, stop loss 3060, target 3030

Geopolitical Tensions, Supporting Bullish Outlook for GoldOver the weekend, geopolitical tensions remained elevated:

A mortar attack targeted the vicinity of Aden Adde International Airport in Mogadishu, Somalia.

U.S. forces launched airstrikes on key targets in Saada, a city in northern Yemen.

Ukrainian forces conducted multiple strikes on Russian energy infrastructure.

Massive protests erupted across dozens of U.S. cities, marking the first large-scale demonstrations since former President Trump returned to office. Trump described the recent U.S. stock market plunge as “intentional” and urged Americans to “stay strong.”

In Europe, Germany is reportedly considering repatriating 1,200 tons of gold reserves currently stored in the United States—signaling potential mistrust in global financial stability.

Fundamental Outlook

Given the ongoing geopolitical uncertainty, investor demand for safe-haven assets like gold is expected to remain strong. As risk sentiment continues to deteriorate, buyers are likely to dominate the market, especially on price dips. We anticipate increased buying interest next week, which could support gold prices and potentially lead to a breakout from the current consolidation zone.

Additionally, macroeconomic data releases will play a crucial role. The U.S. CPI report, due Thursday, will be the most closely watched indicator. A higher-than-expected CPI could cause markets to reassess the timing and scale of potential Fed rate cuts, resulting in a temporary rebound in the U.S. dollar and Treasury yields. However, sustained higher borrowing costs would intensify recession risks, limiting any dollar strength. This dynamic continues to favor gold in the medium to long term.

We are entering a phase where the fundamental and technical landscapes are increasingly aligned in favor of the bulls. The recent pullback in prices presents a strategic opportunity for medium- to long-term buyers to accumulate positions.

Those already holding long positions—whether currently in profit or facing temporary drawdowns—are advised to remain patient and avoid emotional exits. The broader structure remains supportive of higher prices in the coming sessions.

I will continue to provide real-time updates, entry/exit suggestions, and risk control strategies during market hours. Be sure to stay connected and follow the guidance closely.

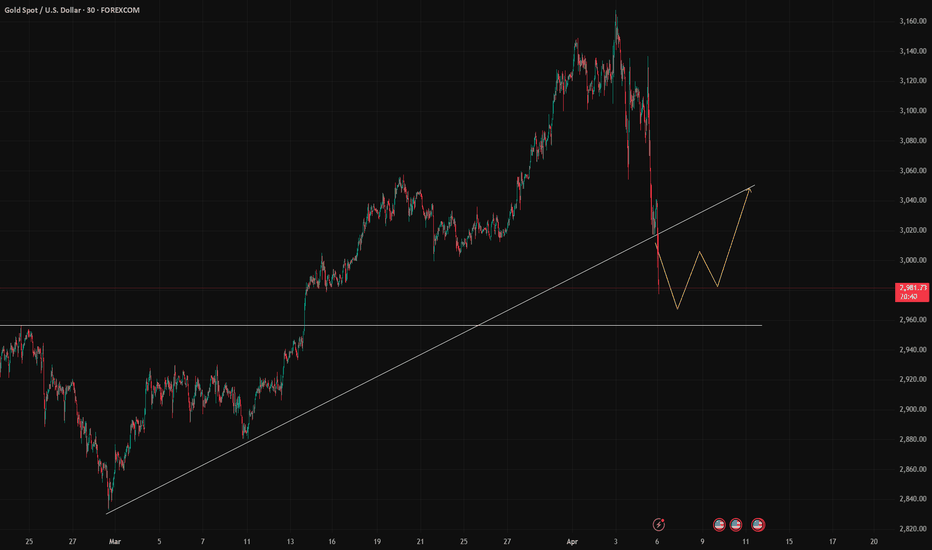

4/7 Gold Trading StrategiesGold opened with a massive gap down today due to growing market panic, plunging below the $3000 psychological level. Although it briefly rebounded to $3030+, selling pressure intensified again, dragging prices back below $3000 and continuing to test lower support levels.

This sharp sell-off wiped out almost two months of previous gains. While the panic is real, it’s important not to be ruled by fear. Lower prices offer entry opportunities for long-term bullish capital. In such moments, we need courage as much as caution.

Rather than following fear blindly, we suggest looking for buy opportunities at lower support zones, with a combination of scalping tactics for short-term trades.

📌 Trading Strategy:

🟢 Buy Zone: $2980 – $2950

🔴 Sell Zone: $3040 – $3060

🔁 Scalping Zone: $3021 – $2996

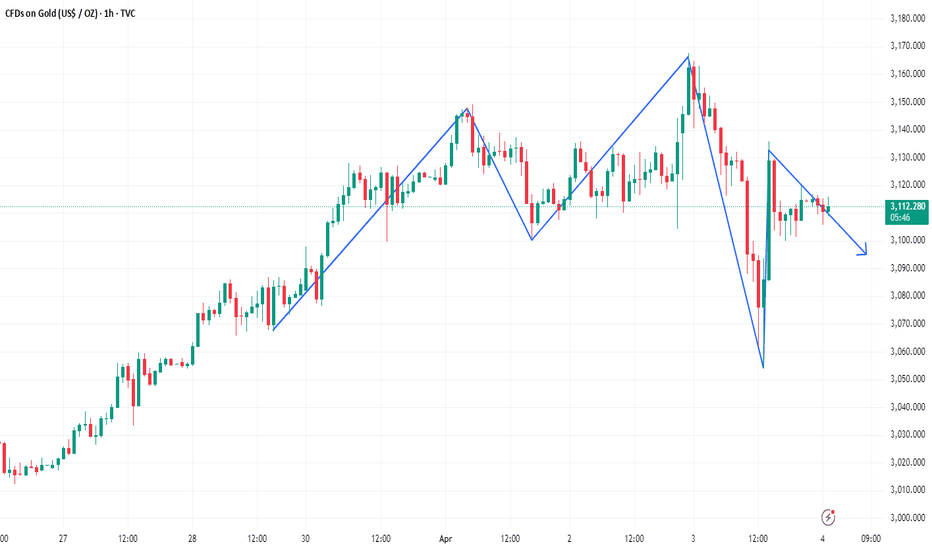

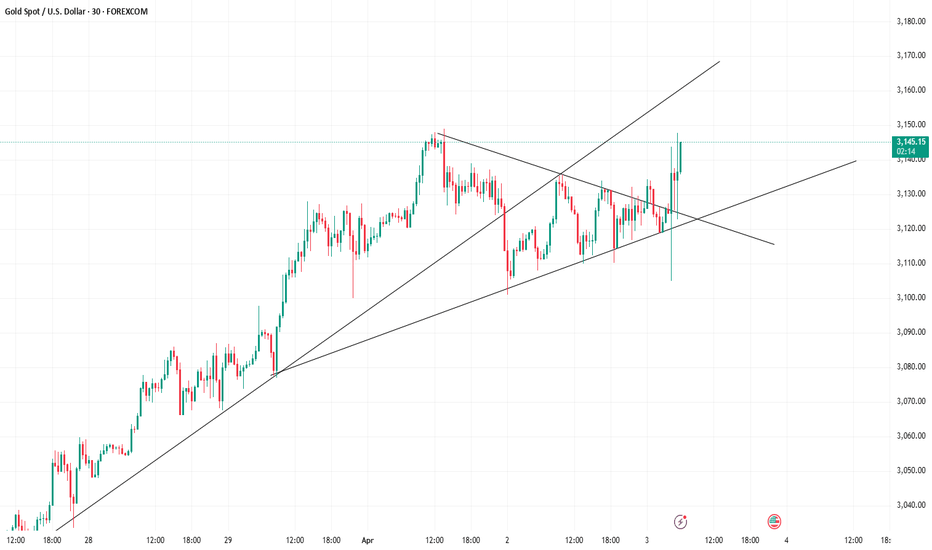

#XAUSUD: Small Time Bearish Correction With Three Take Profit! After reaching a record high of $3,150, the XAUUSD currency pair has experienced a decline. Analysis conducted over the past few hours has led us to anticipate that the price may experience minor corrections within a short time frame.

Upon analysing the data and price movements, we have identified three distinct zones or targets that could serve as potential price levels for the XAUUSD pair.

For further insights into chart analysis, please consider liking and commenting on our content. We appreciate your continuous support.

Sincerely,

Team Setupsfx_

#XAUUSD: Last Sell Idea Dropped +300 Pips, Bias Changed? XAUs price behaviour has deviated from previous analysis, which had anticipated a +300 pips increase. However, we now anticipate the price to continue its upward trend, potentially reaching another record high. Our next target price range is estimated to be between 3170$ and 3200$.

We extend our best wishes for your successful trading endeavours. To enhance your trading outcomes, we strongly recommend employing accurate risk management techniques.

Team Setupsfx_

🚀❤️

4/4 Gold Trading StrategiesAfter yesterday’s sharp drop, gold quickly rebounded, and by the end of the session, prices had returned close to the opening level. I’m not sure if anyone is currently stuck in unfavorable positions. Under normal circumstances, if your account has sufficient margin and risk tolerance, such volatility shouldn’t cause major damage. However, for those with weak positions or who bought at the top or sold at the bottom, losses may have occurred—especially common among newer traders who are often influenced by emotions.

If you are currently holding short positions and hoping to wait for a price pullback, you'll need both time and sufficient margin. Based on current candlestick patterns, gold may attempt to test the 3128–3136 resistance zone again. Whether it moves higher will depend on the strength of the bulls.

Importantly, there are several key U.S. economic data releases during the New York session today. Based on preliminary expectations, the data appears to favor the bears, which could put additional pressure on gold prices.

📉 Today’s Trading Strategy:

Sell within the 3133–3152 zone

Buy within the 3065–3032 zone

📊 Scalping/Short-Term Trades:

Be flexible in the 3128–3088 range

XAU/USD Analysis – Wedge Breakdown & Bearish Trade Setup1. Chart Overview

The 15-minute XAU/USD chart shows a descending wedge pattern forming after a price rally. The wedge is characterized by a series of lower highs and lower lows, signaling a gradual weakening of bullish momentum. After consolidating within this wedge, the price has broken down, suggesting a bearish continuation.

This setup provides a high-probability short trade with clear entry, stop-loss, and multiple take-profit levels.

2. Key Technical Elements

A) Chart Pattern – Descending Wedge Breakdown

A descending wedge is typically a bullish reversal pattern when forming at the bottom of a downtrend. However, in this case, it appears at the end of a corrective move, making it a bearish continuation setup.

The upper trendline (black dashed line) acts as resistance, preventing price from breaking higher.

The lower trendline (solid blue line) represents temporary support.

The wedge narrows as price action contracts, leading to an eventual breakdown.

👉 Breakout Confirmation:

The price has broken below the wedge’s support trendline.

A minor pullback to retest the broken trendline suggests validation of the breakdown.

B) Resistance & Support Levels

1️⃣ Resistance Level (Sell Zone) – $3,100 to $3,135

This area previously acted as a supply zone, rejecting bullish attempts.

Price was unable to sustain above this level, leading to further downside pressure.

Stop-loss should be placed above this level ($3,135.57) to protect against invalidation.

2️⃣ Support Level (Buy Zone) – $3,050 to $3,056

This was a previous reaction zone where price briefly bounced before continuing lower.

Now acting as Take Profit 1 (TP1) at $3,056.58.

3️⃣ Breakout & Retest

After breaking the wedge, price retested the trendline but failed to reclaim it, confirming the bearish trend.

3. Trade Setup & Execution

🔵 Entry Point:

Short trade activation upon the breakdown and retest of the wedge structure.

Price rejection at the trendline confirms seller strength.

🔴 Stop-Loss:

Placed at $3,135.57, slightly above recent swing highs.

This protects against false breakouts or sudden reversals.

🎯 Take Profit Levels:

TP1 ($3,056.58): First target where buyers might step in.

TP2 ($3,022.39): Midway target, acting as another strong support.

TP3 ($2,985.44): Final target where price may stabilize or reverse.

4. Market Context & Confirmation Indicators

📉 Bearish Confirmation:

Strong downward momentum suggests continued selling pressure.

Price action is failing to make new highs, confirming lower highs and lower lows.

📊 Risk-to-Reward Ratio (RRR):

The trade offers a favorable RRR, as the downside potential is significantly larger than the stop-loss range.

⚡ Additional Confirmation:

A strong bearish candle confirmed the breakout, rejecting higher levels.

Potential support breakouts suggest that price could reach TP3 if bearish momentum continues.

5. Conclusion – Trading Strategy Summary

✅ Pattern Identified: Descending Wedge Breakdown (Bearish)

✅ Trade Direction: Short (Sell)

✅ Entry Trigger: Breakout & Retest of the Trendline

✅ Stop-Loss: Above $3,135.57 (Wedge Resistance Zone)

✅ Take Profit Targets:

TP1: $3,056.58

TP2: $3,022.39

TP3: $2,985.44

📌 Final Thoughts:

This setup provides a high-probability trade with a clear breakdown structure and downside potential. If the price continues to respect the bearish trend, reaching all TP levels is likely. However, traders should monitor for reversal signals and manage risk accordingly.

🔔 Risk Warning: Always use proper risk management and adjust positions according to market conditions! 🚀

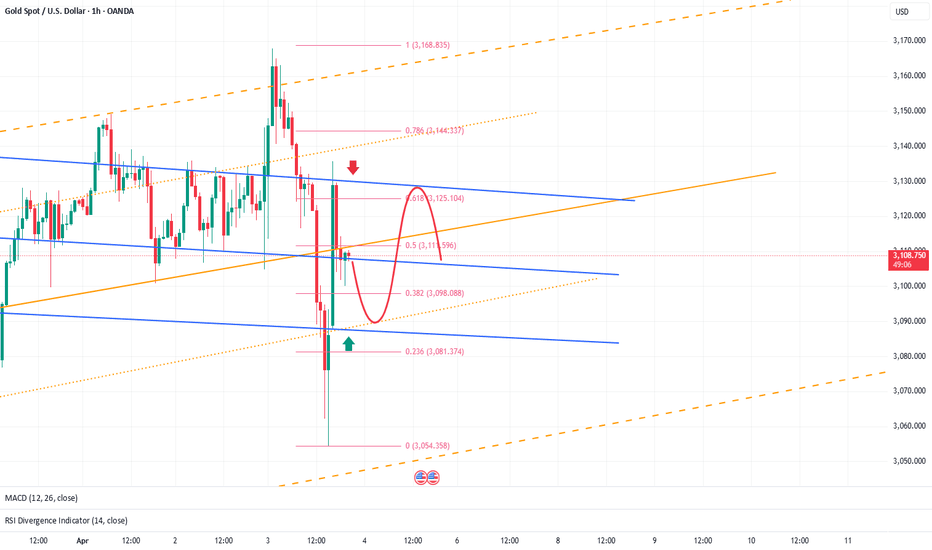

How will gold perform after the super rollercoaster market?Gold's 1-hour moving average still shows signs of turning downwards. Although gold bulls have made a strong counterattack, it is also because of the risk-aversion news that stimulated a retaliatory rebound. However, gold continued to fall after rising, and gold began to return to volatility. In the short term, gold is supported near 3100. If gold falls below the support near 3100 again, then gold shorts will still have an advantage in this war. Overall, the impact of today’s non-agricultural data is expected to be dim. What is more important is the stimulation of the news. However, it may be noted that if gold holds the 3100 mark for a long time, then gold is expected to fluctuate upward above 3100.

Trading idea: short gold near 3115, stop loss 3125, target 3100

The above is purely a sharing of personal views and does not constitute trading advice. Investments are risky and you are responsible for your profits and losses.

NFP - Shorting GoldThe gold market experienced huge fluctuations on Thursday, which created very good profits for us. During the entire trading process, we seized the profits of fluctuations of more than $50.

The unemployment rate and NFP data during the US trading session on Friday, as well as Powell's speech on the economic outlook, are the focus of Friday's trading.

Judging from the data released in March, the unemployment rate and NFP are more likely to be bearish for gold, so when trading data, my plan is to focus on short positions.

At present, in terms of technical form, the indicators show that the bulls have not ended. In this case, the transaction needs to pay attention to the 3123/3136 resistance. If it cannot break through, the price is expected to fall again to 3103 or even 3086.

Overall, today's trading focus is to sell at high levels.

XAUUSD: Buy or Sell?Today's gold market can be said to have the largest intraday volatility since 2025! After experiencing violent fluctuations, the current trend of gold has once again become anxious.

However, from the perspective of range conversion, it is certain that gold is currently operating in a weak position, and after the brutal and violent fluctuations, the market also needs to recuperate. And there will be NFP tomorrow. It is expected that before NFP, it will be difficult for gold to form a new unilateral market again. So in the process of shock, I think both long and short sides have a certain profit space.

First of all, pay attention to the resistance of 3125-3135 area on the top. If gold touches this area during the shock process, we can still short gold;

And the first focus on the 3095-3085 area on the bottom is that if gold touches this area during the shock process, we can still consider going long on gold.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Gold (XAU/USD) Breaks Ascending Channel – Bearish Move Ahead?📉 Market Structure:

Gold was moving in an ascending channel, but price has now broken below the support trendline.

This suggests a possible trend reversal or correction.

📌 Key Levels:

Resistance : $3,125 - $3,170

Support: $3,054 - $3,035

Target: $3,000 - $2,995

📊 Trade Idea:

A pullback to support-turned-resistance could give a short entry.

Bearish target: $3,000 if rejection holds.

Invalidation: If price reclaims $3,125.

🔍 Watch for:

Price reaction at the former channel support.

Possible retest before further drop.

Let me know if you need any modifications! 🚀

4/3 Gold Trading StrategiesTariff concerns and inflation have once again triggered significant volatility in gold. After yesterday’s price surge following news announcements, today’s market opened with continued bullish momentum, reaching around 3170.

For traders who managed to keep up with the market rhythm, this was a golden opportunity—but for those caught on the wrong side, it was a disaster. The persistent price rally has put short sellers under significant pressure. While I hope most of you are in long positions, I also understand that’s not always the case. For those stuck in short trades, the key now is to minimize losses or even turn the situation into a profit.

Based on the current price structure, I expect a high-level pullback. If your short position isn't causing serious damage to your account, holding on could be a viable strategy.

The expected trading range includes a high point at 3166-3178 and a low point at 3138-3123. Additionally, several key technical levels need to be monitored for potential reversals.

Trading Recommendations:

📌 Main Trades:

Sell in the 3166-3182 range

Buy in the 3136-3121 range

📌 Short-Term Scalping:

Be flexible in the 3147-3158 range

Manage your risk carefully and adjust your trades based on market movements! 🚀

Data will be Bearish for GOLDAffected by tariffs and inflation news, gold fluctuated sharply before the market closed. The market was in a situation of double kills for both long and short positions, and the sentiment was still fermenting. At present, the bulls also took this opportunity to successfully break through the resistance, and the price returned to above 3140 again. From the perspective of the pattern, there is still room for growth in the short term.

Before the US market, you can look for trading opportunities in the 3158-3123 range. The unemployment benefit data will be released during the US market, and the data is expected to be bearish for gold. Therefore, within 30 minutes before the data is released, if you hold a long order, please be cautious. At that time, I will also send you the latest trading plan based on the market situation.

If you are currently in trouble and need help, you can leave me a message.

Gold: Soaring on Tariffs, Testing Technical WatersIn the early trading session of the Asian market on Thursday (April 3rd), spot gold continued its upward trend and once reached a new all - time high of $3,167 per ounce. This was because US President Donald Trump said on Wednesday that he would impose a benchmark tariff of 10% on all goods imported into the United States and impose higher tariffs on some of America's largest trading partners. This move will lead to an intensification of the trade war that he initiated after returning to the White House, causing the market's risk - aversion sentiment to soar sharply.

However, given the rapid increase in the gold price, one should not blindly chase after buying more gold. On the one hand, the rapid rise in the gold price has accumulated a certain amount of pressure for a correction, and there is a high probability that a pullback and subsequent recovery rally will occur. On the other hand, the highly anticipated Nonfarm Payrolls data will be released tomorrow. On the eve of its announcement, the market will not quickly break out of a well - defined trading range and price level.

On the daily chart level, gold entered a downward adjustment mode on Tuesday, breaking the previous consecutive upward trend with positive candles. However, the current moving - average system still maintains a pattern of diverging upwards. Today, the key focus is on whether the downward movement of the market is sustainable. Firstly, we need to pay attention to the support effectiveness of the short - term moving average MA5. Currently, this moving average is roughly located around 3098, which is extremely close to yesterday's low of 3100 when the price dropped. If this support level can hold, then in the short term, gold can still be regarded as being in a strong pattern.

XAUUSD

buy@3105-3115

tp:3140-3160

Gold (XAU/USD) – Rising Wedge Breakdown & Bearish SetupOverview

Gold (XAU/USD) has been in a strong uptrend, making consistent higher highs and higher lows. However, the price action has formed a Rising Wedge Pattern, which is typically a bearish reversal formation. This pattern suggests that the bullish momentum is weakening, and a potential sell-off could follow.

The recent breakdown of the wedge structure confirms the bearish bias, and sellers are now in control. Based on price action analysis, we can anticipate further downside movement toward key support levels.

📊 Technical Analysis – Rising Wedge Breakdown

1️⃣ Understanding the Rising Wedge Pattern

The Rising Wedge is a bearish pattern that occurs when the price consolidates within an upward-sloping channel but shows signs of exhaustion. Here’s how it developed:

Higher Highs & Higher Lows: The price consistently formed higher peaks and troughs, indicating an uptrend.

Declining Bullish Momentum: As the wedge progressed, price action became increasingly squeezed, showing reduced bullish strength.

Breakout Confirmation: Once the lower trendline of the wedge was breached, it confirmed that buyers were losing control and that sellers had stepped in.

2️⃣ Key Levels & Market Structure

🔵 Resistance Level: The upper boundary of the wedge around $3,150 - $3,163 acted as a supply zone, where sellers pushed prices lower.

🟠 Support Level: The lower boundary of the wedge, around $3,100 - $3,120, initially provided demand but eventually failed to hold.

🔻 Breakdown Confirmation: The price broke below the wedge, which is a strong bearish signal.

🎯 Trade Setup & Strategy

3️⃣ Bearish Trading Plan

Given the breakdown of the wedge pattern, the setup favors a short (sell) trade. Here’s how to approach it:

📉 Sell Entry:

The ideal short position is initiated after a confirmed break of the wedge’s support level.

📍 Stop Loss (SL):

A tight stop-loss is placed above the previous resistance at $3,163.67, ensuring risk is controlled if the trade goes against the bias.

🎯 Take Profit (TP) Targets:

TP 1: $3,080.66 – First major support level, where buyers might step in temporarily.

TP 2: $3,057.33 – Extended downside target, offering a greater risk-to-reward ratio.

4️⃣ Additional Price Expectations

Retest of the Wedge Breakdown: The price may pull back to the broken wedge support before continuing downward.

Stronger Bearish Momentum: If selling pressure remains strong, price could fall even lower, breaking TP 2.

Invalidation Level: If price climbs above $3,163, the wedge breakdown would be invalidated, signaling that bulls have regained control.

📌 Conclusion & Market Sentiment

🔹 Rising Wedge Breakdown Signals Further Downside – The market structure suggests that sellers are gaining control.

🔹 Sell Setup with Risk-Managed Approach – With a defined stop-loss and two profit targets, this trade offers a favorable risk-to-reward setup.

🔹 Gold’s Short-Term Bearish Outlook – The chart confirms a potential correction, and price may drop towards $3,080 and $3,057 if the bearish momentum continues.

📊 Final Thought:

This is a high-probability short trade based on classic technical analysis. Traders should monitor for confirmation retests and manage risk accordingly. ✅

Would you like any refinements or additional insights? 🚀

XAUUSD Head & Shoulders Breakdown – Bearish Target Ahead?This chart represents a detailed technical analysis of Gold Spot (XAU/USD) on the 1-hour timeframe with a structured trade setup based on a Head and Shoulders (H&S) reversal pattern. Below is an in-depth explanation of the chart components, price action, and trade strategy.

1️⃣ Key Chart Patterns and Analysis

A. Head and Shoulders Pattern (Bearish Reversal)

This is a well-known bearish reversal pattern that signals a potential trend change from bullish to bearish. It consists of three peaks:

Left Shoulder: A rise followed by a temporary pullback.

Head: The highest peak in the pattern, showing strong buying pressure before reversal.

Right Shoulder: A smaller rise compared to the head, indicating weakening bullish momentum.

B. Neckline (Support Level) and Breakdown Confirmation

The neckline (horizontal support level) is drawn across the lowest points between the shoulders.

A break below the neckline confirms the reversal, triggering a bearish move.

The chart suggests price is at the neckline zone, preparing for a breakdown.

2️⃣ Trendline and Support/Resistance Analysis

A. Uptrend Trendline Break

The price was following a strong ascending trendline (dotted black line).

A trendline breakout has occurred, indicating potential trend reversal.

This supports the bearish bias further.

B. Resistance and Support Levels

Resistance Level: Marked at the top of the Head region, which aligns with previous price rejection zones.

Support Levels:

First support (TP1 - 3,053.269): This is the first potential take profit level.

Second support (TP2 - 3,030.556): The next target if price continues downward.

3️⃣ Trade Setup & Risk Management

A. Entry Point (Short Position)

Sell (Short) after the neckline breakout, ensuring bearish momentum is confirmed.

B. Take Profit (TP) Targets

TP1: 3,053.269 (Initial support target).

TP2: 3,030.556 (Stronger support zone, deeper profit target).

C. Stop Loss Placement

Stop Loss: 3,150.726 (Above the resistance zone).

This is a logical stop-loss placement, allowing price fluctuations without prematurely stopping the trade.

4️⃣ Overall Market Sentiment & Trade Bias

Bearish Bias: Due to the formation of the Head and Shoulders pattern, trendline breakout, and weakening bullish momentum.

Confirmation Needed: A strong bearish close below the neckline increases probability of downward continuation.

5️⃣ Final Thought – A High-Probability Trade Setup

If neckline breaks, the trade is valid with potential for a 3%+ downside move.

If price holds above the neckline, the pattern may fail, leading to reconsidering trade execution.

This structured risk-managed approach ensures a strategic entry, controlled risk, and maximized profit potential. 📉🔥 Let me know if you need further refinements! 🚀

GOLD: May fall below 3100So far, gold has continued to fluctuate in the 3110-3136 range. Although the candle chart has many long lower shadows, the high point is moving down. If this trend is not broken, the probability of falling below 3100 today is very high, so when trading, everyone must be cautious. Personally, I suggest selling as the main method.

A rebound is a good opportunity to short goldGold rebounds from 3100, but is the bullish momentum truly revived?

I don’t see it that way. Yesterday’s retracement to 3100 has already weakened the strong bullish structure to some extent, with 3150 likely acting as a key resistance level. I believe the current rebound is merely a technical retest of the 3150 zone, reinforcing it as a potential cycle high and paving the way for a double-top formation, which could provide a bearish technical setup for further downside.

Following the initial 3100 test, a second retest of this support level is likely. If gold fails to hold 3100 on the second attempt, a break lower towards 3095-3085 would become increasingly probable.

I will continue to scale into short positions within the 3132-3142 zone, with an initial target of 3120-3110. If gold approaches 3100, I will closely monitor the price action to assess the likelihood of a further breakdown.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

4/2 Gold Trading StrategiesAfter yesterday's upward movement, gold experienced a deeper pullback, testing the 3100 area before rebounding to around 3120. However, based on technical indicators, the bullish outlook remains uncertain.

The key resistance to watch is around 3125—if the price fails to break through, we shouldn't expect higher levels today. In that case, the main trading direction will be short positions, with a possible drop to 3086 before tomorrow’s data release.

However, if 3125 resistance is broken and sustained, bulls may attempt another rally towards 3138-3150. On the bearish side, support in the 3103-3096 region is crucial.

Trading Recommendations:

📌 Main Trades:

Buy in the 3098-3086 range

Sell in the 3138-3148 range

📌 Short-Term Scalping:

Sell in the 3124-3131 range

Buy in the 3109-3103 range

Continue to short gold, there is still huge downside potentialGold fell below the short-term key support of 3120 and extended to around 3100. The short-term raid caught most long traders off guard. Today, I evaluated from both market factors and risk factors, and made a plan to short gold in the 3135-3145 zone, with the goal of a pullback to 3100. The potential profit space is $50. I believe that as long as you pay attention to and follow my trading strategy, you will definitely make a lot of money today!

At present, gold has rebounded slightly after touching around 3100, but I do not recommend going long on gold in this position area; because a sharp drop in gold can easily hit the confidence of long traders, stimulate profit-taking and panic selling, so I think the decline is not over.

Even from a technical perspective, although gold has a certain degree of technical repair after a rapid decline, it is obvious that the 4-hour level has not started to make up for the decline, indicating that there is still a lot of room for correction below. In this round of decline, I think gold is likely to continue to fall to the area around 3085, or even the 3075-3065 zone.

Therefore, for short-term trading, we can still consider shorting gold in batches after it rebounds to the 3115-3125 zone, with the target pointing to the 3095-3085 zone.The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

4/1 Gold Analysis & Trading SignalsThe combination of fundamental influences and technical patterns led to a sharp surge in gold prices after the market opened yesterday. The upward momentum only slowed during the New York session, but prices remained above 3100. However, after this rally, the technical setup is not particularly favorable for bulls. That said, if fundamental factors continue to support the market, any technical pullback could provide another buying opportunity for bulls.

Key Considerations:

🔸 Besides technical factors, we need to monitor geopolitical tensions—if the situation eases, demand for gold as a safe haven could decrease.

🔸 If tensions escalate further, gold is likely to rise, making it unwise to blindly short the top. Instead, we should adjust our trading strategy based on market developments while using technical patterns for entry and exit points.

🔸 If a pullback occurs, support is seen around 3109.

🔸 If the price continues upward, given current market conditions, a single rally is unlikely to exceed $30, so the first resistance zone is estimated at 3136-3145.

Trading Strategy for Today:

📈 Buy in the 3111-3101 range

📉 Sell in the 3135-3145 range

Stay flexible, follow the market closely, and adjust strategies accordingly. Let me know if you need further insights!

XAUUSD:Adhere to the strategy of selling at high levelsI have consistently adhered to the strategy of shorting gold. Today, after the gold price spiked upwards, it showed a pattern of being under pressure. The price reached a peak of 3149 and then pulled back. After fluctuating during the U.S. trading session, it continued to decline. Currently, it has broken below the intraday demarcation level of 3120, which in the short term indicates that the bullish trend has temporarily come to an end, and a retracement and adjustment trend has started.

This is also the risk that has been repeatedly highlighted. One should not be blindly carried away by the bullish sentiment and should always maintain a sense of reverence for the market. In the early morning, when the price tested the resistance level around 3135, short positions could be initiated. Now, the price has plummeted rapidly to the resistance level of 3100. It is estimated that most long positions have been stopped out, but we have still achieved the take-profit.

In the subsequent trading, focus on the resistance level around 3130. If this level is not breached, one can continue to chase short positions.

XAUUSD Trading Strategy:

sell@3130

TP:3110-3100