4/1 Gold Analysis & Trading SignalsThe combination of fundamental influences and technical patterns led to a sharp surge in gold prices after the market opened yesterday. The upward momentum only slowed during the New York session, but prices remained above 3100. However, after this rally, the technical setup is not particularly favorable for bulls. That said, if fundamental factors continue to support the market, any technical pullback could provide another buying opportunity for bulls.

Key Considerations:

🔸 Besides technical factors, we need to monitor geopolitical tensions—if the situation eases, demand for gold as a safe haven could decrease.

🔸 If tensions escalate further, gold is likely to rise, making it unwise to blindly short the top. Instead, we should adjust our trading strategy based on market developments while using technical patterns for entry and exit points.

🔸 If a pullback occurs, support is seen around 3109.

🔸 If the price continues upward, given current market conditions, a single rally is unlikely to exceed $30, so the first resistance zone is estimated at 3136-3145.

Trading Strategy for Today:

📈 Buy in the 3111-3101 range

📉 Sell in the 3135-3145 range

Stay flexible, follow the market closely, and adjust strategies accordingly. Let me know if you need further insights!

Xauusdsell

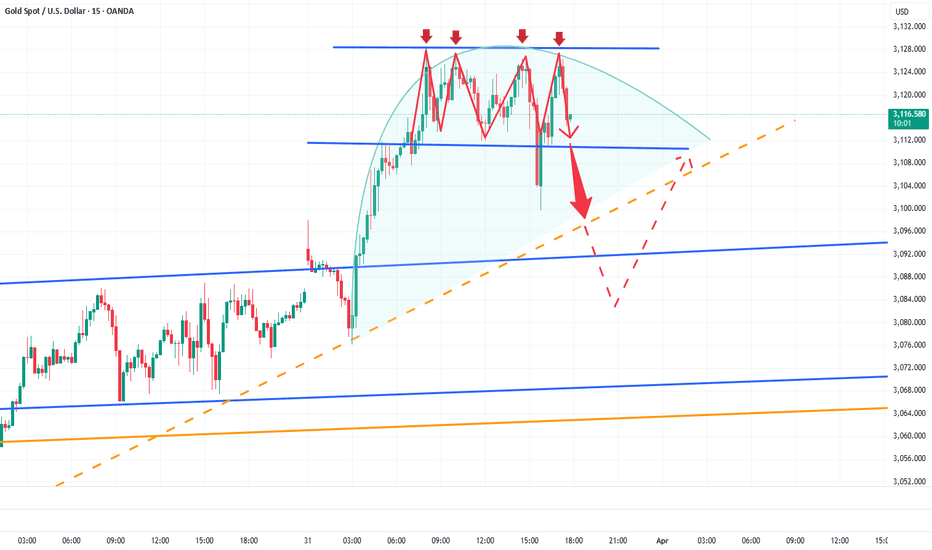

XAUUSD:Adhere to the strategy of selling at high levelsI have consistently adhered to the strategy of shorting gold. Today, after the gold price spiked upwards, it showed a pattern of being under pressure. The price reached a peak of 3149 and then pulled back. After fluctuating during the U.S. trading session, it continued to decline. Currently, it has broken below the intraday demarcation level of 3120, which in the short term indicates that the bullish trend has temporarily come to an end, and a retracement and adjustment trend has started.

This is also the risk that has been repeatedly highlighted. One should not be blindly carried away by the bullish sentiment and should always maintain a sense of reverence for the market. In the early morning, when the price tested the resistance level around 3135, short positions could be initiated. Now, the price has plummeted rapidly to the resistance level of 3100. It is estimated that most long positions have been stopped out, but we have still achieved the take-profit.

In the subsequent trading, focus on the resistance level around 3130. If this level is not breached, one can continue to chase short positions.

XAUUSD Trading Strategy:

sell@3130

TP:3110-3100

GOLD-Sell in the 3128-3138 rangeThe buy orders placed at 3121-3124 yesterday successfully reached the take-profit zone of 3132-3138 today, after which the price also entered the short-selling zone of 3135-3145, leading to another profitable trade.

As of now, the 3124 support remains intact, but bullish momentum has significantly weakened. Without further fundamental catalysts, a technical-based approach suggests prioritizing short positions, as the recent surge of over $130 makes a technical correction increasingly imminent.

Trading Strategy for Today:

📉 Sell in the 3128-3138 range

📈 Buy in the 3103-3093 range

Short gold, profit target: 500pipsAfter reaching a fresh high of 3150, gold pulled back and has since been consolidating in a narrow range around 3132. While there is no denying that gold remains in a strong bullish trend, I believe it is now at its peak and could top out at any moment. This is why I continue to look for shorting opportunities rather than blindly chasing long positions—because I must first evaluate whether I have the risk tolerance to withstand a potential long-side drawdown.

Currently, gold is showing signs of exhaustion, retreating from 3150 and stalling near its ascending trend channel resistance. There is a strong possibility that this marks the end of the parabolic uptrend, leading to a rounded top correction, similar to the previous price cycle. A potential retracement zone aligns with a $50 pullback.

From a risk management perspective, going long at elevated levels presents significant challenges in setting a stop-loss (SL). A tight SL increases the probability of being stopped out due to market volatility, while a wider SL or no SL at all could expose long positions to severe drawdowns or liquidation if the market collapses.

On the contrary, short positions allow for better-defined SL placement, and gold tends to correct sharply after an extended rally, offering favorable exit opportunities. The worst-case scenario for short sellers is missing out on further upside gains, but in return, we significantly reduce the risk of capital destruction. This is the primary reason why I remain firmly bearish on gold at current levels!

Gold has retreated from its 3150 high, showing signs of momentum exhaustion. Given this price action, traders can consider initiating short positions within the 3135-3145 zone, aiming for a pullback toward the 3100 level. This setup offers a potential $50 profit per trade.

GOLD: Potential RisksIf the price reaches the 3136-3148 range, there is no need to hesitate, just sell. This is the gold trading strategy for today provided to you before yesterday's closing. I wonder if any friends have grasped this profit?

After getting support near 3125, the price rebounded again. It is still in the rising stage. The resistance continues to focus on the vicinity of 3148.

Here is a reminder for everyone: During the trading process, the technical pattern of the 2H and above cycle level has a turning point. This is not a joke, so everyone must be cautious when chasing highs.

Even if there is news supporting the market now, news is something we cannot control. Once there is news of easing the situation, the risk aversion of gold will subside, and the decline will definitely not be small.

So while we follow the trend, we must also learn to think against the trend!

XAUUSD Bearish Breakdown: Riding the Rising Wedge to Profit1. Chart Pattern: Rising Wedge (Bearish Reversal)

The Rising Wedge is a technical pattern that occurs when price makes higher highs and higher lows within converging trendlines. This pattern is considered bearish, as it usually precedes a breakdown when price fails to sustain the higher levels.

The pattern is clearly visible as price moves within two upward-sloping black trendlines.

The narrowing range suggests that buying pressure is weakening, and sellers are gaining control.

A confirmed breakdown occurs when price breaks below the lower trendline, indicating potential further downside.

2. Key Technical Levels

Resistance Level (Highlighted in Beige, Top Box)

This area represents a strong supply zone where price has struggled to move higher.

Each time the price reaches this level, selling pressure increases, pushing the price lower.

The chart labels this as the Resistance Level, suggesting a potential reversal zone.

Support Level (Highlighted in Beige, Lower Box)

This is the previous demand zone, where price has rebounded multiple times.

Once price reaches this level, buyers may attempt to push it higher.

However, if this level fails to hold after the breakdown, further downside is expected.

Stop Loss Level (~3,150)

The stop loss is placed just above the recent highs.

If price moves beyond this level, it would invalidate the bearish setup.

Traders use stop losses to limit risk in case the market moves against the position.

Target Level (~3,080)

This is the projected downside target based on the height of the wedge.

A measured move (calculated from the highest to the lowest point of the wedge) aligns with this target.

It represents a potential 1.78% decline from the breakdown level.

3. Price Action & Trade Setup

Breakout Confirmation:

The price broke below the lower trendline, confirming a wedge breakdown.

The bearish momentum suggests sellers are in control.

Entry Zone:

A good short-selling opportunity is identified after the breakdown and potential retest of the lower trendline.

Risk Management:

Stop loss at 3,150 (above resistance).

Profit target at 3,080 (expected support).

This gives a favorable risk-to-reward ratio.

4. Market Psychology Behind the Pattern

Rising Wedge Psychology:

The pattern forms as buyers push price higher, but each new high has weaker momentum.

Eventually, selling pressure outweighs buying interest, leading to a breakdown.

Resistance & Support Psychology:

The resistance area acts as a supply zone where big traders sell their positions.

The support zone may hold temporarily, but if it breaks, panic selling could accelerate the decline.

5. Possible Scenarios After the Breakdown

Bearish Case (Most Likely Outcome)

Price continues downward after breakdown.

It reaches the 3,080 target with increased selling momentum.

Confirmation of a bearish reversal pattern.

Bullish Case (Invalidation of Setup)

Price reclaims the wedge and moves back above resistance.

It invalidates the bearish breakdown, stopping out sellers.

A potential bullish continuation toward new highs.

Final Thoughts

This chart presents a high-probability short trade based on the Rising Wedge breakdown and resistance rejection. Traders can manage risk by setting a tight stop loss above resistance while aiming for a target at the next key support zone. The pattern suggests a bearish sentiment in the short term, favoring sell setups over buying opportunities.

Would you like me to add further insights, such as Fibonacci levels or RSI analysis, to strengthen the trade idea? 🚀

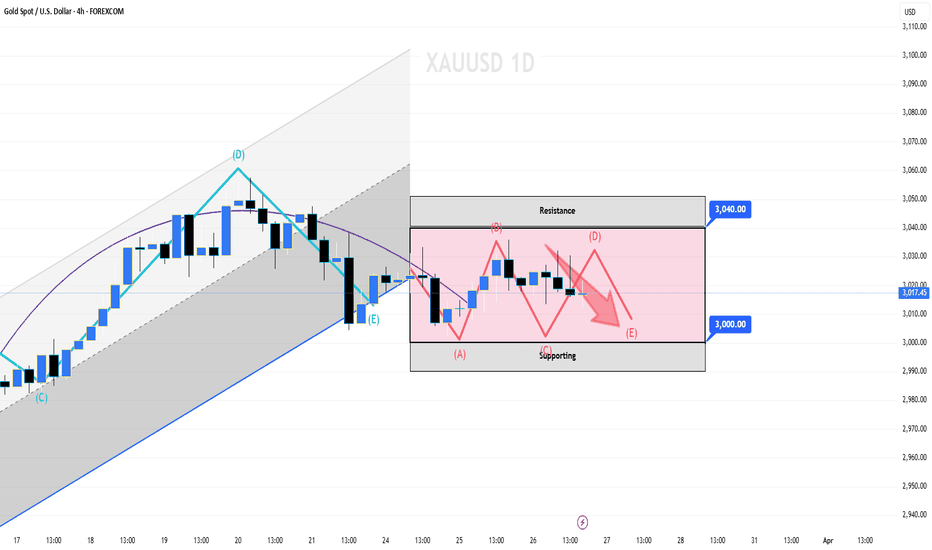

3/31 Gold Trading StrategiesThe five-wave upward movement in gold has been completed. Next, we expect a period of consolidation around 3130, forming a short-term top before a potential pullback. However, during this consolidation phase, there is a possibility of a price surge, though the probability is low.

Trading Suggestions:

For conservative traders: Avoid rushing into positions. It’s better to wait for a pullback and the confirmation of a secondary top before entering trades.

For aggressive traders: You may enter at the current price, but be cautious with your position sizing and leave room for potential additions.

Based on the magnitude of the previous upward movement, the expected retracement zone is around 3110-3096, where a minor support level may form.

Trading Strategy:

📉 Sell in the 3121-3131 range

📈 Buy in the 3105-3090 range

Trade carefully

GOLD: What to do if you Hold a Short position?Gold is rebounding. Pay attention to the resistance above 3020. At present, we can see obvious selling pressure on the 2H chart. MACD has formed a divergence. 2H is a larger period. Its form is short, which means that tomorrow or the day after tomorrow, the market will fall sharply.

In addition, the divergence of MACD is sometimes repaired by shock market. This situation is not uncommon, so when trading, we need to focus on the support.

Judging from the current candlestick chart arrangement, there is support near 3100, followed by the 3096-3088 range. If a larger divergence pattern is to be formed, the price may reach the 3036-3048 range. At that time, there is no need to hesitate too much, just sell it.

Multiple top signs appear, short gold!Although gold rebounded quickly after hitting 3100, it does not rule out the process of testing and confirming the top. I think that in the short term, we can still short gold in batches with the help of 3025-3035 zone suppression. Then wait patiently for gold to retrace!

If gold can fall below the 3100-3095 zone during the decline, gold may accelerate downward to the area around 3085 under the stimulation of selling. Let us wait and see!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

GOLD:Short positions are dominant in New York sessionToday, gold jumped higher and opened higher. After filling the gap, it continued to rise, breaking through the 3100 mark and approaching 3130. The excessive and rapid rise caused the MACD indicator to diverge, giving us the opportunity to short this time, from which we gained 1000+ points of profit. Together with the profit of nearly 2000 points in the Asian session, we have gained more than 3000 points of profit today.

At present, the price is still falling, with weak support roughly around 3107 and strong support around 3098. Before the start of the US session, the price is expected to fluctuate in the 3100-3130 area. There will be large fluctuations after the opening, and the possibility of falling from a high position is greater, so the US session can pay more attention to the opportunity to short at a high position.

Gold Bullish Frenzy? Watch for Reversal SignalsAt present, it seems that the situation for the bulls is promising. However, the market is not necessarily so. This kind of behavior to induce more long positions is quite normal in the market.

Market makers often operate in a strategic way. After they have reaped the profits from the bulls, it's highly likely that the next target will be the bears.

Looking at the gold market specifically, the price of gold is currently at a high level and is bound to decline. This frenzied bullish trend simply cannot be sustained, and this is an inevitable outcome. The current gold price has seriously deviated from its normal track. One could even

say that it has completely derailed or "strayed from the norm". Such a situation is clearly unreasonable, and a return to a reasonable level is inevitable.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

The short-term short positions in gold are now yielding profits!Currently, the market continues to maintain a range - bound oscillation pattern. In the short term, there are no conditions for a significant unilateral upward or downward movement. In terms of short - term trading, the price is currently trading at $3032. From the perspective of intraday trading strategies, this price level can be regarded as an entry point for short positions. Today, special attention should be paid to the $3020 level, which serves as the daily demarcation line between bulls and bears. If the price drops from a high level as expected, effectively breaks below the $3020 level and closes below this price, the short - side is expected to witness a sharp acceleration in the bottom - seeking trend.

Since the week began, considering global economic trends and gold market volatility, we've steadily shorted gold. All signals, from our in - depth analyses, have proven accurate. I'll keep giving accurate signals, factoring in market changes.

XAUUSD

sell@3030-3035

tp:3025-3015

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Sell@3080Today, the XAUUSD market is mired in extraordinary volatility. The uptrend in prices has continued unabated, with values rocketing to $3086. This powerful rally has inflicted heavy losses on bearish traders, leading to a mass liquidation of their positions.

Currently, the market is in a “double - whammy” situation, where both bulls and bears are feeling the pinch. This is the result of large - scale capital inflows. Savvy institutional investors and market players are deploying capital strategically, aiming to maximize profits.

Despite this current upward surge, we remain steadfast in our bearish outlook. Our in - depth analysis of multiple factors—including long - term economic trends, geopolitical developments, and technical indicators—reinforces our conviction. Many fundamental indicators suggest that the current rally is likely a short - lived market aberration. As the market continues to digest various macroeconomic data, we anticipate downward pressure to build, eventually reversing the current upward trend.

💎💎💎 XAUUSD 💎💎💎

🎁 Sell@3085 - 3080

🎁 TP 3040 3030 3020 3010 3000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

XAUUSD:Still consider shorting at a high price.As I stated in my morning post, one could try shorting around 3080. It has been proven that this strategy is completely correct. Shorting around 3080 has achieved three consecutive profitable trades. Today is Friday and it's approaching the closing of the market. For gold, this strategy can still be implemented. Continue to short, with the take-profit level set around 3070.

sell@3080-3085

TP:3070-3065

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

GOLD: Short, Target 3041-3036After yesterday's rise, some gold indicators have formed a relatively obvious short position, so in today's trading, I personally recommend focusing on the short position.

During the trading process, we need to pay attention to the support points of 3046/3037/3032, the high point of resistance of 3060, and the possible new high of 3067.

From the overall situation, it is unlikely to break through 3067 today, but it is more likely to fall to around 3037.

Gold breaks out for new highs. Ideal for shorting!Today, major funds in the gold market are rapidly covering their short positions, triggering a short - term technical rebound. Despite the bearish outlook remaining solid from a fundamental perspective, investors should prioritize prudent position sizing and effective risk management. Notably, once this corrective upward movement concludes, the market may face a more pronounced downward trend.

XAUUSD

sell@3050-3055-3060

tp:3035-3025

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

How d'we beat 'em? Sell@3060Energy Accumulation during Sideways Consolidation

The consecutive days of sideways consolidation represent a temporary equilibrium between the bulls and the bears. During this period, the bulls are constantly accumulating strength, while the bears' strength is gradually being depleted. Just like a compressed spring, the longer the sideways consolidation lasts, the greater the upward momentum accumulated, which creates conditions for a subsequent breakout.

Breakthrough of Key Resistance Level

The $3040 level is an important resistance level. When the gold price successfully breaks through this level, it triggers follow - up buying from a technical perspective. According to technical analysis theory, breaking through a key resistance level is an important signal of trend continuation or reversal. Once the resistance level is broken, it will attract a large number of technical investors to follow suit and buy, driving the gold price to rise further. Meanwhile, after the resistance level is broken, the original resistance level will turn into a support level, providing support for the further rise of the gold price.

Market Sentiment Aspect

During the period of sideways consolidation and oscillation, although the price fluctuations are relatively small, the bullish sentiment in the market may gradually accumulate. Once the gold price breaks through the resistance level, this bullish sentiment will be ignited, triggering more buying behaviors from investors. In addition, some large institutional investors or professional traders may, through means such as technical analysis, lay out long positions in advance. When the gold price breaks through the resistance level, their long positions start to generate profits, thus attracting more investors to follow suit and buy, forming a situation where the bulls take the lead.

💎💎💎 XAUUSD 💎💎💎

🎁 Sell@3055 - 3065

🎁 TP 3040 3030 3020 3010 3000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Gold (XAU/USD) Double Top Pattern – High Probability Trade Setup📌 Overview of the Chart:

This 4-hour timeframe chart of Gold Spot (XAU/USD) highlights a Double Top pattern, one of the most reliable bearish reversal signals in technical analysis. The price has tested a strong resistance zone twice (Top 1 & Top 2) but failed to break above, suggesting that bullish momentum is weakening and a possible trend reversal is imminent.

This setup provides an excellent opportunity for a short (sell) trade, provided the price confirms the pattern by breaking below the neckline. The potential downside targets are marked as TP1 ($2,983) and TP2 ($2,938), with a stop loss placed above resistance ($3,056) to manage risk effectively.

📌 Key Chart Patterns & Market Dynamics

1️⃣ Double Top Pattern – The Bearish Reversal Signal

The Double Top pattern occurs when:

✅ The price reaches a resistance zone and gets rejected (Top 1).

✅ It then retraces downward to find support at the neckline.

✅ The price makes another attempt to push higher but fails at the same resistance level (Top 2).

✅ A break below the neckline confirms the bearish trend, as buyers lose strength and sellers take control.

🛑 Why is this pattern important?

The failure of buyers to push beyond resistance shows that sellers are dominating. This creates a psychological shift in the market, making traders and institutions more likely to sell aggressively once the neckline is broken.

2️⃣ Resistance Level – The Rejection Zone

🔵 Price Level: $3,050 – $3,056

🔵 Role: Key supply area where sellers are strong

🔵 Market Impact: Strong rejections at this level indicate that big players (institutions) are offloading positions, leading to bearish momentum.

Why Does This Matter?

📌 If the price breaks above this level, it would invalidate the bearish setup, leading to potential further upside.

📌 This is also why we place our Stop Loss above this level—to protect against unexpected bullish breakouts.

3️⃣ Neckline Support – The Breakout Zone

🔻 Price Level: Around $3,020

🔻 Role: The last line of defense for buyers before a bearish breakout

🔻 Market Impact: If this level is breached, it confirms the Double Top pattern, leading to a sharp decline.

📌 A confirmed break of the neckline is the ideal point for traders to enter a short (sell) position, targeting lower price levels.

4️⃣ Key Take Profit (TP) Targets – Where Price Might Drop

🎯 TP1 – $2,983:

This level is a minor support zone where price may temporarily pause before further decline.

Conservative traders may choose to secure profits here.

🎯 TP2 – $2,938:

A stronger historical support zone, making it a high-probability target for a full bearish move.

More aggressive traders may hold positions until this level.

📌 Why These Levels?

These targets align with Fibonacci retracement zones and previous market structure, increasing the likelihood of a reaction at these points.

5️⃣ Stop Loss – Managing Risk Like a Pro

Placement: Above the resistance zone at $3,056

Reason: If price breaks above resistance, it invalidates the bearish thesis, meaning we need to exit the trade.

Risk-Reward Ratio:

TP1: ~2:1

TP2: ~3.5:1

A good risk-reward setup, ensuring a profitable edge over multiple trades.

📌 Trading Strategy & Execution Plan

📉 Bearish (Sell) Setup:

1️⃣ Wait for confirmation – Price must break below the neckline ($3,020) before entering a short trade.

2️⃣ Sell Entry: On a confirmed break and retest of the neckline.

3️⃣ Stop Loss: Above the resistance zone ($3,056).

4️⃣ Take Profit Targets:

TP1 ($2,983) – First profit level.

TP2 ($2,938) – Secondary target for deeper decline.

📌 Optional Confirmation:

Look for bearish candlestick formations (e.g., Bearish Engulfing, Shooting Star, or Doji) near resistance or after a neckline breakout.

Monitor RSI/MACD for bearish divergence, confirming weakening momentum.

📌 Market Psychology Behind This Pattern

1️⃣ First Peak (Top 1): Buyers push the price up, but sellers step in at resistance and force a pullback.

2️⃣ Pullback to Neckline: Some buyers re-enter, believing the uptrend will continue.

3️⃣ Second Peak (Top 2): Price attempts another rally but fails at the same resistance, showing buyers' exhaustion.

4️⃣ Break of the Neckline: Sellers take full control, leading to a high-momentum sell-off.

📌 Key Takeaway:

💡 The Double Top is a trader’s favorite because it reflects a real psychological shift in market sentiment—from greed (buyers) to fear (sellers).

📌 Final Verdict – High Probability Trade Setup

✅ Double Top formation confirms a bearish trend reversal.

✅ Strong resistance & multiple rejections signal seller dominance.

✅ Clear risk management strategy (Stop Loss & TP Levels).

✅ Waiting for neckline break ensures a high-probability entry.

🚀 Watch this setup carefully! If the neckline breaks, GOLD could experience a sharp decline! 📉🔥

🔍 Pro Tips for Smart Traders

💡 Don’t rush into a trade! Wait for a solid break and retest of the neckline for confirmation.

💡 Monitor volume: A strong breakout should be accompanied by increasing volume for validation.

💡 Use confluence: Combine with other indicators (RSI, MACD, EMA) to increase accuracy.

🔥 What’s Your Take on This Setup? Will You Trade It? Let Me Know in the Comments! 🚀

GOLD: Bullish pattern, Short first then LongIn the 4H chart, the bulls have not completely unloaded their strength. From the perspective of the pattern, it should be possible to reach the area around 3050-3058.

In the 30M chart, it is currently near resistance, focusing on the resistance of the 3037-3044 range. You can consider shorting around 3043, and the target is temporarily set around 3033.

Today there is initial jobless claims data, and I personally expect it to be bullish for gold, so I plan to hold long positions when the data is released.

Latest XAUUSD Price Analysis: Short High, Long LowAnalyzing from a holistic market perspective, the gold market is firmly in a bullish upswing. Twice, it has tested and successfully held the 3,000 mark, vividly demonstrating robust buying sentiment.

At present, the crucial factor lies in the validation of the “W” bottom pattern at 3,000. A successful breakthrough above the 3,035 resistance level will likely trigger an attempt to test the resistance near 3,045, with the historical high at 3,057 also in sight. Conversely, if today’s upward momentum fails to continue, the price will likely remain within the 3,030 - 3,000 trading range.

On the 4 - hour chart, a small double - bottom support has emerged near 3,000. Today, consecutive bullish candlesticks signal a strong uptrend, with the K - line firmly above the short - term moving average. Notably, the middle Bollinger Band resistance has been breached. Should the price consolidate above this level, upward movement towards the upper Bollinger Band becomes probable. The 3,013 level now serves as a key dividing line between bullish and bearish sentiment. The market’s future direction—whether it retraces for confirmation before continuing its ascent or retreats for further range - bound trading—hinges on the closing price of the next candlestick.

Overall, Ben recommends adopting a trading strategy for today’s short - term gold market. Prioritize short - selling on price rebounds and use pullback - based long - positions as a secondary approach. In the short term, closely monitor the resistance zone between 3,030 and 3,035, along with the support area between 3,005 and 3,000.

💎💎💎 XAUUSD 💎💎💎

🎁 Sell@3040 - 3030

🎁 TP 3010 3000 2990

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates