Gold turns bearish in the short termGold has weakened once again, with the price dropping rapidly and breaking through the support level of 3022, heading towards the sub - 3000 zone.

The previous strong upward trend in the gold market has come to an end!

The price has dipped to test the 3000 level for the first time, and the market direction has turned bearish.

The bearish trend is now firmly established, so it is advisable to set aside long positions for now, as the market is currently dominated by bears.

Once the gold price rebounds and adjusts, short positions can be considered again.

XAUUSD

sell@3025-3030

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Xauusdsell

GOLD Finally Gave Bearish P.A , Short Setup Ready For You !Here is my opinion on Gold , and now the price closed below my support , and i`m waiting the price to retest it to enter a sell trade to take this 500 pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

Analysis of Trading Strategies for the XAUUSD 1 - Hour ChartRecently, in the 1 - hour chart of XAU/USD, the upward channel has been broken downward, indicating that the short - term upward trend has temporarily stalled.

Currently, the price is in the buyer zone, which has certain support. If obvious signs of price stabilization emerge, such as formation of a bullish K - line combination, one can attempt to place long positions, and set the stop - loss at the key support level below this zone.

If the price rebounds to the seller zone and is blocked, short positions can be considered, with the stop - loss set above the zone.

XAUUSD

buy@3020-3030

tp:3040-3045-3050

sell@3040-3050

tp:3030-3020

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

XAUUSD Today's strategyThe gold price fluctuates within the range we have marked. In the short term, both long and short positions are feasible. However, you must pay attention to setting the stop-loss level and avoid taking on excessive risks

Pay attention to when the upward pressure range will be broken through. Also, keep an eye on the 3010-3020 USD range on the downside. If this range is repeatedly tested, then there might be a short-term pullback to 3000 USD

Today's xauusd trading strategy

buy@3010-3020

SL:3005

tp:3040-3050

There are risks in trading. If you are not sure about the timing, it is best to leave me a message. This will better confirm the timing of the transaction, It can also better expand profits and reduce losses

XAUUSD: Profit-Taking and Trading StrategiesThe recent substantial rise in gold prices has prompted some investors to take profits, leading to a subsequent price pullback.

Additionally, the Federal Reserve has maintained the benchmark interest rate within the 4.25%-4.50% range. Projections suggest two rate cuts are likely in 2025.

The Fed's interest rate decision has once again disappointed the bears. Contrary to expectations of a decline, gold has surged to a new all-time high of $3056.

XAUUSD

buy@3035-3040

tp:3050-3055-3060

sell@3060-3070

tp:3055-3050-3045

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

XAUUSD Today's strategyAccording to the content of the FOMC meeting of the Federal Reserve, the Fed kept the target range of the federal funds rate unchanged at 4.25% - 4.5%. The market had already had certain expectations for this, which to a certain extent provided a stable environment for the gold price and prevented the gold price from being pressured due to a significant strengthening of the US dollar.

From a technical perspective, the current bullish structure of gold is obvious. However, indicators show that a divergence has emerged after the continuous rise, and the price has entered a risky area for bulls after reaching $3040. Nevertheless, in the current market environment, the bullish trend remains relatively strong. Without a clear reversal signal, the gold price may continue to follow the upward trend.

Today's xauusd trading strategy

buy@3025-3030

SL:3020

tp:3050-3060

There are risks in trading. If you are not sure about the timing, it is best to leave me a message. This will better confirm the timing of the transaction, It can also better expand profits and reduce losses.

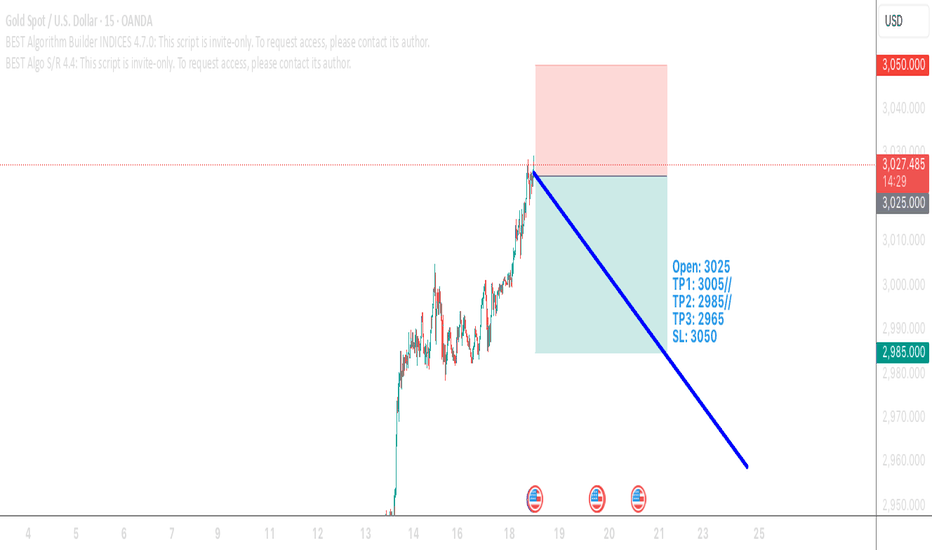

XAUUSD SELLWhat a surprising bullish move from XAUUSD, price kept on pushing, however since I have always believed in trade's basic principle, since we have seen a very massive bullish move from this instrument, I have been on Sell priority at this time. My TP gap is quite big and unfortunately it seems as though my Tp's becomes the support level that it finds it hard to tap, for my previous trade, previous TP was 2978 and unfortunately it only tapped 2979 then reversed. But it's alright, that's the reality of trade. We can continue trying again, as long as the losses are controlled, I will always have the opportunity to recover it back. So for this trade, Im setting 3TP's and and SL again. Everytime my TP is Hit I will be closing half then push the SL to previous opening. Here's my current set up Open: 3025 TP1: 3005// TP2: 2985// TP3: 2965 SL: 3050. Let's see how this rolls

Day6 of 100

L:2

W:0

Short - selling Strategy for XAUUSDGold has been on a sustained upward run, yet the bullish momentum is largely spent. Thus, extreme prudence is of utmost importance when contemplating long positions.

After surging to approximately 3045, the gold price plummeted sharply and then rebounded vigorously. Nevertheless, it fell short of breaking through the 3045 level in one attempt. If it fails to break through rapidly, a significant correction is highly likely.

XAUUSD

sell@3030-3040

tp:3015-3020

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear.

For those who are seeking professional guidance in trading trend analysis, strategy formulation, and risk management, please click below to get the daily strategy updates.

XAUUSD Today's strategyToday, gold rose again to its latest high of $3,045, an increase of $165 from last week's lowest point of $2,880. Such an increase is rare in the history of gold, indicating that the recent geopolitical factors and international situation have caused market risk aversion to heat up again.

Investors are closely awaiting the Federal Reserve's policy statement and the press conference of Federal Reserve Chairperson Jerome Powell. If the Federal Reserve sends a hawkish signal, it may have some suppression on the price of gold. If the policy is more dovish or the economic outlook is concerned, the price of gold is expected to rise further.

Today's xauusd trading strategy

sell@3040-3050

SL:3055

tp:3025-3030

There are risks in trading. If you are not sure about the timing, it is best to leave me a message. This will better confirm the timing of the transaction, It can also better expand profits and reduce losses.

The current strategy for XAUUSDTraders can seize a high-reward trading opportunity with an attractive risk-to-reward ratio by patiently waiting for the price to reach the golden pocket and support zone. As with all trading scenarios, implementing robust risk management strategies is essential to effectively navigate inevitable market volatility.

XAUUSD

buy@3025-3030

tp:3040-3050

sell@3035-3045

tp:3005-3015

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear.

For those who are seeking professional guidance in trading trend analysis, strategy formulation, and risk management, please click below to get the daily strategy updates

The Current Trading Strategy for GoldCurrently, AXUUSD is oscillating in the vicinity of 3030. A thorough market appraisal uncovers a distinct bullish impetus. Amid the global economic uncertainties, such as trade disputes and erratic monetary policies, market participants are increasingly flocking to gold as a haven asset, driving the upward trajectory of AXUUSD. Technically, pivotal indicators such as moving averages and the Relative Strength Index (RSI) suggest the sustenance of the ongoing uptrend.

For investors, a judicious course of action is to establish a long position of suitable size when the price retraces to the 3025 - 3030 support band, with a profit - taking target set at 3040 - 3050. In light of the market's inherent volatility, it is essential to closely monitor geopolitical events and key economic data in order to adeptly adjust trading strategies.

XAUUSD

buy@3025-3030

tp:3040-3050

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear.

For those who are seeking professional guidance in trading trend analysis, strategy formulation, and risk management, please click below to get the daily strategy updates.

Gold bulls are going crazy, need to be careful at this time

Gold bulls are too crazy and there is no chance of a pullback. So when the market is too hot, you have to be careful. You need to be cautious when doing long positions at high levels, and beware of gold falling back after a surge and starting to make a sharp adjustment.So at this position I think shorting would be better

XAUUSD:Consider flipping to shortThe morning's bullish gold strategy has turned profitable. Gold has seen a rapid spike-and-drop on the 1-hour chart, indicating emerging short-term resistance. As long as it fails to hit a new high, the resistance around 3028 will solidify, potentially triggering a reversal. Caution is needed when chasing long at current highs to avoid a sharp correction.

Market conditions are real - time. Gold had a strong bullish trend, but high market enthusiasm calls for prudence. Try shorting at high levels under the resistance.

Latest trading strategy:

sell@3021

sl:3030

tp:3000-2900

I always firmly believe that profit is the sole criterion for measuring strength. I will share accurate trading signals every day. Follow my lead and wealth will surely come rolling in. Click on my profile for your guide.

XAUUSD Continue to Long or Start to Short?Gold witnessed a substantial upward surge today, showing no chance of a pullback. When the market becomes overly fervent, caution is necessary as gold may stage its final speculative spree.

Gold trading strategy:

sell @:3030-3034

buy @:3000-3005,2983-2987

My current gold trading strategies and signals have been consistently accurate. If you also want free, precise signals, you can visit my profile to access them.

Today's Strategy Analysis for XAUUSDThe current global landscape is highly complex, significantly impacting XAUUSD dynamics. Recently, the unpredictable tariff policies of the United States have heightened tensions in international trade, leading to a surge in economic uncertainty. Simultaneously, ongoing instability in the Middle East and the lack of progress in Russia-Ukraine peace negotiations are amplifying risk aversion in financial markets.

From a fundamental perspective, trade tensions have severely disrupted global economic growth. In response, investors are increasingly turning to safe-haven assets, driving the demand for gold to unprecedented levels.

XAUUSD

buy@2995-2985

tp:3010-3015

sell@3010-3020

tp:2995-3000

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear. For those pursuing financial goals, click below for daily strategy updates.

For those who are seeking professional guidance in trading trend analysis, strategy formulation, and risk management, please click below to get the daily strategy updates.

XAUUSD Today's Strategy AnalysisLast Friday, after consolidating around the 2980 level, bullish momentum finally broke higher, driving prices to accelerate during European trading hours. Gold pierced the psychological 3000 resistance level but was rejected and pulled back into a choppy consolidation phase. The session closed near 2985 with a doji candlestick, maintaining the strong bullish trend with unidirectional momentum.

From a 4-hour technical perspective, today's downside support levels are focused on the vicinity of 2975-80. Particular attention should be paid to the critical bull-bear dividing line support at 2960-2963. Intraday pullbacks should maintain a bullish bias initially while holding above the 2975-80 support zone. Upside targets remain focused on breaking above recent highs.

Gold trading strategy:

sell @:3000-3005

buy @:2975-2980 , 2960-2963

If you are currently not satisfied with your gold trading performance, and if you also need to obtain accurate trading signals every day, you can check the information in my profile. I hope it can be of some help to you.

XAUUSD Start to Short?The gold price briefly pierced the $3,000 per ounce threshold again today.

From a 4-hour technical perspective, today's downside support levels remain focused on the vicinity of 2975-2980.

The current day's orders are already in profit.

Gold trading strategy:

sell @:3000-3005

buy @:2975-2980 , 2960-2963

If you are currently not satisfied with your gold trading performance and need daily accurate trading signals, you can visit my profile for free strategy updates every day.

XAUUSD Today's strategyLast week, the gold market surged sharply, touching the long-awaited $3,000, and the world continued to increase its gold reserves with relatively large intensity, providing a solid bottom support for gold prices.

After such a sharp rise, a short-term pullback is normal, but the short-term bullish trend remains strong. If it can break through the key psychological level of $3,000 and gain a foothold, there is potential for further gains.

Today's xauusd trading strategy

buy@2965-2975

SL:2960

tp:3008

Analysis of the Gold Price Trend Next WeekThis week, the spot gold price witnessed a breakthrough market trend. Influenced by the continuous gold purchases by central banks of multiple countries, the heightened global economic uncertainties, and the expectations of trade frictions, the gold price soared to as high as US$3,005 per ounce at one point, reaching a historical high. Although the short-term overbought signals and the pressure of profit-taking may trigger market volatility, the long-term bullish pattern has already been established.

The key resistance level on the daily chart is at 3025, which is the combination of the previous high and the 2.618 Fibonacci retracement level. The support level below is at 2956, which is the recent level where the top has transformed into the bottom. The hourly chart shows that during the U.S. trading session, the price correction only reached 2978 before gaining support. If the price stabilizes within the range of 2970 - 2975, there will still be short-term upward momentum.

Suggestions for gold trading operations next week:

buy@2970-2975

SL@2963

TP:2998

Gold is falling as expectedThe market has started to decline. Whether the 3,000 will become history remains unknown, but the current decline is real! In the evening, it is necessary to avoid emotional trading. Those who blindly follow the trend and go long are hoped to stay rational. After continuous rises, it has now started to fall. Currently, the market is in a slump. This situation won't be in a high-level range bound. If it doesn't rise, it will fall.

Today is already Friday. Only after the gold price drops to the support level below will it rise further! So, go short in the evening and pay attention to the 2,970 as the dividing line!

Trading Strategy:

sell@2990-2980

tp 2970-2960

I always firmly believe that profit is the sole criterion for measuring strength. I will share accurate trading signals every day. Follow my lead and wealth will surely come rolling in. Click on my profile for your guide.

XAU/USD "The Gold vs U.S Dollar Metals Market Money Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold vs U.S Dollar Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 1H or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 3H timeframe (2930) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 2830 (or) Escape Before the Target

Secondary Target - 2750 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Sentimental Outlook, Intermarket Analysis, Future Prediction:

XAU/USD "The Gold vs U.S Dollar Metals Market is currently experiencing a Bearish trend., driven by several key factors.

1. Fundamental Analysis with All Factors📌

Interest Rates: Rising Fed rates (e.g., 5.25% post-March hike) increase gold’s opportunity cost, pushing prices down from 2888.

Inflation: Cooling global inflation (e.g., U.S. CPI at 2.5%) undermines gold’s hedge appeal, signaling overvaluation.

Dollar Strength: USD rally (e.g., DXY to 102-105) suppresses gold, marking 2888 as a peak.

Global Economic Health: Improving growth (e.g., U.S. GDP above 3%) reduces safe-haven demand, favoring bears.

2. Macroeconomic Factors📌

Bearish macro conditions:

U.S. Economy: Strong jobs (e.g., unemployment below 4%) and PMI above 50 weaken gold’s case at 2888.

Eurozone: Recovery signs (e.g., GDP at 1.5%) bolster EUR, pressuring gold.

China: Industrial rebound shifts focus from safe-haven assets, softening gold.

Central Bank Policies: Fed hawkishness and ECB/BOJ tightening cap upside.

3. Geopolitical Factors📌

Bearish geopolitical shifts:

U.S.-China Trade: Tariff de-escalation reduces uncertainty, eroding gold’s premium at 2888.

Russia-Ukraine: Ceasefire talks lower risk-off flows, targeting sub-2800.

Middle East: Stabilizing oil supply (e.g., Iran deal) eases inflation fears, weakening gold.

Political Uncertainty: Resolved U.S./Europe tensions diminish volatility, favoring bears.

4. Supply and Demand Factors📌

Bearish supply/demand dynamics:

Supply: Increased production (e.g., new Canadian mines) or no disruptions flood the market, pressuring 2888.

Demand:

Physical: Western retail demand fades as prices peak.

Central Banks: Slowed buying (e.g., Russia, China pausing) removes support.

Investment: ETF outflows accelerate as investors sell at 2888.

5. Commitment of Traders (COT) Data (Latest Update)📌

Hypothetical COT data as of March 4, 2025:

Non-Commercial (Speculators): Longs at 340,000, shorts at 70,000, net position +270,000—bullish unwind from 295,000 signals profit-taking.

Commercial: Longs 65,000, shorts 400,000—heavy hedging bets on a drop.

Open Interest: 525,000 (down 5,000), showing reduced speculative interest.

Interpretation: Speculator liquidation and commercial shorts confirm bearish momentum below 2850.

6. Technical Factors📌

Bearish technicals at 2888:

Moving Averages: 50-day SMA (e.g., 2850) crossing below 200-day SMA (e.g., 2870) signals reversal.

Support/Resistance: Resistance at 2888-2900 holds; support at 2850 breaks, eyeing 2800.

RSI: 70+, overbought, triggers selling.

MACD: Bearish crossover confirms downward momentum.

7. Sentiment Factors📌

Bearish sentiment signals:

Retail: Social media posts shift to fear at 2888, citing USD strength.

Institutional: COT hedging aligns with bearish media (e.g., “Gold overbought”).

Media: “Fed hikes crush gold” headlines fuel sell-offs.

8. Seasonal Factors📌

Bearish seasonal trends with added points:

March Profit-Taking: Q1 tax season in the U.S. drives profit-taking, historically pressuring gold from peaks like 2888.

Post-Rally Fatigue: Early-year rallies (e.g., January-February) often fade in March, amplifying bearish momentum.

Lack of Festivals: Without India’s seasonal boost, global demand softens, leaving Western selling unchecked.

Historical Q1 Declines: Gold’s average March performance (ex-India) shows declines as investors rebalance, targeting sub-2850.

Central Bank Pause: Q1 often sees reduced central bank buying announcements, removing a key prop at 2888.

9. Intermarket Analysis📌

Bearish intermarket signals:

USD: DXY rallying to 105 crushes gold to 2800.

Yields: 10-year yield at 4.5% competes with gold, driving declines.

Equities: Stock rallies (e.g., MSCI World above 3100) divert capital.

Commodities: Oil at $70/barrel signals deflation, weakening gold.

10. Market Sentiment Analysis of All Types of Investors📌

Bearish investor sentiment:

Retail: Panic selling at 2888 as USD rises; X shows fear.

Institutional: Speculators trim longs (COT); hedgers pile into shorts.

Central Banks: Pause buying, letting prices slide.

Speculators: Futures traders short 2888, targeting 2800.

11. Next Trend Move and Future Trend Prediction (Bearish Focus)📌

Short-Term (1-4 weeks):

Bearish Target: 2820-2850. Drop to 2820 as USD hits 102 and RSI confirms overbought.

Bias: Strongly bearish, driven by technicals and COT liquidation.

Medium-Term (1-3 months):

Bearish Target: 2700-2800. Decline to 2700 with Fed hikes, DXY at 105, and easing tensions.

Bias: Bearish, with macro stabilization.

Long-Term (6-12 months):

Bearish Target: 2500-2600. Fall to 2500 if growth rebounds, DXY hits 110, and inflation drops below 2%.

Bias: Bearish, as safe-haven demand fades.

12. Overall Summary Outlook📌

At 2888 on March 10, 2025, XAU/USD is set for a bearish slide. A strong USD (DXY to 105), rising yields (4.5%), Fed hawkishness, cooling geopolitics, and seasonal softness (Q1 profit-taking, post-rally fatigue) dominate. Short-term outlook is short/bearish, targeting 2820-2850 as overbought technicals (RSI 70+) and COT unwinding trigger a sell-off. Medium-term is bearish, eyeing 2700-2800 with macro improvement. Long-term is bearish, forecasting 2500-2600 as growth stabilizes.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩