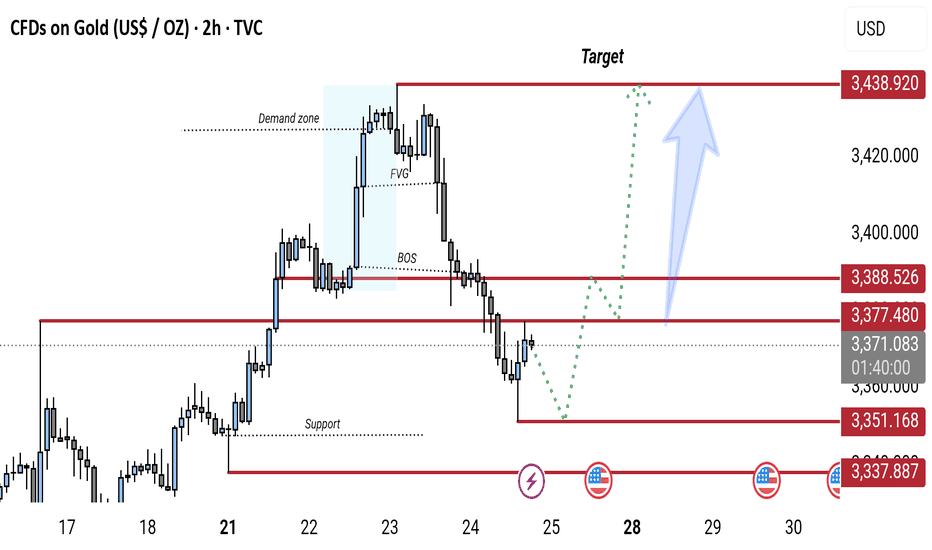

Gold 2H Chart: Bullish Reversal Expected from Key Support ZoneGold (XAU/USD) 2H chart shows a bearish break of structure (BOS) followed by a pullback toward a key support zone (around 3,337–3,351). A potential bullish reversal is expected from this zone, targeting the 3,438 resistance level. The chart highlights a demand zone, FVG (Fair Value Gap), and possible retracement before continuation to the upside.

Xauusdshort

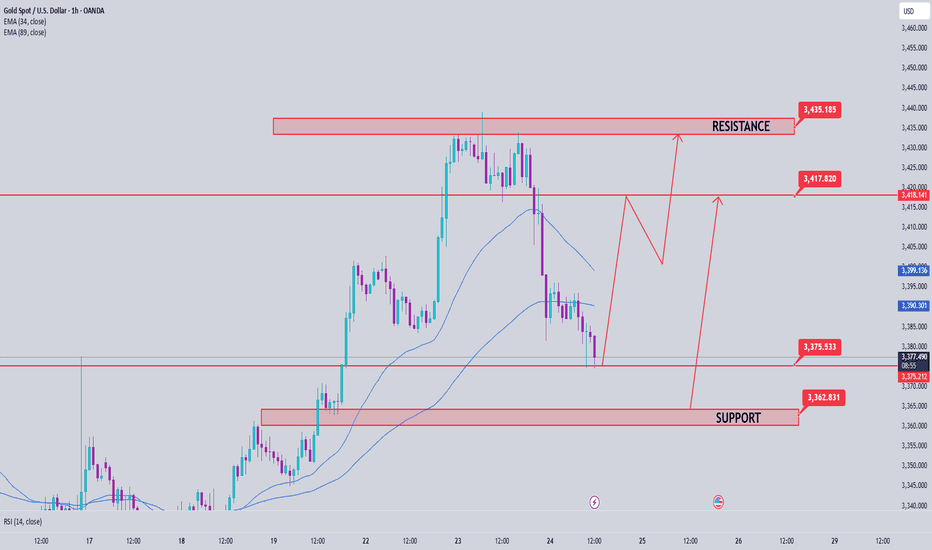

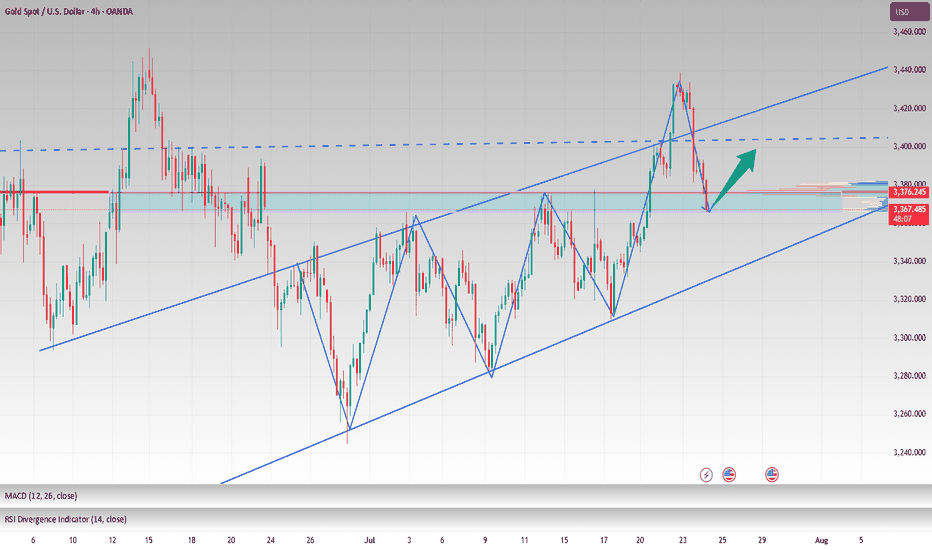

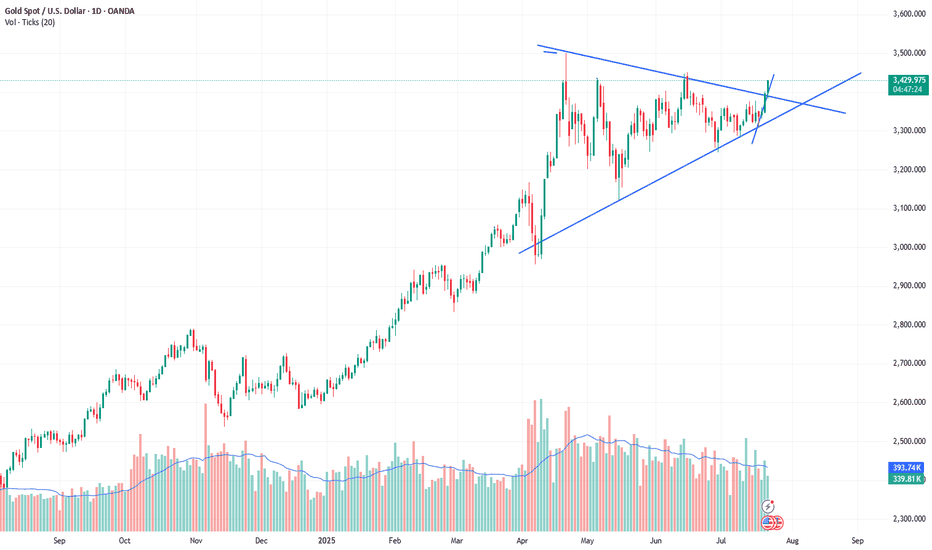

Gold Price Analysis July 24After a correction of about 50 prices in yesterday's session, gold is showing a necessary "breathing" in the long-term uptrend. This is a positive signal, showing that the market is accumulating before continuing its journey towards a new ATH around the 3500 area.

Currently, gold prices are fluctuating within the boundary zone limited by two upper/lower trendlines - creating a clear structure of support and resistance. Avoid trading against the trend if this boundary zone is broken.

📌 Trading plan:

Strategy: Prioritize BUY when price sweeps to support zone

Active buy zone: 3375 (reaction price)

Potential buy zone: 3363 (deep support)

Target: 3431 in the immediate future → further towards 3490

Support: 3375 – 3363

Resistance: 3418 – 3431 – 3490

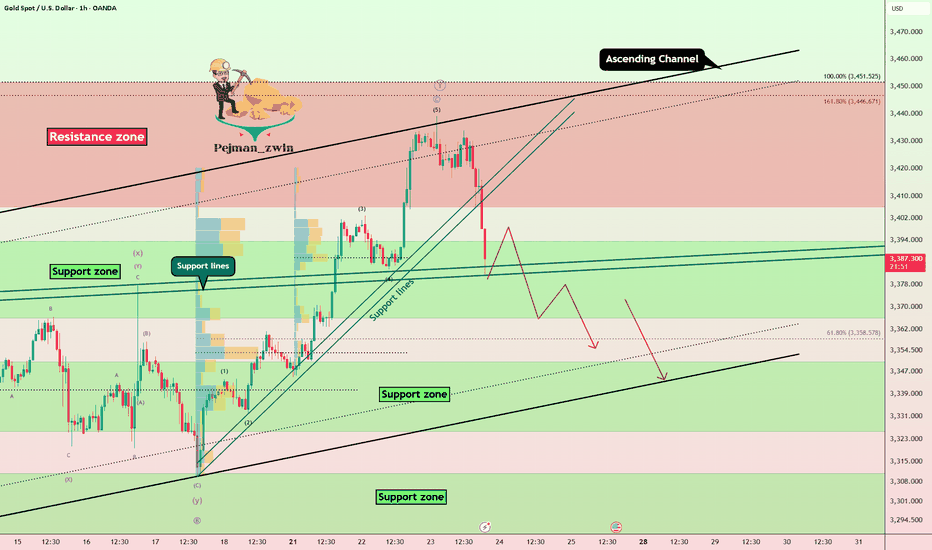

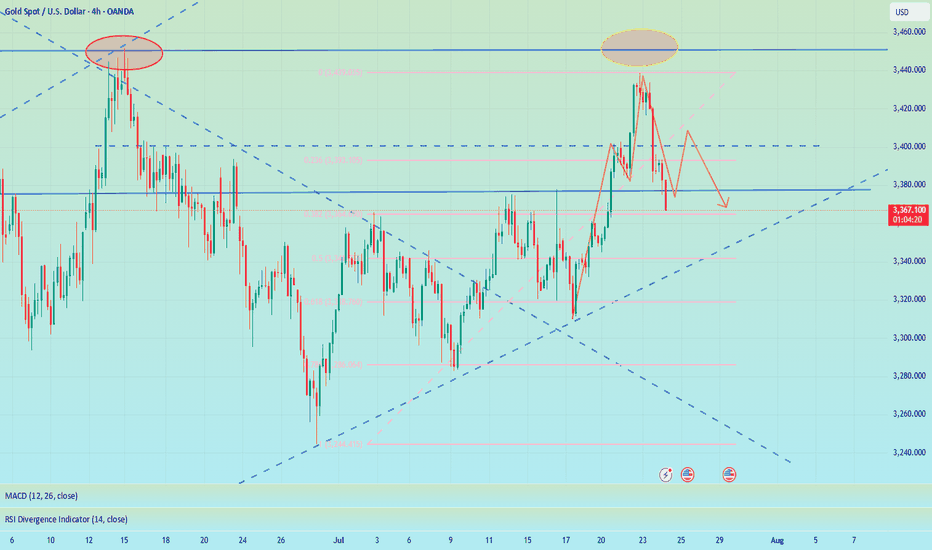

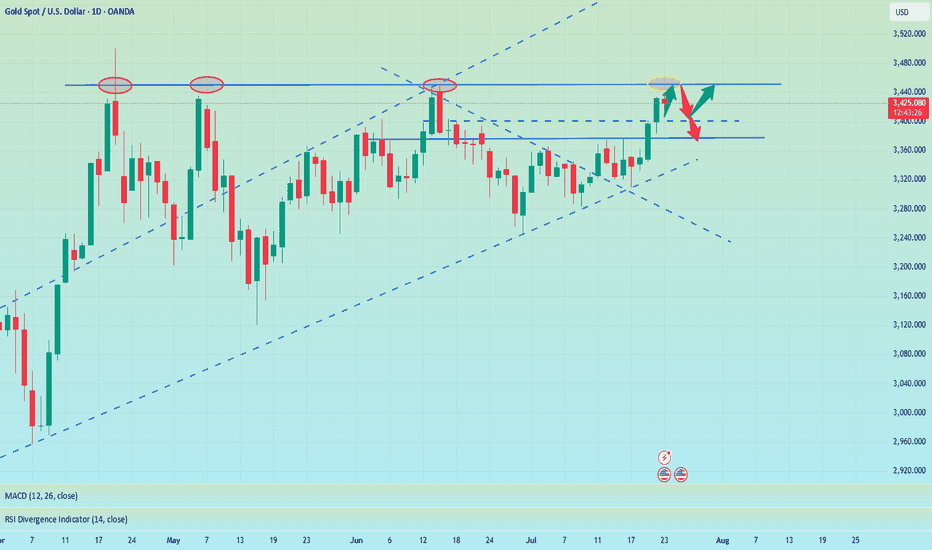

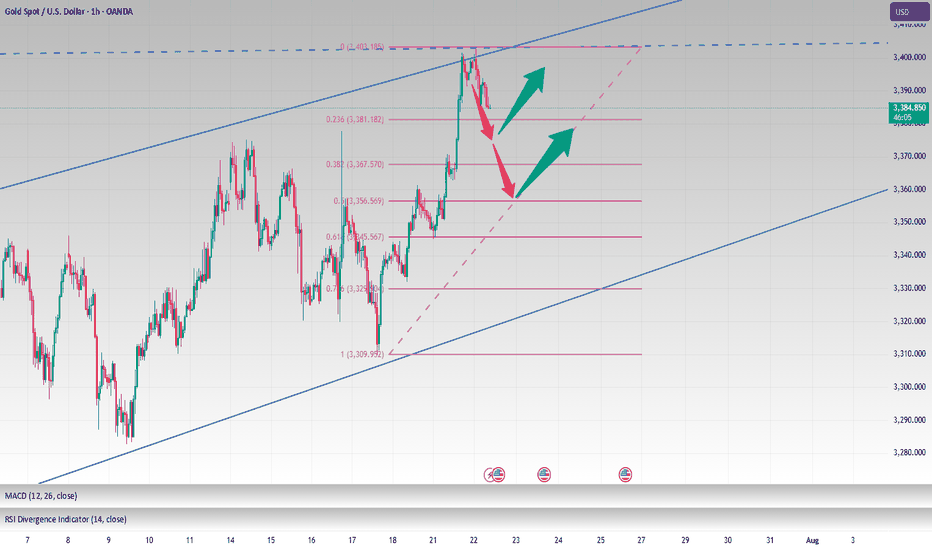

Gold Fails at Resistance, Elliott Wave Signals Deeper CorrectionGold ( OANDA:XAUUSD ) started to rise after the Richmond Manufacturing Index(Actual:-20/Forecast:-2/Previous-7) index was announced, but failed to break the upper line of the ascending channel and the Resistance zone($3,451-$3,406) .

Gold has now broken through the Support lines and is attempting to break through the next Support lines and Support zone($3,394-$3,366) .

In terms of Elliott Wave theory , it appears that the main wave Y has completed above the ascending channel.

I expect that given the momentum of gold's decline , gold will be able to break the Support zone($3,394-$3,366) and Support lines and fall to at least $3,356 . The next target could be the lower line of the ascending channel .

Note: Stop Loss (SL) = $3,423

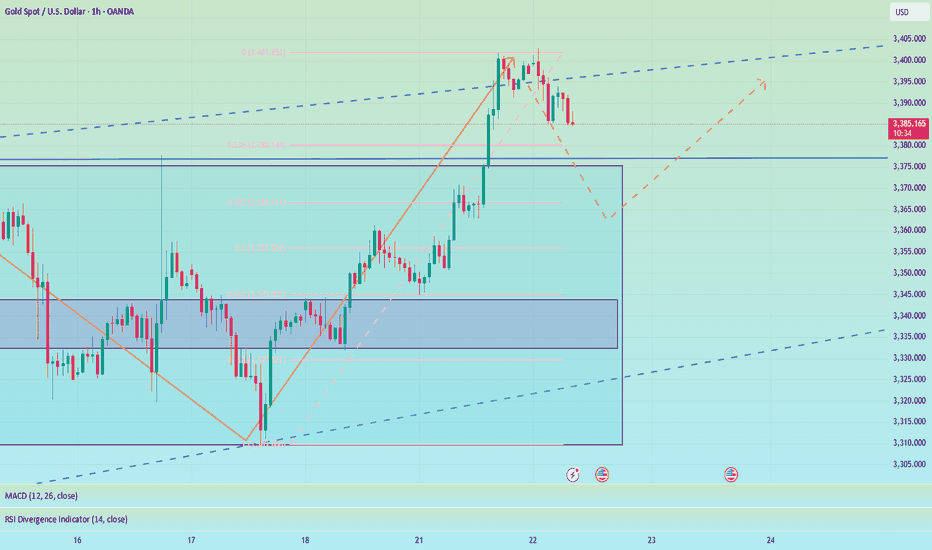

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

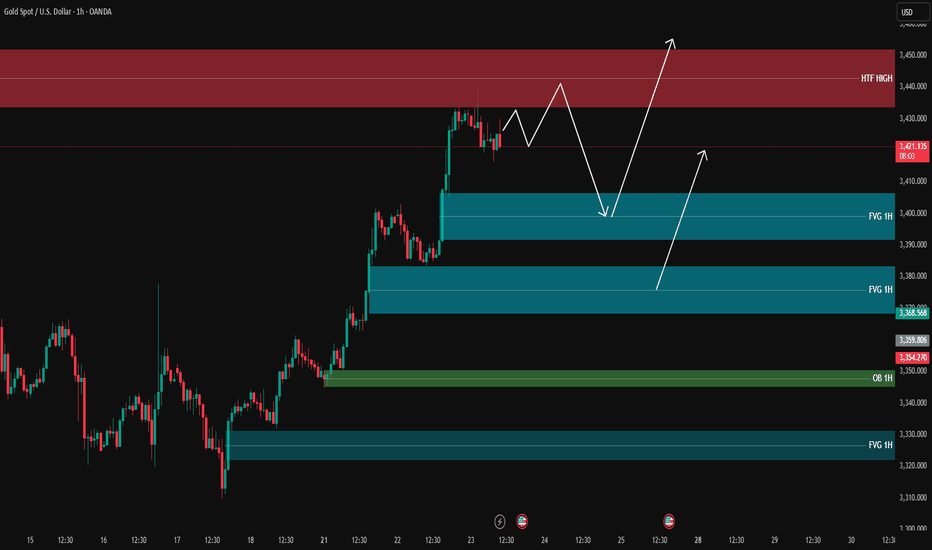

XAUUSD analysis - 1H FVG and OB setupsOn the 1H timeframe, price is reacting as it approaches the HTF high zone (3430-3450) and is currently pulling back.

The 1H FVG zones at:

🔹 3400

🔹 3368

and the 1H OB around 3350 are key areas we are watching for potential long entries.

📌 Plan:

We will wait for price to pull back into one of these 1H FVG/OB zones and look for entry confirmations on the 5M or 3M timeframe to go long.

🎯 Targets: 3430 – 3440 – 3450

❌ No sell setup for now unless a clear structure break happens.

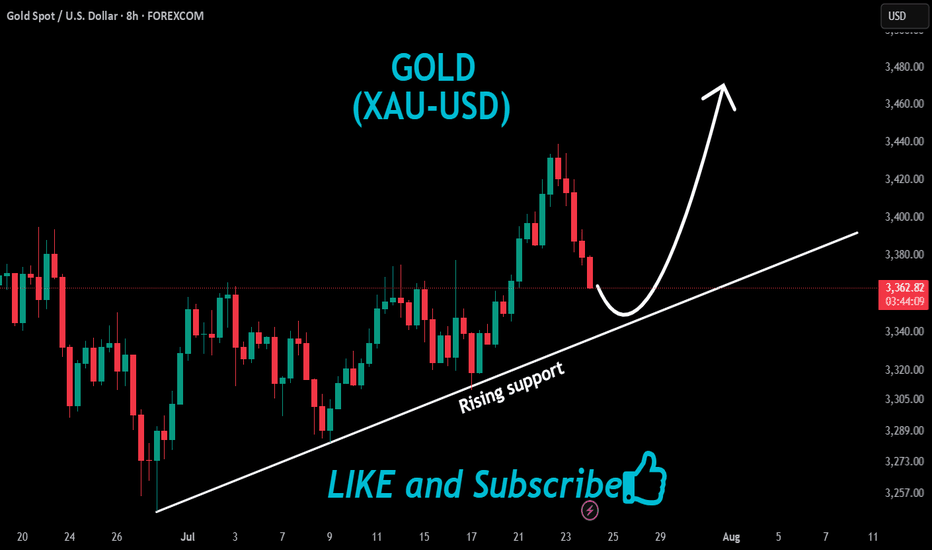

Correction is not bearish, buy on rebound at low levelToday is critical. Yesterday, gold fell under the pressure of 3396. The next 3396 area is very critical, and it will be relatively weak below it. If it goes up, the market rebound will expand. Pay attention to 3405 or 3420 area, with the focus on 3420. As long as it is below here, it will be mainly bearish. Breaking through 3420, the market is expected to continue to rise and break yesterday's high to test the 3450 area, and then seek to fall again. On the downside, pay proper attention to the 3380 area, which is short-term support; the focus is on the 3370~3365 area, which is the next bull-bear watershed.

The daily line fell yesterday and included the previous day's big positive rise, which represents the current high-level fluctuation of the price. At present, we need to pay attention to the lower moving average support corresponding to SMA10 at 3367, while the moving average SMA30 is around 3351-53, the middle track is at 3344, and the moving average SMA60 is at 3330.

From the daily level: today's decline will not fall below 3351-53, and it is likely to be around 3367-70. We have the opportunity to participate in long orders near 3370.

Therefore, if the price touches 3370-3365 for the first time during the day, you can consider going long, with the target at 3390-3400; if the downward trend of gold continues during the day, you can go long again at 3355-3353, defend 3345, and exit the market after earning a difference of $10-20.

OANDA:XAUUSD

Gold fell as expected, can it reverse?📰 News information:

1. Initial unemployment claims data

📈 Technical Analysis:

Gold has made a profit retracement correction as expected. The two-day rising market has led to an overly bullish sentiment in the market. Under this pattern, it is very easy to trigger an unexpected reversal trend, which is often a key opportunity to break the psychological defense line of retail investors in the market.

From the bottom of gold at 3244 to the high of 3439 this week, it can be found that the current 38.2% support position is near 3364. Moreover, the current daily SMA10 moving average position is also near 3364, SMA30 and the middle track of the Bollinger Band are near 3343, and SMA60 is near 3330.

From the daily line, if the daily line can stand above 3364, then there is still a possibility of refreshing the high of 3438 in the future. On the other hand, if the daily line falls below 3364, then 3438 may become the high point in July.

If there is a rebound in the morning, then 3384 in the white session will be the bottom support, and short positions must be participated in the European and American sessions. If the downward trend continues in the morning, there will be an opportunity to participate in long orders around 3370. At the same time, the possibility of further decline and reaching the middle line of 3343 cannot be ruled out. At the same time, if the 4H chart can form a head and shoulders top pattern, then the intraday long rebound point will not exceed 3410.

Therefore, on the whole, if it falls directly, it can be considered to go long when it first touches 3375-3365, and the target is 3390-3400; if the intraday decline is strong, the second trading opportunity is below 3355-3345, and the target is $10-20 before exiting.

🎯 Trading Points:

BUY 3375-3365

TP 3390-3400

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

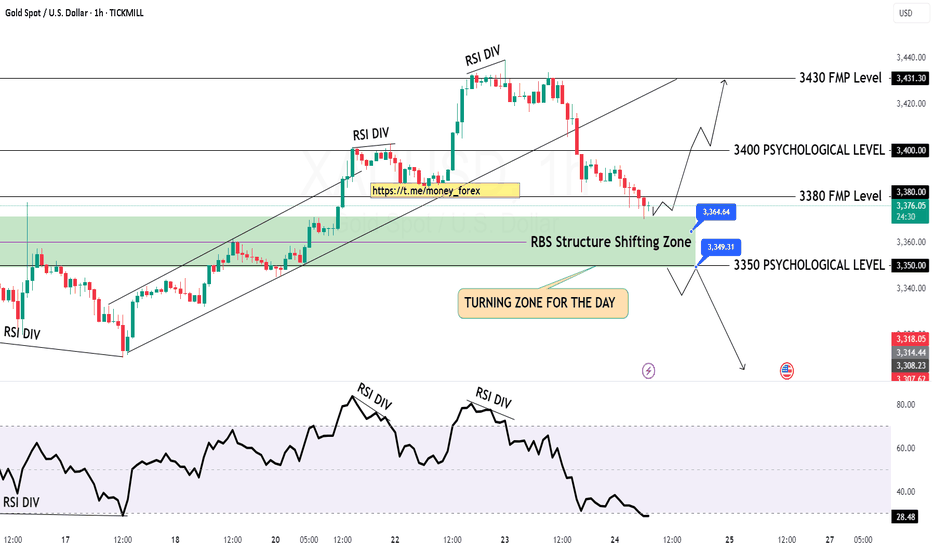

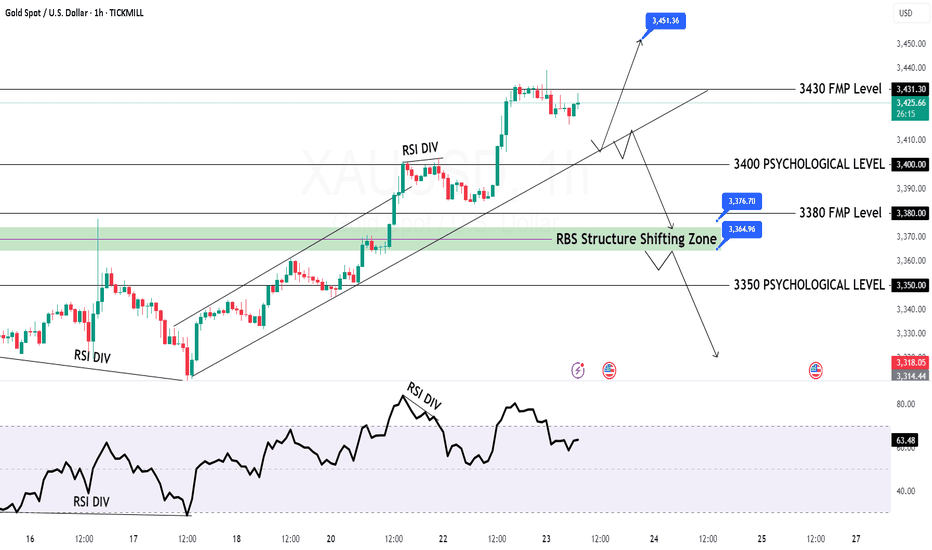

GOLD H1 Chart Update for 24 July 2025Hello Traders,

we got fall yesterday on RSI DIV and right now all eyes on 3350 Psychological level breakout if market successfully breaks that level then it will move towards 3330 or even 3315 level

some retracements remains pending around 3400-3412 zone GOLD will might retrace that zone before going further down

Reminder: PMI's day in the market

Disclaimer: Forex is Risky

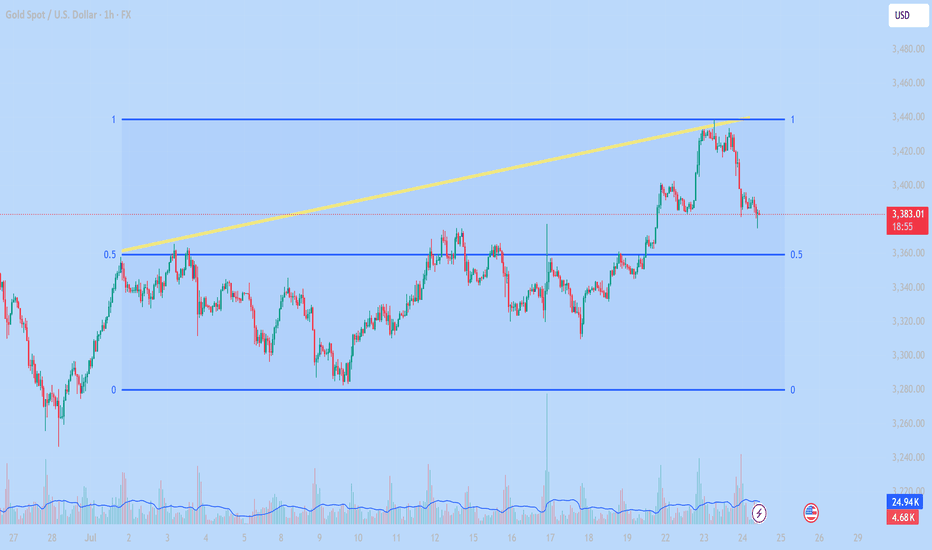

Technical Analysis of XAUUSD – 1H July 24, 20251. Fibonacci Levels

The chart uses a Fibonacci range from 0 to 1, likely drawn from a significant low to a recent high.

The 0.5 Fibonacci level (around $3,360) is acting as a major support zone and price is currently testing this level.

2. Short-term Trend

Price broke above the previous high and formed a new high near $3,440, but then reversed sharply.

Now it’s pulling back toward a key support zone between $3,360 – $3,380.

3. Volume Analysis

Volume spiked at the top near $3,440, suggesting strong selling pressure or profit-taking.

Volume slightly increases again as price reaches support → possible buying interest at the current level.

4. Trendline (Yellow Line)

The ascending yellow trendline has been broken to the downside, signaling a break in short-term bullish momentum.

Possible Scenarios

Scenario 1 – Bullish Rebound from Support:

If price holds above the $3,360 zone and forms bullish candles, we could see a recovery toward $3,400–$3,420.

That area can act as a short-term profit-taking zone.

Scenario 2 – Bearish Breakdown Below 0.5 Level:

If price breaks below the $3,360 support with strong bearish candles, it may drop further toward the Fibonacci 0 level (~$3,280).

Conclusion

Gold is at a critical decision point. Holding the $3,360 support could lead to a bullish bounce. Breaking it would likely confirm a short-term downtrend. Monitor the next few candles closely for confirmation.

Would you like a trade plan or entry/exit suggestion based on this chart?

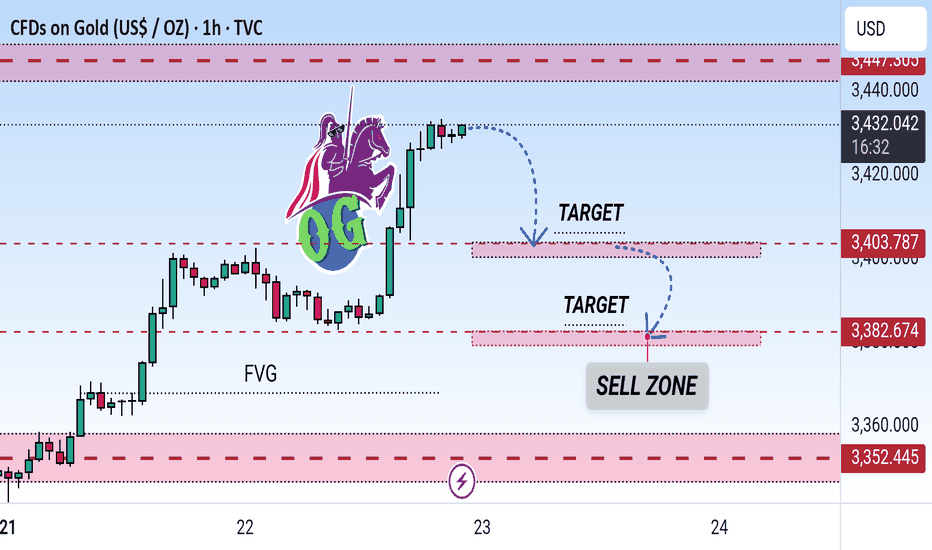

Gold (XAU/USD) 1H Analysis: Sell Zone Identified with Downside This chart shows a technical analysis of Gold (XAU/USD) on the 1-hour timeframe. Price is approaching a Sell Zone near resistance around $3,431, with two downward target levels marked at $3,403.787 and $3,382.674. The chart also highlights a Fair Value Gap (FVG) suggesting potential bearish retracement.

The callback continuity is poor, and the bulls are still strong📰 News information:

1. Geopolitical situation

2. Tariff retaliation

📈 Technical Analysis:

Trump continued to lash out at the Fed, but seemed to have backed off on whether to remove Fed Chairman Powell. The continuous rise of the gold index, once close to 3440, also ushered in a new high in more than a month. Next, we need to pay attention to whether gold can reach the 3450 mark.

Judging from the daily chart, there were three times when it touched around 3450 and then fell back. If it breaks through and stabilizes above 3450 this time, the historical high of 3500 may be refreshed. If it cannot effectively break through 3450, the probability of subsequent retracement is still very high.

From the hourly chart, the bottom support is almost at 3405-3400. However, the recent rhythm belongs to the consolidation of the Asian and European sessions, the US session has begun to rise, and the risk of serious overbought data indicators is still there. This is why I told everyone in the morning that we need to be vigilant about the current rise. Waiting for a pullback to go long is relatively more stable. I also explained in the morning that if it falls below 3405-3400, the decline may continue to around 3385. After all, the fundamental purpose of our trading is to make a profit, so we must minimize the foreseeable risks to the greatest extent possible.

On the whole, if there is an obvious stop-loss signal at 3405-3400, you can consider going long and looking at 3450. Once it falls below 3400, don't chase it easily, and pay attention to the possibility of a retracement below 3385.

🎯 Trading Points:

BUY 3405-3400

TP 3440-3450

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD TVC:GOLD

Excellent profits booked [500 pips SECURED ]As I mentioned throughout yesterday’s and Today's commentary session:

My strategy is still the same – sell from 3430-3435.

Gold around my key level yesterday at 3432-3435, which the market respects well and as our first target was 3405 then 3495

Very happy with the profits so far.

My medium-term targets remain 3390 & 3380 which is achieved alhumdulliah .I sold gold from every local high.

Also I mentioned 3420 turns retest and i opend my another sell trades on down side

All I say thanks to those who followed us and made profits.

Gold Price Analysis July 23📈 Gold Trend Analysis – Strong Uptrend but Signs of Slowdown

Gold continued to set a new peak for the week when closing the day above 3430 – confirming that the uptrend is still dominant. However, buying power is starting to slow down as the market formed a fairly wide range, around 50 prices in today's session.

Profit-taking pressure at high prices can create a short-term correction, opening up two-way trading opportunities for flexible investors.

🔑 Important technical levels (Key Levels):

🔻 Resistance zone & Sell zone:

3445: Price rejection zone – can consider selling if price fails to break through.

3463: Strong Sell zone – expect increased supply here.

🎯 Sell target:

3405: Nearest support, target for short-term sell orders.

🟢 Buy Setup:

3402: Breakout zone in US session – if price breaks strongly through this support with good volume, consider buying on the next uptrend.

Gold breaks new high, expect a pullback in the evening#XAUUSD

After the rapid rise of the previous day, the gold market has fallen into an overbought state, but yesterday's increase of nearly $60 still provided solid support for the bulls. It is expected that the market will show repeated fluctuations in the future⚖️.

In terms of operation, it is recommended to pay close attention to the gains and losses of the 3,400 mark. If it is successfully broken through, it is expected to further test the 3,420-3,425 and 3,450 lines; on the downside, pay attention to the top and bottom conversion support of 3,403📈.

📊At present, you can consider shorting near 3430, defending 3440, and aiming at 3410💡

🚀SELL 3430-3440

🚀TP 3415-3405

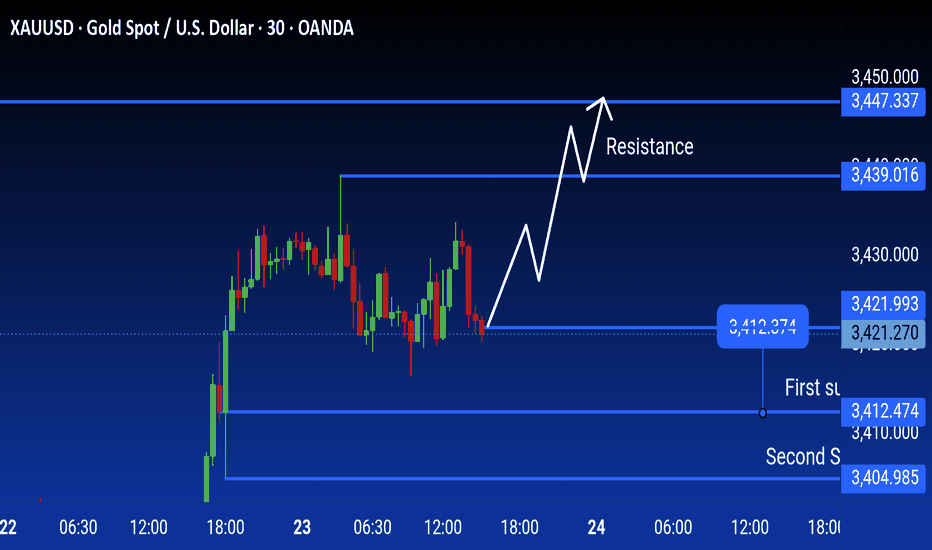

XAUUSD 30-Min Chart Analysis: Bullish Move Toward Resistance This 30-minute chart of XAUUSD (Gold vs. USD) shows key support and resistance levels. The price is currently around 3,422.615. Resistance is marked at 3,447.337, while the first and second support levels are at 3,412.474 and 3,404.985, respectively. The chart suggests a potential bullish move toward resistance.

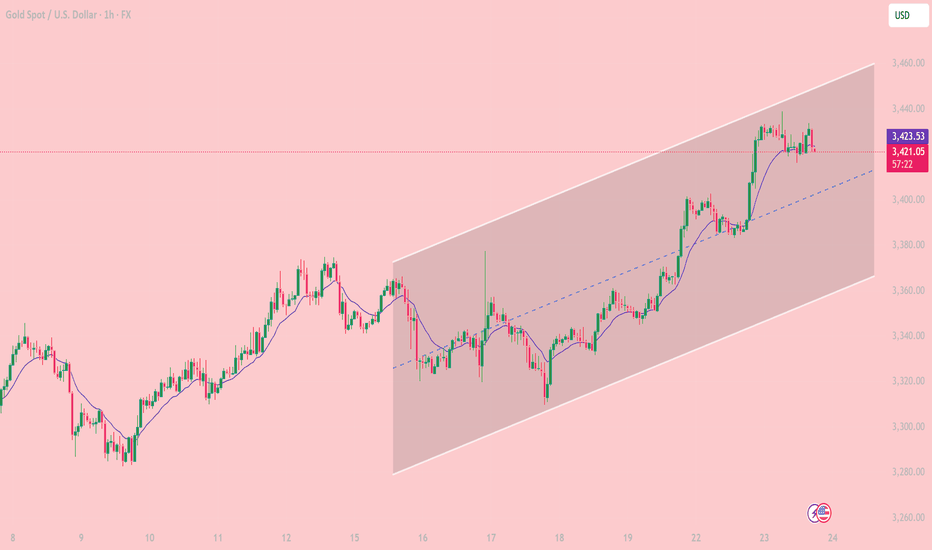

Bullish Channel in Play Key Trading Zones and Strategy for JulyOn the 1-hour chart, XAUUSD is clearly moving inside a well-defined ascending price channel, with price respecting both the channel boundaries and the midline as dynamic support/resistance. The pair continues to print higher highs and higher lows, confirming short-term bullish structure.

Trend Channel: Since July 18, gold has been steadily climbing within an ascending channel, bouncing off the lower boundary and riding above the midline.

EMA Support: The 10-period EMA (purple) has been acting as a dynamic support. Price has yet to close below it during this bullish swing.

Candle Behavior: Recent bullish candles with strong bodies show that buyers still have control, although price is stalling near the upper boundary of the channel.

Technical Level

3,459 USD. Major Resistance. Top of the channel – potential reversal or take-profit zone

3,423 USD.Immediate Support. EMA10 and current consolidation area

3,400 USD. Mid-Channel Support. Key pullback zone if price rejects near highs

3,360 – 3,365 USD. Major Support. Bottom of the ascending channel – break may invalidate bullish setup

Scenario 1 – Buy the Dip (trend continuation):

Wait for price to retest the 3,400 – 3,410 USD area or EMA10.

Look for bullish confirmation (e.g., pin bar, bullish engulfing).

Target: 3,445 – 3,459 USD

Stop loss: below 3,395 USD

Scenario 2 – Short at Channel Top (mean-reversion setup):

Monitor price behavior near 3,455 – 3,459 USD resistance.

If bearish reversal candles appear (e.g., shooting star, bearish engulfing), consider shorting.

Target: 3,420 – 3,410 USD

Stop loss: above 3,465 USD

As long as price remains inside the rising channel, buying pullbacks is the preferred strategy.

Stay alert to macroeconomic catalysts (Fed comments, PMI data, labor market releases) that could increase volatility.

Gold remains in a strong short-term uptrend on the 1H chart. Trading in the direction of the trend with proper risk management continues to offer the best opportunities for intraday traders.

If you found this analysis useful, don’t forget to follow for more trading strategies and ideas!

3400 has been reached, wait patiently for a pullback to go longGold opened on Monday with a volatile rise. After breaking through the 3360-65 area, the bulls turned strong. After breaking through the 3375~80 area in the evening, the bulls accelerated their rise, reaching the highest point of 3402. It fluctuated sideways in the late trading, and the daily line closed at around 3397 with a big positive line! Gold temporarily broke the small range oscillation pattern, but the bulls were not strong, and it still fluctuated upward.

From the perspective of the intraday cycle, after yesterday's rapid rise, the market fell into a serious overbought state; however, yesterday's $60 big positive line supported the bulls, and it is expected that the market will fluctuate; the next focus is still the 3400 mark area. The pressure in the 3400~05 area was dense last night, and adjustments may be made at any time before the breakthrough; and since the rise of 3282, it has just touched the upper edge of the parallel channel. The big sweep will continue, but the range is constantly changing!

So although gold broke the recent volatility yesterday and hit the 3400 mark with a big positive line; however, if it cannot stand above it, then it will continue to fall; recently we have repeatedly and many times emphasized the importance of the 3400 mark. If it stands here, the market will gradually rise to 3420~25 and break through to the 3450 area before looking for a decline.

Today we will continue to focus on the 3400 mark area. First, we will rush to the high altitude, with the goal of retracement to the 3375 and 3356 regional support platforms, and then pay attention to long opportunities; if the bulls stand above the 3400 mark, they will further bullishly impact 3420~25 and break through the 3450 area before falling back.

OANDA:XAUUSD

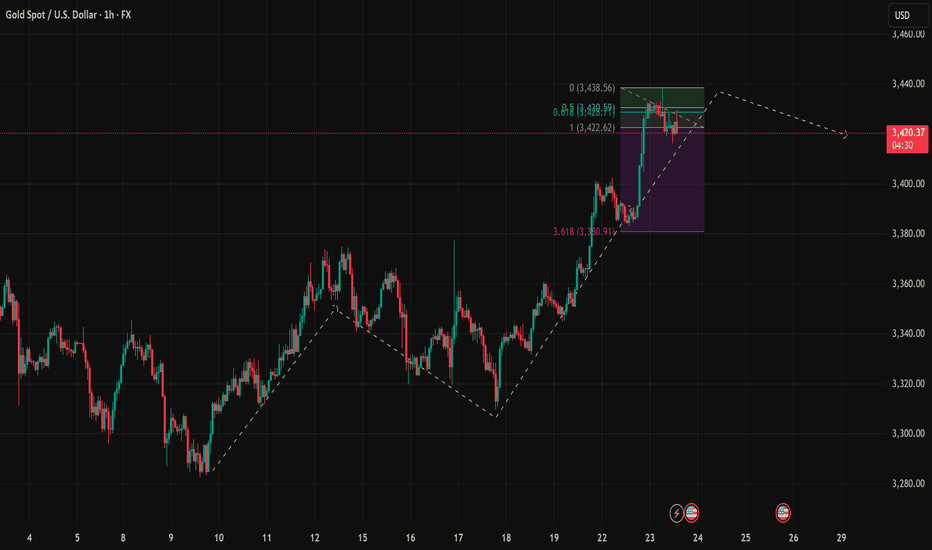

Gold Faces Key Fibonacci Resistance Is the Bullish Momentum FadiTrend Structure: Gold remains in a short-term bullish structure, with a clear series of higher highs and higher lows. However, price action shows signs of hesitation near a critical Fibonacci extension zone.

Key Resistance Zone:

$3,428 – $3,438: This area aligns with the 0.618 Fibonacci extension at 3,428.59 and the 0.0 level at 3,438.56, forming a confluence resistance zone that has started to trigger selling pressure.

Immediate Support Levels:

$3,422.62: The 1.0 Fibonacci extension, serving as the first support on a minor pullback.

$3,408 – $3,410: A potential bounce zone combining short-term trendline support and prior consolidation structure.

Fibonacci & Price Waves: The recent bullish leg from $3,330 to $3,438 has completed a 3.618 extension (noted at $3,330.91 on the purple projection). This increases the probability of a corrective retracement.

EMA & RSI (suggested for confirmation): EMA20 (not shown) should act as a dynamic support. Watch RSI for potential overbought signals or bearish divergence if it crosses above 70.

Trade Setups to Watch: Scenario 1 – Short Setup at Fibonacci Resistance Entry: $3,428 – $3,432, only if price action confirms rejection (e.g., bearish engulfing, pin bar)

Stop Loss: Above $3,438

Take Profit 1: $3,422

Take Profit 2: $3,410 (if trendline breaks)

Scenario 2 – Buy Setup on Pullback Entry: Around $3,408 – $3,410 upon bullish price action confirmation

Stop Loss: Below $3,400

Target: $3,428

Final Thoughts: Gold is approaching a strong resistance zone, and short-term pullback is likely unless bulls break through $3,438 with momentum. Traders should stay patient and wait for confirmation signals before entering. Remember: discipline beats impulse.

Follow for more updated strategies during the US session. Save this idea if you find it helpful! Let’s discuss your view in the comments below.

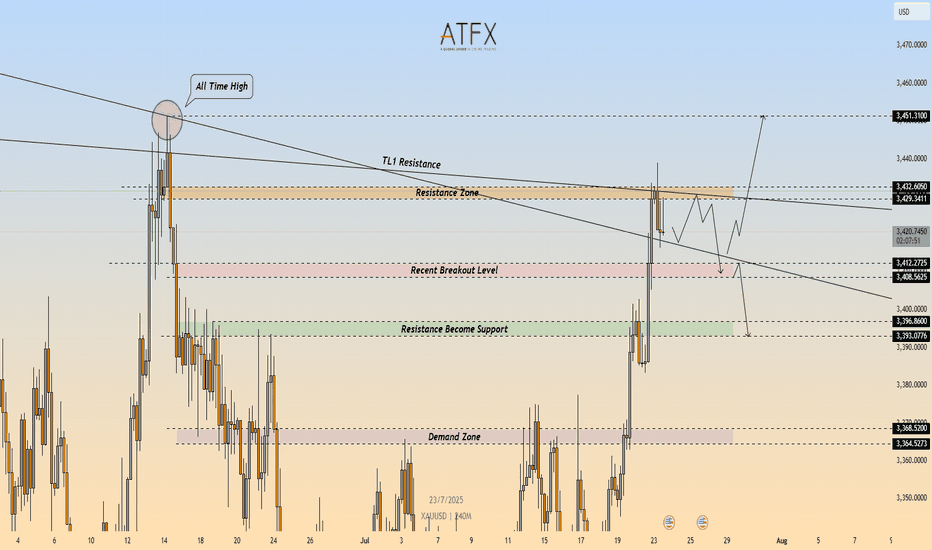

XAU/USD: Bearish Rejection at $3,432 – Short Setup in Play🔴 XAU/USD – Bearish Rejection at Key Resistance Zone ($3,432)

🔍 Technical Outlook

Gold (XAU/USD) failed to break through the $3,429–$3,432 resistance zone, which aligns with a descending trendline (TL1) and prior swing high. The rejection from this confluence zone is reinforcing bearish pressure, with price now carving out lower highs on the 4H timeframe.

A clean break below $3,412 would confirm bearish continuation and open the door toward the $3,400 area, followed by the demand zone at $3,368–$3,365.

🔻 Short Setup

Entry: 3,432

Stop Loss: 3,436

Take Profit 1: 3,412

Take Profit 2: 3,396

R\:R Ratio: ≈ 1 : 6.95

Invalidation: Close above 3,436

📌 Key Levels

Resistance: 3,429 – 3,432

Support 1: 3,412

Support 2: 3,368 – 3,365

Trendline: Long-term descending resistance acting as ceiling

📘 Summary

Gold remains capped beneath a critical resistance cluster. The rejection around $3,432 could trigger a deeper pullback toward $3,396, especially if sellers push price below $3,412. Bearish bias remains valid while price holds under the trendline.

📉 Bias: Bearish

📈 Confirmation Trigger: Break below $3,412

⚠️ Invalidation Level: Above $3,436

GOLD Intraday Chart Update for 23 July 25Hello Traders

First of all i hope you were enjoying yesterday move with 400 Pips Reward

For today we have 3400 Psychological remains in focus if market breaks below 3400 then it will move towards 3364-76 zone otherwise we are remain buyers above 3400 Level

Strong Resistance zone for intraday is at 3445-3465 if market cross 3465 the it will move towards ATH test which is around 3500

Disclaimer: Forex is Risky

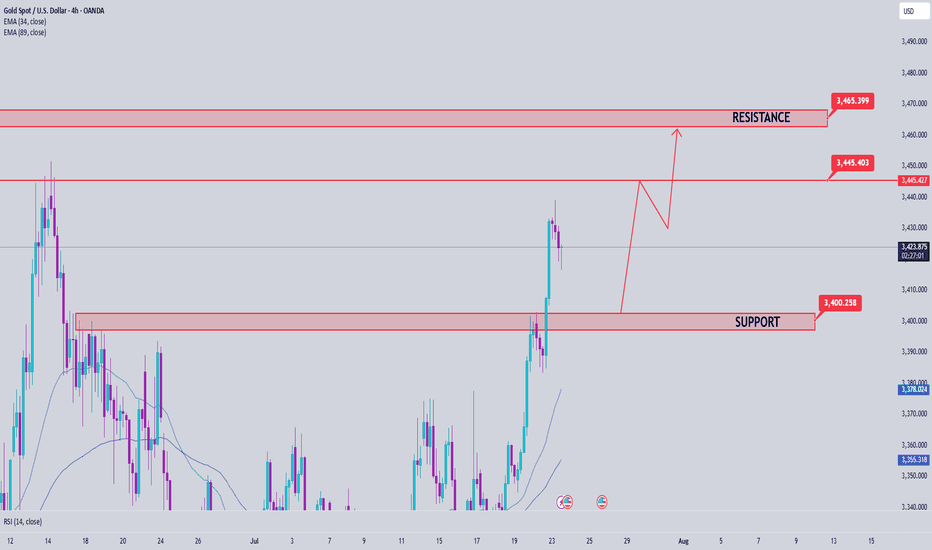

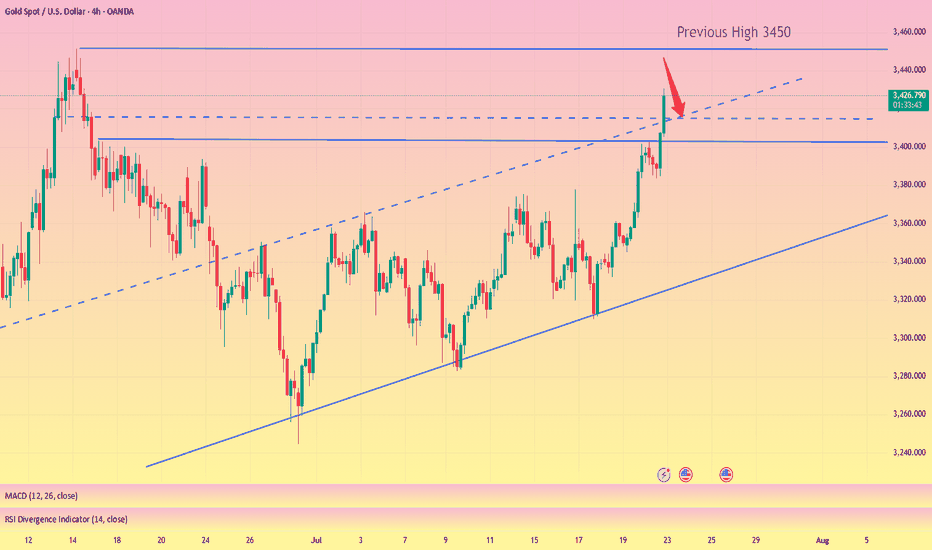

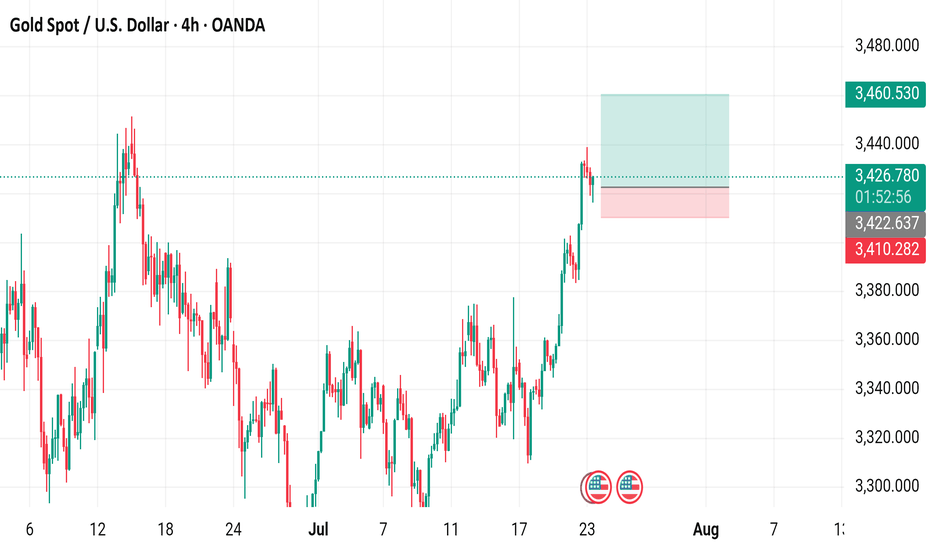

Gold Spot / U.S. Dollar (XAUUSD) - 4 Hour Chart (OANDA)4-hour chart from OANDA displays the price movement of Gold Spot (XAUUSD) from late July to early August 2025. The current price is 3,426.260, with a recent decrease of 5.185 (-0.15%). The chart shows a buy price of 3,426.580 and a sell price of 3,425.950, with a resistance level around 3,460.530 and support near 3,410.282. The data reflects trading activity as of 01:54:22 on July 23, 2025.

xauusd:3450-3500?Combined with the trend of the US dollar index, the probability of continuing to fall in the short term is high. Today, the manufacturing industry is significantly bullish for gold prices, which is expected. Powell's speech in an hour will be the key factor in today's New York market.

The pressure of interest rate cuts is imminent. Will Powell continue to insist on not cutting despite all objections? This is what we need to pay attention to. Make two plans. First, continue not to cut interest rates, the US dollar will be supported, and gold will retreat. If there is a retracement of 3400-3410 points, it needs to be paid attention to. Second, it is not discussed. Or interest rate cuts are beneficial to gold prices. This is the driving force for gold prices to hit 3500-3450.

To be honest, the conclusion of the Band Trading Center Research Institute tends to the latter. So if you buy, you need to set TP/SL strictly.

Bulls are still the main theme, 3400 is not the high point📰 News information:

1. Fed Chairman Powell delivers a welcome speech at a regulatory conference

2. The tariff deadline is approaching

📈 Technical Analysis:

Today's opening high reached around 3402, and did not effectively break through the upper resistance of 3405-3415. As I said yesterday, a decline and return to the moving average is an inevitable result. The tariff issue is still there, with the deadline on August 1, and the daily MACD indicator still shows a golden cross. The general direction of short-term bullishness has not changed, but from a technical point of view, gold still has room to fall to correct the overbought part.

Below the day, we first focus on the top and bottom conversion position of 3377-3375. As time goes by, the 4H middle track will probably resonate with the 50% position of the Fibonacci line at 3355, which is also a good long position I expect. Therefore, if the price falls back to 3380-3375 for the first time during the day, you can consider going long. If the price continues to fall, pay attention to the second opportunity to go long at 3355, with the target at 3390-3410.

🎯 Trading Points:

BUY 3380-3375

TP 3390-3410

BUY 3360-3350

TP 3370-3380

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD