Waiting for non-farm payroll dataGold prices (XAU/USD) remained under pressure in Asian trading on Friday, trading below $3,300, not far from the January low reached earlier this week. Gold failed to extend its modest overnight rebound, primarily due to the strong US dollar.

The Federal Reserve's latest hawkish tone has prompted a reassessment of the timeline for interest rate cuts, boosting demand for the US dollar and weighing on the non-interest-bearing asset, gold.

The US dollar index rose for the seventh consecutive day, reaching a new high since late May, further weakening gold's appeal. Key to the dollar's momentum lies in the latest inflation data: the US PCE price index rose to 2.6% year-on-year in June, while the core index remained stable at 2.8%, exceeding market expectations and reinforcing the view of persistent inflation.

"Both inflation data and GDP data suggest the US economy remains resilient, giving the Fed little reason to rush into easing," said a Fed observer. "This limits gold's near-term potential as a hedge."

Meanwhile, US President Trump signed an executive order on Thursday imposing import tariffs ranging from 10% to 41% on several trading partners, including Asian countries. Countries with trade deficits will face tariffs of at least 15%. This move has heightened global trade concerns, boosted market demand for safe-haven assets, and provided some support for gold.

Despite this, gold prices remain mired in a downward trend. Investors are generally maintaining a wait-and-see approach, awaiting Friday's release of the US July non-farm payroll report. This data is seen as a key indicator of economic resilience and the interest rate outlook. Expectations suggest an increase of 110,000 jobs and a slight rise in the unemployment rate to 4.2%.

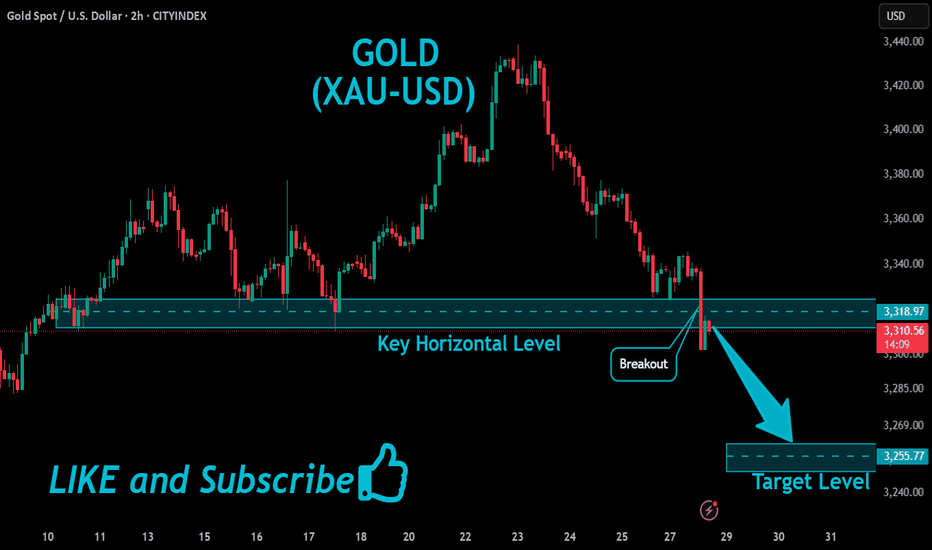

The daily gold chart shows that prices are in a weak consolidation phase, capped by key resistance near $3,320. If gold prices fail to break through this area, there is a risk of further decline in the short term. Stronger resistance lies above $3,350. A breakout on strong volume could trigger a rebound towards the $3,380 area, potentially pushing the price above $3,400.

As for downside support, the 100-day moving average provides initial support near $3,270. A break below this could trigger further downward pressure, targeting the $3,240 area, the June low. A further break below this level would target the psychologically important $3,200 level.

In terms of indicators, the MACD death cross continues, with a shortening red bar, indicating weakening bearish momentum but no reversal. The RSI remains in neutral to weak territory, not clearly oversold.

The current gold trend is characterized by a "structurally bearish, sentimentally supportive" pattern. Despite the trade war and heightened global risk aversion, the Federal Reserve's caution about inflation and the strong dollar are exerting significant pressure.

If the July non-farm payroll data is strong, gold could test further technical support. Conversely, weak data or a pullback in the dollar could trigger a technical rebound. PEPPERSTONE:XAUUSD ACTIVTRADES:GOLD VANTAGE:XAUUSD FOREXCOM:GOLD EIGHTCAP:XAUUSD FOREXCOM:GOLD

Xauusdsignal

Bounce From Final Liquidity or Start of a Bullish Move? Bounce From Final Liquidity or Start of a Bullish Move?

After the FOMC event, gold completed a sweep of the final liquidity zone at 3269–3271 and rebounded strongly, in line with the broader bullish trend. The price has now recovered sharply and is gradually returning to the liquidity zones left behind after yesterday’s sharp drop.

📍 At the moment, gold is reacting around 3295, which aligns with a CP (Compression Point) Zone on the M30 chart. We're seeing a slight pullback here, and another retracement could occur before a strong upward continuation — potentially breaking out of the descending trendline that’s formed over recent days.

📊 Trading Plan & Key Levels

✅ BUY ZONE – Trend Continuation Setup

Entry: 3286–3284

Stop Loss: 3278

Take Profits:

3290 → 3294 → 3298 → 3304 → 3308 → 3312 → 3316 → 3320 → 3330 → …

💡 This is a prime area to look for re-entries into the dominant bullish move. Price action left a clean liquidity zone below after the aggressive upside reaction — ideal for riding the next wave.

❌ SELL ZONE – Only Valid Below VPOC

Entry: 3328–3330 (Volume Point of Control)

Stop Loss: 3335

Take Profits:

3324 → 3320 → 3315 → 3310 → 3305 → 3300

🔻 This is a high-probability short only if price stays below 3330. If gold closes above this VPOC region, the structure shifts to bullish and we should look for sells higher up — around 335x–337x zones.

📅 Monthly Candle Close – Watch for Indecision

As it’s the last trading day of the month, note that the past two monthly candles have printed doji-like wicks, signalling indecision and liquidity grabs. The market is still waiting for a clearer signal from the Fed on the first potential rate cut of the year.

🚫 Avoid emotional trading. This is a highly reactive environment, so careful risk management is key.

🧭 Final Thoughts

Gold continues to respect market structure and liquidity theory. The first major test lies at the 3313 resistance level — if broken, it opens the door to stronger bullish momentum toward the broader VPOC zone.

⏳ Be patient and only act when price confirms your bias.

Non-farm payrolls are coming. Will it trigger the market?On Thursday, the US dollar index briefly rallied after the Federal Reserve's favorite inflation indicator unexpectedly rebounded, crossing the 100 mark for the first time in two months. This marked the sixth consecutive trading day of gains and the first monthly gain since 2025.

Spot gold rebounded as risk aversion lingered amid uncertainty surrounding Trump's tariff deadline, reaching a high of around $3,315, but its intraday gains narrowed after the release of the PCE data.

The dollar has already firmly established itself above the 100 mark on the daily chart, so the next target is likely to be between 101.5 and 102.0. Currently, support levels on the daily chart are visible at 99.5 and 99.0.

The gold market is currently consolidating in the 3315-3275 range. However, if the dollar rises again, Quaid believes gold prices could fall below 3275.

On the daily chart, if it falls below 3275, the price would likely be around 3250. If 3250 falls below, the market could test 3200. However, the possibility of a consolidation between 3315 and 3275 remains undisputed.

Before the release of the non-farm payroll data, scalping within this consolidation range is advisable. However, the risk is relatively high, so please take profits in time.

Non-farm payrolls are coming. What's the gold trend?Gold fell sharply on Wednesday, but Thursday's market didn't continue the downward trend as some investors expected. Instead, it showed a trend of rising and then falling.

From the daily perspective, we first need to focus on the resistance level near 3300 where the 5-day moving average is located. This position is not only a short-term technical resistance, but also reflects the market's psychological expectations to a certain extent. If prices can successfully break through this level and stabilize above it, it will indicate that bullish momentum is strengthening, potentially boosting market sentiment. At this point, the next resistance area to watch is the 3330-3340 range. This area converges the 10-day, 20-day and 30-day moving averages, forming a strong resistance band.

As for the support below, the primary focus is Wednesday's low of 3268. However, if this level is lost and the price continues to fall, the next support area will be around 3245, which is the previous low.

Trading strategy:

Short around 3300, stop loss at 3310, profit range 3280-3260.

The US dollar is strong. Be wary of gold.The US dollar index rose, now above 100, before retreating slightly and fluctuating slightly, reaching 100 for the first time in two months. After a sharp drop to around 3270 on Wednesday, gold rebounded sharply today. With the US dollar breaking through 100 and the USD/JPY pair breaking through 150, gold is now struggling to maintain its position.

Thus, Quaid believes it's not appropriate to be overly bullish on gold for now. A significant decline is likely.

The 4-hour chart shows that the upper moving average resistance is currently around 3310-3315. If it breaks through 3315, it could potentially move towards 3325.

Conversely, if it fails to break through 3315 today, it could continue to consolidate in the 3315-3285 range. Waiting for new data to guide its trend.

Gold bottomed out and rebounded, and gold is still rising!The latest news indicates that Trump has announced a 50% tariff on Brazilian products and a 25% tariff on Indian products, and has firmly stated that the tariffs will take effect on August 1st, with no further grace period. These positive factors will also support a rebound in gold.

As for tomorrow's big non-farm payrolls, considering that both the previous two times were negative and contrary to the ADP, it is very likely to be bullish for gold, which may help boost a steady rebound in gold, so there is no need to worry if you are stuck with gold.

Nothing rises forever, and nothing falls forever. Last week, the market rose in the first half, then fell in the second half. With the first half of this week's decline, the daily chart has already fallen to near the 100-day moving average. Be wary of a rebound in the second half. Gold is bearish today, but don't chase shorts. Focus on the 3300 resistance level. If it breaks above and stabilizes, expect a continued rebound to 3330-3345!

A real-time strategy is like a beacon guiding your investment journey. The market will never disappoint those who persevere and explore wisely. FX:XAUUSD VELOCITY:GOLD FXOPEN:XAUUSD ACTIVTRADES:GOLD PYTH:XAUUSD

Gold fluctuates. Is the decline halted?Information Summary:

Despite diminished market expectations for a September US rate cut, gold rebounded from a one-month low hit the previous session on Thursday, boosting its safe-haven appeal as newly announced US tariffs sparked new trade uncertainty.

So far, gold has risen 1.15%, hovering around $3,310, a gain of nearly $40 today. On Wednesday, gold prices hit their lowest point since June 30th: $3,267.79.

Market Analysis:

On the 4-hour chart, prices remain below the middle Bollinger Band, with a descending trendline defining the current bearish momentum. Prices rebounded after hitting this month's low on Wednesday. In the short term, watch for price rejection signals near the trendline. Upward pressure currently lies between $3,315 and $3,325, while support lies between $3,280 and $3,270.

Currently, prices are fluctuating upward. Quaid believes the bullish trend may continue. If the current resistance level is broken, it could reach the 3335 high before Wednesday's decline.

Trading strategy:

Go long near 3300, stop loss at 3290, profit range 3320-3330.

XAUUSD Update – Down Continuation to 3250?1. What Happened Yesterday

After an anemic correction that formed a bearish flag, Gold finally broke below 3300 and even dipped under the 3280 support zone — which was my primary downside target. While the move during the day didn’t have enough momentum to reach my second sell limit, I was already in a low-volume short position, so I didn’t miss the move entirely.

2. The Key Question

Has the drop ended, or are we looking at further downside?

3. Why I Expect More Downside

• The overall structure remains bearish.

• The newly formed resistance (previous support) is now the new sell zone.

• If the price drops towards 3280 again, continuation to 3250 becomes very probable.

4. Trading Plan

Selling rallies remains the preferred strategy, especially on spikes into resistance. As long as the price stays below 3335-3340 zone, the bearish outlook remains intact.

5. Conclusion

Sell the rallies. The technical picture still favors downside continuation — no need to overcomplicate it. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold Crashing After Hot U.S. Data – More Pain Ahead?Minutes ago, important indices were released from the US , which catalyzed the continuation of gold's downward trend .

Key U.S. Economic Data Just Dropped!

ADP Employment: 104K

GDP q/q: 3.0%

Both came in stronger than expected , signaling that the U.S. economy is holding up better than many thought!

Strong job growth

Solid economic expansion

The result? A stronger U.S. dollar ( TVC:DXY ) and potential downward pressure on Gold .

All eyes are now on FOMC meeting .

Will the Fed still hint at future rate cuts despite the solid data? Or is the easing cycle officially on hold? What is your idea!?

----------------------

Gold ( OANDA:XAUUSD ) has already managed to break the Support zone($3,350-$3,326) , Monthly Pivot Point , 50_EMA(Daily) , Support lines , and the lower line of the ascending channel . Also, Gold trading below $3,333 plays an important role for me, which can increase the possibility of a continuation of the downtrend .

I expect Gold to drop to at least the Potential Reversal Zone(PRZ) before the FOMO meeting and if the Support zone($3,307-$3,272) is broken, we can expect further declines to $3,253(Second Target) .

--------------------------------

Information we need to know:

How should the Federal Funds Rate be announced to cause a deeper drop in Gold ?

The Fed needs to take a hawkish stance — meaning:

They keep rates unchanged, but make it clear they intend to keep them elevated for a prolonged period.

They emphasize strong economic data like today's solid ADP and GDP numbers .

They express concern that inflationary risks remain, and cutting rates isn’t on the table anytime soon.

In this case, markets get disappointed, rate cut hopes fade, and gold drops as real yields( TVC:US10Y ) rise and the U.S. dollar strengthens.

--------------------------------

Note: Stop Loss (SL) = $3,340

Gold Analyze (XAUUSD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Short position profit. Latest strategyYesterday's gold price fluctuated: it maintained sideways fluctuations in the morning and started a downward channel after the opening of the US market. The Federal Reserve's interest rate decision remained unchanged. In addition, Powell's speech suppressed expectations of a September rate cut. The gold price directly fell to around 3267 and closed the day with a negative line, which exceeded expectations.

Looking back at recent trends, gold prices saw a brief correction on Tuesday after four consecutive days of decline, but failed to sustain the upward trend, falling sharply again yesterday, demonstrating that the weak market remains intact. Judging from today's market, theoretically there is still room for further decline, but before yesterday's low is broken, we don't expect a big drop for the time being; if the support here is effective, the market may tend to correct.

Pay attention to the daily resistance near 3315, and try shorting with a light position; the hourly resistance is near 3301, which is also a good position for shorting; the intraday bull-bear watershed is near 3294. If the market falls weakly and rebounds here, there may be a decline. The target below will first look at 3275. If yesterday's low of 3267 is broken, look further to 3250: On the long side, pay attention to the 3249 support below. If it is close to broken, you can try short-term buying.

【Operation ideas】👇

The bearish strategy in the morning remains unchanged. The short position at 3315 was publicly set up in the morning. The market rebounded to 3314 and then went down directly. The idea of setting up short positions at 3301 in the morning session remains unchanged. Friends who did not follow up with the short positions at 3315 can now add short positions with a light position at 3300.

PEPPERSTONE:XAUUSD ACTIVTRADES:GOLD VANTAGE:XAUUSD ACTIVTRADES:GOLD ICMARKETS:XAUUSD VELOCITY:GOLD PYTH:XAUUSD

XAUUSD H2 | Downside Target 3270Gold (XAUUSD) recently rejected from a key resistance zone around 3300, showing strong bearish momentum on the 2H timeframe.

💡 Setup Idea:

• Price broke support → Retest as new resistance ✅

• Clean imbalance left behind → Fills expected 📉

• Target: 3270 zone (300 pips move) 🎯

• Risk-Reward potential is solid for intraday/swing entries.

Trade Plan:

If price holds below 3300, we expect continuation toward the 3270 zone. This area also aligns with previous structure and liquidity grab.

🕐 Timeframe: 2H

📌 Resistance: 3300

🎯 Target: 3270

📍 RR: 1:2+

#XAUUSD #GoldSetup #PriceAction #SmartMoney #FXTrading #TradingView #ForYou

GOLD Breakdown Setup | Clean Sell Targets Ahead!XAU/USD (Gold) Analysis – 2H Timeframe

After a clear rejection from higher levels, Gold has pulled back to retest the broken support zone around 3340–3350, which now acts as a resistance.

If the price sustains below this zone, we can expect a smooth move down toward clean liquidity areas below.

This is a textbook bearish continuation setup. 💥

🔻 Trade Idea – Short Setup:

• Sell Below: 3,340

• Target 1: 3,300

• Target 2: 3,280

• Stop Loss: 3,355 (above resistance zone)

🧠 Confluences:

• Bearish market structure

• Support zone retest

• Trend continuation

• High-impact USD news ahead (watch for volatility)

📅 Key Dates: July 30 – Aug 1

⚡ NY session could trigger the move!

The Federal Reserve maintains a neutral stanceAs the Federal Reserve maintains its neutral monetary policy stance despite acknowledging slowing economic growth, the gold market is attempting to reclaim the $3,300 per ounce mark.

As expected, the Fed kept interest rates unchanged, maintaining them within a range of 4.25% to 4.50%. The most notable change in the Fed's monetary policy statement was a slight downward revision of its assessment of the economy, noting that growth in the first half of the year slowed from the "solid pace" seen in June.

In its monetary policy statement, the Fed stated: "While volatility in net exports continues to impact the data, recent indicators suggest that the growth of economic activity has moderated somewhat in the first half of the year."

The market's initial reaction to the Fed's statement was renewed volatility in gold prices. On Wednesday (July 30), spot gold closed at $3,274.88, down $51.47, or 1.55%, with an intraday low of $3,268.02. In early Asian trading on Thursday, spot gold rebounded to around $3,296, putting it within reach of the previous support level of $3,300.

While the Federal Reserve maintained its neutral monetary policy stance, dissent began to emerge within the committee. Fed Governors Bowman and Waller both voted in favor of a rate cut at this meeting.

However, analysts noted that the split vote was unsurprising, as both committee members had been outspoken about their dovish views.

With the Fed's decision unsurprising, Michael Brown, senior market analyst at Pepperstone, predicts the Fed will be slightly more hawkish this year than the market currently anticipates.

Despite the Fed's current neutral stance, the market still expects the Fed to cut interest rates twice this year, starting as early as September.

"My baseline forecast remains that the resilient nature of the labor market and continued tariff-induced price pressures will keep the Fed on the sidelines for now," Brown said. "My view remains that only one 25 basis point rate cut is likely this year, likely at the December meeting." OANDA:XAUUSD ACTIVTRADES:GOLD EIGHTCAP:XAUUSD FOREXCOM:GOLD EIGHTCAP:XAUUSD

XAUUSD – 4H Short Setup AnalysisGold (XAUUSD) has broken below the dynamic support zone of the Keltner Channel structure and is currently trading beneath the 200 EMA zone, signaling bearish momentum. Price has rejected the upper resistance band near 3385, forming a lower high and triggering a short entry at the 38.2% Fibonacci retracement zone.

📉 Trade Idea (Short Bias)

Entry: Around 3360

TP1: 3317 (key support zone)

TP2: 3275 (38.2% Fib ext)

TP3: 3208 (100% extension target)

SL: 3385 (61.8% Fib retracement)

Confluences:

Price rejection from upper channel

200 EMA trend resistance

Clean bearish structure with momentum confirmation

Fib confluence adds precision to entry and target levels

If momentum sustains below 3360, further downside is likely toward the 3200 zone.

GOLD – A Bottom in Place or Just the Calm Before the Storm?GOLD – A Bottom in Place or Just the Calm Before the Storm?

Gold has recently shed nearly $50, indicating sustained bearish pressure. But here’s the real question:

👉 Is this simply a liquidity sweep before a bullish reversal?

👉 Or are we witnessing the early stages of a broader bearish continuation?

Let’s break it all down – step by step – to map out smart, reaction-based trading opportunities.

🌍 Macro & Fundamental Overview

The US–EU trade and defence agreement has dampened gold’s role as a safe haven in the short term.

The US Dollar and equity markets remain strong, driven by solid macroeconomic data.

Overall market sentiment leans “risk-on”, pushing capital into riskier assets and away from precious metals.

📆 Upcoming Key Events:

Tuesday: ADP Employment Data

Friday: FOMC Statement & Nonfarm Payrolls (NFP)

These events could drastically shift market expectations around Fed policy, impacting gold’s direction.

📊 Technical Picture (Timeframes H1–H4)

Gold has rebounded from recent lows and is currently moving within a parallel bullish channel.

However, price is now nearing a critical resistance level at 3342 – a potential turning point.

🔎 Key Technical Zones:

🔺 Short-Term Resistance: 3342

🔺 Major Supply Zone: 3369–3388 (Order Block + Fair Value Gap + Fib 0.5–0.618)

🔻 High-Liquidity Support Zone: 3293–3290

🔻 Key Demand Zone (FVG): 3275–3273

🔺 High-Level Resistance: 3416

🧭 Trading Plan – Based on Price Action (Not Prediction)

We don’t guess the market. We wait, watch, and react based on price confirmation.

✅ Scenario 1 – Buy the Dip (Scalp Setup)

Entry: 3293 – 3291

Stop Loss: 3286

Targets: 3296 → 3300 → 3304 → 3308 → 3312 → 3315 → 3320 → 3330

🟢 Ideal for intraday scalps within high-liquidity zones.

✅ Scenario 2 – Buy from Deep Demand (Swing Setup)

Entry: 3275 – 3273

Stop Loss: 3269

Targets: 3280 → 3284 → 3288 → 3292 → 3300 → 3305 → 3310 → 3320 → 3330

🟢 Great opportunity if price absorbs selling pressure at the FVG zone and reverses.

❌ Scenario 3 – Short from Key Resistance (3342)

Entry: 3340 – 3342

Stop Loss: 3346

Targets: 3335 → 3330 → 3325 → 3320 → 3310

🔴 Use if price fails to break and hold above 3342.

❌ Scenario 4 – Short from Major Supply Zone (Swing)

Entry: 3369 – 3372

Stop Loss: 3376

Targets: 3365 → 3360 → 3355 → 3350 → 3345 → 3340 → 3330 → 3320

🔴 Higher-risk setup; enter only on strong rejection or bearish candlestick confirmation.

⚠️ Risk Management Guidelines

Avoid entries during the London and NY open – fakeouts and stop hunts are common.

Always wait for clear price reaction within zones – avoid impulsive entries.

Respect your stop-loss levels, especially with this week’s major data releases.

🎯 Final Thoughts for UK & Global Traders

Let the market come to you – never chase price.

Stay disciplined, especially in volatile weeks like this one.

The best trades are reactionary, not predictive.

💬 Found this plan useful?

Feel free to comment your views or follow for more structured gold analyses throughout the week.

Scalping Sell Setup – Trendline Break & Pullback Confirmation📉 Scalping Sell Setup – Trendline Break & Pullback Confirmation

Posted earlier – trade progressing as planned.

As shared in the previous chart, a Sell scalp position was executed based on the trendline break followed by a pullback retest.

Three Take-Profit levels were marked and the price is moving in line with the forecast. ✅

🟢 TP1 Hit

🟢 TP2 Reached

🔵 TP3 in progress

📌 The setup remains valid, and as long as structure holds below the retested trendline, the bearish bias continues.

We will monitor price action near TP3 zone for final exit or trailing stop update.

> Analysis worked perfectly so far – let’s see if TP3 gets cleared soon. 🔍💥

Gold: ADP, Fed & Key Resistance Gold has been range-bound today—let’s focus on the impact of the ADP data and Fed rate decision ⚠️.

Key resistance lies around 3345-3350 📍: a breakout could fuel further upside 📈, while a rejection may trigger an oscillating pullback 📉

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Buy@ 3325

🚀 TP 3333 - 3339 -3344

Daily updates bring you precise trading signals 📊 When you hit a snag in trading, these signals stand as your trustworthy compass 🧭 Don’t hesitate to take a look—sincerely hoping they’ll be a huge help to you 🌟 👇

XAU/USD (Gold Spot vs US Dollar) Technical Analysis – 4H Char🔍 XAU/USD (Gold Spot vs US Dollar) Technical Analysis – 4H Chart

Based on my shared image from TradingView, here's a detailed analysis of the current XAU/USD market scenario:

---

🧩 Chart Type & Indicators Used

Timeframe: 4-Hour (H4)

Platform: TradingView

Indicators:

Ichimoku Cloud

Bollinger Bands (BB)

Support/Resistance zones

Trendlines

Price Action with Target Points Marked

---

📉 Current Market Structure

Price: ~$3,324 (Sell/Buy zone shown)

Overall Trend: Turning bearish in the short term.

Price Action:

Price has broken below an ascending trendline, suggesting a shift from bullish to bearish momentum.

The price is trading below the Ichimoku cloud, reinforcing a bearish bias.

Failed retest of the cloud resistance zone (around 3,335–3,340), which now acts as a resistance.

---

🔻 Bearish Signals

1. Trendline Break:

The rising trendline support (mid-July to now) is broken.

This indicates a potential reversal from the previous bullish momentum.

2. Retest & Rejection:

Price attempted to retest the breakdown zone and was rejected from the 3,335–3,340 level.

3. Ichimoku Cloud Bearish Setup:

Price is clearly below the cloud.

Future cloud is bearish (red shaded).

Chikou Span (lagging line) is below price candles and cloud.

---

🎯 Targets

First Target Point: ~3,300

This is the next horizontal support level (near recent lows).

Final Target Point: ~3,270

Stronger support zone and measured move from breakdown.

---

🛡 Resistance Zone

Immediate Resistance: 3,335–3,340

Stronger Resistance: 3,370

---

📌 Conclusion

The XAU/USD 4H chart shows a bearish breakout below the rising channel, with confirmation from Ichimoku and price rejection at cloud resistance. The market is targeting 3,300 as the first support, and if that breaks, 3,270 will likely follow.

---

✅ Strategy Suggestion (if trading):

Bias: Short/Sell

Entry: After a weak pullback or retest near 3,330–3,335

Targets:

TP1: 3,300

TP2: 3,270

Stop Loss: Above 3,345 or near 3,350 zone

Let me know if you'd like this in simpler terms or want me to track the next setup.

XAUUSD analysis - 1H FVG and OB setupsOn the 1H timeframe, price is currently approaching two key supply zones (OB 1H):

🔴 First OB zone: around 3354 – 3360

🔴 Second OB zone: around 3368 – 3370

We're watching these zones for potential short setups, only with confirmation on the lower timeframes (5M or 3M).

If price reacts to one of these OBs, we expect a move down toward the green 1H demand zone around 3280 – 3290, where a long setup may later form.

📌 Key scenarios:

1️⃣ Price hits the first OB → confirmation → short

2️⃣ Price moves to the second OB → confirmation → short

3️⃣ Target for both setups = green OB around 3280

4️⃣ No entry without confirmation from LTF

❗️ Do NOT enter without lower timeframe confirmation.