Gold once fell below the 3,300 mark, can it rise again?

📌 Driving Event

Spot gold (XAU/USD) once fell below the 3,300 US dollar mark, a significant correction from the previous historical high of nearly 3,500 US dollars. The market's risk appetite has increased, making the attractiveness of safe-haven assets weakened in the short term. However, repeated news about the direction of US policy and the Fed Chairman's movements may still affect the market in the medium and long term.

📊Comment Analysis

From the perspective of market sentiment, the strong rise in gold prices in the early stage mainly relied on safe-haven demand and speculation about subsequent monetary easing. However, the short-term trend has led to some profit-taking in safe-haven assets due to the recovery of the equity market. This change in sentiment reflects the current market's optimism and caution about the US macroeconomic environment: once risk appetite weakens again, gold may be supported again; if risk appetite continues to rise, gold prices may continue to retreat.

Overall, the market is in a state of repeated game, and sudden news can easily lead to large fluctuations in gold prices, and we need to continue to pay attention to the evolution of risk sentiment.

✅ Outlook for the future

Short-term outlook: In the case of short-term technical continuation signals, gold prices may remain weak, and the support around $3,300 and $3,230.00 is worth paying attention to. If volatility further increases, it is not ruled out that prices will rebound quickly or bottom out rapidly.

Medium- and long-term outlook: The upward structure at the daily level has not been completely destroyed. If the uncertainty of US policies increases or economic data is weak in the future, it will once again drive the recovery of safe-haven demand. Gold prices may still regain their upward momentum and hit $3,500 or even higher. On the contrary, if the equity market continues to strengthen, gold prices will face deeper correction pressure.

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose a lot size that matches your funds

- Profit is 4-7% of the fund account

- Stop loss is 1-3% of the fund account

Xauusdtrade

Gold "skydived" from $3,500, where will the landing price be?Fundamental analysis: the game between policy signals and safe-haven demand

From a fundamental perspective, Trump's moderate statement is the core driving factor of this round of gold correction. However, as tariff expectations cool, investors are beginning to reassess the attractiveness of risky assets. The three major U.S. stock indexes closed higher on Tuesday, and the 10-year U.S. Treasury yield fell slightly, indicating that the market's confidence in the economic outlook has recovered. Against this background, the safe-haven premium of gold has been weakened, and profit-taking has accelerated.

In addition, the Fed's policy expectations are still an important variable affecting gold. At present, the market generally expects the Fed to continue to cut interest rates in 2025, but the pace and magnitude depend on inflation data and economic performance. If the expectation of interest rate cuts further heats up, the US dollar index may be under pressure, thereby providing some support for gold.

Technical analysis: pullback pressure and key support

The gold price fell below the support of $3,300, and the next key level points to $3,282, which coincides with the low point on April 17. If the decline continues, $3,150, as the pivot point in early April, will become an important defensive line for bulls. On the contrary, if the price stabilizes and rebounds, the pivot point of $3,415 will be the first resistance level, and further upward movement needs to pay attention to the higher resistance of $3,464. It is worth noting that the current price is far away from the resistance level of $3,415, and the rebound momentum may be limited in the short term, unless new fundamental catalysts appear to push the RSI back to the overbought area.

Quaid's comprehensive analysis:

The gold market has entered a consolidation phase after a rapid rise, and short-term correction pressure still exists, but in the long run, safe-haven demand and fundamental support remain solid. Quaid recommends that traders pay close attention to US policy trends, the trend of the US dollar, and the performance of key technical levels to grasp the market rhythm.

At the same time, Quaid will always pay attention to international news so as to make timely analysis and suggestions for traders; to help traders get out of the current predicament.

Gold is falling wildly, is a key position coming?As of press time, spot gold has fallen wildly to below the support level of $3,300, having hit a record high of $3,500.05 the previous trading day.

At present, gold has fallen more than 5% from its historical high, and the fundamentals seem to be changing.

Quaid believes that gold has reached a key "turning point". After a strong rebound, the precious metal not only gave up all its gains, but also fell to a new low.

The sharp rise in gold prices is mainly due to the market pricing of "stagflation" risks, but as this risk is gradually eliminated, gold may experience a significant correction, especially considering that "long gold" has become one of the most crowded trades in the market, and its parabolic rise is an obvious signal. From a larger cycle perspective, gold is still in an upward trend, because the real yield may continue to decline against the backdrop of the Fed's easing policy. But in the short term, if good news about tariffs continues to be released, gold prices may fall further, and the market will adjust according to the new environment.

Daily chart analysis

From the daily chart, gold has given up all of Monday's gains. From a risk management perspective, buyers may look for a more cost-effective entry position at 3290 in the hope of further gains, while sellers hope that prices can break further down, thereby increasing bearish bets.

4-hour chart analysis

In the 4-hour chart, prices found support around 3300 and rebounded. Buyers intervened at this position and set risks below this support level in an attempt to push prices higher again. Sellers hope that prices fall below this level to push prices further down.

Quaid's analysis:

The current market is crazy. If it can fluctuate and adjust around the 3300 support level, the downward trend will stop and it may rise to 3400.

If this support level fluctuates and falls, it may plummet to around 3150.

Traders can wait and see for a short period of time before trading.

I hope Quid's analysis can help you get out of your current predicament. I also wish that all traders can fight for their own money waves in the market and achieve financial freedom under Quaid’s advice and analysis.

Gold short position wins streak, waiting to continue shortingThe 1-hour moving average of gold continues to turn downward. If a downward dead cross pattern is formed, then there is still room for gold bears to fall. Gold is under pressure to fall near the resistance line of 3340.

Gold's current rebound is not very strong. Although it seems to rebound a lot every time, that is because the market volatility has increased. Gold is still a bearish trend in the short term, and the rebound continues to be bearish.

Trading ideas: short gold near 3338, stop loss 3350, target 3318

Gold falls from highs, medium-term bullish structure remains uncSpot gold prices continue to fall, extending the correction of the psychological level of $3,500.

At the same time, senior Trump administration officials hinted that they are "paving the way" for a trade agreement with Asian powers, further boosting investors' confidence in the global economic outlook, thereby weakening demand for safe-haven gold.

Fed policy expectations still support gold's downward space.

Despite improved risk sentiment, the market still expects the Fed to launch a new round of interest rate cuts in June, with three rate cuts expected throughout the year, which makes gold's medium-term trend still optimistic. At present, weak US economic data and the president's erratic trade policy have further suppressed investors' confidence in US dollar assets.

Quaid believes that the market's expectations for the Fed's interest rate cuts have supported the structural upward trend of gold, even if it faces a technical correction in the short term.

Technical aspects show that gold may adjust in the short term, but the support below is strong.

Quaid's analysis:

The current adjustment pressure faced by gold comes more from short-term market sentiment repair and technical profit-taking, but the medium- and long-term fundamentals are still strong. The Fed's interest rate cut expectations have not changed, the US dollar has a clear medium-term weakening trend, and geopolitical factors are still highly uncertain. Gold is still in a bull-dominated pattern overall.

Operation strategy:

3325 long, stop loss 3315, take profit 3350. If it stops rising at 3350, traders can flip the operation strategy and short at this position.

Gold operation strategy, how to grasp the ups and downs of the mAt the end of the Asian market, spot gold maintained a sharp decline in the day. The current gold price is around $3,305/ounce, and it plummeted during the day.

Gold prices fluctuated this week, hitting a record high of $3,500/ounce, and then encountered resistance and fell to the $3,300/ounce level. The main reason for the record high in gold prices was that the market was worried that the Federal Reserve would lose its independence after US President Trump verbally attacked Federal Reserve Chairman Powell.

US President Trump said on Tuesday evening local time that he had no intention of firing Federal Reserve Chairman Powell. Trump also said that tariffs on Chinese imports would be "substantially" reduced from the current 145%.

Quaid believes that the hope of easing Sino-US trade tensions has driven a positive shift in risk sentiment and a recovery in the US dollar. Investors used this as an excuse to take profits on their gold long positions.

Latest trading analysis:

The gold daily chart shows that the 14-day relative strength index (RSI) has fallen back from the overbought area to the bullish area. The latest decline in this leading indicator supports a new round of decline in gold prices. However, as long as gold prices can hold the $3,300/oz level, gold buyers still have hope.

If the gold correction deepens, gold prices may challenge the 21-day simple moving average (SMA) of $3,163/oz. Before that, the $3,200/oz mark may provide some support for buyers.

On the other hand, if the upward trend resumes, gold prices may re-break through $3,400/oz and then aim for the historical high of $3,500/oz.

Gold has been volatile recently. If traders are not doing well in gold operations at present, I hope Quaid's analysis can make your investment smooth. Welcome all traders to communicate.

Gold price plunged nearly $200. The signal of cooling down the tIn the early Asian session on Wednesday, spot gold opened nearly $40 lower and hit $3,313.51 per ounce, down nearly $200 from the historical high of 3,500 hit on Tuesday. Because U.S. Treasury Secretary Benson hinted that international trade tensions would ease, which stimulated optimism in the stock market and boosted the dollar to a near one-week high; spot gold closed down 1.2% on Tuesday, closing at $3,380.95 per ounce.

Bob Haberkorn, senior market strategist at RJO Futures, said: The latest remarks suggest that the trade war with the Asian giant may ease, but this is the time to start selling.

After Benson said that the tariff deadlock was unsustainable, the U.S. stock market rose by more than 2%, suppressing the safe-haven buying demand for gold, and the rebound of the U.S. dollar also suppressed the price of gold.

Quaid believes that its roller coaster trend is still continuing. I hope traders will pay attention to the speeches of several Fed officials later this week, hoping to find clues to future monetary policy at a time when people are worried about the independence of the Fed. And I will analyze it for you as soon as possible and give you reasonable suggestions.

Current strategy:

Relative to the market situation: as long as the price can continue to rise, it means that the current situation is just a volatile market, not a peak retracement, which is also a feature of the volatile trend; at the same time, the current market is not extremely strong after a sharp drop, and it is still in a volatile rise; therefore, do not go long, but go long after the retracement support.

Gold hits a new high. Will it have no ceiling?Analysis of gold trend:

Spot gold continued to rise in early Asian trading on Tuesday.

Fundamentals:

On Monday, the US dollar index plunged to its lowest level in three years as Trump's remarks on Powell undermined investor confidence in US assets. The United States plans to impose new tariffs on solar products imported from Southeast Asia, and Trump's approval rating has dropped to the lowest since returning to the White House. Risk aversion has increased, and gold prices have strengthened significantly. The current global trade tensions will continue, and concerns about economic growth, inflation expectations, etc. will continue to support gold prices.

Technically:

From a technical perspective, it is difficult to see such a large upside, and in this uptrend, there is basically no room for adjustment. Therefore, it is difficult to keep up with the rise of this bullish trend. Gold does not guess the top in the bullish cycle, as long as it can give a decline, it is an opportunity to go long. From the daily chart, the big positive line in the daily K-line is pulled up, and the trend is mainly broken; the shape is bullish; the golden cross of the stochastic indicator suggests that the bulls have not ended; the MACD double lines are upward, which is the main bullish signal; the short-term 4-hour level, the current 5-day moving average support has moved up to the 3438 line, which is also the bullish support level after the normal adjustment of the market. It should be difficult to give a very strong trend, so you should be flexible in operation. Don't look at the serious divergence of MACD and the serious overbought of RSI for the time being, and you can't help but short it.

Quide's analysis: The current market rise is all due to tariffs, and the technical aspect has no great reference significance. As long as the tariffs are not relaxed, gold will be difficult to pull back. Today's gold rise is expected to rush to 3,500 US dollars. Further look at 3,520-3,550.

I am Quide. Seeing my analysis strategy, no matter the past gains and losses, I hope that you can achieve investment breakthroughs with my help and turn every tide of the gold market into our wealth wave.

Gold Weekly Outlook: Strong Upward Trend, Continue to Go LongThere is no analysis to be made on gold at present, basically all longs are made, this bull market has to be said to be too crazy.

Since gold started to rise from the low point of 2956, except for two normal adjustments in the middle, the price of gold has maintained a strong upward trend relying on the MA5 moving average for most of the time. This trend characteristic shows that in a shorter period, the MA5 moving average has become an important support line for the rise in gold prices. As long as the price runs above the MA5 moving average, the bulls will dominate.

At present, 3500 is about to arrive in a flash, it is just a matter of time. The current market depends on everyone's courage. If you go in with a long order, you will definitely make a profit, and it is very easy, with basically no callback.

And any callback is an opportunity. In terms of operation, you can continue to go long relying on the short-term moving average MA5.

Just like the analysis in Quaid's previous article, you can boldly believe that it can reach the new height you think. Believe in Quaid, believe in yourself, brother, you can do it.

I am Quaid. After seeing my analysis strategy, no matter your past gains and losses, I hope that you can achieve an investment breakthrough with my help and turn every tide in the gold market into our wealth wave.

XAUUSD buy opportunity targeting 3400XAUUSD buy opportunity targeting 3400

1. A golden opportunity emerges as XAUUSD eyes a bullish breakout.

2. Current market dynamics strongly favor long positions in gold.

3. Investor sentiment shifts amid global economic uncertainties.

4. Safe-haven demand fuels upward momentum in precious metals.

5. Technical indicators signal strong support and bullish continuation.

6. The 3400 target aligns with historical resistance and Fibonacci extensions.

7. Central bank policies and inflation concerns bolster gold's appeal.

8. Volatility in fiat currencies drives capital toward tangible assets.

9. Momentum traders are positioning early ahead of the breakout.

10. A strategic buy now could yield significant returns as gold ascends.

Trump's high tariff policy triggers risk aversion, gold price apGold prices maintained a strong upward trend during the Asian trading session, approaching the integer mark of $3,400 during the session, setting a record high. The main driving force is the market's growing concerns about US President Trump's latest tariff policy.

Trump recently announced that tariffs of up to 145% would be imposed on goods from some Asian countries, and some categories even reached 245%. According to market surveys, Asian countries also immediately imposed tariffs of up to 125% on US products, triggering concerns about the risk of a global economic downturn.

The current policy and trade uncertainties will continue to support the buying enthusiasm of non-yielding assets such as gold.

Despite the strong bull market, the technical side shows that gold is already in an overbought state, and the daily RSI index exceeds 70, indicating that there may be an adjustment or consolidation trend in the short term. If there is a pullback, the support levels are $3,350, $3,328 and $3,300, respectively, and the key support is in the $3,284 area.

Next focus of the market

This week, the market will focus on the upcoming global PMI preliminary data, which will provide further guidance on the health of the global economy. At the same time, the speech of Chicago Fed President Goolsbee may also have a certain impact on the trend of the US dollar.

Judging from the current multiple factors, the price of gold is still strong in the short term due to the support of risk aversion. However, the overbought signs on the technical side cannot be ignored, and the short-term adjustment will provide a more stable foundation for the medium-term rise.

Quide's operation suggestion:

3380 long, stop loss 3270, take profit above 3400.

I am Quaid. Seeing my analysis strategy, no matter the past gains and losses, I hope you can achieve investment breakthroughs with my help and turn every tide of the gold market into our wealth wave.

Market Analysis: Gold Extends Record RunMarket Analysis: Gold Extends Record Run

Gold price started a fresh surge above the $3,250 resistance level.

Important Takeaways for Gold Price Analysis Today

- Gold price started a fresh surge and traded to a new record high at $3,384 against the US Dollar.

- A key bullish trend line is forming with support at $3,322 on the hourly chart of gold at FXOpen.

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price formed a base near the $3,200 zone. The price started a steady increase above the $3,250 and $3,280 resistance levels.

There was a decent move above the 50-hour simple moving average and $3,350. The bulls pushed the price above the $3,380 resistance zone. A new record high was formed near $3,384 and the price is now consolidating gains.

On the downside, immediate support is near the $3,362 level and the 23.6% Fib retracement level of the upward move from the $3,283 swing low to the $3,384 high.

The next major support sits at $3,322. There is also a key bullish trend line forming with support at $3,322. It is near the 61.8% Fib retracement level of the upward move from the $3,283 swing low to the $3,384 high.

A downside break below the trend line support might send the price toward the $3,282 support. Any more losses might send the price toward the $3,242 support zone.

Immediate resistance is near the $3,384 level. The next major resistance is near the $3,388 level. An upside break above the $3,388 resistance could send Gold price toward $3,500. Any more gains may perhaps set the pace for an increase toward the $3,520 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAUUSD/GOLD: What happens when GOLD goes too high?Gold Price Soars Amid Geopolitical Tensions – Is There a Correction Coming?

As political tensions, especially the ongoing trade issues between the US and China, continue.

Showing Gold’s Safe Haven Status in These Uncertain Times.

- What’s Driving This Rise?

With investors always looking for safety and minimal risk, recent news surrounding new tariff threats and diplomatic tensions between the two economic giants has added to the interest in buying gold.

- So, Where Will the Gold Peak Stop? Is 3400 or 3500 .. the Final Peak?

🔼 Key Resistance Levels to Watch Are 3358 and 3380

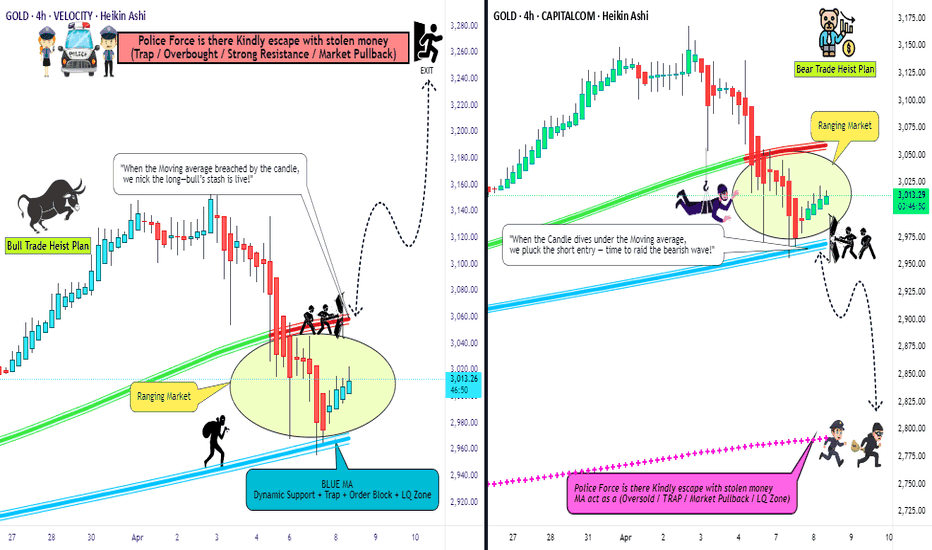

XAU/USD "The Gold" Metal Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸"Take profit and treat yourself, traders. You deserve it!"💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 3070

🏁Sell Entry below 2950

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy (or) sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

🚩Thief SL placed at 2960 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 3050 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers : TP 3260 (or) Escape Before the Target

🏴☠️Bearish Robbers : TP 2800 (or) Escape Before the Target

⚒💰XAU/USD "The Gold" Metal Market Heist Plan is currently experiencing a neutral to bullish trend,., driven by several key factors.... 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉🔗🔗

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GOLD 4H ANALYZEHello dear traders,

I’ve been away for a while, but I’m back now to share fresh market analysis and trading signals.

As you can see on the gold (XAUUSD) chart, we’re continuously seeing the formation of new price highs. Every price correction in key zones can offer a great buying opportunity.

The price range between 3190 and 3195 is a high-potential buying area.

Make sure to pay attention to the note highlighted in the image.

Wishing you all success and happiness!

Gold prices continue to rise as profit-taking takes place? Will Gold prices fell from an all-time high of $3,357 an ounce after Fed Chairman Powell warned that the Fed's goals could conflict, sparking concerns about stagflation. Regarding trade negotiations, U.S. President Trump said they were progressing well, adding that he was very confident of reaching a trade deal with the European Union and China. This statement has boosted market risk appetite and hit safe-haven gold.

So the previous decline only reflects investors taking profits before the long holiday weekend. However, the weak dollar and trade tensions have kept it above $3,300 an ounce.

Quaid believes that there is no short selling, only longs, and there have been many one-sided markets during this period. Judging from the current trend chart, it is still running upward and has shown signs of rising bottoms, which shows that the bulls have occupied a more advantageous position. If the big positive line continues to break new highs next week, there will be an opportunity to continue to attack 3,400.

For next week, the bullish position of gold retracement is around 3,290.

Quaid wants to say to everyone: Before going out to sea, fishermen don't know where the fish are. But they still choose to go because they believe they will return with a full load. And you, my friend, don't know whether you can make a profit, but you still need to try. Success is not something that will happen in the future, but from the moment you choose and decide to do it, you will gain something if you persist in believing. The same is true for Huang Investment. You may still be confused at the moment, but as long as you persist, the problem will eventually be solved.

Trading suspension period. What is the future trend of gold?The dollar continues to fall. Fundamentals depend on Sino-US relations and economic data, especially after Powell's speech. The weekly close is close to the support level, and the decline may continue.

Gold recovers after shock. Fundamentals show that prices may continue to rise. The market will be closed for the next three days and traders will take a break. During the holiday, the weekend is full of too many unknowns. But from a technical point of view, the focus is on the medium-term level. Quaid believes that its upward trend is still strong.

If there is no supernatural event during the holiday, gold may rebound from the nearest resistance level in the Asian session and test the trend support level before continuing to rise. If there is any major change in the mood of the country/politicians, I will update my thoughts in time. Give traders time to adjust their positions.

Gold Price Surpasses $3,300 for the First Time in HistoryGold Price Surpasses $3,300 for the First Time in History

Just six days ago, we highlighted the historic breakthrough of the $3,200 level for the first time. Now, as the XAU/USD chart shows today, the price of an ounce of gold on global exchanges is fluctuating above $3,300.

Bullish sentiment is being driven by a weakening US dollar and rising trade tensions between the United States and China, which are boosting gold’s appeal as a safe-haven asset. In response to these developments, Goldman Sachs analysts have raised their year-end 2025 forecast to $3,700.

However, technical analysis is beginning to flash some bearish signals.

Technical Analysis of XAU/USD

Using the latest data, we have drawn an ascending channel on the hourly chart that more accurately reflects price action since 8 April. Initially, the price moved within a narrow range, but after breaking the S-line, it found support (indicated by an arrow) at the lower boundary of the channel.

At present, there are signs of fading upward momentum in the gold market, as the price:

→ is failing to reach the median line (marked with a symbol);

→ is falling below the lower boundary of the channel.

After a rally of over 26% since the beginning of the year, the market may now be heavily overbought, and a correction could help “let off steam”. In this case, a test of the $3,250 level cannot be ruled out.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Gold continues to wait for a new ATH of 3381

📌 Driving Events

On Thursday, gold prices (XAU/USD) entered a consolidation phase, fluctuating in a narrow range near the all-time highs set during the Asian session, as investors digested conflicting market signals. Stronger-than-expected US retail sales data and tough comments from Federal Reserve Chairman Jerome Powell supported the US dollar (USD), curbing some of the upward momentum of gold. At the same time, optimism in the stock market and slightly overbought technicals prompted traders to remain cautious, currently limiting a new round of buying interest in precious metals.

📊Comment Analysis

Gold now continues to maintain its high strength, and gold is still in a bullish trend. The short-term correction does not change the upward trend of gold. The decline of gold is an opportunity to go long. The current price of gold is 3320, which is directly long!

💰Strategy

Long position:

Gold is long around 3320-25, defend around 3310 area, and the target is above 3340

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

- Profit is 4-7% of the fund account

- Stop loss is 1-3% of the fund account

How will gold go? Trader Quaid explains it for youIf there is positive news on the US-China trade situation or profit-taking selling pressure breaks out, it may trigger a sell-off.

Gold prices have risen by nearly $700 this year, with tariff wars, expectations of rate cuts and strong central bank buying all helping.

The current market trend has become a little out of control and there is a risk of correction. However, the correction we have seen in more than a year has not been large, and every time the market falls back, there is buying waiting behind it.

The upward trend in gold prices remains, and buyers are paying attention to the $3,370/ounce level. If it breaks through this level, gold prices will target the $3,400/ounce mark. If gold strengthens further, bulls will further look to key psychological levels such as $3,450/ounce and $3,500/ounce.

On the contrary, if gold prices fall below $3,300/ounce, the first support level will be $3,229/ounce, followed by $3,200/ounce.

I hope this analysis can help you.

I am Quaid. After seeing my analysis strategy, no matter your past gains and losses, I hope that you can achieve an investment breakthrough with my help and turn every tide in the gold market into our wealth wave.

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout then make your move at (3185) - Bearish profits await!"

however I advise to Place sell stop orders below the Breakout level (or) after the breakout of Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 30min timeframe (3240) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 3130

💰💵💴💸XAU/USD "The Gold" Metal Market Heist Plan (Day / Scalping Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness).., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

2 hours ago