Is it profitable to be long gold now?📍Although gold is in an overall downtrend, its decline has not been smooth during multiple tests of the 3000 level. Therefore, the support zone between 3005 and 2995 remains valid. Considering the downward momentum observed during the tests of 3000, gold is unlikely to experience a sharp drop. Instead, it may follow a pattern of gradual, oscillating declines. If gold receives strong support in the 3005-2995 range, a rebound toward the 3015 level is still possible, with the potential to extend further to the 3025 level.

🔎Trade Idea:

Xauusd: Buy at 3010-3000

TP:3015-3025

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Xauusdtrade

Short gold? No, I choose to buy gold📍Gold Plunges to Around 3006 — Is This Really a Good Opportunity to Chase Shorts? To be frank, despite the sharp short-term decline in gold, bullish resilience remains evident. As long as the price holds above the 3000-2995 support zone, the defensive line remains strong and unbroken. Therefore, I don’t consider chasing shorts a prudent decision at this stage. On the contrary, the presence of strong buying interest and solid support below significantly increases my preference for long positions in gold.

🔎Trade Idea:

Xauusd: Buy at 3015-3005

TP:3025-3035

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

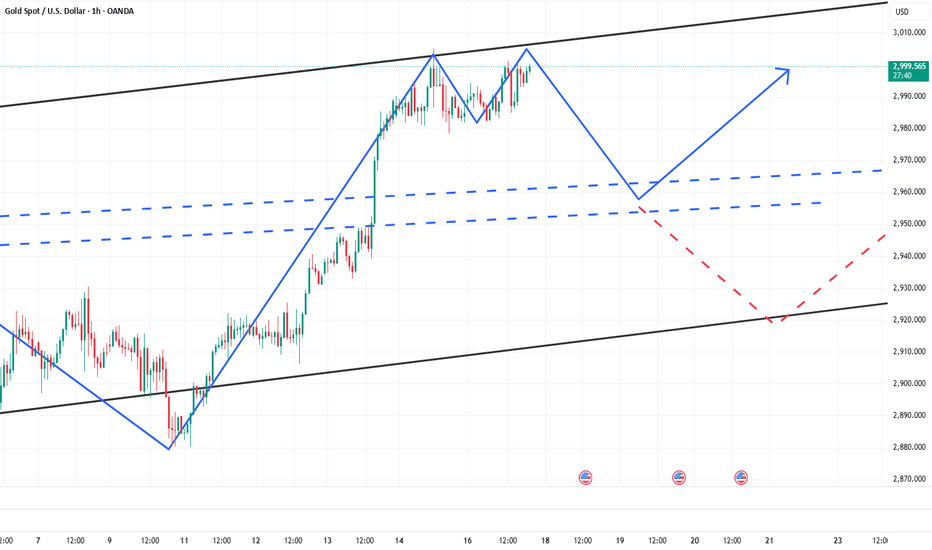

Gold focuses on suppression near 3038 aboveThe hourly chart suppression point of gold is around 3038. As long as the trend line is not stable, gold may still retreat. At present, we need to pay attention to whether 3038 can be stabilized. As long as you do not stand firmly above this position, you can rely on the 3030-40 range to go short.

Bearish Bias Under Head and Shoulders Formation📍Gold is currently leaning towards a bearish trend under the pressure of a well-defined head and shoulders pattern. Therefore, our primary trading approach remains focused on short positions.

📍In the short term, the key resistance to watch is in the 3030-3040 zone. However, it's worth noting that on Friday, gold quickly recovered most of its losses after testing the 3000 level, indicating the presence of strong buying interest and solid support below.

📍From a trading perspective, there is still an opportunity to capture profits from potential technical rebounds. The main support levels to monitor are:

📌3010-3000 as the initial support zone

📌2995 as the secondary support level

🔎Trade Idea:

1. Xauusd: Sell at 3035-3045

TP:3020-3010

SL:Adjust according to risk tolerance.

📎But if gold shows signs of holding support, a short-term rebound could provide opportunities for counter-trend trades.

2. Xauusd: Buy at 3015-3005

TP:3025-3035

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

WHAT WILL BE THE NEXT MOVE OF GOLD ?🚀 GOLD (XAU/USD) – High-Probability Trade Setups! 🚀

Hey, traders! Hope you're all geared up for another exciting week in the markets! 🏆 As we get ready for the market open, let’s break down what’s next for Gold (XAU/USD).

📊 Last Week’s Recap

📈 Gold hit 3057, but before the market closed, we saw a strong rejection pushing price back down. Now, Gold is stuck in a range between 3024 resistance and 3020 support—meaning we need a breakout before taking action!

💡 No-trade zone = 3020 - 3024 ❌ Stay out until a breakout happens!

Two Possible Trading Scenarios

🔵 Scenario 1: Buy Above 3024

📌 If a 30M candle closes above 3024, we wait for the next candle to wick down while keeping the previous low safe.

📌 Once price breaks the high of the previous closed candle, we enter buys targeting 3034! 🚀

✅ Break-even after 40 pips—lock in those profits! 💰

🔴 Scenario 2: Sell Below 3020

📌 If a 30M candle closes below 3020, we wait for the next candle to wick up while keeping the previous high safe.

📌 Once price breaks the low of the previous closed candle, we enter sells targeting 3011! 📉

✅ Break-even after 40 pips—protect your capital!

📍 Final Trade Plan

📊 BUY above 3024 🎯 TP: 3034

📊 SELL below 3020 🎯 TP: 3011

📢 Don’t chase trades! Let the market confirm and follow the plan! 📈🔥 #XAUUSD #GoldAnalysis #ForexTrading #SmartMoney

The Bear Awakens: A Perfectly Executed Short on Gold📍Over the past few days, I’ve consistently emphasized that the bear is on the verge of fully awakening, warmly inviting everyone to watch it dance. Today, gold has indeed pulled back to the 3000 level as anticipated, making our short position from the 3035-3045 range a resounding success!

📍Since gold has tested the 3000 level for the first time, a second test is highly likely. Therefore, the primary trading strategy remains focused on selling gold on rebounds. The head-and-shoulders formation continues to exert significant pressure, making a sustained breakout to the upside unlikely in the near term.

📍With this in mind, the resistance zone can be adjusted lower to 3025-3035. If gold fails to break through this region during its rebound, further downside movement is expected. In that case, gold will likely retest the 3000 level and could potentially breach it, extending losses towards the 2995-2985 range.

🔎Trade Idea:

Xauusd: Sell at 3025-3035

TP:3005-2995

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

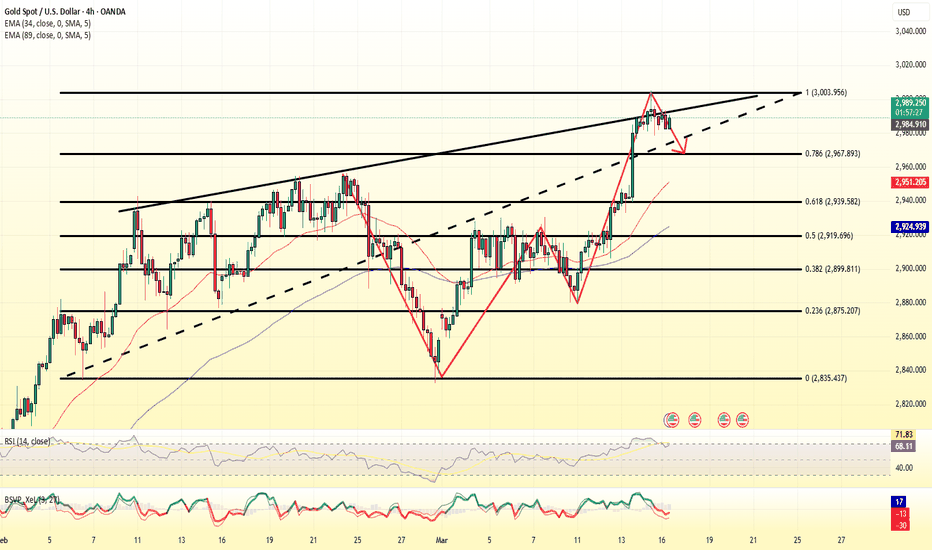

The bearish trend will continue📍Since the day before yesterday, I've been sincerely inviting everyone to watch the bear dance.Gold has decisively broken below the recent support zone at 3030-3026 and extended its decline to around 3021. Based on this price action, two key conclusions can be drawn:

1. 3057 is now confirmed as the current high.

2. Gold has successfully formed a head and shoulders pattern in the short term.

📍This indicates that bearish momentum remains strong and far from exhausted. Under the pressure of structural resistance, gold is likely to continue testing lower support levels around 3010-3000, with a possible extension toward 2995.

🔎Trade Idea:

Xauusd: Sell at 3035-3045

TP:3015-3005

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Boldly short gold, the bear has awakened!📌Bros, as mentioned in the previous article, Marvin invites you to grab a cup of coffee and quietly watch the dancing bears.

📍As I just said, if gold cannot break through the 3040-3050 area, it will build a head and shoulders structure in the short-term structure, and gold may accelerate downward to the 3020-3010 zone.

🔎Xauusd: @3040-3050 Sell

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Watch as the bears are about to dance!📍Bros, we must pay attention to the 3040-3050 area next. If gold cannot break through this area during the rebound, then the technical level may build a head and shoulders top structure, further stimulating the decline of gold. The market bullish factors for gold have all appeared. If there is no extra force to support the rise of gold, then the bears will fully wake up and may even go down to the 3020-3010 area.

📌So in terms of short-term trading, we can try to short gold in the 3040-3050 area.

🔎Xauusd:@3040-3050 Sell

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Seize the callback opportunity to go long goldBros, after hitting a high near 3057, gold fell back as expected. It has now fallen back to around 3030.

📍Although the fall in gold was expected, the strength of the fall was less than expected. According to the current strength of the fall, gold may not be able to form an effective downward force. It is more likely to attract friends who missed the entry ticket in the early stage to enter the market again to buy gold;

📍After the breakthrough, there are many supports below. It may be difficult to break through the heavy support area in a short period of time. The primary support below is in the 3025-3015 area. We can try to buy gold with this area.

🔎Xauusd:@3030-3020 Buy

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

How to Trade News!Heads up, everyone! The Federal Reserve's interest rate decision will be announced in one hour! Currently, gold is consolidating in a narrow range around the 3035 level. At this point, it's not advisable to enter short positions on gold just yet.

📍From a technical perspective, gold has formed an ascending triangle pattern. If it fails to break below the 3027-3025 support zone, the bullish momentum could persist, with an upside target in the 3045-3055 range. Therefore, it's best to hold off on aggressive short positions for now.

📍However, if gold, driven by the upcoming announcement, struggles to break above the 3045-3055 resistance area, 3045 may establish itself as a short-term top. In that scenario, short positions can be considered using the 3040-3050 zone as a resistance level.

🔎Xauusd:@3040-3050 Sell,TP:3030-3020;

📍On the other hand, if gold decisively breaks below the 3025-3020 support level, attention should be focused on the 3010-3000 range. Should gold find support and stabilize within this range, it may present a favorable opportunity to go long once again.

🔎Xauusd:@3010-3000 Buy, TP:3030-3040

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Bears are about to revive, short gold!Gold has rebounded to around 3040 once again. It is undeniable that the risk of going long is gradually increasing. At this level, the primary strategy should be to avoid blindly chasing long positions in gold to mitigate the risk of a significant pullback.

Additionally, during the recent retracement, gold only briefly touched the 3023 level before rebounding. Given the insufficient depth of the pullback, this swift rebound suggests that gold may continue to test its short-term highs. Currently, there is no clear technical topping pattern, and the candlestick formations remain strong, indicating further upward potential. Gold could extend its gains toward the 3050-3060 range.

From a trading perspective, it may be prudent to consider short positions in the 3045-3055 range.Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Short gold with 2930-2940 zone as resistanceBros, the situation in the Middle East is turbulent again! Gold took advantage of the trend and continued to rise to around 3028. Stimulated by the news, gold's rise was obviously abnormal and showed a disorderly rise! This kind of price rise is actually very dangerous, so we can't directly chase gold. According to my expectations, the highest price of gold will only reach around 3040, so I think shorting gold with 2930-2940 zone as resistance is the best trading opportunity at the moment.

However, in the short term, the correction of gold may be smaller than expected because the market is enthusiastic about going long. So the first thing we should pay attention to below is the 3005-2995 zone.

Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Open your eyes and watch the bear dance!Bros, I have clearly pointed out in the last article update that gold will continue to rise and hit the 3030-3040 area, and the highest will only reach around 3040; gold has risen to this area as expected, and has reached a maximum of around 3038.

I have doubled my short position in gold around 3038; gold has risen sharply due to fundamental support and has seriously deviated from the technical side, so the faster gold rises, the more dangerous it is! After the market calms down, gold may experience a deep retracement.

So I’m looking forward to when the bears dance next! And I am always optimistic about gold falling back to the 3015-3005 area!

Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

XAUUSD Strategy AnalysisGold has been on a consecutive rally, and caution is warranted for every attempt to chase long positions. After surging to 3045 in the afternoon, prices quickly reversed lower and failed to immediately retest the high, indicating overhead resistance. If gold cannot break out sustainably, a significant correction may be imminent.

Gold trading strategy:

sell @:3049-3054

buy @:3030-3035,3002-3007

If you are currently not satisfied with your gold trading performance, and if you also need to obtain accurate trading signals every day, you can check the information in my profile. I hope it can be of some help to you.

XAUUSD trading strategy: Keep going longThe 1-hour moving average of gold is still in a bullish arrangement with a golden cross pointing upwards, and it is still diverging upwards without any signs of turning.

Therefore, the bullish momentum of gold remains. The support level of gold on the 4-hour chart is in the 3028 area. Today's trading strategy is to go long directly when the price retracts to the 3028 area.

XAUUSD trading strategy:

buy@3028

TP:3045-3050

I always firmly believe that profit is the sole criterion for measuring strength. I will share accurate trading signals every day. Follow my lead and wealth will surely come rolling in. Click on my profile for your guide

Last chance to short gold💡Today, gold hit a low of around 2980 during its decline. Obviously, gold's decline has not reached its peak! There is still demand for gold to continue to retreat.

💡At present, gold has rebounded to above 2998 again, but gold has not broken through the 3005-3010 zone during multiple rebound tests. The upper space has been compressed smaller and smaller, and the bullish momentum has been largely consumed. Gold is expected to seek a breakthrough downward;

💡In the process of multiple rebounds, the momentum of the rebound has gradually weakened, the bull market confidence above 3000 is not strong, the confidence of bulls is not firm, and after the profit realization and selling psychology gradually gain the upper hand, gold is likely to have a flash crash!

📉So we can short gold in the 3000-3010 zone! The first target: 2985-2975, followed by 2965-2955

📞Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

The bear is coming soon, TP: 2965-2955Bros, bears are about to see the dawn!

Gold is fiercely fighting for control in the 2985-3000 zone. Although the winner has not been completely decided, the balance of victory is tilting towards the bears!

As gold stands above the 3000 mark, the upper space is relatively compressed, and the liquidity is getting lower and lower. Gold needs to retreat to increase liquidity! Judging from the candle chart, gold stood above 3000 twice and then quickly fell back, forming two obvious upper shadow lines, indicating that the bull market is not completely convincing, and it is very likely that a double-top structure will be technically constructed to further stimulate the decline of gold!

At present, gold has not been able to effectively fall below 2880. In addition to having a certain support structure, it is more likely to be a bull market trap! So in the next short-term trading, I do not recommend continuing to chase gold. You can use the 3005-3015 zone as resistance and boldly short gold! Then wait patiently for gold to fall back to the 2965-2955 zone.

Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Can gold continue to go long?

The 1-hour moving average of gold continues to spread upward, and the strength of gold bulls is still relatively strong. Gold's moving average support has now moved up to around 2983, and today's low for gold is around 2982, so gold still forms a strong support around here. I think gold can be shorted first, and then it can continue to go long if gold falls back around 2985

XAUUSD Start to Short?The gold price briefly pierced the $3,000 per ounce threshold again today.

From a 4-hour technical perspective, today's downside support levels remain focused on the vicinity of 2975-2980.

The current day's orders are already in profit.

Gold trading strategy:

sell @:3000-3005

buy @:2975-2980 , 2960-2963

If you are currently not satisfied with your gold trading performance and need daily accurate trading signals, you can visit my profile for free strategy updates every day.

After Reaching $3,000: Next - Week Analysis of Gold MarketThis week, the gold market witnessed an impressive upswing. Notably, the price of gold managed to reach the long - awaited $3,000 price range. After such a substantial increase, it is only natural for gold to undergo a short - term pullback and adjustment. However, the short - term bullish trend of gold remains intact, with its bullish momentum still robust.

Fundamentally, multiple factors underpin the upward movement of the gold price. On one hand, the global economic outlook is still fraught with uncertainties, and geopolitical tensions flare up from time to time. This has led to a rise in investors' risk - aversion sentiment, and gold, as a traditional safe - haven asset, has thus become highly favored. For instance, the recent escalation of trade frictions has made the market worry about the global economic growth prospects, causing a flood of capital to pour into the gold market for hedging purposes. On the other hand, the continuous accommodative monetary policies of major central banks also provide support for the gold price. In a low - interest - rate environment, the opportunity cost of holding gold decreases. Moreover, the expectation of currency depreciation has increased, enhancing the hedging appeal of gold.

In the short term, the gold price is expected to fluctuate and adjust around the $3,000 mark. If it can effectively break through this crucial psychological threshold and hold steady, there is hope for further upward potential.

Suggestions for gold trading operations next week:

buy@2960-2970

SL:2955

TP:3020

I firmly believe realized profit and a high win - rate are the best measures of trading skill. Daily, I share highly precise trading signals. These include clear entry points, stop - loss levels for risk control, and profit - taking targets from in - depth analysis. Follow me for big financial market returns. Click my profile for a trading guide on trends, strategies, and risk management.

GOLD hit 3000$ The first notable event is the Bank of Japan (BOJ) monetary policy meeting on Tuesday, followed by the US Federal Reserve (FED) interest rate decision on Wednesday. The Swiss National Bank (SNB) and the Bank of England (BOE) will announce their interest rate policies on Thursday.

These moves can directly affect the strength of the USD and capital flows into gold. This expert believes that if the FED maintains a "hawkish" stance and takes a cautious view on cutting interest rates, the USD may continue to strengthen, putting pressure on gold prices. On the contrary, if the signals from the FED are more easing, the precious metal may maintain its upward momentum.

Commodity experts at Macquarie have raised their gold price forecast to $3,500 an ounce by the third quarter of 2025. They had previously targeted $3,000 for mid-year, but gold prices have hit that mark earlier than expected.