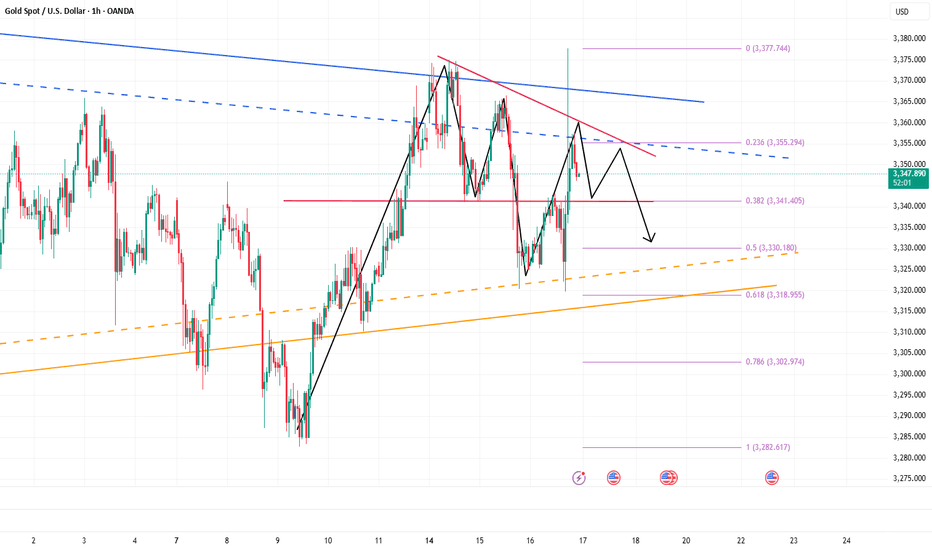

False breakout? Gold reverses sharply after news surgeBecause of the news that Trump hinted at firing Powell, gold surged strongly in the short term and passed to 3377, recovering the recent decline in one fell swoop. We went long on gold near 3323 in advance, and went long on gold near 3340 again after gold retreated, hitting TP: 3345 and 3355 respectively. The two long trades successfully made a profit of 370pips, with a profit of more than $18K.

Although gold has risen sharply in the short term and effectively destroyed the downward structure, it is mainly news that drives the market. After Trump denied firing Powell, gold rose fast and fell fast. So we can't chase long gold too much. First, the sustainability of the news-driven market needs to be examined, and second, the certainty of Trump's news is still unreliable. He always denies himself the next day.

After the gold price retreated quickly, a long upper shadow appeared in the candlestick chart, indicating that the upper resistance should not be underestimated. Therefore, we should not rush to buy gold. We can still consider shorting gold in the 3355-3365 area. We should first focus on the area around 3340. If gold falls below this area during the retreat, gold will return to the short trend and test the area around 3320 again, or even fall below this area after multiple tests and continue to the 3310-3300 area.

Xauusdtradingview

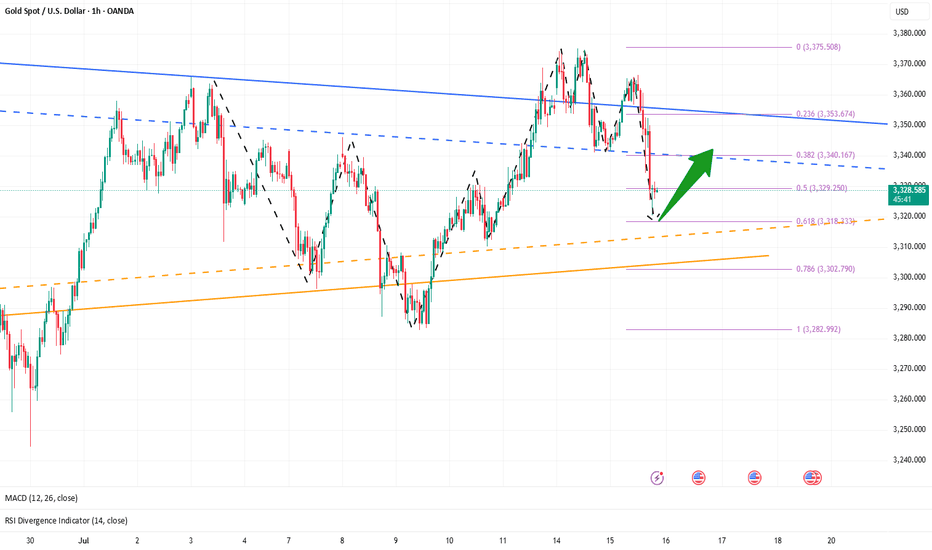

Golden Support Holds — Bulls Poised for Another Leg Higher"If gold cannot break through the 3365-3375 area, gold will fall under pressure again, or refresh the recent low of 3341, and continue to the 3335-3325 area." Gold's performance today is completely in line with my expectations. Gold just retreated to a low of around 3320, but soon recovered above 3325, proving that there is strong buying support below.

From the current gold structure, the short-term support below is mainly concentrated in the 3320-3310 area. If gold slows down its downward momentum and its volatility converges when it approaches this area, then after the gold bearish sentiment is vented, a large amount of off-site wait-and-see funds will flow into the gold market to form strong buying support, thereby helping gold regain its bullish trend again, thereby starting a retaliatory rebound, or a technical repair rebound.

Therefore, for short-term trading, I still insist on trying to go long on gold in the 3330-3320 area, first expecting gold to recover some of its lost ground and return to the 3340-3350 area.

Continue to try to find the top of the band to short goldGold maintained a slow and volatile rise structure during the day. The highest has reached 3348, and it is only a step away from 3350. Will gold continue its upward momentum as usual?

In fact, it was beyond my expectation that gold could break through 3345 in the short term. According to my original expectation, the intraday high of gold was almost around 3345. Although the rebound of gold exceeded expectations, it is currently located near the resistance of 3348-3350, so I will definitely not give priority to chasing gold at high levels in short-term transactions.

Moreover, gold is currently in the resistance area of 3348-3350. The volatility of gold has converged, and the upward momentum has declined. As gold continues to rebound and faces the key resistance area again, the bulls are relatively more cautious. In this context, this resistance area may act as a catalyst, and the bears will react, leading the decline in gold. However, as gold rebounds and the support below gradually stabilizes, we can appropriately reduce the expectation of gold's decline and adjust the decline target to the 3330-3320 area.

So for short-term trading, I will still short gold based on the resistance area, trying to find a swing top in the 3340-3350 area, and look at the target area of 3330-3320.

Golden Trap: Bulls Exhausted, Bears Ready to StrikeToday, the gold market is in a stalemate between long and short positions, with the market fluctuating sideways for a long time and maintaining an overall volatile trend. Although the rebound of gold has won a respite for the bulls, the rebound of gold during the day is not enough to completely reverse the decline. I think that before the 3325-3335 area is stabilized, the bears still have spare power to dominate the market!

According to the current structure, although gold rebounded again after touching 3310 during the retracement, it has retreated many times during the rebound. The candle chart is interspersed with obvious negative candle charts, indicating that the rebound strength is weak. In the short term, it is under pressure in the 3330-3340 area, and it is difficult to break through in a short time.

So I think the role of the gold rebound may be to trap more buyers, so we try not to chase gold after the rebound. The area near 3310 is not a key support in the short term. 3305-3300 is the current key support area. Once the bears regain control of the situation, gold may test the 3305-3300 area again. Once it falls below the reformed area, it may test 3280 again, or even refresh the recent low to around 3270.

So the downward potential of gold is not over yet. We can still look for opportunities to short gold in the 3325-3335 area and look at the target 3305-3295 area.

Start buying gold, a rebound may come at any time!Gold is undoubtedly weak at present, and bears have the upper hand. However, since gold touched the 3290-3280 area, gold bears have made more tentative moves, but have never really fallen below the 3290-3280 area, proving that as gold continues to fall, bears have become more cautious.

From the perspective of gold structure, multiple technical structural supports are concentrated in the 3285-3275 area, which makes it difficult for gold to fall below this area easily. After gold has failed to fall below this area, gold is expected to build a short-term bottom structure with the help of multiple supports in this area, thereby stimulating bulls to exert their strength and a rebound may come at any time.

Therefore, in the short term, I do not advocate chasing short gold; instead, I prefer to try to find the bottom and go long gold in the 3290-3280 area; but we should note that because gold is currently in an obvious short trend, we should appropriately reduce the expectation of gold rebound, so we can appropriately look at the rebound target: 3305-3315 area.

GOLD - The One That Survived All Ages - Trading PsychologySummer light reading between trades💫

From Ancient Gods to modern banks — Gold never needed marketing to be priceless.

Gold was never invented.

It was found, worshipped, stolen, buried, and bled for.

Long before charts, before forex pairs, before brokers — it was power.

So if you're wondering why this metal moves the world?

Let’s take it back — way back.

But before we dive into history, here’s why traders are addicted to XAUUSD:

It’s fast. Ruthless. Liquid. It can deliver a week’s profit in one candle — or wipe you out in seconds.

If you understand structure, it will reward you like nothing else.

If you’re lazy, impulsive, or just guessing?

It’ll humble you fast and without mercy.

The Discovery – Gold Before Currency

• Gold was first discovered in Paleolithic caves (~40,000 B.C.), admired purely for its beauty.

• Ancient Egyptians called it “The flesh of the Gods” — Pharaohs were buried with it, because in their mind, you couldn’t enter the afterlife without gold.

• No value was assigned — it simply was value.

Empire Fuel – Gold as the Engine of War

• The Roman Empire used Gold Coins (Aureus) to expand its reach.

• Spain and Portugal built fleets just to steal it from the Americas.

• Entire wars were started and sustained by it — Gold wasn’t a luxury; it was national survival.

Gold & the Banks – Trust in a Metal

• 1816: The UK made Gold its official standard.

• By the early 1900s, most major economies followed — every currency was tied to the physical rulling metal .

• Why? Because you can’t print trust. But you can weigh it.

• Even today, central banks don’t hoard crypto or tech stocks — they hoard Gold, quietly, relentlessly.

Collapse, Rebirth, and Chaos – The Modern Era of Gold

• 1971: U.S. President Nixon kills the gold standard.

➤ Until then, every dollar had to be backed by real gold in U.S. vaults.

➤ After that? Dollars became promises, not assets.

• Welcome to the fiat era — where money has no anchor, just hope.

• Gold, no longer “money,” became something more powerful:

➤ The panic button, the global fallback, the last honest asset when everything else crumbles.

• And crumble it did:

🔹 2008: Banks collapse — Gold soars.

🔹 2020: Global lockdown — It explodes.

🔹 2022–2024: War, inflation, debt ceilings, de-dollarization — Gold reclaims the throne.

When fear wins, this metal doesn’t blink. It rises.

From Ancient Tombs to 2025 – Gold’s Unshakable Throne

• Today, you stare at candlesticks.

You mark order blocks, gaps, and key level zones.

But beneath that technical setup is a story written in blood, empire, and survival.

• Gold has outlived Kings. Outlasted currencies. Outsmarted every attempt to replace it.

You can crash a stock. You can ban a coin.

But you can’t cancel this number 1.

• And now? It’s 2025.

The world is uncertain. Digital assets are volatile.

And Gold is still the most traded, most hoarded, most feared asset on Earth.

• You’re not here by accident. You chose to trade this beast — not because it’s easy, but because you know what it means to master chaos.

So you’re not trading a metal.

You’re trading a legacy, so pay respect.

Every setup is a whisper from history — and every move on Gold is just the past repeating itself…

Only this time, the empire isn’t outside.

It’s YOU.

And your chart is your battlefield. So make an effort and study XAUUSD before trading it.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

The bears will take the 3290-3280 area stronglyGold started to fall from 3342 during the day and fell below 3300 at one point. Gold is in an obvious short position, and during the London market, gold continued its downward momentum without any decent rebound. Gold is in an extremely weak state. In the absence of a rebound in the London market, I think New York is very likely to continue to fall.

According to the current structure, gold is facing technical suppression of the head and shoulders in the short term, which greatly limits the rebound space of gold and suppresses the rebound limit within 3335. As the center of gravity of gold moves down, the resistance in the short term moves down to the 3315-3325 area. After breaking through 3330, the downward space has been opened up to a certain extent. So don’t be fooled by the false bullish candle that appear near 3330. Gold will inevitably continue to fall to the 3290-3280 area.

The 3290-3280 area is bound to be won, so shorting gold is still the first choice for short-term trading. You can consider shorting gold with the 3315-3325-3335 area as resistance, and look to the target area: 3295-3285-3275.

Short gold ,it is expected to retreatToday, we accurately seized the trading opportunity of long gold at 3350 according to the trading plan, and hit TP: 3380 in the process of rebounding. We firmly grasped the profit of 300pips in the short-term long trading. At present, gold maintains the trend of continued rise! Now I definitely do not advocate chasing gold in short-term trading. On the contrary, I will actively look for good opportunities for short-term short trading to earn profits from short-term retracement.

In the short term, the suppression area I focus on is the 3390-3395 area, because the gold trend is relatively strong during the European session, and the US session should continue. If gold cannot break through this area in the short term, gold will likely usher in a wave of retracement. I think it should not be difficult to test the 3370-3360 area downward; secondly, we must pay attention to the same suppression area as the short-term high of 3402: 3405-3415; if gold touches this area and stagflation occurs, then it may form a secondary high in the short term, thereby hitting the firmness of the bulls' confidence and ushering in a retracement.

So next, I will test the gold short trade around the two areas of 3390-3395 and 3405-3415. Relatively speaking, the profit and loss ratio is still very favorable to us! But in the process of trading, we must strictly set up protection, after all, it is a counter-trend trade in the short term!

Buy gold, there is still potential to hit 3400Gold gradually fell after touching 3403, and the current lowest has fallen to 3364. Has the gold bull market ended? In fact, I think the gold retracement is a good time to buy, and I am not afraid of gold retracement.

From the overall perspective of the day, gold did not fall below the 3360 mark during today's retracement. This area has become the intraday strength and weakness dividing line. As long as gold can stay above 3360, I think gold still has the potential to continue to rebound. Moreover, the tariff issue and geopolitical conflicts have not been effectively resolved, which is still favorable for gold in terms of fundamentals. Moreover, gold has broken through 3400 twice. I think the bull market will not end easily, and there is still the potential to test 3400 again, and it may even rise to the 3410-3420 area.

Trading strategy:

Consider shorting gold in the 3365-3355 area, TP: 3390-3400

Buy gold, TP: 3355-3365Technical aspect:

Gold stopped falling and rebounded after touching 3333. The highest price has only rebounded to 3353. It seems that the bullish potential is weak and the rebound is weak. However, the gold candlestick chart closed with a long lower shadow after touching 3333, proving that there is a certain degree of buying support below; if gold can maintain above 3340-3330 in the short term, gold bulls still have the opportunity to rebound to 3355-3365;

From the perspective of morphological structure, as long as gold remains above 3330, the gold bull structure has not been effectively destroyed, and bulls still have the opportunity to counterattack. It also proves that the buying support below is effective, and the bottoming and rebounding structure is established in the short term, so we can still consider continuing to go long on gold in short-term trading.

Trading strategy:

Consider the 3345-3335 area as support, and try to go long on gold in small batches;TP:3355-3365

Under pressure in the short term, short gold after rebound!In the short term, gold has risen sharply under the simultaneous stimulation of tariffs and geopolitical conflicts, but it has gradually fallen back after reaching around 3392, and has not broken through the 3400 mark in one fell swoop, indicating that the bullish momentum does not have the potential to continue to rise for the time being, so it may still need a certain degree of technical support, so gold has a need to retrace in the short term;

In addition, if gold continues to retrace, then there may be a structural form at the technical level that offsets the short-term double bottom structure support, so gold may also form a double top structure in the short term. The first thing we need to pay attention to is the resistance near 3370, followed by the resistance near 3390; and below we must first pay attention to the support near 3345, followed by the 3330-3320 support area.

Trading strategy:

1. Consider continuing to short gold in the 3370-3380 area, TP: 3355-3345;

2. If gold first retreats to the 3345-3335 area and does not fall below this area, consider going long on gold; TP: 3360-3370

Keep gold shorts open and look forward to profits!After breaking through the resistance areas near 3335 and 3355, gold continued to rise to around 3379; although the rise in gold was relatively large, after gold touched above 3370, the bullish momentum weakened and there were signs of high-level stagflation, so gold is still expected to usher in a wave of retracement in the short term.

After the sharp rise in gold, the current relatively obvious support area is located in the 3345-3335 area. If gold cannot effectively break through 3380, then gold is expected to retrace to test the support of the 3345-3335 area again.

As the trading strategy shared in my previous opinion, I have shorted gold in batches in the 3370-3380 area as planned. At present, we still hold short positions. Let us look forward to the expected retracement of gold!

CAPITALCOM:GOLD OANDA:XAUUSD FOREXCOM:XAUUSD TVC:DXY

Continue to try to short goldTechnical aspects:

Gold has risen sharply in the short term and has broken through the short-term resistance area of 3250-3260. The structure of the pattern has been biased towards the bullish pattern, and the successful construction of the triple bottom pattern has strengthened the effectiveness of the structural support below. With the rise of the structural low point, the short-term support area below will first focus on the 3260-3250 area, followed by the 3230-3220 area; in addition, after a sharp rise in the short term, gold is facing the 3290-3300 short-term resistance area and the 3215-3225 short-term resistance area above. So I think that in order to grab liquidity, gold may have a need to retreat to the 3260-3250 area in the short term, so we might as well try to short gold in small quantities.

Trading strategy:

Consider continuing to try to short gold in small quantities at 3280-3290, TP: 3260-3250

Gold rebound height is limited, short goldTechnical aspects:

Gold has failed to make a major breakthrough in the recent rebound process, and the rebound height has been limited to a smaller and smaller level. Overall, gold is now in a state of shock and short position; as the center of gravity of gold shifts downward, the current short-term resistance is in the 3220-3230 area; and gold has tested downward many times recently, which makes it easier for gold to fall below 3200. Once gold falls below 3200 again, it is very likely to extend to 3190, or even around 3160.

Trading strategy:

Consider starting to short gold in batches in the 3220-3230 area, TP: 3205-3195

Is there still a chance for short sellers to make a profit?At present, gold continues to rebound to around 3230, and the intraday rebound has reached $100. Today, both short trades have touched SL, giving back most of the profits of the long positions in the morning. So are there still opportunities for shorts to make profits?

I think there are still considerable profit opportunities for shorts. Although gold has rebounded strongly to around 3230, it will soon face the short-term resistance area of 3240-3245, which happens to be the 38.2% split area when it retreats from 3435 to 3120, so this area has a certain suppression effect on gold in the short term! Then there is the suppression effect of the area around 3260; so I think there are still considerable profit opportunities for gold shorts. As gold rebounds, the short-term support below is raised to 3200-3190, followed by 3175-3165.

Trading strategy:

Consider trying to short gold in the 3235-3245 area, TP: 3200-3190

Continue to short goldTechnical aspect:

Gold rebounded gradually after hitting 3120, and has now rebounded to around 3200. Where will gold rebound? Is there still a chance to continue to short gold?

In fact, from the current structure, gold has not shown a clear bottoming signal, so this wave of rebound can only be regarded as a technical repair after the decline; however, the rebound from 3120 to around 3200 is not small, which will significantly increase the probability of 3120 as a short-term bottom; so where will gold rise? I think gold is currently under resistance in the 3200-3210 area, and it may be difficult to break through this resistance area in a short period of time. When facing this resistance area, gold may fall under pressure and test the 3165-6155 area again;

If gold really needs to form a reversal structure, it is necessary for gold to retest the 3165-3155 area support again and form a "W" double bottom structure with the 3120 low; only in this way can a complete reversal structure be formed.

Trading strategy:

Consider continuing to short gold in the 3195-3205 area, TP: 3165-3155

Continue to short gold after the reboundFundamentals:

1. Focus on Powell's speech at the Thomas Laubach Research Conference;

2. Pay attention to the situation of the Russia-Ukraine negotiations;

Technical aspects:

Gold has successively broken through the important support area of 3200 and 3160, and continued to around 3120; the short-term bearish trend is very obvious; although gold has rebounded to around 3170 again in the short term, I think the reason is one of the technical rebound repair after the decline; the second is the result of profit-taking of some short positions. So I fully believe that gold has the need to fall again after the rebound;

At present, we need to focus on the resistance of the 3175-3180 area, followed by the resistance of the 3195-3200 area; if gold cannot break through this resistance area during the rebound, gold is expected to fall again and continue to the area around 3100.

Trading strategy:

Consider the opportunity to short gold after gold rebounds to the 3275-3285 area; TP: 3150

TVC:DXY FOREXCOM:XAUUSD OANDA:XAUUSD CAPITALCOM:GOLD

Firmly bullish on gold to 3280-3290 areaAs the trading strategy I published in my last article, I am still holding my gold long position. Obviously, I am confident that gold still has the potential and space to rebound. Gold just hit a low of around 3226 during the decline, and did not break the "W" shape structure formed by the recent low of 3207 and the second low of 3215. The oscillating upward structure remains intact, which is conducive to the continued rise of gold; the foreseeable resistance area in the short term is in the 3280-3290 area. Once this area is broken, the area around 3320 is just around the corner!

Trading strategy:

At present, our gold long position has made very good profits, continue to hold it, and let gold fly for a while!

TVC:DXY FOREXCOM:XAUUSD OANDA:XAUUSD CAPITALCOM:GOLD

CPI data market, buy gold!Fundamentals:

Focus on CPI;

Technical aspects:

As expected in my previous article, gold has rebounded to the area around 3250-3260 as expected.According to the current structure, gold tends to fluctuate upward in the short term; it may even extend to the 3280-3290 area.Gold rebounded after touching 3207, and combined with the secondary low point near 3215 to form a "W" structure. This technical structure has formed a strong support structure for gold prices; and after the bad news is exhausted, the on-site wait-and-see funds will gradually enter the market, which will also push up the gold price to a certain extent. So I think gold still has the conditions to challenge the 3280-3290 area!

Trading strategy:

Consider starting to go long on gold in batches in the 3250-3240 area, target price: 3270-3280

Continue to short gold after the reboundFundamentals:

The positive signals from the China-US negotiations have eased the market's concerns about the US economic recession, and the weakening of risk aversion has stimulated a sharp pullback in gold. Market funds are no longer eager to seek safe-haven assets, so they withdraw their funds from gold and turn to risk markets.

Technical aspects:

The gold price plummeted by $110 during the day. Although it has rebounded slightly at present, the overall rebound momentum is relatively weak. The upper 3280-3290 area is currently the main short-term suppression level, followed by the 3240-3250 area. If the rebound in this area is not broken, you can continue to short gold, and the shorts may continue to reach new lows; focus on the support of the 3200 mark below. If 3200 is not broken, then the bulls may try to counterattack and fill the upper gap; if gold falls below 3200, gold will continue to fall to the area around 3170.

Trading strategy:

1. Consider shorting gold after it rebounds to the 3245-3255 area, TP: 3220

2. Consider going long on gold after it continues to fall to the 3180-3170 area, TP: 3220;

3. If gold stabilizes above 3200, we can consider going long on gold around 3200 in advance.

Gold Sniper Zones - XAUUSD May 12 Monday🔍 Key Intraday Demand Zones (Potential Bounce Areas)

🔵 3220–3200

Current area of interest with short-term absorption signs

May serve as temporary reaccumulation base if bulls defend this area

Ideal zone for intraday reaction → confirmation required before acting

🔵 3180-3165

Strong historical reaction level

Previously held structure before rally

If price breaks below 3209, this is likely where buyers will re-enter aggressively

🔺 First Major Intraday Resistance Zones

🔴 3240–3255

First clean lower high zone

Recent bearish pressure originated here

Any bounce toward this area may face sharp rejection

🔴 3275 - 3290

Former structure base, now flipped

Watch for potential NY spike into this region → rejection likely without a confirmed breakout

🧠 Final Words:

Gold isn’t in freefall. It’s moving between precision zones that traders either recognize — or get wrecked by.

At this stage:

Below 3209 = bearish pressure likely continues toward 3170s

Above 3255 = watch for liquidity sweeps and false confidence

🎯 Stay with structure. Ignore the noise. Let the market earn your entries.

Drop a 🚀 Follow, comment, and share with your trading crew — if this helps your trading; let’s build a sharp Gold team

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

Start buying goldTechnical aspects:

Gold has bottomed out and rebounded after a rapid decline today. It has now stood above 3330. When gold breaks above 3330, it has to some extent broken away from the technical repair structure and began to tend to a bullish pattern in terms of form. Although gold is currently under pressure in the 3350-3360 area, as the center of gravity of gold moves up, the support below has gradually moved up to the 3325-3315 area. So I think there is still room for gold to rise, and it may continue to rebound to the 3345-3365 area.

Trading strategy: Consider going long on gold in the 3330-3320 area, TP: 3345-3365

Golden stage low area: 3285-3275!Fundamentals:

1. Focus on Trump's dynamics and tariff-related issues;

2. Pay attention to whether geopolitical conflicts will escalate, including the situation between India and Pakistan, Russia and Ukraine, and the situation between the United States and Iran, etc.

The current expectation of interest rate cuts has declined, and the tariff storm has cooled down. At the same time, the market is betting on a further trend correction, which may cause capital outflows from the market, which will further hit gold bulls!

Technical aspects:

As I expected in my previous article, gold is expected to fall below 3300. Sure enough, gold has shown signs of falling below 3300. In the current structure, gold may further extend to the 3280-3270 area, which is also an important support area of primary concern in the short term; and as gold fell sharply, the market was bearish, and short-term resistance also moved down to the 3315-3325 area.

Trading strategy:

1. Consider the shorting opportunity after gold rebounds to the 3315-3325 area, TP: 3300-3290

2. Consider the longing opportunity after gold falls to the 3285-3275 area, TP: 3300-3310