Gold is about to break through 3400! On June 21, 2025 local time, U.S. President Trump announced that the U.S. had launched strikes against three Iranian nuclear facilities—Fordo, Natanz, and Isfahan—using six B-2 stealth bombers 😲. This move marked the formal intervention of the U.S. in the Middle East conflict, prompting the UN Security Council to convene an emergency meeting immediately. This underlies the core logic of our sustained "long gold" strategy last week: the geopolitical situation in the Middle East harbors the risk of escalating at any moment 🤯. If the Security Council fails to roll out direct solutions, gold, as a safe-haven asset, may continue its upward trajectory driven by market panic 📈.

The UN Security Council meeting on June 23, 2025 failed to break the deadlock, and the Middle East situation remains highly fluid. Given that the U.S. is highly unlikely to implement any solutions proposed by the Security Council, the regional crisis may deteriorate further 🚨

Gold is about to break through 3,400! 🌟

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Xauusdupdates

War breaks out again? The latest analysis and layout of gold📰 Impact of news:

1. The ceasefire agreement reached earlier did not take effect, and Trump believed that both sides violated the agreement

2. Federal Reserve Chairman Powell delivered a speech 3 hours later

📈 Market analysis:

At the 4H level: the Bollinger Band opening is enlarged, the MACD indicator double-line death cross is downward, the short-selling force is strengthened, but the RSI indicator rebounds after being oversold. Overall, there are obvious signs of a rebound in gold prices. At the hourly level: the gold price is in a downward channel, the Bollinger Bands are expanding, the MACD indicator is dead cross and the red bars are converging, and the short momentum has weakened. The RSI indicator rebounds from oversold, and the demand for spot gold rebounds is obvious. Therefore, we still hold long orders near 3320 in the short term. Short-term operation suggestion: go long when it stabilizes at 3325-3315, pay attention to the resistance range of 3370-3380 on the upside, and consider shorting when encountering resistance and pressure.

🏅 Trading strategies:

BUY 3325-3315

TP 3335-3345-3365

SELL 3370-3380

TP 3340-3330

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD FXOPEN:XAUUSD TVC:GOLD

Gold updateAfter the previous level was broken and structure shifted, we’re now entering a new phase of analysis.

In this fresh setup, we’re looking for buy opportunities — but not blindly!

As always, waiting for a clean pullback to the new zone and a solid entry signal.

Experience teaches us: real profits come from patience and planning.

Here’s my new gold analysis — high probability, low risk.

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

Weakness continues, continue to short the bear market📰 Impact of news:

1. Pay attention to Powell's speech in New York

2. Pay attention to geopolitical influence

📈 Market analysis:

Gold opened lower and showed a weak situation. The 1H moving average was arranged downward. In the short term, bears still occupied the main trend. From the 4-hour analysis of gold, the bulls still had repeated resistance before breaking down. Once it breaks down, the market will go further bearish. Pay attention to 3330 below. 3400 is still the key above in the short term. Only by breaking through the bulls can the rebound continue. In terms of operation, high-altitude and low-long are temporarily maintained. Pay attention to the short-term resistance of 3355-3365 above, and the support of 3340-3330 below. Pay attention to the breakthrough! Pay attention to Powell's speech in the New York session.

🏅 Trading strategies:

SELL 3370-3365-3355

TP 3340-3330

BUY 3340-3335-3320

TP 3345-3355-3365

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

TVC:GOLD FXOPEN:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD

XAU/USD 24 June 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 23 April 2025

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Following previous high, and printing of bearish CHoCH, price has pulled back to an M15 supply zone, where we are currently seeing a reaction. Therefore, I shall now confirm internal high.

Price is now trading within an established internal range.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

XAUUSD Breaks Trend – Deeper Correction Ahead?Gold (XAUUSD) has just broken below its rising H4 trendline and the key support zone around 3,340 – a strong signal for a potential short-term downtrend. A sharp bearish candle with high volume confirms sellers are now in control.

The 3,360–3,365 zone has flipped into resistance and may act as a retest area before further declines.

If price fails to hold 3,320,

the next targets are 3,300–3,280,

possibly down to 3,260.

Volume Profile indicates money is leaving the upper range, reducing the chance of a strong rebound.

Preferred strategy: wait for a pullback to 3,355–3,365,

set SL above 3,370,

and aim for TP at 3,300–3,280.

Caution: the Fed’s “higher for longer” stance and USD strength are applying pressure on gold. Long positions are risky at this stage. Monitor the 3,300 level closely for potential buyer reaction.

GOLD Intraday Chart Update For 24 June 2025Hello Traders, As you can see that GOLD fell sharply this morning due to Israel- Iran Cease fire scenario

Further more FED Chair POWELL Testifies Starts from Today and end on Tomorrow make sure to manage you trading accordingly

Right now GOLD is in Strong Bearish Trend only clear Breakout of 3368 level for the day below this market remains Bearish

All eyes on 3300 Psychological Digit for now if market breaks 3300 Successfully then it will move towards 3250 soon

Disclaimer: Forex is Risky

Gold, Will USA-Iran-Israel conflict affect it? The USA-Iran-Israel conflict can significantly impact gold prices. Gold is a safe-haven asset, so demand often rises during geopolitical tensions, pushing prices up

3406 gonna be first target for me, if it breaks this lvl with huge volume and FVG on 1h+ then most likely we will see ATH in near future

bearish scenario(lest likely) - price breaks down 3340 and close with nice volume and fvg on 1h+ which will open move all the way down to MO

Gold (XAU/USD) Analysis - 24 June 2025📊 4-Hour Chart: Supply & Demand Structure

1. 📐 Market Structure & Bias

Gold has bounced off the $3,340–3,350 demand area multiple times—confirming a strong support structure on the 4H timeframe .

Following this bounce, gold made a higher-low, reinforcing a bullish trend.

Overall bias remains bullish, as long as prices hold above the $3,340 region. A break below this zone may bring deeper correction.

2. 🔍 Demand Zones (Buy Areas)

Zone A – $3,340 to $3,350

Comes with trendline support and prior consolidation.

Volume and price action confirm institutional buying interest.

Zone B – $3,300 to $3,310

A more significant base zone for deeper pullbacks or additional liquidity running.

3. ⚠️ Supply Zones (Sell Areas)

Zone C – $3,380 to $3,390

Shallow zone where recent rallies have stalled—ideal for supply fade strategies.

Zone D – $3,400 to $3,410

Major resistance zone—historical retracement area with institutional selling.

🔍 1-Hour Chart: Intraday Entry Zones (Aligned with 4H Bias)

Below are premium-level intraday buy setups made for quick execution within the bullish structure:

Entry Type Zone ($) Description

1. Buy the Dip 3,340 – 3,345 Touches 4H demand + trendline — watch for bullish rejection wicks or volume pickup.

2. Quick Dip Buy 3,350 – 3,355 Opportunistic entry higher in demand zone — quicker reentries with lighter pullback.

3. Deep Bounce 3,300 – 3,310 For deeper intraday swings only—requires strong confirmation from lower timeframes.

(Optional) Sell Supply Fade 3,380 – 3,390 Aggressive fade only if strong price rejection appears—caution advised.

Tips for Entry Confirmation:

Look for bullish pin bars, engulfing candles, volume confirmation, or trendline bounces within these zones. Only trade entries with clear price action confirmation.

XAUUSD Sideways – Breakout Setup FormingGold is currently in a clear consolidation phase on the 4-hour chart, moving within the range of 3,320 to 3,393. After a pullback from the 3,460 peak, the price has repeatedly formed ParSE and ParLE patterns, indicating a strong tug-of-war between buyers and sellers. This suggests that the market is building pressure for a potential breakout in the coming sessions.

Technically, the 3,393 – 3,400 zone remains a key resistance as price has been rejected multiple times there.

Meanwhile, the 3,320 – 3,330 area is holding as solid support, showing strong bullish reactions in previous touches.

The 3,342 – 3,350 range is acting as a neutral zone where price is accumulating before making its next move.

There are two optimal trading strategies at this stage.

The first is range trading: look to buy near 3,320 – 3,330 and target profits at 3,350 – 3,370; conversely, consider selling around 3,390 – 3,393 with take-profit targets back at 3,350 – 3,365. The second is breakout trading: if the price closes a 4H candle above 3,393 with strong volume, it opens up long opportunities targeting 3,420 – 3,445.

On the flip side, a clear break below 3,320 may lead to further downside toward 3,285 – 3,260.

From a macroeconomic perspective, traders should closely monitor US inflation data and upcoming Fed policy signals. Any hints of easing from the Fed could act as a strong bullish catalyst for gold. Additionally, geopolitical developments and USD trends remain crucial as they directly influence safe-haven flows into gold.

In summary, this is a key phase to observe and prepare for decisive action when the market breaks out of consolidation. Patience, disciplined entries, and strict risk management are essential in the current environment.

Follow for daily updates and actionable strategies as the setup unfolds.

Gold Spot / U.S. Dollar (XAU/USD) 2-Hour Chart2-hour chart from OANDA shows the price movement of Gold Spot (XAU/USD) against the U.S. Dollar. The current price is $3,344.210, reflecting a decrease of $24.965 (-0.74%). The chart highlights a recent upward trend with a shaded area indicating a potential price range between $3,324.354 and $3,380.000, with key support and resistance levels marked. The timeframe spans from June 12 to July 3, 2025.

Gold is in the bullish direction after correcting the supportHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Gold bottoms out and tests resistance, long positions at night📰 Impact of news:

1. Bowman hinted at a July rate cut

2. Fed Governor Kugler and FOMC permanent voting member and New York Fed President Williams hosted the "Fed Listening" event.

📈 Market analysis:

Gold will maintain a short-term volatile trend. Although the United States intervenes in the conflict between Iran and Israel, the geopolitical situation will affect the market trend to a certain extent. However, the remarks of Federal Reserve Board member Bowman hinting at a rate cut in July have eased market volatility to a certain extent. Gold maintains a narrow range of fluctuations at the 4H level, and the technical pattern is gradually adjusted. The K-line stands firmly on the short-term moving average. The short-term trend shows that it is necessary to observe the second opportunity for pull-up after the confirmation of the retracement. At the hourly level, the short-term moving average diverges upward, and the short-term volatile and strong pattern is maintained. In the evening, pay attention to the upper resistance area of 3395-3405, focus on the suppression of the 3405 line, pay attention to 3375-3365 below, and further pay attention to the 3345 support line if it breaks through.

🏅 Trading strategies:

SELL 3385-3395-3405

TP 3370-3365-3345

BUY 3375-3365-3355

TP 3390-3400-3405

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

TVC:GOLD FXOPEN:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD

Conflict breaks out, risk aversion rises, can 3400 be broken?Bowman's dovish comments in the afternoon eased the market, by which time risk aversion was deepening as sudden geopolitical conflicts continued to deepen. Will the USA make a corresponding response to this matter? This series of events has once again put gold into a complicated situation. Can gold hit the 3,400 mark today?

Free trading strategies are updated daily🌐. All trading strategies released since this month have been verified and can serve as a good reference📈.👇 I sincerely hope that these strategies can be helpful to you👇.

OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD FXOPEN:XAUUSD TVC:GOLD

Gold Spot / U.S. Dollar (XAUUSD) 2-Hour Chart2-hour candlestick chart displays the price movement of Gold Spot (XAUUSD) against the U.S. Dollar, with the current price at 3,373.97, reflecting a +5.99 (+0.18%) change. The chart highlights recent price trends, including a notable upward movement, with key support and resistance levels marked around 3,366.81 and 3,410.25, respectively. The time frame spans from approximately 6:00 AM to 3:35 PM CEST on June 23, 2025.

Gold opens high and moves lower, focus on 3340 support📰 Impact of news:

1. Federal Reserve Board member Bowman speaks on monetary policy and the banking industry

2. The United States intervenes in the Iran-Israel conflict and pays attention to the geopolitical situation

📈 Market analysis:

In the early Asian session, gold prices surged but failed to break through the key watershed of 3405. The current risk aversion conflict failed to break through the key resistance level, so the short-term trend is still weak and bearish. On the hourly chart, gold continues to retreat. As the current short-selling momentum continues to gain momentum, we will first look at whether the double bottom support of 3340 is effective. If it fails to break through while retreating, we can consider a short-term upward rebound in the support and consider going long. Looking at the second decline point at 3370-3375, unless the news stimulates the gold trend, you can still consider placing short orders if it touches the 3370-3380 line! On the whole, pay attention to the resistance line of 3370-3380 above and the support line of 3345-3335 below.

🏅 Trading strategies:

BUY 3350-3345-3335

TP 3360-3370-3380

SELL 3370-3380

TP 3360-3350-3345

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD FXOPEN:XAUUSD TVC:GOLD

Gold Spot Price Trend Analysispresents a detailed analysis of the gold spot price trend against the U.S. dollar, captured over a four-hour interval. The chart displays a fluctuating pattern, with prices ranging from approximately $3,320 to $3,383.74 USD. A notable decline is observed, marked by a red box indicating a support level at $3,332.53, while a green box suggests a resistance level at $3,383.74. The current price stands at $3,353.94, with a slight decrease of 0.42%. The chart provides valuable insights for investors and traders seeking to understand the dynamics of the gold market.

XAUUSD and USOILHesitation Geopolitical factors have led to the escalation of relations between several countries. The Middle East is in chaos. Although this is a trading market, the relationship between the two is too close. This is why the Asian market XAUUSD reached a high of 3400.

But it is not stable. Because after the news that stimulated the rise in gold prices over the weekend, there were some negative news. For example, peace talks, time differences, negotiations and other factors have eased the tense atmosphere. Then the gold price fell with the trend, reaching a low of 3347.

From the overall situation, the market still has the momentum to rise in the short term. But this depends on Iran's response. Including the impact of the Strait of Hormuz. This is the key factor in the rise or fall of oil prices. Investors with larger funds can arrange long orders in advance.

The view on XAUUSD is to buy at low levels. The impact of geopolitics is too huge. On the basis of interest rate cuts, buying is the key to profit. But everyone's financial situation is different, so when trading, remember to control the position ratio. Prevent trading errors from leading to account liquidation.

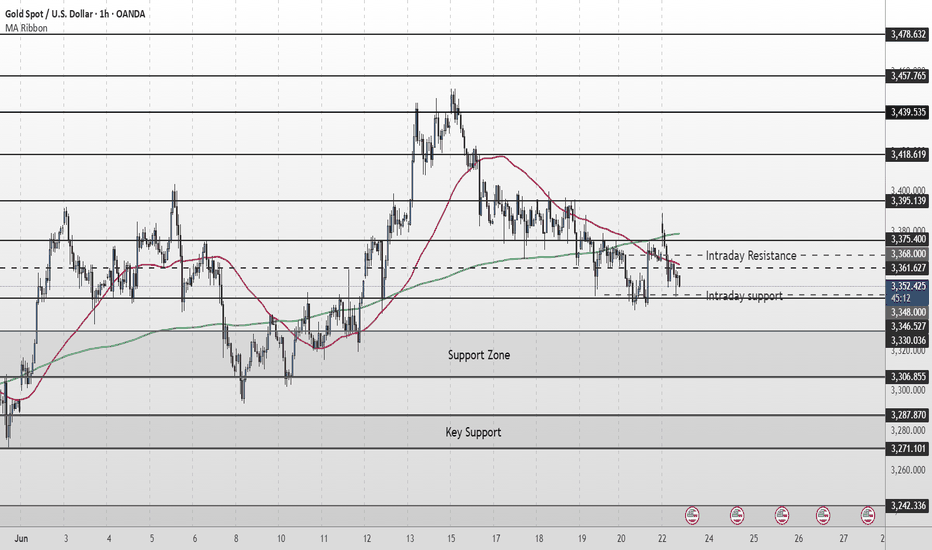

Gold Short Term OutlookGold is currently trading around $3,368, caught between dynamic moving average resistance and an intraday resistance zone.

Price must break and hold above the $3,378 resistance to open the path toward $3,395. A confirmed break above the key $3,395 level could signal the start of the next bullish leg.

However, repeated failure to break above $3,395 — or even $3,378 — may drag gold lower into key support zones.

📌 Key Levels to Watch:

Resistance:

$3,375 • $3,395 • $3,418 • $3,439

Support:

$3,361 • $3,346 • $3,330 / $3,306

$3,287 – Critical demand zone

🧠 Fundamental Insight:

Gold remains supported amid rising geopolitical tensions. Over the weekend, U.S. airstrikes targeted Iranian nuclear sites, escalating concerns over a broader conflict in the Middle East. This has reignited safe-haven demand, with gold catching a bid despite recent technical pullbacks.

Meanwhile, traders are weighing softer U.S. inflation signals against the Fed’s cautious stance. If tensions persist and economic data weakens, gold could benefit from both risk-off flows and increased speculation around potential rate cuts.

Gold Medium Term OutlookGold is currently trending within a rising channel after rejecting the $3,439 resistance zone, which marked a new Higher High (HH). Price is respecting the ascending channel support and is now testing the 50MA. The uptrend remains intact, with a sequence of Higher Lows (HL) and Higher Highs (HH) forming within the channel.

A break and hold above $3,378 could open the path for a re-test of $3,439 and potentially $3,501. However, failure to hold the rising channel support may shift momentum bearish, with $3,303 and $3,226 as the next major downside targets.

📌 Key Levels to Watch This Week:

Resistance: $3,378 • $3,439 • $3,501

Support: $3,303 • $3,226 • $3,171

🧠 Fundamental Insight:

Gold remains supported amid rising geopolitical tensions. Over the weekend, U.S. airstrikes targeted Iranian nuclear sites, escalating concerns over a broader conflict in the Middle East. This has reignited safe-haven demand, with gold catching a bid despite recent technical pullbacks.

Meanwhile, traders are weighing softer U.S. inflation signals against the Fed’s cautious stance. If tensions persist and economic data weakens, gold could benefit from both risk-off flows and increased speculation around potential rate cuts.

GOLD Intraday H1 Chart Update For 23 June 25 GOLD Intraday Chart show mid term Bearish move for now

For Today keep an eyes on 3368 level Breakout for Buy Scalping for long trade we may wait for dip around 3330-3340 zone SL remains possibly 100 pips

As long as market sustains below 3400 Psychological Level it will remains Bearish and will try to move towards 3200-30 Psychological

Gold (XAU/USD) 4H Analysis-23 June 2025Gold (spot XAU/USD) is currently trading around $3,358. On the 4-hour chart, price has been range-bound between $3,356 and $3,400. Recently, gold attempted to break higher (up to around $3,394) but quickly reversed — a sign that the breakout may have been a smart money trap. Technically, the structure saw a break below $3,380 in mid-June, leading to a push toward the $3,323 region. This reflects a short-term bearish wave followed by stabilization near the lows.

Bias: The market is currently neutral-to-bullish, depending on key supports. As long as price holds above the $3,322–$3,330 swing-lows, dips are considered buying opportunities. Notably, an order block/demand zone around $3,357–$3,360 appears to be holding well and attracting buyers. On the upside, $3,400 acts as a strong resistance level. A break above $3,400 would shift the bias firmly bullish, while a break below $3,338 would suggest bearish momentum returning.

🔑 Key 4H Support & Resistance Levels

Resistance:

• $3,400 – Major round number and recent high

• $3,434–$3,435 – Next resistance above $3,400

• $3,451–$3,452 – Recent swing top

• $3,500 – All-time-high level

Supply Zone:

• $3,388–$3,394 – Minor resistance and previous support turned supply

Demand Zone (Order Block):

• $3,357–$3,360 – Major 4H demand area showing strong buyer interest

Support:

• $3,338 – Critical support level below the order block

• $3,322–$3,323 – Multi-source key swing support

• $3,280–$3,300 – Lower targets if support fails

• $3,260 or below – Worst-case downside projection if breakdown accelerates

📈 1-Hour Intraday Trade Setups

Buy the Dip

• Entry: $3,357–$3,360

• Confirmation: Bullish reversal candle on 1H

• Stop Loss: Below $3,336

• Targets: $3,380 → $3,400

Sell a Rejected Rally

• Entry: Near $3,400 (only if clear rejection is seen)

• Confirmation: Bearish reversal candle or price stalling

• Stop Loss: Above $3,400

• Targets: $3,360 → $3,330

Breakdown Short

• Entry: If price breaks below $3,338 with strong 1H close

• Stop Loss: Above $3,345

• Targets: $3,323 → $3,300

Bullish Breakout Trade

• Entry: Break and retest above $3,400

• Confirmation: Clean 1H close above $3,400

• Stop Loss: Just below $3,400

• Targets: $3,434 → $3,452

✅ Final Takeaway

Gold is currently trading inside a $3,330–$3,400 range. The best intraday opportunity is to buy dips into the $3,357–$3,360 demand zone with a stop below $3,330, targeting $3,400+. If support breaks, flip to short toward $3,320–$3,300.

Gold Spot / U.S. Dollar (XAU/USD) 4-Hour Forex Chart4-hour forex chart displays the price movement of Gold Spot (XAU) against the U.S. Dollar (USD) from late June to early July 2025. The chart shows a recent price of 3,377.73 USD, with a slight increase of +9.76 (+0.29%). The candlestick pattern indicates a downward trend following a peak, with a highlighted resistance zone around 3,400 USD. The chart includes a 4-hour timeframe and key price levels ranging from 3,330.00 to 3,400.00 USD.