Gold (XAU/USD) Premium Technical Outlook - 18 July 2024As gold continues to trade near record highs, the market’s current price action around $3,336–3,340 demands a sharp, disciplined technical view. This premium analysis combines price action, Fibonacci techniques, institutional concepts (ICT and Smart Money Concepts), and advanced supply–demand dynamics to identify actionable trade opportunities.

We anchor on the 4-hour timeframe for directional bias and zoom into the 1-hour chart for precision intraday setups.

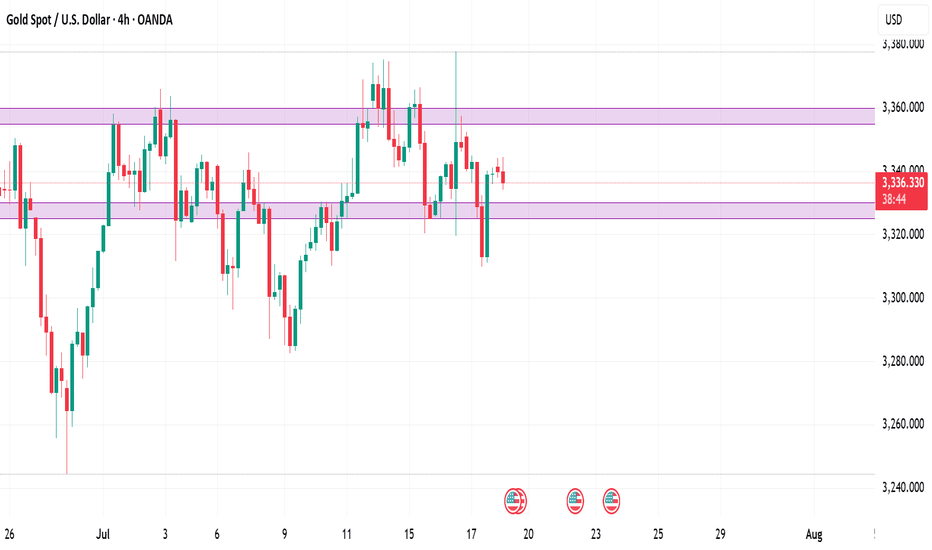

📊 4‑Hour Timeframe: Structure and Directional Bias

Gold remains in a clear bullish structure on the 4-hour chart, as evidenced by sustained higher highs and higher lows. The most recent bullish Break of Structure (BOS) occurred above the $3,320–3,325 level, confirming buyers’ control for now.

Currently, price hovers near equilibrium at the 61.8% Fibonacci retracement, testing prior resistance as potential support. This zone aligns with a small fair value gap (FVG), reinforcing it as an area of interest for smart money participants.

Key 4H Levels to Watch

Level Significance

$3,360–3,365 Major supply zone & bearish OB

$3,350–3,355 Minor resistance

$3,337–3,340 61.8% Fib / equilibrium

$3,330–3,333 BOS retest & key support

$3,300–3,310 Strong demand zone & bullish OB

$3,285–3,295 Secondary demand zone below BOS

The directional bias on 4H remains neutral-to-bullish, contingent on price holding above $3,300. A clean break and close above $3,360 could open a path to $3,400–3,420, while a sustained drop below $3,300 would mark a change of character (CHOCH) and shift bias to bearish.

🪙 Institutional Concepts in Play

Order Blocks (OB): Strong bullish OB sits at $3,300–3,310, while a bearish OB dominates at $3,355–3,365.

Fair Value Gaps (FVG): On the bullish side, $3,300–3,315 remains unfilled; on the bearish side, $3,330–3,345 caps rallies.

Liquidity Grabs: Dips toward $3,295–3,300 appear to sweep sell-side liquidity, while spikes above $3,360 tap into resting buy stops.

The area around $3,330 remains a key battleground where smart money likely accumulates positions before the next impulsive move.

⏳ 1‑Hour Timeframe: Intraday Trade Setups

On the 1-hour chart, the market is compressing between a bullish order block and bearish supply. Price action shows evidence of short-term liquidity sweeps and reactions to imbalances, offering two clear scenarios for intraday traders.

📈 Setup A – Bullish Zone Bounce

Entry: Buy limit at $3,332–3,333

Stop-loss: Below $3,328

Take-Profit 1: $3,345

Take-Profit 2: $3,355

Rationale: Confluence of 4H demand, Fib retracement, BOS retest, and 1H bullish order block.

📉 Setup B – Supply Rejection Short

Entry: Sell limit at $3,355–3,360

Stop-loss: Above $3,365

Take-Profit 1: $3,337

Take-Profit 2: $3,330

Rationale: Price into 4H bearish OB, aligning with supply and stop runs above recent highs.

🌟 The Golden Setup

Among these, the Bullish Zone Bounce at $3,332–3,333 stands out as the highest-probability trade. This level represents maximum confluence:

Retest of 4H BOS.

Bullish OB on 1H.

61.8% Fibonacci support.

Unmitigated fair value gap.

This setup offers a favorable risk–reward profile with clear invalidation and multiple upside targets.

🔎 Summary Table

Bias Key Support Zones Key Resistance Zones

Neutral-to-bullish $3,300–3,310, $3,330–3,333 $3,350–3,355, $3,360–3,365

Intraday Setups Entry Zone Stop-Loss Take-Profit Targets

Bullish Zone Bounce 🌟 $3,332–3,333 < $3,328 $3,345 / $3,355

Supply Rejection Short $3,355–3,360 > $3,365 $3,337 / $3,330

📣 Final Word

Gold maintains a structurally bullish outlook above $3,300, with strong institutional footprints evident in the $3,300–3,333 demand zones. Traders should remain vigilant around $3,360, where sell-side liquidity and supply are concentrated.

The Golden Setup — a bullish bounce from $3,332 — offers the best confluence and statistical edge intraday.

Xauussd

XAU/USD 10 March 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Analysis/Bias remains the same as analysis dated 07 March 2024.

Price has printed a bullish CHoCH according to analysis and bias dated 28 February 2025.

Price is currently trading within an established internal range.

Intraday Expectation:

Price is now trading in premium of 50% internal EQ where we could see a reaction at any point. Price could also target H4 supply zone before targeting weak internal low, priced at 2,832.720

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Analysis and bias remains the same as analysis dated 03 March 2023.

As mentioned in my analysis dated 28 February 2025, whereby price printed a bullish CHoCH but stated I would continue to monitor price.

On this occasion I have marked the previous bullish CHoCH in red as price did not pull back deeply enough to warrant internal structure breaks, additionally, there was minimal time spent .

Price has printed a further bullish CHoCH which is now confirmed. Price is not trading within an established internal range.

Intraday Expectation:

Price to continue bullish, react at either premium of internal 50% EQ, or M15 supply zone before targeting weak internal low priced at 2,832.720.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

Gold (XAUUSD) Respecting Parallel Channel Support

Technical Breakdown

Gold has been trending inside a well-defined parallel ascending channel, respecting both the support and resistance levels. Currently, price is testing the lower boundary of the channel, which has acted as a strong support multiple times in the past.

Key Observations :

✔️ Support Zone : Price is bouncing off the channel's lower boundary, indicating a potential bullish reversal.

✔️ Confluence Factors : This area also aligns with a previous structure support level, making it a strong buy zone.

✔️ Risk-Reward Ratio : The trade setup offers an excellent risk-to-reward ratio, with a well-placed stop loss to minimize risk.

📊 Trade Setup :

🟢 Entry: Around $2,950 (Confirmed support bounce)

🎯 Target 1 : $3,000 (Mid-channel resistance)

🎯 Target 2 : $3,050+ (Upper channel resistance)

🛑 Stop Loss : Below $2,900 (Invalidation level)

💡 Trading Tip: Always wait for confirmation like bullish candlestick patterns (pin bars, engulfing candles) before entering. Managing risk with proper SL placement is crucial.

🔥 Do you agree with this analysis?

Let me know in the comments & share your thoughts!

disclaimer trading involves high risks

12.26 Gold Trend Trading Strategy

🎈Currently, spot gold is trading sideways at a high level, and the current price is 2617 US dollars/ounce. The support and pressure levels are high selling short and low buying long. The pressure level is 2633 and the support level is 2600. On Monday, gold opened at a low level in the Asian morning, and tested the support of the 2608 area. On Tuesday, it opened again in the 2613 area, indicating that the support below is strong. The support area is still bullish. Focus on the upper 2626 and 2633 points. The retracement is also expected. Without the retracement, the bulls can't go far. Due to the Christmas holiday, the bulls have no strength during the day and return to the range of shocks.🔴

🎈There are two scenarios for tomorrow's opening:

The first scenario is that the Asian morning session directly jumps up and opens above 2620, and then rises sharply in the morning session, breaking through 2626 and then trading sideways in the 2633 area. The European session exerts force again, directly breaking through 2633, and continues to rise to 2642. After the US session retests around 2633, the bulls exert force three times to directly probe above 2650. In terms of operation, hold the long orders in hand, break through 2626 and 2633 tomorrow and continue to go long. The first time it touches 2642, go short, and look at 2635-33. The US session retests around 2633 and directly goes long again, looking above 2650!🔴

🎈In the second case, the Asian market opened at a normal high in early trading. After a small retest of the 2613 area in the morning, it rose directly to the 2642 area in the early trading. The European market fluctuated and consolidated above 2633. The bulls in the US market made a second effort and broke through the 2650 area again.🔴

🎈Gold strategy:

Go long when gold retests near 2613, target 2642, 2650, 2664; go short if 2642, 2650, 2664 are given for the first time; go long in batches if 2610, 2607, 2601 are given; more real-time layout is subject to the actual market;🔴

🎈The difference between these two situations is whether it opens with a gap or opens at a normal high, which determines the strength of the bulls and how far they can go. If it opens with a gap, the strength of the bulls basically stops at the 2650 area, and if it opens at a normal high, the expected limit of the bulls can be seen in the 2670 area!🔴

XAU BUYFrom my last publish, the apt analysis of the xau market was the bullish insight, the buy momentum has kick-started and the zones whicb can cause a market reaction has been carefully highlighted,let's watch it all play out as the market continues moving

Follow for more helpful analysis on the xau market 👍...

1958 go long directly

Gold can't fall anymore. The big positive line at the bottom has obviously stopped the decline. Especially since the gold price once dropped to around 1944, it is obvious that the downward pressure is great. The K line cannot go down. The big positive line directly swallows up the five positive lines. decline, and at the same time, there is an obvious bottom signal, which is a bullish engulfing pattern.

The four-hour gold price line has a strong Yang line. The K-line starts from below the 50-day moving average and directly breaks out of the suppression of the moving average. At the same time, the 50-day moving average also shows a strong twist upwards. At least the pause button is pressed for the downward movement. , the big positive line continues to exert force on the moving average, go long directly in 1958

Operation strategy: long gold 1958, stop loss 1950, target 1975

XAUUSD Continue to be bullishGold has continued to rise since the opening yesterday (Monday), and it has been consistent with my prediction yesterday. It has exceeded 1860, and the price of gold has risen by nearly 30 US dollars. The war between Israel and Hamas has shocked the market, and this war may spread further throughout the Middle East. Risks are also rising, demand for safe havens is increasing, Federal Reserve officials issued dovish speeches, and the U.S. dollar index fell to more than a week low, which also promoted the ability of gold prices to rise. I think gold prices may re-target the 1900 area.

GoldViewFX - 1H CHART UPDATED LEVELS AND TARGETSHey Everyone,

Please see our 1H chart updated levels and targets.

Price is sitting tight between two weighted structures, with a candle body close gap above

1963 is a weighted Goldturn level and therefore will need a EMA5 cross and close above at 1925 and below at 1912. We will use this to plan our trades in line with our long term trend when buying dips.

We will continue to track the movement level to level with ema5 cross and lock.

Our long term projection still remains Bullish.

BULLISH TARGETS

1924

1931

EMA5 CROSS AND LOCK ABOVE 1931 WILL OPEN 1938, 1944 AND 1950

BEARISH TARGETS

1912

EMA5 CROSS AND LOCK BELOW 1912 WILL OPEN THE SWING RANGE

SWING RANGE

1895

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Please don't forget to like, comment and follow to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR

Open Sell Gold/XAUUSDIf the price is up to 2030 - 2035 , consider open sell order. Please wait for signals from the market.

Note: The content of this article reflects the opinion of the author. Documents published on this site are provided for informational purposes only and are not intended to provide investment advice.

GoldViewFX - END OF WEEK UPDATEHey Everyone,

A PIPTASTIC finish for us this week completing all targets. 1982 Goldturn support provided a nice bounce back into 2000 allowing us to buy the dip to secure a clean 50 pip TP. Although we have HIT our 2006 target this gap was re-opened yesterday, which price fell short by a few pips but still provided a nice bounce into the range.

2006 Goldturn is holding well as resistance. As we stated at the start of the week, unless we see EMA5 cross and lock above 2006 to open the upper range we will continue to see rejection here.

However, we continued to buy dips and secure TP exits below this level for safe exits.

We will now come back Sunday with our multi timeframe analysis and trading plans for the coming week.

BULLISH TARGETS

2006 - DONE

EMA5 CROSS AND LOCK ABOVE 2006 WILL OPEN

2029

2050

BEARISH TARGETS

1982 - DONE

1955 - DONE

EMA5 CROSS AND LOCK BELOW 1955 WILL OPEN 1938, 1928, 1915 AND 1907

SWING RANGE

1915 - 1907

Please don't forget to like, comment and follow to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR

XAUUSD NY OutlookGood afternoon gold gang! .. Im currently in this trade taking it up to the highlighted area.

I took the sells this morning and exited full for 35 pips so this would be icing on the cake today as we know friday isnt the most volatile day.

I will take a look how price reacts from the area and see if we can expect more bearish action but for now lets see how deep the NY pull back takes us

Have a great session and an even better weekend

Tommy

Gold daily analysis 07.04.2022Gold is still ranging between its support 1916 and resistance 1933.

We see the triangle will close in a day. So be ready for breakout.

We should not be biased about the direction of breakout and I suggest to take trades ones the price completely fall or rise

So go for buy above 1880 and sell below 1966.

For today dont take any trade until the price touches any of these levels

GoldViewFX - UPDATED LEVELS & TARGETS$Hey Everyone,

Another awesome day for us with our analysis playing out perfectly. We rode the BUYS up with todays movement, breaking the trades up in 30 to 40 pips using our intraday Goldturn support levels.

We have updated our H1 Goldturn Levels with the most up to date data and this chart should now allow us to map out gaps using EMA5 cross and lock. We have a gap at 1940 and also a gap at 1911.

We remain Bullish and therefore buying dips and targeting the 1940 level as a TARGET!!! with 1911 in mind to risk manage, should we get a new Goldturn above. Our swing range is at 1907, which is also inline with the 1911 gap.

We remain Bullish and will continue to buy dips. The current Goldturn levels will allow us to safely enter and exit levels using EMA5 cross and lock for confirmation and failures also allowing safe exits should the market turn.

As always we will keep you updated with any changes. Please don't forget to like, comment and follow to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR