#X #XUSDT #XEMPIRE #LONG #Setup #Eddy#X #XUSDT #XEMPIRE #LONG #Setup #Eddy

XUSDT.P Long Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Note : The price can go much higher than the second target, and there is a possibility of a 100% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

Warning : The stop loss is dramatic and large. Place the stop loss based on your strategy and after getting entry and confirmation on the entry point behind the last shadow that will be created.

Be successful and profitable.

I hope you enjoyed the previous analysis and signal of this currency.

Previous analysis and signal Of X Empire :

Xempire

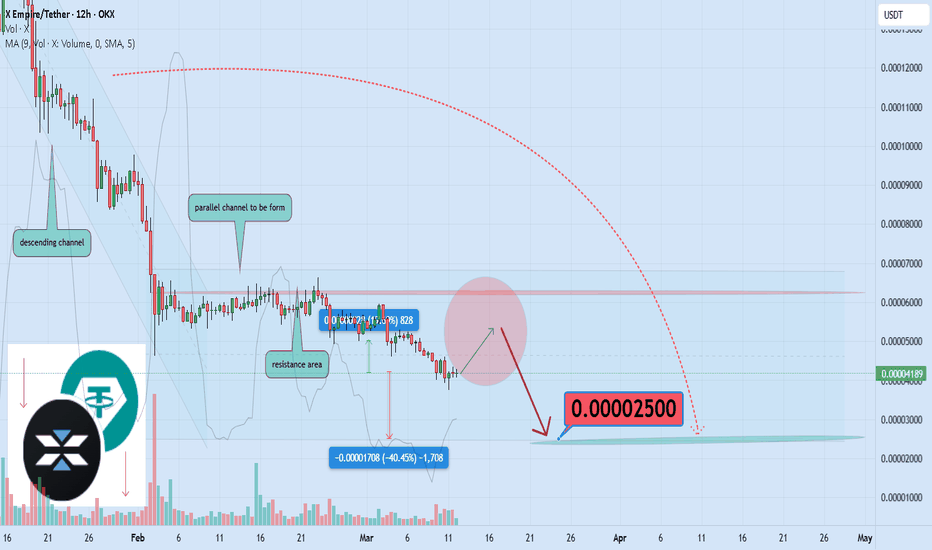

X Empire Breakdown: 40% Drop Targeting 0.000025Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for X Empire 🔍📈.

The X Empire has exhausted all its key support levels, and I project an additional decline of at least 40% moving forward. The primary target for this downturn is 0.000025. Following this, I anticipate a phase of consolidation, characterized by range-bound price action and the potential establishment of a parallel channel.📚🙌

🧨 Our team's main opinion is: 🧨

X Empire has lost all support, with a 40% decline expected to 0.000025, followed by consolidation and a possible parallel channel.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

What is Tether Gold (xusdt) and Its Future in Crypto?Hello and greetings to all the crypto enthusiasts, ✌

Personal Insight on Tether Gold and Its Future Potential:

When I analyze a new project, I personally dedicate a significant amount of time to thoroughly studying its various aspects. However, this was the first time that while reviewing a particular project, I found my attention so intensely and inexplicably drawn to it. After careful consideration, I am confident that, in the near future and at the appropriate time, I will be making a personal investment in it. That being said, please take note of the disclaimer section at the bottom of each post provided by the website, this is merely my personal opinion and should not be interpreted as financial advice.

There is something truly captivating about the fusion of the ancient, physical world of gold with the innovative and rapidly evolving realm of cryptocurrency. This, in essence, is the concept behind Tether Gold, and it represents a highly compelling idea with extraordinary growth potential. In the world of cryptocurrency, it is often these unique and forward-thinking ideas that pave the way for significant market breakthroughs. What makes Tether Gold even more intriguing is that it is not just a speculative idea; it has the robust backing of a trusted entity like Tether.

Now, let’s take a closer look at this project and its key features:

What is Tether Gold (XUSDT)?

Tether Gold (XUSDT) is a digital token issued by Tether, and it is backed by physical gold. Each unit of XUSDT is pegged to one troy ounce of gold, with a purity of 99.9%. This gold is securely stored in insured vaults, ensuring both safety and transparency. Tether Gold provides a means for investors to participate in the gold market digitally, without the need for the physical handling or storage of gold.

Tether Gold combines the benefits of cryptocurrencies—such as fast and easy transfers, and decentralized security—with the timeless stability and intrinsic value of gold. This token is tradable on major blockchains, including Ethereum and Tron, and has been positioned as a secure, efficient, and transparent means for digital gold investment.

A Brief History of Tether Gold:

Tether Gold was launched by Tether in January 2020, marking a significant expansion of the company’s product offerings. Tether, which is primarily known for its stablecoin USDT, introduced Tether Gold in response to increasing demand for digital assets backed by physical commodities, particularly gold. The company recognized the growing interest in stable digital assets that combine the safety and value of gold with the flexibility and innovation of blockchain technology.

The Benefits of Investing in Tether Gold:

Investing in Tether Gold presents several key advantages, making it an attractive option for a wide range of investors. This digital asset offers an innovative way to invest in gold, providing greater convenience, flexibility, and lower costs compared to traditional methods of purchasing and storing physical gold.

Some of the most notable benefits of investing in Tether Gold include:

Security and Transparency: Each Tether Gold token is fully backed by physical gold stored in secure vaults, and this backing is regularly audited, ensuring full transparency. Investors can have peace of mind knowing their investments are securely backed by tangible assets.

Efficient Transferability: Unlike physical gold, which can be cumbersome and costly to transfer, Tether Gold can be easily transferred across the globe, quickly and at minimal cost. This opens up the opportunity for investors to access and trade gold in a way that is both convenient and cost-effective.

Accessibility: Tether Gold allows investors to gain exposure to the gold market with relatively small amounts of capital, without the need to buy, store, or insure physical gold. This makes it a highly accessible option for those who may not have the resources or desire to invest in physical gold.

Stability and Value: Gold has long been regarded as a safe-haven asset, maintaining its value even during times of economic instability. By combining the stability of gold with the technological advantages of blockchain, Tether Gold offers a powerful and stable investment vehicle.

From a technical perspective:

Tether Gold is currently positioned for potential significant growth. After experiencing several rounds of declines, it now finds itself in a strong position for an explosive upward movement. This could be an ideal time for investors to consider entering or increasing their positions in Tether Gold, as the market appears poised for a potential surge.

🧨 Our team's main opinion is: 🧨

Tether Gold (XUSDT) is a digital token backed by physical gold, offering the stability of gold with the flexibility of blockchain. It’s an easy, secure way to invest in gold digitally, and with its strong backing from Tether, it has great growth potential in the crypto market.

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

X Empire price has done something incredible !)💰 Something phenomenal has happened that hasn't been remembered for many years: NYSE:X #Empire altcoin has made +1750% in a week

Whether it was the exchange's promotional campaign, #Trump's election victory+ his colleague #muskempire and everything directly or indirectly related to him are now “in chocolate” or all together, but God grant most altcoins to grow like this.

Then we will feel the real taste of the alt-season

The #X #marketcap has grown from 20 million to the current 300 million.

We have two questions for you:

Where will the OKX:XUSDT price go next: 🐳 along the blue route by $0.0014 or 💔 along the red route by $0.00014 (the difference is only 0 or 10 times ;)

What other low-cap altcoins do you think will pump like this? You write your options in the comments, and we will analyze some of them and publishing ideas here

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

EMA, The correct way of usage - Part 4 - minor structure_2To confirm a minor trend, we need to see a Strong Break of Structure (BoS) with the body of a candle, in the direction of the trend. This means in the ARZ Trading System, shadows do not count as breakouts for confirming a trend continuation.

let's elaborate on the concept:

- after receiving pullback from 13&20EMA in A, the previous low has been broken strongly and made a stBoS. This confirms we are in a minor downtrend. So, from now on we are looking to go short any chance we get.

- in B & C we are looking for a reason to sell. but weak BoS after will make us cautious and at #1 we are analyzing and not trading until the direction of the minor trend gets clear.

- the strong bullish candle after #1 tells us we are indeed in a ranging market! Not an uptrend. Please note that: the minor uptrend should be confirmed.

- in D we see buyers are weak, and at #2 it confirms that a minor uptrend is not going to happen. Now wait for a confirmation of a minor downtrend.

- stBoS after E confirms we are in a minor downtrend, so we look for opportunities to sell after F, G, H, & I.

- at #3 we are officially in a range again. So, we trade as a ranging market, until J tells us we have to trade downward.

- a wBoS after K warns us, and we see the price reversed upward. Weak continuation downward at #4 & #5 confirms it.

- the stBoS upward after #5 tells us we are in an uptrend, but a weak pullback up until 6 tells us the uptrend might be done.

- Then, there is a stBoS downward after L. So, until it breaks upward and has a strong BoS in that direction, the price could continue declining.

Keynote: Short-term traders must always trade in the direction of the minor trend. Unless they are to trade in a ranging market or are medium or long-term traders.

Question: do we have to just use periods 13 & 20 for analyzing short-term trends?

Answer: Absolutely not! It's the trader's choice only.

Don't panic! Uptrend is still valid!As we can see, the price has maintained a minor trend in #1. If we see the same thing in #2, the price will continue upward, and TP targets are based on MC high.

EMA, The correct way of usage - Part Three - minor structureFor trend traders, analyzing the short and long-term trend direction is crucial. By usage of 20EMA & 13EMA, we can understand short-term trend direction and power. In future articles, we will look at Major Structure (long-term trend analyses).

Keynotes:

1. When 20 is below 13 it means we are in an uptrend, and a Downtrend is when 20 is above 13.

2. EMAs should have a slope. If just one of them is flat, or both are sloped toward each other, or the price crosses and closes both of them, we are in the minor range. the possibility of a third one happening could be predicted by identifying an MC in the past (please refer to the MC article ).

4. We look at the distance between these two EMAs as a zone. So we don't expect the price to close exactly on any of them, to analyze for a probable pullback (Please refer to Part One and Two ).

Watch 4H:

- #1 Is where the price crosses and closes both. we are in a minor range. Then, the continuation of shaping green candles and then the cross of EMAs, means we are in a minor uptrend.

- #2 a flat 13 shows a slight range, which then again turns into an uptrend. Although we have predicted it before by drawing MC boxes.

- #3 shows 13 is toward 20. Then we are in a minor range. This is followed by price crossing and closing both in #4. Again it has been predicted by MC box to happen.

- Candle #5 is normal. Because we are in a range and in here anything can happen. But when the price couldn't cross and close both in #6 and the continuation of the downtrend and pullbacks in #7 & #8, it shows we are in a minor downtrend now. So, we are not going to trade upward until it reverses.

EMA, The correct way of usage - Part Two - PullbackOur core belief in ARZ Trading System: Trading, is to have an "expectation" from the market. If not, at any movement, the trader will be confused! If you look at the market and don't have any expectations, don't trade! In a future article, we will discuss what to do if an expectation is not met.

In the case of Pullback, Price is not a ball, and EMA (or any other kind of S&R) is not a brick wall, especially in this case.

If you put an EMA with any period, you'll see that the price crosses it easily most of the time! Then, it might come back as a shadow or a Fake Breakout. This means we should have a confirmation system for accepting or rejecting a Pullback. Otherwise, we'll always see a pullback shaping!

Key Note 1: the higher the EMA period is, the longer will take for a pullback to shape!

Key Note 2: Never trust and trade based on just one S&R level! Always have at least 2 or 3 levels to confirm your pullback. Either in a classical way by drawing trendlines and channels, or using any kind of Indicator as a means of dynamic S&R level.

Key Note 3: a flat EMA is supposed to break easily! If not, it'll reject the price strongly. It means we have to wait for what will happen at a flat EMA to decide what to do next or expect the price will breach it (Please refer to article part one).

Key Note 4: An ascending EMA can only act as a support, and a descending one acts as a resistance, not the other way! This is critical, believe me!

Accepted ways of confirming a pullback in the ARZ System are:

1. Wait for a strong reversal pattern to shape at S&R. Never jump the gun!

2. Use a Volume Indicator like WAE (Waddah Attar Explosion) to confirm your entry at the S&R level.

In this chart:

- Pullback #1 (Bearish Engulfing) is not accepted, because it's just based on one S&R (13EMA) and the reversal pattern closed near the support of MC.

- Pullback #2 (Bullish Engulfing) is strong but closed near 100EMA. Can't trust it.

- Pullback #3 is awesome! This is a multi-candle Evening Star (Key Note 1&2), of 100EMA & Resistance of UTP & MC.

- Pullback #4 is again good but has closed near the low of MC and is risky to take.

$X Token Gains Momentum as Binance Launches Perpetual ContractsIn an exciting development for the NYSE:X token, Binance has listed it as a trading pair in its perpetual contracts, a move that's set to drive substantial market interest. This development comes alongside Binance’s latest futures offerings, giving users access to leveraged trading up to 75x. With this listing, NYSE:X is poised for potential upside gains as traders and investors react to the expanding trading opportunities.

Technical Analysis

The NYSE:X token’s daily chart reveals a promising falling wedge pattern, often signaling a bullish reversal. Trading currently above key moving averages (MAs) and up 5.51%, the token shows resilience, holding strong even amid recent retracements. Additionally, the Relative Strength Index (RSI) is sitting at 48, suggesting balanced momentum with a potential upward shift as buyers gradually regain control. Traders are closely watching for a breakout from this pattern, as this could catalyze a rapid price surge.

Volume dynamics further emphasize this potential. In the wake of Binance’s listing announcement, NYSE:X saw a significant 102% spike in intraday trading volume. Such a surge in volume underscores heightened interest, with traders positioning themselves in anticipation of a stronger price rally. This volume uptick also supports a potential bullish continuation as demand outweighs supply.

Binance Listing Sparks Optimism

Fundamentally, Binance’s addition of NYSE:X to its futures and perpetual contract offerings opens new doors for market participation. By allowing up to 75x leverage, Binance offers traders substantial upside potential, making NYSE:X a particularly attractive asset for those with high-risk, high-reward strategies. The exchange’s user base, known for its active trading engagement, is now positioned to push demand for NYSE:X even further.

Further, Binance’s reputation for boosting assets upon listing adds to the optimism surrounding NYSE:X ’s potential. Previous tokens, such as PNUT and ACT, saw impressive price hikes following their Binance debuts. The listing also brings added credibility and visibility to NYSE:X , likely enhancing its attractiveness to a broader audience.

Future Outlook

Beyond technical signals and exchange activity, NYSE:X ’s fundamentals remain compelling. With a supportive and rapidly growing community, the token has gained traction through various initiatives aimed at increasing adoption. The combination of strong tokenomics and a passionate user base aligns with a long-term bullish outlook. As more users enter the ecosystem via Binance’s leveraged options, increased liquidity and market interest are likely to push NYSE:X to new heights.

EMA, The correct way of usage - Part OneIn ARZ Trading System, we use multiple EMAs to analyze the market, as follows:

1. 200EMA, 100EMA, & 50EMA: Analyze the big picture (Major Structure). What is happening in higher timeframes? Long Term Bulls are stronger or Bears?

2. 20EMA, & 13EMA: Analyze the trading timeframe (minor structure). When to enter a trade and how to manage it? Short Term Bulls are stronger or Bears?

Points to consider:

1. If an EMA is flat, it's not a valid S&R and we expect the price to break it easily. If not, it'll act as a strong S&R and we expect a strong movement after Pullback on it.

2. Based on the period of Flat EMA, the fluctuation around it could be big and bigger. It means, a flat 20EMA has a smaller range of fluctuation and shorter duration of ranging market around it, in compare to 200EMA which generally is wider and longer.

3. If EMAs are close to each other, cannot act as S&R. Only when there is some distance between them we can see them as S&R that can encapsulate price between them for a period of time.

Here we see a strong bullish entry after hitting Flat 200EMA and 50% LTP. If cross and closed above all EMAs, a Pump is in hand!

To be continued...

New MC for Daily! (X Empire)Watch 1D: Previous MC violated. Analyze in this timeframe is based on this MC from now on.

- Strong Bearish ➡️ Target: $0.00008 (50% of LTP)

- Strong Bullish ➡️ Target 1: $0.00060 , Target 2: $0.00077 , Target 3: $0.00094

Analyze at target.

Sign of Possible Breakout (X Empire)Watch 1H:

- Sign of possible Breakout: Converging Bollinger Bands (20,2)

- Strong Bearish ➡️ Target: $0.00016

- Strong Bullish ➡️ Target 1: $0.00045 , Target 2: $0.00060

Analyze at target.

Two weak candles, then strong! (X Empire)If current candle closed as a weak one (like Pinbar), we have 2 weak candles in the direction of the uptrend that is a sign of strong upward movement coming after it.

If not, price will continue downward.

Likewise, after two strong candles in the direction of a trend, we have to see a weak one. It is normal!

Beautiful! (X Empire)If stopped and reversed, a really nice place to add on the position. We expected this nice beautiful retracement!

And yes, Ranging! (X Empire)As we expected, NYSE:X is ranging, and it is normal! Still there is no reason to sell! Even if it moves downward, until it touches LTP, there's nothing no analyze! don't panic, just hold!

For more information, read the attached post.

Target levels (X Empire)The ARZ method is based on Wyckoff. The base (range) is MC which you can see in the chart. After breaking of this range, if price moves in one direction and stayed in the momentum (Bullish or Bearish with acceptable retracements), we expect the movement to continue on.

Here we see price has achieved 3 of the targets which are: $0.00031, $0.00045, and $0.00059 . If movement continues, next 3 targets are: $0.00073, $0.00087, and $0.00101 . After reaching each one of these targets, we expect a retracement, and it can be strong, then no worry should come with it.

And again, whatever happens, I'm holding tight to $X!

Conditional Bullish (X Empire)We have to see a cross and close above $0.0003134. If happened, this upward movement will continue. Otherwise, there will be a big retracement.

What ever happens, I'm holding tight!

X Empire(X) can PUMP[+10%_+20%_30%]Today, I want to analyze the telegram game token X Empire , which has been listed in various exchanges for about 1 day , so that if you participate in the Airdrop of this telegram game , where you can sell your tokens or even profit from the increase in the price of the token X .

X token ( OKX:XUSDT ) has managed to break the Downtrend line .

I expect X Empire(X) to rise again after the pullback to the Downtrend line and attack the resistance zone , and if the resistance zone is broken, we should expect it to rise to $0.000084 & $0.000091 .

⚠️Note: Because there is not much data on token X, be sure to observe capital management in this position more than before.⚠️

⚠️ Note: If you have the X token and want to sell, the resistance zone can be a suitable zone, or if the support zone breaks, it is better to sell this token because it is more likely to fall. ⚠️

🔔Be sure to follow the updated ideas.🔔

X Empire Analyze ( XUSDT), 15-minute time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

X Empire Token ($X) Got Listed Today But Saw a Slight DipX Empire Token ( NYSE:X ), a Tap-to-Earn mini-app on the TON blockchain, has been making headlines recently—but not for the reasons many would have hoped. After getting listed on major exchanges like Bybit, Bitget, and OKX, NYSE:X saw its price quickly plummet from $0.000108 to $0.00005868, sparking outrage among early investors and participants of the game’s airdrop. Some are calling the project a scam, while a few remain optimistic about its long-term potential.

Let’s break down the current state of NYSE:X , exploring both the technical and fundamental aspects, and assess where the token might be headed in the coming days.

Fundamental Analysis

X Empire ( NYSE:X ) is marketed as a Tap-to-Earn Mini App integrated with other mini apps on the TON blockchain. The project aims to tap into the gamified experience of earning tokens, allowing users to engage with mini-apps and earn NYSE:X tokens. However, shortly after its listing, users voiced frustration, accusing the team of mismanagement and branding the project as fraudulent.

One user pointed out that X Empire processed a $27 million transaction while the token’s market cap is around $32 million. This discrepancy has raised questions about the token’s financial structure and transparency.

Amidst the negative sentiment, some holders remain bullish. A handful of users believe NYSE:X could surge 50-100x in the next 72 hours, comparing the token’s potential to other explosive meme coins. But with a sharp 45.35% price drop in just 24 hours and dwindling market confidence, many remain skeptical.

Current Market Data

- Live Price: $0.000059 USD

- 24-Hour Trading Volume: $21.9 million

- Price Decline in the Last 24 Hours: -45.35%

- Market Cap Ranking: #2742

- Circulating Supply: Not available

- Max Supply: 690 billion NYSE:X coins

Despite the grim performance, NYSE:X continues to garner attention with a high trading volume, indicating that it is still on the radar for both traders and investors looking for speculative opportunities.

Technical Outlook

From a technical perspective, NYSE:X is currently down 27%, trading at $0.000079 at the time of writing. Most of the selling pressure has come from airdrop participants, leading to a bearish trend. Many of these users are looking to offload their tokens, which is contributing to the constant price decline.

However, on the 15-minute price chart, NYSE:X is showing a bullish harami pattern, a technical formation that suggests potential for a price reversal. This indicates that there could be some short-term optimism, especially if the influx of buyers persists. If the token manages to attract enough buyers, it could target the $0.0001 pivot point, a key psychological and technical resistance level.

Key Support & Resistance Levels:

- Immediate Support: $0.000058

- Key Resistance: $0.0001 (pivot point)

- Overhead Resistance: $0.000108 (initial listing price)

In the short term, NYSE:X will need to break through the $0.0001 mark to regain market confidence. However, traders should be cautious as the RSI (Relative Strength Index) is likely to show oversold conditions soon, making it a highly volatile asset for day traders and short-term investors.

Conclusion: A Tale of Two Perspectives

The X Empire Token ( NYSE:X ) is facing significant hurdles, with growing skepticism surrounding its legitimacy and future potential. However, the presence of bullish patterns on shorter timeframes indicates that the token could experience a short-term rebound if market conditions improve.

For now, the project is battling jeets (weak holders) and bears, and all eyes are on the next 2 to 3 trading days to see if NYSE:X can consolidate and find stability. Those who are bullish believe the token could reach new highs, while others remain wary of the risks.

If you're considering trading or investing in NYSE:X , it’s crucial to stay updated on the latest developments and market sentiment, as both could heavily influence its next move.