Confidence and A Conditional Reprieve Amid Oversold LowsAT40 = 11.7% of stocks are trading above their respective 40-day moving averages (DMAs) (hit an intraday low of 9.4%, oversold day #3)

AT200 = 32.3% of stocks are trading above their respective 200DMAs (intraday low of 30.0%)

VIX = 21.3 (a decrease of 14.7%)

Short-term Trading Call: bullish

Commentary

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), fell as low as 9.4% on Friday. AT40 dropped as low as 8.6% intraday during the February swoon (February 9, 2018 to be exact). Since 1986, AT40 has closed below 9.4% only 92 trading days, and AT40 last closed below this level on January 21, 2016 at 8.3%. The day before that, AT40 closed at 7.4% and traded as low as 3.8%. AT40 obviously cannot trade much lower than these levels.

AT200, the percentage of stocks trading above their respective 200DMAs, is very important now as an oversold gauge. AT200 closed the week at 32.3%. In January, 2016, AT200 managed to get as low as 9.0%, a level last seen around the historic March, 2009 bottom. In other words, while AT40 suggests the market is set up for a sustained bounce, AT200 reminds me that these oversold extremes can get yet more extreme if panic gets a fresh heaping of fuel.

Trading action around important technical levels also remind me that the market could go lower. The S&P 500 (SPY) is essentially back to flat for the year but is still 7.2% above this year’s double bottom. A retest will be in play if the index fails to win what is perhaps the stock market’s most important battle: a test of 200DMA support. During the February swoon, the S&P 500 only ONCE closed below its 200DMA. The index closed below its 200DMA on Thursday and set up Friday’s drama. The index gapped up just above its 200DMA in an effort to clear out bearish sentiment. Sellers quickly closed the gap and then failed to take the index lower. Buyers fought off a test of the intraday low and managed to churn the index toward the day’s open for a 1.4% gain on the day. It was a messy way to demonstrate the importance of the 200DMA! If buyers can follow through early this coming week, the technical pattern will look like a (short-term) washout of the market’s most motivated and panicked sellers. I call this a conditional reprieve in the middle of oversold conditions because of the criticality of this 200DMA pivot.

{The S&P 500 (SPY) closed right on top of its 200DMA support after sellers almost ruined an opening gap up.}

The NASDAQ had a battle similar to the S&P 500’s; the main difference came with an intraday pullback that did not create a complete reversal of the gap up. The Invesco QQQ Trust (QQQ) did not fully reverse its gap above the 200DMA. Its 2.8% gain on the day has the look of a successful, and bullish, reversal of a 200DMA breakdown.

{The NASDAQ gained 2.3% with a gap up and then close just below its 200DMA.}

{The Invesco QQQ Trust (QQQ) made a convincing leap with the reversal of the opening gap up only touching 200DMA support. QQQ ended the day with a 2.8% gain.}

While the big indices fared well at the end of the day, other indices did not. Their poor performance underlined Friday’s conditional reprieve. Some of these sectors need to wake up to help the stock market mount a credible and sustainable bounce out of oversold conditions.

The faders managed to keep these indices plastered with bearish sentiment. The iShares Russell 2000 ETF (IWM) closed flat after sellers completely reversed the opening gap up. The Financial Select Sector SPDR ETF (XLF) suffered a similar fate. This disappointment was even more critical given the wake of bank earnings from the likes of JP Morgan Chase (JPM). The iShares US Home Construction ETF (ITB) held no pretense of recovery as its fade resulted in a 1.0% loss and fresh 17-month low. ITB has dropped 17 of the last 18 trading days in a sign of a near complete market retreat from home builders.

{The iShares Russell 2000 ETF (IWM) ended the day flat as it clings to the starting point of the big May breakout.}

{Bank earnings failed to save Financial Select Sector SPDR ETF (XLF). Sellers faded the opening gap up to a flat close on the day. At least buyers were able to bounce back from a fresh 2018 intraday low.}

{The iShares US Home Construction ETF (ITB) continued its epic slide with an 18th straight down day. The 1.0% loss closed ITB at a 17-month low.}

As suggested by the breadth indicators, the sell-off is causing broad damage. The Health Care Select Sector SPDR ETF (XLV) had a solid uptrend coming out of the February swoon. XLV even broke out to a new all-time high in late August. Last week, XLV broke down solidly below its 50DMA support and nearly reversed all its gains from the breakout.

{The Health Care Select Sector SPDR ETF (XLV) gained 1.5% in a return to the lower Bollinger Band. A 50DMA breakdown is not confirmed.}

The volatility index, the VIX, dropped 14.7% to 21.3. The intraday high failed to top Thursday’s intraday high: a small positive for volatility faders. Still, the VIX is still considered elevated given its perch above 20.

{The volatility index, the VIX, remains elevated despite a 14.7% pullback.}

The VIX typically serves as a gauge of fear on the high side and complacency on the low side. If we had an equivalent for government economic policies, say a “GIX”, the GIX might be at record lows. Confidence is of course half the battle of economic performance and confidence is tangibly oozing from D.C. (from one side anyway!). With consumer confidence at record levels, unemployment down to historic levels, and economic growth impressively strong, the rhetoric accompanying policymakers represents a euphoria perhaps only matched by the complacency of the “Great Moderation” when the Federal Reserve (mostly under Chair Alan Greenspan) was heralded for ushering in a time of lasting economic prosperity…just ahead of the Great Recession. If you knew nothing about economics, you might conclude this time around that the U.S. really has figured out how to repeal the laws of economic cycles.

In particular, Larry Kudlow, the leader of President Trump’s National Economic Council, is beating a steady drum of unapologetic and triumphant confidence. In a CNBC interview, Kudlow issued a sound bite that *I* am confident will one day in the not-so-distant future sound cringeworthy to those of us who follow economics. Kudlow declared: “We are in a hot economic boom. There’s no end in sight.”

Other key points from this interview…

Not worried about the Fed killing the economy. It has staying power. {Me: This message is consistent with Treasury Secretary Mnuchin’s reassurances about monetary policy. Contrast these claims with President Trump’s worries over rate hikes.}

Biggest blue collar employment boom since the 1980s.

In 2018, U.S. entered an economic boom that no one thought was possible.

Loves the skepticism. Proved the skeptics quite wrong. Don’t think that’s going to change.

I fully understand why Kudlow is blowing the trumpets and beating the drums. For example, the display is an “eye-for-an-eye” response to the shrill skeptics who denounced the policies that helped kicked the economy into a higher gear. However, as an investor and particularly as a trader, I cannot help but think about the contrary implications of important government officials claiming that the economic good times will continue as far as the eye can see. Such claims defy experience and the laws of economic/business cycles. Such claims help form a foundation of hubris which can lead to policy errors. My unavoidable wariness feels even more poignant when in parallel I stare at charts showing a stock market violently and sharply falling off its all-time highs. I am not worried about over-optimism today or this quarter, but it is something that makes me stand up and take notice. (At the end of the chart review, I include a link to a Bloomberg Politics video for more context on Kudlow’s economic triumphalism).

For now, I am keenly focused on my strategy for trading oversold market conditions. The stock market is on day #3 of oversold conditions. The average oversold period lasts about 5 days and the median is around 2 (50% below 2 and 50% above 2). At the current oversold depths, it could easily take another 2 or 3 days to climb out of trouble. The longer an overperiod lasts, the more bearish the implications. Similarly, the more frequently the market returns to oversold conditions, the more bearish the implications. The drama at the 200DMAs is extremely important context for these bearish implications. A stubbornly oversold market with an S&P 500 and NASDAQ below 200DMAs is a recipe for fading rallies.

{Mean and Median Duration Below Given T2108 Threshold}

The drama at the 200DMAs made me a little less aggressive. I sold my S&P 500 call options immediately after the open. I added to my Caterpillar (CAT) put options. I took profits in other bullish positions. I selected two small fades with a short on Roku (ROKU) which was up as much as 10% at one point, and I bought shares in Direxion Daily Russia Bear 3X ETF (RUSS). On the bullish side, I doubled down on put options on the ProShares Ultra VIX Short-Term Futures (UVXY) and opened a calendar call spread on Nvidia (NVDA). I become an aggressive buyer of SPY and QQQ call options on a combination of indices trading well below their lower Bollinger Bands (BB), volatility surging, and AT40/AT200 reaching toward historic oversold lows. Again, with earnings season coming up, I am leery of taking on a lot stock-specific risk as part of the oversold trading strategy.

XLF

Stock Market Cascades Down to Oversold TerritoryAT40 = 16.7% of stocks are trading above their respective 40-day moving averages (DMAs) (a drop of 14.2 percentage points to an 8-month low and the first day of an oversold period)

AT200 = 38.6% of stocks are trading above their respective 200DMAs (a drop of 7.6 percentage points to a 6-month low)

VIX = 23.0 (an increase of 44.0%)

Short-term Trading Call: bullish (change from neutral)

Commentary

Sellers dominated the trading action in a way that we have not seen in a long time…

The S&P 500 (SPY) dropped 3.3%, its largest single-day loss since early February.

The NASDAQ dropped 4.1%, its largest single-day loss since June 24, 2016.

The volatility index, the VIX, soared 43.9%, its 11th largest gain ever. The last time the VIX gained more in a single day was the record-setting 115.6% gain on February 5, 2018.

Roll out the bull, the lower prices are here and fear has finally steamrolled complacency.

In my last Above the 40 post that covered Friday’s trading action, I wrote: “So while the shorter-term indicator is at levels that have frequently marked bottoms in this bull market, the longer-term indicator is not yet creating the kind of breakdowns that overwhelm bulls with bargain signs.” The indicators are flashing bargains now. AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), plunged sharply from 30.9% all the way to 16.7%. AT40 indicates the market is oversold (below 20%), and my favorite indicator has not been this low in 8 months.

{AT40 (T2108) experienced its sharpest downdraft since the February swoon. At 16.7% AT40 went from "close to oversold" to definitively oversold!}

AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, plunged alongside AT40. AT200 dropped from 46.2% to 38.6%, a level unseen for 6 months. Suddenly, investors are looking at a BROAD swath of stocks that have broken down below their long-term (up)trends.

{AT200 (T2107) experienced its sharpest downdraft since April. At 38.6% AT200 definitively shows a market experiencing a broad-based breakdown.}

These extremes immediately give me a bias for buying. I flipped the short-term trading call from neutral to bullish. I closed out almost all my bearish positions (hedges). I started my transition to bullishness by buying put options on ProShares Ultra VIX Short-Term Futures (UVXY). The VIX’s surge is an extreme that history says cannot be sustained for long. At 20, the VIX traditionally indicates an elevated level of fear. From this point and higher, sellers exhaust themselves relatively quickly. I like starting with a volatility fade because it can still pay off even after more substantial gains from the VIX. The inevitable collapse in volatility is typically sharp enough to cause substantial losses in the long volatility products. I chose expiration dates for the end of next week to give an initial first runway to this potential action.

{The volatility index, the VIX, has returned to levels last seen in the waning days of the last big market sell-off.}

The major indices are all over the place with a mix of bearish breakdowns and lingering hopes for critical support to hold. This downward cascade of selling and breakdowns means that the selling can continue for another day or two before a relief rally off the oversold extremes ensues. In particular, the S&P 500 has not yet quite tested 200DMA support. The index last touched this critical long-term support in May and only closed below its 200DMA ONCE during the sell-off earlier this year. Before that episode, the index last tested support during the election related swoon in November, 2016 and last closed below the 200DMA in June, 2016. In other words, traders and investors alike should be watching the coming showdown with the 200DMA very closely. I was amazed to see the important 2800 level give way so easily, especially with the S&P 500 already so far below its lower Bollinger Band (BB). The index is extremely extended to the downside here. Ditto for the tech-laden indices and small caps.

{The S&P 500 (SPY) dropped 3.3% in a path that took it all the way from 50DMA support to within less than 1% of 200DMA support.}

{The NASDAQ confirmed its 50DMA breakdown with a bearish 200DMA breakdown. The NASDAQ last traded below its 200DMA in July, 2016!}

{The Invesco QQQ Trust (QQQ) lost 4.4% and closed right on top of its 200DMA in a move reminiscent of its picture-perfect close on top of 50DMA support 4 trading days ago.}

{The iShares Russell 2000 ETF (IWM) confirmed its bearishly precipitous slide with a 2.9% loss and 200DMA breakdown.}

{The Financial Select Sector SPDR ETF (XLF) lost 2.9% in a move that confirmed 50/200DMA resistance.}

{The SPDR S&P Retail ETF (XRT) lost 2.5% with a 200DMA breakdown that confirmed the end of the rally in retail stocks.}

A washout of sellers is a great way to resolve oversold conditions, but such a cataclysmic end seems so regularly elusive. A gap down at the open would generate the right amount of panic to force out even the most reluctant sellers. A gap down would put the major indices at an unsustainable extreme below lower Bollinger Bands except in the case of massive successive waves of selling characteristic of a bear market. However, instead of a gap down what often happens in these cases is that the follow-on selling in international markets somehow satisfies the selling urges in the U.S.; buyers eagerly jump into the market right before the open. On the flip side, a gap UP would leave a lot of motivated sellers awaiting higher prices to unload their burdens. In any case, the 200DMA breakdowns in the major indices provide good tells of the potential limits (resistance) of the first relief rally.

Per the AT40 oversold trading strategy, I will get more aggressively bullish the lower AT40 goes. Additional extreme upward changes in volatility enhance that aggressiveness. With earnings season presenting a lot of stock-specific risk, I will mainly focus on the major indices for buys. The less aggressive strategy features waiting for the first sharp pullback in volatility while AT40 is oversold or to wait until AT40 ends its oversold period. Always note that an oversold market can get more oversold and the end of one oversold period can lead to a new one. In a bull market, supports hold and oversold periods are short-lived. The February swoon started with a 1-day oversold period followed by a 4-day oversold period. Three weeks later, AT40 dropped close to the 20% level before bouncing never to return until now.

I enjoyed reading and listening to many of the narratives swirling around to explain the market’s sell-off. Few, if any, are useful because they all have to do with data and information we have known for quite some time, including the Fed’s slow and steady rate hikes. The main difference now is that the market suddenly cares about the negatives and the headwinds. Most importantly, the current sell-off reminds us that poor (and shrinking) breadth during a strong run-up is a sign of underlying weakness. I saw a number of pundits claim that breadth was fine and/or that a narrow market did not matter given strong economic fundamentals and corporate earnings.

The truly new catalysts will come with the stories companies tell about earnings as the season kicks off in earnest in a day or two. I have already noted two companies that sent up important warning signs: Acuity Brands (AYI) and PPG Industries (PPG). Fluor (FLR) provided more bad economic news in the after hours session.

Not A Bear - Just A Bull Looking for Lower PricesAT40 = 31.0% of stocks are trading above their respective 40-day moving averages (DMAs) (was as low 28.1%)

AT200 = 46.7% of stocks are trading above their respective 200DMAs

VIX = 14.0 (was as high as 15.8)

Short-term Trading Call: neutral

Commentary

So much for a small bounce before continuing a decline toward oversold conditions!

The jobs report for September seemed to be a non-event as the S&P 500 (SPY) opened slightly higher and drifted higher for the first 15 minutes of trading or so. By the second breakdown to an intraday low, it was clear that sellers were eager to hit the exits. For the S&P 500, the selling ended just below its 50-day moving average (DMA). Buyers took over from there and pulled the index back from an ominous 50DMA breakdown.

{The S&P 500 (SPY) briefly broke down below its uptrending 50DMA support before buyers rallied the index back to its intraday low from the previous trading day.}

Like the S&P 500, small caps gave some faint hope of a bottom as buyers picked the iShares Russell 2000 ETF (IWM) off the very critical support of an uptrending 200DMA.

{The iShares Russell 2000 ETF (IWM) closed at a 4-month low after buyers picked the small cap index off 200DMA support.}

The parallel selling in the NASDAQ confirmed a 50DMA breakdown. The selling in Invesco QQQ Trust (QQQ) created the 50DMA breakdown that the tech-laden index barely avoided the previous trading day.

{The NASDAQ closed near a 3-month low as sellers confirmed the previous day's 50DMA breakdown.}

{The Invesco QQQ Trust (QQQ) reversed all its gains from late August with its 50DMA breakdown.}

The selling even took down financials which had rallied going into Friday’s jobs report. The Financial Select Sector SPDR ETF (XLF) lost 0.4% after 50DMA resistance rejected it and sent XLF to a fresh 200DMA breakdown.

{The Financial Select Sector SPDR ETF (XLF) turned back neatly from 50DMA resistance and again broke down below its 200DMA.}

At the height of the selling, the volatility index, the VIX, soared to a 22.1% gain. This move was below the previous day’s 36.4% intraday high. The VIX closed with an even smaller gain of 4.2% as the volatility faders went into hyperdrive after buyers started defending critical technical levels on the indices. The VIX even closed below the 15.35 pivot in a demonstration of the continued stubbornness of bullish sentiment that keeps tilting toward complacency.

{Faders pushed so hard on the volatility index, the VIX, that it swung from a 22% intraday gain to a 4% close below the 15.35 pivot.}

Finally, AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, dropped into the 20s for the first time in 6 months. The buying off the lows only took AT40 back to 31.0%. AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, dropped to a 5-month low by closing at 46.7%. So while the shorter-term indicator is at levels that have frequently marked bottoms in this bull market, the longer-term indicator is not yet creating the kind of breakdowns that overwhelm bulls with bargain signs.

This spot is particularly tough for making a short-term trading call. I left the short-term trading call at neutral only because the risk of new short positions is pretty high at this juncture. I closed out some shorts and put positions last week even and have nothing new on my list of shorts. This is a better time to prepare to buy. In other words, I am purposely avoiding getting bearish so that I can be ready to buy the market at lower prices. Recall that October is one of the riskiest months of the year in terms of potential drawdowns. Yet, with November and December offering two of the lowest risk months of the year, October can offer some timely buy-the-dip opportunities.

{August, September, and October are the S&P 500's most dangerous months on an average basis. On a median basis, maximum drawdowns do not have such a dramatic spread of performance.}

I am guessing that October is all the more dangerous this year given the exceptionally strong stock market performance in the third quarter (July to September). In other words, the market is “due” for more than a garden variety 1% or 2% drawdown on the S&P 500.

I think technician Carter Worth made a good case for a retest of the 2800 level on the S&P 500. See below.

The 2800 level was important as resistance in June and then important as support from July to August. By the time the S&P 500 gets back to 2800, uptrending 200DMA support should be there to meet the index with a kiss. More importantly, AT40 should also be at or near true oversold levels (20%).

Even with this mental model, I am preparing for the possibility that last week’s selling was about as good as it well get. After all, sellers dramatically failed twice to keep the VIX elevated. If I see enough sign of buying power, small caps, IWM specifically, would be the obvious place to start under the assumption that 200DMA support is holding. A complete reversal of Friday’s losses would be a good first sign.

$XLF bullish credit spreadNew bullish credit spread on XLF (financials) for OCT 12! Not this Friday. Solid movement this morning in the market and financials is starting to show strength. Decided to take this move out two weeks to allow for the bottom to confirm and some bullish movement to occur.

Entry 27.79

Max profit 28.50

Break even 28.14

0.38:1 risk/reward

An Over-Stretched Market With Notable AnchorsAT40 = 41.2% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 51.6% of stocks are trading above their respective 200DMAs

VIX = 12.1

Short-term Trading Call: neutral

Commentary

The stock market is stretched yet again based on AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs). AT40 closed the week at 41.2% after opening at 37% on Friday and closing at 38.7% on Wednesday. AT40 was last below 40% in late March and early April when the S&P 500 was in the process of forming a double bottom from the February swoon. AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, also broke down to a 3-month low. So on a relative basis, the S&P 500 (SPY) is not likely to go much lower from here without a specific and very bearish catalyst. The S&P 500’s ability to levitate above its uptrending 20DMA adds to the impression that support will hold.

The NASDAQ and the Invesco QQQ Trust (QQQ) were last at all-time highs at the end of August. Both indices spent most of September pivoting around their uptrending 20DMAs. While the NASDAQ still looks locked into the pivoting, QQQ looks like it is breaking away.

While these indices are holding up well, other major indices have created anchors weighing on AT40.

The iShares Russell 2000 ETF (IWM) sold off enough in September to break down below 50DMA support. The Financial Select Sector SPDR ETF (XLF) broke out for a brief moment in mid-September only to reverse sharply. XLF ended September at a 5-week low and 50/200DMA breakdown.

The home builders represent another sector weighing on the market. On a percentage basis they are small, but the fresh technical breakdown last week spoke volumes.

The volatility index, the VIX, muddles the technical picture. It dropped on Friday to 12.1. I typically would look for a rebound in the VIX from these levels; it is hard for me to expect a fresh rally in the stock market from here. Of course, a rally is still possible and would likely push the VIX to or into extremely low territory below 11. From there, the historical record shows the market can continue a bull run for quite some time. August’s very brief stay below 11 was a notable exception.

Earnings season is coming up as the next major catalyst for the stock market. Until then, I cannot get too excited about the market’s upside prospects, but I also cannot get bearish with AT40 as low as it is.

Cash money, but just how much?For those following the Financial Sector two big dates are coming up fast for Citigroup ($C): The 26th of September next week, when the Fed decides rate raising (decreasing/no hike) and mid October when $C and other banks report earnings.

The Sept 21 - $72 strike was just too tempting at $0.20/contract. Now that Citigroup, $XLF and the market in general is heading north, should gains be cut and collected today, tomorrow or are we gliding to the weekend on the wings of euphoria? $C beaten down MACD converged bullish, and the buy rumor sell news still has about 5 more days before expiration (unlike the Sept 21 contracts). The resistance at the $71.5 strike seems to be the only remaining obstacle before a short-term run on $73.

As always, do your own due diligence.

-Bayarizard

Paper Portfolio vs S&P500 - Update #1This is the first update for the video series here to grow the paper portfolio on TradingView in an attempt to beat the 'S&P index real time. Normally, I will compare the portfolio to the market, talk about weak vs strong stocks and sectors & go into what I will be changing moving forward. The portfolio has been able to get ahead of the general market and below are the specific percentage changes if they weren't clear in the video:

AUGUST 2018

Portfolio = +1.83%

'S&P Index ('SPX) = +1.36%

'SPY ETF = +1.57%

So far there is only a small difference between the market and the portfolio, but with adjustments and the market moving however it wants to, the changes should be expected to be more different over time. In general and in brief, my process of dealing with my portfolio according to my trading strategy is to check the health of my portfolio to determine where weakness is coming from, then run a stock screen according to my very own specific criteria to pick out the stocks that have high chance of performing very well, and finally an analysis of the market sectors to make sure changes I make will make sense.

So this time around my portfolio suggested reducing exposure to stocks in Energy, Financials and Industrials. My stock screen, compared to the previous stock screen run at the beginning of the portfolio, suggested reducing exposure to stocks in Energy, Financials, Technology & Utilities and increasing exposure in Basic materials, Consumer goods, Healthcare and Industrials. The market sector ETFs from the video also echoed a similar idea, and so the orders will be placed for Monday. I am considering putting more weight in the stocks that have a better chance of doing well than before but we will see what happens over the next month.

Again this is will not be a one time "get rich quick" process with excessive risk-taking or gambling, but a more disciplined approach to trading. It takes some work and it can be tough to maintain discipline, but after a while it becomes routine. Again, monthly updates on the current state of the portfolio will be continued and the next one can be expected to be made on 10/06/18 (1 month from now) and every month from that point onward.

Starting capital - $10,000

Risk per trade - 1%

Max. positions at a time - 20

Investment style - Equities long only (no short-selling, only stocks >$7, technical analysis > fundamental analysis)

The stocks shown will not be shown as investment advice but rather shown as a form of education only. Comment on what you would like to see or hear more about!

Thanks and stay tuned (will try to keep videos not too long)!

STI Break OutShares of regional bank SunTrust (STI) have recently broken out to new highs and looks to have some room to run further.

I'm jumping in via October 19 $77.5 calls (the $75's would be fine, too... a $75/$80 spread could help lower cost), as it takes me thru the next earnings report on Oct. 18. That said, I'll likely exit prior to the report to capture the increase in premiums that occurs leading in to an earnings release, as well as protect profits (assuming the trade works out as planned, of course).

Visa Breaking Out (Again)Shares of Visa (V) are yet again breaking out to new highs. Barring the market turning south, I don't see much to stand in their way, either.

It's been an almost picture perfect stair-step of resistance turning to support. The latest puts minor support at the $141-143 level, with additional support at $136, and with more significant support at the breakout level around $125-127, which happens to coincide with the 200-day moving average at $125. There's an upward sloping trend line in play, as well, which has held up nicely all year long. The MACD has turned positive, and the RSI has broken out of a nice base and is climbing, too.

I've been long this name for a while and will continue to buy any dips of significance. Just this past week, as it appeared to be gaining momentum for a breakout, I bought October $150 calls in both my trading account and IRA.

Should we get a dip to that $125 area, I'd be a buyer of outright shares for long-term holding.

If you're looking for a consumer play, this is the perfect one. While there are some great companies to own in that actual sector (like KORS, ULTA, LOW, HD, etc), this captures them all because there's a very strong chance you'll use the same card at each one, and there's a strong chance it has "VISA" in the corner of the card.

I like MA and AXP, too, but V is my preference (DFS to a lesser extent, but growing direct and tuition loans give reason for concern longer-term as the credit cycle squeezes). If you don't own V already or want to add to an existing position, you should be looking to buy any decent weakness!

General Market OverviewThis video is the first of many, and I discuss the behaviors of the sectors and potential markets that are poised to trend in the near future. The "freshest" sectors quietly trying to start a new trend are the Industrial and Consumer Discretionary Sectors. The sectors (along with their industries) I think should be on every trend follower's radar are:

XLF - Financials Sector (including some real estate stocks): setting up to break out of its 5 month range; main movers are the bank industry (not the Goldman Sachs and Morgan Stanley kind of banks)

XLI - Industrials Sector: breaking out today with the possible trend beginning here in an unpopular sector; main movers are the service industries

XLK - Technology Sector: obvious uptrend that should be followed with caution, but is getting ready to continue; main movers are the software and IT services & consulting industries

XLP - Consumer Staples Sector: in early stages on uptrend with possible correction or continuation in the near future; moved by multiple industries

XLRE - Real Estate Sector: also in the early stages of possible uptrend; main movers of sub-sector have been REITs

XLU - Utilities Sector: also in the early stages of possible uptrend; main movers are electric utilities industry

XLV - Health Care Sector: uptrend already in motion with test of all-time highs today, with great potential for trend continuation; main movers are medical equipment and managed health care industries

XLY - Consumer Discretionary Sector: breaking out today with the possible trend beginning here in a sector where the media does not favor much; main movers are the apparel, discount, footwear and auto industries (mostly retail)

I am going to do more videos on how I diversify my portfolio, and how to create such a portfolio according to what is moving in the whole market so it would be great to get feedback from this video that I can include in those, and also ideas on material you would like to see more of!

Thanks, enjoy.

Facing Fresh Challenges and Lacking Confirmation, S&P 500 StallsThe volatility index experienced the most change over a week as macro worries resurfaced. AT40 also failed to confirm stock rally.

Above the 40 (August 10, 2018) - Facing Fresh Macro Challenges and Lacking Technical Confirmations, the S&P 500 Stalls Under All-Time Highs

drduru.com $SPY $QQQ $IWM $XLF $XRT #VIX #AT40 #T2108 $DXY $USDTRY $AUDJPY #forex $CMG $DPZ $EWZ $FB $INTC $MSFT $RDFN $TWLO $USCR $Z

XLF - Falling wedge breakout buying opportunity**Market Structure**

-A falling wedge has broken

-Due to the price rise going into the wedge as well as the downward sloping nature of this wedge, that gives is a solidly bullish bias

-The overall markets have been bullish and we could see the tide lifting all ships higher

**Trading Tips**

-A bearish pinbar has formed on the daily so we may see price drop lower in the near term

-I expect the overall bullish picture to stay intact, and so any push lower may be met with strong buying

-If price does drop lower to retest the upper channel of the falling wedge, using this price action information (bullish trend, bullish pattern breakout), it may create a high probably buying opportunity

**Trading Ideas**

-This ETF could be purchased outright right now for a decent risk/reward setup

-If you are willing to wait and see if price falls it may offer a better entry point, at the risk of missing the trade if it doesn't fall

-The price target is the peak of the pattern @ $30 so different ways to get long this trade are to buy the stock outright, create a synthetic long position buy selling a put and buying a call at the same strike(about 1:5 leverage), or selling a vertical put spread for a defined risk trade

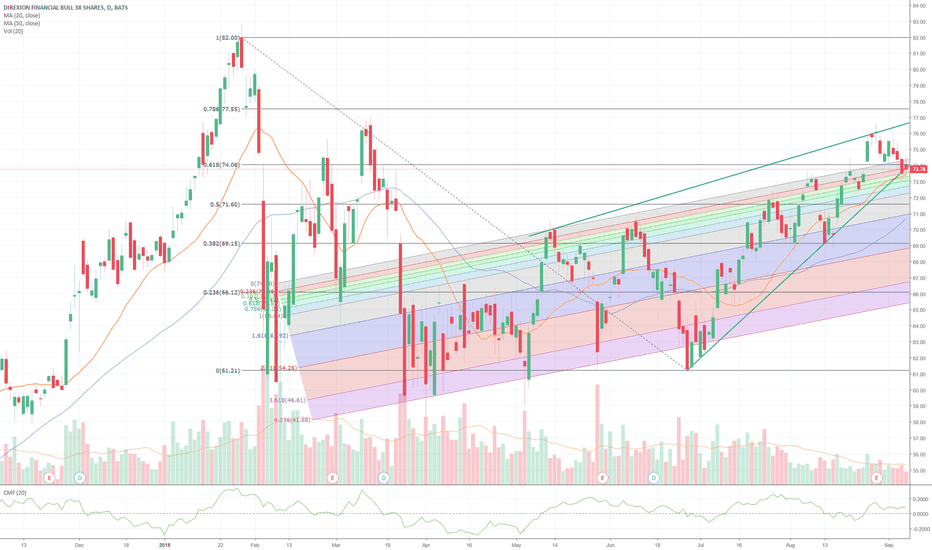

XLF Has Its Pre Financial Crisis High In SightsThe popular ETF, XLF follows the financial sector and after weeks of selling, it looks to have found support and be gearing up for a big move indicated by the Weekly Squeeze coiling for the past 8 weeks, with the momentum shifting to bullish this week. If you take a look at C (Citigroup), it too has a Weekly Squeeze. If you take a look at it on a Daily it also has a Squeeze which looks like it will fire long. If this move for the financial sector plays out long, I would expect a retest of its high back from January (30.33) then a retest of it's high of 30.84. This high (30.84 - May 28, 2007 - 11+ year ago) is an important one because this was the peak of the financial sector ETF ( XLF ) before the financial crisis of 2008.