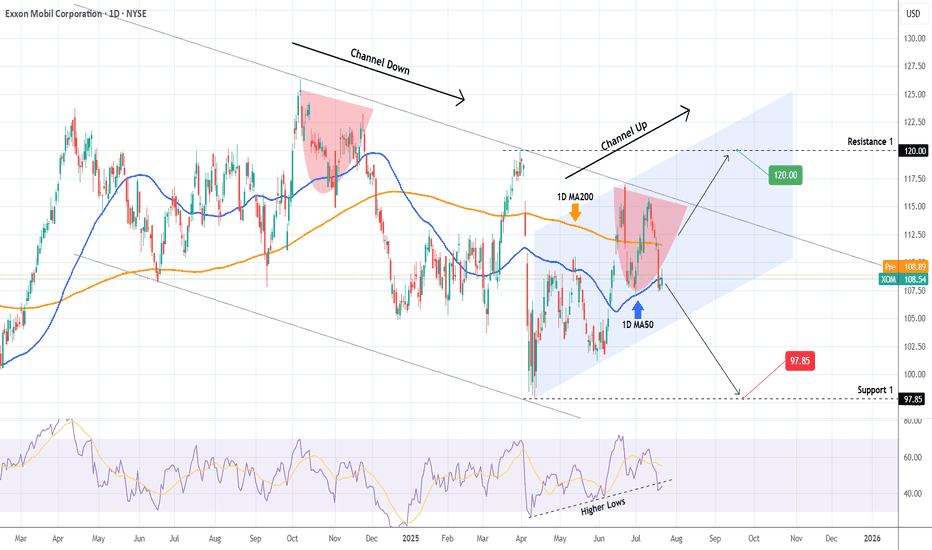

EXXON MOBIL Critical crossroads.Exxon Mobil (XOM) has been trading within a Channel Down since the June 17 2024 Low and just recently on the July 11 2025 High, it made a Lower High pattern similar to November 22 2024.

As long as the price trades below the 1D MA200 (orange trend-line), we expect to start the new Bearish Leg and test at least Support 1 (97.85).

If however it breaks above the 1D MA200 it will invalidate all prior Lower High patterns, and will most likely follow the (blue) Channel Up to break above the Channel Down. In that case, we will be targeting Resistance 1 (120.00).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XOM

Sudden Oil Spike - what you need to know!Iran suspended cooperation with the U.N. nuclear watchdog, amid a surprise build in US crude inventories.

Iran’s move added a modest risk premium to prices, though analysts noted that no actual supply disruptions have occurred.

$66 is a key level for WTI crude to hold above.

If it can maintain this area, we will likely see higher price. $66 is a multi year trendline of support going back to 2021.

Energy stocks / XLE basket is showing some bullish divergence, perhaps indicating this oil move has legs.

Israel VS Iran War: Oil Spike!Tensions between Israel and Iran have escalated dramatically, with both nations engaging in direct military strikes. Israel launched Operation Rising Lion, targeting Iran’s nuclear infrastructure, missile factories, and military personnel. In response, Iran retaliated with missile attacks on Israel, hitting Tel Aviv and wounding civilians

The conflict stems from long-standing hostilities, particularly over Iran’s nuclear program, which Israel views as an existential threat. The situation has drawn international attention, with the United States distancing itself from Israel’s actions while maintaining strategic interests in the region.

The escalation has raised concerns about a wider regional war, with analysts warning of unintended consequences and further retaliation. The global markets have also reacted, with oil prices surging amid uncertainty.

RIG Mega Profits SecuredRIG is a high beta oil stock. We secured profits today and looking for another entry.

With the recent breakout and upside momentum in oil, this name caught a massive bid.

Crude oil has seen a sharp rise in just the last week and shaping up for a continuation move higher.

If this breakout holds energy stocks should continue to fly.

WTI has its first major resistance level coming up within 1% from current price.

Look for pullback buys in energy if oil continue to hold the inverse head & shoulder breakout.

XOM - Bearish in 4 months more DOWNTREND

The price of XOM has gone too far with the MA200. It will have to return to the MA200 as soon as possible if it does not want to crash.

Let's take a look at its price on the WEEK frame. MA50 and MACD support bearish.

On the DAY frame, the volume decreased, the price movement was low, the candles were very weak. The possibility of continuing the downtrend is very high.

Price target up: $105.94.

Price now: $104.56 (11:15 AM, 04.16.25).

Price target down: $98.00/ $91.84.

The price history will repeat itself as in Q4 2023.

IMO amateur trader.

XOM Analysis: Oil's Next Move & Policy ShiftsNYSE:XOM currently piques my interest, particularly with oil prices potentially stabilizing or rising further. Recent geopolitical developments and policy shifts under Trump’s administration—such as rolling back Biden-era energy regulations, reducing methane fees, and easing LNG export permits—could significantly influence the energy landscape.

My intuition suggests Trump’s "Mar-a-Lago Accord" might involve major global economies reducing holdings of US dollar assets, swapping short-term treasuries for century bonds. Such currency shifts and reduced drilling activity could lead to a tighter oil supply, benefiting prices. Additionally, a weakening US dollar could positively impact technology stocks, as investors rotate towards sectors less affected by traditional commodities.

Technical Analysis (Daily & Hourly Chart)

Current Price: Approximately $103.00

Key Resistance Levels:

Immediate resistance: $103.93 (L.Vol ST 1b)

Important resistance zone: $104.74 (118 AVWAP)

Critical resistance (Last week's high): ~$106.46

Key Support Levels:

Near-term support: $101.13 (Weeks Low Long)

Major support: $97.92 (Best Price Short)

Trading Scenarios

Bullish Scenario (Continued oil strength & supportive policy shifts):

Entry Trigger: Sustained breakout and close above immediate resistance at $103.93.

Profit Targets:

Target 1: $104.74 (AVWAP resistance)

Target 2: $106.46 (recent swing high)

Stop Loss: Below recent pivot around $101.00, limiting risk effectively.

Bearish Scenario (Oil price weakness or production surge):

Entry Trigger: Failure to sustain the above resistance at $103.93 or a breakdown below near-term support at $101.13.

Profit Targets:

Target 1: $99.00 (psychological & short-term support)

Target 2: $97.92 (strong support, ideal short target)

Stop Loss: Above $104.75 to control risk in case of a reversal.

Thought Process & Final Thoughts

Given the current geopolitical and regulatory environment, XOM appears poised for potential upside if oil prices remain strong and policy shifts materialize. However, caution is warranted, as oil companies seem hesitant to increase production due to profitability concerns. Clearly defined technical levels will help navigate trade entries and exits effectively around these evolving macroeconomic conditions.

Earnings Date: May 2nd—Keep positions nimble as earnings can significantly impact short-term volatility.

EXXON MOBIL: This strong rally won't end any time soon.Exxon Mobil is about to turn overbought on its 1D technical outlook (RSI = 67.390, MACD = 2.260, ADX = 52.087) as for the 4th straigh week it is posting gains. This rally started on the first week of March when the stock almost touched the bottom of the 2 year Channel Up. This is a similar bullish wave to the one that started after the January 2024 bottom, which eventually reached the 1.236 Fibonacci extension. Aim for a bit under the top of the Channel Up (TP = 128.00.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

ExxonMobil: Toward the ResistanceExxonMobil: Toward the Resistance

As planned, XOM recently continued to rise with the magenta wave . We give this movement a bit more room, but another smaller corrective movement of wave should start below the resistance line at $126.34 before XOM ultimately surpasses this mark. Once the upward movement stalls below $126.34, it is important that the price doesn't fall too deeply afterward. After all, there is a 40% probability for our alternative scenario, where not wave in magenta but wave alt.2 in turquoise would develop its high – confirming an already established top of the overarching wave alt.(B) and, thus, a generally corrective scenario.

ExxonMobil: Final Pullback ExpectedExxonMobil should soon resolve the ongoing sideways phase, allowing the turquoise wave 2 to establish its corrective low below $104.84. This final pullback is still needed before the next impulsive rally unfolds. Alternatively, there is a 32% chance that the key low was already settled by the turquoise wave alt. 2. A break above $123.74 would confirm this scenario.

EXXONMOBIL ($XOM) EARNINGS & OUTLOOKEXXONMOBIL ( NYSE:XOM ) EARNINGS & OUTLOOK

1/7

ExxonMobil is back in the spotlight after Q4 2024 earnings. ⚡️💰

From a $59.5B Pioneer merger to record Permian production, there’s plenty to unpack. Let’s dig in!

2/7 – Q4 & FULL-YEAR EARNINGS

• 2024 earnings: $33.7B, down from $36.0B in 2023

• Q4 2024: $7.6B net income (~$1.72/share), with $12.2B in operating cash flow

• Distributed $36B to shareholders in 2024—talk about rewarding loyalty! 💸💥

3/7 – EXPANSION & STRATEGY

• Targeting higher output in Permian Basin & Guyana, despite oil oversupply

• FWB:20B annual share-repurchase program planned for 2025

• Recent Pioneer merger boosts upstream portfolio—long-term production potential just got a big upgrade 🚀

4/7 – VALUATION VS PEERS

• P/E ratio ~13–14, below the industry range (15–18) ✅

• Dividend yield ~3.5%, beating the 3.0% sector average

• Stacks up against Chevron ( NYSE:CVX ) & Shell ( NYSE:SHEL )—but ExxonMobil’s Guyana assets could be the real differentiator 🌍⛽️

5/7 – RISK FACTORS

1️⃣ Oil oversupply + OPEC+ cuts → Price uncertainty 📉

2️⃣ Global economic slowdown → Softens demand

3️⃣ Regulatory scrutiny → Heightened costs

4️⃣ Shifting to renewables → Could reduce big-oil momentum

6/7 Is ExxonMobil truly undervalued given its strong cash flow & dividend?

1️⃣ Yes – Undervalued gem

2️⃣ No – Oil oversupply risk is too high

3️⃣ Maybe – Need more clarity on renewables

Vote below! 🗳️👇

7/7 – SWOT SUMMARY

• Strengths: Advantaged assets (Permian/Guyana), robust cash flow 🏭

• Weaknesses: Reliance on oil price, smaller renewables exposure

• Opportunities: Pioneer merger, carbon capture, high-value chemical products

• Threats: Regulatory, oversupply, economic slowdown

Crude Oil LongWTI's price broke through the 200-day MA. In the next few days, we should also see the breakup in the 50-day MA versus the 100-day MA.

Energy stocks will benefit from the price swing in Q1 2025. Look at XOM, BKR, CVX

The Chinese government's introduction of ultra-long special government bonds to boost infrastructure spending and consumer demand has heightened expectations for increased oil consumption.

Saudi Arabia and OPEC+ have continued their production cuts, tightening supply. Saudi Arabia raised the price of its flagship Arab Light crude for February by $0.60 per barrel.

The outlook for February 2025 is bullish for oil. We should expect continuing supply constraints. OPEC+ production cuts and sanctions on major oil producers like Iran and Russia are expected to persist, maintaining a tight supply environment.

The incoming Trump administration's potential tightening of sanctions on Iran could significantly reduce Iranian crude exports, further constraining supply.

EXXON MOBIL Will it recover the devastating December?Exxon Mobil (XOM) gave us an excellent buy signal on our last idea (September 27 2024, see chart below) as it quickly hit our $120 Target:

Since the November 22 2024 (Lower) High though, it had an aggressive sell-of that stopped on the December 20 2024 Low. The price has stabilized for now but hasn't yet gained the necessary momentum to stage a rebound.

On the other hand, there are some very encouraging signals that justify going long as the Risk/ Reward Ratio has turned very favorable for buying. The price might not be exactly at the bottom (Higher Lows trend-line) of the Channel Up but the 1W RSI is on the 38.35 Support, which is the exact level where the it bottomed on January 19 2024, on the previous Higher Low.

At the same time, the 1D MACD has completed a Bullish Cross, which has always been a solid buy entry below the 0.0 level. As a result, even though the stock may deliver one last pull-back to test the bottom of the 14-month Channel Up, it is worth buying now as the upside is significantly higher. Our Target is the Resistance 2 level at $126.40.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Exxon Mobil (XOM): Preparing for a Q1 2025 SetupHeading into Q1 2025, we believe NYSE:XOM could present a promising buying opportunity, and we are preparing a setup to align with our bias. Since April, we have been closely monitoring Exxon Mobil, and the technical picture continues to gain clarity as the stock respects both the range middle and range high. The wave ((b)) overshot wave A by a significant margin but still within acceptable limits for a flat correction.

Since the overshoot in early October, NYSE:XOM has seen a substantial decline—falling 17% over 75 days, a significant move for this stock. The primary driver behind this decline seems to be ongoing shareholder challenges. Over the last three years, Exxon Mobil has resisted calls for meaningful carbon emissions reductions, instead doubling down on traditional oil and gas operations. Legal action against shareholder activists pushing for emissions reduction targets has only added to the controversy, with proposed changes falling short of expectations.

The shareholder concerns highlight a critical point: some voting patterns defy logic when aligned with long-term goals. Questions remain about whether Exxon Mobil should, or can, prepare for a carbon-neutral future. The widely publicized shareholder vote in 2021, which many hoped would lead to substantial changes, seems to have produced minimal practical outcomes.

Despite these issues, we see potential for NYSE:XOM to resolve its challenges in the near future. From a technical standpoint, we observe a strong likelihood of a wave C drop into the $101–$92 range, which aligns with the 61.8%–78.6% Fibonacci retracement levels. This would be a key area to begin building a position.

$XOM Trade Analysis DarkPoolsKey Observations:

Descending Wedge Pattern:

The chart shows a descending wedge, marked by a narrowing price range between the green support line and red resistance line. This is a bullish reversal pattern.

Price is currently testing the upper red resistance trendline, signaling a potential breakout.

Dark Pool Levels:

Key levels include:

111.76 (BA SW).

110.82 and 109.12 acting as potential support or resistance zones based on price action.

These levels suggest significant institutional activity, making them critical for trade planning.

Support and Resistance:

Support levels:

The wedge's lower green trendline near 106.28.

Major dark pool support at 104 (BB SW 104).

Resistance levels:

108.07 (Dark Pool Level).

111.76 and 112.00 (Dark Pool and Fibonacci target).

Higher targets at 115.00, 117.50, and 120.00 (Fibonacci extensions).

Trend Analysis:

The price is currently near the 8 EMA and 21 EMA, suggesting consolidation and potential for a breakout.

A break above 108.07 (dark pool level) could trigger bullish momentum.

Trade Idea:

Entry:

Breakout Entry: Enter above 108.07 if confirmed with strong volume.

Pullback Entry: Enter near 106.28, the lower wedge support, for a better risk-to-reward ratio.

Profit Targets:

112.00: First target aligning with Fibonacci and dark pool levels.

115.00: Second target, key Fibonacci extension.

117.50: Third target based on continued bullish momentum.

120.00: Final target for a strong bullish move.

Stop Loss:

Close below 106.00: Invalidates the wedge pattern breakout.

Close below 104.00: Signals bearish continuation, as the price would break significant support.

Risk Management:

Ensure position size aligns with risk tolerance.

Risk-to-reward ratio should be at least 1:3, considering entry at 108.07, stop loss at 106.00, and initial target at 112.00.

Additional Notes:

Volume Confirmation: Look for above-average volume on breakout above the wedge's resistance line.

Dark Pool Reaction: Monitor price action near dark pool levels (especially 108.07 and 111.76) for reversals or breakouts.

Fibonacci Levels: Higher Fibonacci extensions suggest strong potential upside if the breakout is sustained.

ExxonMobil: PullbackXOM stock has experienced a setback over the past two weeks. However, we maintain our view that turquoise wave 3 is still in progress and has further upside potential. Once a top is established, we expect a corrective movement before another rally completes the larger green wave (1). The recent decline brings our 35% alternative scenario into focus, which places the stock in green wave alt.(2). This scenario will activate if the price falls below the support level at $95.77.

XOM Stock: Using The Rocket Booster Strategy In 3 StepsThe oil prices NYMEX:CL1! are looking like

they are going to rise.

Why?

Am really not sure about why

but one thing for sure is the

price hike is coming

The oil price affects this stock

which is one of the stocks on

my watch list

Because of my change of trading

I have developed a permanent watchlist

Again you need to understand

that am not day-trading these stocks

forex or crypto

am looking at these trades like

investment opportunities.

Yes you may get discouraged but

don't give up

On building your watchlist

which is a very important step

to a successful trading career

Also notice that this

price action follows the rocket booster

strategy

The rocket booster strategy

has 3 steps:

#1-The price has to be above the 50 EMA

#2-The price has to be above the 200 EMA

#3-The price has to be in an uptrend.

This is what you are seeing here on

this chart of NYSE:XOM

Remember to learn more rocket boost

this content

Disclaimer: Trading is risky please learn

risk management and profit-taking

strategies.

Exxon's Make-or-Break Moment: $123 Resistance in FocusThe chart distinctly illustrates that the stock has been in a consolidation phase for over a year and is presently trading slightly below its resistance zone.

For a potential upward movement, the price must surpass the 123 level and maintain its position above this threshold.

At the same time, there is a significant likelihood that the stock price may encounter rejection once more, leading to a decline towards its trendline support level.

Looking for a break and retest of ATH's for XOM!🔉Sound on!🔉

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

EXXON MOBIL Buy signal on the 1D MA200.Exxon Mobil (XOM) has turned sideways since the June 17 Low and yesterday hit and held and 1D MA200 (orange trend-line). Technically this calls for at least a Resistance 1 test on the short-term so we turn bullish, targeting 120.00 (marginally below that level).

If however it turns out that the dominant pattern is indeed now a Channel Up, on the long-term we can see prices as high as the 1.5 Fibonacci extension (131.50), which is where the previous Higher High was priced on April 12 2014.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Looking bullish immediately on XOM! 🔉Sound on!🔉

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!