XOP

Energy's volume confirming trendTechnical Short-term Analysis

We have a new potential uptrend line drawn in the chart.

RSI is showing some divergence as it has reached the level from the beginning of February. However; I would take this divergence with a grain of salt, as it did reach Overbought levels and did not break the 40 level on the RSI (typical bullish behavior).

OBV has a clear uptrend, supporting the uptrend in price.

Trade Setup

Would sell a partial position if we break the ~new potential uptrend~.

Would sell the rest if we break the 50sma.

Hope this helps!

The Week Ahead: MJ, SRNE, INO, NKLA, XOP, ICLN, IWM PremiumLooking for the juice? Here's where it's at ... .

Options Highly Liquid Single Name >$10/Share With Earnings in the Rear View, Sorted By 30-Day with a >50% Cut-Off:

CRON (43/236) (Cannabis)

AMC (21/218) (Theatres)

TLRY (40/185) (Cannabis)

SRNE (5/165) (Biotech)

INO (4/145) (Biotech)

ACB (11/127) (Cannabis)

NKLA (12/125) (EV)

CGC (23/99) (Cannabis)

NCLH (4/99) (Cruise Lines)

NIO (34/97) (ADR; EV)

M (5/80) (Retail)

IQ (13/75) (ADR; Internet)

RCL (2/72) (Cruise Lines)

DKNG (5/69) (Online Gambling)

CLDR (6/64) (Software)

JD (28/61) (ADR; Internet Retail)

DDOG (19/61) (Software)

GPS (10/54) (Apparel)

AEO (1/52) (Apparel)

Options Highly Liquid Exchange-Traded Funds, Sorted By 30-Day, With a >35% Cut-Off:

MJ (47/80) (Cannabis)

XOP (6/57) (Oil and Gas)

ICLN (10/54) (Clean Energy)

LIT (40/52) (Battery Tech)

JETS (1/46) (Airlines)

EWU (3/46) (United Kingdom)

XBI (20/44) (Biotech)

EWZ (3/43) (Brazil)

XLE (6/41) (Energy)

GDX (3/39) (Gold Miners)

KRE (6/38) (Regional Banks)

SLV (8/38) (Silver)

XLK (7/36) (Technology)

Broad Market, Sorted by 30-Day:

IWM (7/31)

QQQ (10/31)

SPY (3/20)

DIA (0/20)

EFA (2/15)

The Pictured Trade:

Depicted here is an MJ July 16th (124 DTE) 17 short put, which was paying 1.11 at the mid price as of Friday close, 6.99% ROC at max as a function of notional risk (20.6% annualized). This is quite a bit more long-dated than I like to go generally, so I'll probably wait for a May monthly to open up (probably next week after the March monthly drops off) before considering doing anything. Similarly, neither ICLN, LIT, nor JETS have May monthlies yet and April will have a gotten a bit short in duration (currently 33 DTE) for those like me who prefer to work with a 45 day or less wheel house.

XOP Finds ResistanceHere is a logical place for the run in oil and gas companies to find some resistance. These stocks have shown some really great relative strength, but maybe it's time for a pause. I don't think a short is advisable, but I'd be cautious adding any longs here and it would probably be a good time to take some profits from existing positions. Top components of XOP include FANG, MRO, DVN, OXY, APA, XOM, VLO

Dead wrong on Oil, but what now?Obviously my previous predictions on Oil were wrong, however, it is hard to forecast a vicious virus from the far East. Now, the doomsdayers are back, touting their long bond positions with gold, saying "I told you so." Those positions have worked, and oil has tanked. To be clear, I don't dislike bonds or gold here, but Oil is ripe for a rebound. We are deeply oversold, indeed, I believe this sell-off is far overdone. From a pure technical perspective, the RSI is now turning, and MACD looks to be bottoming out. We should retest the ~60 level again, as this was the previous range bound channel crude was trading in. If 50 is broken, this thesis is invalidated and I am dead wrong. We will see.

Long $XOP Multi-timeframe analysisBullish pennant on the shorter TF for $XOP with confluence at weekly support for the pennant target which shows an amazing R:R for a long opportunity.

But, being that this ETF is fundamentally bearish because of current concerns for the new virus strain and the fact that technically this is still bearish on the weekly, Ill be setting first target to top of pennant. Then, move stop to BE and then just wait and see how the pennant pattern plays out. At this time, when stop is at BE this would be a risk free trade.

THE WEEK AHEAD: FDX, LEN, MU, CCL EARNINGS; XOP/XLE, IWM/RUTEARNINGS ANNOUNCEMENT-RELATED VOLATILITY CONTRACTION PLAYS (IN ORDER OF ANNOUNCEMENT):

Here are the options-liquid underlyings announcing next week that I've culled down to 30-day >50% as candidates for volatility contraction plays:

LEN (21/49/11.6%),* announcing Wednesday after market close

MU (24/52/12.2%), announcing Wednesday (no time specified)

FDX (29/53/11.9%), announcing Thursday after market close

CCL (27/91/21.1%), announcing Friday (no time specified)

Pictured here is a January 15th 17.5/27.5 short strangle in CCL which announces Friday, paying 1.36 as of Friday close with delta/theta of -4.86/4.84 with break evens wide of 2 times the expected move on the call side, and between the 1 and 2 x on the put. Although no time is currently specified, it is likely to announce before market open (because who, like, announces after Friday close?), so would look to put on a play in the waning hours of Thursday's session if you want to take advantage of Friday's post-announcement volatility contraction.

EXCHANGE-TRADED FUNDS RANKED BY BANG FOR YOUR BUCK:

XOP (21/60/16.3%)**

GDXJ (15/44/12.9%)

XLE (30/45/12.5%)

KRE 924/41/11.1%)

SLV (25/40/11.2%)

GDX (16/38/10.7%)

EWZ (15/39/10.6%)

XBI (24/38/10.0%)

BROAD MARKET EXCHANGE-TRADED FUNDS:

IWM (25/30/7.8%)

QQQ (23/30/7.6%)

DIA (16/23/6.0%)

SPY (16/23/5.6%)

EFA (20/24/5.1%)

TREASURY/BOND FUNDS:

Adding a little bond/treasury section to here since I occasionally park what would otherwise be idle cash in short puts (See Post Below).

TLT (11/15/3.99%) (1.609% yield)

HYG (11/11/2.41%) (4.917% yield)

EMB (5/9/--)*** (4.024% yield)

AGG (29/8/--)*** (2.252% yield)

* -- The first metric is the implied volatility rank or percentile (i.e., where 30-day implied is relative to where it's been over the last 52 weeks); the second, 30-day implied volatility; and the third, what the January 15th at-the-money short straddle is paying as a function of stock price.

** -- Here, I'm using the short straddle price nearest 45 days until expiry to calculate the "bang for your buck" percentage, which would be the January 29th weekly.

*** -- EMB and AGG don't have weeklies nearest 45 days.

Long $USOIL $GUSH $XOPFrom the NYT : "Under the agreement, members of the Organization of the Petroleum Exporting Countries along with Russia and other countries will increase production by 500,000 barrels a day in January and, potentially, by a similar amount in the following months. The increase, less than 1 percent of the global oil market"

From WSJ : "The price rout has also laid low big, publicly traded oil companies like Exxon Mobil Corp. and Royal Dutch Shell PLC, triggering big losses and job cuts. Shell and BP PLC both recently cut their dividend for the first time in years to preserve cash. Chevron Corp. on Thursday said it was joining peers in slashing spending."

Oil companies are an important fixture in all of the most powerful countries in the world. While I fully recognize that the oil industry is a dying one, the financial stress that the majors are currently under is causing them to be undervalued relative to their integration, importance, and efficiency at this point in time.

Higher oil prices from where they currently are is in the best interest of every major economy. It is a perfect time to make this happen given the effectiveness of the almost-approved Covid-19 vaccines.

Just an idea!

THE WEEK AHEAD: XOP/XLE, GDXJ/GDX, KRE, EWZ, IWM/RUTEARNINGS:

It's a light week for earnings announcements, which means it's an even lighter week for options liquid underlyings, none of which meet my cut-off for 30-day implied >50%.

EXCHANGE-TRADED FUNDS RANKED BY PERCENTAGE THE JANUARY AT THE MONEY SHORT STRADDLE IS PAYING AS A FUNCTION OF STOCK PRICE:

XOP (18/59/15.8%)

GDXJ (16/42/13.2%)

XLE (26/46/11.6%)

KRE (24/40/11.4%)

GDX (17/40/11.4%)

USO (7/46/11.0%)

EWZ (15/39/10.6%)

SLV (25/38/10.3%)

Honorable Mention:

GLD (23.5/18.5/5.0%)

* * *

Pictured here is an XOP January 15th 46 short put, which was paying .92 as of Friday close (2.04% ROC as a function of notional risk at max; 15.5% annualized at max). I still like bullish assumption, pandemic recovery plays in the oil space, although implied volatility has bled out quite a bit here, and the break even (45.08) would be above the 2020 lows.

GLD gets an honorable mention here due to its being nearly 15% off of its early August highs with the January 15th strike nearest the 16 delta (the 157) paying .94 as of Friday's close (.60% as a function of notional risk at max; 4.6% annualized). The ROC %-age isn't great, however, but if you're looking to establish a gold position, now might be the time to consider starting one. I'm already working one here, (See Post Below), and will consider adding once December out-of-the-money's fall off or I manage them.

Alternatively, look to establish a position in SLV, GDXJ, or the more liquid GDX, all of which are more scalable due to size and provide more bang for your buck, with the GDXJ January 15th 42 paying .70 (1.7% ROC as a function of notional risk; 12.9% annualized), the GDX January 15th 30 paying .40 (1.4% ROC at max; 10.3% annualized), and the SLV January 15th 19 paying .30 (1.6% ROC at max as a function of notional risk; 12.9% annualized at max).

For those of a defined risk bent, the GLD January 15th 153/158 short put vertical was paying .54 at the mid as of Friday close (10.8% ROC at max; 82.1% annualized).

BROAD MARKET

IWM (23/29/7.8%)

QQQ (19/25/6.9%)

DIA (16/22/5.8%)

SPY (13/21/5.3%)

EFA (16/18/4.6%)

Volatility has pissed out mightily here, and the <10% the at-the-money short straddles are paying in the January cycle are reflective of that.

The IWM January 15th 157 short put was paying .94 (.6% ROC at max as a function of notional risk; 4.6% annualized) as of Friday close, which isn't exactly great. Here, defined is more compelling from a pure ROC %-age return perspective (it usually is), with the IWM January 15th 158/163 was paying .54 as of Friday's close (10.8% ROC at max; 82.1% annualized) and its cash-settled counterpart RUT, paying 5.10 for the January 15th 1610/1660 with similar ROC %-age metrics with the short option legs camped out at the 16 delta strike. Naturally, you can be more aggressive, bringing in the setup more toward the expected move.

THE WEEK AHEAD: LB, ARMK, TGT EARNINGS; XOP, GDXJ, KRE, IWM/RUTEARNINGS-RELATED VOLATILITY CONTRACTION PLAYS:

LB (7/69/16.0%):* Announcing Wednesday after market close.

ARMK (11/56/13.1%): Announcing Tuesday before market open.

TGT (30/39/8.6%): Announcing Wednesday before market open.

Honorable Mentions:

LOW (23/39/8.6%): Announcing Wednesday before market open.

HD (17/31/6.7%): Announcing Tuesday before market open.

WMT (24/30/6.4%): Announcing Tuesday before market open.

Pictured here is an LB December 18th (34 days) 29/39 short strangle paying 1.99 at the mid price as of Friday close (.99 at 50% max) with 2 x expected move break evens.

EXCHANGE-TRADED FUNDS RANKED BY BANK FOR YOUR BUCK:

XOP (14/54/12.7%)

GDXJ (15/46/11.3%)

KRE (26/45/10.6%)

USO (6/50/10.3%)

BROAD MARKET RANKED BY BUCK BANG:

IWM (25/31/6.9%)

QQQ (23/29/6.3%)

SPY (16/23/4.9%)

EFA (17/20/4.6%)

* -- The first number is the implied volatility rank or percentile (i.e., where 30-day implied volatility is relative to where it's been over the past 52 weeks); the second, 30-day implied volatility; and the third, the percentage the December at-the-money short straddle is paying as a function of stock price.

XOP long on pull-back Target 60The energy pack broke out of a multi-month downtrend, and pierced through anchored quarterly VWAP and it's 1 stdev. After a strong move, it's doing what bulls want it to do - after strong candle 1 and 4, retracing from 2nd Stdev before the next leg up. Expect continuation of the TD sequential.

Target 59-60 to profit take, its immediate support at 47, strong support at 44.

Position: Long call

Disclaimer: These should be seen as the commentator's Notes to Self. Hopefully educational but aiming for entertaining. No legal or financial liabilities should be pursued from these materials.

THE WEEK AHEAD: DKNG, BYND, LYFT EARNINGS; XOP, GDXJ, SLV, QQQEARNINGS ANNOUNCEMENT VOLATILITY CONTRACTION PLAYS:

WKHS (18/146/38.8%),* Monday, before market open.

PLUG (32/100/25.6%), Monday, before market open.

DKNG (32/89/23.6%), Friday, before market open.

CGC (39/132/23.5%), Monday, before market open.

BYND (32/77/18.9%), Monday, after market close.

LYFT (16/71/18.0%), Tuesday after market close.

Pictured here is a BYND December 18th 130/200 short strangle that was paying 7.95 at the mid price as of Friday close, with the short legs camped out at the 18 delta. This yields at or greater than two times expected move break evens and a delta/theta metric of -.58/23.86.

Alternative Defined Risk Setup: BYND December 18th 125/130/200/205 iron condor, paying 1.59 at the mid price as of Friday close with break evens at the expected move on the put side/greater than 2 x the expected on the call and delta/theta metrics of .96/2.45.

Unfortunately, WKHS, PLUG, and CGC all announce on Monday before the open, so any play would've been best put on before the end of Friday's session, although they could still be playable after they make their earnings announcement move.

LYFT: Short straddle or iron fly.

DKNH: Short strangle or iron condor.

EXCHANGE-TRADED FUNDS RANKED BY PERCENTAGE OF STOCK PRICE THE DECEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING:

XOP (14/53/14.1%)

USO (9/57/13.4%)

GDXJ (16/47/12.9%)

SLV (38/50/12.7%)

GDX (16/39/10.9%)

EWZ (17/41/10.7%)

XLE (25/41/10.6%)

BROAD MARKET RANKED BY PERCENTAGE OF STOCK PRICE THE DECEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING:

QQQ (25/30/7.2%)

IWM (24/29/7.2%)

SPY (19/24/6.0%)

EFA (21/21/5.3%)

IRA DIVIDEND EARNERS RANKED BY PERCENTAGE OF STOCK PRICE THE DECEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING:

SLV (38/50/12.7%)**

EWZ (17/41/10.7%)

XLE (25/41/10.6%)

KRE (22/39/10.5%)

* -- The first metric is the implied volatility rank or percentile (i.e., where 30-day implied volatility is relative to where it's been over the past 52 weeks); the second, 30-day implied volatility as of Friday close; and the third, what the December at-the-money short straddle is paying as a percentage of stock price.

** -- Neither SLV nor GLD pay a dividend.

THE WEEK AHEAD: ROKU, WYNN, SQ EARNINGS; XOP, USO, GDXJ, EWZEARNINGS ANNOUNCEMENT VOLATILITY CONTRACTION PLAYS:

... Screened for options liquidity and 30-day implied greater than 50% and ranked by "bang for your buck":

ROKU (38/31/16.4%),* announcing Thursday after market close.

WYNN (27/76/14.7%), announcing Wednesday (no time specified).

SQ (43/74/14.3%), announcing Thursday after market close.

PYPL (56/60/11.6%), announcing Monday after market close.

GM (20/59/11.4%), announcing Thursday after market close.

QCOM (45/54/10.9%), announcing Wednesday after market close.

BABA (65/55/10.5%), announcing Thursday after market close.

Pictured here are two 2 x expected move setups in ROKU, one in November (19 days 'til expiry), and one in December (47 days 'til expiry).

The November setup was paying 8.55 at the mid price as of Friday close, with delta/theta of -.89/51.22; the December: 10.13 at the mid price as of Friday close, with delta/theta of -.95/27.88. I could see doing either, with the primary benefit of the shorter duration being that the volatility contraction tends to be more rapid, and with the primary benefit of the longer duration one being that you've got a little bit more room to be wrong.

If you're of a more defined risk bent, look for an iron condor setup paying at least one-third the width of the wings in credit, such as the November 20th 160/165/265/270, paying 1.63.

Look to put this on in Thursday's session prior to market close, adjusting strikes as necessary to accommodate movement between now and then.

With the exception of GM, the remainder of the underlyings can be short strangled or iron condored, but would go short straddle or iron fly in GM due it's size (34.53 as of Friday close).

EXCHANGE-TRADED FUNDS RANKED BY PERCENTAGE OF STOCK PRICE THE DECEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING AND SCREENED FOR THOSE PAYING >10%:

XOP (23/69/18.7%)

USO (14/71/17.5%)

GDXJ (22/56/15.7%)

EWZ (29/56/15.5%)

XLE (38/57/14.9%)

GDX (23/46/13.3%)

SLV (28/48/13.0%)

XBI (36/44/12.1%)

EWW (35/49/11.6%)

IWM (42/42/10.8%)

SMH (28/42/10.9%)

QQQ (43/40/10.8%)

BROAD MARKET:

IWM (42/42/10.8%)

QQQ (43/40/10.8%)

SPY (38/38/9.6%)

EFA (33/30/8.4%)

IRA DIVIDEND-EARNERS RANKED BY PERCENTAGE OF STOCK PRICE THE DECEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING AND SCREENED FOR THOSE PAYING >10%:

EWZ (29/56/15.5%)

XLE (38/57/14.9%)

KRE (32/50/14.1%)

SLV (38/48/13.0%)**

XBI (37/44/12.1%)

* -- The first metric is the implied volatility rank or percentile (where 30-day implied is relative to where it's been over the past 52 weeks); the second, 30-day implied volatility; and the third, the percentage of stock price the November at-the-money short straddle is paying.

** -- SLV does not pay a dividend.

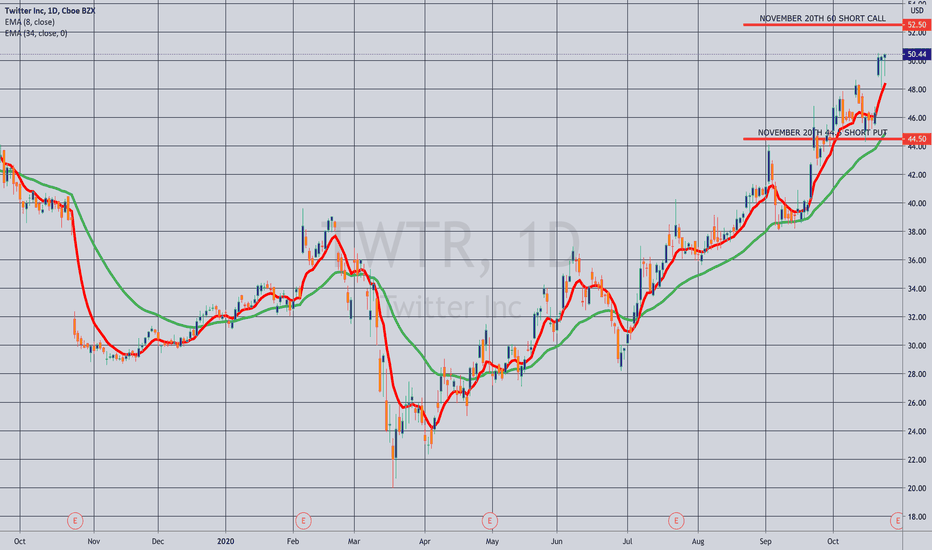

THE WEEK AHEAD: TWTR, MGM, AMD EARNINGS; JETS, XOP, GDXJEARNINGS:

If you like to play earnings for volatility contraction, there are a ton this coming week. Here are the ones that made my cut for volatility contraction plays based on options liquidity and bang for your buck as a function of stock price:

TWTR (49/73/15.9%),* announcing Thursday after market close.

MGM (16/69/15.2%), announcing Thursday before market open.

JBLU (22/73/14.6%), announcing Tuesday before market open.

TECK (20/64/14.1%), announcing Tuesday before market open.

AMD (30/62/14.0%), announcing Tuesday after market close.

BA (19/59/12.4%), announcing Wednesday after market close.

FB (47/52/11.1%), announcing Thursday after market closes.

Honorable Mentions:

AMZN (63/51/11.2%), announces Thursday after market close. (Option illiquid).

AAPL (36/47/9.8%), announces Thursday after market close. (November 20th short straddle paying less than 10% of stock price).

GOOG/GOOGL (40/40/8.6%), announce Thursday after market close. (Options illiquid).

MSFT (32/40/8.2%), announces Tuesday after market close. (November 20th short straddle paying less than 10% of stock price).

Pictured here is a TWTR short strangle in the November 20th expiry (26 days) with the short options camped out at the 22 delta. Paying 2.72 at the mid price as of Friday close, it has -.55/10.56 delta/theta metrics and break evens wide of 2 times the expected move on the call side, between the expected and 2x on the put.

For those of a defined risk bent, the uneven winged** November 20th 40/44.5/60/65 iron condor pays 1.50, has delta/theta metrics of 2.53/3.43, and has a 2x expected move break even on the call side and an expected move break even on the put.

MGM: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

JBLU: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

TECK: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

AMD: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

BA: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

FB: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

EXCHANGE-TRADED FUNDS RANKED BY BANG FOR YOUR BUCK AND SCREENED FOR THE DECEMBER AT-THE-MONEY SHORT STRADDLE PAYING >10% OF STOCK PRICE:

JETS (12/50/16.1%)

XOP (15/56/16.0%)

GDXJ (17/49/15.1%)

SLV (36/48/13.9%)

EWZ (17/43/13.3%)

XLE (26/44/12.6%)

GDX (16/40/12.6%)

XBI (30/41/11.6%)

SMH (21/35/10.3%)

EWW (23/35/10.0%)

I threw JETS in here due to continued high implied volatility in airlines which is sticking in there even for names that have already announced "earnings" (or lack thereof) (e.g., DAL (63.5%), UAL (80.7%), AAL (106.6%)).

BROAD MARKET:

QQQ (30/34.9.7%)

IWM (29/33/9.0%)

SPY (23/27/7.6%)

EFA (23/24/6.3%)

IRA DIVIDEND-PAYERS SCREENED FOR THE DECEMBER AT-THE-MONEY SHORT STRADDLE PAYING >10% OF STOCK PRICE:

KRE (25/45/13.3%)

XLE (26/44/12.6%)

EWZ (17/43/13.3%)

* -- The first metric is the implied volatility rank (where 30-day implied volatility is relative to where it's been over the past 52 weeks); the second, implied volatility in expiry nearest 30 days until expiry; and the third -- for earnings: what the November at-the=money short straddle is paying as a function of stock price; for exchange-traded funds, broad market, and IRA dividend-payers, what the December at-the-money short straddle is paying as a function of stock price. For lack of a better term, I've dubbed this last metric as the "bang for your buck".

** -- Only 5-wides are available on the call side.

THE WEEK AHEAD: AAL, TSLA, SNAP, NFLX EARNINGS; XOP, GDXJ, SLVEARNINGS:

Got a bunch of potentially worthwhile, earnings announcement volatility contraction plays on tap this coming week. Here there are, ordered by "bang for your buck":

AAL (29/99/19.7%), announcing Thursday before market open: Due to its size, I would probably go short straddle or iron fly, with the November 20th 12 short straddle paying 2.46 (19.7% as a function of stock price), and the November 20th 8/12/12/16 four-wide iron fly, paying 2.00 even.

TSLA (29/79/19.1%), announcing on Wednesday after market close. Pictured here is a 10-wide iron condor, with the short option legs set up at the 20 delta. Markets are showing wide in the after hours, but would adjust strikes as necessary to get at least one-third the width of your wings in credit (i.e., 3.33 for a 10 wide, 1.67 for a five, etc.).

SNAP (35/97/17.2%), announcing Tuesday after market close. The November 20th 19 delta 24/35 short strangle was paying 1.35 at the mid price, with the defined risk 22/25/33/36 iron condor paying 1.11.

NFLX (43/62/14.3%), announcing on Tuesday after market close. The November 20th 455/465/635/645 was paying 3.91 at the mid price as of Friday close. As with the TSLA defined risk play, look to adjust strikes as necessary to get at least one-third the width of your wings in credit.

EXCHANGE-TRADED FUNDS, RANKED BY PERCENTAGE OF STOCK PRICE THE NOVEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING AND SCREENED FOR THOSE PAYING GREATER THAN 10%:

XOP (14/55/13.1%)

GDXJ (18/49/12.6%)

SLV (39/50/11.2%)

XLE (26/45/10.2%)

EWZ (15/42/10.0%)

BROAD MARKET:

QQQ (33/35/8.0%)

IWM (29/33/7.2%)

SPY (23/27/5.8%)

EFA (18/22/4.6%)

IRA DIVIDEND EARNERS, RANKED BY PERCENTAGE OF STOCK PRICE THE NOVEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING AND SCREENED FOR THOSE PAYING GREATER THAN 10%:

SLV (39/40/11.2%)*

XLE (26/45/10.2%)

KRE (24/43/10.1%)

EWZ (15/42/10.1%)

MUSINGS:

16 days left until the general election. Out of an abundance of caution, I'm not adding anything here, but may do some "window dressing" rolls of my IWM and QQQ shorts puts I have on in the November 20th expiry just to lock in realized profit, and I'll do an educational post as to what that would entail. Handsitting, thumb twiddling while the markets do their thing is the hardest part ... .

* -- Neither SLV nor GLD pay a dividend.

THE WEEK AHEAD: UAL, DAL, SLB, WBA EARNINGS; XOP, SLV, QQQEARNINGS:

There are four options highly liquid underlyings that pop up on my screener for next week with 30-day implied of >50%: UAL (23/88/22.6%)* (on Wednesday after market close); DAL (13/74/19.1%) (Tuesday before market open); SLV (18/59/16.4%) (Friday, before market open), and WBA (43/54/12.2%) (Thursday, before market open).

Pictured here is a directionally neutral 29/50 short strangle in the November monthly with the options camped out at the 16 delta, yielding a 2 x expected move break even on the put side and > 2 x expected move on the call. Delta/theta -.41/6.00; paying 1.87 at the mid price as of Friday close (.94 at 50% max).

The DAL November 20th, 16 delta 27/42 short strangle was paying 1.83 at the mid price as of Friday close; delta/theta 1.48/4.39.

SLB is small enough to short straddle, but would go "skinny," as the November only has 2.5 wides to play with. The November 20th 15/17.5 was paying 1.48 as of Friday close, but treating it as a short straddle and taking profit at 25% max (.37) isn't particularly compelling, so would probably pass on the play and deploy buying power elsewhere.

WBA suffers from a similar affliction (2.5 wides out in November), but the 32.5/40 is paying 1.54 there, albeit with break evens greater than the expected move, but not quite 2 x.

EXCHANGE-TRADED FUNDS RANKED BY PERCENTAGE OF STOCK PRICE THE NOVEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING AND SCREENED FOR THOSE PAYING >10%:

XOP (15/56/14.5%)

SLV (45/51/13.1%)

GDXJ (15/49/12.9%)

EWA (15/42/11.6%)

XLE (27/43/11.2%)

GDX (15/40/10.7%)

XBI (29/43/10.3%)

USO (4/43/10.1%)

BROAD MARKET RANKED BY PERCENTAGE OF STOCK PRICE THE NOVEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING:

QQQ (28/33/8.2%)

IWM (25/32/7.6%)

SPY (19/25/5.9%)

EFA (13/20/4.8%)

DIVIDEND PAYERS RANKED BY PERCENTAGE OF STOCK PRICE THE NOVEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING AND SCREENED FOR THOSE PAYING >10%:

KRE (25/44/11.7%)

EWZ (15/42/11.6%)

XLE (27/43/11.2%)

GENERAL MUSINGS:

I already have a UAL covered call on, so am unlikely to partake in that underlying further here. Moreover, in the IRA/retirement account, I'm already deployed in everything at the top of the heap from an implied volatility standpoint, although I may carry on with my standard weekly 16-delta short put in the broad market instrument with the highest implied volatility, which would be QQQ. Alternatively, I'll do a QQQ 10-percenter (See Post Below) instead, as NDX isn't fantastically liquid, and a November 27th (currently, 48 days until expiry) will be available. To emulate a 50-wide, however, in NDX, I'll have to go 10-wide with 5 contracts or 5 wide with 10, etc. For example, the November 27th 240/245 is paying .50, and I'd have to sell 10 of those to emulate the NDX November 27th 9925/9975, paying 5.04. I would naturally prefer just selling one NDX spread, since it means fewer fees, but if the bid/ask is grotesque, I'll just have to go with QQQ or a RUT 50 wide. (The RUT November 27th 1385/1435 was paying 5.04 at the mid as of Friday close).

* -- The first metric is the implied volatility rank (where implied volatility is currently relative to where it's been over the last 52 weeks); the second, 30-day implied volatility; and the third, what the November at-the-money short straddle is paying as a percentage of stock price.