Gold Bull Markets: Long-Term Overview & Current Market UpdateGold Bull Markets: Long-Term Overview & Current Market Update (2024–2025)

________________________________________

🏆 Historic Gold Bull Markets: Timeline & Stats

1️⃣ 1968–1980 “Super Bull”

• Start/End: 1968 ($35) → 1980 ($850)

• Total Gain: ~2,330%

• Key Drivers:

o End of the gold standard (Bretton Woods collapse)

o Double-digit inflation, oil shocks

o Political/economic turmoil (Vietnam, stagflation)

• Correction:

o Nearly –45% drop (1974–1976)

• Recovery:

o Took years; massive rebounds afterward

2️⃣ 1999–2012 Bull Market

• Start/End: 1999 ($252) → 2012 ($1,920)

• Total Gain: ~650%

• Key Drivers:

o Commodities supercycle

o Emerging market demand

o US dollar weakness, financial crisis fears

• Correction:

o ~–30% during 2008 crisis, but fast recovery

• Recovery:

o Rebounded quickly after 2008, then peaked in 2011–12

3️⃣ 2016/2018–2027 (Current Cycle)

• Start/End: 2016/2018 ($1,050–$1,200) → ongoing ($3,500+)

• Key Drivers:

o Record central bank buying

o Persistent inflation & low real rates

o Geopolitical instability (Russia/Ukraine, China/US, etc.)

• Correction:

o Only –20% drawdown in 2022; quick recovery

o Broke 13-year technical “cup-and-handle” base in 2024

________________________________________

📊 Current Bull Market Stats (2025) – At a Glance

Metric 1968–80 Super Bull 1999–2012 Bull 2018–2025 Current Bull

🚀 Total Gain ~2,330% ~650% ~200% so far

⏲️ Duration 12 years 13 years 7–9 years so far

💔 Max Drawdown –45% (1974–76) –30% (2008) –20% (2022)

🏦 Central Bank Role Moderate Emerging Dominant

📉 Correction Recovery Years 4 years Months

🏛️ Technical Pattern Secular breakout Multiple peaks 13-yr base breakout

________________________________________

📈 Top 10 Stats of the Current Gold Bull Market (2025):

1. Gold Price:

o ~$3,338–$3,364/oz; ATH > $3,500 in April 2025

2. Year-to-Date Gain:

o +29% YTD (2025); +30% in 2024

3. Central Bank Demand:

o 1,000 tonnes bought for 4th straight year; reserves near records

4. Inflation Hedge:

o Strong negative correlation with real yields; safe-haven demand up

5. Gold vs S&P 500:

o Gold +27% YTD; S&P 500 up only ~2%

6. Jewelry Demand:

o Down –9% in 2024, projected –16% in 2025 (high prices suppress demand)

7. Gold-Silver Ratio:

o Now ~94 (down from 105); silver catching up

8. Record Closes:

o Over 40 daily record closes in 2025; price consolidating near highs

9. Technical Breakout:

o 13-year “cup-and-handle” breakout (March 2024)

10. 2025 Forecasts:

• Range: $3,600–$4,000 by Q2 2026; some see $4,500+ if risks persist

________________________________________

🔄 How This Bull Market Stands Out

• Dominance of Central Banks:

Central banks are setting the pace—record demand, making gold a reserve anchor again.

• Faster Recovery:

Corrections are less severe, recoveries are quick (months, not years).

• Synchronized Rally with Equities:

Rare for gold and stocks to hit highs together—shows systemic confidence in gold.

• Technical Breakout:

13-year base break signals powerful, long-term momentum.

• Future Outlook:

Targets as high as $7,500/oz (650% from cycle lows) possible by 2026/27, if historical analogs play out.

________________________________________

⭐️ Recommended Strategy (2025 and Beyond)

• BUY/HOLD/ACCUMULATE on Dips:

Favor physical gold, gold ETFs (GLD), and miners (GDX).

• Physical Over Paper:

Preference for allocated, physical bullion amid rising counterparty risks.

• Diversify with Miners/Silver:

Gold-silver ratio suggests silver may offer leverage; quality miners benefit in the latter stage of bull runs.

• Long-Term Perspective:

Anticipate volatility, but higher highs are likely if macro themes persist.

________________________________________

🧭 Summary Table: Historic vs Current Bull Markets

Feature 1968–80 1999–2012 2016/18–2027

Total Gain 2,330% 650% 200%+ (so far)

Duration 12 yrs 13 yrs 7–9 yrs (so far)

Correction –45% –30% –20%

Main Buyer Retail Funds Central Banks

Pattern Parabolic Cyclical Cup & Handle

Key Risks Inflation USD/credit Inflation, war, geopolitics

________________________________________

Key Takeaways

• Gold’s current bull market is distinguished by relentless central bank demand, robust technical momentum, and swift recoveries from corrections.

• The macro backdrop—persistent inflation, global uncertainty, and sovereign de-dollarization—supports an extended cycle.

• Expectations for $4,000+ gold in the next 12–24 months are widely held, with even higher targets in a true global crisis.

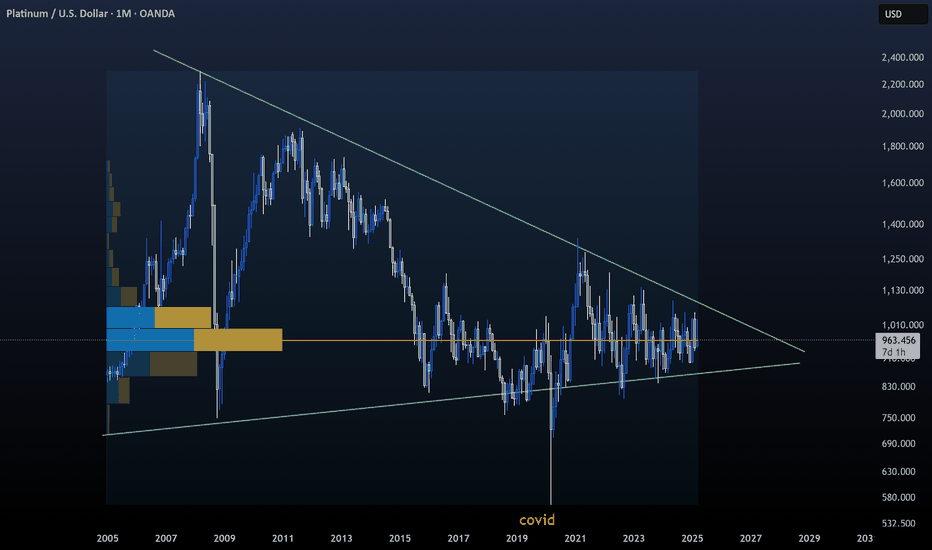

XPT

Platinum- While everyone is chasing Gold’s rally, I’ve got my eyes on Platinum.

- That doesn’t mean Gold is a bad investment, it just means it’s already had its moment.

- Platinum feels “delayed,” but its time is coming.

- Observe closely, this simple graph reveals a tightening triangle.

Remember my first rule: Buy the blood, not the moon.

Stay sharp. Diversify. Never go all in.

Happy Tr4Ding

Platinum Bullish GartleyI think that after the accumulation period, Platinum prices will head towards the Bullish Gartley target.

* What i share here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose all your money.

PLATINUM Buy signal on the 1D MA50.Platinum (XPTUSD) is ranged lately within the 1D MA50 (blue trend-line) and 1D MA200 (orange trend-line) but with its 1D RSI rising steadily since the December 30 2024 Low. That was the technical bottom of the Falling Wedge pattern that broke upwards.

As you can see, this has been a very common pattern since September 2023, with all Falling Wedges eventually breaking to the upside to hit at least the 1.618 Fibonacci extension. As a result, our current short-term Target is $999.50.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

PLATINUM Huge buy opportunity at the bottom of the Channel Up.Platinum (XPTUSD) has been trading within a Channel Up for almost 1.5 year and currently it is testing the pattern's bottom. This process is similar to the Lower Lows bottom sequence of February 12 2024.

As you can see, even the 1D MACD fractals are the same and we are about to post the decisive Bullish Cross that signals the buy. As long as the price remains below the 1D MA50 (blue trend-line), it is a huge long-term buy opportunity.

The previous Bullish Leg hit the 1.236 Fibonacci extension within the Channel Up and peaked above it on the 1.5 Fib ext. As a result, our technical Target is on the modest 1.236 Fib at 1090.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XPT Surges as EMAs Align with Bullish Chart PatternH ello!

XPT broke out from a falling wedge (See green trendlines!) formation with strong bull power, as the MACD shows. It wasn't against expectations since falling wedge chart patterns usually break upward. It's often a bullish formation. Thus, MACD and chart patterns align with a bullish outlook. Furthermore, the price is above EMAs (20/50/100/200). EMAs crossed upward on the 24th of September. Seemingly, nothing stands in the path of bulls until the green target circles. However, stay vigilant and don't go all in.

Regards,

Ely

XPTUSD About to test the 1D MA200. Strong buy above it.Platinum (XPTUSD) is going quite well since our October 25 buy call (see chart below) as we caught the bottom and the price is now rebounding:

The long term pattern is a Channel Up. At the moment the price is supported by the 1D MA50 (blue trend-line) buy restrained below the 1D MA200 (orange trend-line) where it got rejected on November 28. Even though the bottom of the Channel Up was made and the 1D RSI patterns between the two sequences are similar, we need confirmation for upward extension by a break above the 1D MA200.

If you didn't buy lower, you can wait until that level breaks, and then target the +28.55% range at $1100.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Decoding Market Trends: Platinum's Dance with AI-Predicted ShiftDear Esteemed TV Members,

P latinum has been swaying within a bearish trend. However, insights from Support Vector Machines (SVMs) applied to daily candles suggest a potential weakening of this bearish momentum. This predictive analysis, coupled with a possible rising channel pattern on the Relative Strength Index (RSI), indicates that the bearish trend might be approaching its conclusion, paving the way for a potential shift towards a bullish scenario.

S VMs, a formidable machine learning algorithm, serve a dual purpose in classification and regression tasks. In market analysis, SVMs are invaluable for identifying candlestick patterns, forecasting price momentum, and pinpointing crucial support and resistance levels. As per my SVMs, Platinum's price seems to be on the verge of entering a support zone, marked by the blue rectangle on the chart. This support zone could act as a catalyst, drawing in sufficient demand to instigate a reversal of the trend into a bullish trajectory.

V isualizing this potential scenario, I've outlined it with blue arrows and proposed a long position in the chart. However, a word of caution: Should Platinum experience a downturn below the outlined demand zone (as indicated by the purple forecast), it would be prudent to steer clear of the long position. In such a scenario, an alternative bullish outlook may emerge, capitalizing on Platinum's oversold conditions—a phenomenon observed previously on March 19, 2020, and a possibility hinted at in the alternative blue forecast.

Happy Trading!

A crucial disclaimer accompanies this insight: This is not investment advice, and the responsibility for trading decisions rests solely with the individual. It's imperative to conduct thorough research, exercise caution, and embrace effective risk management strategies.

Best regards,

Ely

Platinum(XPTUSD)is heading toward 1010$Hello Traders

Our technical view has been shown in the chart.

If you like it then Support us by Like, Following, and Sharing.

Thanks For Reading

Team Fortuna

-RC

(Disclaimer: Published ideas and other Contents on this page are for educational purposes and do not include a financial recommendation. Trading is Risky, so before any action do your research.)

XPTUSD Long-term buy opportunity near 1 year Support.Platinum (XPTUSD) is having a strong start to the week following a streak of 2 red 1W candles rejected on both the 1W MA50 (blue trend-line) and 1W MA200 (orange trend-line). Regardless of the obvious 1W Golden Cross pattern that those two are aiming to complete, the price got again near the 895 - 903 Support Zone, which has been closing all 1W candles above since September 2022.

With the 1W RSI on a bottom sequence similar to the February 2023, December 2021 and September 2021 fractals, we consider this an excellent long-term buy opportunity. Our target is the bottom of the Resistance Zone at 1100.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XPTUSD ( Platinum / USD ) Commodity Analysis 18/07/2021Technical Analysis:

As you can see, there exist a Hidden Bullish Divergence with MACD and it is the very sign of bullish trend continuation as the Price is Bullish Bounding in an ascending channel.

We draw Fibonacci retracement from the low to the top of previous impulsive wave for specifying the Bullish Cycles and the Possible Pivot Points and Reaccumulation levels in the correction wave condition, which are defined as the Fibonacci and Support and Resistance levels on the chart.

Currently The commodity is consolidating and Reaccumulating on Fibonacci Golden Zone.

naturally XPTUSD is moving in ascending channel presently.

we believe that the commodity is getting ready in order to shoot to the defined targets by Fibonacci Projection of the Past impulsive wave

XPTUSD Buy opportunity with High expected in June.Platinum (XPTUSD) is trading on a Triangle pattern which is within a larger Channel Up. Last time we had this sequence on patterns was last November-December. Once the price hit the 1D MA50 (blue trend-line), it rebounded to the 1.5 Fibonacci extension. The current 1.5 Fib is at 1180 but we set a Target slightly lower at 1170. Notice how even the 1D MACD sequences between the two fractals are identical.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XPTUSD - BULLISH SENTIMENTXPTUSD - has been ascending solidly with minor exceptions in a bullish channel since the beginning of February 23. Due to some uncertainties around the mining crisis in SA, one of the largest producers of the precious metal the price tag by BofA is set around $1400-$1500 by year-end, which makes a 40%-50% anticipated surge in the next 7-9 months.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Platinum is the one to buy and hold for yearsI've been bullish platinum for a long time now, but breakouts from such long-term ranges take time. We've seen similar shapes in crude oil and in copper, both of which have broken out. I started discussing the upcoming crude oil breakout on Twitter in 2019 already, and I've been doing the same for platinum. In time, we will surpass the all-time highs, which isn't strange considering that platinum can be used as an industrial metal to support the electrification trend.

Don't expect this to breakout tomorrow. It could take until 2024, but I'm very confident that it will be a matter of time. In the short term, I am looking for a drop by possibly as much as 3-5%, which is when I will start adding to my existing position. A critical level is $1,040 and it seems likely that we will see a test of that level before we head back to the current levels. On a side note: platinum looks like it will be outperforming gold in the coming years. The gold/platinum chart is an interesting one to look at.

PS: Please disregard the RSI indicator here, it wasn't supposed to be shown.

PLATINUM Perfect long-term Channel with 2 extremes to consider.Platinum (XPTUSD) got rejected two weeks ago on the 'war candle' on the 1W time-frame and is on the 3rd straight red week since. The importance of that rejection, is that the candle closed within the metal's long-term (almost 4 year) Channel Up that started half-way through 2018. As you see XPTUSD tends to trade exclusively within this Channel Up structure, unless a 1W candles closes outside (either above or below) the pattern.

In almost 4 years we had two such 'extreme' cases, one was the March 2020 market crash due to the COVID pandemic, which was the bearish extreme that reached as low as (marginally breaking) the -1.0 Fibonacci extension level and the other the Q1 2021 bullish extreme that reached as high as (marginally breaking) the 2.0 Fibonacci extension level. Notice who both distances are symmetrical on the extremes and that in both cases the candles, despite breaking marginally below/ above, they managed to close back inside the Fibonacci extensions.

This pattern provides a low risk frame-work to long-term investors. Buy low and sells high within the Channel and if the pattern breaks and closes a 1W candle outside its top/bottom, trade to the direction of the break-out, either towards the -1.0 Fib or the 2.0 Fib.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------