XRP/BTC – Channel Midline in Play The XRP/BTC pair trade inside a multi-year channel, with price currently testing the midline of this structure — a pivotal level that could define the next macro leg.

If bulls manage to break the midline to the upside and successfully retest it as support, the upper boundary of the channel becomes the next major target.

🔼 Upside Scenario:

A confirmed breakout above the midline would signal structural strength and likely lead to a rally toward the upper channel resistance.

If this move aligns with BTC dominance dropping below the 60% threshold, we could see a full-blown altseason emerge.

Under such conditions, historical XRP/BTC behavior suggests that XRP/USD could reach $12–$24.

🔽 Downside Risk:

Losing the mid-channel from here would weaken the structure and invalidate the breakout thesis.

In that case, XRP/BTC would likely rotate back toward range lows, and a defensive strategy is warranted.

Macro Implication:

The 60% BTC Dominance level remains critical. A clean breakdown below it historically marks the beginning of altseason, where high-beta plays like XRP against BTC have outperformed. XRP’s current posture within the channel reflects this high-stakes moment.

Xrparmy

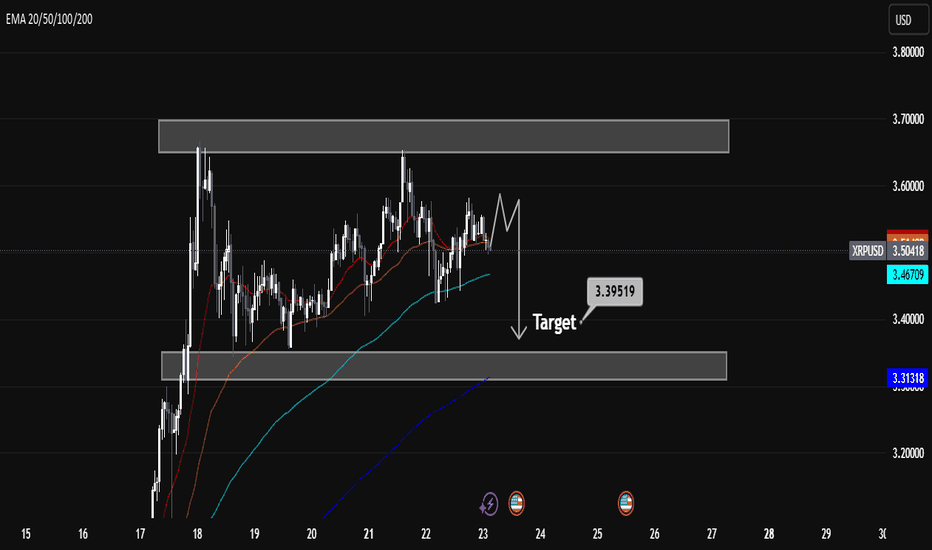

XRPUSD Technical Analysis — Bearish Retracement in PlayXRPUSD Technical Analysis — Bearish Retracement in Play

Overview:

XRPUSD is currently exhibiting signs of bearish momentum after failing to break through a key resistance zone. Price action suggests a potential retracement towards the marked target level of 3.39519, supported by multiple technical indicators and price structure.

Key Technical Levels:

Immediate Resistance: 3.70 – 3.75 (strong supply zone; price rejected here multiple times).

Support Zone: 3.30 – 3.39 (prior demand zone and EMA confluence).

Target: 3.39519 (short-term bearish target as marked on chart).

Current Price: 3.50 (as of chart time).

Indicators & Price Action:

EMA Analysis:

EMA 20/50 (red/orange) are flattening out, indicating weakening short-term momentum.

EMA 100 (cyan) acts as current dynamic support.

EMA 200 (blue) is far below, suggesting room for deeper retracement if sentiment weakens.

Price Structure:

XRPUSD formed a double top near resistance, followed by lower highs.

Recent candle patterns show indecision and possible distribution.

Projected bearish leg toward 3.39519 suggests sellers are in short-term control.

Conclusion:

XRPUSD is likely to retest the 3.395 support level after rejecting the upper resistance zone. The bearish structure is supported by EMA alignment, price action, and repeated failure to break resistance. A break below 3.395 could open further downside towards 3.31. However, a strong bounce from support could invalidate this setup.

Trade Bias: Short-term bearish toward 3.395, watching for reaction at support.

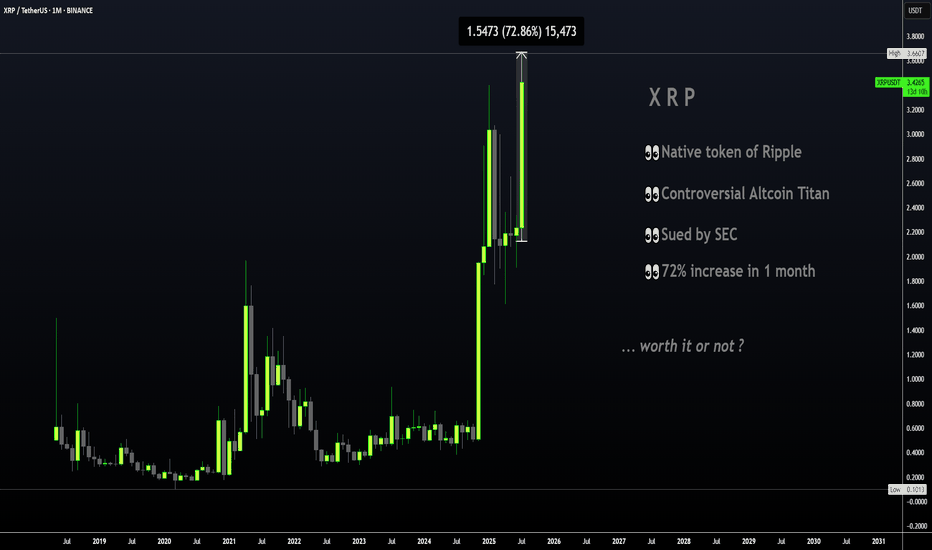

XRP | Great TP Zone is HERE for HODLERSXRP has seen a 62% increase since breaking out above the moving averages in the daily timeframe.

The previous time XRP broke out above the moving averages in the daily, the price increased around 440%:

However, with XRP being the ultimate pumper and dumper, I'll take my chances at 62%! Because this bull run has been anything but ordinary and it's best to avoid being too greedy. The price of XRP falls extremely quick, just as quick as it rises.. ( Maybe not overnight but you know, it has happened before ).

If you're one of few who bought around $1, or heck even later at $2, this is a solid increase and it should not be taken for granted. XRP has gone LONG periods without increases and often stayed behind making new ATH's when other cycles have come and gone (twice), as other alts make new ATH's. Over the years, I've made extensive posts on XRP; documented its use case, followed the SEC case closely and yet, XRP still remains one of the strangest and most unpredictable alts I have ever tried to analyze. Long term followers will remember that a I was bullish in 2018/2019 and then slowly became uninterested up until the point of negative towards XRP for probably the past 3-4 years.

This is not only because of the lagging price compared to other older alts that soared like ETH and even Litecoin. Sure we did not see the growth and the taco stand ( who remembers ) just kept dumping on the market... But the entire "scandal" of the actors marketing/pimping, the dumping behind the scenes by executives to fund Ripple in early days, the lawsuit etc. was just such a colossal mess that I even wonder how XRP is still alive and kicking today.

All I'm saying is that this is truly a spectacular moment - it's hard to even imagine cripple crossed $3 after years and years of waiting on XRP when other alts x1000% and beyond. Point being - Don't miss it! Trading only works when you take profits.

________________________

BINANCE:XRPUSDT

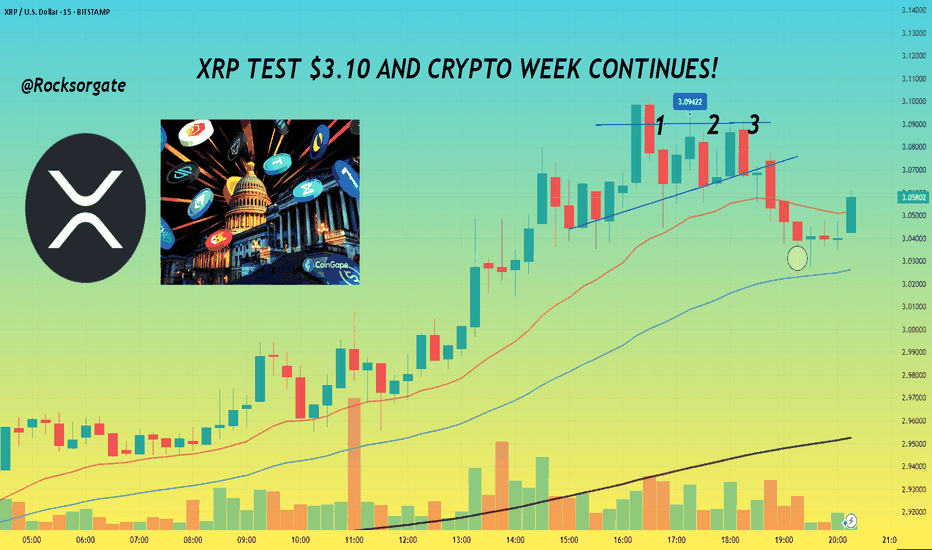

XRP TEST $3.10 AND CRYPTO WEEK CONTINUES!📊 Hey hey, hope all is well, gonna keep this idea pretty short and concise for the day, have a lot to do but thanks for joining as always.

📊 With Crypto week ongoing and the House of Representatives considering the Guiding and Establishing National Innovation for U.S Stable coins or GENIUS for short. Alongside that there's the Digital Asset Market Clarity Act or Clarity for short which is being considered as well. The last bill being considered is one which would be directed towards blocking the Federal Reserve from issuing a central bank digital currency directly to individuals.

📊 For summary CBDC is fiat money, just in digital form and that fiat money is issued and regulated by a central bank of a country.

📊 GENIUS has already made the rounds and passed through senate but is facing a snag, in limbo as House lawmakers as some lawmakers like Marjorie Taylor Greene and Chip Roy who themselves we're looking to get anti-CBDC language in with 12 republicans voting no on Tuesday's vote. Least to say things are still in flux, so we'll have to see if lawmakers can come to an agreement and sort things out simply put.

📊 If passed GENIUS would require stable coins to be fully backed by U.S dollars or similar liquid assets. Along with this you'd have annual audits for issuers with a market cap of more than $50 billion and guidelines would be established for foreign issuance.

📊 the Clarity Act takes a full on approach to crypto and would create a clear regulatory framework for crypto, this would function through the U.S Securities and Exchange Comission and Commodity Futures Trading Commission will regulate the crypto space. Digital asset firms would also have to provide retail financial disclosures and separate corporate from customer funds. More than likely in a nod to the collapse that FTX brought about for money when the company took advantage and started using customer funds.

📊 Overall these bills and acts alongside the CBDC bill would be a significant change for the digital asset space and give much more clarity for Institutions further allowing more money to enter the space basically.

Reference:

www.coindesk.com

www.theblock.co

📊 XRP itself will be impact by these changes just like the rest of the space with some digital assets making significant jumps or declines based on what bills and changes are ultimately decided so it's a crazy week to say in the least. For Technical I've added a chart below for reference:

📊 Can see how we're facing that horizontal level of resistance at $3.10 now, gonna set an alert for that but more than anything, right now what's gonna make or break things will be the news, we've already seen how much that's done us the last few weeks, grateful and blessed for it as always.

📊 Main thing now is to keep an eye on the news and watch that $3.10 level for resistance or a further breakout. We've also converged with our 200 EMA on the 3 minute chart so no doubt we'll see bulls and bears fight to break or keep that point. Should be an interesting next few days.

📊 Have to go study but as always, grateful for the continued support and those that take the time to read through these and continue with me on this journey, it's taken a few years but things are coming together finally, grateful we've perservered.

Best regards,

~ Rock '

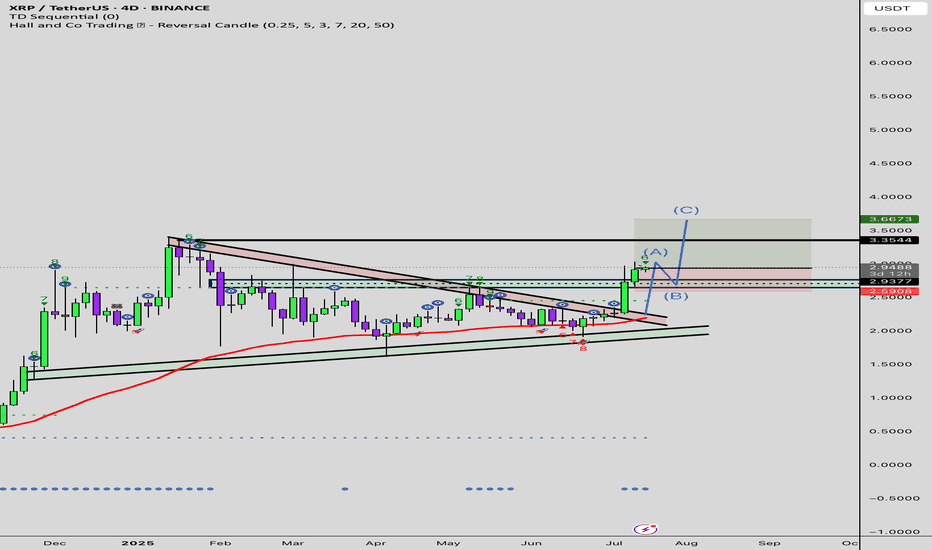

XRP/USD (RIPPLE) BUYtitle: XRP/USD (RIPPLE) BUY

Asset: Crypto

Symbol: XRP/USD

Market Entry Price 1: $2.9450

Limit Entry Price 2: $2.7450

Stop Loss: $2.6450

Take Profit 1: $3.145 (close 10%)

Take Profit 2: $3.345 (close 25%)

Take Profit 3: $3.645(close 50%)

Take profit 4: $3.845 (close 75%)

Let any remaining Xrp run risk free

Why XRP Holders Are About to Get Super Rich!I believe XRP is heading into a mass adoption cycle—something even bigger than what Bitcoin saw in 2021. We’re looking at a truly sustainable growth pattern fueled by a longer accumulation phase and crypto being adopted and invested in by major institutions.

This means we could see XRP skyrocket to $22 as my lowest target— and potentially even well over $100 per coin . This coin is truly ready for massive things. Be prepared!

Let me know what you think: Will XRP crash? Or is it heading for mass adoption? Share your thoughts in the comments below.

As always, stay profitable,

– Dalin Anderson

XRP SHOOTS UP TO $3! 🌠 Wow, we'll, we've done it. We've hit $3 once again. Before I start this idea just want to give my thanks for tuning in, appreciate it.

🌠 This month has been pretty incredible for Ripple to say in the least from the BNY-Mellon Custodian Deal to Trump's Media company filing for a crypto Blue Chip ETF of which included the likes of XRP. With all the news and positive sentiment around XRP and Bitcoin which itself has hit a new All-Time-High hitting $123,000! Below I'll add a Bitcoin chart for reference:

🌠 To say in the least it's been a golden month for Crypto and Digital Assets. And one important thing to note is that as of today the Fedwire Funds Service is set to go live with the ISO 20022 standard starting July 14, 2025. The implementation will replace Fedwire's dated (FAIM) format with the ISO 20022 message format with the change happening over a single day.

🌠 For those that don't know ISO 20022 is a global messaging standard for financial transactions meant to reduce cost and fraud alongside automate transactions and reduce transactional costs. What this means for XRP is that it could become a much bigger player in cross-border payments now through RippleNet as XRP is one of the selected assets for the ISO 20022 standard.

🌠 ISO 20022 and global institutions will start utilizing XRP and it's ability to process transactions seemingly instantly and efficiently while significantly cutting down on cross border and transaction costs making it a considerably solution for banks and financial institutions. After all, if your objective is to make money, and you can make more money while cutting down on costs and making transactions, record keeping much simpler, then why not? Especially in an age where everyday things are continuously advancing and improving nobody want's to be left behind. Especially the big financial players.

🌠 Curious to see if prices can hold and keep pushing but just going off technical, we already know $3 is a tough point. At $3 just over 95% of XRP holders are in profit which makes a good reason for many to sell and take profit but with all the news and ISO now really kicking in we may not see as much selling, especially as holders are more confident and less likely to be swayed in letting go of their XRP. So it'll definitely be interesting to see how things play out.

🌠 Main thing will be Bitcoin, even if XRP holders hold I can't guarantee the same for Bitcoin, especially should it start to reverse, we know how financial institutions play taking advantage of the news. Just be cautious and set some price level alerts whether your trading XRP or Bitcoin.

🌠 In the long run things look very good regardless of what happens in the next week or two so keep that in mind. I'll be watching XRP to see if we can continue and break $3 but in my experience, with these impulse waves we usually see a big move up followed by some retracement as traders look to test support and liquidity so the waters may turn choppy but again like I said, we're here focused on the long term, whatever happens happens. We'll still be here for that but nonetheless the main objective is the longterm. $3 may seem like a lot but it's nothing compared to what XRP has in store.

🌠 This week is also 'Crypto Week' for lawmakers in DC as U.S lawmakers get ready to potentially pass changes in the regulatory setting when could push even more institutional demand further adding to the hype and optimism the crypto space has been running with as of lately.

🌠 Have to run but thanks as always for tuning in, really appreciate it and hope everyone is doing well! thanks as always and all the best till next. Feel free to keep posted and follow for more as always.

Best regards,

~ Rock '

XRP SKYROCKETS AND BREAKSOUT PRICE RANGE! ⭐️In a pretty crazy twist and turn of events we're seeing XRP absolutely skyrocket and breakout with this morning's announcement on behalf of President Donald Trump with his Truth Social media platform announcing it had filed for a Crypto Blue Chip ETF with the SEC.

⭐️ The Blue Chip ETF proposal includes 70% holdings in Bitcoin, 15% in Ethereum, 8% in Solana alongside 5% in XRP and 2% in CRO which is from Crypto.com. This notably has led to the breakout with XRP that we're currently seeing with the crypto already up 12% since the day started and news broke out. It's still early morning too so we'll see how the market reacts as the day continues and traders wake up to the news.

⭐️The past few weeks have seen XRP stuck within this horizontal channel and constant tug a war between $1.90-$2.30 with this breakout and the last week signaling bullish optimism towards the crypto alongside news of the BNY-Mellon deal with BNY Mellon set to become the Custodian for Ripple's RLUSD Stable coin. And for those that don't know BNY-Mellon is America's oldest bank having been founded in 1784 and with an estimated $45.7 trillion in assets under custody and/or administration. To say in the least this is a big step for Ripple showing more institutional growth.

⭐️To note also is this as I'll show below on Bitcoin's chart:

⭐️ It's crazy to say but we've just seen Bitcoin form a new All-Time High at $118,100 alongside the Crypto Blue Chip announcement, more than likely with investors and institutions flocking to buy in before the ETF get's approved and likely in anticipation of a bullish shift.

⭐️ We've already seen the crypto space weather the storm through the last few weeks and months with everything that's happened from global escalations to all the new bills and changes in the government. Through thick and thin the crypto space has proved resilient and investors are taking note.

⭐️ Have to run for work but wanted to get a quick idea out there, especially since this news just broke out. Some pretty crazy stuff and I'll be watching these levels here to see if things continue or if the news has simply given us a breakout, regardless it's a win-win with all this news only pushing the directive and story towards crypto and digital assets for many. I'll attach a link below to an article on the Blue-Chip ETF for reference as well.

⭐️ Thanks so much as always and all the best till then, feel free to keep posted for more updates and ideas as we continue on this journey we've been riding the last few years already. It's been a lot but it's got much more to go. Let's keep at it and keep our heads up.

⭐️ Reference on Crypto Blue Chip ETF:

apnews.com

Best regards,

~ Rock'

Congress passes H.R 1 into law. About the new bill.🔵 In what's been an eventful last few weeks congress passed H.R 1 which is essentially Trump's 900 page mega bill Act. Both Democrats and Republicans ultimately united against each other over the bill with Vice President Vance casing the tiebreaking vote giving Senate Republican's the large legislative victory.

🔵 To note is that independent-minded Republican Lisa Murkowski, senator of Alaska had some concerns with the bill before GOP negotiators we're able to acquire her vote for the 50-50 votes. Murkowski's primary issue was with the legislation's changes to Medicaid and federal food assistance funding which she was concerned would hurt her home state understandably. Republican's originally tried to sway her vote by adding language to shield Alaska from the full effect of the legislation's Medicaid and SNAP cuts.

🔵 Parliament opposed that as it violated the Byrd Rule which is there to determine the legislation that can go into a budget reconciliation package as well as passing with only GOP votes. Least to say the amendment was reworked many times in order for the waivers for the SNAP funding cuts to apply more broadly than just Alaska and Hawaii. Parliament rejected the prior amendment and language which targeted just the two states understandably.

🔵 With the rework the new SNAP provisions are planned to reduce food assistance funding more slowly in about 10 states with the number ultimately being decided by a formula and based on the error rate in delivering food assistance benefits in a year. After an arduous process the amendment was passed and Republican's secured the vote with Murkowski saying it was an agonizing process.

🔵 When speaking with reporters afterwards Murkowski noted that the process was stressful with them operating under an artificial timeline in reference to the pressure Trump put on the Senate to pass the bill.

🔵 Her concern was as follows: “Rather than taking the deliberative approach to good legislating, we rushed to get a product out. This is important. I want to make sure that we’re able to keep in place the tax cuts from the 2017 Jobs Act,” said Murkowski when asked about her support for the bill and why it was hard for her to come around to giving her vote.

🔵 “I struggled mightily with the impact on the most vulnerable in this country when you look to the Medicaid and the SNAP provisions,” said Murkowski. This point highlights just how the effort to push the bill through was met with haste and pressure notably.

🔵 The bill itself is projected to add $2.8 trillion to the federal deficit by 2034. Main reason for that would be thanks to a reduction in revenues as well as interest cost which could have the deficit rise by a potential $5 trillion if some temporary provisions become permanent. Interest payments on the national debt are also expected to increase significantly by 2034.

🔵It should be noted that these numbers and estimates are based on a "current law" baseline and are largely thanks to tax cuts in the bill with Economist having differing opinions on the economic impact of the bill. Time will tell us how estimates go but least to say this is a large turnaround from what many we're expecting with even DOGE's Elon Musk opposing the Bill and forming a new party in strong opposition.

🔵 The tax and spending bill will see spending increase and phase in a cut to Medicaid of an estimated $1 trillion over the next decade with the CBO projecting roughly 11.8 million more American's t hat would become uninsured within the next 10 years compared to the current law. This could lead to many losing healthcare services due to medical cost with states as well likely needing to adjust their own programs and having to take on a larger share of the cost whether that means reducing services or even closing some facilities.

🔵 The bill has many key changes but in summary it solidifies many tax breaks from Trump's first term with an estimated $4.5 trillion in tax cuts alongside tax deductions on tips, overtime and auto loans with deductions for adults that make under $75,000 and a boost to the child tax credit from $2,000 to $2,200 though millions of families at lower income levels would still not receive the full credit as one of the credit's, requirements is a minimum earned income of $2,500. In 2022 alone an estimated 18 million children under age 17 (26 of all children) were ineligible for the full child Tax credit because the family income was not high enough as reported by Columbia University's Center on Poverty and Social Policy.

🔵 To say in the least the new bill has many implications for the country and the next few months and years will definitely represent those changes and how the country shifts and adjusts to this with many having differing opinions understandably. I'll definitely keep you guys posted through it all but definitely a lot to see so much happen so quick and only time will tell and show us just how things play out simply put. The market itself is still continuing within this ascending channel, especially since we got that convergence with the 200 EMA and broke that $6,130 resistance. $6,300 is what I'm expecting resistance to hit the strongest so definitely gonna keep an eye there as traders process the news and changes.

🔵 Have to go but grateful as always for the support, definitely a long idea here but wanted to focus on some important points though the bill itself has so many changes it's hard to go over every one but you get the point. This is a big changes and we'll definitely see things shift a lot over the next few months and years and as always we'll keep posted with things. Thanks as always and all the best.

Best regards,

~ Rock'

XRP | SHORT CRIPPLE to $2XRP is currently trading BEARISH, since we're seeing a trade right on top of the current support level.

The more times a support level is testes, the weaker it becomes. Therefore, the current support may break and then it's a free-fall to $2.

Additionally, with the price trading UNDER the moving averages in the 4h, we can confirm a bearish sentiment from a technical indicator perspective.

With a fairly tight SL, and a modest TP, the risk is low with this short setup:

___________________

BINANCE:XRPUSDT

XRP AND IDEA 556!⭐ First thing's first, this is the 556 idea, crazy to say but here we are. Hope everyone is doing well today, it's a chill Sunday and all so we're gonna get a quick idea down for you.

⭐ Again, can't believe it, 556 ideas and counting! Feels like I just started this journey only a few months ago and yet here we are, 741 followers and counting, I couldn't have imagined that but I'm so grateful for it and each and every single one of you, thank you for joining me and supporting me on my journey as we continue to strive for nothing less than success.

⭐ Before we get going with this quick idea, feel free to leave a like and follow for many more great ideas to come! Got some good stuff in mind and excited for all the market has in store for us the next few months, and without further a due, let's give it our best!

⭐ Gonna keep this short and concise since I understand it's Sunday so let's get this done.

⭐ First thing's first, we already see we've exited our trend with that exit of the ascending channel in which we also lost the 200 EMA on the 2 hour timeframe prompting a bearish convergence as we kept trying to establish a higher high but without the support of our 200 EMA prompting the reversal which then formed this descending channel towards the end of May leading into June as referenced below:

⭐ We'll be looking to $2.08 for support should we end up reversing further which is a possibility though unlikely since we've deviated from that 200 EMA and soon enough we're going to have to converge and get a bullish crossover of that 200 EMA which will help send us back up. Till then it's fair game for Bulls and Bears, especially with BITSTAMP:BTCUSD sitting at $105,000 right now as many traders watch which direction Bitcoin looks to take next.

⭐ I'll be watching that $2.08 for support as well as the descending channel and 200 EMA, that's basically it right now, gonna stick to trading objectively and sticking to my indicators. Simply enough then, watch that descending channel to see if we continue within it and trend further down or if we can breakout and get a bullish crossover with our 200 EMA which could help prop us back up above that $2.3 range.

⭐ Gotta go, got a lot of things to get done as usual but thanks so much as always for the support! Still can't believe this makes idea 556! So grateful again for everyone and all the support as we climb this mountain, it may not be easy, but the view at the top will be more than worth it.

Best regards,

~ Rock '

XRP/USD LONG SET UPTitle: XRP/USD (RIPPLE) BUY

Asset: Crypto

Symbol: XRP/USD

Market Entry Price 1: $2.28

Limit Entry Price 2: $2.08

Stop Loss: $1.88

Take Profit 1: $2.48 (close 10%)

Take Profit 2: $2.78 (close 25%)

Take Profit 3: $3.38 (close 50%)

Take profit 4: $3.88 (close 75%)

Take profit 5: $4.38 (close 100%)

Status: ACTIVE

XRP AND A QUICK FRIDAY LOOK🔥 Hey hey, happy friday, it's definitely a busy one but hope everyone's doing well. As usual, we'll get going with our thoughts and try and keep things short.

🔥 Gonna focus on technical for the most part today as we look at things and follow up from our previous idea which is also linked below for reference.

🔥 Looking at our 2 hourly we can see that we're still we continued with the trend and we're able to keep within that ascending channel but we did end up hitting a pretty tough resistance at $2.5 at which we got a pretty quick reversal, sell off. More than likely a coordinated move to sell off enough to have us lose that 200 EMA which was successful.

🔥 We ended up losing that 200 EMA and as of currently we've exited our ascending channel so to get reference on things we've got our Fibonacci chart below to find some good horizontal levels, especially as we approach an important support level being $2.99-3

🔥Next few day's I'll be keeping watch of that Fibonacci Retracement Chart for those levels. It's not perfect but gives some pretty good insight on things and these sort of horizontal channels we've got. Take $2.45-$2.42 for instance. Whenever we got out the channel we broke out or at least tried to and whenever we fell below that $2.35 support we'd get vice versa and fall, retrace.

🔥 So main things so watch right now are whether or not we can keep within that channel or if we'll fall into the one below and if we can regain that 200 EMA or if we fail by which then we could be seeing a retest of $2.99 and should that fail look to $2.20 and $2.10.

🔥 Regardless, XRP still stands in a great position for the long term as we last noted on our previous Big picture idea and whatever happens within the next few days and weeks will simply be market makers playing their game and technical running things till we get some more news or developments. On that note I've got to run but happy we could get something quick out today.

🔥 And as always, thanks so much for the support! Really appreciate it and let's keep at it till, same as ever. Always have more to gain and get done, work towards. Till next, keep posted and have a positive day.

Best regards,

~ Rock'

XRP AND A BIG PICTURE LOOK!🥂 Hey hey, hope everyone's doing well! Great to see how things have been moving this week for the market as a whole, especially for digital assets with XRP leading the pact, been a while since we did a big picture look at our technical so figured we'd do a quick update and as always thanks for giving me a few minutes of your day.

🥂 First thing off the bat is XRP breaking $2.5, in our latest idea we spoke on XRP and we're watching for a retest of that $2.48-5 level which proved to be successful and we kept within our ascending channel even breaking out of it as I'll show in the chart below on the hourly time frame:

🥂 So not only did we keep within the ascending channel but we broke out of it and have kind of formed this new channel which is gonna gave a much better look on the shorter time frames now that we know we can watch this for bullish or bearish trends, pivots.

🥂 Main challenge on the hourly is to keep above that channel and if we do retrace and enter the channel next goal would then be to avoid falling out of that channel, keep pushing much like we did with our ascending channel that helped us get the confirmation we wanted and see that $2.5 successfully get retested and beat.

🥂 Next thing up is our chart below, I went ahead and added a Fib. Retracement to give us some clarity on where we stand right now for a big picture view and we can see that as we stand right now, we're at this pivot basically. $2.5 is that make or break it point so now we'll have to see if bulls can sustain enough pressure to keep above $2.5.

🥂 One good thing to note is that each time we retest these levels we have more and more support and positive sentiment behind XRP and Ripple which continues to build and form partnerships thus every time we hit these levels there are more and more people and financial institutions that believe in XRP and the coin only grows stronger with every retest and with each and every single day.

🥂 Whether we keep the pressure and break, keep pushing upwards or retrace and fall back the same fact will stand true, XRP will continue to build it's backing and continue working towards it's goals and cementing itself in the future as we know it. I can definitely see XRP hitting $3-5 within the next few months if the company keeps playing it's cards right and the SEC approves a Spot XRP ETF which would be a solid win to say in the least.

🥂 Definitely keep all this in mind and feel free to add to your own charts, we're at a pivot point on the daily and for the hourly I would watch those channel's and that EMA, that's about the main things for right now.

🥂 And as always, thank you so much for the support, really appreciate it and hope everyone's having a great day, and many blessings, let's keep at it and stay tuned for more!

Best regards,

~ Rock'

XRP DISTRUPTS AND TAKES ON HEALTHCARE!⚕️ Hey hey, hope everyone is doing well, before I start just want to give thanks as always, appreciate the support and let's keep at it.

⚕️ First thing right off the bat is a pretty exciting development I'd say! In a crazy development Wellgistics Health made the announcement to integrate and incorporate the use of XRP into their company and infrastructure utilizing the digital currency as a treasury reserve as well as a form of real-time payments.

⚕️ This is the first time we're seeing a publicly traded company, not to mention a healthcare company integrate XRP this much into their infrastructure and system in such a manner highlighting their faith and confidence in the asset, In the announcement they highlighted many benefits and incentives such as the speed, noting XRP's settlement time of just 3-5 seconds as compared to traditional methods such as ACH and wire transfers which can take days.

⚕️ I could continue listing but I'll share the bullet points they made:

Speed: XRP settles transactions in 3-5 seconds vs. 1-3 days for ACH or wire transfers, allowing for near real-time settlement among pharmacies, suppliers, and manufacturers.

Cost: Less than $0.0002 per transfer vs. $10-$30 for standard bank wires.

Transparency: All transactions are logged on the XRP Ledger for real-time compliance, rebate tracking, and auditability.

Scope: Supports global vendor payouts with significantly low foreign exchange and wire transfer fees.

Flexibility: Allows for XRP-backed lines of credit to support independent pharmacy liquidity.

⚕️Welligstics Health then went on to add and highlight the use cases across the ecosystem as they put it:

Real-time settlement between pharmacies, suppliers, and manufacturers

Smart rebates calculated automatically based on real-world data

XRP-backed credit lines to enhance liquidity for independent pharmacies

Global vendor payouts with near-zero foreign transaction and wire costs

Immutable compliance layer supporting DSCSA reporting and pricing validation

“We’re working to unlock capital velocity with surgical precision,” said Mark DiSiena, CFO of Wellgistics Health. “We believe that our XRP-powered infrastructure will allow us to run leaner, faster, and with more control than any of our peers in pharma infrastructure.”

⚕️ I'll share the reference to the announcement for any that want to read more on it but just off these points alone we can see just how much the benefit and incentive is for the company to incorporate XRP into their infrastructure which would put them ahead of the competition, essentially making them the first movers. No doubt others will be looking to Wellgistics Health to see the impact this makes in the next few months for the company, especially for their balance sheets and should things play out well I don't see why other companies won't follow in suit. So definitely excited by this development. Now we're seeing real utility kick in and XRP's purpose and use case being put to the test on a real scale.

⚕️ For reference NASDAQ:WGRX is essentially a middleman and provider that supports a wide range of categories and services in the pharmaceutical sector, the main being pharmaceutical distribution, prescription technology, as well as clinical fulfillment in which Wellgistics connects over 150 direct manufacturer contracts to a network of over 6,000 independent pharmacies nationwide. So we've basically got this huge player in the industry picking XRP as an alternative and essentially reworking their infrastructure completely around this digital asset. There's no doubt they did their due diligence and I'm sure the results will be noticeable for the quarterly reports, especially when you consider how much the company will save on transaction fees for a company that primarily deals in transactions the difference is incalculable to say in the least against traditional methods.

⚕️ Here's a reference link to the announcement as well for anyone who would like to read further into things.

www.globenewswire.com

⚕️ We've spoken many times on XRP and how it's real use case and utility has yet to really be put to the test so seeing this will really give us some good data and insight on the asset's real use case and what kind of role it'll play in the future, as I noted, I'm sure other companies will be looking as well to see how everything plays out and more than likely, we'll get positive results and start seeing other companies in other sectors begin to incorporate XRP into their own infrastructures.

⚕️ That's the wonderful thing, XRP doesn't just work for one sector or one company, it has so many use cases and utility it can be scaled in many ways for many industries and I think the next few years will have us seeing this come into play without a doubt and XRP's real utility and role taking place and shape. After all, we're still basically just starting off still funny as it may sound.

⚕️ For technical we'll keep things quick first using the charts below for reference:

⚕️ Used a Fibonacci Retracement picking our lowest and highest price points which honestly gave some pretty good insight, we can see just how accurate price action matches our Fib and those horizontal levels giving us a clear picture of things.

⚕️ For this chart I simply changed the Fib to blue and added in our ascending and descending channel's to simplify things, we had that ascending channel help Bull's keep pushing but once we lost that channel and hit the $2.5 resistance we can see just how quick traders we're to take profit and in turn we fall out that chanel and formed the current descending channel we're in.

⚕️ For the last chart we took away the Fib and this is the barebone of stuff. Can see how we moved up within this channel and then started retracing once we tested that horizontal resistance level at $2.48-5 putting us in our current position in which Bull's will have to keep price above that Fib. level of $2.32 which would help us avoid falling back into that descending channel and losing the 200 EMA. So basically if we stay within the channel we'll fall further and if we can break out of it and avoid losing that 200 EMA then we get another shot to retest $2.48.

⚕️ I have to run but If you've made it this far I appreciate it as always and hope the read was a productive update and informative, feel free to follow and keep tuned for more as always and don't just make it a good day, make it a great one.

Best regards,

~ Rock '

XRP CLIMBS AND A QUICK TECHNICAL🔥 Hey hey, hope all is well, been a few days and figured I'd chime in and we'd do a quick rundown on our technical and look into how our chart's currently playing out, this shouldn't take too long so feel free to join, thanks.

🔥 Right off the bad we can see how this sort of resistance level formed after we last got that channel rejection in April which ended up pushing us further down and down until bulls were able to break that level and get the much sought after breakout which in turn saw our 20,50 day EMA's finally converge which in turn led us to see bulls taking back that 200 EMA which only boosted things propelling us back up into our ascending channel.

🔥 We already know that ascending channel has been doing a lot for us the last few weeks, so it's fair to see that resistance hit again at $2.4 which in itself is a win considering we we're able to establish a higher high versus our last local high on the 28th in which the highest candle closed out at $2.33 so definitely gonna take this latest pull back up as a bullish win.

🔥 Main thing we'll have to watch for now is the bottom of our channel, we already know we'll likely see some price action start trading within the channel as both sides gear up for another tense battle but all of this is excluding a new exciting development for Ripple which I will get into with the next idea.

🔥 Just wanted to keep this idea simple and technical for our technical traders out there, watch that ascending channel and those EMA's. We've already discussed and focused on the fact that the EMA's are lagging indicators but the fact still stands they can give us good confirmation on the trend and it's direction so definitely keep those eyes peeled.

🔥 I've got to run but thanks for tuning in as always for a quick ta, really appreciate it and definitely keep tuned for that next idea with the new development, excited to post on that when I get back and as always, thanks for the support and let's keep our heads up.

Best regards,

~ Rock '

MASTERCARD PICKS XRP AS BRIDGE PAYMENT! ⚡ Hey hey, hope all is well, been a few days since our last post, we got a cool development and I figured I'd give a quick update and follow up with things on that note!

⚡ To start off, Mastercard has now taken on and recognized XRP as a bridge currency for international payments making sure to denote XRP's significance as a token which can process expedited and low cost international payments offering a low-cost solution for traditional international payment methods. One of these traditional payment methods notably is the Society for Worldwide Interbank Financial Telecommunication or as it's better known and referred to as: SWIFT.

⚡SWIFT itself is basically a messaging network that helps banks all around the world process international money transfers averaging about 50 million messages a day or close to roughly $5 trillion per day and even including the 250 business days per year, close to $150 trillion a year. So basically we've got Mastercard picking XRP's fast and cheap expeditated transactions and network as a replacement to SWIFT's traditional message system.

⚡ May not seem too significant but considering just how much XRP is doing, it's slowly taking a bite out of the SWIFT system more and more as more companies and business pick XRP as their form of doing digital transactions replacing a system which has long been overdue for a change citing significant intermediary and middleman cost with traditional international payments as oppose to the sleek and efficient system that Ripple has created and is working towards on a daily basis.

🔥 So yeah, this is a great development for us, it's another step in the right direction and another step towards the Future and change that the company Ripple is seeking to bring about no doubt. Below I'll add a reference link to the Mastercard document which mentions XRP as a bridge currency as well as an article that speaks more on the subject for anyone who would like to check that out.

x.com

www.livebitcoinnews.com

🔥 I've you've made it this far, I appreciate it, we'll take a quick look at our TA and wrap things up.

🔥 In our last idea we noted the main thing was just to watch that ascending channel and see if we could keep within it and we indeed have, we did have a 200 EMA crossover on the 3 hour but bulls managed to pull back up and into the channel so we're definitely in some wavy waters here. We're really testing that channel support as bears try to break it but bulls keep firm. Main thing right now is to watch if we can keep within the channel and potentially make another leg up to $2.4 and break $2.3 which is proving to be a strong horizontal resistance level.

🔥 So basically watch the ascending channel and the horizontal channel, if we do fall out of the ascending channel, next up will be the horizontal channel for a test of support so keep noted with that. Technical aside though we still do have the chance of the SEC approving an XRP Spot ETF soon which if done soon, would more than likely have us seeing a significant breakout and shift in sentiment on behalf of retail and institutional investors so definitely keep your eyes peeled.

🔥 I've got to run but I appreciate the time and and support as always, you already know I'm more than happy to keep you guys updated with me as we continue on with this long but well worth journey. Thanks so much as always and till next, keep posted and have a great day!

Best regards,

~Rock'

XRP | Second Wind or PUMP AND DUMP !!XRP is on another bullish leg at the current moment, moving strongly towards the next resistance zone.

I would however trade with much caution, considering the extreme pump and dump nature of the coin. With high gains in short timeframes, but also massive losses in sort timeframes.

A sharp wick towards the 50d moving averages already shows the buying pressure has likely peaked, even if the price can push higher the BINANCE:XRPUSDT test of the 50d MA is an early sign that bullish pressure is on its last leg:

I will say this: short term, if you look at the chart, you simply must be bullish. But I still won't touch XRP with a ten foot pole at this price. Other altcoins such as TIA present much better, lower risk entries.

_____________________

BINANCE:XRPUSDT

XRP GETS THE ETF APPROVAL!✨ Hey hey, hope all is well, happy to be here with some good news as I'm sure many of you have heard as well, we knew this week could be intense but this is great to see, and without further delay, we'll give the quick rundown.

✨ Yesterday the 27th the U.S. Securities and Exchange Commission Approved three XRP ETFs from ProsShares which is an issuer of ETFs. The ETF's will be three XRP-tracked ETFs as listed: an Ultra XRP ETF, an Ultra Short XRP ETF and a normal short XRP ETF. So basically two ETF's with x2 leverage for the long and shorts and one normal ETF for basic shorts.

✨ Also to note is that the SEC has yet to approve ProShares separate application for a Spot XRP ETF so their still waiting on that approval alongside other asset managers with other XRP spot fund applications such as 21Shares and Grayscale so it seems the SEC is still waiting to approve any direct spot futures on XRP so when that does happen it'll no doubt boost price action and bolster sentiment. I've also added a reference link below to an article on the ETF's for anyone who'd like to read more into the matter.

www.theblock.co

✨Below we'll also take quick look at our technical analysis for the day highlighting a new channel that's formed since we last broke out of our descending channel.

✨As the chart demonstrates, we can see that traders managed to avoid falling below the horizontal channel we spoke on last time and that combined with the ascending channel that's formed and this ETF news has really helped XRP rally back up already over 6% for the week so happy to see the development and the S&P 500 itself has been rallying the last week so that's helped too.

✨ I'll leave the idea here for now, we mainly just have to watch that ascending channel for price action and hope traders can keep price within the channel and continue pushing, especially with the ETF news to help, so keep watch for that on the technical, watch news for the beyond technical and keep posted with me for more updates of course!

✨ As always, thank you so much for all the support, really appreciate you guys and let's keep at it, things will work out.

Best regards,

~ Rock '

XRP AND CRYPTO WHERE DO WE STAND NOW? 🔥 Hey hey, hope all is well, it's another day and another chance to make a change and difference so let's keep at it and give it our best.

🔥 Last few weeks as shown in the chart below we've been following XRP which has been stuck within this descending channel and dragged down along with the S&P 500 as the market took a dive the last few weeks with Trump's tariffs and all the uncertainty surrounding him.

🔥Next we'll look to our 1 hour chart depicting that exit from our descending channel with the horizontal channel as well signifying strength above our $2.00 mark with bulls currently taking the lead, especially as the S&P 500 and market has been more optimistic the last few days contributing to things.

🔥 Main thing right now is to watch that horizontal level and that $2.3 mark which has proved to be resistance a couple times already so we can look to that for a pivot or possible breakout indicator when we come back up again to that mark so I'd set some alerts for that as well as $2.15 which is the top of our horizontal channel. I've been following this channel since the 19th and we can see just the kind of impact it'd had on price action from when we formed this on the 19th as shown below:

🔥 Since then it'd been pretty clear that once we exited the descending channel traders then took to that horizontal channel for price action, indicators as we can see we fell out of the channel once or two before getting pulled back in and breaking out and above the channel bringing us to where we currently sit above it and with that 200 EMA underneath us.

🔥 Next few days I would keep mindful of that 200 EMA as well as the channel, no doubt if we fall back within the channel we'll likely be caught up with some sideways trading action again as traders search for the next breakout or fall depending on how the market sentiment is next week, most of that will fall upon Trump and his words.

🔥 It should be noted that in the last few day's Trump's tone and stances have shifted with him essentially turning down the flame as he expressed, especially after Monday in which trump met with the CEO's for Walmart, Target, and Home Depot which are amongst three of the nations largest retailers with the CEO's warning trump on the effects of his tarrifs and how it would leave shelves empty and disrupt their supply chains. This meet seemingly promtped Trump to shift his stance announcing on Tuesday that he was in the works on trade talks with China looking at much lower tariff deal than the current 145% and clarifying that he had no plan or intention on firing Powell which spread fear and uncertainty in the market last week with some rumors floating around. So we'll have to see what stance Trump takes next week and if he can keep the flame down, and linked below is a reference link to an article for anyone else that wants to read up more:

www.axios.com

🔥 As always, so grateful for the support and everything, appreciate you guys and wishing all the best till next, let's keep our heads up and keep pushing!

Best regards,

Rock'

XRP Wave 2 or Wave B incoming Part 1Hello there,

I am presenting a bearish (short term; current post) count and a bullish count (in my next post). This is showing that we hit a truncated top (see previous posts; attached) and we are coming down in the $1.9 - $1.4 ish range to compete Wave 2 (or could be Wave B) of cycle. I see us pushing to the $2.9 - $3.2 ish range to finish the C wave of the Major wave B of the wave 2 before finishing. it seems to me that we are making a Flat in this sideways chop.

please review and ask me any questions

GOD BLESS AND TRADE ON

Stay Humble and Hungry