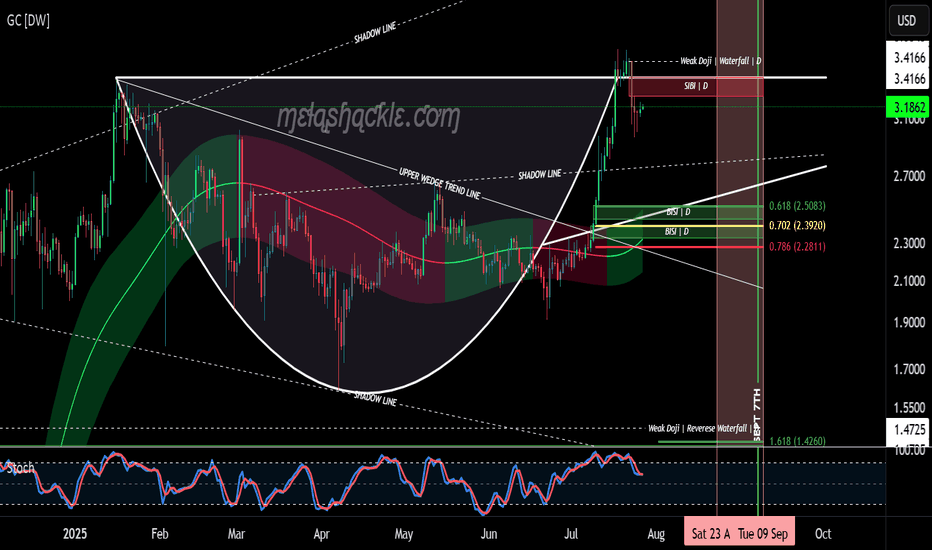

XRP Cup & Handle Pattern on the Daily Chart.XRP is now forming the handle on a very nice cup-and-handle pattern on the daily chart, starting at the previous all-time high set on January 16th, 2025.

But this pattern isn’t all sunshine and rainbows. The price of XRP could drop down into the $2.50 range—toward the bullish fair value gaps I’ve outlined at the bottom of the handle—before making any credible gains or a major breakout to higher levels.

I do believe we’ll see much higher prices in XRP in the coming years as we continue moving into the new global digital financial system. However, for this pattern to fully play out, there will likely be some pain before the pleasure.

I’d keep a close eye on the pink area marked on the charts—spanning from August 23rd through September 8th—as a potential zone for bearish price action.

Luckily for me, my XRP bags have been filled since before the Trump election pump, so I don’t personally need to buy more—unless I see a clear buying opportunity.

Good luck, everyone!

XRPUSDC

XRP to $10? 🚨 XRP to $10? Here's What No One Is Telling You 💣

XRP is quietly being tested as a global liquidity bridge by BRICS & Gulf nations. If Ripple powers the rails of future CBDCs…

$6.50 to $10 XRP becomes a math problem — not a fantasy.

✅ Ripple IPO incoming

✅ U.S. relisting possible

✅ Token supply shrinking

✅ Wall Street quietly watching

This isn’t hype. It’s the sleeper setup of the decade.

Would you hold XRP if it replaced SWIFT?

XRP's situation+ Target PredictionThe XRP is in a Bullish phase by a Falling Wedge Pattern.

A falling wedge indicates the potential for price to reach to $3.

Note if the PRZ ZONE is broken downwards with the strength of Bearish candles , this analysis of ours will be failed.

Best regards CobraVanguard.💚

"XRP Analysis" (Update)Here's what I can gather from the chart right now:

The Minor Resistance zone has been strongly broken to the upside; we haven't seen good pullbacks to this level yet.

On the other hand, below the broken zone, there's a price gap toward the FVG, as indicated by the arrow.

Also, the pullback to the breakout level at 0.382 has not been completed, and no patterns have formed in that area!

So? When we analyze all the breakout factors, we see a very high chance of a correction.

Now, this correction could start from the confirmation level at 2.11 OR 2.05, or with an overextension, it could happen from the 2.3 zone.

Stay Awesome , CobraVanguard

XRP is exhibiting a nice Reverse Dragon Pattern on the Daily.XRP has been doing its best impression of a yo-yo for quite some time now, but as you can see, XRP is also now showing a nice Reverse Dragon Pattern on the daily chart, which has the potential to be extremely bullish in the short to mid term.

The Dragon’s head is now forming on the daily chart, just above the upper trendline and, as I’ve discussed with my followers, has the potential for a strong bullish move upward—followed by a liquidation candle in the general area of the Weak Doji/Reverse Waterfall line—then a continuation move upward, likely back into the $3+ range over the course of the next couple of weeks in the month of May.

Good luck, and always use a stop loss when trading.

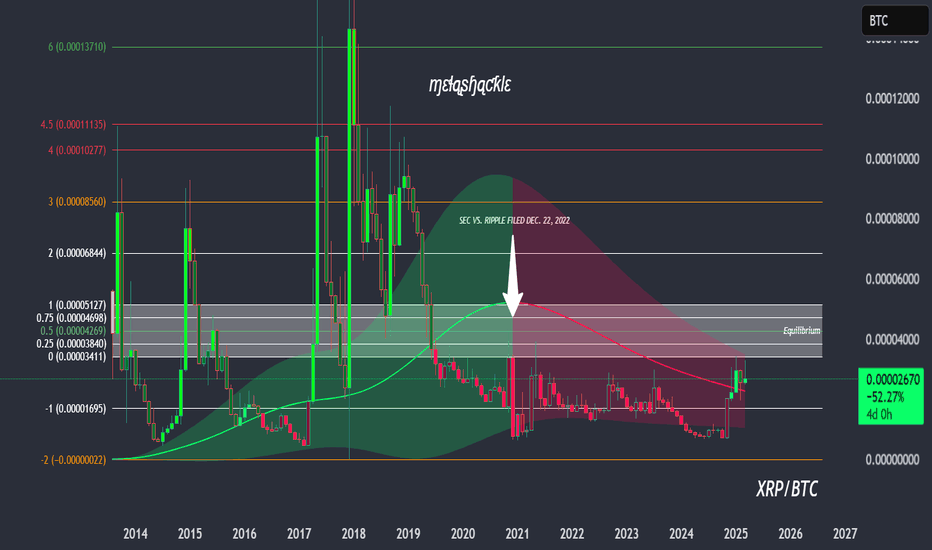

XRP is looking like it may trade back to the equilibrium zone.XRP has been struggling to gain a significant amount of ground and is, in my opinion, one of the most heavily manipulated cryptos in the entire cryptosphere. That should tell you something about its long-term potential if the powers that be are willing to put so much time and effort into keeping its price suppressed.

Good luck, and always use a stop-loss!

XRP with likely levels, and alternatives for April 'flash crash'Here's my latest XRP chart, which includes potential levels that could be hit, along with an alternative path for the 5th wave, assuming the bottom is already in on the chart.

- If wave 4 is already complete, then the wave 6 "flash crash" low would likely be higher than the chart shows, perhaps staying within the lower white trendline (thicker white line).

- If wave 4 isn't complete, then the wave 6 "flash crash" would likely go outside the lower white trendline (thicker white line), targeting the green fair value gap (FVG) in the chart or somewhere between that FVG and the lower white trendline, sweeping the previous lowest low of the entire pattern.

- The fair value gap that absorbed the "Trump Crypto Reserve" tweet breakout—which quickly failed after hitting the gap—would likely be filled during the 5th wave (false breakout leg), taking out that high before the April "flash crash."

- The real breakout, the 7th wave, would likely take out the previous all-time high and run to the top of the pattern, reaching the area of the upper white trendline (thicker upper white line).

I will be going over this chart again very soon for anyone who follows me.

Keep in mind that the "flash crash" in April is a theory and may not come to fruition or could be off in timing. However, I do believe that the breakout will begin in May, even if the "flash crash" does not occur in mid to late April.

Good luck, and always use a stop loss!

My current XRP 'flash crash in April' thesis chartThis is the current chart that I'm using, which includes approximate areas and an approximate timeline for my coming 'flash crash in April' thesis. This involves XRP bottoming out very soon, then going on a 'false breakout' heading into April, followed by a flash crash sometime in mid to late April. This will then mark the low of this area of the chart, and the real breakout will occur sometime in May, which I believe will take XRP to a new all-time high and true price discovery.

Keep in mind that this is a theory, which is developing day by day, and may or may not actually come to fruition. It's based on a chart I've released in the past called 'THE XRP BREAKOUT CHART.'

*** The yellow line on the chart is a simple wave count, and not affiliated with Elliot Wave Theory, just for clarification.

Enjoy the ride.

Good luck, and always use a stop loss!

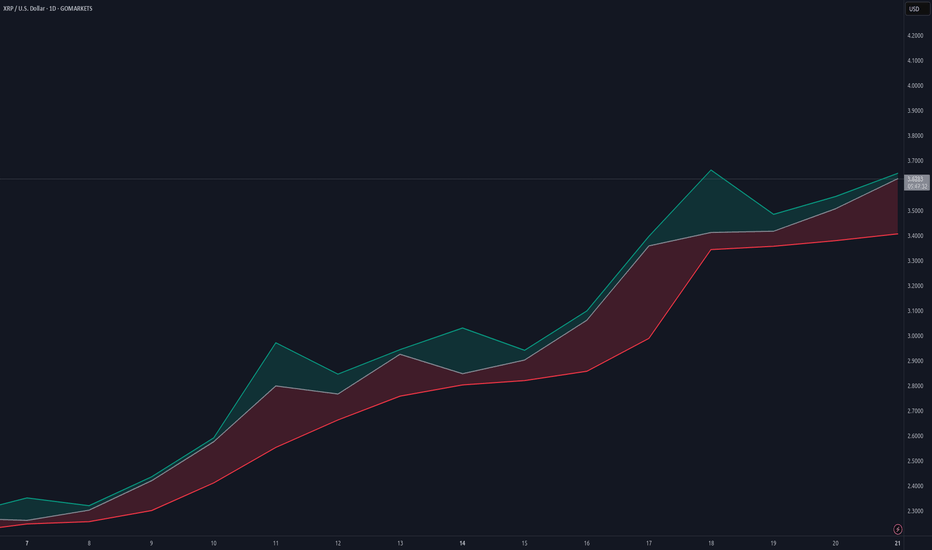

XRP | Know what you hold!XRP went on an absolute tear starting on November 3rd through mid-December during the 'Trump election pump,' but has pulled back and consolidated heavily. Even though we had a nice pump a few days ago when President Trump released his U.S. Crypto Reserve tweet, which featured XRP in the first position on the list, the price action has now retraced the majority of that move.

I wouldn't write off XRP just yet, and regardless of whether it drops more from current levels, there isn’t a crypto on the entire market that has the potential that XRP does moving forward—in my opinion.

Good luck, and always use a stop loss!

XRP - Food For ThougtThe total supply of XRP tokens is capped at 100 billion, ensuring that no more than 100 billion XRP tokens will ever be created. As of now, approximately 52% of the total supply is in circulation, with the remaining tokens held in escrow accounts by Ripple Labs.

Currently priced at $2.54 per token, transferring $1 billion via the XRP Ledger (XRPL) would require 393,700,787.4 XRP. However, if XRP were valued at $100,000 per token, only 10,000 tokens would be needed for the same transaction.

You might be thinking, "That would mean the XRP ecosystem, if fully distributed, would be worth $100 trillion... IMPOSSIBLE!" But let's delve into some numbers. Every day, approximately $5.7-6 trillion is transacted in the foreign exchange (FOREX) market. Annually, this equates to $2.1 quadrillion. If just 5% of that volume were moved across the XRPL, it would amount to $105 trillion. And this doesn't even account for the tokenization of stocks or real estate, which also see trillions in volume.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) system processes an average of nearly 50 million messages per day. While the exact monetary value of these transactions isn't publicly disclosed, it's estimated to be in the trillions of dollars daily. It's important to note that SWIFT and FOREX serve different functions in the financial world. So, in addition to FOREX moving $2.1 quadrillion annually and SWIFT handling another quadrillion, that's a massive volume of transactions. We now know that the XRPL ledger has recently been connected to SWIFT.

So, is a $100,000 XRP a pipe dream? Far from it. Bitcoin has hovered around $100,000 based on user sentiment. XRP represents an infrastructure of value.

XRP drops 47.5% over 18 days after setting a new all-time high.The crypto market crashed today, dragging down virtually every cryptocurrency you can imagine. XRP saw a drastic decline along with the broader market, losing 47.5% since setting a new all-time high was set just 18 days ago. This has many people worried that the decline may continue, but this drop also changed XRP's structure dramatically, merging what were previously two bullish wedges into a single broadening wedge.

If you look closely at the standard Fibonacci levels that I use—based on what I call the "equilibrium zone"—you’ll see that the uppermost and lowest Fib levels align perfectly with the price high and low throughout that 18-day period.

Although the overall market feels bearish right now, as the average retail investor's emotions run off the scale due to the incredible devaluation of their digital asset portfolios, experienced traders and investors see this drop as an opportunity.

There’s no guarantee that this is the bottom or that price will recover the higher levels that have now been lost. However, in my opinion, the chart pattern we now see as a result of this drop has amazing potential if price continues to hold above the lowest green Fib level.

It was a painful day for some and a day of incredible gains for others (shorts), but the game never stops being played. Dust yourselves off, catch your breath, get your game plan together, and keep moving forward.

Good things will come to XRP in due time.

Good luck, and always use a stop-loss!

XRP is just getting started. XRPBTC chart has lots of room left.XRP has made some spectacular moves since the "Trump election pump" began on November 4, 2024, but we haven’t seen anything yet. Bitcoin has been absorbing hundreds of billions of crypto investment dollars during this timeframe, but when money starts fleeing Bitcoin in search of more undervalued assets, XRP will be the prime beneficiary.

Bitcoin is obsolete and is being rejected by countries around the world as a consideration for strategic crypto reserves. ETH is too energy-inefficient and costly to use. XRP is the only viable option. Plus, with RLUSD, the ability to on-ramp or off-ramp has never been easier or more efficient than it is right now.

Get ready!

Good luck, and always use a stop-loss!

XRP bullish wedge pattern update.XRP is kicking butt and taking names. After my previous post, XRP broke sharply to the downside along with the broader crypto markets, sweeping all the liquidity below the current bullish wedge pattern in which it is trading, then reversing course and quickly returning to the equilibrium zone. If you weren't bullish on XRP before that downside move, you should definitely be bullish now. A recovery of that magnitude in such a short window of time is EXTREMELY BULLISH!

I would not be surprised if we see a bullish move to the upside in short order.

Good luck, and as always, use a stop loss!

XRP is holding its own in the equilibrium zone.XRP has been holding its own in the wedge pattern that it is currently trading in. Although it has the potential to form a bearish divergence on the weekly RSI, it appears that XRP is getting ready for another leg to the upside.

Good luck, and always use a stop loss!

XRP is forming a 'potential' bearish divergence on the weekly.XRP looks to be forming a potential minor bearish divergence on the weekly chart. I still think that XRP has plenty of room to run, but we need the bullish momentum to continue in order to negate what could be a minor bearish divergence on the weekly chart.

I'm not saying that it's definitely going to form, or that it will necessarily be bearish, but it has the potential to do so. This is something that we, as traders and investors, need to be aware of and take into consideration, depending on the trades you're considering.

Just something to think about.

Good luck, and always use a stop loss!

The pattern identified in THE XRP BREAKOUT CHART continues...The pattern that I identified in mid-2024, where the price action forms a fair value gap followed by an 8-month candle pattern (3 + 5), and then breaks out on the 8th candle, is playing out exactly as predicted many months ago. This means that if the pattern, which has occurred identically four times thus far, repeats for a 5th consecutive time, we can expect an incredible period of price appreciation following the breakout of the 8th candle in the month of May 2025.

I believe that around mid-April to early May, we will see a 'flash crash' type of liquidity run on the sell-side liquidity before the 8th candle breaks out as predicted.

Prepare to be amazed!

Good luck, and always use a stop loss!