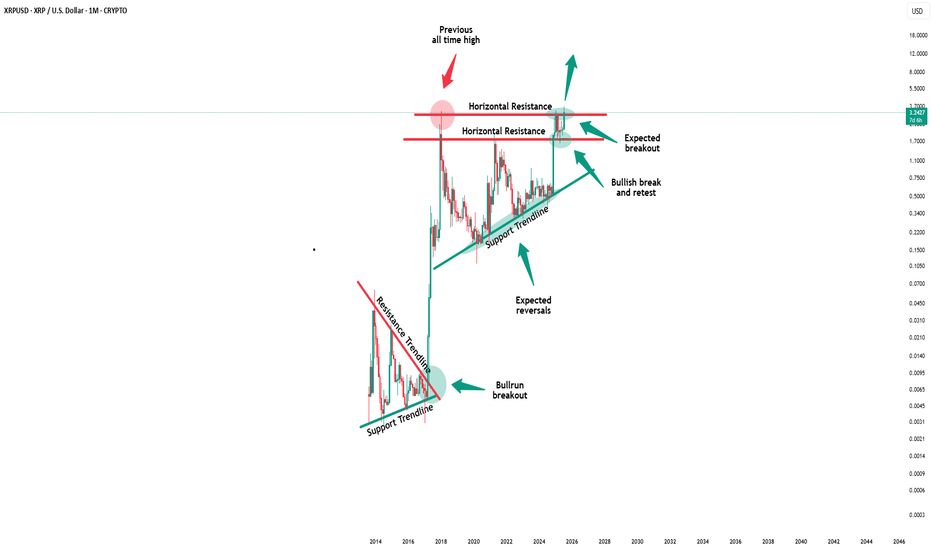

Xrp - This is the bullrun breakout!🔑Xrp ( CRYPTO:XRPUSD ) breaks the triangle now:

🔎Analysis summary:

After the recent bullish break and retest, Xrp managed to already rally another +100%. This is a clear indication that bulls are still totally in control of cryptos and especially Xrp. It all just comes down to the all time breakout, which will then lead to a final parabolic rally.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Xrpusdforecast

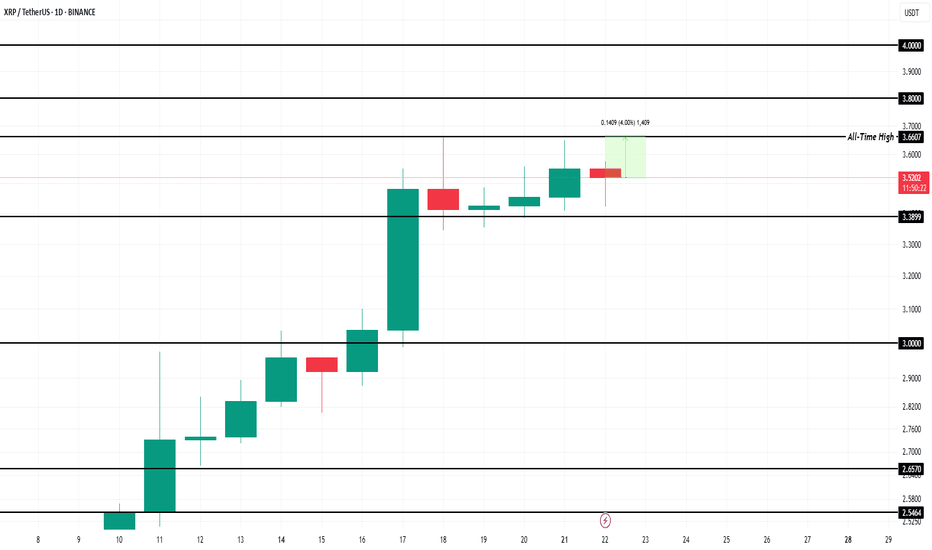

XRP Price Reversal Likely After $2.81 Billion Selling In 7 DaysBINANCE:XRPUSDT is currently trading at $3.48, only 4% away from its all-time high . Over the past week, exchange wallets saw an influx of nearly 450 million XRP, valued at more than $2.81 billion . This spike in supply indicates that holders are moving their assets to sell, usually a bearish indicator in market cycles.

Despite the proximity, BINANCE:XRPUSDT price is showing signs of weakness and is clinging to the $3.38 support level . Without renewed buying interest, this support may not hold much longer.

If investor selling continues, BINANCE:XRPUSDT could fall through $3.38 and test the $3.00 support . A drop to this level would erase the recent gains and confirm a near-term bearish reversal. The loss of $3.00 could signal a longer consolidation phase or deeper correction.

However, if market participants absorb the sold supply and restore demand, BINANCE:XRPUSDT could rebound quickly . In this scenario, the altcoin might surpass $3.66, breach $3.80, and aim for $4.00 . Such a move would invalidate the bearish outlook and set a new all-time high.

XRP Cools Near $3.00 Amid Overbought SignalsFenzoFx—XRP remains bullish after piercing $3.00 earlier this week but cooled near resistance. Trading around $2.90, Stochastic (~84) and RSI 14 (80) indicate overbought conditions, suggesting consolidation.

We anticipate a pullback toward $2.66 support before resuming the uptrend. Alternatively, a decisive break above $3.00 would target $3.21 next.

XRP Technical Analysis – Massive Breakout in Play!After months of tight consolidation inside a symmetrical triangle, XRP/USDT has finally broken out with strong bullish momentum on the daily timeframe.

🔹 Chart Pattern: Symmetrical Triangle

🔹 Breakout Confirmation: Daily candle closed above the descending trendline resistance

🔹 Support Zone: ~$2.00 – $2.20 (Held multiple times since April)

🔹 Breakout Level: ~$2.48 – $2.50

🔹 Next Resistance Levels:

▫️ $2.62 – Minor horizontal resistance

▫️ $3.39 – Major resistance from previous highs

▫️ $4.92 – Long-term macro target (measured move from triangle)

🧠 Why does this breakout matter?

✅ Strong Volume: Breakout happened with increased volume – a sign of genuine breakout

✅ Multi-month Base: The longer the consolidation, the stronger the breakout

✅ Support Respect: XRP respected the demand zone repeatedly, showing accumulation

✅ Momentum Building: A clean break could trigger trend-following bots and new buyers

XRP Breakout Loading… or Just Another Trap?XRP has been locked in a sideways range since early April, bouncing between $1.90 and $2.45 for nearly 3 months.

Now, it’s pressing into the top of that range once again — and traders are watching closely for either a confirmed breakout or another fakeout rejection.

📊 Technical Breakdown:

🔹 Sideways Since April: The structure has been consolidative and indecisive.

🔹 BOS 1 + BOS 2: Each break of structure led to temporary rallies — but failed to hold above resistance.

🔹 Trap Zone Identified: ~$2.45–$2.50 has repeatedly acted as a liquidity magnet.

🔹 Fakeout Risk Still Present: Without strong follow-through, this could reverse into the range again.

📈 Breakout Scenario:

• Clean candle close above ~$2.50

• Targets: $2.90 and $3.20

• Look for volume confirmation

📉 Rejection Scenario:

• Wick into resistance + bearish engulfing

• Back to midrange or support zone ~$2.10

XRP: Break Above $2.338 Opens Path to $2.480FenzoFx—Ripple (XRP) eased near weekly highs of $2.338, with Stochastic and RSI 14 signaling overbought conditions. The trend stays bullish above the anchored VWAP or $2.165, but consolidation toward $2.2240 is expected before resuming.

A break above $2.338 would target the next supply zone at $2.480.

$XRP ALERTCRYPTOCAP:XRP price is pushing toward breakout resistance!

Don't FOMO in yet — confirmation comes above the red zone!

Break and hold above signals bullish continuation

Rejection could lead to a pullback to the demand zone!

Resistance zone: $2.35- $2.63

Support zone: $1.92 - $2.07

Patience brings profits!

XRP Back on the MENU! XRPUSD Ripple next move? XrpUsdtIt's been a while since we looked at this chart.

🌍 SeekingPips 🌎 View remains the same and so we are strictly looking for strategic LONG entry points in

TIME & PRICE. 👌

Yes it's a WEEKLY chart and I understand that many of the trigger happy TRADERS or in some cases GAMBLERS can't stand to look at anything longer than a 30 minute chart BUT really sometimes you really just have to STEP RIGHT BACK to see the BIGGER PICTURE👍

✅️This week's candle CLOSE really has the potential to setup the next few weeks for easy MULTIDAY TRENDING MOVE TRADE SETUPS 👍

ℹ️ Note the price location on what we viewed as a HTF FLAG MANY WEEKS AGO .

Yes it was breached both sides but 🌎SeekingPips🌍 doesn't trade the patterns themselves but the HUMAN PSYCHOLOGY AROUND THESE PATTERNS.🤔

ℹ️ Note where most of the volume has been trading and also note the moves around the extreems of the dead patteren too.💡

In an even higher TIMEFRAME THE FLAG would still be valid and forming the flag itself too.

📊 [ b]CHECKOUT the MONTHLY chart for the example. 📉

Anyway we will see what the next 48 hours🕦 hold but no doubt this one is on our RADAR this week.

✴️ 2.048 to hold otherwise a potential for current low of this year to be tested.

✴️ Alternatively if support starts to form on the 240min chart at current levels last weeks high could expected to be tested

✴️ if so Xrp could easily give a multiday upside trending move.

Now like a NINJA we wait and stalk...

As always ladies and gentlemen whilst Seeking Pips 🌍 SeekingPips 🌎 says

" NO TRIGGER NO TRADE"

& "STICK TO YOUR PLAN"✅️

👍 Have a GREAT WEEK and we will see you soon with an UPDATE...

XRPXRP just created a Inversion FVG on the 1h timeframe, paired with a sweep of the Previous Day Lows, indicates a strong move upwards.

We should see a retest of Previous Day High at $2.36 which may lead to a test of a 4h FVG between $2.38 - $2.40.

If we get any big announcements this weekend, we may see run towards $3 heading into the week.

Have an exit strategy once we have our banana move, it's been a great journey.

LOCK IN.

Is XRP the Next Crypto Rocket?$2,5 Breakout Targets $3.5 or moreI see a clear setup with actionable insights. The chart shows XRP forming a range and deviation at 1.77$, with a recent bullish breakout attempt. Here’s my breakdown:

Technical Analysis

Deviation of the global range points at potential consolidation(blue horizontal line)

Breakout Attempt: A sharp green candle pushed above the $2,36 resistance, but it’s yet to close convincingly above it. The red arrow projecting upward suggests optimism for a move toward $3–$3,5if the breakout holds.

Given today’s date (May 18, 2025, 03:40 PM EEST), this setup aligns with recent crypto market trends. XRP’s price action could be reacting to broader market sentiment, regulatory news, or Ripple-related developments, which have historically driven volatility.

This chart screams opportunity if the breakout holds. However, watch for a false breakout—crypto is notorious for shakeouts. A failure to close above $2,5 could see price retrace to $2,3 or lower. I’d monitor the next 2-3 weeksfor confirmation.

XRPWe are fixing to witness a run to $3 in a hurry.

New outlets, governments, banks, institutions, are all diving into crypto. An ounce of great news for XRP sends us moving up in a HURRY.

Have an exit strategy in place to take profits, and cycle some profits into other assets to continue to build your wealth.

Lock In.

XRPUSDT Bullish Setup – Swing Trade Opportunity Toward $6.00XRP has shown a consistent pattern of strong bullish impulses followed by consolidation zones, and this rhythm has repeated multiple times on the weekly chart—signaling high confidence in pattern continuation.

Let's break it down

🔁 Repetitive Buying + Consolidation Patterns

19 Sep 2022: Strong buying candle triggered a short-term rally, followed by a multi-week consolidation period.

10 July 2023: Similar impulse move occurred—buying strength picked up, and then the price consolidated again.

4 Nov 2024: Most recent and strongest impulse—3 consecutive bullish candles that broke out of long-term descending resistance, confirming structural shift. This was again followed by consolidation—mirroring previous price behavior.

📈 Breakout Confirmation & Trend Structure

Breakout of Descending Trendline (Red): XRP broke out of its long-term bearish trendline decisively, confirming a trend reversal.

Support Zone Holding Firm (1.95 USDT): Price retraced slightly but respected the newly established support above 1.9500.

Consolidation Above Breakout: Post-breakout consolidation is forming a bullish continuation pattern.

Key Technical Levels

Entry Zone (Buy Area): Current zone between $2.10 and $2.50 (ideal accumulation zone for swing traders).

Technical Stop Loss: $1.9500 – key level that has acted as both resistance and now flipped to support.

Take Profit Targets

TP1: $3.4157 – previous resistance and a strong psychological level.

TP2: $6.000 – projected top of current trend channel (green line), aligns with 131.59% upside from current level.

Risk-Reward: Over 5:1 R:R on this setup, extremely favorable for mid-to-long-term swing trades.

Bearish Invalidations

If the price closes significantly below $1.95 on the weekly, the current bullish thesis weakens, and price may retest deeper supports around $1.25 or below. But as long as the structure holds, bulls are in control.

📊 Trade Setup Summary

📥 Entry 2.10 – 2.50

🛑 Stop Loss 1.9500

🎯 Take Profit 1 3.4157

🎯 Take Profit 2 6.0000

⚖️ R:R Ratio 5.32x

The chart tells a powerful story—repeated buying, breakout confirmation, support holds, and continuation setup. XRP is positioning itself for a major move, with $6.00 potentially on the table by the end of 2025.

This is an ideal zone for swing traders and position traders who are comfortable with multi-month holding periods and high R:R setups.

XRP/USD "Ripple vs U.S Dollar" Crypto Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (2.600) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2.4200

💰💵💸XRP/USD "Ripple vs U.S Dollar" Crypto Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XRPPrice has swept the Weekly Lows of last week. Now, we should begin our climb towards $2.36, which was previous weeks high.

We may see a impulse move towards $2.26 mid week, followed by more buying heading into the weekend.

If we fail to break above $2.26 we may see more drawdown towards $2.08 support.

There are plenty of catalyst to propel us towards $2.50+, we should still be accumulating if possible.

Stay diligent, our time is coming!

Crypto XRPUSD Bear Bull Zone! What is Ripple Xrp next Big move? 🌎 Crypto XRPUSD Bear Bull Zone! What is Ripple Xrp next Big move?

🟢SeekingPips🟢 Says...

"when levels are as clean as this we can always use one of our intermediate TIMEFRAMES".

In todays case that task falls onto the 📉 120 MINUTE CHART📈

The GREY ZONE is our BIAS going forward for at least the next 48 HOURS.

Therefore 🟢 SeekingPips 🟢 is strictly BULLISH ABOVE & BEARISH BELOW the GREY ZONE.

🚥 SIMPLICITY is a KEY ingredient to having LONGEVITY in the FINANCIAL MARKETS 🚥

XRP - Modest outlook for 4.21.2025 -

We should see a little pullback around $2.10, I don't believe we will fall under $2.08 again.

With Derivatives trading going live on Coinbase today, we should see a nice push towards $2.25. If we get any more major news come out today, we will reach $2.50 in a hurry.

The bottom is in, if you missed buying under $2, now is your chance to buy under $3. I believe we won't be under $3 for much longer with so many catalyst coming.

THINGS TO WATCH:

- XRP has nearly 20 ETFs fixing to go Live over the next 30 days

- Trump has a plan with GOLD, potential pairing with XRP

XRP/USD "Ripple vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 2.4700

🏁Sell Entry below 2.10000

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 2.2000 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 2.35000 (swing Trade Basis) for Bearish Trade

Using the 3H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 3.1000 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 1.65000 (or) Escape Before the Target

XRP/USD "Ripple vs U.S Dollar" Crypto Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Positioning and future trend..👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩