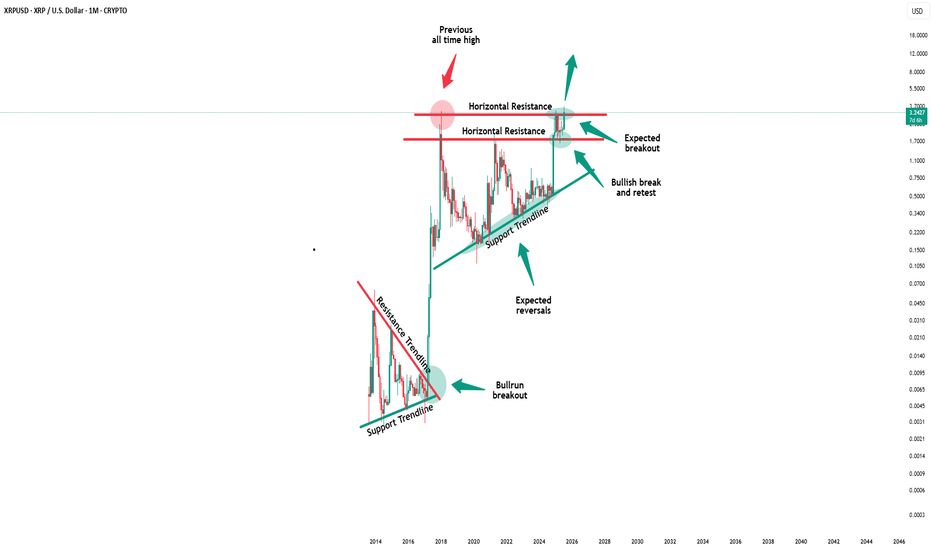

Xrp - It all comes down to this!🚀Xrp ( CRYPTO:XRPUSD ) has to break structure:

🔎Analysis summary:

After Xrp created the previous all time high in 2018, we have been seeing a consolidation ever since. With the recent all time high retest however, Xrp is clearly showing some considerable strength. It all comes down to bulls being able to push price higher, above the massive horizontal structure.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Xrpusdidea

Xrp - This is the bullrun breakout!🔑Xrp ( CRYPTO:XRPUSD ) breaks the triangle now:

🔎Analysis summary:

After the recent bullish break and retest, Xrp managed to already rally another +100%. This is a clear indication that bulls are still totally in control of cryptos and especially Xrp. It all just comes down to the all time breakout, which will then lead to a final parabolic rally.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

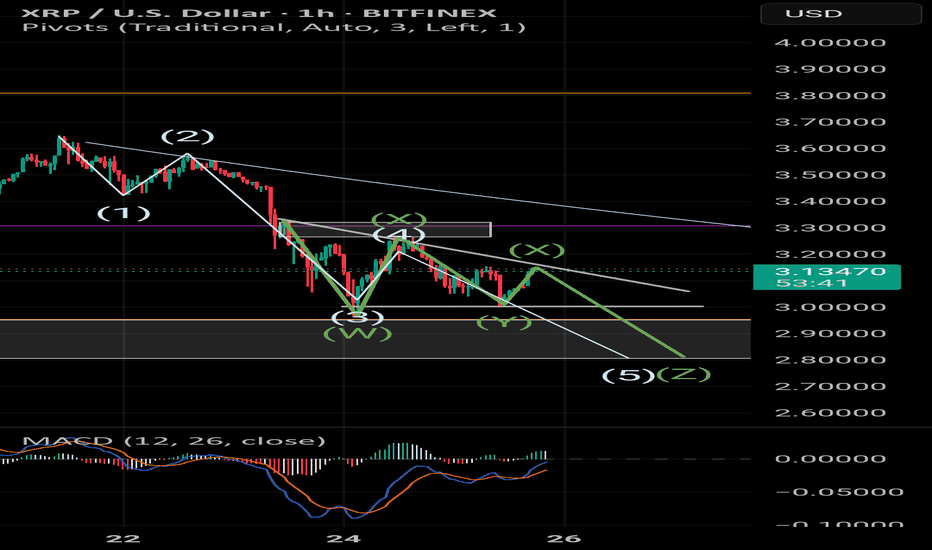

XRP to 2.80So, conjugate waveform or Elliot wave retracement is 5 steps. With 3 being the longest. 5 obviously the lowest. Once a demand or supply zone is tapped/broken into, they want the extreme of that zone. That's why I think 2.80 low.

With, 1234 break on Z out of the bearish Pennant into the demand. Forming the bottom of the, now larger C&H.

And aAaAway we go!

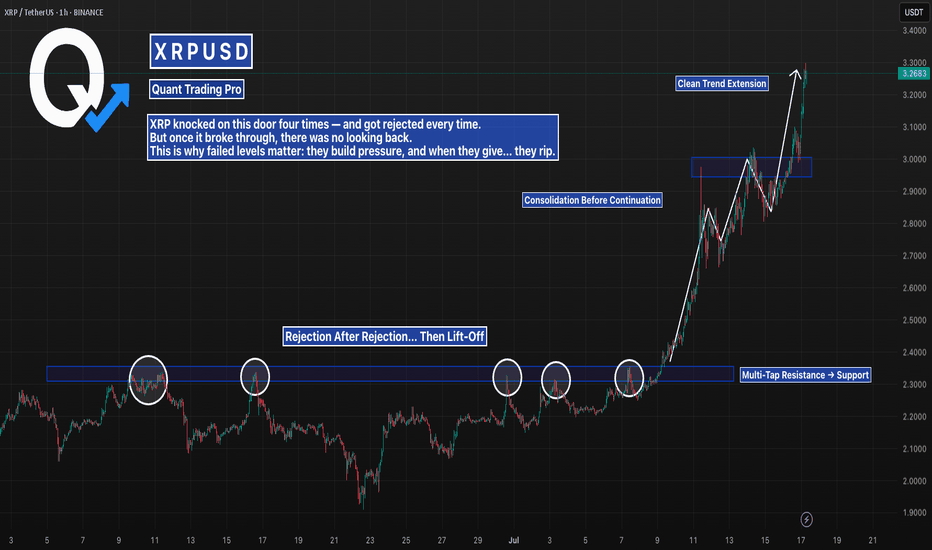

Four Failed Breakouts… Then the Real One HitThe $2.22 level stopped XRP dead in its tracks four times.

Each failed breakout built more pressure — and when it finally cleared, price exploded.

Now it’s trending clean, breaking structure after structure.

This is what a proper breakout looks like.

#XRP #XRPUSD #BreakoutTrading #ChartPatterns #FailedBreakout #CryptoSetup #BacktestEverything #TradingView #QuantTradingPro

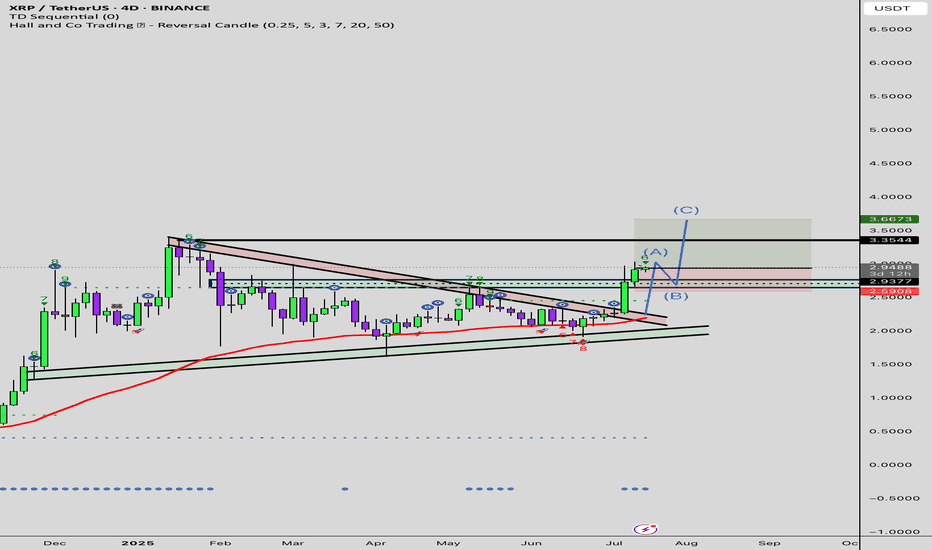

XRP/USD (RIPPLE) BUYtitle: XRP/USD (RIPPLE) BUY

Asset: Crypto

Symbol: XRP/USD

Market Entry Price 1: $2.9450

Limit Entry Price 2: $2.7450

Stop Loss: $2.6450

Take Profit 1: $3.145 (close 10%)

Take Profit 2: $3.345 (close 25%)

Take Profit 3: $3.645(close 50%)

Take profit 4: $3.845 (close 75%)

Let any remaining Xrp run risk free

"XRP/USD: Bullish Raid Alert! Ride or Escape Fast!"🚨 XRP/USD HEIST ALERT: Bullish Loot Grab Before the Escape! (Thief Trading Style) 🚨

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

🔥 Thief Trading Strategy Activated! 🔥

Based on ruthless technical + fundamental analysis, here’s how we SWIPE THE LOOT from XRP/USD (Ripple vs. Dollar). Follow the chart’s Long Entry blueprint—our target is the high-risk YELLOW ATR ZONE (overbought, consolidation, potential reversal). Beware of traps! Bears and cops lurk here, but we strike smart.

🏴☠️ ENTRY:

"Vault’s cracked—bullish loot is FREE GAME!"

Buy Limit Orders preferred (15-30 min timeframe near swing lows/highs).

Aggressive? Swipe instantly—just mind the cops (liquidity traps).

🛑 STOP LOSS (Save Your Loot!):

Swing Thieves: 4H recent wick low ($2.1500).

Risk Tactics: Adjust SL based on your trade size, orders, and guts.

🎯 TARGETS:

Main Take: $2.5400 (or escape earlier if momentum fades).

Scalpers: Longs ONLY! Trail your SL—no greedy holds!

💣 KEY DRIVERS (Why This Heist Works):

Bullish momentum brewing (check fundamentals, COT, on-chain data 👉go ahead to klick 🔗).

NEWS ALERT: Avoid fresh trades during high-impact news—protect open positions with trailing stops!

💥 BOOST THIS HEIST!

Hit 👍 LIKE, 🔔 FOLLOW, and 💬 COMMENT to fuel our next robbery plan. Together, we steal the market’s cash—EVERY. SINGLE. DAY.

📢 Final Warning: Markets shift FAST. Stay sharp, adapt, and CASH OUT BEFORE THE COPS ARRIVE.

🤑 Stay tuned—more heists incoming! 🐱👤🚀

$XRP ALERTCRYPTOCAP:XRP price is pushing toward breakout resistance!

Don't FOMO in yet — confirmation comes above the red zone!

Break and hold above signals bullish continuation

Rejection could lead to a pullback to the demand zone!

Resistance zone: $2.35- $2.63

Support zone: $1.92 - $2.07

Patience brings profits!

XRP Back on the MENU! XRPUSD Ripple next move? XrpUsdtIt's been a while since we looked at this chart.

🌍 SeekingPips 🌎 View remains the same and so we are strictly looking for strategic LONG entry points in

TIME & PRICE. 👌

Yes it's a WEEKLY chart and I understand that many of the trigger happy TRADERS or in some cases GAMBLERS can't stand to look at anything longer than a 30 minute chart BUT really sometimes you really just have to STEP RIGHT BACK to see the BIGGER PICTURE👍

✅️This week's candle CLOSE really has the potential to setup the next few weeks for easy MULTIDAY TRENDING MOVE TRADE SETUPS 👍

ℹ️ Note the price location on what we viewed as a HTF FLAG MANY WEEKS AGO .

Yes it was breached both sides but 🌎SeekingPips🌍 doesn't trade the patterns themselves but the HUMAN PSYCHOLOGY AROUND THESE PATTERNS.🤔

ℹ️ Note where most of the volume has been trading and also note the moves around the extreems of the dead patteren too.💡

In an even higher TIMEFRAME THE FLAG would still be valid and forming the flag itself too.

📊 [ b]CHECKOUT the MONTHLY chart for the example. 📉

Anyway we will see what the next 48 hours🕦 hold but no doubt this one is on our RADAR this week.

✴️ 2.048 to hold otherwise a potential for current low of this year to be tested.

✴️ Alternatively if support starts to form on the 240min chart at current levels last weeks high could expected to be tested

✴️ if so Xrp could easily give a multiday upside trending move.

Now like a NINJA we wait and stalk...

As always ladies and gentlemen whilst Seeking Pips 🌍 SeekingPips 🌎 says

" NO TRIGGER NO TRADE"

& "STICK TO YOUR PLAN"✅️

👍 Have a GREAT WEEK and we will see you soon with an UPDATE...

XRP/USD Crypto Profit Raid: Steal Gains with This Blueprint!🔥 Chart Heist Blueprint: Snag Profits in XRP/USD "Ripple vs U.S Dollar"! 🚀💰

Crafted for sharp traders ready to raid the XRP/USD "Ripple vs U.S Dollar" market, this sleek strategy fuses razor-sharp technicals with savvy fundamentals to maximize your gains. 📊🕵️♂️ Surf the bullish surge, but watch for traps in the Overbought Resistance Zone where bears could strike! 🐻 Lock in your loot before the tide turns. 🌊

- 🎯 **Entry Tactics: Hit the Sweet Spot**

- Long on pullbacks near 1.9000 (or) above the price level 🏹

- The Breakout entry : at 2.5000

- Set alerts for breakouts or pullbacks to strike in real-time. 🔔

- 🛡️ **Stop Loss Hacks: Guard Your Gains**

- Place stops below the nearest 1 Day swing low or candle wick. 🔧

- Tailor stops to your risk and lot size—precision over recklessness! ⚡

- 💸 **Profit Goals: Cash In Big**

- Bullish traders aim for 3.2000 or exit early if momentum dips. 📈

- Scalpers focus on long-side quick wins, trailing stops behind big players. 🚀

- 📡 **Market Edge: Why This Plan Wins**

- XRP/USD "Ripple vs U.S Dollar" is charging bullish, driven by COT data, macro shifts, sentiment outlook, and intermarket flows. 🔍

- Check the linkss for deeper insights. 🌐

- ⚠️ **News Alert: Dodge the Chaos**

- Skip new trades during major news releases. 📰

- Use trailing stops to secure profits on active trades. 🔒

- 🤝 **Join the Profit Crew**

- Boost this plan, share the vibe, and let’s raid the markets together! 🤑

- Stay sharp for the next big score in the XRP/USD "Ripple vs U.S Dollar" heist! 💥

Happy trading, chart bandits! 🎭📉

XRP/USD LONG SET UPTitle: XRP/USD (RIPPLE) BUY

Asset: Crypto

Symbol: XRP/USD

Market Entry Price 1: $2.28

Limit Entry Price 2: $2.08

Stop Loss: $1.88

Take Profit 1: $2.48 (close 10%)

Take Profit 2: $2.78 (close 25%)

Take Profit 3: $3.38 (close 50%)

Take profit 4: $3.88 (close 75%)

Take profit 5: $4.38 (close 100%)

Status: ACTIVE

XRP - Modest outlook for 4.21.2025 -

We should see a little pullback around $2.10, I don't believe we will fall under $2.08 again.

With Derivatives trading going live on Coinbase today, we should see a nice push towards $2.25. If we get any more major news come out today, we will reach $2.50 in a hurry.

The bottom is in, if you missed buying under $2, now is your chance to buy under $3. I believe we won't be under $3 for much longer with so many catalyst coming.

THINGS TO WATCH:

- XRP has nearly 20 ETFs fixing to go Live over the next 30 days

- Trump has a plan with GOLD, potential pairing with XRP

XRP Made a New Lower Low: What's NextFenzoFx—XRP (Ripple) trades at approximately $2.089 and made a new lower low in yesterday's trading session. The primary trend is bearish, as the price is below the 50-period simple moving average.

If the price holds below the immediate resistance at $2.218, the next bearish target could be testing the $1.80 support area.

Conversely, the bearish outlook should be invalidated if XRP/USD exceeds $2.218 and forms a new higher high.

Navigating XRP Regulatory Winds and Technical TidesThe crypto sphere remains fixated on XRP, a digital asset perpetually caught between regulatory scrutiny and promising technological advancements. Recent developments, including the delayed decision on a potential XRP ETF, the nearing conclusion of the SEC vs. Ripple lawsuit, and the launch of CFTC-regulated XRP futures, have injected fresh volatility and speculation into XRP's price trajectory.

ETF Delay and SEC Lawsuit: A Tale of Two Catalysts

The anticipation surrounding a potential XRP Exchange-Traded Fund (ETF) has been palpable. However, the recent delay in the SEC's decision has tempered immediate expectations. While a positive verdict would undoubtedly trigger a massive price surge, the postponement underscores the regulatory hurdles still facing the cryptocurrency market.

Conversely, the long-standing legal battle between Ripple and the SEC is seemingly approaching its denouement. Reports suggest the SEC is considering dropping the case against Ripple, a development that has already spurred significant price appreciation. The dismissal of the lawsuit, even if partial, would provide much-needed regulatory clarity, significantly boosting investor confidence. This potential resolution drove XRP up 12+% to $2.50, indicating the market's sensitivity to legal outcomes.

Technical Analysis: Charting a Course to New Highs

From a technical standpoint, XRP's price action displays a complex interplay of support and resistance levels. A critical resistance zone lies between $2.60 and $2.89. Overcoming this barrier is crucial for XRP to unlock its full potential and embark on a sustained upward trend. However, XRP has shown resilience, maintaining support above the $2.0 mark, which suggests underlying strength.

Analyzing the Elliott Wave theory, some analysts suggest XRP is currently in a corrective Wave 4. Within this framework, the $2.66 level emerges as a pivotal point. Breaking above this level would signal the completion of Wave 4 and the initiation of Wave 5, potentially leading to new all-time highs. This wave count, while speculative, provides a valuable framework for understanding potential price movements.

Conversely, trading below the 100-day moving average (MA) presents a significant setback for XRP buyers. This would signal a potential shift in momentum and could lead to further downward pressure. Investors should closely monitor this MA as a key indicator of short-term price direction.

Bitnomial's XRP Futures: Bridging Traditional and Crypto Markets

The launch of Bitnomial's CFTC-regulated XRP futures marks a significant milestone for the asset. This development provides institutional investors with a regulated avenue to gain exposure to XRP, potentially increasing liquidity and market depth. This regulated futures market may also provide more price stability, while also providing a tool for shorting XRP.

How High Can XRP Price Go After a Ripple Victory?

The question on everyone's mind is: how high can XRP soar if Ripple secures a decisive victory against the SEC? Predicting exact price targets is inherently challenging, but several factors suggest a bullish outlook.

Firstly, regulatory clarity would remove a major overhang that has suppressed XRP's price for years. This newfound certainty would attract a wave of institutional and retail investors who have previously been hesitant to invest due to legal uncertainties.

Secondly, Ripple's continued expansion and adoption of its technology, particularly in the cross-border payments sector, positions XRP for long-term growth. The increasing demand for efficient and cost-effective payment solutions could further fuel XRP's price appreciation.

Thirdly, the psychological impact of a legal victory should not be underestimated. It would validate XRP's legitimacy as a digital asset and potentially trigger a FOMO (fear of missing out) rally.

Based on these factors, some analysts speculate that XRP could potentially retest and surpass its previous all-time high, potentially reaching double-digit valuations. However, the timing and magnitude of such a surge remain subject to market dynamics and regulatory developments.

Why Is XRP Surging? The Convergence of Catalysts

The recent surge in XRP's price can be attributed to a convergence of positive catalysts. The nearing conclusion of the SEC lawsuit, coupled with the launch of CFTC-regulated XRP futures, has created a perfect storm of bullish sentiment.

Furthermore, general market sentiment towards cryptocurrencies has been improving, with increasing institutional adoption and growing awareness of the technology's potential.

Navigating the Volatility: A Word of Caution

While the outlook for XRP appears promising, investors should remain cognizant of the inherent volatility of the cryptocurrency market. Regulatory developments, market sentiment, and technical factors can all significantly impact price movements.

Therefore, investors should conduct thorough research, manage their risk prudently, and avoid making impulsive decisions based on short-term price fluctuations.

In conclusion, XRP is navigating a complex landscape of regulatory headwinds and technological tailwinds. The nearing conclusion of the SEC lawsuit, coupled with the launch of regulated futures, presents a compelling case for a bullish outlook. However, investors should remain vigilant and exercise caution as they navigate the volatile crypto market. The interplay of legal outcomes, technical analysis, and market sentiment will ultimately determine XRP's future trajectory.

XRP/USD Technical Analysis: Trend Reversal and Key Levels to WatThe overall price direction shows a transition from a downtrend to an uptrend, which can be broken down into 3 phases:

Strong Downtrend: At the beginning of the chart, the price declined sharply, dropping from levels above 2.50 to 1.89708 (lowest point).

Consolidation and Correction Phase: After reaching the low, the price started to consolidate and attempt to form a bottom. Several buy signals (green triangles) appeared at the bottom, indicating a potential reversal.

Clear Uptrend: Starting from the middle of the chart, the price began forming higher highs and higher lows, with moving averages crossing upwards, signaling a positive trend continuation.

The main reason for identifying the trend as currently bullish is:

Price recovery to 2.50 after forming a bottom at 1.89.

Moving averages crossing upward.

Increased buying momentum, as seen in technical indicators.

Bullish Indicators

Breakout above previous resistance at 2.30, allowing price to rally towards 2.50.

Moving Averages (MAs) show a positive trend, with price trading above the blue and red lines, indicating continued upward momentum.

Buy signals (green triangles) at lows, suggesting strong buying pressure.

Relative Strength Index (RSI) surpassing 60, indicating bullish momentum.

Increased trading volume during upward moves, confirming buying strength.

Bearish Indicators

Sell signals (red triangles) at resistance levels, which may indicate a price rejection or strong resistance around 2.50 - 2.52.

Price approaching a key resistance at 2.52, where it might struggle to break through without additional momentum.

RSI approaching overbought territory (near 80), which could signal a potential pullback.

High price volatility with a sudden spike, which may lead to short-term profit-taking.

Conclusion

Overall Trend: Bullish after breaking out of the consolidation phase.

Potential Upside Targets: If the price breaks 2.52, it could target 2.60 - 2.70.

Support Levels: 2.30, followed by 2.10 (in case of a pullback).

Resistance Levels: 2.52, then 2.60.

Expected Scenario: As long as price holds above 2.30, the bullish trend remains intact. However, if 2.52 is rejected, a slight pullback may occur before resuming the uptrend.

XRP/USD "Ripple vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (3.0000) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout Level (or) placing the Buy limit orders within a 15 or 30 minute timeframe, Entry from the most Recent or Swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (2.7000) swing Trade Basis Using the 2H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 3.8000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, On Chain Analysis, Sentimental Outlook:

╰┈➤XRP/USD "Ripple vs U.S Dollar" Crypto Market is currently experiencing a bullish trend,., driven by several key factors.

╰┈➤Fundamental Analysis

Network Congestion: Ripple's network congestion has decreased, with an average transaction time of 2 seconds.

Transaction Volume: The transaction volume for Ripple has increased by 12% in the last 24 hours.

Partnerships: Ripple has announced new partnerships with several financial institutions, increasing its adoption and use cases.

╰┈➤Macro Economics

Inflation Rate: The global inflation rate is expected to decrease to 3.1% in 2025, which could lead to increased demand for cryptocurrencies like XRP.

Interest Rates: The US Federal Reserve has maintained its hawkish stance, keeping interest rates at 5.25% to combat inflation.

Global Trade: The ongoing trade tensions between the US and China are expected to have a minimal impact on the cryptocurrency market.

╰┈➤Global Market Analysis

Cryptocurrency Market: The global cryptocurrency market capitalization has increased by 1.5% in the last 24 hours.

Bitcoin Dominance: Bitcoin's dominance has decreased to 40.1%, which could lead to increased demand for altcoins like XRP.

Altcoin Market: The altcoin market has increased by 2.5% in the last 24 hours.

╰┈➤On-Chain Analysis

Transaction Count: The transaction count for Ripple has increased by 10% in the last 24 hours.

Active Addresses: The number of active addresses for Ripple has increased by 5% in the last 24 hours.

Hash Rate: The hash rate for Ripple has increased by 2% in the last 24 hours.

╰┈➤Market Sentiment Analysis

The overall sentiment for XRP/USD is bullish, with a mix of positive and neutral predictions.

60% of client accounts are long on this market, indicating a bullish sentiment.

╰┈➤Positioning

The long/short ratio for XRP/USD is currently 1.6.

The open interest for XRP/USD is approximately 1.2 billion contracts.

╰┈➤Next Trend Move

Bullish Prediction: Some analysts predict a potential bullish move, targeting $3.20 and $3.50, due to the increased adoption and use cases of Ripple.

Bearish Prediction: Others predict a potential bearish move, targeting $2.60 and $2.40, due to the increased competition from other altcoins and the potential decrease in global cryptocurrency demand.

╰┈➤Real-Time Market Feed

As of the current time, XRP/USD is trading at $2.9000, with a 1.2% increase in the last 24 hours.

╰┈➤Future Prediction

Short-Term: Bullish: $3.00-$3.20, Bearish: $2.80-$2.60

Medium-Term: Bullish: $3.50-$3.80, Bearish: $2.40-$2.20

Long-Term: Bullish: $4.00-$4.50, Bearish: $2.00-$1.80

╰┈➤Overall Summary Outlook

The overall outlook for XRP/USD is bullish, with a mix of positive and neutral predictions.

The market is expected to experience a moderate increase, with some analysts predicting a potential bullish move targeting $3.20 and $3.50.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XRP - WHAT HEAD AND SHOULDERS?XRP has gained a lot of attention by influencers who claim the chart forms a head and shoulders top.

logic tells me to do the opposite of any influencer or news headline.

what's a more optimistic pattern than the dreaded head and shoulders? perhaps a bullish consolidation wedge? XRP's chart is full of bullish flags and symmetrical triangles. if one focuses on not just a pattern, but a common pattern (very meta indeed), there seem to be common points where rays can be projected.

it just so happens those rays in my opinion show me the consolidation range, breakout point, and retracement level before confirmation and continuation.

anyone else see what i see?

XRP/USD "Ripple vs US Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 3.0000

Sell Entry below 2.2000

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

Thief SL placed at 2.7000 (swing Trade Basis) for Bullish Trade

Thief SL placed at 2.5000 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 4.1000 (or) Escape Before the Target

-Bearish Robbers TP 5.0000 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XRP/USD "Ripple vs US Dollar" Crypto market is currently experiencing a Neutral trend (there is a higher chance for Bullishness)., driven by several key factors.

🔶Fundamental Analysis

Ripple Adoption: Growing adoption of Ripple's payment technology, with increasing partnerships with major financial institutions

XRP Supply: The total supply of XRP is capped at 100 billion, which could lead to increased demand and higher prices

Regulatory Environment: The regulatory environment for XRP is still uncertain, which could impact its price

🔷Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for cryptocurrencies, including XRP

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for cryptocurrencies as a hedge against inflation

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting cryptocurrency markets

🔶COT Data

Net Long Positions: Institutional traders have increased their net long positions in XRP to 60%

COT Ratio: The COT ratio has risen to 2.5, indicating a bullish trend

Open Interest: Open interest in XRP futures has increased by 20% over the past month, indicating growing investor interest

🔷Sentimental Outlook

Institutional Sentiment: 65% bullish, 35% bearish

Retail Sentiment: 60% bullish, 40% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +40.

🔶Technical Analysis

Moving Averages: 50-period SMA: 2.5000, 200-period SMA: 2.2000.

Relative Strength Index (RSI): 4-hour chart: 68.21, daily chart: 64.14.

Bollinger Bands: 4-hour chart: 2.8000 (upper band), 2.5000 (lower band).

🔷Market Overview

Current Price: 2.7500

Daily Change: 4.2%

Weekly Change: 18.1%

🔶Overall Outlook

The overall outlook for XRP/USD is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in Ripple adoption, growing demand for XRP, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XRP AnalysisXRP Analysis

XRP is currently trading at 2.38, which represents a significant support level that has historically demonstrated its strength in preventing the price from breaking lower. On the occasion when the price did briefly penetrate this level, it was quickly rejected, and the candle closed above the support line. This rejection and subsequent close above the level further reinforces its importance and highlights the respect for this support by price action.

With the price now trading above this key level, it is reasonable to anticipate a potential bullish movement, suggesting a possible upward trend could emerge.

What are your thoughts on this scenario? As always, it is crucial to conduct thorough analysis and consider risk management strategies before taking any trading positions.

XRP/USD "Ripple vs US Dollar" Crypto Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📉 : Traders & Thieves with New Entry A bull trade can be initiated at any price level.

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 2h period, the recent / nearest high level

Goal 🎯: 2.55000 (OR) Before escape in the market

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental Outlook 📰🗞️

The XRP/USD (Ripple vs U.S Dollar) market is expected to move in a bearish direction, driven by several key factors.

🟢Fundamental Analysis

Lack of Adoption: Despite Ripple's efforts, XRP's adoption as a payment solution has been slow, leading to decreased demand.

Increased Competition: Other cryptocurrencies, such as Stellar (XLM) and Bitcoin (BTC), are gaining traction as payment solutions, increasing competition for XRP.

Regulatory Uncertainty: The ongoing SEC lawsuit and regulatory uncertainty in other countries have created a negative environment for XRP.

🟡Macro Analysis

Cryptocurrency Market Downturn: The overall cryptocurrency market has been experiencing a downturn, with many assets losing value.

Global Economic Uncertainty: Economic uncertainty, trade tensions, and geopolitical risks have led to increased market volatility, negatively impacting XRP.

Inflation and Interest Rates: Rising inflation and interest rates in some countries have decreased the attractiveness of cryptocurrencies like XRP.

🔵Market Sentiment

Institutional Investors: Institutional investors have been reducing their XRP holdings, contributing to the bearish sentiment.

Retail Traders: Retail traders are increasingly bearish on XRP, with many expecting further price declines.

📌Sentiment Analysis

- Bearish Sentiment: 62% of traders and investors are bearish on XRP/USD, expecting a price drop.

- Bullish Sentiment: 26% of traders and investors are bullish on XRP/USD, expecting a price increase.

- Neutral Sentiment: 12% of traders and investors are neutral on XRP/USD, expecting no significant price movement.

📌Retail Trader Sentiment

- Long Positions: 42% of retail traders have long positions on XRP/USD.

- Short Positions: 58% of retail traders have short positions on XRP/USD.

📌Institutional Investor Sentiment

- Bearish Sentiment: 70% of institutional investors are bearish on XRP/USD.

- Bullish Sentiment: 20% of institutional investors are bullish on XRP/USD.

- Neutral Sentiment: 10% of institutional investors are neutral on XRP/USD.

Please note that sentiment analysis can change rapidly and may not always reflect the actual market performance. These percentages are based on current market data and may not reflect future market movements.

🟣Latest and Upcoming Events

SEC v. Ripple Lawsuit: The ongoing lawsuit has created uncertainty and negatively impacted XRP's price.

Ripple's Q4 2022 Earnings Report: The report showed decreased revenue and customer growth, contributing to the bearish sentiment.

Upcoming Regulatory Decisions: Regulatory decisions in the US and other countries may further impact XRP's price.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

🚨Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

🚨Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂