XRPUSD top-down analysis Hello traders, this is the full breakdown of this pair. We will take this trade if all the conditions are satisfied as discussed in the analysis. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Xrpusdsignal

A complete review of the popular Ripple currency in Elliott stylAccording to the complete review I did on the previous rising trend, I came to the conclusion that this rise was done during a complete wave (ABC).

as a result :

We have to wait for the completion of a full 5 waves.

According to my research, we are now in wave 3 of decline.

Wave 3 itself is an extended wave and 5 waves, which has already completed 3 waves out of 5 waves and we are currently making wave 4 from wave 3.

This wave is erosive and with many fluctuations.

Wave 4 itself moves in the form of (ABC), which is currently being created as wave (A).

Make the most of the fluctuations of this wave.

Note: This trend is a trend (ND.A), so if you use Fibonacci, the safest level to take the price floor is 50%.

In this trend model, we see high volatility and large price shadows, so if you use 50% fibo, set your loss limit to 83%.

(be successful and profitable)

XRP Buy a break of pivotal value.XRP - Intraday - We look to Buy a break of 0.3374 (stop at 0.3288)

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible.

Short term momentum is bullish.

0.3362 has been pivotal.

0.3372 has been pivotal.

A break of 0.3372 is needed to confirm follow through bullish momentum.

Our profit targets will be 0.3619 and 0.3719

Resistance: 0.3370 / 0.3500 / 0.3600

Support: 0.3200 / 0.3100 / 0.3060

XRP: Can recent bullish momentum last?!XRP

Intraday - We look to Buy at 0.3771 (stop at 0.3658)

Support is located at 0.3800 and should stem dips to this area. 0.3755 has been pivotal. We are trading at oversold extremes. We look for a temporary move lower.

Our profit targets will be 0.4048 and 0.4098

Resistance: 0.4100 / 0.4250 / 0.4400

Support: 0.3900 / 0.3800 / 0.3700

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’) . Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

XRP Bullish...XRP has been in a downward trend since topping on 14th April 2021, and have been expecting to get into the bluebox since the beginning of the year(2022) and now we are there, and still expecting to go lower!

That top(14 April) marked a decline in a 7 swing sequence which has been in play and is about to end. What I see currently is a push to the upside to about $0.51, which completes wave 4 in the orange colour degree of which we will see the price moving lower to break the May 12, low ($0.33). I am expecting price to reach about $0.25 which is the bottom of the channel trendline containing a zig zag structure completing our (5th wave in orange, & also (y) in blue; and also our(Y) in the white degree and in-turn our wave (ii) in purple. Only then can we expect price to push up higher to new highs. Understanding wave degrees is the primary key to know which direction price will take especially in such a corrective Instrument which has been held up by the SEC lawsuit.

Alternative View....!

On this Instrument, the alternative will come in play if price breaks below $0.11, otherwise there isn't much of a downside possibility, (Take with Caution!)

NOTE: I would love to see the 5th wave that will break the May 12, ($0.33) moving impulsively to the downside( a spike) to show exhaustion.

Price could also turn from were it is currently with the most important thing it has to do is break the May 12, 2022 low.

Target:

1st at $3.00 (conservative)

2nd at $13.00

3rd at $120.00

If however you are a XRP holder like me I wouldn't Shy away a Price of $9700, its a very plausible target...

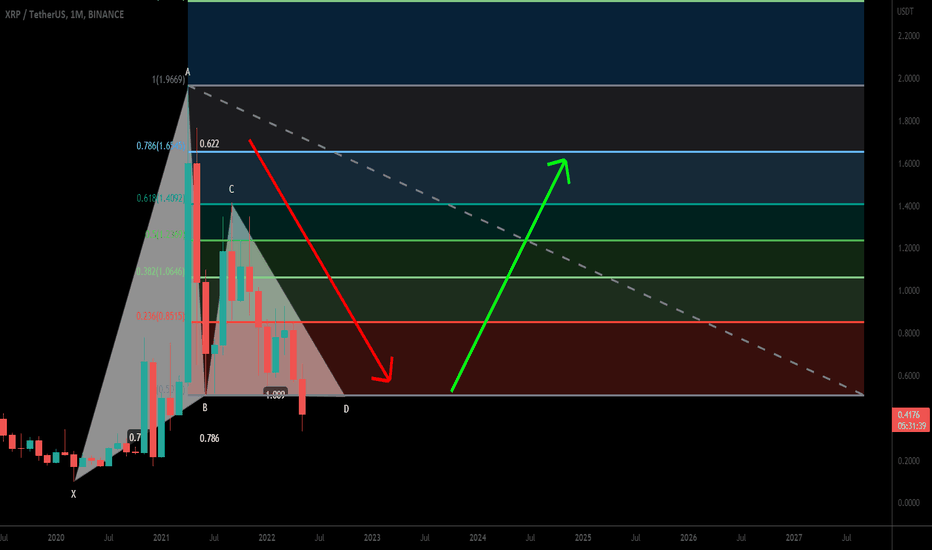

XRP formed big bullish Gartley for upto 870% huge moveHi dear friends, hope you are well and welcome to the new trade setup of XRP.

On a monthly time frame, XRP has formed a bullish Gartley pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

XRPUSD Short-term trade signal!Hi friends, I hope y'all having a profitable week ;)

Today, we've got two weekly counter-trend bullish signals on top of the long-term trend bearish signal that we took a trade on the first week of May 2022. We still going to hold the long-term trade till we get an exit signal that will trigger once the price has bullish broke and closed above the 1st Weekly Key Lvl and 8 m.a. The counter-trend trade we aiming to take, will probably end on the long-term trades exit key level. So we kind off looking to breakeven in some way here. Now lets take a look at how the bulls and bears will behave in triggering the 2 trades and dis-confirming them.

Bulls: -The price may bullish rally to the last take profit point - probably after it has bearish bounced off the Mini Daily Half a Neckline/4H Neckline 2 and 8 (dark blue) m.a (1st signal) to bullish breaking and retesting the Mini 4H Half a Bat Neckline (2nd signal) . That will trigger what I call a Double Bottom C-E.1 & E.2 signal.

Bears: The price will dis-confirm the rally - probably after it has formed a bearish reversal pattern that will drop the price to bearish and retest the 4H Neckline together with the 50 (light blue) and bearish crossed (dark blue and red) m.a's.

That's its. I hope you found value in this. If you have a different view, feel free to share it in the comments section. I'd love to know your thoughts!

Stay Blessed,

Doji-2K1