XRP is looking like it may trade back to the equilibrium zone.XRP has been struggling to gain a significant amount of ground and is, in my opinion, one of the most heavily manipulated cryptos in the entire cryptosphere. That should tell you something about its long-term potential if the powers that be are willing to put so much time and effort into keeping its price suppressed.

Good luck, and always use a stop-loss!

XRPUSDT

Xrp (Ripple)Ripple

Xrp usdt Daily analysis

Time frame daily

Risk rewards ratio >3.2 👈👌

Target 3.2$

Ripple technical analysis ✅️

My last short position reached the target.

Head and shoulders pattern completed.

Now it is a good time to start

My critical area is red box that you see on the chart. It is very important area .

If Ripple can reach and break this resistance, we will have a good pump

But now 3 _3.2$ is a good target

XRPAs we bear the end of April, we should see continuation to the upside eyeing $2.50.

May is filled with ETFs going Live, Paul Atkins will come to a conclusion on the XRP v SEC case, plus many more catalyst.

Once we break $2.50 we will hit $3, very quickly. From there, the upside is hard to predict. We've seen $5 - $100 by the end of year, but in all honest. We must stay patient, and continue to stack our bags.

THIS IS NOT FINANCIAL ADVICE. IT IS MY OPINION ONLY.

Can XRP crack resistance and rally straight to $2.50?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Ripple 🔍📈.

Ripple appears poised for a potential breakout above its current descending channel in the coming days.

A projected upside of at least 16% is anticipated, with the primary target set at $2.50.

This level aligns closely with a key resistance zone, marking a critical point for bullish momentum.📚🙌

🧨 Our team's main opinion is: 🧨

Ripple may soon break out of its downtrend, targeting a 16% rise toward the key $2.50 resistance level.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

XRP Update, It Gets Better —You Deserve The Best!We have some movement but not wild movement. This can be considered good and bad.

This is good if you want to enter a trade with this pair, it is still early.

This is bad if you are already in and would like to see growth. If that's the situation you are in, just wait patiently because the market will reward you for your patience; it will get better.

The consolidation pattern has been broken. A very small downtrend line has been broken and XRPUSDT is fully bullish.

» XRP is trading daily above EMA55, EMA25, 9, 10, 20, etc. So this is bullish confirmed.

» XRP is also trading daily above SMA200 (MA200) safely and this is the most important moving average for the long-term perspective. Trading above this level means and confirms that XRPUSDT is in a situation where it can grow for months.

"It can grow for months," think about it... Not three days, three weeks or two months, many months. Focus on the long-term.

The market will move and grow but this growth will never be the end. Wait for the peak price before collecting profits because this will be an awesome bullish wave.

Patience is absolutely key.

We got a great entry, great entry prices and timing, the next challenge is to sell at the right time. The market will try to shake you out of your hand (your position). Do not let it do so.

If you focus on the long-term, you know prices will be growing regardless of what the short-term does. Knowing this, aim high... You deserve the best. You deserve big profits because you are here when everybody is gone.

You were here when the market was depressed and you were greedy when others were fearful, now you only need to hold.

You made the right choice so stay with it long-term.

You are blessed and you have great timing. Make the most of your position.

Truly, you deserve the best.

Namaste.

XRP ANALYSIS🚀#XRP Analysis :

🔮As we can see in the chart of #XRP that there is a formation of "Falling Wedge Pattern". In a daily timeframe #XRP broke out the pattern. Expecting a bullish move in few days if #XRP retest the levels

⚡️What to do ?

👀Keep an eye on #XRP price action. We can trade according to the chart and make some profits⚡️⚡️

#XRP #Cryptocurrency #TechnicalAnalysis #DYOR

Check support near 2.2582

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(XRPUSDT 1D chart)

XRP's important support and resistance area is near 2.6013.

When this area breaks upward, it is the breakout trading period.

However, in order to feel more stable, buy when support is confirmed near 2.2582.

Therefore, XRP is still in an ambiguous position to consider it as a buying period.

It is not good to think that you can make more profit by buying in advance when there is not much left anyway.

The reason is that it is highly unlikely that a suitable countermeasure will be made.

Therefore, even if you buy at a slightly higher price, it is best to buy when it fits your own rules, that is, your trading strategy.

-

Like BTC, since the HA-Low indicator has been leveled off since it was created, if it rises above the HA-Low indicator this time, it is likely to lead to an additional rise.

If it does not rise and falls, it is highly likely that the price will continue to rise only if it maintains above the M-Signal indicator on the 1M chart.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

XRP Friendly Reminder, Amazing Opportunity, Last ChanceThis is just a quick update for you but a very important one; this is the last chance.

The vacations week is over and the market is in no situation to continue with boring sideways anymore. XRPUSDT is about to blow up and this is the last chance to enter before bullish momentum starts to grow.

You can approach this chart and this pair in whatever way you like, just make sure to be in because once the first jump happens, there is no going back, it is gone forever; never to trade at this low prices ever again.

A major low happened just weeks ago, we are seeing some consolidation now. As the consolidation ends, we will get the start of the next bullish jump. This next bullish jump is the 2025 bull market in full force. The strongest growth in many years. For most of the market, it will be the best since 2021, for XRP, it will be the best since 2017, so this will be big.

It is better to be in and positioned than to miss.

You cannot miss this.

This is it!

I hope this article finds you well.

Timing is right. This is a successful trade.

Thank you for reading.

Buy and...

Just buy!

Namaste.

XRP/USD "Ripple vs U.S Dollar" Crypto Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (2.1000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (1.9500) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 2.2700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XRP/USD "Ripple vs U.S Dollar" Crypto Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XRP/USD "Ripple vs U.S.Dollar" Crypto Market Heist (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S.Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2.0500) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (2.3000) Swing / Day Trade Basis Using the 5H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.6500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XRP/USD "Ripple vs U.S.Dollar" Crypto Market Heist Plan is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XRP/USD "Ripple vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 2.4700

🏁Sell Entry below 2.10000

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 2.2000 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 2.35000 (swing Trade Basis) for Bearish Trade

Using the 3H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 3.1000 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 1.65000 (or) Escape Before the Target

XRP/USD "Ripple vs U.S Dollar" Crypto Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Positioning and future trend..👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XRPThe next leg up is NOW.

We've bounced off the .786 fib nicely, next we're eyeing a fast push towards $3.

I don't think we will ever fall below $2 again, SWIFT news is coming, ETF approvals are less than a month away, and the U.S. government will make a move to save the dollar.

We are on the cusp of something truly incredible.

LOCK IN. 🔒

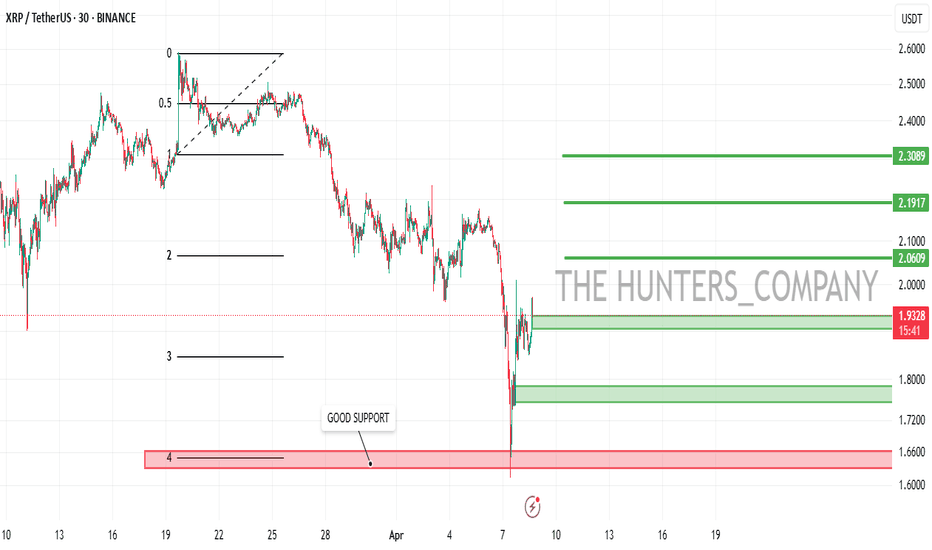

XRP/USDT Breakout Pattern (15.04.2025)The XRP/USDT Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 2.0158

2nd Support – 1.9362

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

SHORT XRP/USDT🔥 #XRP/USDT

🔴 SHORT

🎲 Entry Zone: 2.1110

✅ Take Profit 1: 2.0675

✅ Take Profit 2: 2.0242

✅ Take Profit 3: 1.9545

✅ Take Profit 4: 1.8867

(Extended if Momentum Persists)

❌ Stop Loss: (A Strong Close Above 2.2100 Invalidates the Short Setup)

💱 Recommended Margin: 2.5% - 5%

🧳 Recommended Leverage: 5X - 15X

⚠️ Take Care of Risk Management for Your Account

XRP - Breakout will push the price to 5+ USDPrice got reject around the previous resistance line formed after hitting the new ATH on 2017. After 7 long years XRP was able to hit the previous ATH value.

After getting reject from the ATH XRP is trading inside the channel, a breakout from this channel would push the price to previous ATH and a strong breakout from previous resistance is needed to reach new ATH.

Lets see if the price break the channel.

Cheers!

GreenCrypto

XRP/USDT I Reverse Short Squeeze Alert! Resistance at 2 USDTHey Traders after the success of my Previous trade this month on NASDAQ:HOOD hitting Target 1 & 2 in 2 days more than 16%+

With a Similar Trade setup But Crypto I bring you today

BINANCE:XRPUSDT

Short opportunity

- Market structure

- Head and shoulder pattern

- Currently will be trading at supply zone which was a recent support and now an ideal place for a reversal which is taking place as we speak- 4 Hour TF.

- Breakdown and retest

- Risk Aversion Dynamics in Cryptocurrency Markets

PROTIP/-

Entry on Bearish candle stick pattern on Current Levels

Stop Loss : 2.2292

Target 1 : 1.4707

Target 2 : 1.0507

Technical View

The orange circle marks a double top within the supply zone, acting as the shoulders of a larger head and shoulders pattern, suggesting strong resistance.

Bearish Trendline

breakdown + Retest

Risk Aversion Dynamics in Cryptocurrency Markets

Fundamental View - How Current Affairs can effect this pair!

The proposed imposition of significant tariffs, such as the 60% levy on Chinese imports suggested by former U.S. President Donald Trump, could trigger a chain reaction across global markets. This scenario would likely amplify risk aversion among investors, potentially catalyzing a sell-off in risk-sensitive assets like XRP (Ripple) in favor of perceived safe havens such as the U.S. dollar (and by extension, Tether/USDT). Below, we analyze the mechanics of this relationship and its implications for the XRP/USDT trading pair.

1. Tariff Escalation and Its Macroeconomic Consequences

1.1 Direct Impact on China’s Economy

A 60% tariff on Chinese exports to the U.S. would directly reduce China’s export competitiveness, potentially lowering its GDP growth by 1.5–2.5 percentage points annually, according to UBS economists. This slowdown would exacerbate existing vulnerabilities in China’s economy, including a property market crisis, weak domestic demand, and deflationary pressures (June 2024 CPI: 0.2% YoY). Reduced economic activity in China—the world’s second-largest economy—could dampen global trade volumes and commodity prices, indirectly affecting risk sentiment in financial markets.

1.2 Global Spillover Effects

The UBS analysis highlights that retaliatory measures by China or other nations could amplify trade fragmentation, further destabilizing supply chains and corporate earnings. For example, the April 2025 announcement of 25% U.S. tariffs on automotive imports triggered a 2.9% drop in the S&P 500 and a 5–7% decline in major Asian equity indices. Such volatility often precedes broader risk aversion, as investors reassess exposure to growth-dependent assets.

2. Risk Aversion Dynamics in Cryptocurrency Markets

2.1 Flight to Safety and USD Appreciation

During periods of economic uncertainty, capital typically flows into safe-haven assets like U.S. Treasuries and the dollar. Tether (USDT), a stable coin pegged 1:1 to the USD, often benefits from this dynamic as crypto traders seek stability. For instance, Bitcoin’s role as a “weak safe haven” for the USD in acute crises suggests that stable coins like USDT could see increased demand during tariff-induced turmoil, while altcoins like XRP face selling pressure.

2.2 XRP’s Sensitivity to Risk Sentiment

XRP, unlike Bitcoin, lacks established safe-haven credentials. Its price action in Q2 2025 exemplifies this vulnerability: a 7.5% decline over 30 days (peaking at 2.57 USDT on March 19 and bottoming at 1.64 USDT on April 7). This volatility aligns with broader patterns where altcoins underperform during risk-off periods. A global slowdown would likely intensify this trend, as retail and institutional investors reduce exposure to speculative crypto assets.

3. Mechanism: From Tariffs to XRP/USDT Price Decline

3.1 Investor Behavior in Risk-Off Environments

Tariff Announcements → Equity Market Sell-Off: The April 2025 auto tariffs caused a 6–7% drop in Asian equities, signaling growing risk aversion.

Liquidity Reallocation: Investors exit equities and crypto (including XRP) to hold cash or cash equivalents like USDT.

USD/USDT Demand Surge: Increased demand for USD lifts USDT’s relative value, pressuring XRP/USDT downward.

3.2 Technical and Fundamental Pressure on XRP

Supply-Demand Imbalance: As sellers dominate XRP markets, the token’s price in USDT terms declines. The 14.56% 90-day volatility in XRP/USDT suggests heightened sensitivity to macroeconomic shocks.

Liquidity Crunch: A broader crypto market downturn could reduce trading volumes, exacerbating price swings.

4. Historical Precedents and Limitations

4.1 Bitcoin’s Mixed Performance as a Hedge

While Bitcoin has shown limited safe-haven properties for the USD in short-term crises, its decoupling from altcoins like XRP during stress periods is well-documented. For example, Bitcoin’s 40% rebound post-COVID crash contrasted with XRP’s prolonged slump in 2020–2021.

4.2 Mitigating Factors

Stimulus Measures: If China implements aggressive fiscal stimulus, as UBS posits, a partial recovery in risk appetite could cushion XRP’s decline.

Crypto-Specific Catalysts: Regulatory clarity or Ripple-related developments (e.g., SEC case resolutions) could counteract macro-driven selling.

5. Conclusion: Bearish Outlook for XRP/USDT in Tariff Scenario

In a tariff-driven slowdown, the XRP/USDT pair faces downward pressure due to:

Risk Aversion: Capital rotation from crypto to stable coins.

USD Strength: USDT demand surges as a proxy for dollar safety.

Altcoin Underperformance: Historical precedent of XRP lagging during macro stress.

People interested should monitor China’s policy response and U.S. tariff implementation timelines, as these factors will determine the severity of XRP/USDT’s downside. A breach below the April 7 low of 1.64 USDT could signal prolonged bearish momentum.

This analysis synthesizes macroeconomic triggers, market psychology, and cryptocurrency-specific dynamics to outline a plausible pathway for XRP/USDT depreciation amid escalating trade tensions.

Not An Investment Advise

Is a 20% Pump to $2.60 Now in Play for Ripple?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Ripple 🔍📈.

Ripple is currently approaching a highly significant trendline, signaling a potential breakout. In addition, the emergence of strong bullish volume suggests growing investor confidence and momentum building toward an upward move. From this level, I anticipate at least a 20% price increase, with the primary target set at $2.60, as the critical $2.50 resistance level appears poised for a breakout in the coming days.📚🙌

🧨 Our team's main opinion is: 🧨

Ripple is gaining momentum near a key trendline with strong buying volume, eyeing a 20% move toward $2.60 as the $2.50 resistance looks ready to break. 📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

XRP/USDT:BUY LIMITHello friends

Due to the price drop, we have reached a good support area, which you can see is supported by good buyers.

Now we can buy in stages and with capital management in the specified areas and move to the specified targets.

Always buy in fear and sell in greed.

*Trade safely with us*