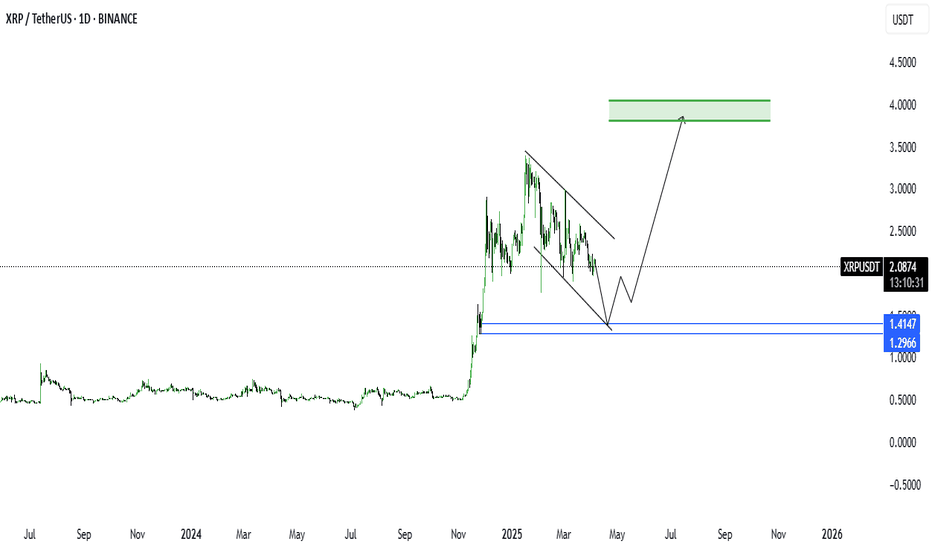

XRP May Collapse During This CycleXRP has a giant head and shoulders formation in daily chart.

If it breaks 2$ level support zone, XRP may lose at least -%30 of it's value.

You can use it for short.

Safe entry would be below 2$ with a closeure of daily candle.

Or.. Simply short right from here but it would be risky.

XRPUSDT

XRP: Fresh Gains Ahead? Bullish Setup Intensifies.XRP Price Poised for Potential Breakout? Bulls Eye Fresh Gains Amid Bullish Setup as Open Interest Surges

The cryptocurrency market is a relentless arena of volatility, sentiment shifts, and technical battles. Among the major digital assets, XRP, the native token of the XRP Ledger, often finds itself at the center of intense debate and speculation, largely due to its unique position, technological proposition, and the long-standing regulatory shadow cast by the Ripple vs. SEC lawsuit in the United States. Recently, however, a confluence of factors has ignited discussions about XRP's potential for a significant upward move. With the price consolidating and holding firm above the psychologically crucial $2 mark, coupled with a notable surge in derivatives' open interest, bullish traders are keenly watching for signs that XRP might be coiling up for its next major run.

The Significance of the $2 Threshold: A Psychological and Technical Battleground

Price levels ending in round numbers often act as powerful psychological magnets in financial markets, and $2 is no exception for XRP. Crossing and holding above such a level can signal a significant shift in market sentiment, transforming previous resistance into potential support. For XRP, reclaiming and maintaining ground above $2 carries several implications:

1. Psychological Boost: A sustained presence above $2 instills confidence among existing holders and can attract new buyers who perceive it as a validation of strength. It breaks a mental barrier that may have previously deterred accumulation.

2. Technical Support: Historically significant price levels often become areas where buying interest clusters. If XRP consistently finds buyers stepping in around the $2 mark, it establishes this zone as a credible technical support level. A strong support base is crucial for launching further upside attempts, as it provides a foundation from which bulls can stage rallies.

3. Confirmation of Strength: In technical analysis, breaking above a major resistance level (which $2 may have been previously) and then successfully defending it as support (a "resistance-support flip") is considered a strong bullish signal. It suggests that the underlying demand is robust enough to absorb selling pressure at that level.

The current price action, characterized by XRP holding above $2 despite broader market fluctuations, is therefore a key factor fueling bullish optimism. It suggests resilience and a potential accumulation phase where buyers are absorbing supply, potentially setting the stage for the next leg higher. However, a decisive break below this level could conversely signal weakness and potentially trigger further downside.

Decoding the Bullish Technical Setup: Chart Patterns and Indicators Aligning?

Beyond the $2 level itself, chart patterns and technical indicators are providing further clues that bulls are closely monitoring. While specific patterns evolve rapidly, several common bullish setups could be in play or forming:

1. Consolidation Patterns: Often, before a significant price move (either up or down), an asset enters a period of consolidation. This can take the form of patterns like:

o Ascending Triangles: Characterized by a horizontal resistance line and a rising trendline of support (higher lows). A breakout above the horizontal resistance is typically considered a bullish continuation signal.

o Bull Flags or Pennants: These are short-term continuation patterns that form after a sharp price increase (the "flagpole"). They represent a brief pause before the trend potentially resumes. A breakout above the flag/pennant's upper boundary signals a likely continuation of the prior uptrend.

o Range Consolidation: Price trading sideways between defined support and resistance levels. A decisive break above the range resistance, especially on high volume, can signal the start of a new uptrend.

2. Moving Averages: Key moving averages (MAs) like the 50-day and 200-day simple moving averages (SMAs) are widely watched indicators of medium and long-term trends.

o Golden Cross: A bullish signal occurs when the shorter-term MA (e.g., 50-day SMA) crosses above the longer-term MA (e.g., 200-day SMA). This indicates that short-term momentum is strengthening relative to the long-term trend.

o Price Above Key MAs: XRP trading consistently above both the 50-day and 200-day MAs is generally viewed as a sign of a healthy uptrend. These MAs can also act as dynamic support levels during pullbacks.

3. Momentum Indicators:

o Relative Strength Index (RSI): This indicator measures the speed and change of price movements. An RSI reading above 50 suggests that bullish momentum is dominant, while readings above 70 indicate potentially overbought conditions (though an asset can remain overbought during strong uptrends). A sustained RSI above 50, possibly bouncing off this level during dips, supports a bullish outlook.

o Moving Average Convergence Divergence (MACD): This trend-following momentum indicator shows the relationship between two exponential moving averages (EMAs). A bullish signal occurs when the MACD line crosses above the signal line, especially if this happens above the zero line.

o

If multiple technical indicators and patterns align – for instance, XRP holding above $2, breaking out of a consolidation pattern, trading above key MAs, and showing strong momentum on the RSI and MACD – the case for a potential run becomes significantly stronger.

Open Interest Surges: Fueling the Fire or Adding Risk?

A particularly noteworthy development often accompanying potential price breakouts is a surge in Open Interest (OI) in the derivatives market (futures and perpetual swaps). Open Interest represents the total number of outstanding derivative contracts that have not been settled. It essentially measures the total amount of capital committed to that market.

• Rising OI + Rising Price: This is generally considered a bullish sign. It suggests that new money is flowing into the market, primarily opening long positions, reflecting increasing conviction among buyers that the price will continue to rise. The new longs add buying pressure and fuel the uptrend.

• Rising OI + Falling Price: This is typically bearish, indicating new money is entering to open short positions, betting on further price declines.

• Falling OI + Rising Price: This might suggest that the rally is driven by short-covering (short sellers buying back to close their positions) rather than new buying interest, potentially making the rally less sustainable.

• Falling OI + Falling Price: This often indicates that traders are losing conviction and closing out existing long positions, potentially signaling the end of a downtrend but not necessarily the start of an uptrend.

The reported surge in XRP's Open Interest while the price holds above $2 aligns with the bullish interpretation (Rising OI + Stable/Rising Price). It implies that traders are increasingly betting on upside continuation, adding capital to back their bullish theses.

However, high Open Interest also introduces risks. A large number of leveraged long positions makes the market vulnerable to a "long squeeze." If the price unexpectedly drops (perhaps due to negative news or a broader market downturn), it can trigger cascading liquidations of these leveraged longs. This forced selling adds intense downward pressure, potentially leading to a sharp price crash. Therefore, while rising OI can confirm bullish sentiment, it also amplifies potential volatility in both directions.

Fundamental Factors: The Ever-Present Shadow of the SEC Lawsuit and XRPL Developments

No analysis of XRP is complete without considering the fundamental factors, dominated by the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). The lawsuit, initiated in December 2020, alleges that Ripple conducted an unregistered securities offering through its sales of XRP.

• The SEC Lawsuit: This remains the single most significant factor influencing XRP's price potential, particularly concerning US-based investors and exchanges.

o Positive Outcome/Settlement: A favorable ruling for Ripple, a clear settlement defining XRP as not being a security, or favorable legislation clarifying the status of digital assets could remove a massive cloud of uncertainty. This would likely lead to relistings on US exchanges and potentially trigger a substantial price rally, potentially decoupling XRP somewhat from the broader market trend.

o Negative Outcome: A ruling deeming XRP a security could have severe negative consequences, potentially limiting its utility, hindering adoption (especially in the US), and causing a significant price decline.

o Ongoing Uncertainty: As long as the case drags on, it acts as a headwind, potentially suppressing XRP's price relative to other cryptocurrencies that don't face similar regulatory challenges. Positive developments or perceived wins for Ripple during the legal proceedings often cause short-term price spikes.

• XRP Ledger (XRPL) Developments and Adoption: Beyond the lawsuit, the underlying technology and its adoption matter.

o On-Demand Liquidity (ODL): Ripple's primary use case for XRP, facilitating low-cost, instant cross-border payments, continues to see adoption, primarily outside the US. Growth in ODL volume signifies real-world utility.

o Central Bank Digital Currencies (CBDCs): Ripple is actively engaging with central banks globally, exploring how the XRPL could potentially support CBDC initiatives. Success in this area could significantly boost the ledger's profile and potentially XRP's utility.

o Other Use Cases: Developments around NFTs, decentralized finance (DeFi), and smart contracts on the XRPL, while perhaps less mature than on other blockchains, contribute to the ecosystem's overall value proposition.

Will Buyers Push XRP Further? Potential Targets and Risks

Given the confluence of factors – holding the $2 support, potentially bullish technical setups, and rising open interest – the question remains: can buyers sustain the momentum and push XRP significantly higher?

• Potential Upside Targets: If the bullish scenario plays out and XRP breaks decisively upwards, potential resistance levels and targets could include:

o Recent swing highs (e.g., $2.20, $2.50, depending on recent price action).

o Psychologically important levels ($2.50, $3.00).

o Fibonacci extension levels based on previous price swings.

o The previous all-time high (around $3.40 - $3.84 depending on the exchange data).

• Key Risks: Despite the bullish signals, significant risks persist:

o SEC Lawsuit: Any negative news or ruling remains the primary threat.

o Market-Wide Correction: A downturn in Bitcoin or the broader crypto market could easily drag XRP down, regardless of its individual setup.

o Failure at Resistance: If XRP attempts to rally but fails to break through key overhead resistance levels, it could lead to a reversal.

o Breakdown Below Support: A decisive drop below the $2 support level would invalidate the immediate bullish thesis and could open the door to lower targets (e.g., $1.80, $1.50, or key moving averages).

o OI Liquidation Cascade: As mentioned, high open interest could fuel a sharp sell-off if sentiment sours.

Conclusion: Cautious Optimism Warranted

The current situation for XRP presents a compelling, albeit complex, picture. The ability to hold the crucial $2 support level is a significant show of resilience. Combined with potentially forming bullish technical patterns and a notable surge in open interest suggesting fresh capital inflow and conviction, the ingredients for a potential price run appear to be gathering. Bulls are rightly eyeing fresh gains, encouraged by these developments.

However, caution remains paramount. The cryptocurrency market is inherently volatile, and XRP carries the unique and substantial burden of the SEC lawsuit's uncertainty. While technicals and derivatives data might point towards bullish potential in the near term, fundamental risks and the ever-present possibility of market-wide corrections cannot be ignored. A breakdown below $2 support or negative news from the legal front could quickly invalidate the bullish outlook.

Traders and investors considering XRP must weigh the potentially explosive upside against these considerable risks. Monitoring the $2 level, key resistance zones, developments in the SEC case, and overall market sentiment will be crucial in navigating XRP's next potential move. While the setup looks promising for the bulls, confirmation through decisive price action and continued positive momentum is needed before declaring that XRP is definitively "ready to run."

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Trading cryptocurrencies involves significant risk, and you could lose your entire investment. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

XRP Ripple Is Showing That Correction In Crypto Is OverHello, Skyrexians!

Let's continue to look at the different confirmations of the incoming growth on crypto. BINANCE:XRPUSDT is one the largest altsoins was in correction for 4 month. This was a global wave 4, now we have the confirmation that Ripple coin will reach new ATH.

Let's take a look at the daily time frame. Previous huge impulse consists of 5 waves. It was a global wave 3, now we are in the ABC shaped wave 4. The anticipated wave C has been finished inside the 0.61 Fibonacci Retracement. Also we can see the bullish divergence and increasing momentum at the Awesome Oscillator. Moreover, we can see the green dot on the Bullish/Bearish Reversal Bar Indicator , which is the great potential growth confirmation. The target for the next wave is approximately at $3.8, but can be recalculated further.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

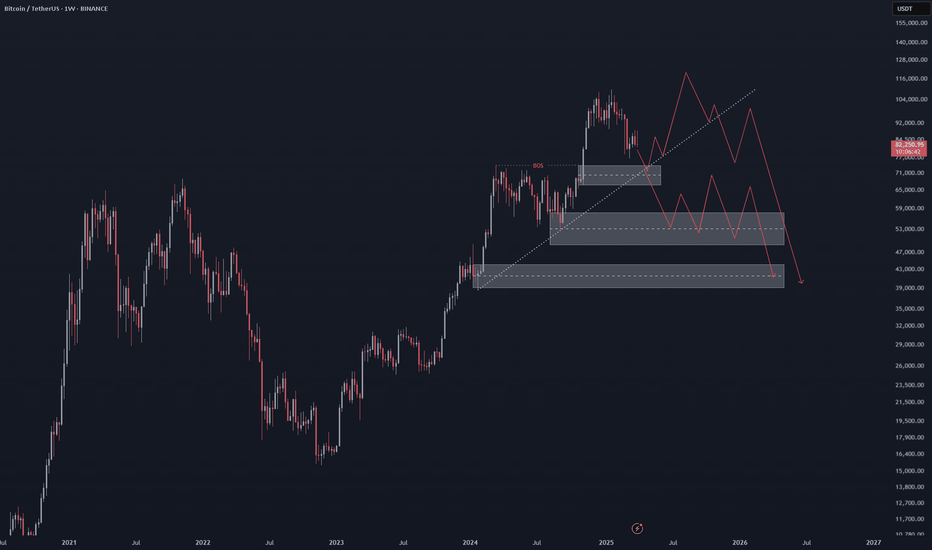

BTCUSDT Daily : Range AreaHi Guys,

As you can see in the chart, with the temporary suspension of trade tariffs, the market was able to recover by about 10%. I expect this kind of pain to continue.

SecondChanceCrypto

⏰ 10/april/26

⛔️DYOR

Always do your research.

If you have any questions, you can write them in the comments below and I will answer them.

And please don't forget to support this idea with your likes and comments.

#XRPUSDT: Bullish Reversal Coming With Price Heading Back To 3.5## XRPUSDT Analysis: Long-Term Perspective

In the long term, we anticipate the XRPUSDT price to revert to its all-time high of 3.5. From a fundamental analysis standpoint, we maintain a positive outlook, with the potential for the price to surpass 3.5. We have identified a favourable trading opportunity, as illustrated in the chart.

Our approach is neutral, as the trend remains undecided. Based on the duration of your positions, you can set two targets:

1. **Short-Term Target:** If you intend to hold your positions for a short period, aim for a price level above 3.5.

2. **Long-Term Target:** For long-term investors, a target price of 4.0 or higher is plausible.

We are committed to providing comprehensive analysis and support. Should you have any inquiries or require further clarification, please do not hesitate to contact us.

Additionally, we would appreciate your insights on which cryptocurrency pair you would like to explore next.

Regards,

Team Setupsfx_

Phemex Analysis #71: Pro Tips for Trading Ripple (XRP)Ripple ( PHEMEX:XRPUSDT.P )has seen significant developments with the launch of its US dollar-backed stable coin, RLUSD (launched in December 2024), integrated into its Ripple Payments platform to improve cross-border enterprise transactions. The stable coin, regulated by the NYDFS, has experienced substantial growth, approaching a $250 million market cap and nearly $10 billion in trading volume, exceeding Ripple's projections. RLUSD is increasingly used as collateral in both crypto and traditional finance markets, and NGOs are exploring its use for donations.

Despite the positive developments surrounding RLUSD, XRP's price has failed to hold above the $1.76 support level. XRP recently dropped to a low of $1.61 due to US tariff news that pushed the broader market downwards.

Today, we will explore several possible scenarios for XRP's price action in the coming days to identify potential profit opportunities in this uncertain market.

Possible Scenarios.

1. Bearish Breakdown Below Support:

If XRP breaks decisively below the $1.61 support level with significant volume, it could signal a continuation of the bearish trend.

Pro Tips:

Consider shorting XRP on a confirmed break below $1.61.

Potential support levels to target: $1.43, $1.28, or even $1.05.

Place a stop-loss order above a recent swing high (e.g., $1.65) to manage risk.

2. Rebound from Support:

The $1.61 level represents a recent low, and a price bounce is possible, especially if broader market sentiment improves. Besides, support levels like $1.43, $1.28, and $1.05 are targets to watch for too.

Pro Tips:

Watch for bullish reversal patterns around the support level (e.g., increased buying volume, RSI divergence, bullish candlestick patterns).

Consider entering a long position on confirmation of a rebound.

Potential resistance levels to target: $2.0, $2.17, and $2.45.

Place a stop-loss order below the targeted support level to protect against further downside.

3. Consolidation within a Range:

XRP might consolidate between the $1.61 support and the $2.0 resistance if market uncertainty persists.

Pro Tips:

Consider range-bound trading strategies: buying near $1.61 and selling near $2.0.

Utilize grid trading bots within this range.

Set stop-loss orders outside the range (below $1.60 and above $2.0) to prepare for a potential breakout or breakdown.

Conclusion.

XRP's price action is currently influenced by both the positive developments surrounding RLUSD and the broader market uncertainty. Traders should remain vigilant and adapt their strategies based on the prevailing market conditions. By carefully monitoring key support and resistance levels, analyzing trading volume and technical indicators, and implementing appropriate risk management measures, traders can position themselves to capitalize on potential opportunities in the XRP market. Whether the price breaks down, rebounds, or consolidates, a disciplined and informed approach is crucial for successful trading.

Tips:

🔥 Break free from "buy low, sell high"! Our new Pilot Contract empowers you to profit from ANY market direction on DEX coins with up to 3x leverage. Go long, go short, go further!

Check out Phemex - Pilot Contract today!

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

Long Position XRP/USDT🚨 XRP/USDT – Intraday Outlook (15-min Chart)

After reacting strongly to the mid-term support at 1.630, XRP has been climbing steadily and is now testing short-term trendline support to break it down to 1.8153.

🔹 Current Price: 1.93

🔹 Support Zone to Watch: 1.8153 – 1.7083 (Possible Long Zone)

🔹 Upside Target: 2.15+

📉 A short-term pullback toward the Possible Long Zone could offer a high-probability long setup. If bulls step in around that level, we might see a trend continuation toward the 2.15 or even higher regions, signaling a potential bullish reversal on the mid-term.

📊 With the overall recovery trend still holding, traders should watch for a break-retest setup or a bullish confirmation in the demand zone.

🧠 Smart Play: Patience is key. Let the price come to your level and watch for confluence.

What do you think? Is XRP ready to reverse for good?

XRP at $1.9: Testing Key SupportXRP is currently trading at $1.9, a pivotal level, as the crypto market grapples with a 4.4% drop in the last 24 hours. Macro uncertainty, think US inflation data and Fed rate hike fears, is pressuring risk assets. Yet, XRP holds steady, buoyed by whispers of a Ripple partnership with a major European bank for cross-border payments and ETF speculation (unconfirmed).

Technical Analysis

Short-Term (Daily Chart):

Support: $1.90 (current), $1.80

Resistance: $2.00, $2.10

RSI sits at 48 (neutral), while MACD hints at bearish momentum. XRP’s testing the lower edge of a descending channel, holding $1.90 could trigger a bounce to $2.00, but a break below eyes $1.80.

Long-Term (Weekly Chart):

Support: $1.70, $1.50

Resistance: $2.50, $3.00

The 200-day MA is sloping down, signaling caution, but $1.70 is a solid base for bulls.

Potential Scenarios

Bullish: If $1.90 holds and $2.00 falls with strong volume, expect a push to $2.10 short-term, possibly $2.50 long-term if adoption news hits.

Bearish: A crack below $1.90 could test $1.80, with $1.70 next if selling ramps up.

Trading Tips and Context

XRP’s real-world use in payments and recent partnerships fuel long-term hope, but the SEC lawsuit looms as a risk. Short-term traders: trade the range between $1.90 support and $2.00 resistance, set stops tight (e.g., below $1.90 for longs). Long-term holders: $1.70 is your critical level. Keep an eye on SEC updates or ETF chatter for catalysts.

Ripple’s Triple Top Signals $2 Breakdown, Eyes $1.90 SupportHello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Ripple 🔍📈.

Ripple has demonstrated a classic triple top formation, with each successive peak showing weaker momentum. As it nears a formidable resistance zone, a break below the $2 threshold appears imminent. This downward move is expected to extend to at least $1.90, reflecting a minimum decline of 18%. Such a drop aligns with the primary target and a key daily support level.📚🙌

🧨 Our team's main opinion is: 🧨

Ripple’s losing steam after three peaks, eyeing a drop below $2 to around $1.90, with an 18% plunge hitting a key support level. 📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

Rounded Top Forming – Will XRP Hold the $2 Support Line?CRYPTOCAP:XRP is currently showing signs of weakness as it continues to drift lower beneath a rounded distribution arc. The price action indicates a potential rounded top pattern, which typically suggests a gradual shift from bullish to bearish sentiment.

The asset has broken below the mid S/R zone and is now trading near a crucial strong support area, just above the 200 EMA — which is acting as dynamic support at around $1.95. This level is a key battleground for bulls and bears.

DYR, NFA

BTCUSDT WEEKLY : BEARMarket Will be start Hi Guys , Good day,

Be carefully, I think bull market is finish ,

I think the bull market may be over. Be very careful with your trades. Check the charts and see where we are at a sensitive point.

SecondChanceCrypto

⏰ 6/april/26

⛔️DYOR

Always do your research.

If you have any questions, you can write them in the comments below and I will answer them.

And please don't forget to support this idea with your likes and comments.

XRP XRP failed to break through the $2.1597 resistance and is now heading back toward the $2.0216–$1.9000 support zone.

If this support fails to hold, lower lows may be on the horizon.

A bullish reversal requires a breakout above resistance and confirmation above the 200 MA.

🎯 Next targets: $2.4729 and $2.59

📉 Weak volume and rejection from key levels increase bearish pressure.

USDT.D Weekly : So IMPORTANT AreaHello and good timeو

Well, as I indicated on the chart, we have two very important areas. The initial box, if the price is rejected in this area, we can expect Bitcoin to be 70,000 to 74,000. However, in the event of a stock market crash and stories related to global tariffs that cause a heavy stock market crash, if the crypto market follows the fall, in the Tether dominance chart, we can reach the upper box areas, which can be said to be Bitcoin at $48,000 to $50,000. Be very careful in your trades.

SecondChanceCrypto

⏰ 6/april/26

⛔️DYOR

Always do your research.

If you have any questions, you can write them in the comments below and I will answer them.

And please don't forget to support this idea with your likes and comments.

xrp update Here's a polished version of your message that you could use for a post or update:

---

**XRP Update:**

Currently trading around **$2.085**, we're anticipating a **pullback toward the $1.40** levels. That zone could offer a **great opportunity** for long-term investors and spot traders to enter.

🎯 **Targets:**

- First target: **$3**

- Second target: **$5**

**⚠️ Patience is key — wait for the opportunity. Don’t jump in too early.**

Good luck, everyone! 💰🚀

---

Want it styled as a tweet, YouTube caption, or short video script?

The more a support is tested, the weaker it becomes.This is my expectation for Ripple in the coming period.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.

The key is whether it can rise above 2.2582

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(XRPUSDT 1D chart)

Important support and resistance areas are

- 2.5641,

- 1.9513,

- 1.5467.

Among them, the 1.9513 point corresponds to the volume profile area, so it can be seen as an important support and resistance area.

A trend is created when the 2.5641 or 1.5467 point is broken, so the trend is expected to be determined depending on which of these points is broken.

-

What you should pay attention to is that the OBV indicator is renewing the low.

This time, if it rises above 2.2582 and maintains the price, we should see if the OBV rises and renews the high.

If not, it is expected to fall below 1.9513.

-

Therefore, the first purchase period is when support is confirmed around 2.2582.

The second purchase period is when support is confirmed around 2.5641.

An aggressive purchase is when it falls below 1.9513 and then shows support again around 1.9513.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015 and has been rising.

In other words, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it shows up to 3.618 (178910.15).

Fibonacci ratio 0.618 (44234.54) is not expected to fall again.

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------