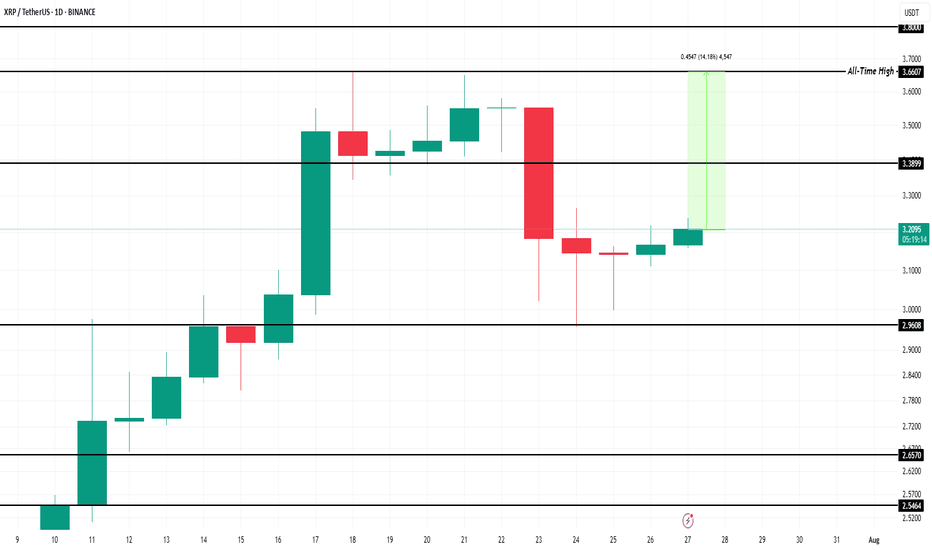

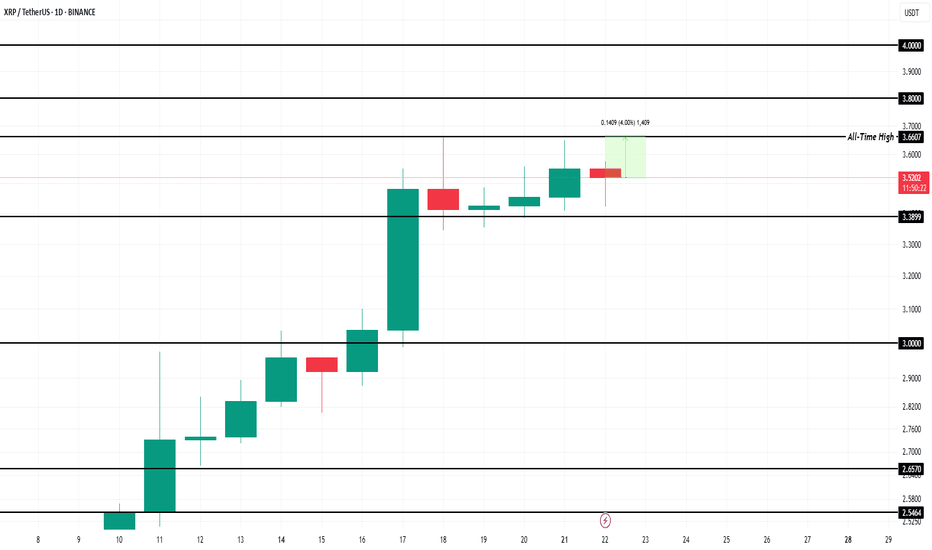

$500 Million XRP Accumulation To Drive 15% Price Rise to ATHBINANCE:XRPUSDT is currently trading at $3.20, which places it 14% away from reaching its ATH of $3.66. The support at $3.38 is crucial, and securing it could lead to further gains.

BINANCE:XRPUSDT has been seeing significant inflows in the past three days. Over 163 million XRP, worth around $519 million , have been accumulated by investors. This buying surge suggests that a wave of optimism is returning to the market, signaling that investors are positioning themselves for a potential price increase.

If BINANCE:XRPUSDT can reclaim support at $3.38 , it will be well-positioned to push past its ATH and reach new highs. This would mark a significant milestone for the altcoin, setting the stage for further price gains.

However, should the investor sentiment shift and selling pressure increase, BINANCE:XRPUSDT could face a decline. If the price falls below $3.00, it could slide to $2.96 or lower , invalidating the bullish thesis.

Xrpusdtlong

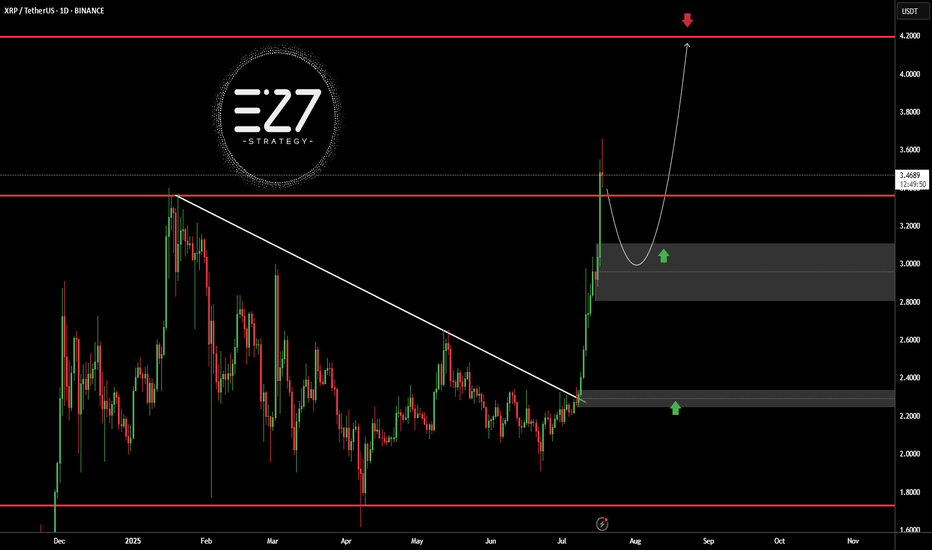

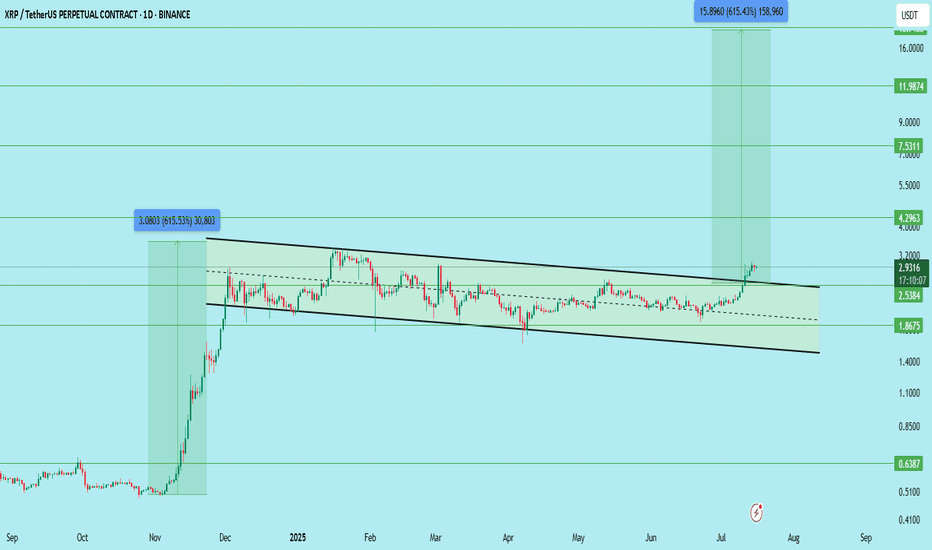

XRPUSDTBINANCE:XRPUSDT broke above its long-term downtrend line and surged to the $3.5000 resistance area, but is now undergoing a correction. The current bullish structure, with a higher high and higher low, suggests the trend remains upward. A pullback toward the $3.0000 demand zone is likely and would be a healthy retracement. Holding this area could trigger a continuation toward the key resistance at $4.2000.

Key Level Price

Main Support $2.2000

Main Resistance $4.2000

Best Buy Range $2.9500 – $3.1500

Best Sell Range $4.1000 – $4.2000

Investment Risk (Buying) Medium

⚠️Please control RISK management

XRP : Long term analysisHello friends🙌

🔊Considering the great growth that the price has had and has set a new ceiling, be careful because we are at the ceiling and when we are at the price ceiling, we should always expect a price correction...

⚠Now, given the strong upward trend we have, you can buy with risk and capital management, but our suggestion is lower prices for the possibility of a correction and the possibility of a reversal pattern.

So we have identified important support levels for you and we have also identified price targets.

🔥Follow us for more signals🔥

*Trade safely with us*

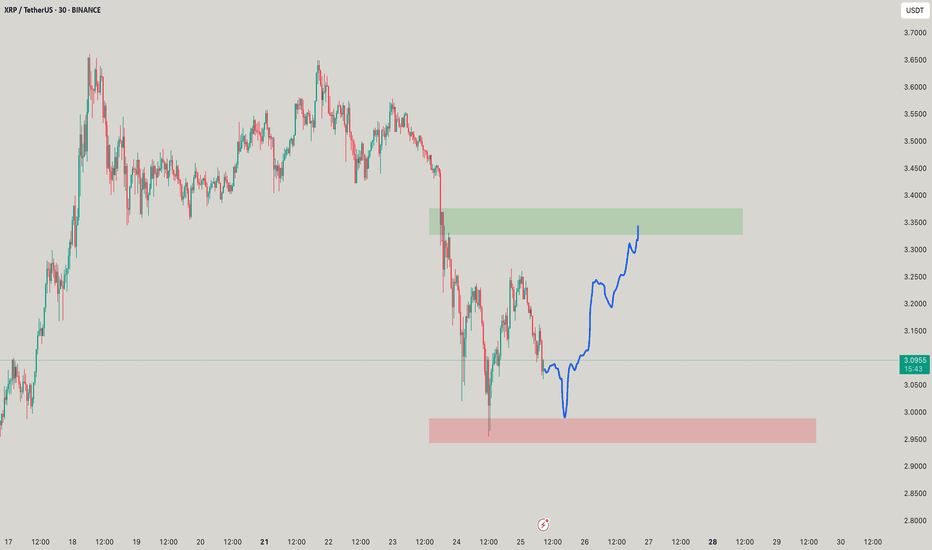

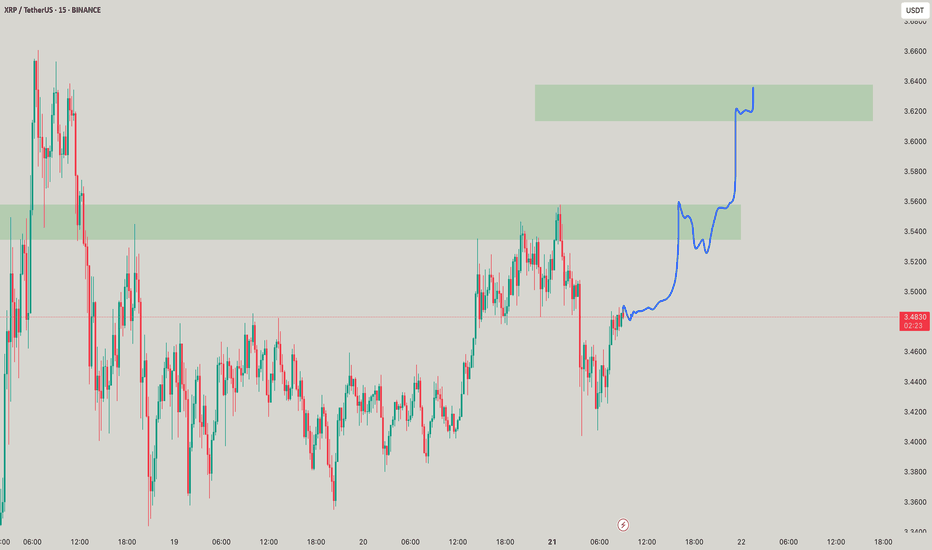

XRP Price Reversal Likely After $2.81 Billion Selling In 7 DaysBINANCE:XRPUSDT is currently trading at $3.48, only 4% away from its all-time high . Over the past week, exchange wallets saw an influx of nearly 450 million XRP, valued at more than $2.81 billion . This spike in supply indicates that holders are moving their assets to sell, usually a bearish indicator in market cycles.

Despite the proximity, BINANCE:XRPUSDT price is showing signs of weakness and is clinging to the $3.38 support level . Without renewed buying interest, this support may not hold much longer.

If investor selling continues, BINANCE:XRPUSDT could fall through $3.38 and test the $3.00 support . A drop to this level would erase the recent gains and confirm a near-term bearish reversal. The loss of $3.00 could signal a longer consolidation phase or deeper correction.

However, if market participants absorb the sold supply and restore demand, BINANCE:XRPUSDT could rebound quickly . In this scenario, the altcoin might surpass $3.66, breach $3.80, and aim for $4.00 . Such a move would invalidate the bearish outlook and set a new all-time high.

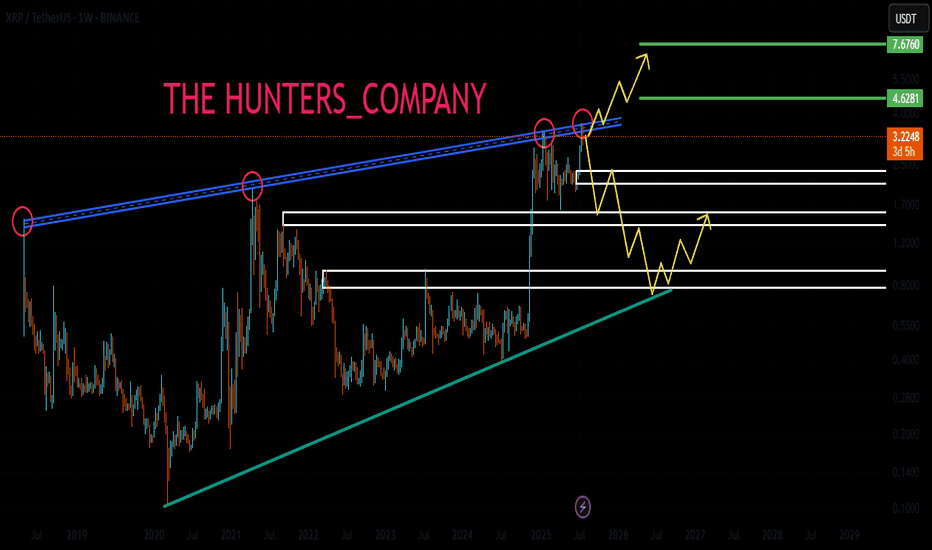

$XRPUSDT LONG TERM SETUP for SPOT !!CRYPTOCAP:XRP has officially broken out of its long-standing descending channel on the daily timeframe.

This is a major structure breakout and opens the door for a big move, but patience is key. Wait for a clean retest before entering the trade.

Trade Setup:

Entry (Ideal Retest Zone): $2.53 – $2.75

Stop Loss: Below $2.38

Resistance/Support Zones:

Immediate Support: $2.53

Resistance Levels: $4.29 / $7.53 / $11.98 / $18.00

Targets (Long-Term):

TP1: $4.29

TP2: $7.53

TP3: $11.98

TP4: $18.00

Potential Profit: Over 500%+ if it plays out fully

This is a long-term breakout structure — don’t rush. Wait for confirmation on the pullback.

DYOR | Not Financial Advice

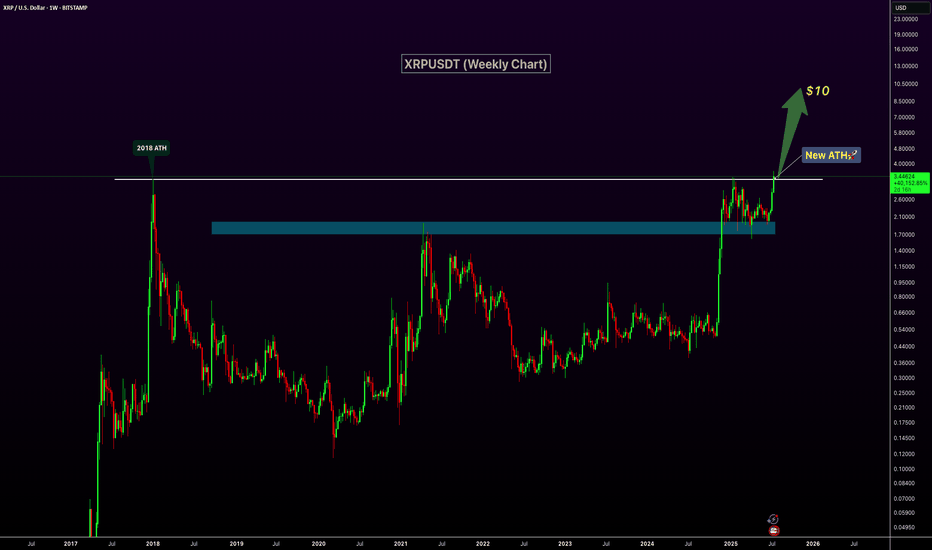

Setupsfx_ | XRPUSDT: Time For Strong Bullish Price Distribution!As previously described, the price bullish reversal did exactly that. The price has moved nicely, and this may be just the beginning of a bigger move. Long-term, we believe XRP will hit a record high, possibly even surpassing $4.

Please use accurate risk management while trading XRP.

Good luck and trade safely!

XRP Breaks 2018 High – New ATH Confirmed!XRP has officially broken above its 2018 peak, signaling a major bullish breakout and printing a new all-time high on the weekly chart. The previous resistance zone around $2.6–$3 has now flipped into strong support, confirming the strength of this move. With increasing volume and momentum behind the rally, XRP appears well-positioned for continued upside. The next key psychological target lies at $10, and current price action suggests a clear path toward that level. If bullish sentiment continues, this breakout could mark the beginning of a significant new uptrend.

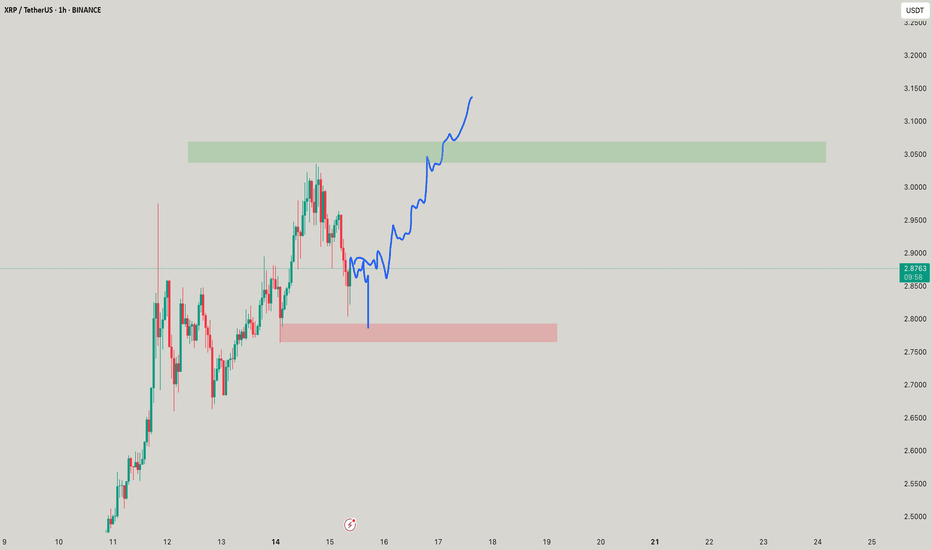

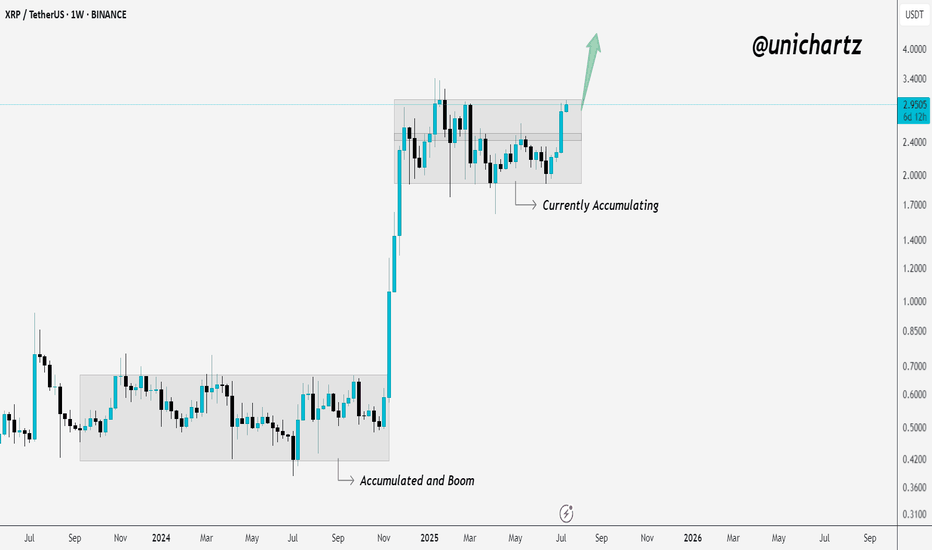

Accumulation Ending? XRP Showing Signs of BreakoutXRP is in the process of breaking out of its weekly accumulation range.

The last time we saw this kind of structure — it led to a massive move.

Now, price is pushing toward the top of the zone again… and momentum is picking up.

If it closes strong above this level, it could trigger the next big leg higher.

Stay alert — this could be the start of something big!

XRPUSDT Breaks Out of Bullish Flag - Big Moves Ahead!BINANCE:XRPUSDT has broken out of a classic bullish flag pattern on the weekly chart, signaling a strong continuation to the upside. This textbook setup is known for its high success rate, and the breakout suggests the potential for significant gains if momentum continues.

The CRYPTOCAP:XRP community remains strong, with long-term holders showing confidence and resilience. With the current market structure and support from loyal investors, there’s a real possibility for the price to double from this breakout zone.

The strategy is simple. Buy and hold for the long term. But as always, traders must manage risk carefully and use a proper stop loss. Let the flag fly high. CRYPTOCAP:XRP could be ready for a major pump from this level.

BINANCE:XRPUSDT Currently trading at $2.43

Buy level : Above $2.4

Stop loss : Below $1.9

Target : $5

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

XRP Technical Analysis – Massive Breakout in Play!After months of tight consolidation inside a symmetrical triangle, XRP/USDT has finally broken out with strong bullish momentum on the daily timeframe.

🔹 Chart Pattern: Symmetrical Triangle

🔹 Breakout Confirmation: Daily candle closed above the descending trendline resistance

🔹 Support Zone: ~$2.00 – $2.20 (Held multiple times since April)

🔹 Breakout Level: ~$2.48 – $2.50

🔹 Next Resistance Levels:

▫️ $2.62 – Minor horizontal resistance

▫️ $3.39 – Major resistance from previous highs

▫️ $4.92 – Long-term macro target (measured move from triangle)

🧠 Why does this breakout matter?

✅ Strong Volume: Breakout happened with increased volume – a sign of genuine breakout

✅ Multi-month Base: The longer the consolidation, the stronger the breakout

✅ Support Respect: XRP respected the demand zone repeatedly, showing accumulation

✅ Momentum Building: A clean break could trigger trend-following bots and new buyers

XRPUSDT Forming Bullish BreakoutXRPUSDT is showing an interesting setup with a bullish breakout potential that could fuel gains of 60% to 70% or more in the coming weeks and months. The recent price action suggests that XRP is breaking out of a long-standing consolidation pattern, with price pushing above a descending trendline and holding well above key support levels. This breakout is attracting both retail traders and big investors who see Ripple’s strong fundamentals and unique use case in the cross-border payment sector as major catalysts for its long-term growth.

The trading volume has remained healthy, signaling strong market participation and increasing confidence that XRP’s next move could be substantial. If momentum continues, traders can expect a potential rally towards major resistance zones, with increased interest from whales likely to accelerate the bullish scenario. Market sentiment around XRP has also improved thanks to positive developments in its legal battles and expanding partnerships, which add further conviction for investors.

XRP’s performance has historically shown that when it moves, it often does so aggressively, rewarding patient holders and active traders alike. This pattern aligns well with broader altcoin market cycles, where XRP tends to outperform during bullish phases. As always, it’s essential to monitor price action around key levels, adjust stop-losses wisely, and stay updated with market news to make the most of this potential run.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#XRP/USDT#XRP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.11.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 2.16

First target: 2.20

Second target: 2.24

Third target: 2.28

XRP - calm before the stormWe've got our bullish reversal sitting at the Golden Ratio price of $2.20. Fed Chairman Jerome Powell speaks today with many speculating that this will be the meeting that sends the markets soaring.

With over 17 ETFs, SWIFT update, Banks offering crypto services, BIS, XRPL EVM side chain, and many more catalyst. This could be the beginning to the largest bull run witnessed in our lifetime.

Have profits targets, an exit strategy, and plan for long-term reinvestments that will continue to make you money.

LOCK IN 🔐

XRP/USDT Poised for Breakout from Symmetrical Triangle!Pattern Identified: Symmetrical Triangle

The symmetrical triangle is a consolidation pattern formed by a series of lower highs and higher lows, converging into a triangle shape. It reflects market indecision and often precedes a significant breakout, either upward or downward, depending on momentum and volume.

🔍 Pattern Description:

Upper Resistance Line (Descending): Connecting the lower highs since February 2025.

Lower Support Line (Ascending): Connecting the higher lows since December 2024.

Consolidation Zone: Price has been moving sideways within the triangle, indicating accumulation.

Critical Breakout Level: Around $2.23 — the price is currently testing this resistance.

📈 Bullish Scenario:

If the price successfully breaks above the upper triangle resistance with strong volume:

Target 1: $2.5855 (previous minor resistance)

Target 2: $2.9534 (key historical resistance)

Target 3: $3.2781

Maximum Target: $3.40 (local previous high and psychological level)

Breakout Confirmation: A daily candle close above $2.30 with significant volume could signal a long entry.

📉 Bearish Scenario:

If the price fails to break out and instead breaks down below the lower trendline:

Support 1: $2.00 (psychological & horizontal support)

Support 2: $1.85

Major Support: $1.55 (strong historical demand zone)

Breakdown Confirmation: A daily close below the lower triangle boundary with high volume would signal further downside.

📌 Summary:

XRP is nearing the apex of a symmetrical triangle — a major move is imminent.

A confirmed breakout could trigger a rally towards $3.40.

A breakdown may lead to a drop toward $1.55.

Recommendation: Wait for confirmation before entering long or short positions.

#XRP #XRPUSDT #CryptoBreakout #SymmetricalTriangle #XRPAnalysis #Altcoins #TradingView #TechnicalAnalysis #BullishCrypto #CryptoSignal

XRPUSDT Forming 2017-Style Flag — Major Breakout Loading! BINANCE:XRPUSDT is currently forming a classic bullish flag pattern, a setup that looks strikingly similar to what we saw back in 2017 before CRYPTOCAP:XRP went on a massive run. The price has been consolidating within a tight range, and this could be the calm before a powerful breakout.

Back in 2017, a similar flag formation led to a parabolic uptrend once the resistance was broken. While history doesn’t repeat exactly, this pattern suggests the potential for a significant upside move if the breakout confirms. Traders and investors should keep a close eye on this structure — a breakout from this flag could reignite bullish momentum and open the door for a sharp rally.

This is a buy and hold scenario for those who believe in XRP’s potential, but remember — risk management is key. Always use a stop loss below the flag support to protect your capital. Momentum could build quickly, so stay alert and watch for volume confirmation on the breakout.

#XRP/USDT#XRP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.21.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading for stability above the 100 Moving Average.

Entry price: 2.24

First target: 2.27

Second target: 2.30

Third target: 2.35

XRP Is Quiet—But This Calm Is Deceptive!Yello Paradisers—have you noticed how #XRP isn't on anyone’s radar right now? It’s not trending, no one’s hyping it, and to many, it’s just another slow mover. But here’s the thing: this type of silence often comes before the real storm, and the technical are quietly lining up.

💎#XRPUSDT is seeing now a period of consolidation The 1D bullish trend structure has been broken, and since then, price has entered into a tightening consolidation phase. While this may seem like indecision, it’s more likely a preparation for a potential high-probability upside expansion.

💎Price is now hovering just above the 0.786 Fibonacci level (~$2.25), which has started acting as a soft support. This is not a level to blindly trust, but one to monitor for reactions. If price manages to hold here, the next high-probability target lies at the short-term resistance around $2.5917, followed by major resistance at $2.9480, which aligns with a broader liquidity zone.

💎One key factor to keep in mind: the descending trendline liquidity has not been swept for a long time. That uncollected liquidity still sits just overhead, and markets usually don’t leave such inefficiencies behind forever. A spike toward that zone becomes increasingly probable the longer we range here.

💎At the same time, the MTF EMA on the daily chart is acting as a soft dynamic resistance, pushing the price down gradually. This setup increases the probability that we may see another touch of the 0.786 level. If that fails to hold decisively, the next likely area of interest will be the major support zone around $2.00.

💎Still, that major support remains unbroken and continues to act as a probability-backed structure for potential bullish defense. Until we get a clean daily candle close below $1.791 (invalidation level), this entire zone remains technically favorable for a potential reversal or liquidity sweep to the upside.

We are playing it safe right now, Paradisers. If you want to be consistently profitable, you need to be extremely patient and always wait only for the best, highest probability trading opportunities.

MyCryptoParadise

iFeel the success🌴