The Great XRP Escape Plan: Thief Strategy Deployed🌀 XRP/USDT – Thief Trader’s Master Heist Plan: Crack the Vault Before They Catch On! 🧠💰

🔐💸 Operation Code: Ripple Raid 3.9 - Eyes on the Prize, Hands on the Trigger 💥

🌍 Attention Global Market Robbers and Strategic Money Movers!

This ain't just another analysis—this is the Thief Trading Style Blueprint, surgically designed for the XRP/USDT Crypto Market. Whether you're a silent sniper or full-squad raider, this trade setup is your next high-voltage money heist.

🔍 Market Breakdown:

📊 Technical + Fundamental = Robbery Precision

Currently, Ripple (XRP) is showing bullish fuel—charging into our trap-the-bears zone. Volatility is tightening, resistance is trembling, and it smells like liquidity is about to get stolen.

⚠️ Warning: The market’s at a risky cross-zone – overbought with heavy consolidation – where big bears and trapped traders usually play defense. That’s exactly where we strike.

🔓 Entry Gameplan – “Wait, Trigger, Execute”

📈 Entry:

"The heist begins when the candle breaks the high and screams confirmation!"

Set Buy Stop Orders above the recent resistance (around 3.1000).

Alternatively, use Buy Limit Orders on pullbacks at key swing levels (15M or 30M timeframes).

We use a multi-layered entry strategy (aka DCA + stacking like a pro thief stacking vaults). Be surgical. Be patient.

📌 Pro Tip: Always set a chart alert at the trigger zone to avoid missing the breakout party.

🛑 Stop Loss – “Breakout First, Then Talk Safety”

🚫 NO SL BEFORE BREAKOUT. Period.

Once price breaks out, then:

🔐 SL = Nearest 4H candle wick swing low (around 2.8000).

But remember, your SL = your risk appetite.

Whether you're placing 1 big order or 10 mini traps, manage it smart.

🎯 Target – "Get Rich, Then Vanish"

🏴☠️ Primary Take Profit Zone:

Target: 3.9000

Or exit anytime you see signs of reversal.

Don't get greedy—get paid.

👀 Scalpers’ Note:

Only play the Long side.

If you're deep-pocketed, dive in straight. If not, ride with swing traders and trail your SL to protect profits.

🔥 Why This Trade is 🔐:

📈 Current price structure, liquidity zones, and momentum favor bulls.

📊 Correlated intermarket signals + on-chain activity + macro backdrop align with XRP strength.

🧠 Smart money accumulation is visible – this is your window before the big breakout.

🚨 News & Position Management Alert:

📢 Stay clear of opening trades during major news events.

Use Trailing Stop-Loss on running positions to lock gains while letting profits fly.

This is not hype. This is precision.

Thief Trader doesn’t guess – we plan, we trigger, we exit.

📌 Final Words:

Whether you're scalping seconds or swinging for days – follow the blueprint. XRP has a vault to crack, and we’re here to rob it clean.

Now go out there, set those traps, and let the market pay you like it owes you.

🧠💸🕶️ Next Heist Plan Coming Soon… Stay Sharp.

Xrpusdtrading

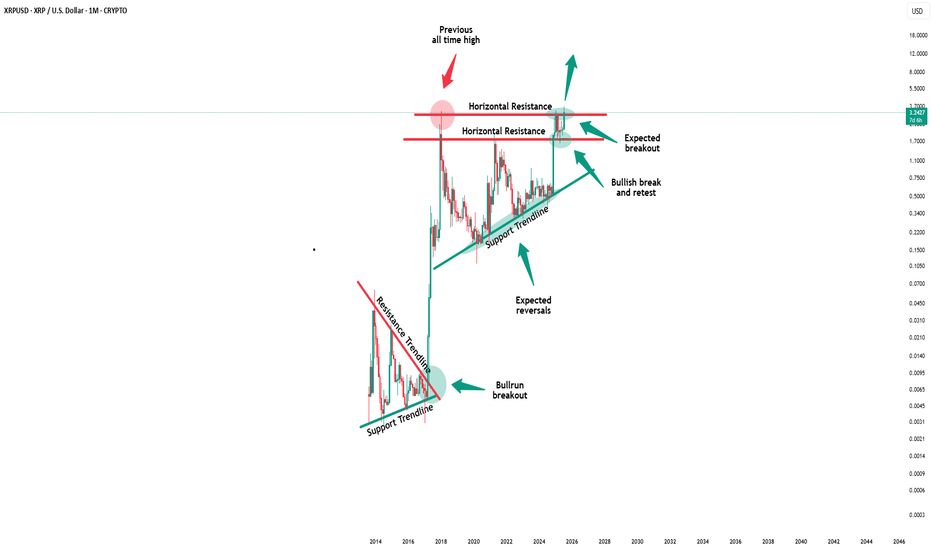

Xrp - This is the bullrun breakout!🔑Xrp ( CRYPTO:XRPUSD ) breaks the triangle now:

🔎Analysis summary:

After the recent bullish break and retest, Xrp managed to already rally another +100%. This is a clear indication that bulls are still totally in control of cryptos and especially Xrp. It all just comes down to the all time breakout, which will then lead to a final parabolic rally.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

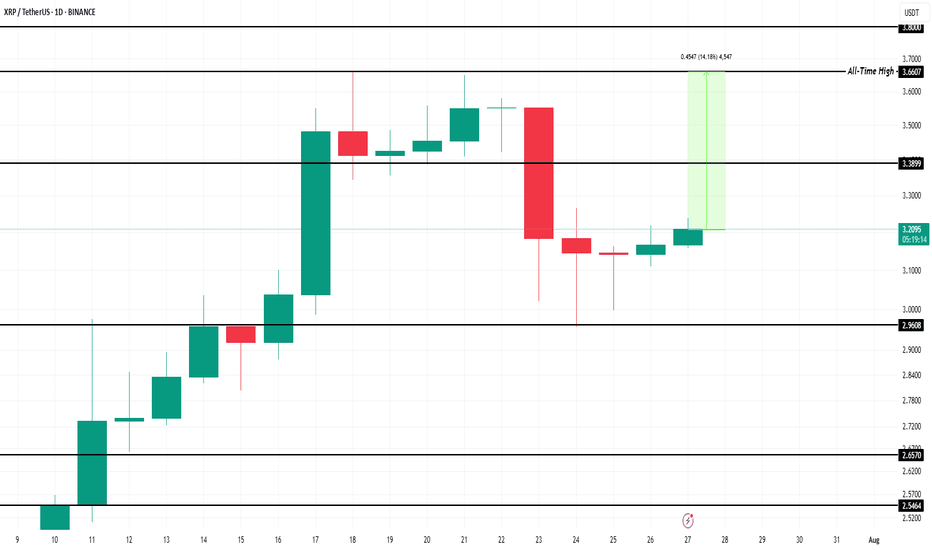

$500 Million XRP Accumulation To Drive 15% Price Rise to ATHBINANCE:XRPUSDT is currently trading at $3.20, which places it 14% away from reaching its ATH of $3.66. The support at $3.38 is crucial, and securing it could lead to further gains.

BINANCE:XRPUSDT has been seeing significant inflows in the past three days. Over 163 million XRP, worth around $519 million , have been accumulated by investors. This buying surge suggests that a wave of optimism is returning to the market, signaling that investors are positioning themselves for a potential price increase.

If BINANCE:XRPUSDT can reclaim support at $3.38 , it will be well-positioned to push past its ATH and reach new highs. This would mark a significant milestone for the altcoin, setting the stage for further price gains.

However, should the investor sentiment shift and selling pressure increase, BINANCE:XRPUSDT could face a decline. If the price falls below $3.00, it could slide to $2.96 or lower , invalidating the bullish thesis.

Setupsfx_ | XRPUSDT: Time For Strong Bullish Price Distribution!As previously described, the price bullish reversal did exactly that. The price has moved nicely, and this may be just the beginning of a bigger move. Long-term, we believe XRP will hit a record high, possibly even surpassing $4.

Please use accurate risk management while trading XRP.

Good luck and trade safely!

XRP/USD: "Bandit’s Breakout" – MA Confirms the Profit Raid!🔥 XRP/USD HEIST ALERT: The Bullish Bank Robbery Plan (MA Breakout Strategy) 🔥

🌟 Attention, Market Pirates & Profit Bandits! 🌟

"The best traders are just thieves with a calculator."

🚨 Mission Brief (XRP/USD):

Based on Thief Trading tactics, we’re plotting a bullish heist on Ripple. High-risk, high-reward—police traps, fakeouts, and overbought zones be damned!

📌 ENTRY ZONE (Breakout or Pullback Heist)

"The heist begins at MA breakout!"

Buy Stop: Above 2.2200 (confirmed candle close).

Buy Limit: Near swing lows (15m/30m pullback).

🚨 Set an ALERT! Don’t miss the breakout.

🛑 STOP LOSS (Escape Route)

"No stop loss till breakout—then hide it like stolen cash!"

Thief SL: Nearest swing low (3H candle wick) ~2.1000.

Rebels adjust at own risk—your funeral, not mine. 😎

🎯 TARGETS (Profit Hideouts)

First Escape: 2.2400 (scalp & run).

Swing Bandits: Ride longer (trail SL advised).

⚡ SCALPERS’ NOTE:

Longs ONLY. Rich? Go all-in. Broke? Join swing heists.

Trailing SL = Your getaway car.

📡 MARKET CONTEXT (Why This Heist?)

Bullish momentum + consolidation breakout play.

Fundamentals? Check COT, on-chain, macro trends (check everything here 👉🔗🔗).

🚨 NEWS WARNING (Avoid Police Raids)

Avoid new trades during high-impact news.

Trailing stops = Your invisible cloak.

💥 BOOST THE HEIST!

"Like & Boost this idea—strengthen our robbery squad! More alerts = more stolen profits. 🚀💰

Next heist coming soon… Stay greedy, thieves. 😈

XRPUSDT Breaks Out of Bullish Flag - Big Moves Ahead!BINANCE:XRPUSDT has broken out of a classic bullish flag pattern on the weekly chart, signaling a strong continuation to the upside. This textbook setup is known for its high success rate, and the breakout suggests the potential for significant gains if momentum continues.

The CRYPTOCAP:XRP community remains strong, with long-term holders showing confidence and resilience. With the current market structure and support from loyal investors, there’s a real possibility for the price to double from this breakout zone.

The strategy is simple. Buy and hold for the long term. But as always, traders must manage risk carefully and use a proper stop loss. Let the flag fly high. CRYPTOCAP:XRP could be ready for a major pump from this level.

BINANCE:XRPUSDT Currently trading at $2.43

Buy level : Above $2.4

Stop loss : Below $1.9

Target : $5

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

XRP/USDT Poised for Breakout from Symmetrical Triangle!Pattern Identified: Symmetrical Triangle

The symmetrical triangle is a consolidation pattern formed by a series of lower highs and higher lows, converging into a triangle shape. It reflects market indecision and often precedes a significant breakout, either upward or downward, depending on momentum and volume.

🔍 Pattern Description:

Upper Resistance Line (Descending): Connecting the lower highs since February 2025.

Lower Support Line (Ascending): Connecting the higher lows since December 2024.

Consolidation Zone: Price has been moving sideways within the triangle, indicating accumulation.

Critical Breakout Level: Around $2.23 — the price is currently testing this resistance.

📈 Bullish Scenario:

If the price successfully breaks above the upper triangle resistance with strong volume:

Target 1: $2.5855 (previous minor resistance)

Target 2: $2.9534 (key historical resistance)

Target 3: $3.2781

Maximum Target: $3.40 (local previous high and psychological level)

Breakout Confirmation: A daily candle close above $2.30 with significant volume could signal a long entry.

📉 Bearish Scenario:

If the price fails to break out and instead breaks down below the lower trendline:

Support 1: $2.00 (psychological & horizontal support)

Support 2: $1.85

Major Support: $1.55 (strong historical demand zone)

Breakdown Confirmation: A daily close below the lower triangle boundary with high volume would signal further downside.

📌 Summary:

XRP is nearing the apex of a symmetrical triangle — a major move is imminent.

A confirmed breakout could trigger a rally towards $3.40.

A breakdown may lead to a drop toward $1.55.

Recommendation: Wait for confirmation before entering long or short positions.

#XRP #XRPUSDT #CryptoBreakout #SymmetricalTriangle #XRPAnalysis #Altcoins #TradingView #TechnicalAnalysis #BullishCrypto #CryptoSignal

XRP/USD – Bearish Rejection from Resistance Zone Targets 2.0686XRP/USD Bearish Reversal Setup – H1 Chart 🕐

Analysis:

Entry Point: Price entered a short zone near 2.21828, which aligns with a previous resistance zone.

Bearish Rejection: The price formed a rejection wick and bearish candle at the resistance, signaling a potential reversal.

EMA Confluence: The price is testing below the red 50 EMA, and the 200 EMA (blue) is acting as dynamic support.

Support Zone Retest: The recent price pullback suggests a possible retest of the small support zone around 2.19106.

Target: The projected downside target is 2.06869, aligned with the prior demand zone.

Stop Loss: Positioned above resistance at 2.21828, just outside the upper rejection area.

📌 Summary:

Trend Bias: Bearish

Entry: Around 2.21828

Target: 2.06869 (≈ -6.67%)

Stop Loss: Above 2.21828

XRP/USDT Bullish Breakout Anticipation XRP/USDT Bullish Breakout Anticipation 🚀

Technical Analysis:

The chart illustrates a potential bullish setup for XRP/USDT based on price structure, support/resistance levels, and harmonic movements.

🔍 Key Observations:

Rejection From Major Support Zone (1.95 - 2.00):

Price previously tested a strong demand zone (marked as “SUPPORT”) and showed significant rejection with bullish candlestick momentum.

Series of Higher Lows ✅:

The price structure shows consecutive higher lows (green arrows), indicating rising buying pressure and bullish intent.

Break of Intermediate Resistance (2.15 - 2.18):

A breakout from the neckline area confirms bullish continuation. Price is currently retesting this level, turning resistance into support.

Target Zone at 2.35 - 2.36 🟦:

A clean target area marked by historical resistance and previous high (red arrow).

Projection indicates a possible move toward 2.3512 USDT, aligning with the measured move from the breakout structure.

Bullish Harmonic Pattern Completion 🔼:

The chart also displays a harmonic pattern completion near the recent low, suggesting a reversal point aligning with market reaction.

🎯 Trading Plan:

Entry Zone: Current retest around 2.15 - 2.18 is favorable.

Target: 2.3512 (as per projection and prior resistance zone).

Invalidation: Break below 2.10 and especially under the key support (2.00) would invalidate the setup.

📌 XRP/USDT is showing bullish strength as long as it holds above the breakout level. A sustained move could trigger momentum towards the 2.35 target zone. 💪📊

XRP XRPUSD XRPUSDTAs before, previous highs often turn into support levels — price respects history. The targets I’m sharing are long-term and global.

At the moment, I’m watching a triangle formation. It could break out to the upside, or we might see a pullback to retest support, likely near one of the prior highs.

XRPUSDT Forming 2017-Style Flag — Major Breakout Loading! BINANCE:XRPUSDT is currently forming a classic bullish flag pattern, a setup that looks strikingly similar to what we saw back in 2017 before CRYPTOCAP:XRP went on a massive run. The price has been consolidating within a tight range, and this could be the calm before a powerful breakout.

Back in 2017, a similar flag formation led to a parabolic uptrend once the resistance was broken. While history doesn’t repeat exactly, this pattern suggests the potential for a significant upside move if the breakout confirms. Traders and investors should keep a close eye on this structure — a breakout from this flag could reignite bullish momentum and open the door for a sharp rally.

This is a buy and hold scenario for those who believe in XRP’s potential, but remember — risk management is key. Always use a stop loss below the flag support to protect your capital. Momentum could build quickly, so stay alert and watch for volume confirmation on the breakout.

XRPUSD: 5 month consolidation ends and targets $8.00 XRP has turned bearish on its 1D technical outlook (RSI = 41.730, MACD = -0.027, ADX = 31.602) as the price has failed to break above the very tight consolidation that started after January's High. This pattern is however very similar to the June - November 2017 consolidation, which was the last accumulation phase before the eventual January 2018 top of that Cycle. That was accomplished a little over the 1.382 Fibonacci extension. This indicates that we should stay bullish on XRP as it can target again the 1.382 Fib, TP = 8.000.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XRP/USD Crypto Profit Raid: Steal Gains with This Blueprint!🔥 Chart Heist Blueprint: Snag Profits in XRP/USD "Ripple vs U.S Dollar"! 🚀💰

Crafted for sharp traders ready to raid the XRP/USD "Ripple vs U.S Dollar" market, this sleek strategy fuses razor-sharp technicals with savvy fundamentals to maximize your gains. 📊🕵️♂️ Surf the bullish surge, but watch for traps in the Overbought Resistance Zone where bears could strike! 🐻 Lock in your loot before the tide turns. 🌊

- 🎯 **Entry Tactics: Hit the Sweet Spot**

- Long on pullbacks near 1.9000 (or) above the price level 🏹

- The Breakout entry : at 2.5000

- Set alerts for breakouts or pullbacks to strike in real-time. 🔔

- 🛡️ **Stop Loss Hacks: Guard Your Gains**

- Place stops below the nearest 1 Day swing low or candle wick. 🔧

- Tailor stops to your risk and lot size—precision over recklessness! ⚡

- 💸 **Profit Goals: Cash In Big**

- Bullish traders aim for 3.2000 or exit early if momentum dips. 📈

- Scalpers focus on long-side quick wins, trailing stops behind big players. 🚀

- 📡 **Market Edge: Why This Plan Wins**

- XRP/USD "Ripple vs U.S Dollar" is charging bullish, driven by COT data, macro shifts, sentiment outlook, and intermarket flows. 🔍

- Check the linkss for deeper insights. 🌐

- ⚠️ **News Alert: Dodge the Chaos**

- Skip new trades during major news releases. 📰

- Use trailing stops to secure profits on active trades. 🔒

- 🤝 **Join the Profit Crew**

- Boost this plan, share the vibe, and let’s raid the markets together! 🤑

- Stay sharp for the next big score in the XRP/USD "Ripple vs U.S Dollar" heist! 💥

Happy trading, chart bandits! 🎭📉

XRPUSDT: Price has reversed, what's next? XRPUSDT has smoothly reversed from our designated reversal buy zone, as clearly pointed out in this chart and our previous analysis. We expect a smooth price reversal taking the price to $4 in the coming weeks. Please use accurate risk management while trading XRP. Crypto is likely to remain more volatile in the coming days.

Two targets are pointed out, which you can set based on your analysis.

If you’d like to contribute, here are a few ways you can assist us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_🚀❤️

XRPUSDT Bullish Setup – Swing Trade Opportunity Toward $6.00XRP has shown a consistent pattern of strong bullish impulses followed by consolidation zones, and this rhythm has repeated multiple times on the weekly chart—signaling high confidence in pattern continuation.

Let's break it down

🔁 Repetitive Buying + Consolidation Patterns

19 Sep 2022: Strong buying candle triggered a short-term rally, followed by a multi-week consolidation period.

10 July 2023: Similar impulse move occurred—buying strength picked up, and then the price consolidated again.

4 Nov 2024: Most recent and strongest impulse—3 consecutive bullish candles that broke out of long-term descending resistance, confirming structural shift. This was again followed by consolidation—mirroring previous price behavior.

📈 Breakout Confirmation & Trend Structure

Breakout of Descending Trendline (Red): XRP broke out of its long-term bearish trendline decisively, confirming a trend reversal.

Support Zone Holding Firm (1.95 USDT): Price retraced slightly but respected the newly established support above 1.9500.

Consolidation Above Breakout: Post-breakout consolidation is forming a bullish continuation pattern.

Key Technical Levels

Entry Zone (Buy Area): Current zone between $2.10 and $2.50 (ideal accumulation zone for swing traders).

Technical Stop Loss: $1.9500 – key level that has acted as both resistance and now flipped to support.

Take Profit Targets

TP1: $3.4157 – previous resistance and a strong psychological level.

TP2: $6.000 – projected top of current trend channel (green line), aligns with 131.59% upside from current level.

Risk-Reward: Over 5:1 R:R on this setup, extremely favorable for mid-to-long-term swing trades.

Bearish Invalidations

If the price closes significantly below $1.95 on the weekly, the current bullish thesis weakens, and price may retest deeper supports around $1.25 or below. But as long as the structure holds, bulls are in control.

📊 Trade Setup Summary

📥 Entry 2.10 – 2.50

🛑 Stop Loss 1.9500

🎯 Take Profit 1 3.4157

🎯 Take Profit 2 6.0000

⚖️ R:R Ratio 5.32x

The chart tells a powerful story—repeated buying, breakout confirmation, support holds, and continuation setup. XRP is positioning itself for a major move, with $6.00 potentially on the table by the end of 2025.

This is an ideal zone for swing traders and position traders who are comfortable with multi-month holding periods and high R:R setups.

#XRPUSDT: First Entry Is Up By 50%, More Growth To Come! Hey there! Our first entry in XRPUSDT is soaring by 50%, and there’s a chance we can make another entry. Once you’ve taken one, you can set a profit target to lock in your gains.

In the long run, we think XRPUSDT will go back to its all-time high of 3.5. From a fundamental analysis point of view, we’re feeling pretty positive and believe the price could even go higher than that. We’ve spotted a great trading opportunity, as you can see in the chart.

We’re keeping it neutral for now, since the trend is still up in the air. If you’re planning to hold your positions for a short time, aim for a price above 3.5. If you’re a long-term investor, a target price of 4.0 or higher is definitely possible.

We’re here to help you make informed decisions, so don’t hesitate to reach out if you have any questions or need more info.

Oh, and we’d love to hear your thoughts on which cryptocurrency pair you’d like to explore next. Let us know!

Cheers,

Team Setupsfx_

"Ripple" Crypto Heist - Bullish Breakout Plan!🌍 XRPUSD Crypto Heist Plan: Unleash the Thief Trading Style! 🤑💸🚀

Dear Market Mavericks & Crypto Bandits, 🏴☠️

Get ready to pull off the ultimate XRPUSD market heist with our Thief Trading Style, blending razor-sharp technical analysis and cunning fundamental insights! 📊🔥 Our mission? Storm the market, grab those bullish profits, and escape before the Dangerous Red Zone traps us in overbought chaos, consolidation, or a bearish reversal. 💥 Let’s outsmart the market and cash out like legends! 🏆🎉

📈 The Heist Blueprint: Long Entry Strategy

Entry Point 🚪:

The breakout is your signal! Wait for XRPUSD to smash through the Moving Average (MA) at 2.5000—that’s your green light for bullish glory! 🌟

Pro Tip:

Set Buy Stop Orders just above the MA for breakout confirmation.

OR place Buy Limit Orders at the most recent 15M/30M swing low/high for pullback entries.

Set an ALERT on your chart to catch the breakout in action! 🔔

Stop Loss (SL) 🛑:

Breakout traders: Hold off on setting your SL until the breakout confirms. Place it at the recent 4H swing low (2.3000) for swing/day trades.

Risk Management: Adjust SL based on your lot size, risk tolerance, and multiple orders. Play it smart—this is your safety net! ⚠️

Rebels beware: If you stray from the plan, you’re dancing with fire. Own the risk! 🔥

Take Profit (TP) 🎯:

Aim for 2.7500—our golden exit.

Escape Plan: If the market screams overbought or shows reversal signs, get out early! Don’t get caught in the Red Zone trap. 🚨

🧲 Scalpers’ Corner 👀

Scalp LONG only—ride the bullish waves! 🌊

Got big capital? Dive in now. Smaller stack? Join the swing traders for the full heist.

Use Trailing Stop-Loss to lock in gains and protect your loot. 💰

📡 Market Pulse: Why XRPUSD?

The XRPUSD market is in a neutral trend with a high probability of bullish momentum. Here’s the intel driving our heist:

Fundamentals: Dive into macroeconomic data, COT reports, geopolitical events, and news sentiment.

Intermarket Analysis: Watch correlated assets for clues.

Seasonal & Positioning Trends: Align with the market’s rhythm.

Future Targets: Check the Overall Score for a full breakdown! 👉🌏🔗

⚠️ Trading Alert: News & Risk Management 📰

News releases can flip the market like a switch! Protect your positions:

Avoid new trades during high-impact news.

Use Trailing SL to secure profits and minimize losses.

Stay sharp—volatility is our friend, but only if we’re prepared!

💪 Join the Heist & Boost the Plan!

Hit the Boost Button to supercharge our Thief Trading Style and make this heist legendary! 🚀 Every boost strengthens our crew, helping us plunder profits daily with ease. 💥 Let’s dominate the XRPUSD market together! 🤝

Stay tuned for the next heist plan! 🐱👤 Keep your charts locked, your alerts set, and your trading spirit wild. See you in the profits, bandits! 🤑🎉

#ThiefTrading #XRPUSD #CryptoHeist #TradingView #MakeMoney

XRPUSD: Can this 1D Death Cross push it to $9.000? XRP is neutral on its 1W technical outlook (RSI = 54.799, MACD = 0.197, ADX = 30.423) which showcases the strong upside potential of the coin. 1D is about to form a 1D Death Cross, the first in over 1 year and even though it is technically a bearish pattern, this time it may work in Ripple's favor. At least that's what happened in November 2017, when the market was coming out of a similar Descending Triangle like this year's (2025). The rally that followed topped on the 1.5 Fibonacci extension. It is possible to see it hit the new 1.5 Fib (TP = 9.000) before the year ends given enough institutional involvement.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XRP/USD "Ripple vs U.S Dollar" Crypto Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (2.600) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2.4200

💰💵💸XRP/USD "Ripple vs U.S Dollar" Crypto Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Buying XRP Ripple long XRPUSDt Bias Trade! The Breakdown inside!Again we have a 🟢SeekingPips🟢 plan where ⏳️ TIME was the MAIN factor in the SUCCESSFUL OUTCOME of our TRADE PLAN.🚀

If you've been following 🟢SeekingPips🟢 for sometime already you will know that we ALWAYS FAVOUR 🕝TIME🕖 OVER PRICE.

🔥I would even go as far and say that PRICE comes a DISTANT 3rd place when compared to TIME & VOLUME.🤔

BUT WHY❓️

That is a Vvveeerrryyyy LONG STORY that will require it's very own very long CHAPTER when 🟢SeekingPips🟢 Finally gets around to the eagerly awaited super blog so stay tuned....

Having seen that the GREY ZONE identified as 🟢 SeekingPips 🟢 Bull & Bear Bias level worked very well, you can also see that the first level of resistance identified came in at the orange level at 2.3615 whilst the printed high up until now came in at 2.3630 (Accuracy👌)

48hrs was also our minimum time window for the grey zone to present some kind of trade opportunity which it did perfectly. ( It's MATH not MAGIC honestly😉)

Note the 🔵 BLUE ARROW LOW 🔵 significant swing point created before 🌍SeekingPips trade analysis signal and just below our GREY BIAS ZONE remained unvisited👌.

Wether or not you entered a bullish trade at MARKET PRICE at time of post ( I always suggest you use your own entry signal ) OR waited for a LIQUIDITY SWEEP at those local lows for the BUYERS to easily pair with at the 🟢GREEN ARROW🟢 you would have enjoyed anything from a 3.2 - 5.2 REWARD TO RISK TRADE by the time our FIRST HIGHLIGHTED zone of RESISTANCE was hit which came into play at the

2.3615 level 🔴RED ARROW🔴.

The 🟣PURPLE/MAGENTA🟣 arrow added CONFLUENCE to the BULLISH BIAS TOO .

🚥Stay tunned for MORE TRADE ANALYSIS as the week progresses.🚥

XRP Breakout Watch — Are You Positioned for the Move?#XRP is still respecting the 150-day falling wedge structure.

Price is pushing toward the upper resistance with rising momentum.

If the breakout confirms, a strong move could be ahead.

Watching closely for confirmation.

Retweet if you're ready.

#Altseason2025

XRPUSDT The Calm Before the Storm: Major Breakout Loading…BINANCE:XRPUSDT has been trading within a well-defined horizontal channel for an extended period, signaling a prolonged consolidation phase. This kind of price behavior often precedes a major breakout, and all signs now point toward an explosive move to the upside.

What makes this setup even more compelling is the presence of an inverse head and shoulders pattern within the channel a classic bullish reversal formation. This pattern, forming after a long sideways trend, adds serious weight to the bullish narrative. It suggests that the accumulation phase is coming to an end, and buyers are preparing to take control.

A breakout above the upper boundary of the channel would confirm the pattern and could trigger a strong rally. Once XRP breaks out with volume, it may leave the consolidation zone behind for good and momentum could carry it to much higher levels.

Traders should watch closely for confirmation and manage risk accordingly. Always use a stop-loss to protect your capital. The opportunity is clear. CRYPTOCAP:XRP is gearing up, and the breakout could be unstoppable.

BINANCE:XRPUSDT Currently trading at $2.19

Buy level : Above $2.2

Stop loss : Below $1.95

Target : $3.5

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts