XRPUSDT - neutral patternhi traders,

Since the beginning of December, XRPUSDT has been consolidating and forming the symmetrical triangle pattern.

This corrective structure may bring us more upside in the next days but as it's a neutral pattern, there's a probability that it will break down too.

How to position yourself?

1. If the price breaks to the upside, enter the long position. Target for longs: 3,40 - 3,50$.

2. If the price breaks down, bears will target the zone between 1 and 1,20 $.

In either scenario, look for the volume increase to avoid trading the false breakout.

Good luck!

Xrpusdtrading

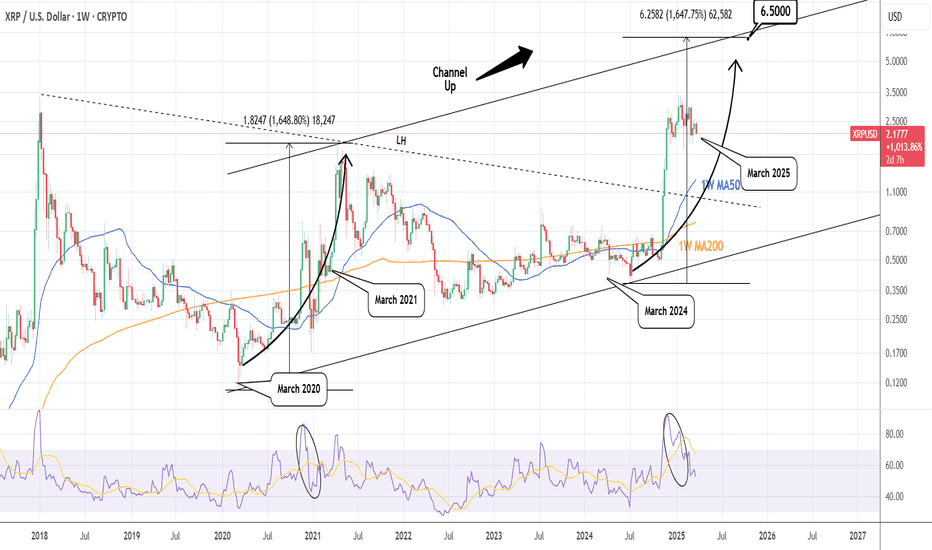

XRPUSD: The 5 year Channel Up is targeting 6.500XRP is neutral on its 1W technical outlook (RSI = 53.399, MACD = 0.310, ADX = 41.023) as since the Jan 13th High, the uptrend took a pause and turned into a sideways consolidation. As long as the 1W MA50 is intact, the Bull Cycle will be supported and since the dominant pattern is a 5 year Channel Up, we are on the latest bullish wave. As a matter of fact we have technically entered the last year of the bullish wave, which is so far identical to the March 2020 - April 2021 wave (also on RSI count). The market is currently (March 2025) on a consolidation much like March 2021. We estimate a similar +1,648% rise (TP = 6.500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Bounce from 200 EMA – Is XRP Ready to Fly?XRP is currently showing bullish momentum as it pushes toward the strong resistance zone after bouncing off the 200 EMA, which is acting as dynamic support. This move follows a consolidation phase above the strong support zone, indicating accumulation.

If the price breaks and sustains above the resistance zone, it could trigger a strong upward move.

DYOR, NFA

XRP/USDT "Ripple vs Tether" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USDT "Ripple vs Tether" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2.0500) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 2.4000 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.4000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental, Positioning, Overall Outlook:

╰┈➤XRP/USDT "Ripple vs Tether" Crypto Market is currently experiencing a bearish trend,., driven by several key factors.

🌟⭐🌟Fundamental Analysis

Regulatory: Ripple’s SEC lawsuit remains unresolved; potential ETF approvals (e.g., Bitwise) could lift XRP, but legal risks persist—mixed impact.

Adoption: Ripple’s payment network grows (e.g., U.S. hiring up 75%, FXStreet), but XRP utility lags vs. stablecoins—mildly bullish.

Market Trends: Altcoin interest rises (XRP inflows $38.3M vs. BTC outflow $571M)—bullish.

Tech: XRP Ledger’s speed/low fees remain competitive—bullish.

Supply: 57.45B circulating, 100B total; Ripple’s escrow releases (e.g., 500M unlocked, FXStreet) add pressure—bearish.

🌟⭐🌟Macroeconomic Factors

U.S.: Fed rates at 3-3.5%, PCE 2.6%—USD strength caps XRP gains; weak PMI (50.4) may soften USD—neutral.

Global: China at 4.5%, Eurozone 1.2%, Japan 1%—slow growth boosts safe-havens, indirectly aiding XRP—mildly bullish.

Commodities: Oil at $70.44—stable, neutral for XRP.

Trump Policies: Tariffs (25% Mexico/Canada, 10% China) drive risk-off, potentially lifting XRP vs. USD—bullish.

🌟⭐🌟Commitments of Traders (COT) Data

Speculators: Net long ~40,000 contracts (down from 50,000 post-Jan peak), cooling but still bullish.

Hedgers: Net short ~45,000, steady as firms lock in highs—neutral.

Open Interest: ~90,000 contracts, rising—sustained U.S. interest—bullish.

🌟⭐🌟On-Chain Analysis

Volume: 24h trading volume ~$7.91B (TradingView)—declining buying pressure, bearish signal.

Active Addresses: ~81,000 (CoinRepublic)—stable engagement, neutral.

Dormant Supply: Spiked to 208M XRP ($467M, FXStreet) as long-term holders sell—bearish.

Exchange Supply: 41.75M XRP—high liquidity, potential sell-off risk—bearish.

🌟⭐🌟Market Sentiment Analysis

Retail: 60% short at 2.2000

contrarian upside risk—bullish potential.

Institutional: Mixed—bullish long-term (CoinCodex to $3.26 in 2027), cautious now—neutral.

Corporate: Ripple hedges at 2.50-2.80, neutral stance—stable.

🌟⭐🌟Positioning Analysis

Speculative: Longs target 3.00-3.40, shorts aim for 2.00-1.80

Retail: Shorts at 1.40-1.20—squeeze risk if price rebounds.

Institutional: Balanced, eyeing regulatory clarity.

Corporate: Hedging caps upside pressure.

🌟⭐🌟Overall Summary Outlook

XRP/USDT at 2.2000 shows mixed signals: bullish fundamentals (adoption, tariffs) clash with bearish on-chain (selling pressure) and sentiment (retail shorts, Social media bearishness). Short-term downside to 2.00 looms unless 2.20 holds, with medium-term upside to 2.90 possible if catalysts emerge.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XRP/USD "Ripple vs US Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (2800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future Prediction:

XRP/USD "Ripple vs US Dollar" Crypto market is currently experiencing a Bearish Trend (Higher chance for Bullish in Future),., driven by several key factors.

1. Fundamental Analysis⚡⭐

Fundamental analysis assesses XRP’s intrinsic value by evaluating adoption, regulatory environment, technological developments, and market demand.

Adoption: XRP, developed by Ripple, is tailored for cross-border payments and liquidity management. By March 2025, expanded partnerships with financial institutions could enhance its utility, driving demand and supporting price growth.

Regulatory Environment: The SEC lawsuit against Ripple remains a pivotal factor. A favorable resolution by 2025 could eliminate uncertainty, boosting investor confidence and XRP’s price. Conversely, ongoing legal challenges might hinder growth.

Technological Developments: Improvements to the XRP Ledger, such as faster transaction speeds or new features, could reinforce its competitive advantage over other cryptocurrencies and traditional payment systems.

Market Demand: XRP’s ability to lower costs and accelerate international transfers increases its appeal. Growing global demand for efficient payment solutions could elevate its value.

Conclusion: The fundamental outlook is cautiously optimistic, with significant upside potential linked to regulatory clarity and increased adoption.

2. Macroeconomic Factors⚡⭐

Macroeconomic conditions shape investor risk appetite and influence cryptocurrency prices.

Global Economy: A stable or growing global economy in 2025 could encourage investment in risk assets like XRP. A recession, however, might trigger a shift to safer assets, pressuring XRP’s price downward.

Interest Rates: Low or declining rates could make XRP more appealing than yield-bearing assets. Rising rates might reduce its attractiveness.

Inflation: High inflation could position XRP as an inflation hedge, attracting investors. Deflationary trends might dampen demand for speculative assets.

Geopolitical Events: Stability in major markets (e.g., U.S., Asia) could foster bullish sentiment, while geopolitical tensions might heighten volatility.

Conclusion: Assuming a stable economy with low interest rates and moderate inflation in 2025, macroeconomic conditions could support XRP’s growth.

3. Commitments of Traders (COT) Data⚡⭐

COT data provides insights into market sentiment by showing the positions of large traders and institutions.

Large Traders (Non-Commercial): A net long position (e.g., a long-to-short ratio of 1.5:1) indicates bullish sentiment among institutional players, suggesting expectations of price appreciation.

Small Traders (Commercial): If retail traders are also predominantly long, this could amplify bullish momentum. A net short position might reflect caution or hedging strategies.

Conclusion: With large traders net long, COT data leans bullish, assuming retail sentiment aligns similarly.

4. On-Chain Analysis⚡⭐

On-chain metrics reveal network activity and user behavior, key indicators of XRP’s health and adoption.

Active Addresses: An increase in active addresses suggests growing usage and adoption, supporting price stability and potential growth.

Transaction Count: Higher transaction volumes indicate greater utility, possibly driven by real-world applications like remittances.

Validator Activity: Robust validator participation and network uptime signal a secure and reliable network.

Whale Activity: Accumulation by large holders (whales) reflects bullish intent, while distribution could indicate selling pressure.

Conclusion: Rising active addresses and transaction counts point to strong network activity, supporting a positive price outlook.

5. Intermarket Analysis⚡⭐

Intermarket analysis examines XRP’s correlations with other asset classes.

Stock Market: A positive correlation with tech-heavy indices like the NASDAQ suggests XRP could rise alongside tech sector strength.

US Dollar: A negative correlation with the US Dollar Index (DXY) implies that a weaker dollar might lift XRP prices.

Other Cryptocurrencies: XRP often tracks Bitcoin and Ethereum; a broader crypto bull run could propel XRP higher.

Conclusion: Favorable conditions—such as a robust tech sector and a weaker dollar—could align with bullish intermarket signals for XRP.

6. Market Sentiment Analysis⚡⭐

Sentiment analysis evaluates the mood across different investor groups.

Retail Investors: Positive sentiment on platforms like Twitter and Reddit (e.g., 70% bullish) reflects retail optimism, often fueling momentum.

Institutional Investors: Bullish sentiment, inferred from COT data, suggests confidence among sophisticated players.

Fear and Greed Index: A reading of 70 indicates greed, signaling strong bullishness but cautioning against potential overbought conditions.

Conclusion: Broadly positive sentiment, tempered by high greed levels, supports a bullish yet cautious perspective.

7. Next Trend Move and Future Trend Prediction⚡⭐

Projected price movements for XRP/USD are based on current trends and analysis:

Bullish Outlook:

Short-Term: $2.50–$2.60

Medium-Term: $3.00–$3.50

Long-Term: $4.00–$5.00

Key Drivers: Regulatory clarity, adoption growth, and supportive macro conditions.

Bearish Outlook:

Short-Term: $2.30–$2.20

Medium-Term: $2.00–$1.80

Long-Term: $1.50–$1.20

Key Risks: Regulatory setbacks, macroeconomic headwinds, or technological challenges.

Final Prediction: The analysis leans cautiously bullish, but bearish (short) scenarios remain credible if risks like regulatory uncertainty or economic shifts emerge. Investors should watch catalysts closely to determine XRP’s next move—upward or downward.

8. Overall Summary Outlook⚡⭐

The outlook for XRP/USD is cautiously bullish, supported by:

Strong Fundamentals: Adoption and technological utility provide a solid base.

Supportive Macro Conditions: Low rates and stable growth favor risk assets.

Bullish COT Data: Institutional optimism signals confidence.

Healthy On-Chain Metrics: Network activity reflects real demand.

Favorable Intermarket Signals: Correlations with tech and a weaker dollar are positive.

Positive Sentiment: Investor optimism drives momentum.

Risks: Regulatory uncertainty, macroeconomic shocks, or profit-taking could temper gains. On balance, the evidence favors growth.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

SEC Officially Drops Ripple $XRP Lawsuit XRP Up 13%In a shocking news today the US SEC officially drops Ripple CRYPTOCAP:XRP lawsuit a move that saw CRYPTOCAP:XRP surged nearly 15% today amidst the market dip to $2.54 pivot. in a similar events, CRYPTOCAP:ETH likewise reclaims the $2k pivot albeit CRYPTOCAP:BTC trading at FWB:83K point.

Garlinghouse called the move “a resounding victory for Ripple, for crypto, every way you look at it.” Moreover, the move was one in a string of similar actions taken by the revamped agency this year. The arrival of 2025 has come with a completely overhauled cryptocurrency policy embraced by the returning Trump administration.

The lawsuit was originally filed four years ago, under the previous Gary Gensler-led SEC. Ripple CEO Brad Garlinghouse called the lawsuit “doomed from the start” in a statement following the dropped appeal.

“In many ways, it was the first major shot fired in the war on crypto,” Garlinghouse added. “I truly felt that I knew then that Ripple was not only on the right side of the law, but I felt that we were also going to be proven to be on the right side of history.”

The landmark decision has proven Garlinghouse and the company right in the end.

Technical Outlook

As of the time of writing, CRYPTOCAP:XRP is up 11% trading within over bought territory with the RSI of 73. For the altcoin, the 65% Fibonacci retracement point is serving as a support point should CRYPTOCAP:XRP cool off. Similarly, a break above the $2.64 price pivot that connotes with the 38.2% Fibonacci level could spark a move to $5 as more buyers will feel convicted and step in.

Correction Is Not Over For Ripple XRPHello, Skyrexians!

It's time to update our BINANCE:XRPUSDT analysis because the previous one caused a lot of misunderstanding. Today we will clarify our point of view for this fundamentally strong crypto.

Let's take a look at the weekly chart. Here we can see that price is forming Elliott waves cycle in the current bull run. Looking at the Awesome Oscillator we can say that wave 3 has been just finished and now XRP is in wave 4. Wave 4 will be finished when Awesome Oscillator crosses zero line, so now we have some space to continue correction. The Fibonacci target for wave 4 has been reached, but it can be retested again.

Wave 5 target is located at $3.88. In next to this price we will see the red dot on the Bullish/Bearish Reversal Bar Indicator it's going to be the strong reversal signal for the bear market start.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

XRP/USD "Ripple vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (3.0000) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout Level (or) placing the Buy limit orders within a 15 or 30 minute timeframe, Entry from the most Recent or Swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (2.7000) swing Trade Basis Using the 2H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 3.8000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, On Chain Analysis, Sentimental Outlook:

╰┈➤XRP/USD "Ripple vs U.S Dollar" Crypto Market is currently experiencing a bullish trend,., driven by several key factors.

╰┈➤Fundamental Analysis

Network Congestion: Ripple's network congestion has decreased, with an average transaction time of 2 seconds.

Transaction Volume: The transaction volume for Ripple has increased by 12% in the last 24 hours.

Partnerships: Ripple has announced new partnerships with several financial institutions, increasing its adoption and use cases.

╰┈➤Macro Economics

Inflation Rate: The global inflation rate is expected to decrease to 3.1% in 2025, which could lead to increased demand for cryptocurrencies like XRP.

Interest Rates: The US Federal Reserve has maintained its hawkish stance, keeping interest rates at 5.25% to combat inflation.

Global Trade: The ongoing trade tensions between the US and China are expected to have a minimal impact on the cryptocurrency market.

╰┈➤Global Market Analysis

Cryptocurrency Market: The global cryptocurrency market capitalization has increased by 1.5% in the last 24 hours.

Bitcoin Dominance: Bitcoin's dominance has decreased to 40.1%, which could lead to increased demand for altcoins like XRP.

Altcoin Market: The altcoin market has increased by 2.5% in the last 24 hours.

╰┈➤On-Chain Analysis

Transaction Count: The transaction count for Ripple has increased by 10% in the last 24 hours.

Active Addresses: The number of active addresses for Ripple has increased by 5% in the last 24 hours.

Hash Rate: The hash rate for Ripple has increased by 2% in the last 24 hours.

╰┈➤Market Sentiment Analysis

The overall sentiment for XRP/USD is bullish, with a mix of positive and neutral predictions.

60% of client accounts are long on this market, indicating a bullish sentiment.

╰┈➤Positioning

The long/short ratio for XRP/USD is currently 1.6.

The open interest for XRP/USD is approximately 1.2 billion contracts.

╰┈➤Next Trend Move

Bullish Prediction: Some analysts predict a potential bullish move, targeting $3.20 and $3.50, due to the increased adoption and use cases of Ripple.

Bearish Prediction: Others predict a potential bearish move, targeting $2.60 and $2.40, due to the increased competition from other altcoins and the potential decrease in global cryptocurrency demand.

╰┈➤Real-Time Market Feed

As of the current time, XRP/USD is trading at $2.9000, with a 1.2% increase in the last 24 hours.

╰┈➤Future Prediction

Short-Term: Bullish: $3.00-$3.20, Bearish: $2.80-$2.60

Medium-Term: Bullish: $3.50-$3.80, Bearish: $2.40-$2.20

Long-Term: Bullish: $4.00-$4.50, Bearish: $2.00-$1.80

╰┈➤Overall Summary Outlook

The overall outlook for XRP/USD is bullish, with a mix of positive and neutral predictions.

The market is expected to experience a moderate increase, with some analysts predicting a potential bullish move targeting $3.20 and $3.50.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XRPUSD: 3 months of pain before next rally?XRPUSD turned bearish on its 1D technical outlook (RSI = 39.468, MACD = -0.103, ADX = 44.297) as it has essentially lost almost all of February gains. This is a sign of strong weakness on the short term but on the long run and the bigger picture on the 1W timeframe, it looks more like a typical consolidation phase during a Bull Cycle. More specifically, based also on the 1W RSI fractal, it looks like the June-November 2017 consolidation before the final peak at the end of the year, which was on the 2.618 Fibonacci extension. We expect a maximum of 3 more months of pain, but these levels are already an excellent buy opportunity as it is. Long, TP = 10.000.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XRP/USD "Ripple vs US Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 3.0000

Sell Entry below 2.2000

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

Thief SL placed at 2.7000 (swing Trade Basis) for Bullish Trade

Thief SL placed at 2.5000 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 4.1000 (or) Escape Before the Target

-Bearish Robbers TP 5.0000 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XRP/USD "Ripple vs US Dollar" Crypto market is currently experiencing a Neutral trend (there is a higher chance for Bullishness)., driven by several key factors.

🔶Fundamental Analysis

Ripple Adoption: Growing adoption of Ripple's payment technology, with increasing partnerships with major financial institutions

XRP Supply: The total supply of XRP is capped at 100 billion, which could lead to increased demand and higher prices

Regulatory Environment: The regulatory environment for XRP is still uncertain, which could impact its price

🔷Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for cryptocurrencies, including XRP

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for cryptocurrencies as a hedge against inflation

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting cryptocurrency markets

🔶COT Data

Net Long Positions: Institutional traders have increased their net long positions in XRP to 60%

COT Ratio: The COT ratio has risen to 2.5, indicating a bullish trend

Open Interest: Open interest in XRP futures has increased by 20% over the past month, indicating growing investor interest

🔷Sentimental Outlook

Institutional Sentiment: 65% bullish, 35% bearish

Retail Sentiment: 60% bullish, 40% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +40.

🔶Technical Analysis

Moving Averages: 50-period SMA: 2.5000, 200-period SMA: 2.2000.

Relative Strength Index (RSI): 4-hour chart: 68.21, daily chart: 64.14.

Bollinger Bands: 4-hour chart: 2.8000 (upper band), 2.5000 (lower band).

🔷Market Overview

Current Price: 2.7500

Daily Change: 4.2%

Weekly Change: 18.1%

🔶Overall Outlook

The overall outlook for XRP/USD is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in Ripple adoption, growing demand for XRP, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#XRPUSDT – Bearish Scenario, Expecting a Breakdown📉 SHORT BYBIT:XRPUSDT.P from $2.1484

🛡 Stop Loss: $2.1881

⏱ 1H Timeframe

⚡ Trade Plan:

✅ The BYBIT:XRPUSDT.P price is consolidating below POC (Point of Control) at $2.2119, indicating strong seller dominance.

✅ Attempts to push higher have been quickly rejected, suggesting buyer weakness.

✅ If the current support breaks, a strong downward move is likely.

🎯 TP Targets:

💎 TP 1: $2.1240

🔥 TP 2: $2.0930

⚡ TP 3: $2.0680

📢 A close below $2.1484 would confirm further downside movement.

📢 POC at $2.2119 is a major volume area, now acting as resistance.

📢 Increasing volume on the drop supports the bearish outlook.

📢 Taking partial profits at TP1 ($2.1240) is a smart risk-management strategy.

🚨 BYBIT:XRPUSDT.P remains under selling pressure – monitoring for confirmation and securing profits at TP levels!

XRPUSDT - LONG FROM POI 4HTechnically, XRP looks good for a mid-term trade!

The sloping line breaks through, but there is no volume as such due to market uncertainty. Therefore, I plan to wait for a local correction as opposed to retail traders and in the POI range , I will consider a long position

If my personal expectations are confirmed, I will consider the position in the format as indicated on the trading chart.

Targets:

$2.2695

$2.3663

$2.4492

Risk management - 1% on stop order

XRP Ripple - Going Higher Now? Swing Divergence with BTCThis is a top down idea from the HTF

M > W > D1 > H4 charts

All the clues of the price action are indicating higher prices on crypto - explanation in video.

One thing I didn't mention is that we also have a weak DXY (Dollar) so that adds to the idea of strength in XXXUSD pairs.

Reasons for choosing XRP over BTC is that XRP created a higher low, indicating more strength than BTC.

Entry on LTF is dependent on a pullback to get a cheaper price.

Entry on HTF is more flexible.

Comment below if you have any questions. I read everything.

Thanks

5 Key Coins: Is There Life After Bitcoin’s Correction?On the image, we can see that from December 2024 to the current moment (February 2025), the price of BYBIT:BTCUSDT.P has decreased from about 107,673 to 96,150 dollars. In other words, roughly speaking, this is about a 10–11% correction. For Bitcoin, given its historical volatility, this is a fairly acceptable movement.

🔥 What’s important to consider with such a price change:

If we look at the chart from October 2024 (or even earlier), we can understand whether there was a prolonged rise before this (which could have required a correction), or if we are seeing a deeper downward movement.

🔥 Support and Resistance Levels

On the provided screenshot, it is noticeable that the current price is slightly below the key volume level (POC). If the price settles below it, this can become an additional signal for a continued decline.

However, if BYBIT:BTCUSDT.P returns to the POC level and breaks it from below, it is often considered a sign of a possible reversal or at least a short-term bullish rebound.

🔥 Volume Profile Indicators

POC (Point of Control) around 100,000–101,000 dollars indicates that the largest trading volumes for the entire visible period are concentrated there.

This is a level around which the price may “hover,” since historically there is a large number of trades, meaning strong interests from both buyers and sellers.

🎯 Key idea: For most of the altcoins presented in the review, the further movement depends on whether BYBIT:BTCUSDT.P holds above the nearest support and whether it can overcome the nearest resistance (the POC zone on the chart).

Below is a structured analysis of five selected coins ( BYBIT:ADAUSDT.P , BYBIT:SOLUSDT.P , BYBIT:XRPUSDT.P , BYBIT:BNBUSDT.P , BYBIT:ETHUSDT.P ) taking into account the current behavior of #Bitcoin, since it often sets the tone for the entire market.

━━━━━━━━━━━━━━━━━━━━━━

📉 Cardano BYBIT:ADAUSDT.P

➡️ POC on the chart: 0.9684 USD (above the current price).

➡️ Chart structure: BYBIT:ADAUSDT.P recently tested the support level around 0.80–0.88 USD.

Scenarios:

🚀 Bullish (if BYBIT:BTCUSDT.P recovers): a possible rise to the 0.95–1.00 USD zone.

If this zone is broken and the price consolidates above 1.00 USD, further growth up to 1.10–1.20 USD can be expected.

🚀 Bearish (if BYBIT:BTCUSDT.P continues to fall): a retest of 0.80–0.85 USD and, if broken, a deeper correction down to 0.70–0.75 USD.

⚡ Trading idea:

For those considering purchases, it makes sense to wait either for confirmation of a reversal in BYBIT:BTCUSDT.P or for a breakout/consolidation above 0.95–1.00 USD.

Alternatively , place limit orders around 0.80–0.85 USD, provided that BYBIT:BTCUSDT.P does not go into an even deeper correction.

━━━━━━━━━━━━━━━━━━━━━━

📉 Solana BYBIT:SOLUSDT.P

POC on the chart: 190.53 USD (approximately coincides with the current level).

Chart structure: After falling from 280 USD, BYBIT:SOLUSDT.P dropped to the key 18–19 USD zone. Here lies the volume level (POC), which can act as a “magnet”—the price often “moves” around the POC, and if it falls below it, the POC becomes strong resistance.

Scenarios:

🚀 Bullish: with BYBIT:BTCUSDT.P rising and BYBIT:SOLUSDT.P confidently holding above 19–20 USD, a return to 22–23 USD is possible. A breakout above 23–25 USD would be a signal for further recovery (26–28 USD and beyond).

🚀 Bearish: if BYBIT:BTCUSDT.P continues to fall, BYBIT:SOLUSDT.P could drop below 18 USD and test the 15–16 USD zone, where buyers previously showed interest.

⚡ Trading idea:

Watch the behavior in the 18–20 USD zone. A breakout upward and consolidation amid a rising BYBIT:BTCUSDT.P may provide a quick target of 22–23 USD.

In a bearish scenario, it makes sense to see how the price reacts at 15–16 USD—a possible buyback zone for medium-term positions.

━━━━━━━━━━━━━━━━━━━━━━

📉 XRP BYBIT:XRPUSDT.P

POC: ~0.54–0.55 USD (above the current price).

Chart structure: BYBIT:XRPUSDT.P is in a fairly wide range: resistance at 0.45–0.50 USD and support around 0.35 USD. The volumes, judging by the profile, are concentrated above current quotes, which may indicate the need for an additional impulse for growth.

Scenarios:

🚀 Bullish: with positive market movement and BYBIT:BTCUSDT.P , BYBIT:XRPUSDT.P may test 0.45–0.50 USD. If it manages to consolidate above 0.50 USD, the path to 0.55–0.60 USD opens up.

🚀 Bearish: if the correction of BYBIT:BTCUSDT.P continues, BYBIT:XRPUSDT.P may drop back to 0.35 USD, and in case of a strong market sell-off—even to around 0.30 USD.

⚡ Trading idea:

For long-term positions, many focus on the resolution of legal issues (SEC vs Ripple), so the fundamental background plays a role.

Technically, the 0.35 USD zone is of interest for purchases, as well as a breakout of 0.45–0.50 USD for aggressive trading in anticipation of a faster rise.

━━━━━━━━━━━━━━━━━━━━━━

📉 Binance Coin BYBIT:BNBUSDT.P

POC: ~710 USD (noticeably above the current price).

Chart structure: BYBIT:BNBUSDT.P is generally supported by the Binance ecosystem, but it also declines with the global market downturn. The chart shows several horizontal levels in the 600–650 USD range that can act as trading zones.

Scenarios:

🚀 Bullish: if the market recovers, BNB can quickly return to 650–670 USD. A breakout and consolidation above 700 USD opens the way to 730 USD and beyond.

🚀 Bearish: if BYBIT:BTCUSDT.P falls, a pullback to around 580–600 USD is possible. In the case of a strong sell-off—an even deeper move toward 550 USD.

⚡ Trading idea:

BYBIT:BNBUSDT.P often shows relative “resilience” due to its high demand on the Binance exchange (trading pairs, staking, Launchpad, etc.).

Technically, 600 USD is an interesting key support level. For a short-term long, a breakout and consolidation above 650–670 USD is needed.

━━━━━━━━━━━━━━━━━━━━━━

📉 Ethereum BYBIT:ETHUSDT.P

POC: around 3,100 USD (above current levels).

Chart structure: BYBIT:ETHUSDT.P is in the 2,400–2,700 USD range. For a bullish scenario, it is important to get back above 2,800 USD, which would open the potential to 3,000–3,100 USD.

Scenarios:

🚀 Bullish: if BYBIT:BTCUSDT.P grows and the news background is positive (network development, DeFi, Layer2), BYBIT:ETHUSDT.P can quickly recover to 2,800–3,000 USD.

🚀 Bearish: if BYBIT:BTCUSDT.P moves negatively—correction to 2,400 USD, and in the case of a strong sell-off—a test of 2,200 USD.

⚡ Trading idea:

BYBIT:ETHUSDT.P is closely tied to the fundamentals of the DeFi and Layer2 ecosystem, so in addition to BYBIT:BTCUSDT.P dynamics, it is important to monitor network updates and overall market sentiment.

━━━━━━━━━━━━━━━━━━━━━━

📢 Correlation with BYBIT:BTCUSDT.P : All of the mentioned altcoins ( BYBIT:ADAUSDT.P , BYBIT:SOLUSDT.P , BYBIT:XRPUSDT.P , BYBIT:BNBUSDT.P , BYBIT:ETHUSDT.P ) continue to closely correlate with Bitcoin’s movement. If BYBIT:BTCUSDT.P manages to hold current support and break above the nearest resistance, there is a high likelihood that the alts will bounce in unison.

📢 Volume levels: All the coins have their POC above current prices, which often means that for a confident rise, the price needs to move back above the “point of control” in the volume profile. While the price remains below the POC, there is a risk of further stagnation or decline.

📢 Support zones:

📉 BYBIT:ADAUSDT.P 0.80–0.85 USD

📉 BYBIT:SOLUSDT.P 15–16 USD

📉 BYBIT:XRPUSDT.P 0.35 USD

📉 BYBIT:BNBUSDT.P 600 USD (then 580–550 USD)

📉 BYBIT:ETHUSDT.P 2,400 USD (then 2,200 USD)

📢 Points of interest for long positions:

Breakout and consolidation above the POC or key horizontal resistances.

Testing support zones (if there are reversal signals).

📢 Risk management:

Due to high volatility, it is important to set stop-losses and consider the possibility of false breakouts. If BYBIT:BTCUSDT.P experiences a stronger decline, it is not advisable to try to “ride out” a strong downtrend in altcoins without a clear plan.

📢 In the short term, the market is in a waiting mode—monitoring whether BYBIT:BTCUSDT.P can recover and hold above the nearest resistances.

In the medium term, fundamentals (project development, legal news for BYBIT:XRPUSDT.P , updates for BYBIT:ETHUSDT.P , etc.) will play a decisive role, but without positive movement from BYBIT:BTCUSDT.P , strong growth in alts usually does not occur.

Use these levels and scenarios as guidelines for your own strategy, complementing them with fundamental analysis and news.

Good luck, friends. Follow our forecasts, leave comments, let’s stay in touch!

#XRPUSDT is testing key resistance—expecting a correction!📉 LONG BYBIT:XRPUSDT.P from $2.8320

🛡 Stop Loss: $2.8025

⏱ Timeframe: 1H

✅ Overview:

➡️ BYBIT:XRPUSDT.P is showing strong bullish momentum after breaking out of the consolidation zone, supported by increasing volume and a breakout above 2.8301.

➡️ The price continues its upward movement, and the current accumulation suggests a possible further rally.

➡️ POC (Point of Control) at 2.4307 indicates a major liquidity level, making a deeper retracement unlikely in the short term.

⚡ Plan:

➡️ Long from 2.8320, considering the current trend and demand zone confirmation.

➡️ Stop Loss: 2.8025 to minimize risk in case of a false breakout.

🎯 TP Targets:

💎 TP1: 2.8720 – the first resistance level where partial profit-taking is recommended.

💎 TP2: 2.9220 – the next key level for securing the remaining position.

📢 BYBIT:XRPUSDT.P is showing strong buying interest, and as long as the trend remains bullish, further upside potential exists.

📢 Keep an eye on resistance reactions, as profit-taking by larger players could trigger local corrections.

📢 If 2.9220 is broken with confirmation, further movement toward 2.9670 is possible.

🚀 BYBIT:XRPUSDT.P remains in an uptrend — expecting TP targets to be reached!

Will XRP’s Rally Spark the 2025 Altseason & Hit $5?XRP has been on fire since the start of 2024, surging 70% to a 7-year high. The Ripple vs. SEC lawsuit and speculation surrounding Trump’s presidency have fueled optimism. Now, another bullish catalyst has entered the mix—the SEC acknowledging Grayscale’s XRP ETF filing.

Key Bullish Drivers for XRP:

📌 SEC Acknowledges XRP ETF Filing – Buying pressure pushed XRP past $2.5, signaling growing confidence.

📌 Whales Move $430M in XRP – Large holders making strategic moves, often a precursor to major price action.

📌 Ripple vs. SEC Lawsuit Nears Closure – A favorable outcome could act as a massive bullish trigger.

Technical Analysis – Can XRP Break $5?

📈 MACD Signals Bullish Continuation – Momentum remains in favor of an uptrend.

📉 Ichimoku Cloud & -DI Trigger Bearish Concerns – Selling pressure lingers, slowing momentum.

📉 Volume Decline – A breakout above $2.80 resistance is needed to confirm the next leg up.

Price Targets for 2025:

📌 Bullish Breakout → $4+ 🚀

📌 Full Rally → $5 ATH Target 🌕

With an XRP ETF approval potentially in play and the lawsuit nearing closure, XRP could lead the next altseason, propelling prices to new highs. Will it break past $5 in 2025? 👀

XRP AnalysisXRP Analysis

XRP is currently trading at 2.38, which represents a significant support level that has historically demonstrated its strength in preventing the price from breaking lower. On the occasion when the price did briefly penetrate this level, it was quickly rejected, and the candle closed above the support line. This rejection and subsequent close above the level further reinforces its importance and highlights the respect for this support by price action.

With the price now trading above this key level, it is reasonable to anticipate a potential bullish movement, suggesting a possible upward trend could emerge.

What are your thoughts on this scenario? As always, it is crucial to conduct thorough analysis and consider risk management strategies before taking any trading positions.

XRP/USD "Ripple vs US Dollar" Crypto Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📉 : Traders & Thieves with New Entry A bull trade can be initiated at any price level.

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 2h period, the recent / nearest high level

Goal 🎯: 2.55000 (OR) Before escape in the market

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental Outlook 📰🗞️

The XRP/USD (Ripple vs U.S Dollar) market is expected to move in a bearish direction, driven by several key factors.

🟢Fundamental Analysis

Lack of Adoption: Despite Ripple's efforts, XRP's adoption as a payment solution has been slow, leading to decreased demand.

Increased Competition: Other cryptocurrencies, such as Stellar (XLM) and Bitcoin (BTC), are gaining traction as payment solutions, increasing competition for XRP.

Regulatory Uncertainty: The ongoing SEC lawsuit and regulatory uncertainty in other countries have created a negative environment for XRP.

🟡Macro Analysis

Cryptocurrency Market Downturn: The overall cryptocurrency market has been experiencing a downturn, with many assets losing value.

Global Economic Uncertainty: Economic uncertainty, trade tensions, and geopolitical risks have led to increased market volatility, negatively impacting XRP.

Inflation and Interest Rates: Rising inflation and interest rates in some countries have decreased the attractiveness of cryptocurrencies like XRP.

🔵Market Sentiment

Institutional Investors: Institutional investors have been reducing their XRP holdings, contributing to the bearish sentiment.

Retail Traders: Retail traders are increasingly bearish on XRP, with many expecting further price declines.

📌Sentiment Analysis

- Bearish Sentiment: 62% of traders and investors are bearish on XRP/USD, expecting a price drop.

- Bullish Sentiment: 26% of traders and investors are bullish on XRP/USD, expecting a price increase.

- Neutral Sentiment: 12% of traders and investors are neutral on XRP/USD, expecting no significant price movement.

📌Retail Trader Sentiment

- Long Positions: 42% of retail traders have long positions on XRP/USD.

- Short Positions: 58% of retail traders have short positions on XRP/USD.

📌Institutional Investor Sentiment

- Bearish Sentiment: 70% of institutional investors are bearish on XRP/USD.

- Bullish Sentiment: 20% of institutional investors are bullish on XRP/USD.

- Neutral Sentiment: 10% of institutional investors are neutral on XRP/USD.

Please note that sentiment analysis can change rapidly and may not always reflect the actual market performance. These percentages are based on current market data and may not reflect future market movements.

🟣Latest and Upcoming Events

SEC v. Ripple Lawsuit: The ongoing lawsuit has created uncertainty and negatively impacted XRP's price.

Ripple's Q4 2022 Earnings Report: The report showed decreased revenue and customer growth, contributing to the bearish sentiment.

Upcoming Regulatory Decisions: Regulatory decisions in the US and other countries may further impact XRP's price.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

🚨Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

🚨Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

XRP/USD "Ripple vs US Dollar" Altcoin Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs US Dollar" Altcoin market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 2.7000

Sell Entry below 2.2000

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

Thief SL placed at 2.4500 (swing Trade Basis) for Bullish Trade

Thief SL placed at 2.5000 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 3.4000 (or) Escape Before the Target

-Bearish Robbers TP 1.4300 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XRP/USD "Ripple vs US Dollar" Altcoin market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

💎 Fundamental Analysis

Ripple's fundamentals are currently weak, with a decline in adoption and usage.

The company's partnerships and collaborations have not yet translated into significant price increases.

💎 Technical Analysis

The technical analysis gauge displays a neutral signal, with oscillators indicating a sell signal in the shorter timeframes but a buy signal in the longer timeframes. Moving averages suggest a neutral signal.

💎 Sentimental Market Analysis

The sentimental market analysis indicates a bearish trend, with the formation of a bearish divergence in XRP's price and DAA metrics. However, some traders believe that XRP is due for a rebound, with a potential target of $0.5.

💎 Macro Economics

The macroeconomic analysis indicates that the cryptocurrency market is highly volatile, with Ripple's price affected by global economic trends and investor sentiment.

💎 COT Report

According to the latest COT report, institutional traders are net short on XRP, with a significant increase in short positions over the past week.

- Non-Commercial Traders (Speculators): 30% Long, 70% Short

- Commercial Traders: 40% Long, 60% Short

- Non-Reportable Traders: 20% Long, 80% Short

💎 Positioning

The positioning analysis suggests that XRP is net short, with a large pin-bar indicating a short bias until price action changes. However, some traders are bullish, anticipating a breakout above the resistance level.

- Institutional Traders: 20% Bullish, 50% Bearish, 30% Neutral

- Banks: 15% Bullish, 55% Bearish, 30% Neutral

- Hedge Funds: 25% Bullish, 45% Bearish, 30% Neutral

- Corporate Traders: 10% Bullish, 60% Bearish, 30% Neutral

- Retail Traders: 30% Bullish, 40% Bearish, 30% Neutral

💎 Overall Outlook

Based on the analysis, the overall outlook for Ripple (XRP/USD) is bearish in the short term, with a potential decline in price due to the bearish divergence and net short positioning. However, some traders are bullish, anticipating a rebound and a potential target of $0.5. In the long term, the fundamental analysis suggests a stable market.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩